Is everlasting life insurance coverage a very good funding for Canadian retirees?

Is entire life insurance coverage the key to constructing “infinite banking wealth” as I maintain seeing on Fb?

What does term-to-100 imply anyway?

Why is everybody attempting to promote life insurance coverage to older Canadians anyway??!!

As tons of of scholars have taken my course on how you can DIY your private Canadian retirement plan, I’ve gotten a ton of questions on “investing in life insurance coverage.” I exploit quote marks there as a result of life insurance coverage is NOT an funding. The funding firm would possibly take your cash and make investments with it – however we ought to be clear proper off the bat that each Fb advert that you just see speaking about “infinite banking” and “investing in life insurance coverage” is attempting to mislead you.

Lengthy story quick in the case of life insurance coverage for seniors in Canada: There’s a 99.9% probability you don’t want it and might simply ignore all of the gross sales discuss and complicated insurance coverage terminology. You don’t want “sufficient to cowl a funeral”, you don’t want “to consider insurance coverage as an funding” – you don’t want it in any respect – until you verify all three of the next packing containers:

- Have maxed out your TFSA and RRSP

- Need the compelled self-discipline of getting to make investable insurance coverage premium funds

- Wish to go away a big tax-free inheritance as a part of your property

Then perhaps you can begin asking: What sort of life insurance coverage is finest for seniors?

I nonetheless don’t advocate it even in that scenario, but it surely turns into not less than debatable when you attain that stage of affluence. Since we’re evaluating taxable DIY investing vs life insurance coverage insurance policies we’ll must dive into some tax math (which we’ll get to later on this article), however at all times take into account that there may be nice worth in simplicity as nicely!

One key consideration to make upfront is that almost all of everlasting life insurance coverage insurance policies are cancelled sooner or later. That is as a result of insuree failing to pay their premiums – and the coverage then “lapsing”. On-line tech startup PolicyMe states that 88% of common life insurance coverage insurance policies by no means pay out dying advantages attributable to folks permitting their coverage to break down.

Canada’s Rational Reminder Podcast produced by CFPs Ben Felix and Cameron Passmore acknowledged that in American research finished in 2019, with regard to entire life everlasting insurance coverage insurance policies, solely 31% of the insurance policies remained in pressure after 30 years.

What this implies is that the common Canadian that takes out an entire life coverage fails to pay the premium sooner or later (forgetfulness, price range considerations, and so forth.) and at the moment, the insurance coverage contract is successfully cancelled, with the insurance coverage firm holding the premiums. Principally, the overwhelming majority of people that pay for everlasting life insurance coverage don’t get to appreciate the good thing about it… or not less than their beneficiaries don’t get the profit.

One different level we must always tackle proper up entrance within the life insurance coverage dialogue is that there are huge commissions on the road for individuals who promote everlasting life insurance coverage insurance policies. This doesn’t imply that each insurance coverage salesperson will advocate terrible insurance coverage insurance policies, however as with all issues in life, everybody ought to concentrate on the incentives concerned.

On that very same podcast episode as mentioned above, Felix and Passmore clarify what they realized from their time promoting life insurance coverage insurance policies themselves:

“The commissions on insurance coverage insurance policies are monumental [..] after I give the instance of a 40-year-old shopping for a coverage for $8,240 per 12 months, the commision on that coverage could be not less than the first-year premium […] It’s large cash.”

“That’s not clear both.”

Lastly, there are area of interest conditions the place it’d make sense to think about shopping for a coverage when you’ve got a company (maybe you’ve saved a bunch of cash in a holding firm), however even on this distinctive scenario, I’d argue there are higher choices (resembling investing in swap-based ETFs inside your company account). Don’t fear if this paragraph was complicated, it in all probability gained’t have an effect on you, however I’m simply attempting to be truthful to all sides right here. We’ll additionally tackle this particular situation additional down on this article.

Are You Saving Sufficient for Retirement?

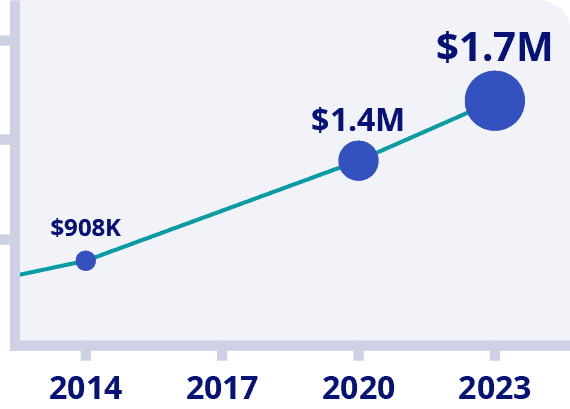

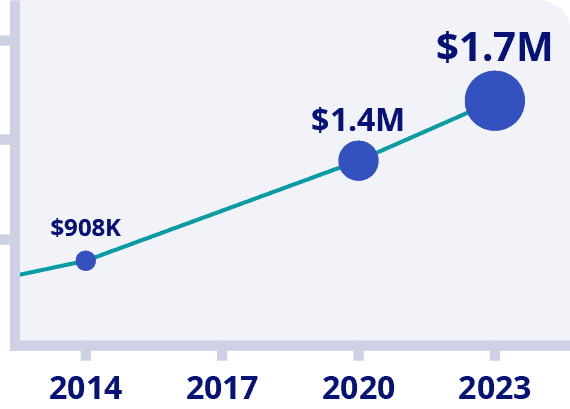

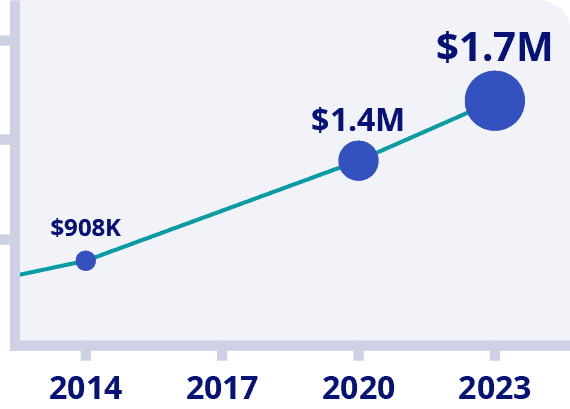

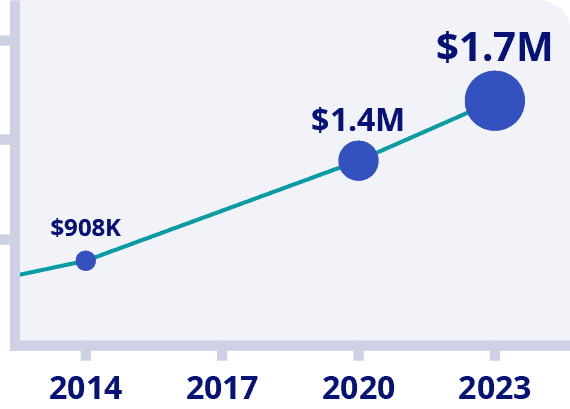

Canadians Imagine They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Monitor?

Change into your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Strive Now With 100% Cash Again Assure

*Information Supply: BMO Retirement Survey

What Is Life Insurance coverage?

A fast reminder on the essential concept of life insurance coverage: Life insurance coverage permits you to financially defend individuals who financially rely on you.

There are various totally different sorts of life insurance coverage, however at its core, life insurance coverage is about changing the earnings you’ll have earned, in order that your family members is not going to must drastically change their way of life when you have been to go away.

That is clearly a wonderful concept. If in case you have a younger household, and have a few years forward of child-rearing prices, mortgage funds, and post-secondary training assist to offer, then you could look into life insurance coverage.

The fundamental mechanics of most life insurance policy are:

1) You pay a month-to-month premium to the insurance coverage firm.

2) The insurance coverage firm takes your cash and places it in an enormous pool of cash from folks similar to you. The corporate then pays some actually sensible math wizards to find out how lengthy the common individual contributing cash to the pool will dwell.

3) The insurance coverage firm then invests your cash in quite a lot of investments (and in response to some fairly stable regulatory guidelines), and guarantees to pay your beneficiaries (often your family members, however it may be whoever you title) a selected amount of cash (tax-free) when you have been to go away earlier than a sure date.

4) If the whole lot works out and the maths wizards have been right, the beneficiaries of everybody who handed away earlier than the desired date will get despatched a cheque. The insurance coverage firm’s investments make sufficient cash that the insurance coverage firm will get to pay all of their workers, pay for promoting, pay for places of work, and so forth – and nonetheless ship a wholesome dividend cheque to shareholders.

If we simply pause there for a second, a lot of you is likely to be pondering: Okay, proper, in order that is smart if I’ve folks relying on me.

However one would possibly ask: if I’m retired and don’t have anybody relying on my earnings any longer, then why would I would like life insurance coverage – a product used to guard folks within the occasion that I can not financially present for family members?

Properly… you then’d just about be heading in the right direction. Don’t stray too removed from this good frequent sense!

If you end up checking all the packing containers above – then you’ll find additional particulars about life insurance coverage for Canadian seniors under – however I need to reiterate that this ought to be one among your final priorities when it comes to retirement planning. There are way more necessary particulars to maintain earlier than we get to area of interest matters like this.

What Are the Totally different Varieties of Life Insurance coverage in Canada?

There are two fundamental classes of life insurance coverage in Canada: time period life insurance coverage and everlasting life insurance coverage.

Time period life insurance coverage is usually fairly easy and simple to match between corporations. The thought is that you’ve a primary life insurance coverage contract the place in return to your premium every month, you might be lined for a selected amount of cash for a selected variety of years. There is no such thing as a want to fret about “money worth” or “dwelling advantages”.

Should you – fortunately – outlive the coverage, you then depend your self blessed, and the insurance coverage firm retains the cash you paid, whereas sending a few of it to individuals who didn’t have your luck and handed away whereas they have been insured.

Everlasting insurance coverage is the place issues get much more difficult – and it’s the class of insurance coverage mostly advisable to seniors in Canada for quite a lot of causes. It additionally – virtually at all times – pays a a lot larger gross sales fee to the individuals who promote it.

Certainly one of my favorite explainers of all issues Canadian finance – Preet Banerjee – does a terrific job explaining time period vs everlasting insurance coverage right here.

So, beneath the large “everlasting insurance coverage umbrella” we’ve got term-to-100 life insurance coverage, entire life insurance coverage, and common life insurance coverage. Every insurance coverage firm will put their very own distinctive spin on a few of these insurance policies, and the specifics can get fairly difficult, however right here’s the gist of it.

Time period-to-100 Life Insurance coverage

The simplest sort of everlasting life insurance coverage, term-to-100 life insurance coverage is typically known as T100. The thought is that you just need to pay a simple one-price premium to your total life. As a result of a majority of these insurance policies sometimes don’t have any “bells and whistles”, they’re the most cost effective kind of everlasting life insurance coverage.

No worries about managing investments inside the coverage or “give up worth” or something like that. Only a easy one-price insurance coverage that you just’ll pay till you hit 100 years of age. Should you dwell previous 100, the premiums cease, however the protection continues.

In fact when you determine to stop paying the premiums on this insurance coverage for any purpose, the insurance coverage firm retains the premiums you paid, and the contract is ended with none additional profit.

Common Life Insurance coverage

Common life insurance coverage is a sort of everlasting life insurance coverage that’s meant to insure you to your total life. The “common” a part of the title comes from the concept your coverage will help you adapt variables such because the dying profit and premiums all through the lifetime of your insurance coverage contract.

Virtually at all times, there is a component of “paying extra upfront – so that you just don’t must pay a lot in a while” in the case of common life insurance coverage. When you pay your premiums, most of those plans offer you some aspect of management over the investments inside the coverage that you could put your premiums into.

As your investments earn cash (hopefully) most UL plans offer you some form of choice to make use of that cash to purchase extra insurance coverage, decrease your premiums, or as a sort of payable money dividend.

You don’t must pay further to purchase investments inside a common life coverage. You possibly can simply pay the life insurance coverage premiums. However one of many causes to purchase a common life coverage is to have the ability to purchase investments, typically structured as mutual funds, that develop tax deferred inside the coverage.

Entire Life Insurance coverage

Like common life insurance coverage, entire life insurance coverage is supposed to insure you till you go to the good tax haven within the sky. There are two primary sorts of entire life insurance coverage. “Taking part” – or “par” – entire life insurance coverage permits the insuree to “take part” within the income of the plan – often by getting a dividend annually (relying on funding efficiency inside the plan).

Non-participating (non-par) entire life insurance coverage is analogous, however you typically don’t receives a commission a various dividend (since you don’t “take part” within the plan).

Entire life insurance coverage typically affords a contract the place you pay a better premium in your first 20 or 30 years, after which an enormous a part of that cash is used to fund investments. The earnings produced by these investments will then typically pay the premiums for the remainder of your life – or an identical setup will likely be in place relying on the small print of the precise plan.

Entire life insurance coverage differs from common life insurance coverage in that you just can’t management what investments your cash is put into inside your insurance coverage account. The life insurance coverage firm will select the investments in your behalf. The investments are typically a mixture of shares, bonds, and actual property.

For prime internet price buyers, what is typically advisable is a collaborating entire life insurance coverage plan the place the dividend cash that you’d be getting is mechanically used to buy extra insurance coverage. In that scenario, you might be primarily utilizing your funding features, to buy extra insurance coverage – and never getting taxed on these features alongside the best way.

The Hidden Tax On Canadian Life Insurance coverage

On the finish of the day, the charges on these life insurance coverage merchandise are a lot larger than the charges you’d pay when you took your premiums and simply invested your cash in a non-registered funding account. Head of Analysis at PWL, Ben Felix (who can be a CFA and CFP) acknowledged on his Rational Reminder podcast that in his analysis, “Sometimes, the charges are nicely above 2%”.

Let’s say that “nicely above 2%” means 2.5% for the needs of truly attempting to color an enormous image of what this all means.

That 2.5% in charges goes to get charged on ALL of the investments that get made inside the common or entire life insurance policies. It can get charged rain or shine, whether or not the investments have good years or unhealthy years.

Should you make investments cash by yourself, and the inventory market has a foul 12 months, you don’t pay taxes on the features in your portfolio – in truth, when you use tax loss harvesting, your portfolio’s unhealthy 12 months can generate tax deductions to offset different taxes that you just would possibly owe on earlier or future capital features.

Now, 2.5% doesn’t sound like a lot. However bear in mind, that is 2.5% of the whole funding NOT the amount of cash that the funding made that 12 months!

So, on condition that many insurance coverage corporations are conservative of their asset allocation, and lots of Canadian retirees don’t need to embrace a risky mixture of investments, let’s be beneficiant and use a 6% funding return in our calculations.

Given the observe file of energetic cash administration in Canada, and that almost all retirees will in all probability select to have a beneficiant serving to of mounted earnings like bonds of their funding combine, I feel 6% might be a contact excessive, however let’s give the good thing about the doubt.

That 2.5% represents a 41.6% “tax” in your common funding 12 months. The one distinction is that on this case the tax will get paid to the insurance coverage firm as an alternative of to the federal government. That “tax” within the type of charges paid to the funding firm might be cash staying in your palms when you merely invested that premium cost cash by yourself.

However Canadian Life Insurance coverage Plans Supply Tax-Free Progress Proper?

The argument in favour of utilizing life insurance coverage as an funding revolves across the premise of a magical tax-free pot of gold on the finish of life’s rainbow. Canadians typically LOVE the thought of getting out of paying taxes. It’s an concept that’s straightforward to grasp, and simple to elucidate at a floor stage. Relating to paying life insurance coverage premiums in return for a payout upon dying nevertheless, we’ve got to ask ourselves how a lot tax we might really be paying if we simply invested the cash on our personal as an alternative of handing it to a life insurance coverage firm.

Funding earnings and features made inside entire life and common life insurance policy are tax-free in most conditions.

BUT – the query turns into, is that tax-free profit price paying for the charges and possible underperformance of the investments inside the plan in comparison with cheaper funding choices?

To not point out the truth that you must type by means of all of the paperwork and complexity of the plan as nicely.

Let’s take a look at the common fee of tax a Canadian goes to pay on their investments if they only took their cash and invested it in a non-registered account. (I’m not going to trouble evaluating to an RRSP or TFSA, as a result of as I defined on the prime, that comparability isn’t even shut. Should you nonetheless have room in your RRSP and TFSA, you then shouldn’t be worrying about difficult insurance coverage merchandise in any respect.)

Given the quantity of tax credit and earnings splitting choices out there to seniors in Canada, it’s fairly doubtless many middle-class Canadian retiree {couples} can pay a decrease tax in retirement than they did whereas they have been working.

Revenue from sources resembling part-time work, CPP, OAS, non-public pensions, and RRSPs/RRIFs will likely be taxed the identical method as earnings you’ll have earned at a job earlier than retirement. For example, let’s say for an above-average earnings retiree couple, these sources of earnings may add as much as $30,000 every in retirement.

TFSA withdrawals are clearly tax-free beneath any circumstances, so no want to fret about paying taxes on that earnings, or having that cash “push you into a better tax bracket.”

If we take a look at our hypothetical couple from above, they are going to every have about $23,000 of “earnings area” out there to them earlier than they hit the second federal earnings tax bracket. Now, the provinces are additionally going to take their tax chunk. Ontario’s first tax bracket goes as much as virtually $50,000, BC’s goes as much as virtually $46,000, Alberta’s goes as much as $142,000, Quebec’s about $49,000. In order a ballpark, we’ll say that our “above-average” retiree couple with maxed out TFSA and RRSP accounts has about $20,000 in earnings area, earlier than they hit that subsequent tax bracket.

Normally, the related tax charges that we need to take a look at when attempting to determine if we want everlasting life insurance coverage are these in that first tax bracket. Right here’s the roughly mixed federal/provincial tax fee that you just’d be taking a look at relying on what investments you’d have in your non-registered portfolio and what province you’re in.

- GIC/Bonds/Excessive Curiosity Financial savings: 20-25%

- Capital Features: 10-14%

- Canadian Dividends (as soon as the dividend tax credit score components is utilized): 0%-5%

Fast Observe: We’ll go away company taxation apart for a second – simply know that the dividends I’m referring to listed here are the dividends we’d get from investing in shares in our on-line brokerage (referred to as eligible dividends) – and that dividends from non-public corporations are often non-eligible dividends and have their very own tax remedy.

You possibly can see once more why we put a lot emphasis on placing the best investments in the best spots once we mentioned Withdrawing out of your TFSA, RRSP, and Non-Registered accounts.

Now, I don’t know too many Canadian retiree {couples} who need to pull out greater than $40,000 per 12 months ($20,000 every) from their mixed non-registered funding account. If that $40,000 consisted of largely Canadian shares, you’d be taking a look at withdrawing all the dividend cash annually, and possibly promoting off a few of the shares annually too.

A part of that cash from promoting the inventory goes to be tax-free (the unique cash that you just paid for the shares is simply your individual after-tax {dollars} coming again to you) after which a part of the cash (the acquire you made) goes to be taxed as a capital acquire.

When you ought to have the ability to shelter the majority of your non-Canadian investments and GICs/bonds in your TFSA and RRSP till later in retirement, it’s potential that you’d have a few of these sorts of investments in your non-registered funding account as nicely.

Numerous tax-saving methods resembling tax-loss harvesting can typically be utilized to additional scale back your tax charges.

So, to get again to our hypothetical couple… If their total mixed earnings for a 12 months in retirement appeared like the next:

CPP + OAS + part-time work + RRSP withdrawals + TFSA withdrawals = $60,000

Canadian dividends (eligible) from non-registered account = $15,000

Non-Canadian dividends from non-registered account = $5,000

Capital features from non-registered account = $10,000

Your individual after-tax a reimbursement from promoting shares in a non-registered account = $10,000

Then on this scenario our hypothetical couple goes to pay about 9% in tax on the mixed funding features they made once they withdraw their spending cash from their non-registered investing account annually. They’d additionally in fact withdraw $10,000 that they obtained again from promoting shares that may be non-taxable.

That’s an instance quantity of tax that might be saved by placing these investments inside a everlasting life insurance coverage plan.

BUT – in return for that pretty meagre tax financial savings, your everlasting life insurance coverage plan goes to cost you someplace round 30-50% of your funding returns in charges (as mentioned above).

I don’t find out about you, however that doesn’t sound like a terrific deal to me.

To additional complicate issues, once we’re speaking about collaborating entire life insurance coverage, the precise underlying asset that you just’re investing into is the profitability of the plan itself, versus any shares, bonds, or GICs. So your precise dividend is NOT primarily based solely on how the investments do, however as an alternative additionally contains the precise assumptions that go into figuring out the general profitability of the block of plans that you just’re part of.

Should you’re pondering that is all method too difficult, you’re virtually actually right. Ben Felix and Cameron Passmore do the perfect job potential explaining how this all suits collectively on this episode of their Rational Reminder Podcast.

Right here’s what the staff at PWL wrote about collaborating entire life insurance coverage in Canada:

Taking part Entire Life (PAR) insurance coverage shares most of the similar options as non-participating WL insurance coverage, with the addition that policyholders can partake within the efficiency of a collective group of insurance policies. This collective group is named the block of collaborating insurance policies.

Successfully, policyholders of collaborating WL pay a better premium than the equal non-participating WL to be able to partake within the efficiency of the insurance coverage firm’s income, because it pertains to all the PAR insurance policies issued and excellent.

An insurer will value their merchandise primarily based on assumptions in regards to the future, the place the premium is about to replicate expectations of assorted components together with mortality, bills, coverage lapses and cancellations, coverage loans, dying profit claims, and taxes.

Premiums obtained in extra of claims and bills are invested in a collaborating fund, and the insurer then units further expectations for the efficiency of those investments. If the precise expertise of the block of PAR insurance policies is healthier than anticipated, “dividends” are paid to policyholders in that collaborating block. Mentioned in a different way, if the funding efficiency of the collaborating account is healthier than anticipated, there’s a constructive impression on collaborating policyholders.

That is necessary: many insurance coverage corporations will showcase the asset allocation and historic efficiency of the collaborating funding fund, however these particulars are irrelevant to the efficiency of PAR insurance policies. What issues to collaborating policyholders is how nicely the insurance coverage firm predicts the efficiency of the collaborating fund once they value the premiums for PAR insurance policies.

If taxes and bills are larger than anticipated, or if dying claims and coverage lapses are larger than anticipated, dividends are negatively affected; coverage lapses go away the insurance coverage firm with much less time to soak up excessive underwriting prices, gross sales prices, and commissions.

To signify the anticipated efficiency of future coverage dividends, advertising and marketing supplies of everlasting insurance policies usually illustrate the “present dividend scale” as a share. This scale can’t be used to match insurance coverage suppliers. The policyholder expertise is solely managed by the unfold between the true consequence and the actuarial assumptions used. The assumptions are stored confidential by insurance coverage corporations whereas the true consequence can’t be reliably predicted with any diploma of certainty…

A Canada Life coverage illustrated in 2010 on the then-current scale of seven.36% could have left policyholders who bought on the idea of “present dividend scale” disenchanted by the common dividend scale rate of interest of 6.23% since then, or the common of 5.75% for the 5 years ending 2021. This highlights the chance of collaborating dividends: they aren’t assured. Insurance coverage corporations are upfront about this reality.

All that to say: Look, the returns on collaborating entire life insurance coverage are ridiculously advanced. They’re additionally misrepresented to be able to promote a really high-commission product.

What About Everlasting Insurance coverage Inside My CCPC?

As an intense sceptic in regards to the idea of “infinite banking” and the gross sales of high-commission everlasting life insurance policy, I imagine in holding life easy and ignoring them utterly.

That stated, if there may be one scenario the place the tax-effectiveness of life insurance coverage actually shines it’s when a coverage is held inside a Canadian Managed Non-public Company (CCPC). Right here’s the fast benefits on this distinctive scenario:

- Your giant premium funds every month are tax deductible as they’re written off as a enterprise expense.

- The dying profit might be paid out tax free utilizing the Capital Dividend Account inside a CCPC.

- Taking part entire life insurance coverage dividends can regularly be used to purchase extra models of life insurance coverage, and thus, funding features are primarily untouched.

Now, it ought to be identified but once more, that each one it takes for these insurance policies to utterly crumble is one missed cost. In case your company ever goes by means of a tough time – or you could pull extra money out of your company than you initially thought – and you may’t pay the insurance coverage premium… wave goodbye to that “cadillac insurance coverage plan” you have been relying on a key a part of your property.

Adjustments to authorities taxation are one other issue to think about. As a majority of these insurance coverage loopholes are extra generally exploited, they are going to change into extra ripe targets for the CRA to go after. Certainly, in a current interview I did with fee-only advisor Jason Heath (CFP) on the Canadian Monetary Summit, he speculated such modifications might be coming down the pipeline.

Is There a Time When Shopping for Life Insurance coverage as a Senior Makes Sense?

It’s debatable.

Should you knew forward of time whenever you have been going to die – and that “your time” was going to come back sooner moderately than later – then it could make sense to purchase life insurance coverage as a senior.

Clearly that’s a reasonably robust information level to provide you with.

And in case your well being is poor, and you purchase a brand new life insurance coverage coverage, the insurer will tag you as excessive threat of their underwriting and your premiums will likely be larger.

I’m additionally biased in direction of simply holding issues so simple as potential in the case of dealing with funds in retirement. Investing the cash that may have been used to buy insurance coverage premiums gives you much more direct management, and it’s simply a lot simpler/much less advanced than worrying in regards to the particulars of a everlasting life insurance coverage plan.

Positive, you’ll pay some taxes whenever you earn and spend your individual cash, or when it passes to your property. BUT, in return you’ll get quick access to your cash all through your total life, you’ll get to decide on the investments, you’ll get to chop charges to the bone, and also you’ll get the worth of simplicity.

Oh – and also you don’t have to fret in regards to the small risk that the insurance coverage firm would possibly go bankrupt sooner or later within the subsequent 50 years. Admittedly there isn’t an enormous probability of this occurring, however Google “AIG 2008” if you wish to scare your self somewhat bit.

There have been three circumstances of Canadian life insurance coverage corporations going bankrupt since 1990. The excellent news is that attributable to authorities regulation, 85% of your coverage advantages will likely be assured in a chapter situation.

Barring clairvoyant data of your individual demise, I feel that there’s a logical case to be made to look into buying life insurance coverage in retirement when you fall into the next scenario:

1) You’ve gotten maxed out your RRSP and TFSA.

2) You’ve gotten a comparatively giant non-registered account or a considerable amount of investments inside a company account (in all probability within the $1 million+ vary).

3) You need to go on the utmost quantity of after-tax earnings to your property – and that’s extra necessary to you than spending on your self in your golden years.

4) You’d moderately pay a excessive month-to-month premium than fear about placing the equal amount of cash in a non-registered account every month.

On this scenario, shopping for some kind of everlasting life insurance coverage that makes use of the accrued funding returns to purchase extra insurance coverage protection – might be a decently tax-efficient option to go away cash to your family members.

On this scenario, the returns in your funding features by no means really get taxed, and the always rising insurance coverage protection that you just purchase may turn out to be useful when settling up your property. Usually there are taxes owing on an individual’s property once they personal a number of properties, or have company tax liabilities.

A life insurance coverage cheque can be utilized to shortly pay these taxes and simplify issues. Life insurance coverage payouts typically don’t must go by means of probate if paid to a direct beneficiary as an alternative of your property, and so the beneficiaries can get the cash faster.

I’d level out that a big amount of cash in an funding account may also be used to pay taxes. Giant quantities of cash may also be gifted to family members or donated to charities whereas nonetheless dwelling, so these are different choices price evaluating excessive life insurance coverage premiums to.

For my part, one may safely ignore the money worth and all that different stuff, as a result of if you must fear about borrowing in opposition to the money worth, you in all probability don’t have the online price and liquidity to be worrying about everlasting life insurance coverage in your golden years.

What If I Already Have a Common or Entire Life Coverage?

Should you’re studying this and also you’ve been paying right into a common or entire life coverage for a decade or two already, you then’re virtually assuredly finest to keep it up if in any respect potential.

Sadly, there are various Canadians annually who’re going to determine they not want their everlasting insurance coverage coverage and determine to stop paying premiums, and take the money give up worth of the plan. That is the worst-case situation that I recognized initially of this text.

Properly… really, I suppose the worst-case might be that your life insurance coverage will get paid out very early after you begin paying premiums. Mathematically, your property will profit from this, however uh… let’s simply say accumulating a life insurance coverage payout has a excessive price concerned.

So the second worst case situation is one detailed in this Star article by David Aston. In the sort of scenario, the necessity for price range room as one will get older makes the everlasting life insurance coverage premium an unaffordable luxurious. When the choice is made to break down the coverage, virtually all the worth of the month-to-month premiums paid through the years evaporates. Positive, you would possibly accumulate a comparatively small money give up worth, however that’s virtually nothing in comparison with when you had simply invested the cash by yourself.

The article above exhibits how a “nicely off” Canadian couple was promised 10% funding returns inside their funding plan. In fact the investments didn’t even come near that promised quantity, and that left the couple nonetheless paying hefty premiums in retirement.

In the event that they fail to pay these huge premiums, they’ll lose the worth of all of the premiums they’ve paid prior to now. Consequently, they’ve needed to reduce on their life-style and forego retirement journey plans amongst different luxuries.

So, it does make mathematical sense to maintain paying the premiums if in any respect potential. Possibly ask the beneficiaries to chip in a bit to assist if wanted? Letting the coverage collapse is often a big internet loss to your property for comparatively small acquire proper now. Because of this it’s so noteworthy that so many costly everlasting insurance coverage insurance policies do collapse earlier than paying out their dying profit.

If in case you have an investable element to a common life insurance coverage coverage, I’d advocate asking about index fund choices. Not all insurance policies supply these choices, however some do, they usually’ll doubtless be vastly superior to the high-fee mutual funds which can be sometimes provided.

Borrowing From Your Personal Insurance coverage Coverage – Money Worth and Money Give up

My favorite line within the PWL whitepaper that I quoted from above is: Essentially the most environment friendly method of accessing a life insurance coverage asset is thru the dying profit, however this, in fact, requires dying.

Something that requires you to die in all probability isn’t a really perfect method to take a look at the long run!

That stated, proponents of infinite banking and everlasting life insurance coverage are fast to level out that life insurance coverage has advantages for the dwelling as nicely.

Usually, the pitch goes one thing alongside the strains of:

- As you hand cash over to the insurance coverage firm yearly, you’ll construct a money worth inside your coverage.

- You possibly can withdraw a few of this money worth at any time (though it’s taxed at that time).

- As an alternative of withdrawing the money, merely borrow cash from the money worth of your insurance coverage coverage. It’s like magic – you “change into your individual financial institution” and pay no taxes. Simply do that without end and also you’ll get wealthy by by no means paying taxes.

This “mortgage cash” can come from the insurance coverage firm itself, or it may possibly come from a 3rd social gathering. Should you borrow from the insurance coverage firm, the rates of interest are often fairly excessive. To make issues worse, if the coverage mortgage will get giant sufficient (greater than the adjusted price foundation) you’ll be able to really be taxed on that mortgage!

Going the third-party route signifies that the money worth of your life insurance coverage coverage can be utilized as collateral to entry a mortgage from a lender resembling a financial institution. On the time of publishing, the rate of interest for coverage loans at RBC was 9.2% (the financial institution’s prime fee +2%).

FAQ About Canadian Life Insurance coverage for Seniors and Retirees

Summing Up Life Insurance coverage Wants for Retired Canadians

- Life insurance coverage is for safeguarding individuals who financially rely on you. If there are not folks financially relying on you you then virtually assuredly don’t want life insurance coverage.

- There are monumental commissions for the parents who promote life insurance coverage. These commissions are answerable for why the merchandise are pushed so laborious.

- Should you meet the excessive net-worth standards described above, there are nonetheless wonderful causes to only make investments by yourself and keep away from the complexity of life insurance coverage contracts.

- Nearly all of everlasting life insurance coverage insurance policies by no means pay out a dying profit as a result of folks cease paying the premiums at a sure level for quite a lot of causes. In these circumstances, you’ve gotten terrible worth to your cash, as you may have bought quite simple time period life insurance coverage as an alternative.

- Assured life and term-to-100 are the most cost effective methods to completely insure your self for the good thing about your property. Don’t fear about money values and all of those different fancy riders.

- To ensure that life insurance coverage to be even a mediocre funding return relative to DIY investing, you’d must die younger. That method your property would get the dying profit with out you paying into the plan for many years. Something that requires you to die younger in all probability shouldn’t be part of your monetary plan!

- If in case you have gotten talked into beginning a everlasting life insurance coverage plan sooner or later, it’s in all probability price having a dialog with the beneficiary about splitting the prices of the insurance coverage premium every month. Mathematically, it in all probability is smart to maintain paying the premiums simply so the plan doesn’t lapse.

Are You Saving Sufficient for Retirement?

Canadians Imagine They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Monitor?

Change into your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Strive Now With 100% Cash Again Assure

*Information Supply: BMO Retirement Survey