Tata Energy Firm Ltd – Power is progress

Included in 1919, Tata Energy Firm Ltd., primarily based in Maharashtra, is a serious participant in vitality, overlaying thermal, hydro, photo voltaic, wind, and hybrid options. As of Q1FY25, it has 8.8+ GW in thermal and 11.4+ GW in clear vitality capability (together with 5.3 GW within the pipeline). For 9 years, it’s been India’s high photo voltaic rooftop EPC firm with an order ebook exceeding Rs.15,000 crore and holds a robust worldwide presence in Central/South Asia and Africa.

Merchandise and Companies

Tata Energy operates below these key enterprise clusters:

- Renewables: Photo voltaic, wind, hybrid property, photo voltaic module manufacturing, and photo voltaic EPC.

- New-age Power Options: Provides rooftop photo voltaic, EV charging, microgrids, and residential automation.

- Transmission and Distribution: Covers 4,626 Ckm of transmission traces, serving 12.5 million prospects (FY24).

- Era: Contains hydro and thermal energy crops.

Subsidiaries: As of FY24, Tata Energy has 91 subsidiaries, 29 joint ventures, and 6 affiliate corporations.

Development Methods

- Increasing Order E book: Partnered with Druk Inexperienced Energy for a 600 MW hydro plant in Bhutan (Rs. 6,900 crore venture). Received a 765 kV transmission venture in Odisha. Signed an settlement with Maharashtra to develop 2,800 MW Pumped Hydro Storage (Rs. 13,000 crore). MoU with Rajasthan for Rs. 1,200 crore in energy investments.

- Renewable Power Enlargement: Launched 4.3 GW photo voltaic cell and module plant in Tamil Nadu, holding 20% market share in photo voltaic rooftop and utility-scale segments.

- Hybrid Initiatives: Creating a 966 MW solar-wind hybrid plant to produce Tata Metal with round the clock renewable vitality.

- Web Zero Purpose: Concentrating on internet zero earlier than 2045, transitioning from thermal to renewable property.

- Clear Power Development: On observe to realize a 15 GW clear vitality portfolio inside 5 years.

Q1FY25

- Income: Up 12% to Rs. 16,810 crore (from Rs. 15,003 crore in Q1FY24).

- EBITDA: Elevated by 11% to Rs. 3,350 crore (vs. Rs. 3,005 crore in Q1FY24).

- Web Revenue: Grew by 4% to Rs. 1,189 crore.

- Capex: Spent Rs. 4,000 crore, with 60% in renewables and 40% in transmission and distribution.

- Credit score Score: Improved to AA+ steady by ICRA and CARE.

FY24

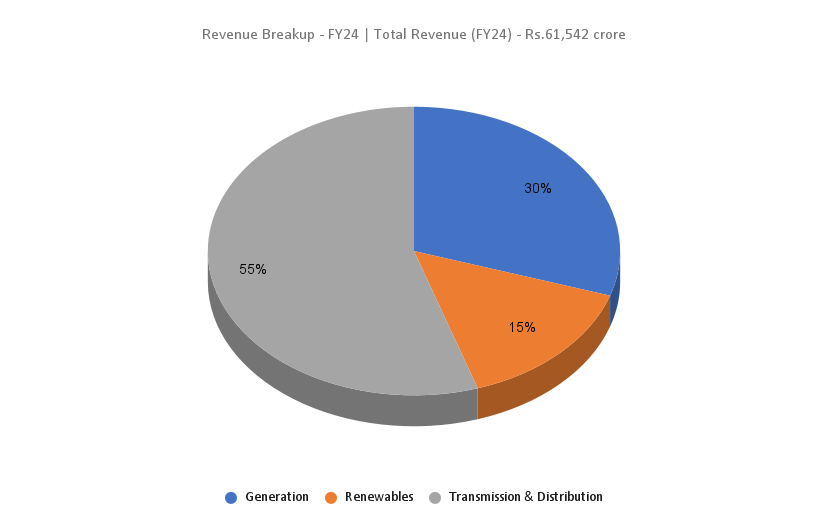

- Income: Elevated by 10% to Rs. 61,542 crore.

- Working Revenue: Grew by 26% YoY to Rs. 12,701 crore.

- Web Revenue: Up by 12% YoY to Rs. 4,280 crore.

- Transmission Initiatives: Received two initiatives value Rs. 2,300 crore.

- Energy Era: Produced 64,600 MUs, with 22% from clear and inexperienced sources.

- Milestone: Grew to become the primary built-in energy firm with authorised Science Based mostly Targets Initiative (SBTi) targets.

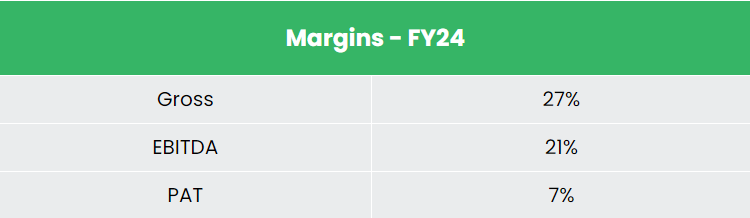

Monetary Efficiency (FY21-24)

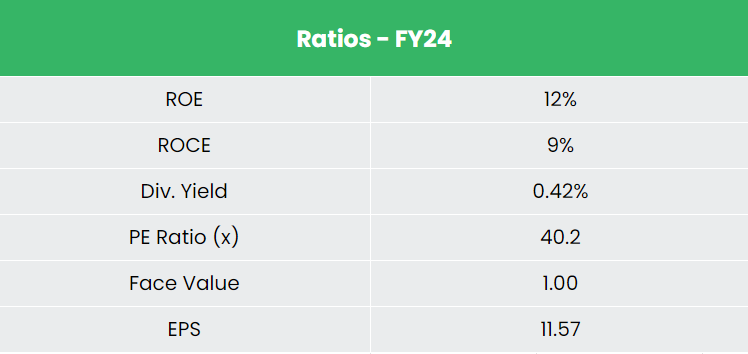

- CAGR (FY21-24): Income grew at 23% and PAT at 44%.

- ROE & ROCE: Common of roughly 11% every over the 3-year interval.

- Debt-to-Fairness Ratio: Stands at 1.66.

Business outlook

- Rising Demand: India’s vitality demand anticipated to outpace different nations on account of measurement and development potential.

- Numerous Power Sources: Contains typical (coal, lignite, pure fuel, oil, hydro, nuclear) and non-conventional (wind, photo voltaic, agricultural, home waste) energy era.

- International Rating: India is the third-largest producer and client of electrical energy worldwide.

- Web Zero Dedication: Goals for internet zero carbon emissions by 2070 and 50% of electrical energy from renewable sources by 2030.

- Capability Enlargement Wanted: Vital will increase in put in producing capability are required to satisfy rising electrical energy demand.

Development Drivers

- Elevated Authorities Funding: The 2024 Finances allocates 50% extra funds YoY for energy sector initiatives, specializing in inexperienced hydrogen, solar energy, and green-energy corridors.

- International Direct Funding (FDI): 100% FDI permitted below the automated route for energy era (excluding atomic vitality), transmission, distribution, and energy buying and selling.

- PLI Scheme for Photo voltaic PV: Rs. 24,000 crore Manufacturing-Linked Incentive (PLI) scheme launched for photo voltaic PV manufacturing below the AatmaNirbhar Bharat initiative.

Aggressive Benefit

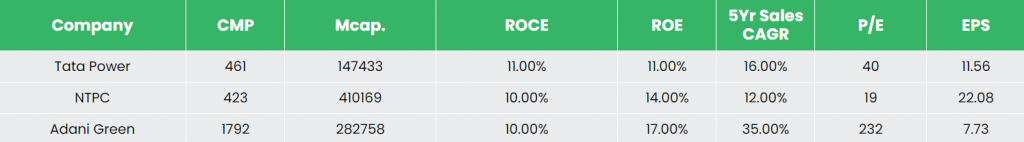

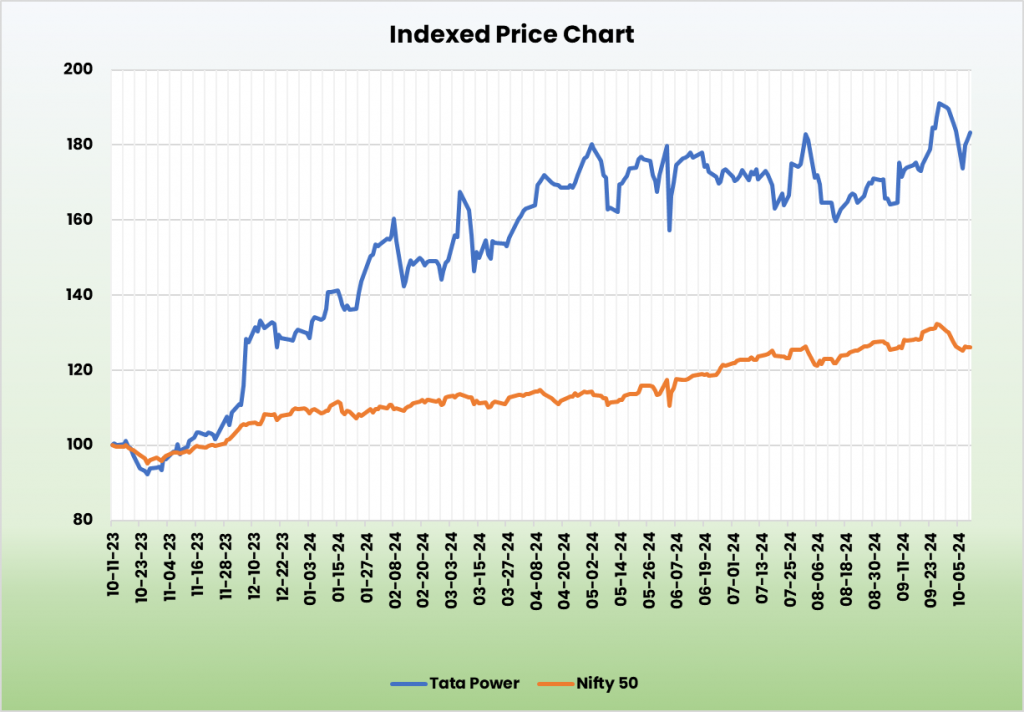

Tata Energy stands out amongst rivals like NTPC Ltd and Adani Inexperienced Power Ltd as probably the most undervalued inventory, delivering steady returns on capital and demonstrating wholesome income development.

Outlook

- Power Demand: There’s a world precedence for constant and protected vitality for all.

- Tata Energy’s Place: With a rising order ebook, strategic development initiatives, modern providers, and large-scale operations, Tata Energy is a key participant within the vitality sector.

- Market Management: Goals to keep up its management in rooftop photo voltaic set up schemes (PM Surya Ghar Program).

- Funding Plans: Planning to take a position Rs. 20,000 crore in FY25.

- Undertaking Implementation: Presently has 8 GW of initiatives below implementation.

- Innovation: Awarded a 20-year patent for its self-regenerating transformer breather.

Valuation

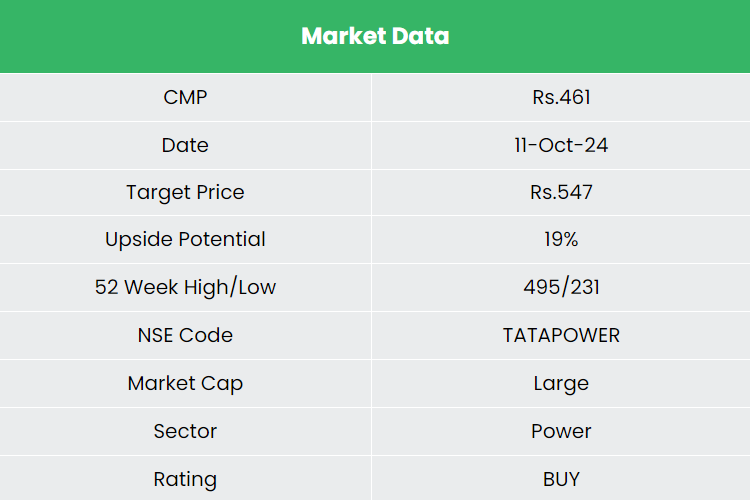

Tata Energy’s various operations, together with rooftop photo voltaic, distribution reforms, transmission alternatives, renewable vitality era, module manufacturing, and pumped storage, are anticipated to drive future development. We suggest a BUY score on the inventory with a goal value (TP) of Rs. 547, primarily based on 32x FY26E EPS.

Dangers

- Regulatory Danger: Evolving insurance policies and rules might have an effect on energy era, pricing, and market dynamics.

- Execution Danger: Delays within the execution of renewable vitality initiatives might hinder the corporate’s development.

Be aware: Please be aware that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

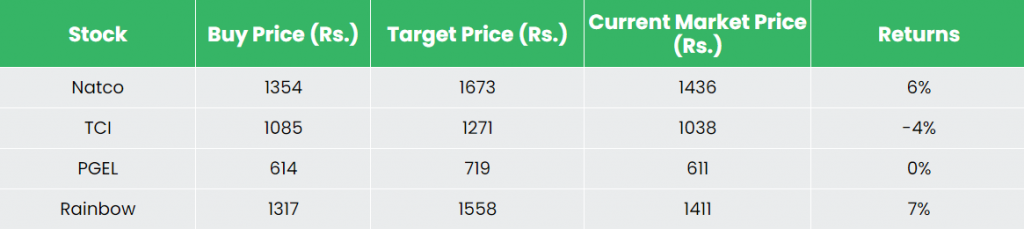

Recap of our earlier suggestions (As on 11 October 2024)

Transport Company of India Ltd

Rainbow Youngsters’s Medicare Ltd

Different articles you could like