The transient’s key findings are:

- Most individuals consider Medicare – not Medicaid – because the well being program for older People, however Medicare doesn’t cowl long-term care providers (LTSS).

- Medicaid does pay for LTSS for these with low incomes and likewise helps cowl their Medicare out-of-pocket prices.

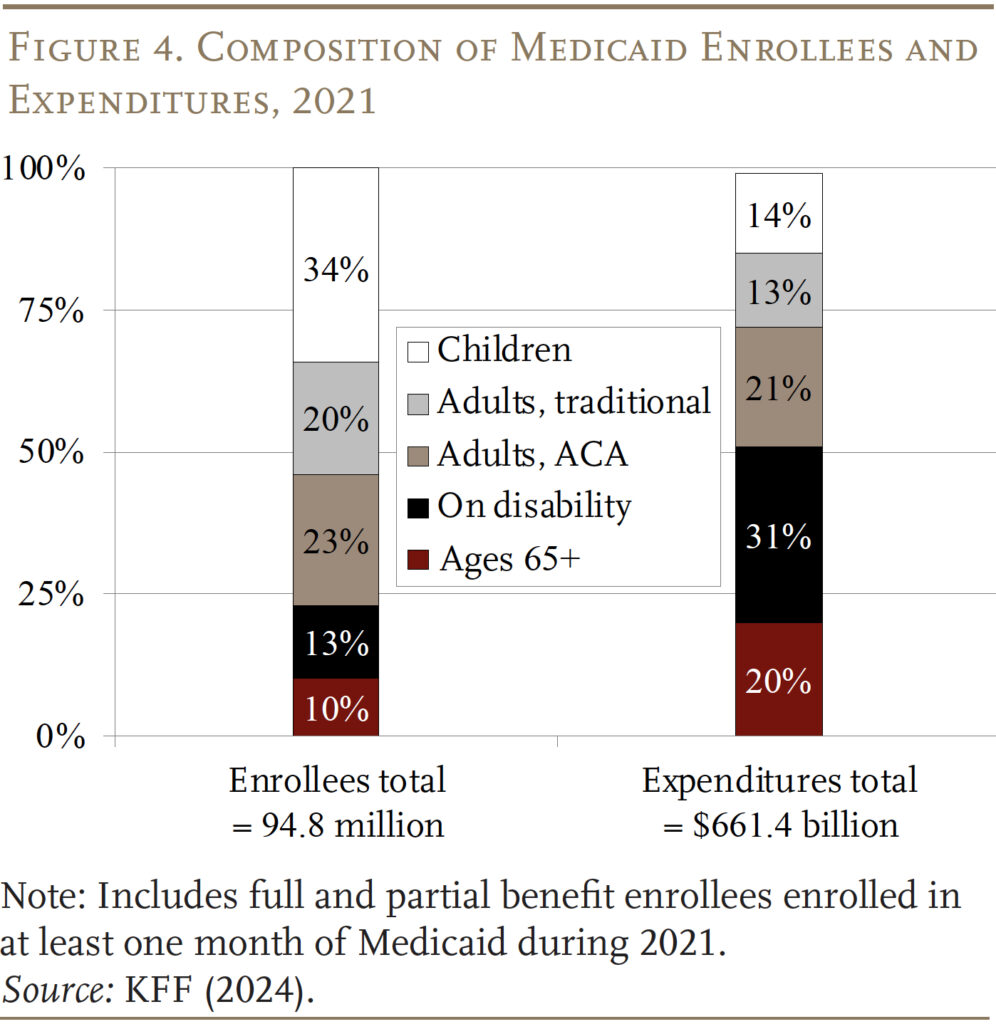

- In consequence, these ages 65+ account for 10 p.c of complete Medicaid enrollees and 20 p.c of its spending.

- Wanting forward, Medicaid might not maintain tempo with rising demand for LTSS, so a heavier burden might fall on household caregivers or extra wants might go unmet.

Introduction

Most individuals consider Medicare – not Medicaid – when contemplating authorities well being look after older People. Nonetheless, Medicaid, this system that covers the medical bills of the poor, spends over $132 billion a 12 months – 20 p.c of its price range – on people ages 65 and over. Aged beneficiaries embody each these with low incomes all through their retirement and those that turn out to be “medically needy” – that’s, fulfill Medicaid’s means checks after incurring excessive well being care bills.

This transient summarizes the character and quantity of Medicaid spending on People ages 65+ – that’s, the inhabitants already receiving advantages beneath Medicare – paperwork the way it has modified over time, and examines projections of future ranges of spending and the implications for each authorities budgets and the well-being of older households.

The dialogue proceeds as follows. The primary part describes the origins and evolution of Medicaid and compares its beneficiaries to these lined by Medicare. The second part describes the pathways via which older People can entry Medicaid advantages. The third part speculates about the way forward for Medicaid and the advantages obtainable to older People going ahead. The ultimate part concludes that Medicaid is an important part of the nation’s well being care system offering important advantages for low- and middle-income elders, however authorities projections counsel that Medicaid outlays might not maintain tempo with the growing long-term care wants of an getting old inhabitants.

A Temporary Historical past of Medicaid

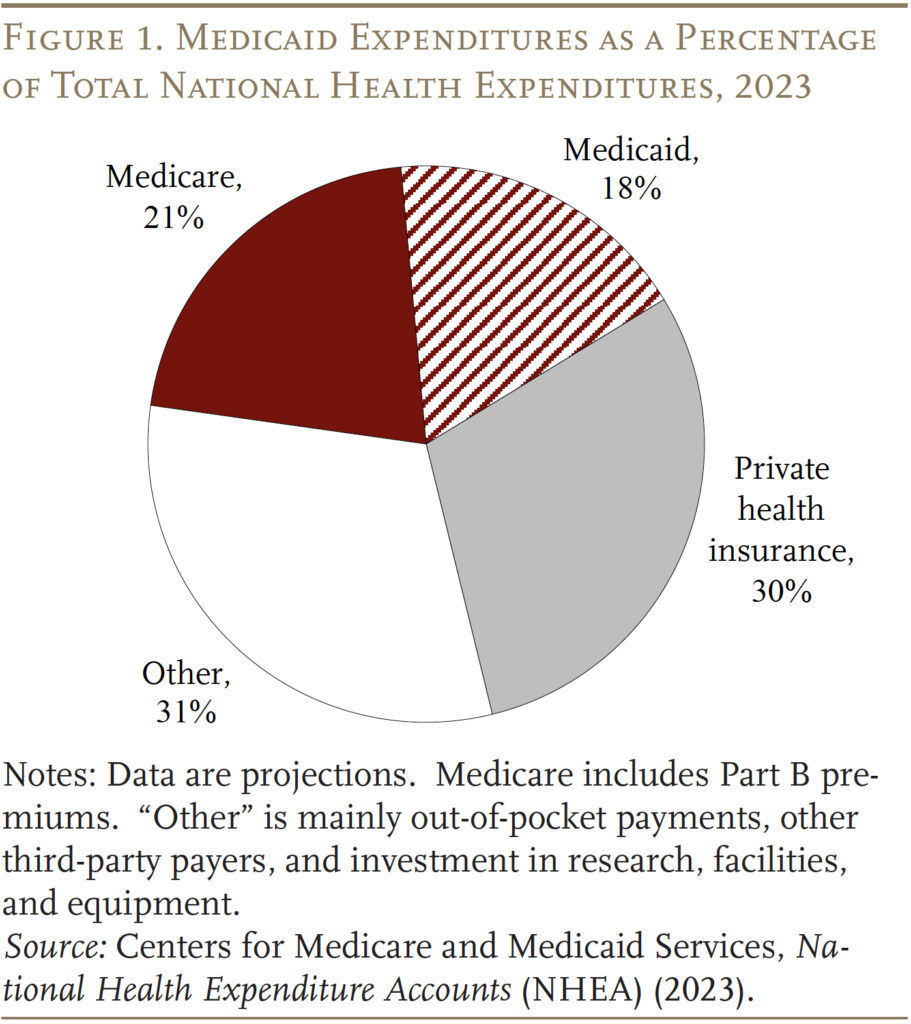

Medicaid was enacted in 1965 as a part of the identical regulation that created Medicare. Whereas Medicare covers all individuals 65 and older and individuals who obtain federal incapacity insurance coverage, Medicaid was designed to assist low-income households who traditionally couldn’t afford personal medical health insurance and to supply long-term care providers for the aged poor. In 2023, Medicare and Medicaid spending collectively accounted for 39 p.c of the nation’s complete outlays for well being care (see Determine 1).

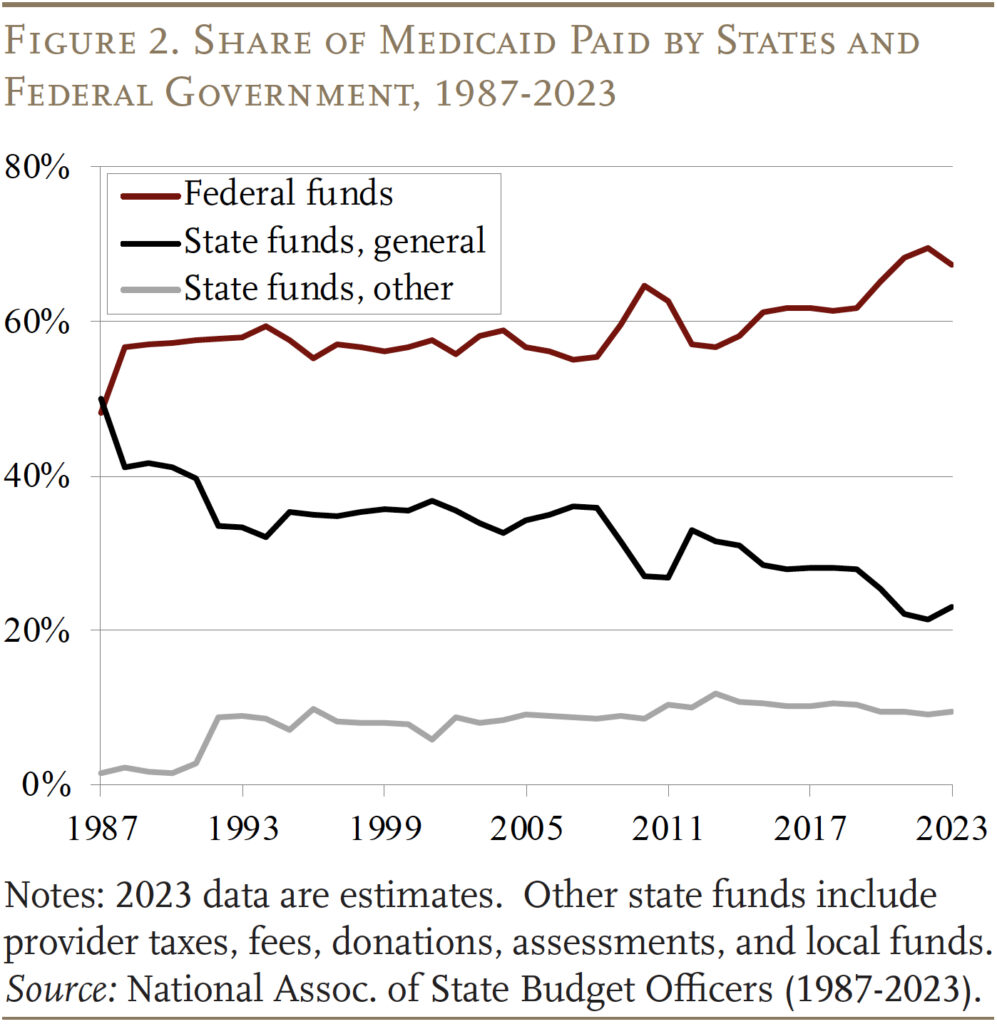

Medicaid is financed collectively by the federal authorities and the states. The federal authorities ensures matching {dollars} and not using a cap for certified providers, based mostly on a state’s earnings degree. That’s, the federal authorities supplies greater reimbursement charges to states with decrease per capita incomes, with the vary various from a ground of fifty p.c to a ceiling of 83 p.c.1 Traditionally the federal authorities has paid for 60 p.c of complete Medicaid prices, albeit this share spiked briefly to 70 p.c in 2022 because of laws enacted through the pandemic (see Determine 2).

State participation in Medicaid is voluntary, however to qualify for matching funds states should comply with broad federal guidelines for advantages and protection. (By 1980, all states had opted in.) Medicaid protection was traditionally tied to receipt of money help – both via the previous Help to Households with Dependent Youngsters (AFDC) program or the Supplemental Safety Revenue (SSI) program, which supplies advantages to youngsters and adults with disabilities and to these ages 65 and over.2 Over time, Congress expanded federal minimal necessities for state participation and offered new protection necessities and choices for states, particularly for kids, pregnant ladies, and other people with disabilities. As well as, states typically present protection that exceeds the minimal ranges set by Congress or federal guidelines.3

Furthermore, in 2010, the Reasonably priced Care Act expanded Medicaid to incorporate non-elderly adults with out dependent youngsters, who had historically been excluded from protection, with incomes as much as 138 p.c of the federal poverty line ($20,780 for a person in 2024). Whereas the Medicaid growth was successfully optionally available, as of 2024, 41 states and Washington, DC have opted in. These states obtain the next federal match price for these lined beneath this expanded eligibility possibility.

Lastly, COVID-19 additionally had an enormous impact on Medicaid spending and enrollment. Firstly of the pandemic, Congress required Medicaid applications to maintain folks constantly enrolled – relatively than requiring reenrollment (usually yearly) – in change for enhanced federal funding. In consequence, enrollment grew considerably between 2019 and 2023. These provisions began to unwind in April 2023, which has decreased the Medicaid rolls by 13 million from the pandemic peak.4

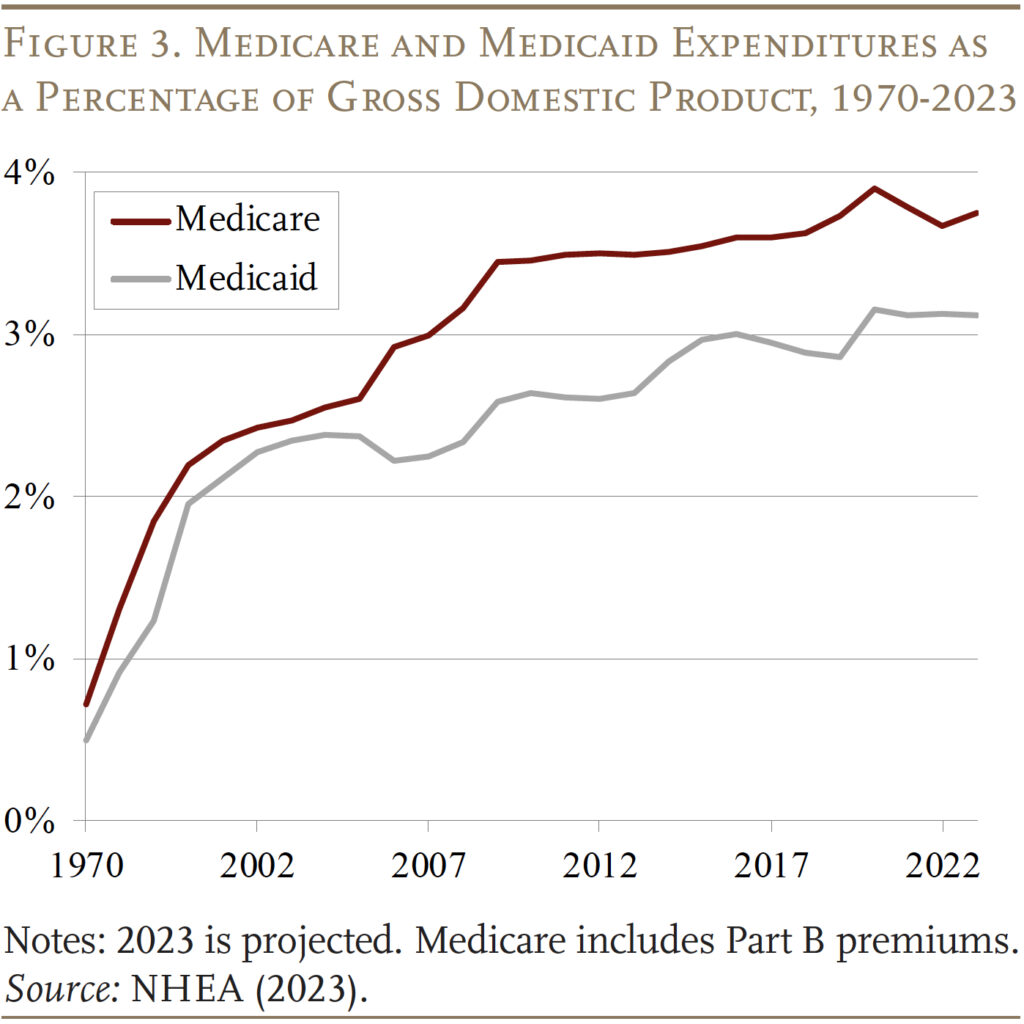

Because of the growth of the teams lined and rising well being care prices, Medicaid expenditures have now grown to three.1 p.c of GDP, however development has slowed for the reason that 2010s. Medicaid expenditures are actually nicely under Medicare expenditures, which started to rise sharply because the Child Increase began to retire (see Determine 3).

Medicaid for “the Aged”

Medicaid supplies advantages for 5 principal teams of low-income people – youngsters, adults (beneath 65) in households, adults (beneath 65) with out youngsters included beneath the Reasonably priced Care Act (ACA), people with disabilities, and people who qualify based mostly on age (65+). In keeping with the newest information obtainable – 2021 – the aged 65+ group accounted for 10 p.c of beneficiaries and 20 p.c of spending (see Determine 4).

Throughout the Age 65+ group, Medicaid beneficiaries may be categorised as “categorically needy” and “medically needy.” Most Medicaid beneficiaries are enrolled via categorically needy applications.5

Categorically Needy

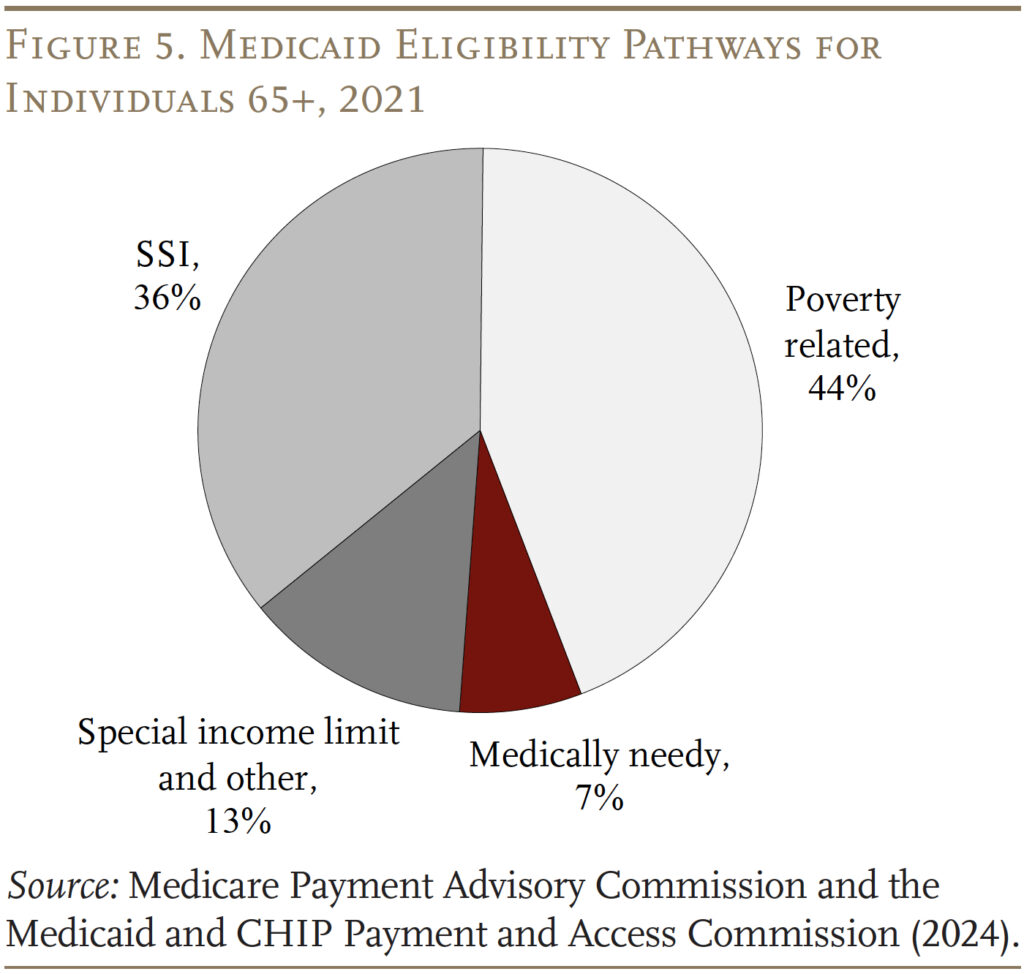

SSI Contributors. As famous above, traditionally, eligibility for Medicaid advantages has been tied to applications that present money advantages to low-income households. Within the case of these 65+, the money advantages have been offered by the SSI program. This pathway has declined in significance over time, nevertheless, for the reason that SSI earnings and asset necessities haven’t been up to date in a long time. In 2024, the utmost month-to-month SSI profit is $943 monthly for a person and $1,415 for a pair, which is 75 p.c of the federal poverty degree. SSI beneficiaries are additionally topic to an asset restrict of $2,000 for a person and $3,000 for a pair. Not surprisingly, the proportion of the 65+ inhabitants receiving SSI has dropped from 9.3 p.c in 1974 to three.7 p.c in 2024. At the moment, SSI individuals account for under 36 p.c of Medicaid 65+ beneficiaries (see Determine 5).

Poverty Associated. Happily, over 40 p.c of states have elected to increase Medicaid to seniors whose earnings exceeds the SSI restrict however is under the federal poverty degree. The majority of those states set the earnings restrict at 100% of the federal poverty line, the federal most for this pathway.

For each these eligible via SSI and the poverty-related path, states should supply Medicare Financial savings Packages (MSPs) via which low-income Medicare beneficiaries obtain Medicaid help with some or all of their Medicare out-of-pocket prices. Medicare’s out-of-pocket prices may be excessive. In 2024, Medicare Half A, which covers inpatient hospital providers, has an annual deductible of $1,632; Half B, which covers outpatient providers, requires an annual premium for many beneficiaries of $2,100 in addition to a 20-percent co-pay for providers. For Medicare beneficiaries with incomes as much as the federal poverty line, Medicaid pays Medicare Elements A and B premiums and cost-sharing. For these with barely greater incomes (100-120 p.c of poverty), Medicaid solely covers the premiums. Poverty-related standards account for the majority – 44 p.c – of complete 65+ Medicaid beneficiaries.

Particular Revenue Rule. Lastly, states are allowed to supply protection particularly for individuals who want long-term providers and helps (LTSS), together with nursing residence care. One pathway to those advantages – supplied by 42 states – is the “particular earnings rule,” which permits people with earnings as much as 300 p.c of the SSI limits to qualify for advantages. About 13 p.c of Medicaid beneficiaries qualify via this pathway.

Medically Needy

Some states additionally prolong Medicaid to “medically needy” people. Recipients should once more have property under limits that modify by state however, beneath the fundamental guidelines, are usually just like the SSI asset limits. The earnings take a look at, nevertheless, is earnings internet of out-of-pocket medical bills. After paying their medical payments, recipients should have incomes under their state’s “medically needy earnings restrict,” which tends to be under the SSI earnings restrict.6 Not all states supply this pathway, and medically needy people account for under 7 p.c of Medicaid beneficiaries ages 65+. Traditionally, the commonest impoverishing expense has been nursing residence care. Certainly, long-term care could be very costly – in 2023, the median annual prices had been $116,800 for a non-public room in a nursing residence, $64,200 for an assisted residing facility, and $75,500 for residence well being aides.7

Overlap of Medicare and Medicaid

After all, nearly all folks 65+ have Medicare, which covers hospital care, doctor providers, and pharmaceuticals. Many mistakenly imagine that Medicare covers long-term care providers, which it doesn’t. One attainable supply of confusion could also be that Medicare covers as much as 100 days of care in a talented nursing facility, after a hospital keep of not less than three days. Nonetheless, over half of Medicare-covered expert nursing facility stays are for 20 days or much less, and 90 p.c for 60 days or much less.8 Equally, Medicare additionally covers some residence well being care providers for as much as 21 days and supplies hospice care. Total, nevertheless, a lot of the care lined by Medicare is medical, short-term, and related to an acute or terminal occasion.

Medicaid is the first payer for long-term care, which incorporates not solely nursing residence care but additionally private help at residence for actions of every day residing, corresponding to consuming, bathing, and dressing, and care offered in assisted residing settings. Lately, the setting for such care has shifted away from institutional care in nursing houses and moved towards home-and-community-based providers (HCBS), which embody care offered in folks’s houses, grownup day care facilities, assisted residing preparations, and group houses.9 The shift displays the preferences of the beneficiaries and necessities for states to supply providers within the least restrictive setting attainable.10 It could additionally maintain fiscal prices in test each by avoiding fee for the room-and-board part of institutional care and by growing reliance on unpaid household care.

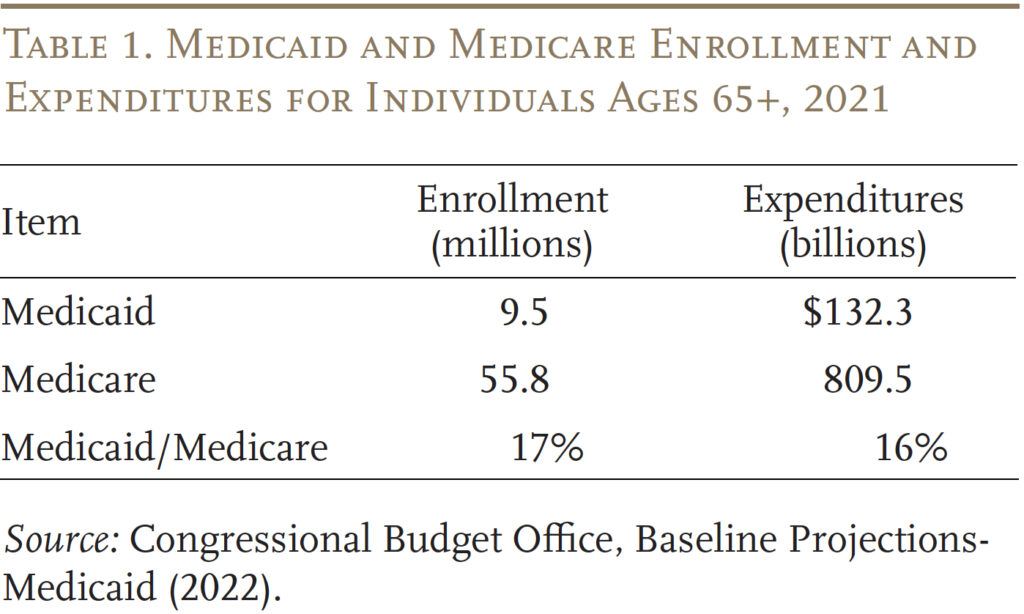

To get some thought of the significance of Medicaid to retirees, Desk 1 compares enrollees and expenditures for these 65+ beneath each Medicaid and Medicare. By way of each metrics, Medicaid accounts for 16-17 p.c of the Medicare determine.

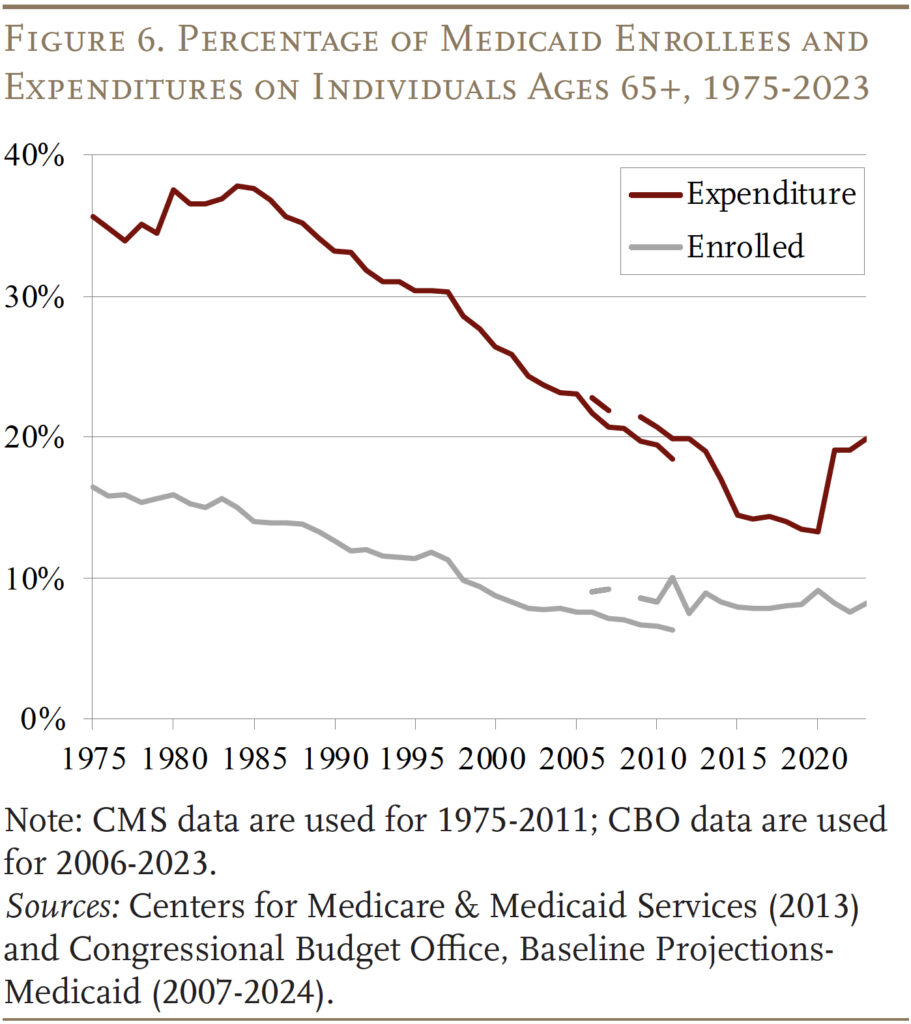

Apparently, whereas nonetheless important, the share of Medicaid advantages going to these 65+ has declined sharply for the reason that inception of this system (see Determine 6). This sample displays the decline within the share of these 65+ receiving SSI plus a deliberate growth of Medicaid by each the federal authorities and the states to cowl youngsters and working-age adults.

Future Medicaid Spending

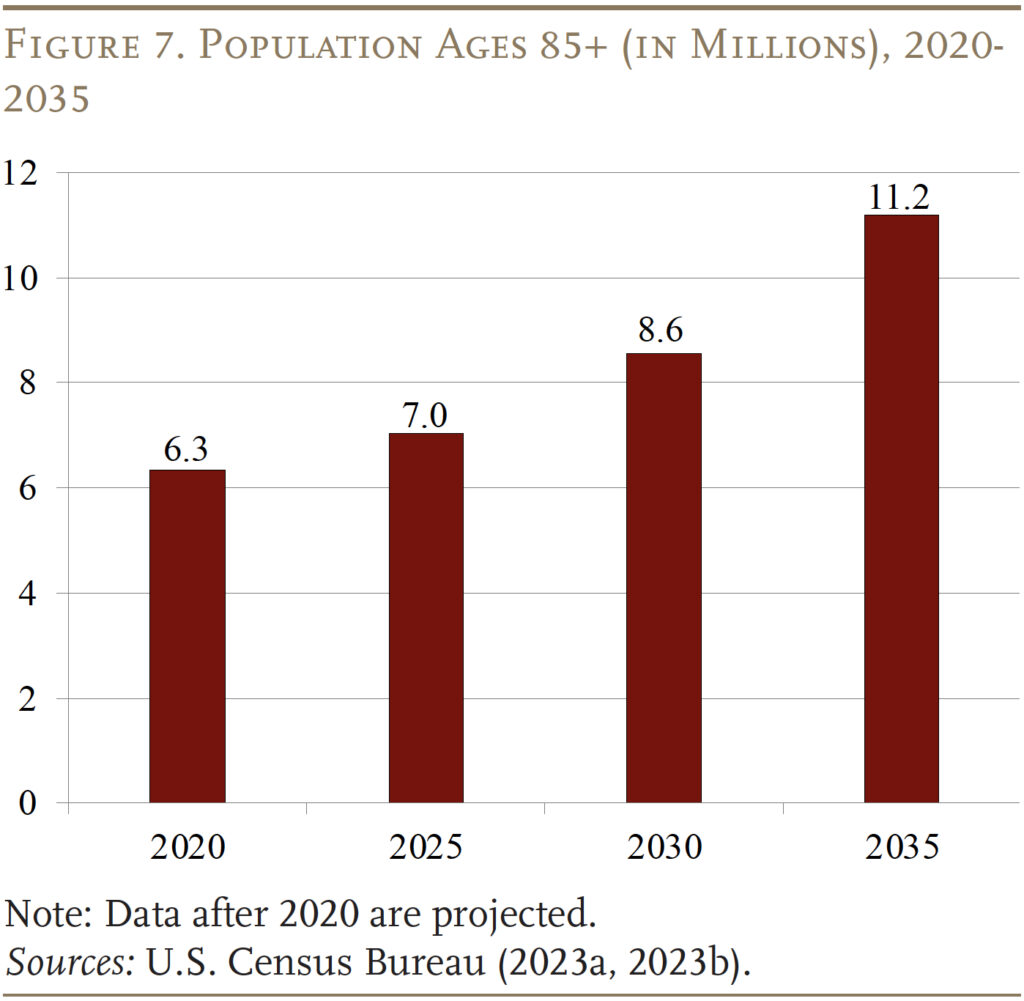

The extra necessary query is what does future Medicaid spending seem like for these 65+, given the getting old of the U.S. inhabitants. Certainly, the variety of folks 85+ – a bunch with substantial wants for long-term care – is projected to extend from about 7 million right now to 11 million in 2035 (see Determine 7). Will future Medicaid spending replicate this elevated demand for lengthy term-care? And what are the implications of future Medicaid spending for presidency budgets and the well-being of older households?

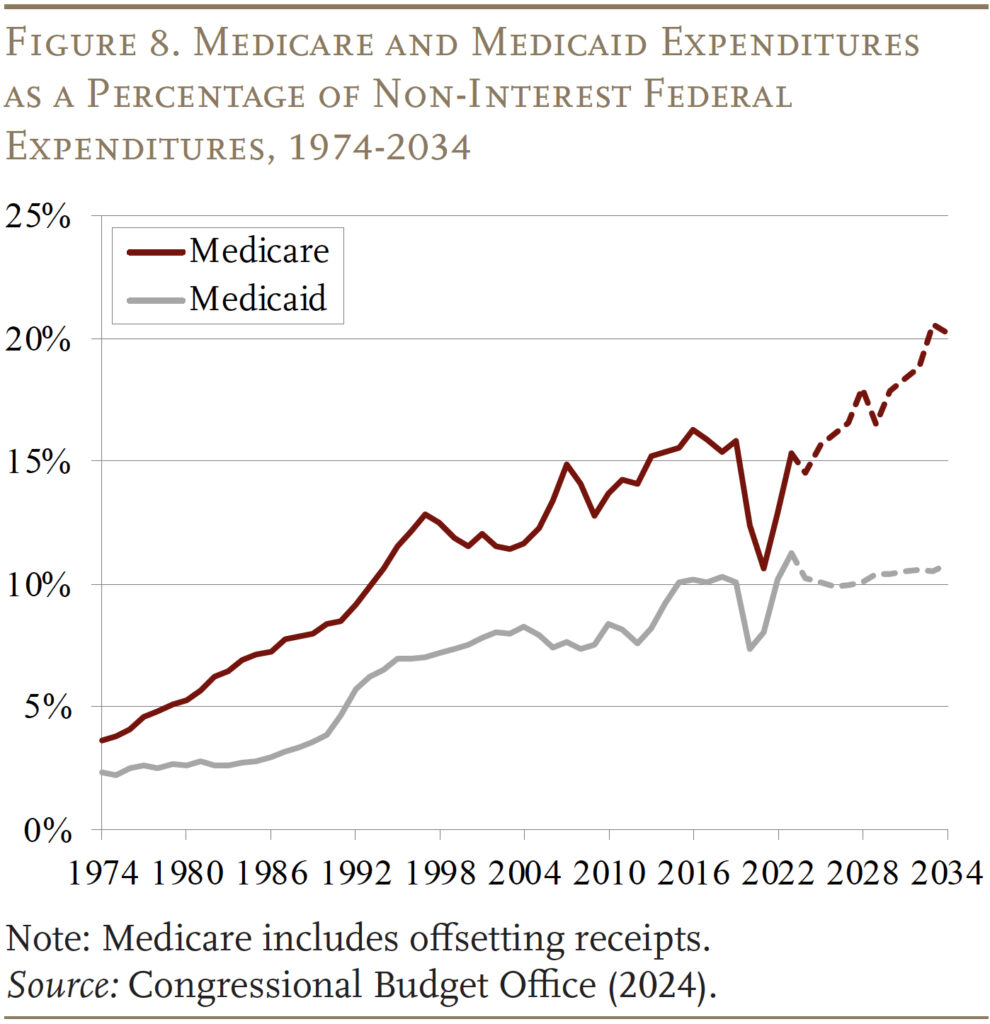

The Congressional Funds Workplace initiatives well being care spending as a share of the federal price range via 2034, which reveals that the federal share of Medicaid is scheduled to carry regular at 10 p.c of non-interest federal spending (see Determine 8). This projection differs sharply from that for Medicare, the place expenditures over the identical interval improve from 15 to twenty p.c of non-interest price range outlays – reflecting each the getting old of the inhabitants and medical inflation.

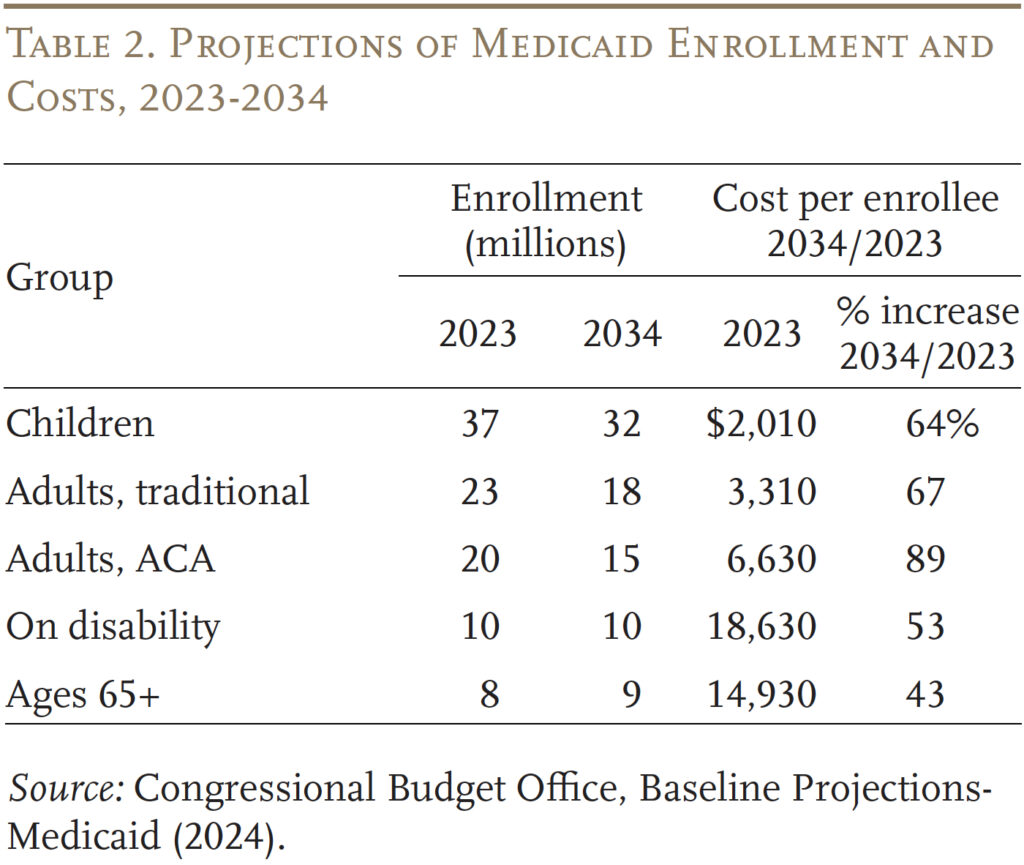

Wanting beneath the hood supplies some insights into the CBO projections. Whole Medicaid enrollment is projected to say no from 97 million to 85 million, led by the unwinding of the pandemic-related steady enrollment provision, which had briefly elevated enrollment. Moreover, decrease start charges are contributing to fewer youngster beneficiaries, and the variety of adults – in each the normal eligibility classes and people eligible via the ACA – is predicted to say no (see Desk 2). The age 65+ class is the one group the place enrollment is projected to extend, albeit by only one million in comparison with 4 million within the 85+ inhabitants.

Turning to prices, the aged and people with disabilities are the 2 costliest teams, however the ones with the smallest will increase in common value. The slower improve in prices doubtless displays each the shift away from nursing amenities to home-and-community-based care and the idea that whereas well being care prices develop with medical inflation, different long-term care prices develop in step with wages. Furthermore, many staff offering long-term care have much less medical training and supply extra hands-on providers than medical professionals. Conversely, the prices for kids and adults are projected to extend sharply, however their value degree is kind of low and, as famous, their numbers are projected to say no. The underside line is that – regardless of the getting old of the inhabitants – Medicaid will not be projected to play a bigger position sooner or later than it does right now.

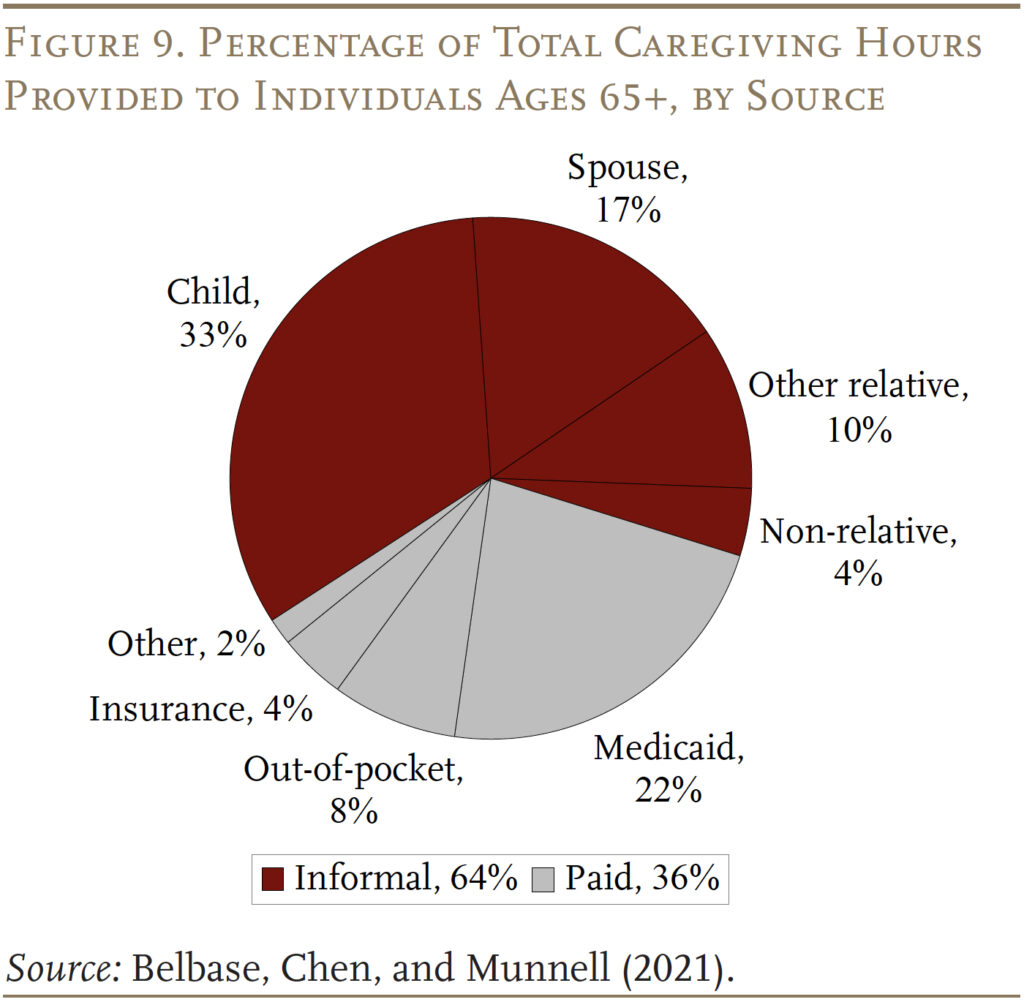

The flipside of fiscal restraint could also be unmet wants or a bigger burden on households. As proven in Determine 9, whereas Medicaid is the key payer for paid care, it covers solely 22 p.c of the hours required to look after these 65+ over their lifetimes. The extra widespread supply of help is unpaid casual care offered by relations – primarily spouses and youngsters. Going ahead, declines in fertility and the rise in divorce will diminish the provision of casual caregivers.11 And, the share of retirees with prolonged household or different neighborhood help techniques has been declining for 3 a long time.12 With out expanded help from Medicaid, the top outcome shall be that many could have care wants that merely go unmet.

Conclusion

Medicaid is the nation’s publicly financed well being and long-term care program for low-income folks. It was initially established to supply advantages to these receiving money help or “welfare.” Over time, nevertheless, Congress and the states have expanded Medicaid to achieve a broad array of uninsured People residing close to or under the poverty degree. Medicaid is financed collectively by state and native governments. The federal authorities units some fundamental necessities, however states have the pliability to design their very own variations of Medicaid inside the federal statute’s fundamental framework. Spending on Medicaid has grown considerably over time as a share of GDP and as a share of federal and state budgets.

Surprisingly, Medicaid is essential for older People. Though most individuals over 65 have Medicare, it doesn’t present long-term care providers and helps, solely restricted residence well being care and post-acute care in a talented nursing facility after a hospital keep. Furthermore, Medicare itself is dear with important premiums and deductibles. Low-income older folks require help for each these wants. At this level, these 65+ account for 10 p.c of Medicaid enrollees and 20 p.c of Medicaid expenditures.

With the projected development within the oldest previous – these 85+ – the demand for long-term care providers will improve. Funds projections, nevertheless, counsel that Medicaid is unlikely to increase past its present position. How will the elevated demand be addressed – extra care from household or unmet wants?

References

Belbase, Anek, Anqi Chen, and Alicia H. Munnell. 2021. “What Assets Do Retirees Have for Lengthy-Time period Companies & Helps?” Difficulty in Temporary 21-16. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Brown, Susan L. and Matthew R. Wright. 2017. “Marriage, Cohabitation, and Divorce in Later Life.” Innovation in Getting old 1(2): 1-11.

Burns, Alice, Maiss Mohamed, Molly O’Malley Watts, and Bradley Corallo. 2024. “Medicaid Eligibility and Enrollment Insurance policies for Seniors and Individuals with Disabilities (Non-MAGI) Throughout the Unwinding.” San Francisco, CA: KFF.

Facilities for Medicare and Medicaid Companies. 2013. “Medicare and Medicaid Statistical Complement, Desk 13.4 and Desk 13.10.” Washington, DC.

Facilities for Medicare and Medicaid Companies. 2023. Nationwide Well being Expenditure Accounts. Washington, DC: U.S. Division of Well being and Human Companies.

Congressional Funds Workplace. 2024. “Funds and Financial Knowledge, Historic Funds Knowledge.” Washington, DC.

Congressional Funds Workplace. “Baseline Projections-Medicaid: 2007-2024.” Washington, DC.

KFF. 2024. “Medicaid 101.” San Francisco, CA.

Komisar, Harriet. 2013. “Medicare Does Not Pay for Lengthy-Time period Care.” AARP: Washington, DC.

Genworth Monetary, Inc. 2023. “Price of Care Survey.” Richmond, VA.

Medicare Fee Advisory Fee and the Medicaid and CHIP Fee and Entry Fee. 2024. “Beneficiaries Dually Eligible for Medicare and Medicaid.” Knowledge Ebook. Washington, DC.

Nationwide Affiliation of State Funds Officers. State Expenditure Report, 1987-2023. Washington, DC.

Olmstead v. L.C. 1999. 527 U.S. 581. Washington, DC: U.S. Supreme Court docket.

Tolbert, Jennifer and Bradley Corallo. 2024. “An Examination of Medicaid Renewal Outcomes and Enrollment Adjustments on the Finish of the Unwinding.” San Francisco, CA: KFF.

Wettstein, Gal and Alice Zulkarnain. 2019. “Will Fewer Youngsters Increase Demand for Formal Caregiving?” Working Paper 2019-6. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

U.S. Census Bureau. 2023a. “Projected Inhabitants by Age Group and Intercourse for the US, Desk 1.” Washington, DC.

U.S. Census Bureau. 2023b. “The Older Inhabitants: 2020.” Report No. C2020BR-07. Washington, DC.

U.S. Congress Joint Financial Committee. 2019. “An Invisible Tsunami: ‘Getting old Alone’ and Its Impact on Older People, Households, and Taxpayers.” (January 24). Washington, DC.