Two of our most well-read articles right here on MDJ cowl the “authorities pension” that consists of CPP and OAS. With a view to give probably the most correct view of the pension panorama in Canada, I believed I’d check out outlined profit pensions plans and outlined contribution plans as effectively.

Each outlined profit (DB) and outlined contribution (DC) plans are typically known as “private pensions.”

Now, to make issues a bit complicated, that broad “private pension” class consists of the pension you’d get in the event you work for the federal or provincial governments. Authorities staff usually have an outlined profit pension, and since they’re working within the public sector it could actually get straightforward to get confused. Consequently, I’ll attempt to be as clears as attainable once I reference them under.

Additionally, it’s vital to remember the fact that not all outlined profit plans belong to authorities staff, and never all authorities staff have these plans. Some authorities staff fall beneath the identical outlined contribution plans which are extra widespread within the non-public sector.

Are You Saving Sufficient for Retirement?

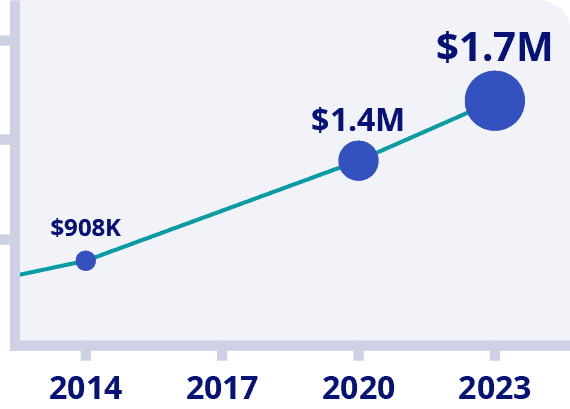

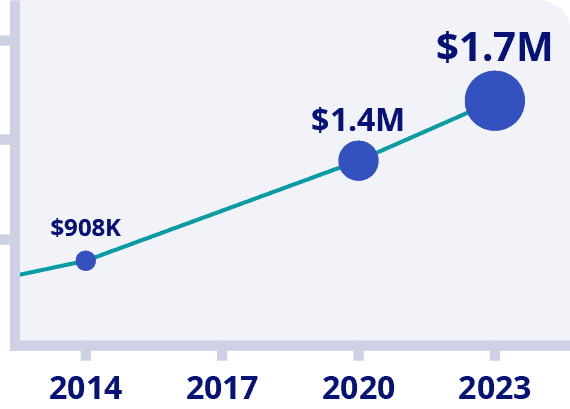

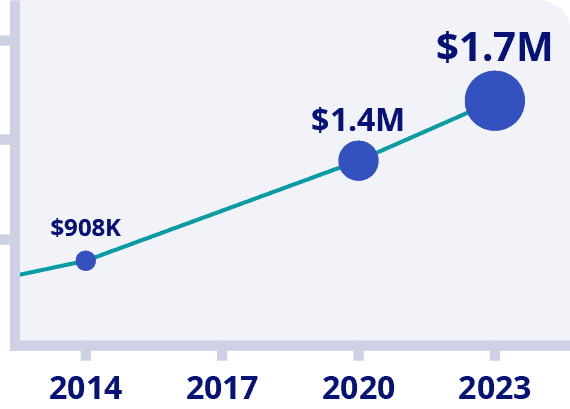

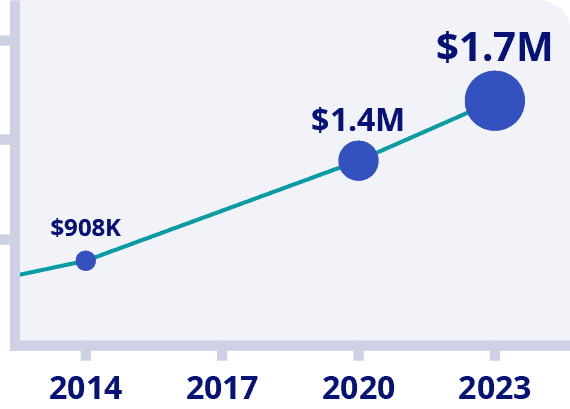

Canadians Imagine They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Observe?

Turn into your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Strive Now With 100% Cash Again Assure

*Information Supply: BMO Retirement Survey

Earlier than we get too far into the weeds within the outlined profit vs outlined contribution plans dialogue, and learn how to take advantage of out of every one, right here’s a fast take a look at the Canadian retirement panorama.

- About 6.6 million Canadians are enrolled in a private registered retirement plan of some type. That’s roughly one third of working Canadians.

- Out of these 6.6 million Canadians with a pension, roughly two-thirds are outlined profit plans. Eighteen % are outlined contribution plans, with the rest being a mixture of hybrid plans and pooled RRSPs, and many others.

- Canadian pension skilled Malcolm Hamilton acknowledged again in an interview in 2015 that the non-public sector had shortly been shifting away from outlined profit plans and into outlined contribution plans. In a latest dialog we had, he confirmed that this development has continued and neither of us see any signal of it stopping.

As a trainer I do know simply how useful a pension plan might be in the case of retirement planning. In reality, for lots of presidency staff, their outlined profit pension IS their retirement plan.

On this article we’re going to cowl a few of the variations between the 2 most important varieties of pensions in Canada, learn how to estimate your pension, learn how to inform in case your pension plan is secure, in the event you ought to take a lump sum pay out, and what sure pension vocabulary like “bridging profit” and “value of residing adjustment (COLA)” means.

Use the Desk of Contents under to leap to no matter a part of the dialog makes probably the most sense to you.

What’s a Outlined Profit Pension Plan?

An outlined profit pension plan might be the kind of setup that you concentrate on when you think about a standard pension.

The essential concept is that you just pay right into a plan when you’re working. The employer then takes your cash, matches it with their very own, after which invests it in your behalf. Whenever you retire, you get a test each month till you go away.

The important thing factor to know a couple of outlined profit pension plan is that the obligation for ensuring these cheques preserve coming is totally on the employer. It doesn’t matter how the investments did or in the event that they screwed up and didn’t accumulate sufficient cash from you up entrance when you had been working – the duty is on them.

Clearly this can be a huge danger for corporations to tackle, and consequently, outlined profit plans have gotten fairly scarce for any Canadians who don’t work for a authorities entity or one of many huge Canadian companies (and even these are getting fairly uncommon).

Usually staff love outlined profit pension plans as a result of precisely how a lot you’ll be getting in retirement and there’s no investing information required on their half. It’s a fairly easy setup from the worker perspective. We’ll get into how pensions are sometimes calculated in only a second.

Benefits and Disadvantages of a Outlined Profit Pension Plan

1) It’s so easy. No worrying about selecting your individual investments or employer matching percentages.

2) A lot simpler to make use of for monetary planning – particularly if there’s a value of residing adjustment inbuilt.

3) There is no such thing as a danger of your cash working out (assuming your employer doesn’t go bankrupt).

4) The funding danger is unfold out amongst generations (like within the CPP) – versus managed by a single particular person.

5) Outlined profit plans are sometimes packaged with different advantages like prolonged well being plans or life insurance coverage affords upon retirement.

6) When you go away comparatively early after retirement, your partner usually will get a portion of your pension – BUT – the remainder of your pension cash shall be left “within the retirement pot” for the remainder of your colleagues to separate up. There is no such thing as a technique to depart your pension funds to your family members in your will.

7) When you go away earlier than your partner, they often solely get 50-75% (relying on the survivor’s profit choices chosen at retirement) of your full fee.

8) They’re very costly and time consuming for personal employers to supply. This doubtless leads to much less up entrance pay to staff.

9) In case your employer (or the pension belief that they’ve created) goes bankrupt, you might not get your full pension. This is named “counterparty danger”. We’ll get to this in only a second.

What’s a Outlined Contribution Pension Plan?

An outlined contribution pension plan is a little more advanced from an worker perspective, however is kind of easy from the employer standpoint. (Therefore the transfer over to one of these pension setup over the previous couple of a long time.)

With regards to outlined contribution plans the employer mainly says, “Look, we wish to assist you to (our worker) save for retirement – however we don’t wish to be on the hook for this long-term payout that might be 80 years into the longer term. As a substitute, what we’ll do is encourage you to save lots of on your personal retirement by making your contribution computerized, or by incentivizing you to save lots of by matching no matter you place into your retirement funding plan.

We’ll depart the precise investing and planning as much as you, however we’ll provide you with some cash as a part of your total compensation package deal. Whenever you retire there aren’t any ensures from our facet, however hopefully you’ve made good use of all the cash we kicked in alongside the way in which.”

Outlined contribution plans can are available many styles and sizes. Listed here are a number of traits to look out for when testing your plan:

- Is your plan computerized? In different phrases, is an quantity routinely deducted out of your paycheque relying in your instructions to HR.

- What’s your “pension match”? How a lot will your employer contribute to your plan relative to how a lot you select to contribute?

- Who administrates your DC plan? Is it a mutual fund firm, only a easy RRSP match – what investments do you get to select from when you contribute?

After you have the solutions to those questions you’ll be able to formulate your individual plan. Listed here are the 2 most vital issues to take into accounts when optimizing your outlined contribution plan.

1) ALWAYS be certain that to get the free cash out of your employer’s match. This is likely one of the best wins in private finance. It doesn’t matter if the match is 100% (“we’ll match it greenback for greenback”), 50% (“we’ll put in $0.50 for each greenback you place in), and even 25%. All the time, at all times, at all times, in the event you can in any respect afford it, attempt to get that free cash out of your employer and get it working in your behalf.

Typically employers will construction outlined contribution plans to say one thing like, “We’ll do a 100% match as much as 3%, after which a 50% match from 4%-8%.” If that’s the case be certain that and contribute 8%!

Tom Reid, senior VP of group retirement companies at Solar Life Monetary lately acknowledged that in the case of not maximizing the free cash from employers, “between $3- and $4-billion throughout the nation per 12 months […] it’s a large quantity of employer match being left on the desk.”

2) All the time select the bottom value + most numerous investing choice obtainable. Increasingly employers are getting sensible about utilizing all-in-one ETFs or robo advisors to assist administrate their outlined contribution plans. Nonetheless others will merely contribute to your RRSP alongside you (my most well-liked choice).

Nevertheless, there are nonetheless many corporations that drive you to select from a predetermined set of mutual funds if you wish to get their computerized contribution math. In these instances, what you need to do is:

- Respectfully ask your employer and HR groups to look into higher investing choices. Mutual funds are typically a horrible funding route in Canada.

- Suck it up, and decide the bottom value fund (search for funds with a low MER), that also spreads your cash out throughout a number of asset lessons and areas of the world.

- Ask what the minimal period of time that you must have your cash within the plans’ mutual funds is – then take out your funds + the employer match as quickly as attainable.

Benefits and Disadvantages of a Outlined Contribution Pension Plan

1) The cash is yours to do with as you please. Some see this as a bonus as a result of they’ve a point of management over the investments (relying on how the plan is run), however some dislike the added duty of choosing investments.

2) By far the largest benefit for most individuals when taking a look at DC vs DB plans is that the property keep inside your private possession. Which means in the event you had been to go away the day after you retire, your property would preserve full management of the cash you had put away. In fact, with a DB pension that cash would keep within the pension pool and go to your former colleagues who had the great fortune to dwell longer.

3) Having the ability to plan while you take your retirement cash may end up in extra environment friendly planning. You’ll be able to plan issues in order that extra of your revenue results in decrease tax brackets, and/or make main purchases earlier in retirement in the event you’re so inclined to make these commerce offs.

4) Employers love outlined contribution plans as a result of they’re quite simple from their perspective. They’re merely answerable for making a one-time contribution as an alternative of the lifetime obligation that exists beneath DB plans.

5) Disadvantages embrace having to know and perceive investing, math, and possibilities to a a lot larger diploma. Larger charges, unhealthy recommendation, and lots of different potential points can depart funding your retirement a little bit of a minefield in the event you’re not the studious planning kind.

6) You don’t get to reap the benefits of mortality credit in a DC plan. Mortality credit imply larger pension funds as a consequence of some people inside DB plans not residing so long as others.

7) It’s all simply extra sophisticated in a DC plan. The uncooked simplicity of a DB plan is an enormous deal for lots of people. Because of this I’d suggest taking a look at transitioning a minimum of a part of your DC plan (if not the entire thing) into an annuity upon retirement. Try our investing in Canadian annuities information for extra particulars.

Outlined Profit Pension Plan Formulation Decoded

So, you by no means thought you’d use that top faculty algebraic math stuff once more, huh?

If you wish to attempt to predict how a lot you’ll get out of your outlined profit pension plan every month you’ve got a number of choices:

1) Ask your HR particular person to sit down down with you and clarify it. This assumes that they really know the way it’s completed – or can level you within the route of somebody who does. Oftentimes these well-meaning people truly aren’t conscious of how all of the variables in these plans work.

2) Learn on under and decode your individual pension plan.

3) Kidnap your outdated math trainer and provide to launch them solely once they can inform you in plain language how a lot cash you’ll be getting every month.

Every outlined profit plan is exclusive, however often they function on a particular formulation. Every formulation will use variables to find out an individual’s distinctive month-to-month payout. The maths people often resolve issues by displaying a variable as a letter or image similar to “x”. I’ll attempt my finest to make use of plain phrases as an alternative of claiming stuff like, “If we let X equal the sq. root of y, then add z, you’ll get your reply – straightforward.”

The commonest variables that you just’ll have to know prematurely of tackling your outlined profit pension formulation are:

- The variety of years that you just labored.

- How a lot you earned every year. (Your pension is usually calculated as a proportion of your high wage. That high wage is usually your remaining three years, generally your finest 5 out of the ultimate 7 years, or generally it’s not a “high wage” however a median of your profession wages.)

- Some pension plans may even use a “magic quantity” the place you add collectively your age plus the variety of years you labored at that job, and while you meet that minimal you’ll be able to start amassing your pension.

Often your outlined profit plan fee formulation will look one thing like this:

(Calculation of your common or high wage) x (2% x # of years labored) = annual pension (divide by 12 for month-to-month quantity).

In fact there are numerous variables that may go into particular plans, however many look one thing like this. So a hypothetical pension calculation could be:

-John’s common wage over his high 5 years was $80,000

-He labored 30 years at this job

80,000 x 60% = $48,000 = A month-to-month pension of $4,000

If there’s an age minimal or “magic quantity” (the place age and years of service are added collectively) then often there’s a pension formulation for a “full” or “unreduced pension” adopted by an extra calculation that has you subtract for the variety of years away you’re from hitting these milestones.

Right here’s an instance.

-Jane’s common wage over her high 5 years was $80,000

-She labored 30 years at her job, beginning at age 25 and ending this 12 months at age 55.

-Jane is eligible for her full pension at age 65 or the “magic quantity” of 85. There’s a penalty of two.5% per 12 months if she retires earlier than she meets both of these standards.

It will likely be 10 years till Jane is 65 years outdated, however solely 5 years till she hits her “magic quantity”.

Jane has the identical years and repair as John, and her unreduced pension could be the identical $48,000 annual pension. Nevertheless, she can not start amassing that quantity if she chooses to instantly start accepting her pension. As a substitute her new formulation could be:

$80,000 x [60 – (2.5 x 5)] = $40,000. Month-to-month pension = $3,333.33

These are the principle “constructing blocks” of most pension formulation, however every outlined profit plan in Canada has been negotiated individually and has distinctive quirks. Many lecturers’ pension plans for instance have modified in some unspecified time in the future within the final 50 years, so some lecturers could have one formulation for the primary a part of their profession, and a separate formulation for the second half. Their remaining annual pension fee shall be some form of mixture of those two agreements, often proportionate to the variety of years labored in every system.

Most often one of the best plan of action to take when making an attempt to foretell your outlined profit plan pension is to ask your HR for a pension estimate. In case you are lucky sufficient to have a union, they usually placed on pension seminars the place you’re free to go and be taught. Take your estimate with you, see in the event you agree with the calculations, after which get your union consultant to double test that the estimate is sensible, and that you just perceive your distinctive pension formulation.

What’s the Price of Residing Allowance on a Pension?

Some of the vital elements of an outlined profit pension is whether or not it features a value of residing adjustment (COLA). A COLA is a yearly change in your pension fee that takes inflation into consideration.

Some pension plans could have a COLA that may enhance your fee by the total proportion of inflation, whereas others will solely enhance it by a fraction. Inflation is often calculated by taking a look at Canada’s Client Worth Index (CPI) every year.

For instance, if Mark retired final 12 months and his preliminary pension was $40,000, then if the CPI enhance was 6%, Mark’s new fee this 12 months could be $42,400 – assuming he had a full CPI Cola.

If Mark’s COLA was solely equal to 2/3rds the CPI, then his new fee could be $41,600.

Price of residing changes are all about defending your buying energy over the long run. If Mark didn’t have any COLA in any respect then he would preserve getting the identical $40,000 every year in retirement. Clearly, if Mark retired at 60, by the point he was 90 that very same $40,000 wouldn’t be buying almost as many services or products because it used to!

This discount in buying energy is because of inflation. If inflation averaged 2.5% throughout Mark’s retirement, then his $40,000 annual pension funds would solely purchase him about half the quantity of stuff/companies at 90 as when he first retired at 60.

The upper the share of the CPI your COLA tracks every year, the extra useful your pension is within the long-term.

What’s a Bridge Profit on a Pension?

A few of Canada’s outlined profit pension plans will embrace one thing known as a bridge profit. The bridge that’s being referred to is supposed to attach your early retirement to while you attain the “regular” retirement age of 65. For instance, many lecturers, nurses, navy personnel, or law enforcement officials who select to retire at 55 will obtain a bridge profit.

As soon as once more, it’s key to know that each pension plan calculates the bridge profit barely in a different way, so be certain that to use your distinctive plan’s formulation.

That stated, most bridge advantages often function within the following method:

- The objective is to offer the pensioner a comparatively comparable quantity of revenue all through their retirement.

- The pension plan directors know that “full CPP” will kick in at 65. So moderately than have your total revenue shoot manner up at the moment, a bridge profit takes a few of the revenue you had been going to get at age 65 and “entrance hundreds” it to the years earlier than that.

- Along with a few of your individual “future pension cash” coming to you a number of years early, pension plans can use a few of the total pension plan’s cash to high up your pension throughout your pre-65 years.

So in the event you select to start receiving your outlined profit pension plan funds earlier than the age of 65, often what meaning is that the amount of cash that you’ve got coming out of your private outlined profit pension plan will go down at 65. Nevertheless, because you’re now getting your OAS and CPP, you’ll both be getting the identical or (more likely) extra total cash despatched to you every month as a result of now you’re getting your private pension + your CPP + your OAS.

In fact, which means to a point you’re buying and selling getting cash at the moment for the flexibility to earn extra sooner or later. When you dwell to be 90+ (actual age relying in your particulars and the main points of your pension plan) then it’s possible that you’d have been forward of the sport to not use a bridging profit. Then again, getting cash that you really want early in retirement is a serious benefit for lots of people.

There are some actually attention-grabbing options that pensioners can use to easy out revenue the place they select to take the retirement bridge profit, take pleasure in that cash till age 65, then start taking their OAS, whereas nonetheless deferring their CPP for a number of years after age 65 as a way to construct up the next assured CPP profit for all times.

What’s the Commuted Worth of my Pension?

The commuted worth of a pension is the quantity of the lump sum the corporate or belief offering the pension must pay out at the moment if an worker determined to take the lump sum in change for the income-for-life of an outlined profit pension plan.

Commuted values are often calculated bearing in mind the current worth of cash versus long run rates of interest and the life expectancy of the group of beneficiaries. Commuted worth is just relevant to an outlined profit plan, as with an outlined contribution plan the employer’s duty ends as quickly as they make the contribution alongside the worker.

As with different components of your pension plan, the commuted worth formulation that applies to you is probably going considerably distinctive to your particular plan. Consequently, asking your HR group to clarify your commuted worth at the moment or for a degree sooner or later shouldn’t be an enormous deal. It must be introduced as, “When you had been to retire on this present day, you’d get these choices of an outlined profit plan vs this commuted worth that might be paid as a lump sum”.

Pension Plan Lump Sum Rollover and Taxes

When you select to take the commuted worth of your outlined profit pension plan as a lump sum, then be ready to pay some substantial taxes that 12 months. These taxes are one of many two huge the reason why I imagine most Canadians are higher served by leaving their retirement financial savings in an outlined profit plan.

The opposite most important consideration is that the majority Canadians simply aren’t excellent at managing their very own cash. Usually we make poor funding choices and we pay an excessive amount of to do it! Even in a finest case situation, we’re all nonetheless topic to the whims of the market.

Now, the tax state of affairs incurred in the event you determine to take the lump sum commuted worth of your pension is a bit sophisticated because it depends upon a number of variables. Often what occurs is that the lump sum is successfully break up up into two components. One half goes right into a Locked-In Retirement Account (LIRA) whereas the second half involves you as money.

For that money half, you’ll be taxed at your marginal tax fee. Contemplating most individuals labored a minimum of a part of the 12 months that they retired, their marginal tax fee on this cash will doubtless high 40%. Now, when you’ve got contribution room in your RRSP, you’ll be able to switch this bulk fee to your RRSP to lower the tax owing “up entrance”.

Then, as you withdraw the cash from the LIRA and/or your RRSP you’ll pay your marginal fee at the moment. Clearly, you’ll be able to management the tempo that you just withdraw cash at that time – and consequently how a lot taxable revenue you’re taking out – till you get to 71 and must convert your funding portfolio to a RRIF. Ensure that to get an in depth estimate on what your tax invoice could be in the event you select to take the lump sum as an alternative of the month-to-month DB cheque!

Deciding on a Survivor’s Profit on your Pension

When you find yourself enrolled in an outlined profit pension plan, you can be requested to make a number of choices on the finish of your profession. The primary is while you want to take a lump sum commuted worth versus a lifetime of pension funds. The second is often while you want to start receiving pension funds. The third issue that may doubtless influence the dimensions of your eventual pension funds is deciding the way you want to deal with the survivor’s profit facet of your DB plan.

The survivor’s profit is setup to guard {couples} who could also be depending on one another’s pension revenue in retirement. The same old setup is that when one partner passes away, the surviving accomplice shall be allowed to gather part of the unique pensioner’s revenue.

Relying on the main points of the precise pension plan, often the survivor’s pension quantity is someplace between 50% and 75% of the unique worth. Most plans will enable the pensioner to decide on the survivor profit proportion upon retirement.

Now, clearly there’s a larger probability that both you or your partner may dwell to a sophisticated age vs solely your individual probabilities of residing to a sophisticated age. That signifies that the pension plan has to take into accounts that it’s extra doubtless that they should make funds for longer.

Consequently, the upper your survivor’s profit proportion that you just select, the decrease the month-to-month funds shall be throughout the pension. Some pension plans may even give a “5- or 10-year assure” choice the place the surviving partner could be entitled to 100% of the pension advantages for as much as 10 years after the unique pensioner started receiving funds. Once more, this comes with the tradeoff of a barely decrease month-to-month pension funds.

For most people it actually comes right down to how dependent the surviving partner could be on that revenue in a worst case situation. If the hole from 50% to 75% substitute would imply a considerable hardship, then it’s most likely definitely worth the comparatively small month-to-month revenue hit. Then again, if the partner of the pensioner is in very poor well being on the time they retire, maybe it is sensible to get rid of the survivor’s profit altogether.

Will My Pension be There for Me?

YES!

Effectively… virtually for certain – YES!

Your pension shall be there for you.

When you’re speaking about your pension cheque nonetheless being there while you retire, you then’re clearly referring to an outlined profit pension plan, as a result of in the event you had an outlined contribution plan, then the cash would keep in your private management the entire time.

Traditionally, DB pension plans have held up very effectively in Canada. Right this moment, I might argue they’re much more rock stable. This isn’t as a consequence of pension plans making smarter choices, it’s just because a a lot bigger proportion of the plans are held by authorities staff and never non-public corporations.

You see, on your outlined profit plan to not pay you, the entity that funds the retirement should declare chapter and be wound up. BUT even when this occurs, most pensioners will nonetheless get a big chunk of what they had been entitled to. Even in a worst case situation just like the Nortel Networks fiasco again in 2009, the pensioners ultimately ended up with 55%-70% of what they had been purported to get.

Now don’t me improper – getting a little bit over half of what you had been relying on getting nonetheless actually sucks!

Right here’s how one can attempt to determine in the event you can rely in your outlined profit pension sooner or later.

1) Do you’ve got a authorities pension?

As a result of in case your pension is roofed by the federal government I’d be over 99.9% sure that you’ll get your full pension funds. There has by no means been a federal or provincial worker not get their retirement advantages as they’ve by no means needed to declare chapter. Whereas I’d be barely much less sure about municipal authorities pensions, they’re much less widespread and even these smaller entities have been very secure for the reason that Nineteen Thirties.

2) When you don’t have a authorities pension, what’s your pension’s switch ratio?

The time period “switch ratio” is the one you’re going to wish to ask your HR group about.

Now, I wouldn’t panic in any respect in the event you don’t have a authorities pension. Canada’s pension guru Malcolm Hamilton has been quoted a number of occasions over the previous ten years saying that on the entire, Canada’s outlined profit pension plans are in a stable state.

So as so that you can not receives a commission, your organization must go bankrupt whereas having underfunded the pension plan. The switch ratio is a measure of how a lot of the plan’s future obligations it may payout if it had been terminated at the moment.

If your organization tells you that your switch ratio is 85% or 90%, I nonetheless wouldn’t panic. Canada has many rules to assist govern these plans, and it may merely be that the plans have had a very unhealthy couple of years in the case of investments, and are prone to get better going ahead.

The possibilities are nonetheless fairly good that your outlined profit pension plan will make funds proper on schedule for the remainder of your life – though I’d be beginning to get involved the additional the plan’s switch ratio dipped under 90. As of 2021 (admittedly this hasn’t but captured the latest market downturn) the common switch fee for Canadian pensions was 103% – so we’re doing fairly effectively.

When you’re fortunate sufficient to dwell and work in Ontario, it’s additionally price contemplating that the Ontario Pension Advantages Assure Fund will insure the primary $1,000 monthly of your pension funds – however they’re the one province to supply that protection presently.

If my HR group acquired again to me and stated that my pension plan had a switch fee of under 85%, I might start factoring that into my long-term retirement planning, and would most likely begin incorporating a attainable hit to my payouts sooner or later – simply to be on the secure facet.

The smaller the switch ratio, the extra cautious I might be in my planning. In fact as increasingly corporations change to outlined contribution plans, this may most likely develop into even increasingly uncommon.

Are You Saving Sufficient for Retirement?

Canadians Imagine They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Observe?

Turn into your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Strive Now With 100% Cash Again Assure

*Information Supply: BMO Retirement Survey

FAQ About DB and DC Pensions in Canada

Canadian Pensions in 2024 and 2025

As we shut in on the tip of 2024, there was some excellent news on the pension entrance. There was a renewed curiosity in outlined profit pension plans during the last couple years, with a slight uptick in DB numbers.

That development doesn’t seem like it’s going to decelerate any time quickly as staff in a number of industries develop extra conscious of their bargaining energy. In fact, that small enhance in DB plans needs to be taken in as a part of the broader total image that also sees most Canadians on the skin wanting in.

I can say that on a private degree, the compelled financial savings of a DB plan actually helped me in my first years as a trainer. Anecdotally, I can say that the overwhelming majority of lecturers could be nowhere near producing the identical revenue in retirement in the event that they had been answerable for saving and investing their very own cash (even with the assistance of a company-matching DC plan).

All that stated, it’s attention-grabbing to listen to a few of my former colleagues speak about how they want that they had the liberty of a few of their DC-planned buddies in the case of retirement spending. They’re a bit envious of the truth that individuals who retire with a DC pension can choose to drag extra of it out of their “go-go spending years” (say age 65-75) after which tail their spending off as they get older.

It will likely be attention-grabbing to see in the event that they nonetheless really feel that manner when roughly half of them dwell to show 85 (and presumably the DB plan will look much more enticing – particularly with a value of residing adjustment inbuilt).

Maybe one of the best information for outlined profit pension plans in Canada was that as of August 2024, the common solvency ratio of the plans was at about 124%! Solely about 5% or so of DB plans had solvency ratios under 90%. In fact, one would count on wholesome solvency ratios given the wonderful run the inventory markets have had during the last 5 years.