If you happen to’re out there for a mortgage this spring, you’ve most likely seen mounted charges are persevering with to development decrease.

That’s thanks largely to falling bond yields, which drive fixed-rate pricing, and a contemporary wave of spring competitors amongst lenders.

Prior to now week alone, some banks and monolines have minimize 3- and 5-year mounted mortgage charges by 10 to twenty foundation factors.

“The spring market begins now,” mortgage analyst Ron Butler not too long ago informed Canadian Mortgage Traits, pointing to what’s sometimes the busiest—and best—season within the mortgage cycle. With many high-ratio mounted charges now dipping beneath 4% for the primary time in months, Butler says the pricing struggle is effectively underway.

In accordance with fee professional Ryan Sims, huge banks are particularly eager to compete proper now after a sluggish begin to the yr for mortgage originations. That’s translating into sharper fixed-rate gives.

Nevertheless it’s a distinct story for variable charges. Whereas the Financial institution of Canada’s in a single day fee dropped one other 25 foundation factors earlier this month, lenders are quietly lowering their variable-rate reductions off prime—successfully making new variable-rate mortgages costlier.

It’s a development that hasn’t gone unnoticed by brokers and debtors alike.

As extra debtors look to variable merchandise in anticipation of additional BoC cuts—as mirrored within the newest huge financial institution fee forecasts—lenders are adjusting pricing to restrict their publicity.

Trimming VRM reductions helps rebalance their mortgage combine and offset the rising value of hedging, explains Sims.

“When the proportion of variable-rate mortgages grows too giant, lenders want to guard themselves by hedging—and that safety comes at a price,” Sims mentioned. “Hedging is like insurance coverage. The value goes up when everybody needs it, and in a falling fee atmosphere, that demand spikes throughout the board.”

Newton acquires 50% stake in Fastkey

Newton Connectivity Techniques has acquired a 50% possession stake in Fastkey Know-how Ltd., fintech firm recognized for its safe CRA doc retrieval service and rising suite of monetary screening instruments.

The partnership brings Newton’s Velocity platform nearer to full integration with Fastkey’s earnings verification service, which pulls key paperwork—equivalent to Notices of Evaluation and tax slips—instantly from the Canada Income Company. The answer has been gaining traction amongst brokers seeking to streamline approvals and cut back earnings fraud danger.

“Investing in Fastkey brings Newton-Velocity nearer to our desired consequence for

sustainable, long run entry to important employment and earnings affirmation

from CRA for each our Mortgage Dealer and Lender prospects,” mentioned Geoff Willis, CEO of Newton.

Fastkey’s CRA Service helps brokers and lenders confirm earnings instantly by means of official CRA channels—lowering the danger of solid paperwork and income-related fraud. The corporate additionally gives instruments for biometric ID verification, AML and PEP screening, felony report checks, title searches, and extra.

“This partnership will assist us speed up the event of our options and be sure that mortgage brokers throughout Canada have probably the most highly effective monetary screening instruments at their fingertips,” mentioned Shane Nercessian, CEO of Fastkey.

Servus CU grows to $29.4B in property following connectFirst merger

Alberta-based Servus Credit score Union—now working beneath the mixed banner with connectFirst—reported robust Q1 financials in its first full quarter as a mixed entity.

As of Q1:

- Belongings beneath administration rose to $38.4 billion, up $800 million from the prior quarter

- Normalized earnings earlier than taxes and patronage got here in at $44 million, after adjusting for $23.9 million in one-time merger-related objects

- Complete loans reached $24.7 billion

- Provision for credit score losses was $22.1 million

The credit score union says its scale and stability post-merger place it to higher assist members throughout financial uncertainty.

“Our focus now could be on integrating our operations so we are able to higher serve our members and communities,” mentioned CEO Ian Burns.

Alberta’s economic system is displaying indicators of progress thanks to grease manufacturing and inhabitants positive aspects, although unemployment and cost-of-living issues stay.

Survey: 82% of Canadians face shock prices in homebuying journey

A brand new Angus Reid research commissioned by on-line actual property brokerage Zown finds that the homebuying course of continues to catch Canadians off guard—and affordability pressures are prompting many to shift their plans.

Key findings:

- 82% of Canadians encountered sudden prices when exploring homeownership, together with realtor charges, closing prices, and property taxes.

- 26% of Canadians plan to purchase a house within the subsequent two years—however 80% of them have reconsidered their desired location attributable to affordability.

- 57% of Canadians attempting to save lots of for a down cost say excessive residing prices are the largest barrier—not rates of interest or housing costs.

- 36% are unaware of accessible monetary assets like down cost help, and 25% of future patrons lack confidence in navigating the method.

The survey additionally exhibits robust demand for schooling and assist, particularly from youthful patrons. Gen Z is the most definitely to see homeownership as a lifetime aim (84%), but the least aware of the instruments accessible to assist them get there.

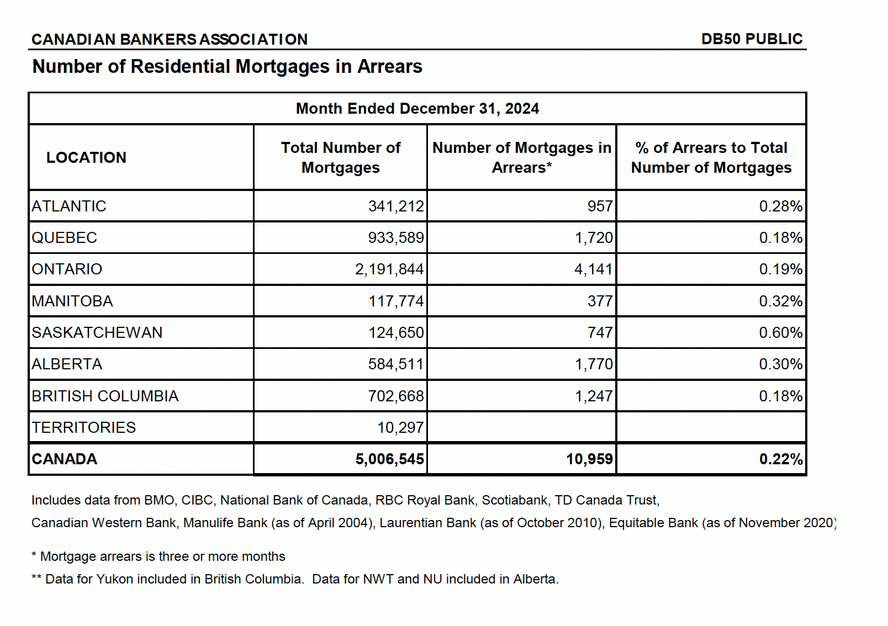

Mortgage arrears proceed to rise

Canada’s nationwide mortgage arrears fee rose to 0.22% in December, with 10,959 mortgages three or extra months overdue, based on the Canadian Bankers Affiliation (CBA).

That’s up barely from 0.21% in November and above the pandemic low of 0.14% in 2022, although the speed stays low by historic requirements.

Saskatchewan continues to report the very best arrears fee at 0.60% (up from 0.59% in November), adopted by Manitoba at 0.32% (unchanged) and Alberta at 0.30% (up from 0.29%). The bottom charges had been recorded in Quebec and British Columbia, each at 0.18%. Ontario’s arrears fee edged as much as 0.19%, whereas the Atlantic area stood at 0.28%.

BCFSA disciplines 23 people tied to unregistered mortgage dealer exercise

The BC Monetary Providers Authority has issued 5 new consent orders following a multi-year investigation into unregistered mortgage dealer Jay Kanth Chaudhary.

The orders are a part of a broader crackdown involving 23 people linked to Chaudhary’s scheme to facilitate non-compliant mortgage exercise in B.C.

Current disciplinary actions embrace licence cancellations and penalties of as much as $75,000 for a number of actual property licensees and one mortgage dealer. Chaudhary was beforehand issued an pressing cease-and-desist order in 2019.

BCFSA has since unredacted associated regulatory actions and issued a shopper truth sheet highlighting the significance of working with registered mortgage professionals.

Mortgage snippets

- Shopper confidence dips to 2025 low: Canadian shopper confidence dipped to a 2025 low final week, with the Bloomberg Nanos Confidence Index falling to 47.43, down from 48.38 final week and beneath the 2025 common of 49.21.

The Expectations Index dropped to 41.01, reflecting rising pessimism in regards to the economic system and actual property. The Pocketbook Index, which gauges private funds and job safety, slipped to 53.84 from 55.03.

Quebec posted the very best confidence at 48.66, whereas Ontario ranked lowest at 45.80. Renters reported stronger confidence than owners, whose rating fell sharply to 47.08 from 51.14 the earlier week.

Simply 10.05% of Canadians count on the economic system to enhance, and sentiment towards actual property fell to 36.21, its lowest degree in over a yr.

- Most owners assured in managing mortgages—CIBC ballot: Regardless of financial uncertainty, a brand new CIBC ballot finds the vast majority of Canadian mortgage holders really feel assured of their means to handle funds and family budgets. Amongst variable-rate debtors, 64% report little to no impression on their way of life, as do 59% of these anticipating increased renewal charges.

High issues embrace inflation (94%), financial situations (89%), and rates of interest (85%). To remain on observe, many are chopping discretionary spending (57%), searching for higher charges (42%), or making lump sum funds (19%). Most upcoming renewers plan to lock in mounted charges (64%).

- Doormat rebrands to Ownright, raises $4.5M: Ontario-based actual property legislation agency Doormat has rebranded as Ownright and closed a $4.5-million seed spherical led by Alate and Relay Ventures, bringing its complete funding to $6.5 million. The corporate says the rebrand displays its mission to ship a wiser, extra clear authorized expertise for homebuyers and sellers.

Ownright has facilitated over $750 million in transactions and gives providers like property closings, mortgage refinancing, and standing certificates opinions by means of its digital-first platform. It goals to surpass $1 billion in transaction quantity by the tip of 2025.

Subsequent Steps: Mortgage business profession strikes

“Subsequent Steps” is a characteristic in our Mortgage Digests that highlights notable job adjustments and profession developments throughout the mortgage business. When you’ve got a job replace to share, we welcome your submissions to maintain the group within the loop.

Management updates at CMI: Todd Poberznick Promoted, Joe Flor Joins as VP, Mortgage Gross sales

CMI Monetary Group has introduced two key management adjustments as the corporate continues to develop its presence within the non-public mortgage market.

Todd Poberznick has been promoted to Senior Vice President, Nationwide Gross sales and Strategic Relationships. On this new function, he’ll deal with increasing CMI’s attain by means of new channels and strengthening strategic relationships.

Since becoming a member of CMI, Poberznick has performed a pivotal function in driving progress, increasing distribution, and forging relationships with brokerages and banks. Throughout his tenure, mortgage originations elevated by 300% between 2020 and 2024. With over 40 years of expertise in monetary administration, mortgage product improvement, dealer relations, and gross sales, he stays a key determine within the business.

Joe Flor has joined CMI as Vice President, Mortgage Gross sales, overseeing the corporate’s Gross sales perform. On this function, he’ll lead the Gross sales group and handle day-to-day operations to strengthen dealer partnerships and drive continued progress.

Flor brings greater than 20 years of expertise in monetary providers, having held management positions at Scotiabank, Wells Fargo Monetary, Glasslake Funding, and Equitable Financial institution. He has an in depth background in nationwide gross sales program improvement, relationship administration, and strategic progress.

CMI says these management adjustments mirror a dedication to strengthening the corporate’s nationwide presence and enhancing its partnerships throughout the business.

Kelly Neuber joins Highclere Capital as Chief Advertising and marketing Officer

Business veteran Kelly Neuber has joined Highclere Capital as Chief Advertising and marketing Officer, bringing over 20 years of mortgage business advertising expertise to the agency.

Her resume contains senior advertising roles at Invis – Mortgage Intelligence, Mortgage Architects, and Mortgage Intelligence.

Highclere, which launched in 2023, has been steadily increasing its group because it seems to be to scale its broker-focused non-public lending platform.

Neuber joins as Highclere prepares to roll out its broker-only lending platform, which shall be powered by capital markets funding and a tech-forward adjudication mannequin. As co-founder Paul Grewal not too long ago informed Canadian Mortgage Traits, “Our aim is to assist mortgage brokers to win and succeed”—a message Neuber will now assist amplify.

EconoScope:

Upcoming key financial releases to look at

The newest headlines

With prepayment penalties surging, game-changing new instrument helps debtors weigh their choices

When can a vendor lend you cash? What to learn about vendor take-back mortgages

Overseas traders dump U.S. shares, pour billions into Canadian bonds

Carney pledges to chop GST for first-time patrons of houses beneath $1M

Federal election set for April 28, with economic system and housing high of thoughts

Inflation nonetheless too sizzling for the BoC to chop charges additional: Scotiabank

Mortgage fee struggle heats up as huge banks slash charges — “The spring market begins now”: Butler

Visited 2,079 instances, 678 go to(s) at the moment

angus reid bcfsa canadian bankers affiliation cibc CMI Monetary Group connectFirst shopper confidence Doormat EconoScope Fastkey mounted mortgage charges Geoff Willis Joe Flor Joins Kelly Neuber newest mortgage information mortgage arrears Mortgage digest nanos shopper confidence newton velocity Ownright ron butler ryan sims servus credit score union Shane Nercessian Todd Poberznick variable mortgage fee Zown

Final modified: March 25, 2025