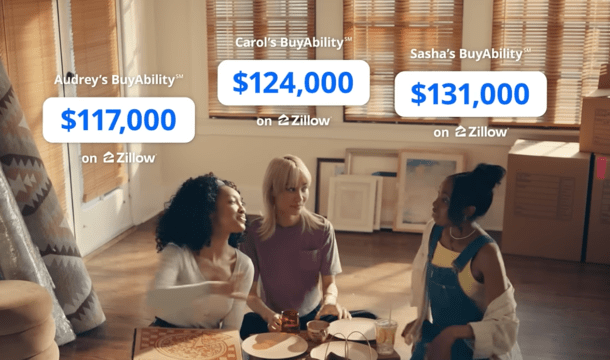

Lately, Zillow started airing a industrial known as “House owner Mates.” It depicts three ladies shifting into a house collectively.

It exhibits their particular person “BuyAbility” adopted by “Your BuyAbility,” the latter of which mixes the buying energy of all three.

The three ladies have particular person shopping for energy of $117,000, $124,000, and $131,000, however a mixed $372,000 when pooled collectively.

This apparently permits them to go in on that near-$400,000 dwelling buy, regardless of not being wherever shut on their very own.

Whereas having co-borrowers does certainly increase your buying energy, the query is it a good suggestion when it’s a pal (or two)?

It’s Onerous Sufficient to Purchase a Residence on Your Personal

Once I first noticed this industrial, I used to be fairly stunned. It felt considerably irresponsible, and quite a bit associated to the present housing market being unaffordable for many.

For me, that doesn’t imply forcing your method into a purchase order. It’d imply holding off in your homeownership objective, saving up more cash, maybe hoping for a increase, and usually getting all of your geese in a row.

Oh, and perhaps reducing your most buy value to one thing you may really afford!

As an alternative, Zillow presents a resolution to only discover a couple shut mates and purchase the home at the moment.

It just about ignores what occurs after the mud settles and the shifting containers are unpacked.

It doesn’t get into what occurs when one of many roommates needs to maneuver out. It additionally seemingly glosses over who will get what room, or what occurs if one of many co-owners loses their job.

Merely put, it presents a really simplistic view of homeownership, with out giving us the entire image, which might get fairly darkish in a rush.

Finally, it’s exhausting sufficient to be a house owner with out having to debate all of the what ifs with two different individuals.

It’s an enormous resolution to purchase vs. lease, and exponentially extra difficult when you multiply that by three people.

Houses Are Too Costly for Many People Proper Now

Making all of it a lot worse is that this industrial solely exists as a result of homeownership has fallen financially out of attain for a lot of People.

Clearly the individuals behind the advert acquired collectively and stated what are the principle ache factors for potential dwelling patrons proper now?

They usually seemingly all agreed that it’s too costly for many to purchase a house because of a mix of excessive dwelling costs and elevated mortgage charges.

However as a substitute of recognizing this, they discovered a inventive workaround to deal with the affordability piece, no matter what the result is perhaps.

Paradoxically, the industrial says, “That’s when shopping for a house acquired actual.” When the three ladies pooled their incomes collectively to make it work.

Sadly, they most likely don’t understand how actual is will develop into after residing collectively and paying the mortgage for a 12 months.

It’s exhausting sufficient to lease with a pal with out going through all types of pitfalls. To purchase a house with a pal and accomplish that efficiently sounds just like the feat of all feats.

In different phrases, it most likely gained’t go properly for many. And the way do you even work out who will get what if somebody needs to maneuver out?

This all sounds so advanced, but is juxtaposed by the three ladies consuming pizza and joking about one in all them breaking the opposite’s vase.

My guess is that might be an afterthought as soon as actual issues reared their ugly head.

Possibly It’s Simply Not the Proper Time to Purchase a Residence…

As I wrote in my different piece, Marriage and Mortgage Could Not Combine, it’s completely fantastic to lease initially, particularly in case your wedding ceremony date and the housing market circumstances don’t precisely line up.

The identical is true right here. There doesn’t have to be a rush to purchase, nor do you have to power the problem if it doesn’t really feel fairly proper. Or just doesn’t pencil.

Whereas I’m an enormous advocate of homeownership and imagine it brings with it loads of positives, it’s not for everybody. Neither is it at all times the fitting time.

I’d personally by no means purchase actual property with mates, and doubtless not even with household when it got here all the way down to it.

Take the time to essentially assume it by when you’re contemplating this. What’s going to it appear to be to personal a house along with your pal(s) a 12 months from now, three years from now, or 5? Will you promote sooner or later or lease it out?

You’re going to want a critical plan when you count on to drag one thing like this off. Even those that bought a house not too long ago on their very own are feeling the warmth.

Now think about a number of individuals coping with conflicting feelings on the similar time. It’s not for the faint of coronary heart.