Regardless that Apple (NASDAQ: AAPL) inventory dipped throughout final week’s sell-off to almost 12% off its 2024 excessive (at Tuesday’s shut), that wasn’t sufficient to make me need to purchase it.

So why am I bitter on a inventory that so many others are bullish on? All of it has to do with valuation.

Apple’s progress has been poor

In the event you reside within the U.S., chances are high you both personal an iPhone or different Apple product, or know somebody who does. Apple is rather less dominant worldwide, however continues to be a extremely recognizable and widespread model.

As a result of Apple’s enterprise is generally centered on high-end electronics, it is extra susceptible to demand cycles than corporations promoting inexpensive electronics. As inflation has taken its toll, Apple’s gross sales have struggled.

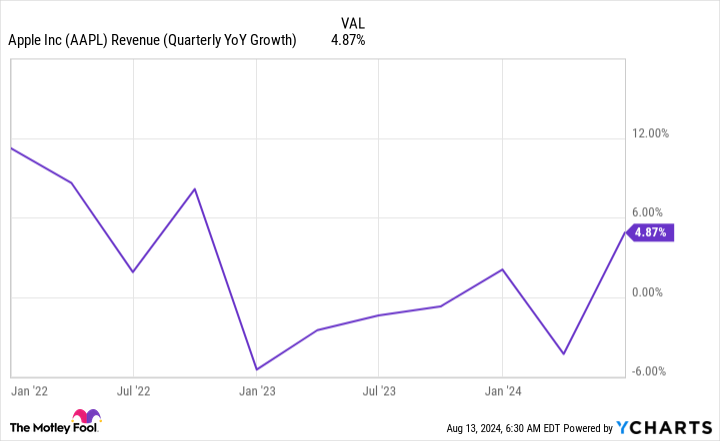

Because the begin of 2022, Apple has struggled to put up double-digit income progress and even had just a few quarters the place gross sales dipped in comparison with the year-ago interval. Its newest quarter noticed income improve yr over yr, however gross sales of its flagship product, the iPhone, decreased barely yr over yr.

The final two and a half years would have been a lot worse for Apple if it weren’t for its providers division. This encompasses income from promoting, the App Retailer, cloud providers, and digital content material like Apple TV and Apple Music. In contrast to its {hardware} income, which fluctuates, providers has extra of a subscription-model really feel to it, which is nice to stability out the extra cyclical aspect of the enterprise.

However is that sufficient to justify buying the inventory?

The numbers do not add up for the inventory

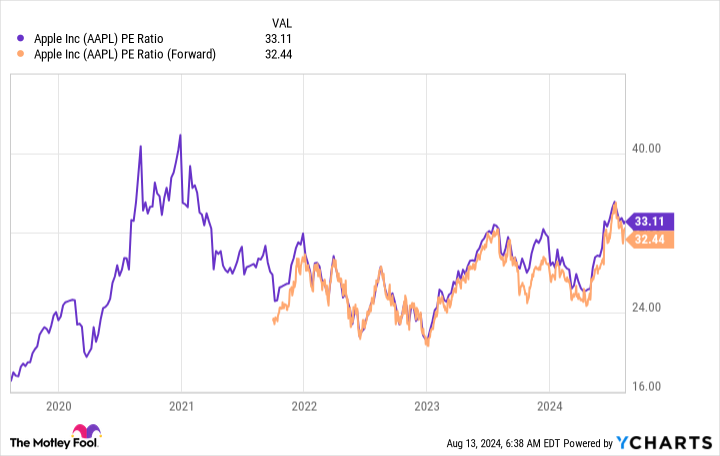

Premium corporations commerce for premium valuations. Some corporations simply have such excessive execution that buyers are keen to pay up for them. Apple has been on this place for some time, however I would wish to problem that notion.

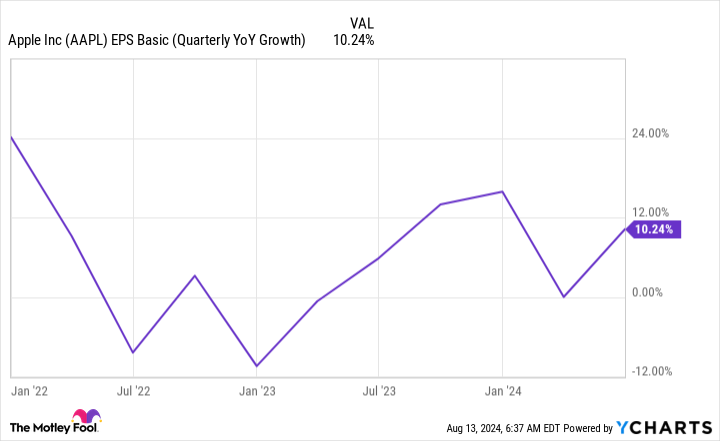

Its income progress has been poor, and whereas its earnings progress has considerably saved up with the overall market, it nonetheless struggles to put up double-digit will increase.

With Apple approaching three years of uninspiring outcomes, I am assured it does not deserve its premium.

At 32 occasions ahead earnings estimates and 33 occasions trailing earnings, the inventory is as costly because it was in early 2021. At the moment, income was rising by 50%, with earnings doubling yr over yr. Apple was definitely worth the premium buyers paid then, however the present Apple shouldn’t be.

Its buyers are holding on to the concept Apple Intelligence, the corporate’s generative AI product, will probably be a must have and trigger shoppers to improve to the newest iPhone. As a result of this characteristic can solely be run on the newest technology of telephones, it might trigger an improve wave. However that is not assured and would not do a lot for the inventory moreover a one-time wave of demand.

There are a lot better tech investments. Microsoft trades at nearly the identical valuation but has constantly posted double-digit income and earnings progress. Or you could possibly take a look at Meta Platforms, which is cheaper and rising extremely rapidly (rising income by 22% within the second quarter and earnings by 75%).

Apple is simply too costly and never performing in addition to it must to justify its valuation. At these costs, there are far too many higher corporations to put money into, and I believe buyers ought to put their cash there as an alternative.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Apple wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Meta Platforms. The Motley Idiot has positions in and recommends Apple, Meta Platforms, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 Inventory I Would not Contact With a 10-Foot Pole, Even After the Market Promote-Off Dropped Its Worth was initially printed by The Motley Idiot