There are many alternative folks concerned within the dwelling mortgage course of.

I wrote about this intimately already, however in all probability didn’t even embrace everybody.

As a result of getting a mortgage is a fairly large deal, a variety of palms are wanted to make sure it goes based on plan.

There are additionally a number of methods to acquire a house mortgage, which require completely different members.

For instance, should you select to make use of a mortgage dealer to get your mortgage, an “account government” can be within the combine.

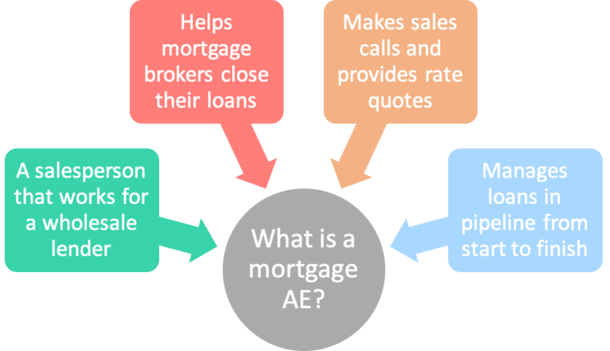

The Position of a Mortgage Account Govt

A mortgage account government, or AE for brief, works as a liaison between a mortgage dealer and the wholesale lender they characterize.

With regard to mortgage lending, wholesale merely means business-to-business (B2B) as an alternative of retail, which is direct-to-consumer (B2C).

Merely put, AEs are NOT consumer-facing and don’t have any interplay with debtors in any respect.

As a substitute, they impart with the mortgage dealer, who in flip corresponds with the borrower.

Sometimes, AEs maintain an inside position on the wholesale lender they characterize, that means they don’t depart the workplace until they’re doing a gross sales pitch.

They merely area telephone calls from third-party mortgage brokers and work with their workers internally to originate and shut loans.

Mortgage brokers depend on AEs to get mortgage pricing, submit loans to underwriting, clear situations as soon as accredited, present standing updates, and ultimately fund their loans.

In a approach, they act equally to a retail mortgage officer, however take care of one other mortgage skilled versus a shopper.

What a Typical Day Appears Like for a Mortgage AE

I labored as an Account Govt within the early 2000s, so I can present some private perception right here.

Usually, mortgage AEs work common banking hours, comparable to 8am to 5pm each day. Maybe staying late on days which are tremendous busy.

On a typical day, an AE will look over mortgage recordsdata which are already submitted to underwriting and accredited.

They may decide what situations are excellent to get them to the subsequent step, whether or not it’s drawing mortgage paperwork to be signed or funding the mortgage.

On the similar time, AEs are salespeople. This implies they should make a variety of outgoing telephone calls to mortgage brokers to drum up new enterprise.

On these telephone calls, they are going to ask brokers if they’ve any mortgage eventualities that have to be priced out.

And if that’s the case, will present mortgage charge pricing within the hopes the dealer will like what they hear and ship the mortgage to them.

Assuming that occurs, the AE might want to manage the file by amassing crucial paperwork, order a credit score report, add a mortgage utility, and get the entire bundle over to the mortgage underwriter.

As soon as the underwriter selections the file, they are going to get in contact with the dealer, and if accredited, ship them an inventory of prior-to-doc situations (PTDs).

Once more, they’ll have to facilitate this paperwork assortment course of, make sure that a house appraisal is ordered, and supply standing updates alongside the way in which.

What they impart to the dealer can be shared with the borrower and everybody will work collectively to shut the mortgage in a well timed vogue.

The Job Is Gross sales and Operations Rolled into One

As you may see, a mortgage AE must be each a salesman and a member of the operations workers.

They want to usher in new enterprise and oversee their mortgage pipeline to make sure the mortgages in course of make it to the end line.

This implies being a great communicator, staying organized, having good time administration abilities, and the flexibility to place out fires once they inevitably floor.

Mortgages not often go fully based on plan, so AEs might want to step in to supply options, save recordsdata, make onerous telephone calls, and extra.

If an appraisal is available in low, they’ll have to name the dealer and work on a brand new plan to make the mortgage work.

Equally, if one thing turns up throughout the underwriting course of, they could have to get inventive to maintain the file in good standing and push ahead.

And keep in mind, whereas all of that is taking place, they nonetheless have to generate new enterprise. It’s a little bit of a juggling act and it may be very anxious.

To make issues worse, there are sometimes quotas to fulfill every month to make sure they make high greenback for the work that they do.

How Do Mortgage AEs Get Paid?

The corporate I labored for paid each a base wage and fee on loans closed throughout the month.

The bottom wage was very low, however nonetheless supplied assurances that you simply wouldn’t stroll away with nothing.

Nonetheless, it was in the end the fee the place you could possibly take advantage of cash. And it was all depending on what number of loans you closed every month.

Those that have been capable of shut above a sure greenback quantity every month have been entitled to a much bigger reduce.

So that you have been incentivized to fund extra loans. This was additionally very anxious, as closing an quantity beneath a sure threshold may cut back your take dwelling wage considerably.

For instance, should you funded beneath X {dollars}, you might have solely been paid a flat price per mortgage. However should you funded above X {dollars}, you’d get a share that amounted to much more cash.

These days, mortgage corporations could pay AEs a better per-loan fee however not present a base wage. This generally is a nice tradeoff should you shut a variety of loans.

Conversely, those that settle for a base wage could not make as a lot per mortgage, regardless of the assured wage.

On the finish of the day, being an AE isn’t a lot completely different than being a retail mortgage officer.

The principle distinction is you’re employed for a wholesale lender and work together with mortgage brokers as an alternative of house owners and/or dwelling consumers.

There are professionals and cons relying on who you ask. Generally it may be simpler to take care of one other mortgage skilled versus say a first-time dwelling purchaser, for apparent causes.