IPO assessment

Tata Applied sciences Ltd stands on the forefront of worldwide engineering companies, famend for its complete choices in product growth and digital options. Established on August 22, 1994, and promoted by Tata Motors Ltd, the corporate has developed right into a powerhouse within the business, delivering turnkey options to world Authentic Gear Producers (OEMs) and their Tier-1 suppliers.

With a focus on manufacturing-led verticals, Tata Applied sciences excels in automotive options, constituting a considerable 75% of its income. Past automotive, the corporate extends its experience to aerospace and transportation and development heavy equipment (TCHM). Proficient in each product engineering and manufacturing engineering inside the mechanical area, Tata Applied sciences is progressively broadening its capabilities in software program and embedded engineering.

As a pure-play manufacturing-focused Engineering Analysis & Growth (ER&D) firm, Tata Applied sciences holds a pivotal place within the automotive sector. In 2022, the corporate engaged with 7 of the High-10 automotive ER&D spenders and 5 of the ten outstanding new power ER&D spenders, a testomony to its business management.

Distinguished by a diversified world consumer base, Tata Applied sciences operates via 19 world supply facilities strategically situated throughout North America, Europe, and the Asia Pacific. The corporate’s dedication to excellence is additional underscored by strong partnerships and alliances with business leaders comparable to Dassault, Logility, Siemens Trade Software program Inc., Codincity, Fantasy, and leveraging Microsoft AZURE merchandise/companies. These collaborations improve Tata Applied sciences’ capabilities, enabling the enlargement of its consumer attain throughout numerous verticals and geographies.

A major milestone within the firm’s development trajectory is its current empanelment by Airbus, which is anticipated to emerge as a potent avenue for future development. Tata Applied sciences continues to be on the forefront of innovation, shaping the panorama of engineering companies on a world scale.

Promoters & Shareholding:

Tata Motors Restricted is the Promoter of the corporate.

| Particulars | Pre – Challenge | Put up – Challenge |

| Promoters – Tata Motors Ltd | 64.79% | 53.39% |

| Promoter Group | 2.00% | 2.00% |

| Public – Buyers Promoting S/h | 10.89% | 7.29% |

| Public – Others | 22.32% | 37.32% |

Public Challenge Particulars:

Provide on the market: OFS of approx. 60,850,278 fairness shares at Rs. 2, aggregating as much as Rs. 3,042.51 Cr.

Complete IPO Dimension: Rs. 3,042.51 Cr.

Value band: Rs. 475 – Rs. 500.

Goal: To hold out OFS by the Promoting Shareholders and to realize advantages of itemizing on a inventory trade.

Bid qty: minimal of 30 shares (1 lot) for Rs. 15,000 and most of 13 tons.

Provide interval: November 22, 2023 – November 24, 2023.

Date of itemizing: December 5, 2023.

Professionals:

- Tata Applied sciences gives end-to-end automotive ER&D companies, from idea design to launch.

- Distinctive experience in rising automotive developments, together with electrical autos (EVs), connectivity, and autonomous applied sciences.

- The corporate’s digital companies and accelerators assist OEMs and Tier-1 suppliers in managing your complete product life cycle and fascinating prospects.

- The corporate maintains a world presence in Asia Pacific, Europe, and North America, partnering with main manufacturing enterprises worldwide.

- International supply mannequin enabling intimate consumer engagement and scalability.

Dangers:

- Tata Applied sciences closely depends on its promoter and some key purchasers for a considerable portion of its revenues, with Tata Motors (Promoter), its subsidiaries, and JLR being among the many prime 5 purchasers by income in Fiscal 2022.

- The corporate’s revenues are considerably depending on purchasers inside the automotive phase. Due to this fact, an financial slowdown or any opposed components impacting this sector could negatively have an effect on the enterprise.

- The corporate has skilled destructive money flows previously and will proceed to face comparable challenges sooner or later.

Subscribe or keep away from?

Sectorial outlook – ER&D companies, comprising product and course of engineering, play a pivotal position in designing, creating, and sustaining merchandise and processes on the market. In 2022, the worldwide ER&D spend reached an estimated USD 1.8 trillion, with USD 810 billion attributed to digital engineering. Regardless of macro headwinds, together with geopolitical uncertainties and inflation, the business is predicted to stay resilient, with a gentle development trajectory.

The digital engineering spend, specializing in applied sciences like IoT, blockchain, 5G, AR/VR, cloud engineering, digital thread initiatives, superior analytics, embedded engineering, and AI/ML, is projected to submit a strong CAGR of ~16% from CY22 to CY26. The worldwide ER&D spend is very consolidated, with the highest 1000 enterprises accounting for ~85% of the market. Manufacturing-led verticals, notably automotive, contribute considerably, comprising virtually half of the worldwide ER&D spending.

The software program and web sector, the biggest ER&D vertical, is predicted to proceed its fast development, accounting for ~20% of the worldwide spend. Providers-led verticals, primarily pushed by digital engineering investments, are the fastest-growing class, representing ~12% of the worldwide ER&D spend.

When it comes to geography, North America leads in world ER&D spend, with a concentrate on software program and web corporations. The APAC area, pushed by elevated spending from Southeast Asian enterprises and excessive digital engineering expenditures by hi-tech corporations, is anticipated to surpass Western Europe. China, contributing over a tenth of worldwide ER&D spending, notably in automotive, semiconductor, and software program and web, is a key participant within the business, with a robust emphasis on battery EVs.

Because the business evolves in direction of digital transformation and rising applied sciences, Tata Applied sciences is well-positioned. With its concentrate on manufacturing-led verticals, together with automotive, and a diversified world presence, Tata Applied sciences is poised to capitalize on the rising demand for digital engineering options. The corporate’s experience in ER&D companies aligns with business developments, providing modern options to OEMs and Tier-1 suppliers. Because the sector advances, Tata Applied sciences is predicted to play a vital position in shaping the way forward for engineering companies.

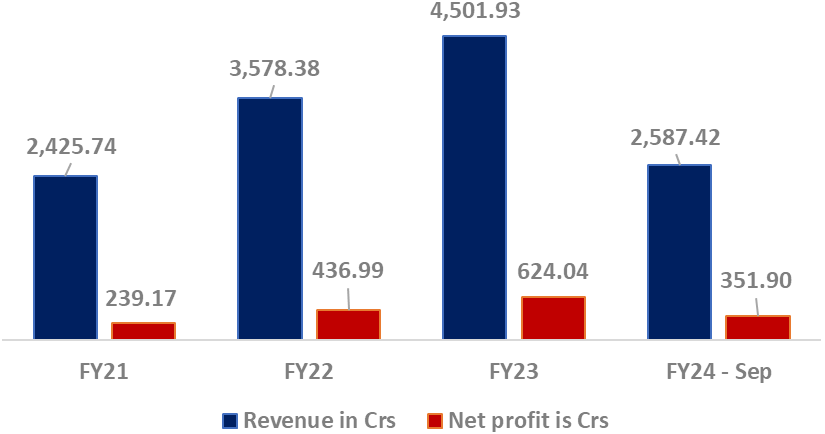

The financials (income and web revenue) are proven within the graph beneath:

Valuation – For the final 3 years common EPS is Rs. 10.68 and the P/E is round 46.8x on the higher value band of Rs. 500. The EPS for FY23 is Rs. 15.38 and the P/E is round 32.5x. If we annualize Q2-FY23 EPS of Rs. 17.34, P/E is round 28.8x. It has KPIT Techno (134.34x), L & T Applied sciences (39.45x), and Tata Elxsi (67.06x) as their listed friends as its listed friends as per the RHP. The corporate’s P/E is between 28.8x and 46.8x. ROA is round 13.6%, ROE and ROCE are at the moment 24.6% and 22.73% respectively. Income has been rising constantly and the margins have additionally been constantly rising.

Suggestion

This portion will probably be obtainable to our purchasers solely.