In contrast to many friends, shoppers have largely caught with him, a present of religion at a time when different managers are getting chased out of a market dominated by a small coterie of tech mega-firms.

The Russell worth index has lagged its progress counterpart in all however two years since 2012. Earlier in 2024, it sank to a document relative low as chipmakers and software program shares rallied amid the artificial-intelligence craze.

In flip, the inhabitants of actively managed funds devoted to worth peaked close to 1,100 in 2015 and has since fallen 15%, in keeping with knowledge compiled by Bloomberg Intelligence mutual fund analyst David Cohne.

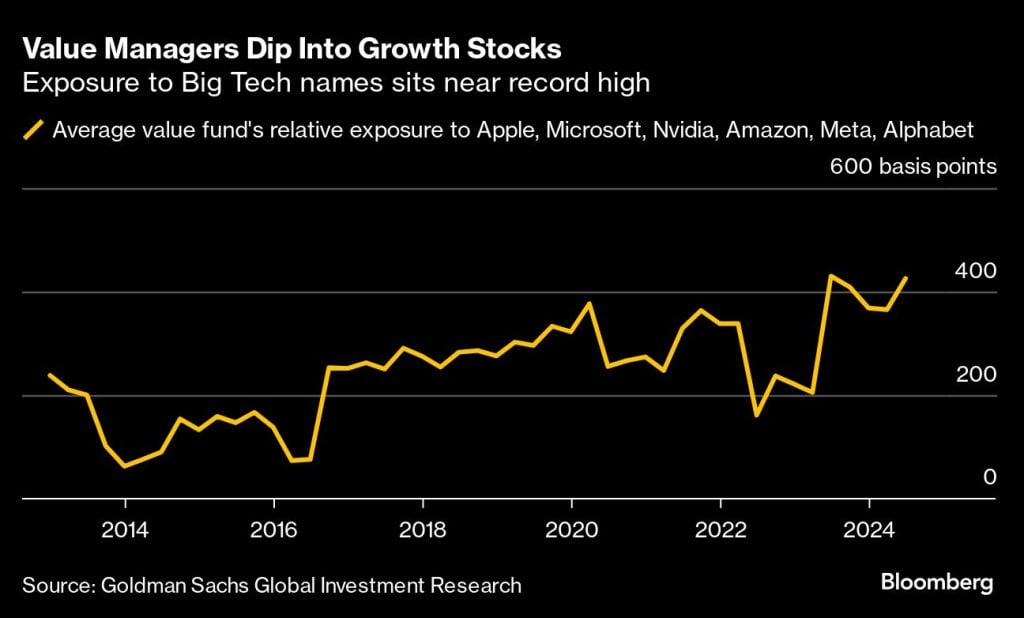

Those who survived have been leaning into expertise equities, principally progress names. As of the tip of June, the typical large-cap worth fund was over-exposed to the group — which incorporates Apple, Microsoft, Nvidia, Amazon.com, Meta Platforms and Alphabet — by 426 foundation factors, the second highest quarterly studying since at the very least 2012, knowledge compiled by Goldman Sachs Group Inc. present.

Nonetheless, whether or not a inventory is a discount depends upon who’s judging it. Worth could be sliced and diced endlessly and index suppliers can’t agree on a definition. Some worth managers seem to have taken benefit of selloffs lately to snap up tech shares seen as extra moderately priced and held them since.

But the widespread observe by this cohort going after progress shares highlights stresses in momentum-driven markets, like right now.

Nonetheless, whether or not a inventory is a discount depends upon who’s judging it. Worth could be sliced and diced endlessly and index suppliers can’t agree on a definition. Some worth managers seem to have taken benefit of selloffs lately to snap up tech shares seen as extra moderately priced and held them since.

But the widespread observe by this cohort going after progress shares highlights stresses in momentum-driven markets, like right now.

Managers who underperform “lose property, they lose their jobs,” mentioned Cullen. “There’s stress on folks to cheat or what have you ever — to stretch it.”