After I first wrote concerning the Smith Manoeuvre (18 years in the past!) – a way to rework your mortgage right into a tax-deductible mortgage – I by no means imagined it could turn into one in all our hottest matters, racking up a whole bunch of feedback.

Although I kicked off my very own Smith Manoeuvre at virtually the worst time within the final half-century (again in 2007), it nonetheless turned out fairly nicely for me.

As we transfer into 2025, it’s turning into clear that top mortgages could be coming down a bit, the times of ultra-low charges are doubtless gone for the foreseeable future. Paying extra in your HELOC as a result of these excessive charges will certainly sting, however don’t overlook that your marginal tax charge successfully reduces that curiosity burden. The truth is, larger rates of interest really give the Smith Manoeuvre a broader edge in comparison with extra conventional mortgage paydowns.

Through the years, I’ve shared a number of updates on my private tax-deductible funding mortgage, in addition to my most well-liked Canadian dividend shares for Smith Manoeuvre accounts.

Since I first wrote about my Smith Manoeuvre portfolio, I’ve acquired a whole bunch of hundreds of {dollars} in dividends, and the market worth of my Canadian dividend holdings has gone up considerably. I’ve additionally saved tens of hundreds of {dollars} in taxes alongside the way in which.

I’ve pulled collectively all my firsthand insights into this Final Information to the Smith Manoeuvre. Be happy to make use of the Desk of Contents to leap straight to the sections that curiosity you most.

Introduction to the Smith Manoeuvre

For individuals who don’t know what the Smith Manoeuvre is, it’s a Canadian wealth technique that’s designed to construction your mortgage in order that it’s tax deductible. Our U.S. neighbours already get the posh of claiming their mortgage curiosity on their yearly tax return, and now there’s a manner for us Canadians to do the identical. (Type of.)

There’s a tax rule in Canada, the place when you borrow cash to spend money on an income-producing funding (like a dividend-paying inventory or an funding property), you’ll be able to deduct the annual curiosity paid on the funding mortgage out of your revenue tax.

In layman’s phrases, when you get a mortgage with x quantity of curiosity per yr, you’ll be able to declare that x curiosity throughout revenue tax season when you use the mortgage towards shares or rental properties. If you happen to’re nonetheless confused, please learn on under the place I’ll ultimately clarify all the things step-by-step.

If you happen to’re questioning if the juice is definitely worth the squeeze – simply perceive that whereas correctly implementing the Smith Manoeuvre does require a little bit little bit of studying, it could prevent hundreds of {dollars} per yr in taxes, in addition to supercharge your long-term funding returns.

Mr. Fraser Smith got here up with the concept of the Smith Manoeuvre (therefore the identify) and revealed it as a manner for Canadians to show their plain outdated mortgage debt, into shiny new funding debt – which was tax deductible and able to develop.

To summarize the Smith Manoeuvre in a nutshell, the principle thought is that you simply borrow cash towards the fairness in your house, make investments it in income-producing entities, and use the tax return to additional pay down the mortgage.

Rinse-and-repeat till your mortgage is totally paid off, leaving you with a big portfolio and an funding mortgage. Voila! Your mortgage is now an funding mortgage which is tax-deductible. Plus, you’ve a a lot bigger portfolio that is able to make the most of the long-term charge of return that shares have historically generated during the last 200+ years.

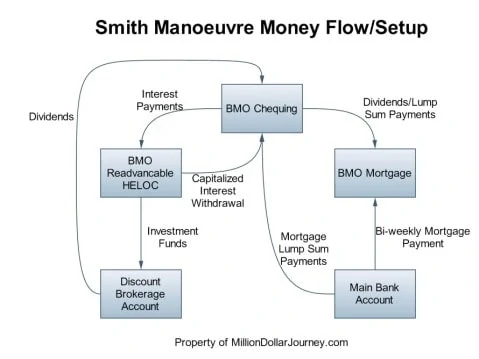

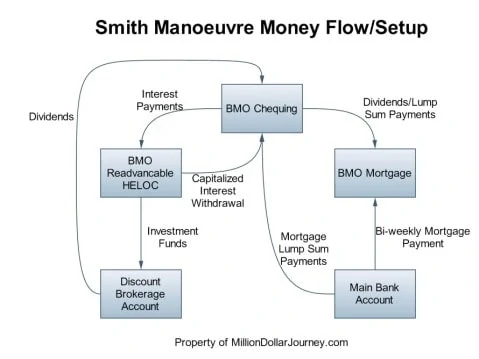

Whereas I tend to optimize, here’s a barely modified model of the Smith Manoeuvre which you should use if in case you have already began a non-registered funding account like I did. When you’ve got not but opened a non-registered account, then simply skip to Step 2.

1. Promote all present inventory from non-registered funding accounts and use it towards a down fee for step 2.

2. Get hold of a readvanceable mortgage. It is a mortgage that has 2 entities, the Dwelling Fairness Line of Credit score (HELOC) and the common mortgage.

Nothing distinctive about this setup EXCEPT that as you pay down the mortgage, the credit score restrict on the HELOC will increase. It is a key function that’s wanted when implementing the Smith Manoeuvre. Be aware that you simply often require at the very least 20% fairness/down fee earlier than you’ll be able to get hold of a readvanceable mortgage.

All of Canada’s main banks supply one of these HELOC + Mortgage setup; nevertheless, I wouldn’t financial institution on strolling right into a department and speaking to anybody who has any thought what the Smith Manoeuvre is!

3. Use the HELOC portion of your mortgage to spend money on revenue producing entities like dividend paying shares or rental property. With each mortgage fee, your HELOC restrict will improve. So with each common mortgage fee, you’ll make investments the brand new cash in your HELOC. Be aware that you simply SHOULD NOT use the HELOC cash to spend money on your RRSP or TFSA as you’ll lose the tax deduction on the invested cash. If you happen to don’t have already got an funding account, here’s a evaluation of the extra common low cost brokerages in Canada.

4. When tax season hits, deduct the annual quantity of curiosity that you simply paid in your HELOC towards your revenue. So, when you paid $6,000 in curiosity funds for the yr and you’ve got a marginal tax charge of 40%, you’re going to get again ~$2,400 of it.

5. Apply the tax return and funding revenue (dividends, and many others.) towards your non-deductible mortgage and make investments the brand new cash that’s now in your HELOC.

6. Repeat steps 3-5 till your non-deductible mortgage is paid off.

As you’ll be able to see, this course of can pay down your common mortgage in a rush.

Moreover, it’s essential to grasp that in its pure kind, the Smith Manoeuvre advocates for by no means paying down the unique HELOC. Merely pay the curiosity annually, deduct it in your taxes, and go away the investments to do their factor. This will, after all, be modified relying in your threat tolerance. That is additionally why multi-millionaires usually have giant funding loans, and why the tax code is about as much as make the most of that truth.

How A lot of My Dwelling Fairness Can I Use for The Smith Manoeuvre?

Nationally-regulated banks can solely permit householders to borrow as much as 65% of their fairness in direction of their “revolving” or house fairness line of credit score portion. Nonetheless, householders can nonetheless borrow as much as 80% of their fairness in whole. Which means that the remaining 15% (80% – 65%) must be within the type of an installment mortgage with an everyday compensation schedule.

It is a comparatively latest guidelines change and the essential factor to recollect is that at no level are you able to ever be borrowing greater than 80% of the entire worth of your own home, and at no time can you’ve a HELOC larger than 65% of the worth of your own home.

Ought to I Do the Smith Manoeuvre?

One explicit (and demanding) truth to remember is that although the Smith Manoeuvre consists of making your Canadian mortgage tax deductible, it additionally features a leveraged funding technique.

What the heck is a leveraged funding technique, you would possibly ask?

Leveraged investing refers back to the act of borrowing cash in an effort to make investments. The time period comes from the concept that whenever you borrow cash to take a position, you’ll be able to “transfer” nice sums of cash – form of like how utilizing a bar and a fulcrum permits somebody to use bodily leverage in an effort to transfer a heavy object.

When utilizing the Smith Manoeuvre and implementing a leveraged investing technique it’s essential that you simply perceive that if markets go down, you continue to must pay curiosity in your funding mortgage.

Consequently, borrowing cash in an effort to make investments will be fairly dangerous within the brief time period, and when you want the cash within the subsequent 5-10 years, I might positively not arrange a Smith Manoeuvre! Leverage works towards you, so when markets go down, you’ll actually really feel that sting in case you are taking a look at your funding accounts on daily basis.

It’s essential that your self, understand how you reply to threat, perceive how investing markets work, and be assured in your long-term technique it doesn’t matter what markets do within the brief time period. I can not emphasize sufficient how essential it’s to know if it is possible for you to to sleep at night time after watching 40% of the worth of your Smith Manoeuvre account seemingly evaporate.

It’s unhealthy sufficient when this occurs inside an RRSP or TFSA, however there’s an added layer of psychological warfare that happens when that funding has been bought with “borrowed cash”. It’s attainable (if unlikely) that you might find yourself with an funding mortgage that’s price greater than your now-cratered funding portfolio.

Now, when you perceive how fairness markets work, and are assured that worthwhile companies will maintain earning profits within the long-term – then this isn’t a giant fear. You may trip it out, maintain making your mortgage funds, maintain deducting the curiosity, and stay life.

If you happen to can’t wrap your head round how this all works, and as a substitute simply maintain coming again to, “It seems like I’m playing my home on the inventory market,” then the Smith Manoeuvre merely isn’t for you.

The Benefits:

- You get to construct a big funding portfolio with out ready to repay your mortgage first (the facility of compounding). That is a completely huge benefit in wealth-building energy relative to the common Canadian!

- You get to pay down your non-deductible mortgage in a rush.

- Your new funding mortgage is tax deductible. This clearly turns into much more invaluable in case you are within the larger tax brackets.

The Draw back:

- You want to be snug with LEVERAGE and investing normally.

- You want a plan ‘B’ within the case that it’s essential transfer and residential values have gone down. If you happen to invested correctly, your portfolio ought to at LEAST cowl your mortgage.

- Some record-keeping must be achieved for tax functions.

What are the Advantages and Funding Returns of the Smith Manoeuvre?

Listed here are my private numbers and plan from again after I began the Smith Manoeuvre – which I’ll use to calculate the profit. You’ll discover that again in 2008, homes had been less expensive, and rates of interest had been a lot larger. These numbers had been my authentic plan, and for probably the most half, they held up fairly nicely:

- Previous Residential Dwelling Worth: $140,000

- Previous Excellent Mortgage: $80,000

- Fairness: $50,000 after Realtor charges.

- Money Financial savings used: $20,000

- Non-Registered Portfolio: $40,000 (liquidate)

- Complete Down Fee: $110,000

- New Home: $275,000

- New Mortgage: $275k-110k= $165,000 (non tax deductible)

- New HELOC (@ 6%): [ ($275k x 75%) – $165k] = $41,250 (tax deductible)

- Complete Debt: $206,250

- New Mortgage Fee (accelerated bi-weekly) @ 5.25%: $584.12 (not together with property tax, insurance coverage and many others).

- Authentic Amortization: 16 years

The Standards:

- All tax returns shall be utilized to the non-deductible mortgage stability, which then once more, will increase the HELOC stability.

- All dividends shall be used to pay down the non-deductible mortgage.

- HELOC curiosity funds shall be capitalized. That’s, the HELOC required funds shall be paid by the HELOC itself. This can keep away from utilizing any of my very own money move to assist the funding mortgage. The spreadsheet will account for this.

- Assume that the LOC shall be invested in dividend paying shares that present an revenue stream of $1400/yr (assume 3.5% common dividend yield). This equates to a $54 / bi-weekly interval utilized to the mortgage. This must be rising yearly however for simplicity sake, I shall be retaining this fixed.

- Assume that since I’m going to proceed to max out my RRSP, I gained’t have any further money to pay down the mortgage.

The Assumptions:

- Marginal Tax Price: 40%

- Common Funding Progress Price: 8%

- Diverted Periodic Investments: $54

- HELOC Rate of interest: 6%

- Mortgage Curiosity Price: 5.25%

The Outcomes:

- Non-deductible mortgage paid off in 11.78 years as a substitute of 16

- Funding Portfolio Worth after mortgage is retired: $244,833

- Portfolio Worth NET of HELOC: $38,583

- Funding Portfolio Worth after 25 years: $908,640

- Portfolio Worth NET of HELOC: $702,390

Abstract:

- This evaluation exhibits the advantages of utilizing the Smith Manoeuvre, not the down aspect. You want to be snug with leverage, particularly the draw back, earlier than you even think about using this technique.

- The Smith Manoeuvre enabled me to repay my mortgage in 12 years as a substitute of the said 16 years with no further money move out of my pocket.

- On the finish of the mortgage time period, assuming that I common 8% returns over that time period, my portfolio worth minus the mortgage quantity shall be roughly $38,000.

- If I proceed to carry the tax-deductible mortgage after paying off my authentic mortgage mortgage, and permit my investments to proceed to compound – the general end result shall be roughly $700,000 extra in my pocket.

A typical argument towards the Smith Manoeuvre is that there’s merely an excessive amount of threat in “playing” your house within the inventory market.

When you’ve got this query, it’s actually a very good indicator that the Smith Manoeuvre isn’t for you – and that’s okay!

You realize what’s not for me?

Something involving motors, wrenches, and many others!

It’s essential to “know thy self” with regards to leveraged investing. Investing within the inventory market would possibly include an inherent stage of threat – nevertheless it’s NOT playing in any respect. Utilizing pretty stagnant house fairness that will simply sit there in any other case, not compounding a lot in your behalf, is NOT “playing your own home”.

Give it some thought this fashion…

Isn’t it a “gamble” in some sense of the phrase whenever you purchase a home and take out a mortgage 5-10x as massive as your down fee?

If you happen to take a look at that home as an funding, you simply leveraged a ton of cash in an effort to purchase an asset that’s about as non-diversified as you will get. That massive sum of money that you simply simply borrowed is now tied up in a single property – which might’t be moved – and that may depend on the whims of the native actual property market, which you don’t have any management over.

PLUS, it’s fairly illiquid and can price you hundreds of {dollars} to promote. How is that much less dangerous than organising a portfolio of secure dividend shares, that are diversified throughout huge industries, and that earn cash from all around the world?!

Not simply that, however they’ve 20+ yr histories of paying their shareholders ever-increasing dividends, yr after yr (Learn: Our listing of Canadian dividends kings). I do know which asset sounds much less dangerous to me!

The diversification of your property that could be a obligatory a part of the Smith Manoeuvre really makes your total monetary image much less dangerous – but when that’s arduous to check, then you definately’ll discover it very troublesome to not panic when markets hit a downturn, and utilizing leveraged investing simply isn’t for you.

Arrange The Smith Manoeuvre

Earlier than I begin with the main points, we have to ensure that your funding mortgage is, in actual fact, an funding mortgage that’s tax deductible. If you happen to get a mortgage to spend money on a tax-sheltered account, like an RRSP, TFSA, and/or an RESP, then the curiosity is not tax deductible.

Additionally, tax deductibility of an funding mortgage is dependent upon when you use the proceeds to generate enterprise/funding revenue. You can’t use a HELOC secured towards your rental property on private bills and nonetheless declare the curiosity as a tax deduction.

Calculate Your Curiosity Deductible:

To find out the tax return of the curiosity paid in your funding mortgage, multiply the whole curiosity paid in the course of the yr by your marginal tax charge.

For instance: when you paid $1,000 in curiosity for the yr and you’re within the 40% marginal tax bracket, you’ll obtain $400 again from the federal government.

CRA Guidelines for the Smith Manoeuvre

Canada Income Company (CRA) expects that when you use borrowed cash to take a position that you’ll obtain some form of revenue out of your investments. The “revenue” consists of curiosity, dividends, hire, or royalties. Even when a inventory that you simply buy does NOT at present pay dividends, so long as they’ve an affordable “expectation” of future dividend funds, then it “ought to” stay deductible.

Though CRA solely expects revenue out of your funding portfolio, in 2003, the finance division declared that to ensure that funding loans to stay deductible, the curiosity/dividends should produce a revenue. That’s, the dividends should EXCEED the curiosity that you’re paying on the mortgage.

I do know, the finance division and the CRA are on totally different pages on this one.

In response to Globe and Mail author Tim Cestnick, the CRA will usually ignore the finance division guidelines and settle for the tax deduction so long as it produces any revenue, however examine together with your tax skilled for the newest guidelines.

I do know this a lot, the businesses on our dividend shares listing (which we replace quarterly) positively meet the CRA’s and the finance division’s standards.

Hold Your HELOC Curiosity Tax Deductible!

As soon as you employ a mortgage/line of credit score to take a position, do NOT withdraw from it until it’s from dividends/curiosity that the funding produces.

For instance, when you use a $10,000 line of credit score to take a position, obtain a $5,000 capital achieve, and subsequently withdraw $5,000 to spend on a trip, how a lot of your mortgage stability remains to be deductible? $10,000? Nope!

In response to Tim Cestnick, because you withdrew 1/3 out of your funding mortgage, solely 2/3 of your remaining mortgage is tax deductible.

This consists of Return Of Capital funds/revenue trusts additionally!

Technically, as you obtain ROC distributions, it should lower the tax deductibility of the funding mortgage. This may be averted through the use of the ROC to pay down the funding mortgage, then re-investing if desired. Technically, this “ought to” be the identical as merely leaving the ROC distributions within the funding account (affirm together with your accountant). If you happen to spend money on dividend shares, there gained’t be any return of capital to fret about, however when you’re invested in REITs (Actual Property Funding Trusts) or numerous varieties of ETFs or mutual funds, there’s more likely to be some return of capital blended into your returns.

If you happen to achieve $300 (or any quantity) in dividends although, you’ll be able to withdraw $300 and spend it as you please. If you happen to’re utilizing an funding mortgage to carry out the Smith Manoeuvre, I might recommend utilizing the dividends to pay down the non-deductible mortgage, in order to additional speed up the conversion to deductible/good debt.

As a aspect observe, many individuals have written feedback about utilizing the funding mortgage to purchase mutual funds with HIGH distributions. Usually, excessive distributions embody return of capital – which is ok, offering that you simply NEVER withdraw them.

If ROC distributions are withdrawn from the funding account, the tax deductible portion of the mortgage shall be lowered. Solely dividends/curiosity will be withdrawn with none consequence to the funding mortgage. This is smart when you think about the precept of “revenue producing securities” being the important thing focus, as a result of return of capital shouldn’t be “revenue” per se.

Smith Manoeuvre Instance:

- Be certain your funding mortgage produces revenue of some type.

- ROC distributions are undesirable for leveraged funding accounts as they lower the tax deductibility of the funding mortgage. There are methods round this, however it could turn into an accounting/paper path nightmare.

Greatest Investments for the Smith Manoeuvre

Look – if I knew which investments had been going to carry out finest (whether or not in your Smith Manoeuvre portfolio or in any other case) I wouldn’t be sharing them totally free on the web. The reality is that I do not know which particular shares are going to skyrocket and which is able to plummet. All I do know is the way to apply Canada’s tax guidelines to your Smith Manoeuvre investments (which must be in a non-registered funding account) and traditionally, how giant teams of shares have fared over the long run.

Nonetheless, with that stated, with regards to the Smith Manoeuvre, I’ve a choice towards buying steadily-growing dividend paying shares. Whereas I nonetheless do my very own analysis, I now use Dividend Shares Rock in an effort to arrange my “watch listing” for wonderful Canadian dividend alternatives.

Why Dividend Shares You Ask?

I imagine that investing in largely Canadian dividend-paying shares is probably the most environment friendly solution to implement the Smith Manoeuvre. The reason is, is that Canadian dividends of sturdy firms (like the large banks) have a historical past of accelerating dividends that can be utilized to pay down the non-deductible mortgage.

If you happen to agree that dividend investing must be your main focus, the very best place to begin your journey is over at Dividend Shares Rock (DSR). Managed by fellow blogger Mike from the Dividend Man Weblog since 2013, DSR isn’t only a weekly publication with inventory picks. It’s a platform that may make it easier to handle portfolio and dramatically enhance your outcomes.

It’s additionally a fantastic massive image technique to make use of for the Canadian inventory market particularly as a result of the truth that Canadians love their massive firms. Individuals would possibly suppose that hockey and maple syrup are probably the most Canadian of issues, however I feel it would really be a love for sturdy oligopolies!

When you concentrate on our banks, pipelines, utilities, insurance coverage firms, railways, and telecommunications firms, they’re all dominated by a handful of enormous firms. Certain, these huge firms are unlikely to see the surging development of a inventory like Shopify, however then once more, they aren’t going to have the identical huge drop off that Shopify had in 2022 both!

As we look ahead to 2025 and 2026 and we learn but extra experiences of market-shaking volatility on the horizon because of the Trump tariff risk, one has to remember simply how unfavorable issues sounded at numerous instances previously as nicely. Again in 2018 we had been due for one more 2008 because it had been ten years because the massive recession.

After a report yr in 2019 we had been positive that NOW it was time for the world to finish. Then 2020 Covid stopped the world economic system and we had been “clearly” in for one more nice melancholy. After a fantastic run in 2021, the markets had been “clearly” overvalued, and now in 2022 and 2023 runaway inflation and rising rates of interest had been going to cripple the inventory market. Lastly, 2024 was going to be the yr when a softening job market and unfavorable market sentiment lastly introduced the market down…

Besides none of that had any lasting influence on Canadian dividend shares, and so they simply continued to pump out dividends whereas watching their inventory worth pattern larger over the medium- and long-term.

Certain, when you had loaded up on tech shares then you definately may need had larger total returns during the last couple of years. But when we’re borrowing cash “towards our home” right here, then to me, it makes all of it a lot simpler to abdomen if our Smith Manoeuvre portfolio consists of secure, stable, blue chip shares.

That’s why I selected Canadian firms with a protracted observe report of getting constant revenue margins and even-increasing dividend funds. Regardless of how unhealthy the information headlines get, I’ve at all times been in a position to rely on incoming dividends to brighten my investing temper, and maintain me targeted on my long-term targets.

Purchase Dividend Shares Utilizing the Greatest Payment-Free Low cost Brokers

At MDJ, we always evaluation and evaluate low cost brokers with a selected deal with FREE ETF and STOCK purchases, so you’ll be able to rebalance your portfolio with out paying an additional. Because it stands, one of the best place to spend money on Canadian ETFs is Qtrade. Not solely is it one of the best Canadian dealer, but additionally the one one which permits for each promoting and shopping for ETFs totally free.

Why not simply purchase curiosity bearing bonds or GICs?

Publicly-traded firms that pay dividends in Canada (suppose “massive firms listed on the Toronto Inventory Alternate”) are eligible for the improved dividend tax credit score, which ends up in a considerable tax break for dividends in comparison with interest-bearing revenue like GICs.

Plus, the superb report for these dividend development shares merely gives a vastly superior long-term charge of return. Corporations like Telus, Enbridge, or RBC are simply in such dominant positions inside the Canadian market, that their prospects for paying ever-increasing dividends are completely wonderful.

To summarize, the sturdy dividend firm (if historical past is any information), will improve their dividend regularly AND you’ll obtain a tax credit score for any dividend revenue that you simply obtain. Placing the dividend revenue and the annual tax refund in direction of the non-deductible mortgage will make the conversion from unhealthy (non-deductible) debt to good (tax-deductible) that a lot faster.

Since dividend investing is a topic all by itself, we’ve additionally written a separate in-depth information on one of the best dividend shares.

Can I Use ETFs or Robo Advisors to Do the Smith Manoeuvre?

One of the widespread questions that I get requested is, “Can I take advantage of ETFs when doing the Smith Manoeuvre?” During the last couple of years, that query has advanced to additionally embody the companies of Wealthsimple – that may handle a portfolio of ETFs in your behalf.

The brief reply is: sure.

The longer reply is… you won’t wish to go that route.

Legally talking, the overwhelming majority of ETFs (and positively the entire most typical ones) meet the CRA’s definition of an income-producing funding.

An individual might actually achieve success in the event that they used primary ETFs to create diversified portfolios, utilizing the cash from their HELOC. Right here’s the 2 foremost points that individuals run into and why I desire to make use of Canadian dividend shares.

1) Nearly any ETF goes to complicate your tax scenario. This is because of the truth that the distribution dividends that ETFs reward traders with annually, generally include non-ideal types of revenue equivalent to overseas bond curiosity, overseas dividends, and distributed return of capital (which is particularly widespread for ETFs that embody REITs).

2) Along with the tax complication – which might imply a number of hours of paperwork annually as you observe your adjusted price base and the place your revenue is coming from – ETFs that embody these various kinds of revenue simply aren’t practically as tax environment friendly as Canadian dividends in a non-registered account.

If you happen to do determine to go the ETF route, a primary Canadian equities ETF that doesn’t embody REITs might be your finest wager.

Personally, lots of that I’m an enormous fan of Canada’s all-in-one ETFs, in addition to old fashioned favourites like XAW or VXC. I really like the moment diversification that they create to the desk, and the way straightforward they’re to advocate to people. I don’t use them in my Smith Manoeuvre, nevertheless.

As an alternative, I take advantage of them in my RRSP and TFSA, in addition to in a separate non-registered account (to make the accounting paperwork simpler). They’re a simple solution to diversify away from the big publicity to Canadian dividend-payers that my Smith Manoeuvre account gives.

Utilizing Robo Advisors Like Wealthsimple for a Smith Manoeuvre

Clearly if ETFs legally work for utilizing the Smith Manoeuvre, then so too would a portfolio of ETFs managed by a robo advisor equivalent to Wealthsimple.

That stated, I really email-interviewed their portfolio administration crew in an effort to affirm that there was nothing that I had missed. They responded that not solely was it absolutely inside the CRA guidelines to run a tax-deductible mortgage by way of a robo advisor account, however that the annual payment that you’d pay to Wealthsimple could be tax deductible as nicely.

Moreover, they talked about that investing by way of a Wealthsimple non-registered account would permit the consumer to make the most of tax-loss harvesting, and that they’d observe the e book prices – significantly aiding within the total paperwork battle that may be the principle downside to utilizing ETFs.

Naturally the identical drawbacks would apply with Wealthsimple’s ETF portfolios, as with the ETFs we lined above, so far as tax remedy for overseas dividends or bond curiosity. You’ll additionally must issue within the tax-deductible charges that Wealthsimple would cost for his or her companies.

Total, I like the concept of getting assistance on the paperwork aspect of issues AND utilizing the Smith Manoeuvre would let you get the entire advantages of Wealthsimple’s VIP ranges – which you’ll be able to examine right here in our full Wealthsimple Evaluate. This might decrease the charges that you simply already pay when you use Wealthsimple in your RRSP, TFSA, and/or RESP.

That stated, I’m nonetheless keen on the simplicity of going with my Canadian dividend technique.

Investing in Your RRSP and TFSA vs The Smith Manoeuvre

One of many widespread arguments that I see on-line, is that maxing out your RRSP plus TFSA – and investing for the long run – will outperform the Smith Manoeuvre.

I’ll agree with the essential math behind the assertion that as a result of the truth that your RRSP and TFSA can develop tax free the place the Smith Manoeuvre, even with tax deductible curiosity, is taxed on the dividends and capital beneficial properties.

Nonetheless, I don’t imagine the Smith Manoeuvre is a substitute in your RRSP and TFSA, however a substitute in your non-registered portfolio.

The optimum technique could be to maximise your RRSP and TFSA, then if in case you have any cash left over, pay down the mortgage, which in flip would improve your HELOC stability. Take the cash from the elevated HELOC stability and put it into secure dividend-paying blue chips.

The truth is, the RRSP is the right place to place your worldwide fairness publicity, and your TFSA is one of the best place to place your mounted revenue. If you happen to use your accounts this fashion, you should use your Smith Manoeuvre investments (that are more likely to be Canadian dividend-paying shares as mentioned above) as a part of a broader balanced portfolio.

The tax remedy for worldwide (particularly American) ETFs is healthier in your RRSP, and the curiosity revenue generated by bonds or bond ETFs is absolutely taxed at 100% of your marginal tax charge until it’s sheltered in a registered account.

All the time keep in mind that there’s an elevated threat concerned with leveraging your investments, so earlier than you try any of this by yourself, you higher be fairly darn snug with investing. Both that, or discover a good monetary planner to place you in tax environment friendly, low-cost ETFs.

Bear in mind that other than the leverage/threat/sleeping-well-at-night aspect, success is dependent upon the equation (market returns)-(funding prices)-(curiosity)-(taxes on inv earnings)+(curiosity tax deduction).

The truth that the curiosity tax deduction is at your marginal revenue tax charge, whereas taxes on the precise funding earnings are doubtless decrease (cap beneficial properties and dividends), juices returns a bit by way of tax arbitrage.

Over a full financial cycle (market returns)-(curiosity) is optimistic, however there isn’t a assure of a giant distinction between what your investments will earn and the curiosity that you simply’ll owe. This actuality signifies that having the nerves of metal to not tinker – in addition to low funding prices to not use up the optimistic unfold – are essential.

The opposite key issue when wanting on the Smith Manoeuvre vs TFSA + RRSP debate is that most individuals who look into this technique gained’t be doing so from a “useless stand nonetheless” as they appear forward on the subsequent 50+ years. Most people shall be someplace halfway alongside their monetary journey’s path, and can doubtless personal a house.

Permitting people to maneuver their fairness from the comparatively low conventional returns on actual property (regardless of what some within the GTA may need you imagine) to comparatively excessive conventional returns in equities, could make an enormous distinction. Check out the maths behind my private $700,000 instance that I initially used for extra proof. Consequently, it’s not a “vs” argument, however extra of a “sure, and” settlement.

Arguments In opposition to the Smith Manoeuvre

A typical argument that I generally see is that paying off your mortgage, after which investing in a non-registered portfolio will outperform the Smith Manoeuvre.

The maths concerned with that argument simply doesn’t make sense. When implementing the Smith Manoeuvre you’re paying down your mortgage at an accelerated charge AND investing in a non-registered portfolio on the similar time. Time and compounded returns ought to make the distinction.

Not solely is there extra time available in the market in your investments to compound, you pay NOTHING out of pocket to take care of your HELOC. You merely withdraw the curiosity owed month-to-month out of your HELOC and re-deposit it. (Aka “capitalizing the curiosity”)

The one difficulty is that in an effort to make the Smith Manoeuvre work, you’ll have to succeed in an funding return that’s larger than the curiosity that you’re charged. For instance, if a HELOC fees 6% and also you’re in a 40% tax bracket, then your efficient curiosity is 3.6% after your tax deduction.

North American inventory markets have averaged 10%+ during the last 100+ years, however I used 8% in my private calculations. In any case, it must be a lot larger (long-term) than 3.6%.

When you’ve got a non-registered portfolio earlier than you begin the Smith Manoeuvre, all the higher! Promote your investments, and pay down your mortgage, then re-borrow and re-purchase the shares once more! Now you’ve a head begin in paying off your non-deductible mortgage AND you should use the HELOC funds to repurchase your investments. That is really the right instance of why the maths is in your aspect when utilizing the Smith Manoeuvre.

One other widespread argument towards the Smith Manoeuvre is that there’s merely an excessive amount of threat in “playing” your house within the inventory market.

Dealing With Cashflow Issues on the Smith Manoeuvre

One other widespread query we get is: What about making the HELOC funds?

Doesn’t that put a crimp in your money move?

To get round this money move drawback you’ll be able to “capitalize the curiosity”.

Basically, that is the place you employ a mortgage to make the mortgage interest-only funds. On this case, you should use the prevailing HELOC to make the HELOC funds.

Complicated? It’s not as unhealthy because it sounds.

For these of you new to this technique, capitalizing on the curiosity is among the bonuses of this technique. It’s the place you employ the funding mortgage to pay for the curiosity owed, and all the things stays tax deductible.

As humorous as that sounds, the rule is that when you take out a mortgage (we’ll name it Mortgage B) to pay for curiosity in your preliminary Smith Maneuver mortgage (Mortgage A), then Mortgage B curiosity can also be tax deductible. So technically, if I take advantage of the HELOC stability to pay for the HELOC curiosity, then your entire HELOC stability ought to stay tax deductible. I make the most of this technique because it permits me to have an funding mortgage with out really utilizing any of my very own money move to service the mortgage curiosity.

The simplest manner is to have your HELOC curiosity robotically deducted out of your chequing account every month – then do a switch for a similar quantity out of your HELOC to repay your chequing account.

I might additionally advocate having a devoted chequing account for this technique in case CRA comes knocking on the door in your information. At the least that’s the way in which that I’ve it setup.

And sure, I might advocate towards maxing out the HELOC as you’ll want the area to pay for the curiosity incurred.

In case you are capitalizing the curiosity although, isn’t there some extent the place you run out of HELOC area (credit score accessible)? The reply is sure! This brings us to our subsequent level under.

Working Out of HELOC Area With the Smith Manoeuvre

In case your instalment mortgage is paid off, and you’re utilizing the HELOC to pay for itself, your HELOC stability will frequently improve. The query is, are you snug with a maxed out HELOC? Be aware that a big HELOC might influence your credit score rating as chances are you’ll be borrowing a considerable amount of your total credit score accessible.

Personally, I’ve seen the influence with my Equifax scores however not a lot Transunion. You may doubtless examine your credit score rating totally free together with your financial institution. In case your financial institution doesn’t supply the service, listed below are another free methods to examine your credit score rating and report. You may as well get your credit score rating (Equifax) totally free with Borrowell.

Let’s check out an instance. Say an preliminary mortgage of $100k from a HELOC with an rate of interest of 4% and a credit score restrict of $250k. Offering that there are not any extra transfers from the HELOC to the portfolio, what number of years will it take for the HELOC to be maxed out? 24 years! Try the desk under.

| Yr | Stability |

|---|---|

| 1 | $100,000.00 |

| 2 | $104,000.00 |

| 3 | $108,160.00 |

| 4 | $112,486.40 |

| 5 | $116,985.86 |

| 6 | $121,665.29 |

| 7 | $126,531.90 |

| 8 | $131,593.18 |

| 9 | $136,856.91 |

| 10 | $142,331.18 |

| 11 | $148,024.43 |

| 12 | $153,945.41 |

| 13 | $160,103.22 |

| 14 | $166,507.35 |

| 15 | $173,167.64 |

| 16 | $180,094.35 |

| 17 | $187,298.12 |

| 18 | $194,790.05 |

| 19 | $202,581.65 |

| 20 | $210,684.92 |

| 21 | $219,112.31 |

| 22 | $227,876.81 |

| 23 | $236,991.88 |

| 24 | $246,471.55 |

| 25 | $256,330.42 |

Let’s check out a private instance that I wrote about my very own HELOC a number of years in the past. At that time, the stability was about $140k with 4% curiosity and a credit score restrict of about $215k. If we had been to have capitalized the curiosity proper up till my credit score restrict, I might have achieved that for about 12 years.

| Yr | Stability |

|---|---|

| 1 | $140,000.00 |

| 2 | $145,600.00 |

| 3 | $151,424.00 |

| 4 | $157,480.96 |

| 5 | $163,780.20 |

| 6 | $170,331.41 |

| 7 | $177,144.66 |

| 8 | $184,230.45 |

| 9 | $191,599.67 |

| 10 | $199,263.65 |

| 11 | $207,234.20 |

| 12 | $215,523.57 |

To mitigate towards the HELOC stability from getting too giant, you might merely make the funds out of your individual money move and/otherwise you use the dividends generated out of your investments to pay down the mortgage.

At that time limit, my Smith Manoeuvre portfolio generates about $7,800/yr in dividends. If I had been to have withdrawn these dividends proper onto the funding mortgage (and to maintain issues easy, let’s assume that rates of interest stayed the identical AND that there was no dividend development – which clearly was NOT nearly as good because the scenario I’ve loved over the previous few years).

| Yr | Stability | Deposit |

|---|---|---|

| 1 | $140,000.00 | $0.00 |

| 2 | $145,600.00 | $7,800.00 |

| 3 | $143,312.00 | $7,800.00 |

| 4 | $140,932.48 | $7,800.00 |

| 5 | $138,457.78 | $7,800.00 |

| 6 | $135,884.09 | $7,800.00 |

| 7 | $133,207.45 | $7,800.00 |

| 8 | $130,423.75 | $7,800.00 |

| 9 | $127,528.70 | $7,800.00 |

| 10 | $124,517.85 | $7,800.00 |

| 11 | $121,386.56 | $7,800.00 |

| 12 | $118,130.03 | $7,800.00 |

| 13 | $114,743.23 | $7,800.00 |

| 14 | $111,220.96 | $7,800.00 |

| 15 | $107,557.80 | $7,800.00 |

| 16 | $103,748.11 | $7,800.00 |

| 17 | $99,786.03 | $7,800.00 |

| 18 | $95,665.47 | $7,800.00 |

| 19 | $91,380.09 | $7,800.00 |

| 20 | $86,923.30 | $7,800.00 |

| 21 | $82,288.23 | $7,800.00 |

| 22 | $77,467.76 | $7,800.00 |

| 23 | $72,454.47 | $7,800.00 |

| 24 | $67,240.65 | $7,800.00 |

| 25 | $61,818.27 | $7,800.00 |

| 26 | $56,179.00 | $7,800.00 |

| 27 | $50,314.16 | $7,800.00 |

| 28 | $44,214.73 | $7,800.00 |

| 29 | $37,871.32 | $7,800.00 |

| 30 | $31,274.17 | $7,800.00 |

| 31 | $24,413.14 | $7,800.00 |

| 32 | $17,277.66 | $7,800.00 |

| 33 | $9,856.77 | $7,800.00 |

| 34 | $2,139.04 | $7,800.00 |

| 35 | -$5,887.40 | $7,800.00 |

As you’ll be able to see from the desk above, utilizing the dividends from the portfolio would lead to paying off the HELOC completely by about 35 years (at the very least on this state of affairs – it’s sooner when you rely the tax deduction).

The principle takeaway right here is that you must plan on capitalizing on the curiosity in your funding mortgage, take observe that you’ll ultimately run out of HELOC area until you intend on: refinancing; paying it off utilizing dividends; and/or utilizing your individual money move.

For additional studying, try my article about working out of HELOC area with the Smith Manoeuvre.

Capitalizing the Curiosity on the Smith Manoeuvre With the Rempel Most

Ed Rempel, a licensed monetary planner (CFP) and accountant, has been an everyday remark contributor to the Smith Manoeuvre articles on this weblog. He has provide you with a twist to the Smith Manoeuvre technique that maximizes the tax and funding return in your leveraged portfolio.

He calls this technique “The Rempel Most“.

Please try the 2 interviews on the Smith Manoeuvre – which my employees author Kyle Prevost recorded during the last couple of years on the Canadian Monetary Summit with Ed.

How Precisely Does “The Rempel Most” Work?

The “Rempel Most” is a variation of the Smith Manoeuvre that maximizes each your tax and potential portfolio return whereas utilizing $0 of your individual money move. If you use the Smith Manoeuvre, you’re going to get a small improve in your HELOC stability as you pay down your mortgage which is then used to take a position.

With the Rempel Most, as a substitute of utilizing the small improve to take a position, you employ the rise to fund your funding mortgage/HELOC. This will lead to acquiring an extra funding mortgage relying on the dimensions of your precept fee. Extra on this under.

This fashion, you get the tax deduction from the HELOC together with the tax deduction from the funding mortgage. Canadian tax guidelines state which you can deduct the curiosity from a mortgage that helps an funding mortgage.

On prime of that, you’ll have a big stability to work with initially to make the most of compounding returns and time.

How Do I Implement the Rempel Most?

You’re most likely questioning how giant of an funding mortgage are you able to get hold of? In response to Ed Rempel:

For instance, in case your mortgage fee pays $500/month of precept ($6,000/yr), you divide the $6,000 by the rate of interest (say 6%), which supplies you $100,000. You improve the credit score line restrict in your readvanceable mortgage to 80% of your house worth, which is usually achieved totally free on the main banks. You then borrow and make investments as much as the credit score line restrict. If there’s lower than $100,000 accessible, then you definately finance the remaining from an funding mortgage.

Based mostly on the above instance, the banks offers you [principle payment/interest] as your most funding mortgage together with your HELOC. Relying on how a lot fairness you’ve in your house, you might find yourself with a pretty big funding mortgage.

What Are the Dangers Concerned With the Rempel Most?

This technique makes use of the utmost leverage accessible to you based mostly in your precept funds, or how a lot your credit score line is readvanced with each fee. For sure, the investor should be aggressive, snug with threat, and skilled with investing.

As you already know, leverage amplifies your returns, good or unhealthy.

Under is an instance from Ed Rempel:

You’ve got a house price $400,000 and a mortgage of $200,000 at 5% curiosity (Editor’s Be aware: Are you able to inform we labored by way of this instance a number of years in the past!) and are paying $1,169/month (25-year amortization). You may re-borrow at a charge of 6%, the investments common a ten% long-term return, and you’re in a 40% tax bracket.

Every mortgage fee pays down $336 of precept x 12 months/ 6% = $67,200.

Since you’ve greater than the $67,200 in accessible credit score in your Smith Manoeuvre credit score line, you’ll be able to borrow this $67,200 to take a position.

The curiosity fee is $336/month – which will be paid completely from the Smith Manoeuvre credit score line every month.

The extra advantage of the Rempel Most over the “plain vanilla Smith Manoeuvre”?

After 25 years of standard Smith Manoeuvre: $410,000

After 25 years of the Rempel Most Smith Manoeuvre: $718,000

That’s over $300,000 in distinction over 25 years! The craziest half is that when you use the Smith Manoeuvre and the principles round borrowing to spend money on Canada to your benefit, this $300,000 distinction would compound over the following 25 years (assuming you by no means paid the loans again, and simply stored making curiosity funds).

Who Ought to Use the Rempel Most Smith Manoeuvre?

There are 3 standards that an individual ought to contemplate earlier than implementing this technique:

- The investor should be skilled and comfy with threat.

- The Rempel Most works finest in case your preliminary HELOC stability is small. ie. Somebody who’s simply beginning the Smith Manoeuvre with a little bit over 25% in fairness.

- The investor should be on this for the long-term (suppose 25+ years).

Abstract:

The Rempel Most is a solution to maximize the potential returns from implementing the Smith Manoeuvre by way of the extra tax deduction and elevated leverage. This may be a particularly highly effective and profitable technique if used correctly over the long run.

In case you are contemplating utilizing this technique twist to the Smith Manoeuvre, just be sure you are snug with the utmost leverage utilized to your portfolio.

I’ve Paid Off My Mortgage – Ought to I Cease the Smith Manoeuvre?

One other widespread set of questions that I get revolved round, “What if I’ve paid off my non-deductible mortgage whereas implementing the Smith Manoeuvre? Now what?”

What do I do with the big remaining funding mortgage?

How do I arrive at this case?

There’ll come some extent the place the non-deductible mortgage will get paid off utterly and the investor is left with a big line of credit score (of tax-deductible “good debt”) which is invested available in the market.

In addition to leaping up and down in celebration, there are a number of choices as soon as the non-deductible mortgage is paid off:

- Hold the funding mortgage ceaselessly. That is the principle technique when you observe the Smith Manoeuvre to a tee. The rationale is to maintain amassing the tax deductions for the rest of your life.

- Repay the funding mortgage utterly over time.The alternative of the above is to begin paying off the funding mortgage as soon as the non-deductible mortgage is worn out. Mainly, the investor right here would apply the outdated mortgage funds towards the HELOC. The tax deduction would nonetheless apply, nevertheless at a lowered quantity yearly because the HELOC stability reduces. I’m extra in favour of this selection, or the one under, as I’m unsure I might be snug having a big looming debt throughout retirement. Even when it’s good debt.

- Repay a portion of the funding mortgage. It is a hybrid of the above technique the place the investor would pay down the funding mortgage to a degree the place they’re snug with the month-to-month funds. The investor can determine how a lot per thirty days they will afford to pay indefinitely and pay down the stability accordingly. After all, the investor must account for larger inflation years as it could have an effect on his or her month-to-month line of credit score servicing prices.

The three solutions above are all appropriate, it’s as much as the investor to determine how a lot threat they will permit of their portfolio and nonetheless sleep nicely at night time..

Report Preserving for Your Dividend Shares as You Do the Smith Manoeuvre

The method of saving and investing is usually a rewarding expertise. Nonetheless, with regards to taxes and reporting your funding returns to the CRA, the expertise will be irritating.

When you’ve got used the Smith Manoeuvre to trade your non-deductible mortgage curiosity for tax-deductible funding mortgage curiosity, chances are you’ll be questioning the way to report that curiosity expense in your tax return.

Submitting Your Smith Manoeuvre Tax Return

On the subject of private finance, correct report retaining ensures which you can observe progress in direction of your targets. On the subject of revenue tax, correct report retaining will help keep away from the denial of a deduction and incur curiosity and penalties.

If you file your tax returns, you aren’t required to submit any documentation to the CRA to show your declare for curiosity bills. Nonetheless, it’s essential to maintain sufficient information to assist your declare in case the CRA asks to see them.

You should be capable of present that the funds withdrawn out of your line of credit score had been used to buy investments. You may present this hyperlink by attaching a cancelled cheque out of your line of credit score to your brokerage assertion or connect your financial institution assertion displaying the funds switch out of your line of credit score to your brokerage account.

You additionally must assist your curiosity expense calculations. Connect copies of your line of credit score statements together with a canopy sheet displaying your calculations to your revenue tax return.

Because of this I personally advocate retaining your HELOC account as 100% Smith Manoeuvre funds. If you happen to start utilizing that HELOC account to fund different purchases, the record-keeping can get simply muddled.

Sustaining correct information will guarantee which you can rapidly entry your information and show your declare at any time.

Private Use of Funds

If you borrow to spend money on revenue producing properties, the curiosity you pay is tax deductible. Nonetheless, curiosity used for private functions shouldn’t be tax deductible.

It is very important be certain that whenever you use your line of credit score to take a position, that you simply keep away from utilizing it for private purchases. Utilizing your line of credit score for private purchases might lead to your deduction being denied until you’ll be able to conclusively hyperlink the proportion of the road of credit score to your investments.

It may be troublesome to find out the correct proportion if there are a selection of private purchases in your line of credit score. There’s additionally a larger chance for error. It’s advisable that you simply use a second line of credit score for private purchases…or higher but, use money!

Reporting Your Tax Return

So, you’ve assembled your financial institution statements and calculated your curiosity expense and now you’re prepared to assert the deductions in your tax return.

The deduction for curiosity paid in your funding mortgage is reported as “Curiosity Bills” on Schedule 4 Half IV Line 221. The outline must be “Funding Mortgage.” The whole quantity reported on Line 221 of Schedule 4 is then recorded on Line 221 of the T1 Earnings tax and Profit Return.

And that’s it!

In case you are not sure of what you’ll be able to declare or what you’ll be able to deduct, it’s advisable that you simply communicate with a tax skilled.

Smith Manoeuvre Guidelines

Whereas the advantages of the Smith Manoeuvre are positively enticing, it’s not one thing that you simply wish to “check out” to see if it’s best for you. As an alternative, it’s a long-term dedication to make use of a confirmed leveraged-investment technique, by way of each good markets and unhealthy.

That can assist you with the choice, here’s a guidelines of issues to contemplate earlier than diving in:

- Do you have already got the 20% down/fairness in your house, to keep away from the CMHC insurance coverage?

- Are you able to deal with,and are you keen to cope with the challenges of utilizing leveraged investing?

- Is your RRSP and TFSA maxed out? This system shines probably the most when achieved utilizing your non-registered (taxable) accounts.

- Are you keen to precisely observe your transactions in case you get audited by CRA? The advantages to the Smith Manoeuvre are clear, however are you keen to do this further little bit of monitoring to make sure that it’s achieved correctly?

- Do you’ve a plan ‘B’ within the case that it’s essential transfer and residential values have gone down? If you happen to invested correctly, your portfolio ought to at LEAST cowl your mortgage.

Smith Manoeuvre Ceaselessly Requested Questions

How Is a Particular person Purported to Pay for Each the Mortgage AND the HELOC on the Identical Time?

That is most likely amongst the largest issues individuals have had, because the borrower shall be accountable for BOTH funds whereas implementing the Smith Manoeuvre. This consists of your main mortgage (precept + curiosity) alongside together with your HELOC (curiosity solely). Appears a bit steep, hey? Say you get a $100k HELOC @ 4.45%, that’s an additional $371/month on prime of your present mortgage fee.

After speaking to each Fraser Smith and Ed Rempel about this difficulty, I’m satisfied that capitalizing the curiosity on the HELOC is the most suitable choice!

Scratching your head but?

If you happen to re-read our part on capitalizing the curiosity you’ll see that it mainly means withdrawing the month-to-month curiosity due from the HELOC account, and redepositing the quantity because the curiosity fee.

If you happen to capitalize the curiosity, you’ll by no means make the additional curiosity funds out of your individual pocket whereas your main mortgage exists.

You’ll solely begin paying the HELOC curiosity out of pocket/cashflow when the first non-deductible mortgage is paid off. In order you’ll be able to see, utilizing the Smith Manoeuvre, you’ll at all times have a fee. It by no means goes away. Nonetheless, the funds at the moment are tax deductible.

Why Would You Want 20% Down on Your Home to Begin the Smith Manoeuvre?

The reason being that many of the readvanceable mortgages on the market REQUIRE 20% down. The mortgages that do NOT require 20% down will cost an additional CMHC payment.

Which Partner Ought to Declare the Funding Mortgage?

When you’re a pair, what’s the finest technique for getting one of the best tax return from the curiosity paid on the HELOC used to purchase investments?

The reply is that it actually is dependent upon the monetary scenario of the couple, and all of the variables that your explicit state of affairs entails – however, let’s take a look at the totally different elements of this query:

Does it matter whose identify the investments are bought underneath or ought to they be underneath each names?

Usually, whoever funds the funding account is accountable for the taxation on the account. Nonetheless, funding loans are totally different. You may have each spouses on the “title” of the funding mortgage (ie. HELOC), nevertheless it’s the identify (the one who submits their SIN) on the funding account who will get taxed (and obtains the suitable to assert the tax deduction).

With that stated, offering that you simply buy tax environment friendly investments, it could be optimum to maintain the investments within the identify of the higher-income partner.

It is smart to assert the funding revenue underneath each spouses if each spouses are in the identical tax bracket. This is able to assist in future years when revenue splitting is a priority.

In response to Ed Rempel, though you’ll be able to have each names underneath one funding account, you’ll be able to select who to cost the funding revenue. So long as you retain the deduction constant by way of the years, this shouldn’t pose an issue.

Does it matter who owns the HELOC or whether it is collectively owned?

As talked about above, if the HELOC is collectively owned, you’ll be able to put the cash into an funding account of both partner, or a joint account.

If the HELOC is underneath each names, does the tax deduction for the curiosity paid get cut up between the 2 individuals?

Once more, it doesn’t matter if the HELOC is underneath each names, what issues is the identify on the account that’s investing the cash. The proprietor of the account investing the cash, is the proprietor of the tax deduction and tax legal responsibility.

Conclusion:

Remember to declare the funding mortgage underneath the partner with the best revenue. If each spouses have related charges, then make investments underneath each names.

Please keep in mind that I’m not a tax skilled, so seek the advice of an accountant earlier than following any taxation recommendation you discover right here.

What’s The Most The Canadian Authorities Will Permit Me To Borrow in a HELOC or Readvanceable Line of Credit score To Do The Smith Manoeuvre?

The utmost measurement of your HELOC in 2022 is 65% of the worth of your house. With house values falling rapidly in some areas, be sure to keep watch over this determine. When you think about that the federal government solely desires your most home debt to be not more than 80% of the worth of your house when mixed together with your mortgage – then your mortgage stability plus your HELOC can by no means prime 80%. That is to forestall an entire housing meltdown like we noticed within the States in 2008.

Is a Leveraged RRSP Higher than a Smith Manoeuvre?

We acquired a reader query concerning the technique of borrowing to spend money on an RRSP as a substitute of a non-registered portfolio (just like the Smith Manoeuvre):

“I’ve a readvanceable mortgage, however why shouldn’t I simply use my RRSP as a substitute of investing in a non-registered account? Wouldn’t it make sense to make use of that area first? Merely take my fairness out as I pay my mortgage (like I’m about to do the Smith Manoeuvre) however as a substitute make investments inside my RRSP. Then get my tax refund again, put that on the mortgage, withdraw the fairness on the opposite aspect once more, and proceed that course of?”

Now I understand that within the state of affairs I simply layed out, I might not obtain the curiosity deduction that you’d obtain for a non-registered funding, however as a substitute would obtain the conventional return that an RRSP would obtain. So far as I can determine, the impact could be receiving a big tax refund within the current (through the use of RRSP) and smaller sooner or later, versus a traditional Smith Manoeuvre the place you obtain a really small refund at first, and bigger sooner or later (on a continuing foundation I understand till the mortgage is paid).

To start, let’s go over the tax guidelines, in addition to the advantages & disadvantages of every technique.

Leveraged RRSP:

- Tax refund on the contribution – thus a bigger tax return to placed on mortgage.

- Funding mortgage is NOT tax deductible.

- All withdrawals from the RRSP are taxed on the marginal tax charge whenever you ultimately retire.

Leveraged Non-Registered Portfolio:

- Tax refund based mostly on the curiosity to service the funding mortgage. Relying on the present rates of interest, this may fluctuate. This tax deduction is small initially however will develop over time because the funding mortgage grows.

- Withdrawals are very tax environment friendly from a non-registered portfolio. Solely 50% of capital beneficial properties are added to revenue, and dividends will be extraordinarily tax environment friendly relying on the quantity of different revenue in the course of the yr.

Having defined the tax guidelines, our Smith Manoeuvre Calculator can be utilized to match each methods. That is the state of affairs and conclusions that we arrived at:

As an alternative of borrowing house fairness because it accumulates to spend money on a non-registered portfolio, borrow to spend money on an RRSP, and apply the complete refund to the mortgage. This makes use of a readvanceable mortgage so there’s loads of flexibility to do that as every fee is utilized.

So, the tweaked Smith Manoeuvre Calculator discovered that:

Inputs:

- $300,000 Home Worth

- $240,000 Mortgage @ 5%

- $1,395.85 month-to-month funds amortized over 25 years

- 8% funding development charge

- 5.75% HELOC charge

- Marginal Tax Price of 46.41%

It must be famous that larger Marginal Tax Charges on the time of contributing to the RRSP make the case for investing in an RRSP extra beneficial when in comparison with the ‘conventional’ Smith Manoeuvre.

Listed here are the outputs:

With Smith Manoeuvre:

- Mtg is retired in 21 years

- $240k HELOC that’s TAX DEDUCTIBLE

- Funding portfolio of $304,142 that’s NON-REGISTERED

- Adjusted price base (not together with commissions) of $138,516

With RRSP:

- Mtg is retired in 18.25 years. Subsequently, run the state of affairs till 21 years nonetheless making ‘mortgage funds’ however the cash now goes to paying the HELOC curiosity and something left goes into RRSP.

- $240k HELOC that’s NOT TAX DEDUCTIBLE

- Funding portfolio of $395,143 that’s in an RRSP

Assuming the identical MTR as used above, the web of it’s whether or not a $240k LOC that prices $13,800 after tax to service yearly and a totally taxable portfolio of $395k (that will be price $212k if cashed out abruptly) is healthier than having a $240k LOC that prices $7,650 after tax to service yearly and a $304k portfolio (that will be price about $265k if cashed out abruptly).

If, nevertheless, your MTR is decrease whenever you money out (e.g. < 30%), then the benefit swings to the RRSP funding – particularly when you can eliminate the HELOC rapidly.

The essential conclusion is that the upper your marginal tax charge AND the bigger the distinction between the price of the mortgage/HELOC and your funding development charge, the higher it appears to be like for the RRSP.

All in all, I don’t see enough proof to recommend that the Smith Manoeuvre/RRSP hybrid can fairly be anticipated to outperform a conventional Smith Manoeuvre so long as tax environment friendly investing is used for the standard Smith Manoeuvre. That’s based mostly on these information:

- On the finish of the 21-year interval, the standard Smith Manoeuvre has a HELOC with tax deductible curiosity funds the place the SM-RRSP hybrid has no tax profit. This can turn into extra essential the longer an investor hangs on to the tax-deductible funding mortgage.

- The RRSP may have vital tax penalties as one withdraws funds from it. The SM’s non-registered portfolio, though smaller, may have considerably much less tax legal responsibility on withdrawals.

- A >4% distinction between the long run mortgage charge and funding efficiency over 25 years is unusual in Canada.

- Many people simply gained’t have the room of their RRSP in an effort to maintain their complete Smith Manoeuvre funding portfolio working by way of it – in order that provides one other layer of complexity as you’d now have a non-registered SM portfolio, and an RRSP SM portfolio.

Ought to I Purchase USA Shares for the Smith Manoeuvre?

One different query that we’ve gotten a few instances within the remark part is, “Can I take advantage of USA shares for the Smith Manoeuvre”.

The reply is: I wouldn’t advocate it.

You’re going to get slammed on the withholding taxes aspect of issues with regards to high-yield US dividend shares. Alternatively, what you might do is spend money on Canadian firms that do loads of enterprise within the USA or all over the world.

For instance TD financial institution generates greater than a 3rd of its income from the US market. Power/Utilities giants like Fortis additionally do loads of enterprise south of the border.

Utilizing these firms to broaden your geographical threat profile – whereas sustaining your dividends in tax-friendly Canadian {Dollars} – makes loads of sense.

Is 2025 the Proper Time to Begin the Smith Manoeuvre?

Sure, 2025 appears to be like to be a good time to begin the Smith Manoeuvre!

Look, I began my Smith Manoeuvre again in 2008 – in different phrases, absolutely the worst time within the final 20 years to make a big fairness buy – and I’ve been very proud of my returns.

As we begin 2025, Canadian shares look fairly valued. I wouldn’t say they’re screaming “shopping for now” when it comes to valuations, however 2022 and 2023 weren’t nice years for many Canadian dividend shares. Consequently, there’s room to develop in 2025.

Maybe the much more essential cause why I really feel assured saying that 2025 appears to be like like a very good time to begin the SM, is that the upper rate of interest you’ll be paying will result in a bigger tax deduction for you. Yup – a silver lining to these pesky mortgage funds going up. The extra curiosity you pay on these mortgage funds, the sooner your Smith Manoeuvre mortgage grows and the extra tax-deductible curiosity you’ll generate.

The Smith Manoeuvre Throughout a Market Crash

Under is an archived article from Million Greenback Journey which was written in the course of the 2008 monetary disaster. I believed I’d re-publish it and replace in our foremost Smith Manoeuvre article contemplating what number of similarities there are with what we noticed in 2022, and what many are predicting when it comes to a recession in 2025.

It’s a very good actuality examine of what occurs within the markets, and the way heavy the losses will be, particularly with a leveraged portfolio. Consider it as a solution to check your self to see if in case you have the suitable temperament for the Smith Manoeuvre.

There was a lot concern over the viability of the Smith Manoeuvre or a leveraged funding technique throughout this latest bear market. The principle issues are as a result of a few causes:

1) Sinking fairness costs

2) The fast improve of rates of interest

The reality of the matter is that leveraged investing is dangerous within the brief time period. My funding account is dealing with the comparatively dangerous fairness market together with constructing curiosity on the capital that helps it. The chance for the account to develop at an accelerated charge is nice, however so is the chance for values to drop.

With present market situations, it’s a intestine examine to see who can actually take the leveraged investing warmth. With HELOC (house fairness line of credit score) charges, hanging between 7% and eight%, that curiosity invoice that your portfolio is having to pay goes house considerably!

What am I doing with my leveraged portfolio throughout this correction? Even with the acute concern within the streets, I’ve my eye on the large image and my lengthy funding timeline. Subsequently, I’m sticking to the plan, watching one of the best dividend paying shares and deploying some money once they seem low-cost.

I’ve stated this earlier than, and I’ll say it once more, these market corrections are momentary and must be considered as a possibility to purchase low-cost equities for the long run. It might take some time (even years) for the markets to bounce again, however when you purchase low-cost, you’ll take full benefit of the upcoming restoration.

As you’ll be able to see, there’s knowledge to be discovered from previous experiences!

All through the early months of the pandemic that we went by way of in 2020 (and the accompanying market panic) I used to be in a position to place my self to capitalize on a market that needlessly penalized high-quality dividend paying firms.

I personally was in a position so as to add many shares of Enbridge at worth factors that proved to be ridiculous. I did a ton of analysis and simply couldn’t perceive why individuals had been so apprehensive concerning the pandemic overly affecting this midstream utility.

Nowadays I discover individuals unreasonably bearish on Canadian utility shares and Canadian financial institution shares. I’m eagerly snapping up shares of these shares whereas individuals have a foul style of their mouths from the fast rise in rates of interest.

The Enbridge decide proved to be among the best returning short-term investments that I’ve ever had the abdomen to make. As soon as the market panic subsided, and other people started taking a look at stability sheets as a substitute of reports headlines once more, Enbridge subsequently bounced again and I lowered my publicity.

I loved snagging the inventory at worth ranges that netted me a 7.5% dividend yield, and likewise loved a 20% capital achieve within the course of. (Sure I do know, I didn’t get in on the very backside – however I’ll take it!)

If you happen to’re going to have the ability to abdomen the ups and downs of the Smith Manoeuvre you’ve to have the ability to suppose previous the short-term noise of the inventory market. For me, specializing in dividend development actually helps overcome irrational purchase/promote behaviour.

Regardless of how good you suppose you’re, we will fall prey to the behavioural biases hidden deep in our lizard brains. If you happen to’re inquisitive about how psychology can have an effect on your investing, I like to recommend testing the work of Daniel Kahneman, Amos Tversky, Dan Ariely, and Richard Thaler.

As we look forward to 2025 and 2026, our crystal ball is actually cloudy. Whereas we seemed to be on a one-way observe down from the 2022/2023 inflation spike, the Trump administration might change all of that with an ill-advised set of coverage rollouts.

I personally suppose that rates of interest aren’t taking place a lot from right here. Larger authorities money owed all around the world are going to result in bond-buyers having way more leverage to demand larger payouts within the years forward. That’s going to necessitate larger rates of interest.

A method to assist mitigate these higher-for-longer rates of interest is to show your mortgage (non-tax deductible debt) into tax-deductible debt. For people in larger tax brackets, that is going to take your actual curiosity fee down fairly a bit when it comes to after-tax chunk.For instance, in case your marginal tax charge is 50%, then your 6% HELOC mortgage can be a 3% actual rate of interest, since you’re going to get half of that curiosity fee again in your tax returns on the finish of the yr. That tax deductibility function was the driving power behind Fraser Smith’s authentic Smith Manoeuvre thesis a number of many years in the past.

No Higher Time to Flip Your Mortgage Right into a Tax Deductible Funding Mortgage

In each 2023 and 2024, inventory markets massively shocked to the upside. Whereas the Toronto Inventory Alternate 60 didn’t get the identical huge bump because the Magnificent 7 tech giants south of the border, they had been nonetheless very stable total returns.

In 2025 I see Canadian dividend shares closing the efficiency hole from the previous couple of years. Canadian financial institution shares, Canadian telecommunications shares, and Canadian utility shares for instance have actually suffered from excessive rates of interest.

These are firms which have taken on some debt through the years to construct out their aggressive benefit. So their backside traces are harm within the short-term, as a result of rising curiosity fee prices. However, the extra essential long-term consideration is that these Canadian dividend-payers have used that borrowed cash to construct oligopolistic firms. It’s just about not possible for a brand new Canadian telecom firm or financial institution to begin from scratch and seize market share. That provides me a ton of long-term confidence.

It might very simply be the case that 2025 is the yr both (each?) the Canadian and American economies fall into recessions. However keep in mind, the economic system shouldn’t be the inventory market. A recession that badly hurts medium-sized Canadian firms isn’t more likely to lead to an enormous loss for a pipeline or a utility.

Given the outcomes of the Canadian inventory market during the last 18 years, the Smith Manoeuvre has generated a number of hundred thousand {dollars} for me. Merely put: I began this factor on the absolute worst time, and my web price remains to be a lot larger than it could have been had I not achieved it. That ought to assist assuage any fears across the thought of, “I can’t begin this now – we’re on the prime of the inventory market and the one place to go is down.” It’s actually attainable we might see a downward worth motion sooner or later this yr, nevertheless it’s additionally attainable the rising earnings will maintain issues in optimistic territory all through the following couple of years.

As a result of so many individuals proceed to first discover this website by way of looking for Smith Manoeuvre info, I intend to personally replace all through 2025 (and past) – so if in case you have any questions, ship them our manner.

FT