[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Constancy Investments is finest often called an administrator for office retirement plans and an internet dealer for retail traders. Along with 401k/403b accounts, Conventional and Roth IRAs, HSAs, and taxable brokerage accounts, Constancy additionally provides accounts that can be utilized for a similar goal as a checking account and a financial savings account.

As a result of Constancy is concerned about having a full relationship with its prospects for each banking and investing and its main focus is on the investing half, it’s in a very good place to supply higher charges and options than banks within the banking half.

This isn’t a sponsored submit. Constancy isn’t paying me to advertise. I’m solely writing as a glad buyer of over 20 years. Listed below are two methods to make use of a Constancy account to handle day-to-day spending and financial savings.

1. CMA as Checking

Constancy Money Administration Account (CMA) is a separate account kind from Constancy’s common taxable brokerage account formally known as “The Constancy Account.” It’s a must to select the account kind once you open the account. A Money Administration Account can’t be modified to a daily taxable brokerage account after you open the account. Nor can an current common taxable brokerage account be modified to a CMA.

Included Options

The Money Administration Account is particularly designed to satisfy banking wants. It has just about every little thing individuals want for a checking account and practically every little thing is free.

– FDIC-insured steadiness (2.72% APY as of June 19, 2024) or a cash market fund (4.95% 7-day yield as of June 19, 2024).

– No minimal steadiness. No upkeep price. Doesn’t require direct deposit.

– Supplies a routing quantity and an account quantity for direct deposits and direct debits.

– Accepts verify deposits by cell app or in individual at a Constancy department.

– Free checkbook. No minimal quantity for writing a verify.

– Free Visa debit card for buy, ATM withdrawal, and teller money advance. It doesn’t require utilizing the debit card a minimal variety of occasions per 30 days.

– No price to make use of any ATM worldwide. Reimburses the ATM price charged by the machine.

– Free Invoice Pay service with eBill.

– Free same-day ACH. Push $100,000 per enterprise time out of Constancy and pull $250,000 per enterprise day into Constancy by on-line self-service. Name customer support to switch the next quantity.

– Free wire transfers. Identical $100,000 per enterprise day by on-line self-service. Name customer support to wire the next quantity.

Select Core Place

The “core place” in a Constancy account is the default holding within the account. Cash coming into the account lands within the core place. Cash going out of the account is withdrawn from the core place first.

You will have a option to maintain your core place both in FDIC-insured banks or within the Constancy Authorities Cash Market Fund (SPAXX). The cash market fund isn’t FDIC-insured however its underlying holdings are short-term authorities securities. I’m comfy protecting my cash within the cash market fund for the next yield. See No FDIC Insurance coverage – Why a Brokerage Account Is Protected.

To change the core place from the FDIC-Insured Deposit Sweep Program to the Constancy Authorities Cash Market Fund (SPAXX), log in on Constancy’s web site, click on on the “Positions” tab, and choose your money steadiness. You will note a “Change Core Place” button.

Your chosen core place stays efficient till you alter it once more. If you happen to make Constancy Authorities Cash Market Fund (SPAXX) your core place, your current core steadiness and all future deposits will routinely go into the cash market fund.

The 4.95% yield from the cash market fund is greater than the yield on many high-yield financial savings accounts as of June 19, 2024. For instance, Ally Financial institution pays solely 4.2% on its high-yield financial savings account, which doesn’t have all of the checking options corresponding to Invoice Pay.

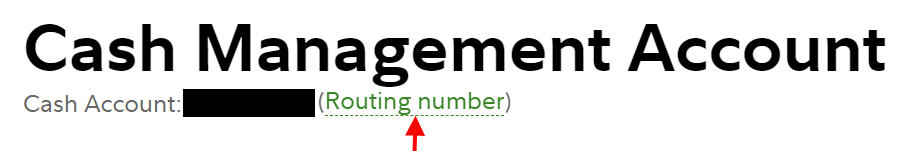

Routing Quantity and Account Quantity

You see the routing quantity and the account quantity for direct deposits and direct debits once you click on on the routing quantity hyperlink beneath the account identify.

Select “checking” because the account kind in the event you’re requested to pick out one.

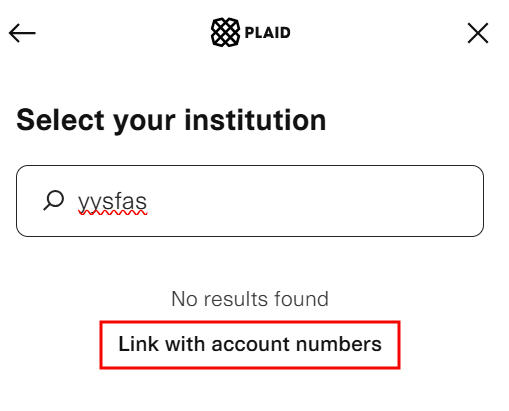

In case your financial institution makes use of Plaid so as to add a Constancy account as a linked checking account, seek for a non-existent financial institution after which click on on “Hyperlink with account numbers.” It is going to make Plaid use a micro-deposit to confirm your Constancy account.

You return to confirm the hyperlink after you obtain the micro-deposit in your Constancy account.

Limitations

Constancy Money Administration Account has some limitations that aren’t a deal-breaker to me.

– Doesn’t settle for deposits of bodily money or cash orders.

– Doesn’t help Zelle within the account. You may hyperlink the debit card within the Zelle cell app.

– Doesn’t hyperlink immediately by way of Plaid (should undergo micro-deposits).

– Doesn’t provide sub-accounts for monitoring completely different objectives.

– Doesn’t present cashier’s checks.

– Recurring ACH pushes out of Constancy solely help month-to-month and annual frequencies. Recurring ACH pulls into Constancy solely help weekly, biweekly, and month-to-month frequencies.

– 1% transaction price on debit card purchases in international nations. This price doesn’t apply to worldwide ATM withdrawals.

– ACH pulls and verify deposits are held for as much as 5 enterprise days. The cash nonetheless earns curiosity. It’s simply not out there for withdrawal whereas it’s on maintain. You gained’t be topic to the maintain if you already know the appropriate approach to switch cash.

I exploit my in any other case dormant Financial institution of America checking account on these uncommon events after I must deposit bodily money, get a cashier’s verify, or arrange recurring transfers on an odd schedule. I don’t use a debit card for purchases or monitor my financial savings by separate objectives.

The maintain time on ACH pulls and verify deposits will shrink over time for established accounts on smaller quantities. My ACH pulls and verify deposits are normally out there for withdrawal in two enterprise days. I do an ACH push from the opposite facet after I want it to be out there instantly.

Safe Your Debit Card

The account routinely comes with a Visa debit card. The debit card can be utilized for purchases with no PIN when it’s run as a bank card. This creates an issue in case your debit card is misplaced or stolen. A person posted on Reddit that she or he was having a tough time getting the cash again after thieves purchased $6,000 value of reward playing cards with the stolen debit card.

It’s higher to not carry the debit card with you in your pockets. If you happen to favor to make use of a debit card for purchases, put the debit card in Apple Pay or Google Pay and faucet your cellphone to pay. It’s tougher for criminals to crack a cellphone than to faucet your misplaced or stolen debit card in every single place. If you happen to usually don’t use a debit card for purchases, maintain it at dwelling and solely take it with you once you anticipate needing to withdraw money at an ATM.

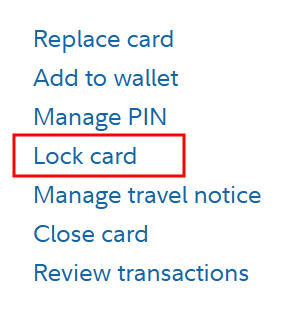

You too can lock your debit card on Constancy’s web site or within the Constancy cell app. Locking the cardboard makes it decline all transactions. I beforehand used the debit card in Venmo to pay pals for shared bills. Venmo additionally works with a checking account. I added the Constancy account as a checking account in Venmo and eliminated the debit card. Now my debit card is securely locked always. I’ll solely unlock it after I want to make use of it to withdraw money.

To lock the debit card on-line, open a brand new tab in your browser after you log in to Constancy and go to fidelitydebitcard.com. Discover your debit card and click on on “Lock card.”

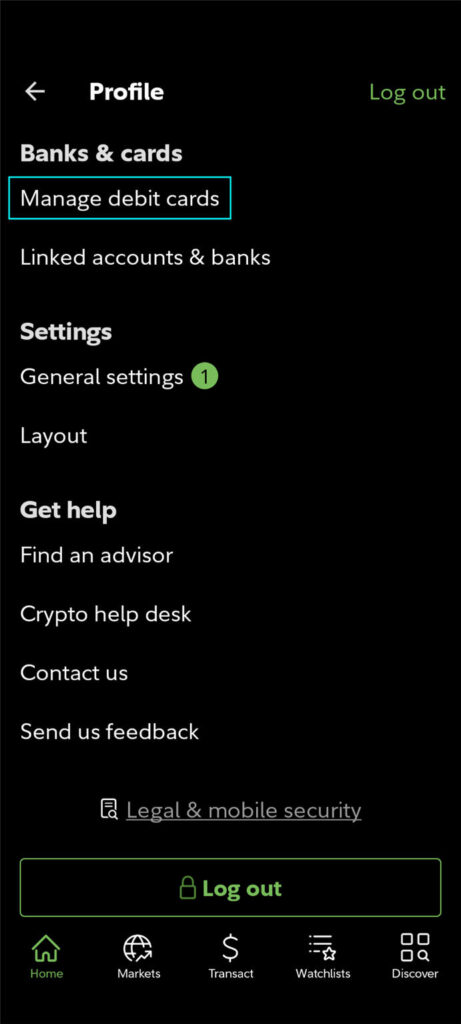

If you happen to set up the Constancy cell app in your cellphone, you’ll be able to unlock the debit card proper earlier than it’s worthwhile to use the cardboard to withdraw money and lock it once more once you’re completed. Faucet the top icon on the highest proper to search out “Handle debit playing cards” in your profile within the Constancy app. Faucet “Lock or unlock card” on the subsequent display screen to lock or unlock the cardboard.

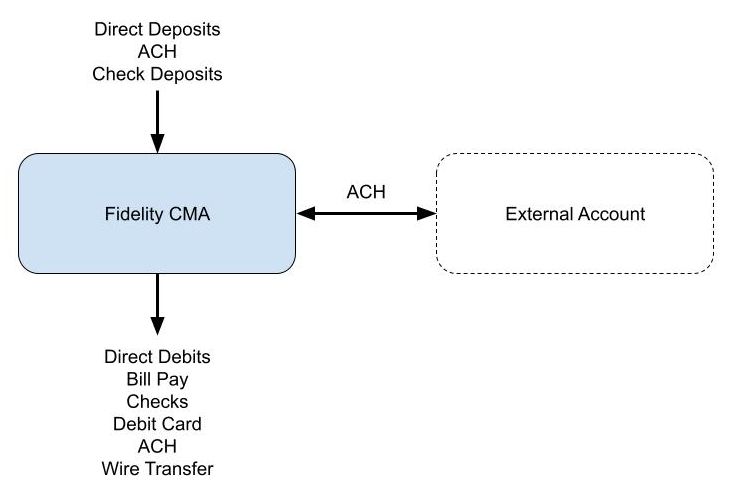

Hyperlink to Exterior Account

Once you use a Constancy CMA as your checking account, you’ll be able to hyperlink it to an exterior account as you usually do with a checking account. For instance, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You should use Vanguard as your financial savings account to earn a barely greater yield whereas utilizing the Constancy CMA as your checking account. The majority of your money earns 5.27% at Vanguard whereas the quantity you want for spending earns 4.95% within the Constancy CMA.

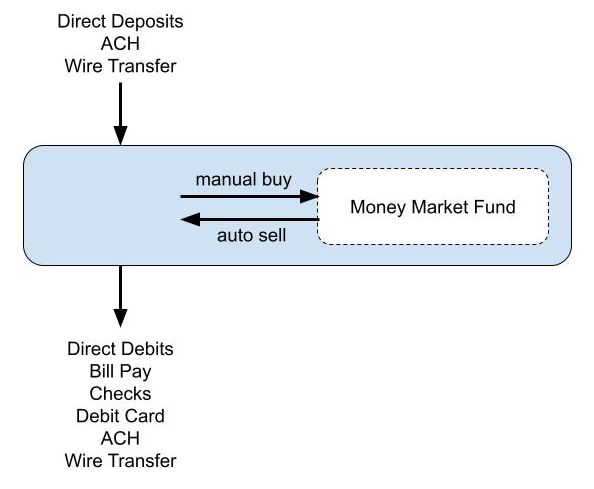

2. CMA as Checking/Financial savings Combo

As an alternative of linking to an exterior account because the “financial savings” half, you’ll be able to maintain each “checking” and “financial savings” within the Money Administration Account. This earns much less curiosity but it surely avoids having to switch backwards and forwards between two accounts. I do it this fashion as a result of it’s easier and it doesn’t forego that a lot curiosity.

Purchase One other Cash Market Fund

Though the CMA is designed for banking wants, it’s nonetheless a brokerage account. With some exceptions (no margin or choices), you should buy within the CMA just about every little thing out there in a daily brokerage account. This contains shares, bonds, brokered CDs, mutual funds, and ETFs.

The CMA turns into a checking/financial savings combo once you purchase a distinct cash market fund in it. The core steadiness within the CMA serves because the checking half and the manually bought non-core cash market fund serves because the financial savings half. Constancy will routinely promote from the non-core cash market fund when your core steadiness within the CMA is inadequate to cowl a debit. That is like having free automated overdraft transfers from financial savings to checking.

Some individuals favor to purchase Constancy Cash Market Fund (SPRXX) or Constancy Cash Market Fund Premium Class (FZDXX). Their yields have been 5.02% and 5.14% respectively as of June 19, 2024, which have been barely greater than the 4.95% yield on Constancy Authorities Cash Market Fund (SPAXX) within the core place. Some individuals favor to purchase Constancy Treasury Solely Cash Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 however extra of the revenue is exempt from state revenue taxes. None of those funds may be set because the default core place however you should buy them manually. See Which Constancy Cash Market Fund Is the Finest at Your Tax Charges.

As a result of Constancy will routinely promote from the non-core cash market fund to cowl debits, in the event you’re so inclined, you may be aggressive in protecting the core steadiness within the CMA low whereas protecting the majority of your account in a non-core cash market fund incomes a barely greater yield. Or you’ll be able to set a most goal steadiness alert with the Money Supervisor to purchase extra shares of the non-core cash market fund when you’ve extra money within the “checking” half.

Some individuals favor to simply maintain every little thing within the default Constancy Authorities Cash Market Fund (SPAXX) as a result of the additional yield from a non-core cash market fund is sort of small.

Money Supervisor Not Wanted

You might have seen some convoluted setups utilizing the Money Supervisor overdraft characteristic within the Constancy CMA. It’s pointless and undesirable.

The one factor remotely helpful within the Money Supervisor is the utmost steadiness alerts. An alert solely tells you that your CMA core steadiness exceeded the utmost goal steadiness. It doesn’t routinely purchase a non-core cash market fund within the CMA for you. You continue to have to purchase it manually if you would like.

You don’t want an alert for the CMA core steadiness dropping beneath a minimal steadiness when you’ve sufficient financial savings in a non-core cash market fund held within the CMA. Promoting from the non-core cash market fund held inside the CMA to cowl debits works out of the field. It occurs routinely anyway even in the event you don’t arrange something within the Money Supervisor.

The Money Supervisor has a “self-funded overdraft safety” characteristic to hyperlink the CMA to a different Constancy account. That is pointless and undesirable once you need the CMA to face by itself. You don’t need unauthorized debits to have an effect on your different accounts.

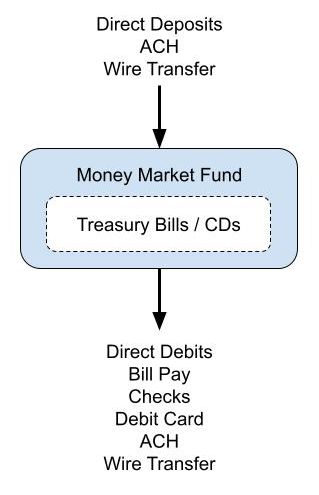

Add Treasury Payments or Brokered CDs

If you happen to’d prefer to take it one step additional, you may as well purchase Treasury Payments or brokered CDs within the CMA when you’ve cash that you already know you gained’t want for a while. The CMA then turns into a checking/financial savings/CD combo. The cash routinely goes into the “checking” half when the Treasury Invoice or brokered CD matures. For instance, the quantity put aside for the subsequent property tax invoice can go right into a Treasury Invoice or a brokered CD. See How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and Methods to Purchase CDs in a Constancy Brokerage Account.

Please notice in the event you allow the “auto roll” characteristic once you purchase new-issue Treasury Payments or brokered CDs within the CMA, the quantity for the subsequent roll reduces your “out there to withdraw” quantity for a number of days throughout the roll. A debit might fail in the event you don’t have sufficient out there to withdraw. It’s not an issue in the event you don’t use auto roll or in the event you maintain a considerably greater quantity in a cash market fund than the quantity for the subsequent roll.

Utilizing a Constancy CMA for spending and financial savings turns into actually set-and-forget. All deposits routinely earn a couple of 5% yield as of June 19, 2024. All debits come out of this cash market fund. It’s like utilizing a financial savings account as a checking account. You may manually purchase a non-core cash market fund however you don’t should. The yield on the default Constancy Authorities Cash Market Fund (SPAXX) is shut sufficient to the yield on one other Constancy cash market fund.

You may nonetheless purchase Treasury Payments or brokered CDs to put aside cash for particular payments sooner or later. Please notice the caveat on “auto roll” and “out there to withdraw” talked about above. It’s higher to do it in a distinct brokerage account in the event you favor to make use of “auto roll.”

***

The largest draw of utilizing the Constancy CMA for spending and short-term reserves is the checking options. You successfully use a financial savings account as a checking account and earn a very good yield from the primary greenback. Every part is seamlessly collectively.

A Vanguard cash market fund and a few much less well-known high-yield financial savings accounts pay extra however they don’t provide checking options. Once you pair it with a checking account that pays near zero, the blended yield on all of your money goes down. For instance, when you’ve got $5,000 in a checking account that pays 0.1% and you’ve got $50,000 in a Vanguard cash market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You may as effectively put the entire $55,000 in a Constancy CMA incomes 4.95% and remove the necessity to watch your checking account steadiness and switch backwards and forwards between two accounts.

Transitioning a checking account takes some effort and time. Banks comprehend it. That’s why they pay you near zero in checking accounts. They wager that you simply suppose it takes an excessive amount of work to modify. Don’t fall for it. It’s simpler than you suppose once you take your time to make the transfer.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.