On September 29, 2023, Mr. Pabrai began the Pabrai Wagons Fund (WAGNX/WGNIX), a ‘40 Act mutual fund, providing retail buyers a car to put money into his inventory concepts.

Mohnish Pabrai, quoting ChatGPT, is a worth investor closely impressed by Warren Buffett and Charlie Munger, with a deal with long-term, concentrated bets on undervalued corporations. He based Pabrai Funding Funds, the place he manages personal partnerships that mirror Buffett’s strategy, usually emphasizing the significance of persistence and low-risk, high-return alternatives.

He has written two notable books:

- The Dhandho Investor: The Low-Danger Worth Technique to Excessive Returns (2007)

This e-book outlines his funding philosophy. The time period “Dhandho” refers back to the idea of enterprise in Gujarati, and Pabrai presents a easy, low-risk methodology to reaching excessive returns by worth investing. - Mosaic: Views on Investing (2004, out-of-print)

This e-book is a group of Pabrai’s writings, the place he shares his ideas on investing, together with classes discovered from profitable buyers like Warren Buffett and Charlie Munger. It affords insights into his private funding philosophy and techniques.

I had learn one in all his books, The Dhando Investor, and was conscious of his friendship with Charlie Munger. I had heard him on worth investing podcasts, listened to a few of his inventory investments, and admired his philanthropy work in India.

Mr. Pabrai has fairly a following within the funding neighborhood and his Pabraisms are sometimes quoted. One I heard lately was “At all times make investments when the market is closed”, adopted by “Take a nap on daily basis”.

I first learnt concerning the Wagon fund by Twitter, the place a focused commercial informed me:

- The S&P 500 Index of US equities presently trades at a trailing P/E of about 27.5x earnings, equivalent to 2000 and considerably concerning the S&P’s 16x long-term common earnings a number of.

- When the P/E was this excessive in 2000, for the subsequent 11+ years, dividends included, buyers made no cash within the S&P 500. The present valuations could possibly be an issue going ahead.

- In juxtaposition, the Wagon Fund carries a portfolio of outstanding world companies, which at the moment commerce at a mean P/E of seven.5x

- Thus, the Wagon Fund is well-suited to outperform the S&P 500 going ahead.

Intrigued by the pitch, I researched the fund’s web site, following which, I reached out to Mr. Pabrai. David Snowball and I met with Mr. Pabrai over Zoom in the midst of September 2024 to study extra concerning the Wagon Fund. What follows is a component evaluation, half Q&A, paraphrased for print.

On this article, we’ll first hear from Mr. Pabrai about his causes for beginning a mutual fund, and we’ll dive into the inventory portfolio of the fund. Subsequent, we’ll have a look at the fund construction and among the challenges on this scenario. I conclude with my tackle the fund’s advantage for potential buyers.

A “Devesh Q and Mohnish A” trade

Q: Why did you begin the Wagon Fund?

MP: I function a number of personal funding partnerships, however the most variety of buyers that we will have in these partnerships is between 100 to 5 hundred. Many particular person retail buyers have reached out to put money into my methods. The personal funds have a excessive minimal funding within the hundreds of thousands of {dollars}. To fulfill the decrease minimums appropriate for small buyers, I began the Wagon Fund, a democratic product.

Q: What are the property underneath administration?

The personal funds have over one billion in property managed by me. The Wagon fund is simply getting began and has round 39 million {dollars} in Belongings (as of Sep ’24, 2024).

Q: Are the returns of the Personal funds out there to buyers so we will study extra about your investing historical past?

(Mr. Pabrai didn’t provide particular numbers for the reason that funds are personal however let on that the funds have outperformed the S&P 500 over the long term, albeit with increased volatility).

Q: What comparisons are you able to draw between the Personal funds and the Wagon fund?

MP: The personal funds are extremely concentrated holding 10 positions. The Wagon Fund holds about 27-28 positions. Mutual Fund laws about diversification require us to run it in a different way than the privates. I’ve a restricted variety of good concepts and thus most of the shares overlap between the funds.

Q: How have you ever utilized Buffett-Munger learnings to inventory concentrations in your personal investing?

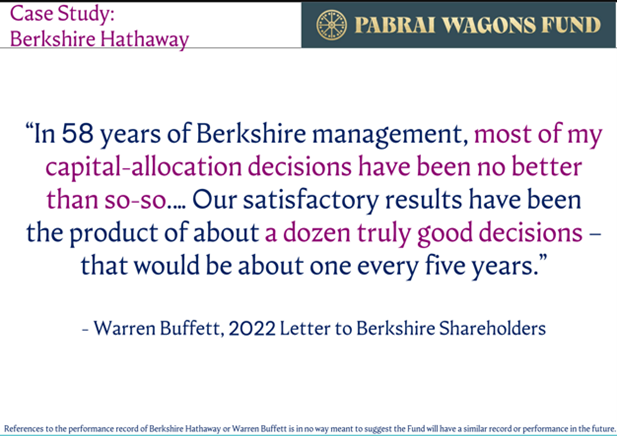

MP: We did a deep dive on each choice made by Berkshire Hathaway since 1965. If we depend Buffett’s personal investments, the general public firm shares he purchased, and essential personnel hires, Berkshire Hathaway has made about 300 vital choices over six a long time. In his 2022 Annual Letter, Mr. Buffett wrote that solely a few dozen choices have been answerable for virtually all of the returns of Berkshire.

We’re speaking a few dozen nice choices out of 300 vital investments. That could be a 4% hit price.

And we’re speaking about GOD right here (referring to Mr. Buffett).

What probability can we mortals should outperform the market? It’s robust. The essential lesson is when alternative knocks, we need to have excessive conviction, guess huge, after which maintain the funding ceaselessly.

Q: Wanting on the allocation of the inventory portfolio within the Wagon Fund, it seems that the fund holds 35% Turkish shares and 60% US shares. Is your mandate to be (1) a International Fund (like Moerus International MOWIX) (2) an EM fund with US publicity (like Artisan Growing APDYX) or (3) a deep worth fund?

MP: Not one of the above. Our solely mandate within the Wagon Fund is to earn cash.

(On the subject of Turkey), the fund has investments in sure shares. They occur to be in Turkey. However I didn’t begin with the concept of shopping for one thing in Turkey.

Q: How would you finest categorize the Wagon fund?

Consider the Wagon fund (and the personal partnerships) as an Anomalies Fund – my strongest views on the place Mr. Market is flawed and created a giant anomaly, permitting me to speculate.

Broadly talking, the Wagon fund’s investments include 6 buckets:

-

- Coal shares (Arch Assets, Alpha Metallurgical Useful resource, CONSOL Vitality, Warrior Met Coal), characterize about 20% of the portfolio.

- US Homebuilders (Pulte, Toll Brothers, Tri Level houses) about 10% of the portfolio

- US Automotive Sellers (together with Asbury Automotive, Penske, Lithia) are about 19% of the portfolio. Right here’s the rationale for our funding on this bucket:

- Markets anticipated Electrical Autos (EVs) to turn out to be a big portion of the automobile fleet, that these EVs could be offered instantly, and these automobiles wouldn’t require servicing.

- We’re not seeing that degree of migration to EVs. The OEMs (the automobile producers) will not be going to bypass the seller community and plenty of of them are locked into these contracts. In any case, sellers don’t make that a lot on automobile gross sales.

- What the market obtained flawed is that the lifetime servicing of an EV is just like Inner Combustion Engine (ICE) automobiles.

- We concluded that Automotive sellers, which had been buying and selling at 5-7x Earnings had been too low-cost. We constructed a place in the very best names we may discover.

- Automotive dealerships are an instance of a contrarian, deep-value guess.

- Our 4th bucket is TAV Havalimanlari Holding: That is the Turkey Airport Holdings Firm, a 12% holding for the Wagon Fund. Thesis:

- Begin with only one airport.

- Throughout COVID, TAV purchased the Almaty airport in Kazakhstan when the passenger site visitors was zero for $400mm. They put in one other $250mm to construct a brand new terminal. The $650mm funding was financed at 4% for 30 years and with a $150mm Fairness funding.

- 95% of the airports world wide are owned and operated by Governments.

- Even when airports are personal, they function on BOT (Construct, Function, Switch), that’s, the airport goes again to the Authorities after 20-30 years.

- In distinction, the Almaty airport license is everlasting (he mentioned, 10,000 years).

- Quick ahead to 2024: Money Circulate from Almaty will probably be $150-200 mm rising at 15-20% per 12 months.

- TAV operates 15 airports throughout 8 nations. It offers a variety of providers along with airport administration, together with duty-free operations, floor dealing with, and different aviation-related providers.

- The inventory’s Fairness Market Cap was $800mm after we invested and is $2.8Bn at the moment.

- Why would I ever need to promote TAV Holdings when it pays for itself many occasions over? I can’t discover companies like these on the NYSE.

- Bucket quantity 5 is the Turkish Coca Cola Bottling Firm, Coca Cola Icecek. We personal inventory in Icecek (the bottling firm), in Anadolu Grubu Holding (the father or mother firm), and Anadolu Efes Biracilik ve Malt Sanayii AS ORD (the holding firm) for a complete allocation of 25%. Via the father or mother and holding firm, the fund additionally has publicity to varied companies in that area. The publicity provides us possession of the biggest beverage and beer distributor in Ukraine and Russia. The enterprise trades at a really affordable valuation.

- Mongolian Mining (which Pabrai talked about in depth) represents a excessive money movement enterprise buying and selling at low Free Money Circulate multiples. Together with Occidental Petroleum, and a smidgen of Amazon and Microsoft, the portfolio is usually spoken for.

These are my nice concepts for now. My two analysts and I’ll spend months diving deep into every firm earlier than investing.

Q: Do you anticipate the Wagon Fund to beat the S&P 500? What about Berkshire Hathaway?

MP: First, let’s speak about why the S&P 500 Index is unbeatable.

The index is a factor of magnificence as a result of it’s so DUMB.

Take, for instance, NVIDIA. The Index has been lengthy NVIDIA since 2001 and fortunately by design is simply too dumb to have offered the inventory. In the meantime, lively managers have purchased and offered NVIDIA from their portfolio quite a few occasions.

Bear in mind the lesson from Berkshire just isn’t the shopping for of nice corporations which creates funding greatness. It’s the half one stays invested in that permits for compounding.

Each Buffett and Munger have publicly disclosed they don’t anticipate Berkshire to outperform the S&P 500. The dimensions of the stability sheet is just too giant to speculate and acquire an edge versus the S&P.

For the Wagon fund, I wish to underpromise and overdeliver. I hope the fund will beat the S&P by 1% to three% over the long term. And since I don’t assume Berkshire can outperform the S&P anymore, it follows I anticipate the fund to outperform Berkshire too.

On the finish of the decision …

Within the ninety-minute Zoom name, Mr. Pabrai delved deep into his evaluation of Mongolian Mining and a few of his Canadian Metal investments round 2005. He was making the purpose that he has a historical past of discovering shares that Mr. Market has mispriced. He finds them, invests huge, and sits on these corporations.

I imagine Mr. Pabrai is a high-quality investor, has a knack for locating areas the place Mr. Market affords anomalies, and may determine stable companies. The Wagon fund seems promising.

However this fund just isn’t for everyone.

There are a number of challenges on the Enterprise aspect.

Points/Challenges for Wagon Fund buyers:

-

-

-

Key man threat. That is the Pabrai Wagon Fund.

If Mr. Pabrai will get hit by the proverbial bus, the fund has no future. There are two analysts, however this isn’t a crew, the place one other Portfolio Supervisor with Mr. Pabrai’s gravitas can take over.

-

Buying and selling precedence between privates and Wagon Fund.

Q. Since Mr. Pabrai operates personal funds and this mutual fund, which funds get precedence to commerce? Is there a battle of curiosity?

MP:

- We’ve got labored on an answer whereby every fund will get a precedence in the future per week. Monday could be Personal Fund 1, Tuesday Personal Fund 2, Wednesday Wagon Fund, and so forth and so forth. The concept is that every day one fund will get first dibs to speculate out there.

- There isn’t a lot buying and selling happening day after day. We make investments and sit on shares for a very long time.

- The Personal fund buyers can solely redeem every year on the finish of the 12 months. Whereas Public funds present day by day liquidity by regulation. By design, the general public funds win in liquidity on the exit.

- It takes 6-9 months to speculate slowly in some enterprise. Bear in mind it took Berkshire eighteen months to put money into the Japanese buying and selling homes.

Evaluation: The concept of rotating liquidity first dibs is pragmatic, however I don’t know the way comfy many buyers will probably be with such a mechanism.

-

Dimension limits to investments?

-

Suppose the Wagon fund would turn out to be a Billion-dollar fund. Do Turkish shares have that form of day by day buying and selling quantity and liquidity? Suppose there’s a market crash and there are redemptions within the Wagon Fund, will you be capable of promote these identical shares to match outflows (if it took 6-9 months to get into these shares).

MP: Firstly, this can be a theoretical, not an actual downside. The Wagon Fund solely has $39 million in property. Second, can set up Strains of Credit score with Banks, so we may use that liquidity to fulfill Outflows if wanted. Third, we personal different shares within the US. We will promote these first to lift the cash to fulfill outflows.

Evaluation: Neither Berkshire Hathaway nor the personal funds are pressured to promote shares in a crash. Their capital is everlasting and locked respectively.

Alternatively, the Wagon Fund is a day by day liquidity product. concentrated investing is a dual-edged sword. When the market goes in your favor, the fund will mint cash and compound at extraordinary charges. When the market goes in opposition to you, the underside falls out. The Wagon Fund will undergo from illiquidity as a nature of its bets.

As a working example, Mr. Pabrai talked about that Personal funds had been down as a lot as 60-70% within the Nice Monetary Disaster of 2008-2009. They did bounce again and had been up roughly 20% by the tip of 2009. Ergo, buyers must be buckled up when investing on this fund when the market is in tough waters.

-

Potential threat of sharper drawdowns than the market

Mentioned Mr. Pabrai, “If you maintain 10 shares within the Personal funds’ portfolio, it’s sure to be extra risky than the S&P 500, which has 500 shares. One in every of our funds in 2008 was a sub-prime funding, which went to zero. When that’s 10% of the portfolio, you get hit.”

Mr. Pabrai added, “Ted Weschler (one of many two Berkshire Teds) was additionally down 70% within the GFC and Buffett nonetheless employed him.”

-

For retail buyers contemplating the Wagon fund, it’s essential to remember the fact that even the good buyers have giant drawdowns and have shares that go to zero. Their greatness just isn’t as a result of they’re good at controlling drawdowns. Quite, it’s as a result of they discover companies that can survive the financial cycles, they usually purchase such companies at nice valuations (and maintain them ceaselessly).

Putting the Stability between Causes to Purchase and Causes to Keep away from

Traders are being offered with entry to a high-quality, deep-value, storied investor, within the type of Mr. Pabrai. The fund’s portfolio is completely different than the Magazine 7, not ridiculously diversified like some index funds, and never invested for the sake of filling buckets. It’s constructed meticulously.

However this entry comes with caveats on the enterprise aspect.

Pabrai hasn’t run a mutual fund earlier than. He’s the Keyman for the fund. Conflicts between personal and public funds, liquidity in worldwide markets, and the correlation between concentrated portfolios and drawdown measures are all on the desk.

Mr. Pabrai would argue my considerations are theoretical. I agree. However it’s my responsibility to level out considerations for potential buyers.

I’m going to put money into the Wagon fund as a result of I like a differentiated portfolio, and I feel Mr. Pabrai has large funding acumen.

However it can’t be a giant place.

I would really like the fund to season and fine-tune on the enterprise aspect – construct an even bigger crew with a seasoned quantity two. I need to see how the fund performs in a market correction – the way it handles outflows and manages liquidity in Turkish shares. And I’d wish to see if the general public vs personal funds create conflicts.

It’s not a fund for everybody, however for these with additional funding capability, and a want to miss the teething issues of the mutual fund, it is likely to be a good suggestion to circle the wagons.

-