For the reason that begin of 2024, Nvidia‘s (NASDAQ: NVDA) inventory has risen round 150%. After a run like that, many buyers assume that they’ve missed the boat and the inventory can’t go any increased. The issue is that the identical pondering has brought on them to not purchase the inventory after it is risen 50% or 100%.

On an analogous word, Nvidia’s inventory is up practically 750% for the reason that begin of 2023. Regardless of the inventory rising considerably, day-after-day was a incredible shopping for alternative in 2023. There’s a pure intuition known as worth anchoring, the place your thoughts latches on to the value you can have paid up to now.

Buyers want to have a look at the assumptions baked into Nvidia’s inventory and resolve: Might it go increased sooner or later? If these assumptions are affordable, then possibly it is not too late to purchase Nvidia inventory.

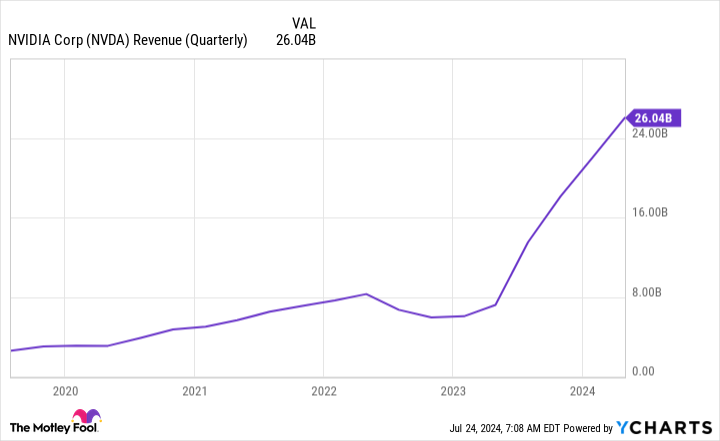

Nvidia’s income and earnings are reaching jaw-dropping ranges

Nvidia’s rise has been tied to its major product: graphics processing items (GPUs). GPUs are utilized in high-performance computing functions due to their skill to course of a number of calculations in parallel. With out this skill, little of the revolutionary synthetic intelligence (AI) expertise we see at the moment could be potential. Because the AI race continues, anybody competing is shopping for as many Nvidia GPUs as they will get their arms on, which is why the inventory has completed so nicely.

Nvidia reported three straight quarters of its income tripling, inflicting its inventory to shoot as much as file highs.

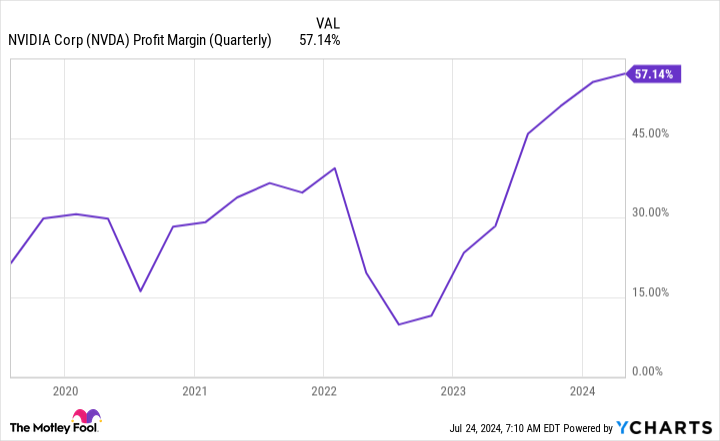

As a result of Nvidia already had the manufacturing capabilities to supply these GPUs, its margins additionally dramatically rose due to unit economics.

When figuring out the place Nvidia’s inventory can go from this level, buyers want to find out if Nvidia can continue to grow and preserve its top-tier revenue margins.

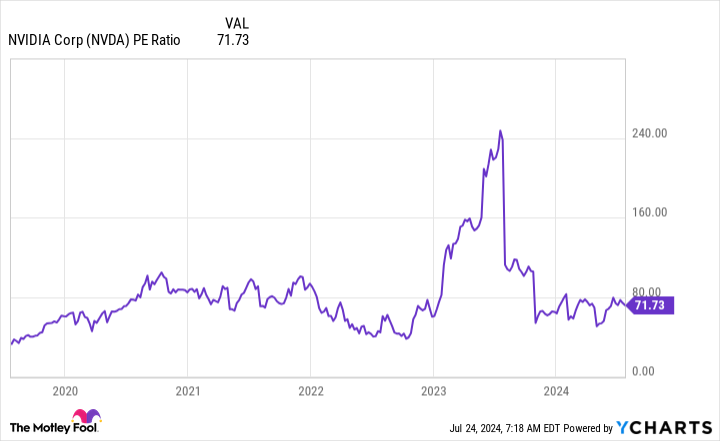

The inventory is not low cost proper now, nevertheless it may develop into its valuation

Nvidia’s income progress is a bit difficult. First, Nvidia has traditionally been a cyclical firm. This implies the corporate goes via ebbs and flows of demand. Proper now, demand is extraordinarily excessive, however the query is whether or not it could keep elevated for years. With the quantity of AI infrastructure that has but to be constructed, many buyers consider that Nvidia may repeatedly ship excessive ranges of income. Moreover, information heart GPUs solely have a lifespan of round 5 years, so they’ll must be changed round that point. When that happens, it’ll ignite one other demand wave for Nvidia’s GPUs that might assist it preserve or develop its income.

Nvidia’s margins are additionally suspect. As a result of they’re reaching such excessive ranges, some corporations wish to reduce out Nvidia and design the GPUs or AI-specific processing chips in-house. This threatens each Nvidia’s income and margins, however the issue is that these merchandise are very particular to a specific use case. Nvidia’s GPUs excel in a broad vary of calculation sorts, which is why they’ll doubtless stay extremely fashionable.

Whereas these are undoubtedly challenges, the present outcomes are closely leaning in Nvidia’s favor.

Now, we have to see what expectations are constructed into Nvidia’s inventory. At 71 instances trailing earnings, Nvidia’s inventory may be very costly.

As a result of Nvidia is a top-tier firm with wonderful margins, it is not unreasonable to anticipate the inventory to have a long-term a number of of 30 instances trailing earnings. If we use that a number of as its base case, then Nvidia would wish to develop its earnings to $100 billion to fulfill that standards at its present valuation.

Wall Road analysts anticipate income of $165 billion in fiscal yr 2026 (ending January 2026). If Nvidia can preserve its 57% revenue margin, that will lead to $94 billion in earnings, which is basically proper the place it must be to realize the valuation stage I set.

That is a couple of year-and-a-half of progress baked into the inventory already. However the query is, is that worth price it? If Nvidia’s progress extends out 5 years, then completely it is price it. If not, then buyers might be in for a impolite awakening.

Nevertheless, all indicators level to the booming AI pattern not being wrapped up in a year-and-a-half, which suggests it is not too late to purchase Nvidia inventory.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $688,005!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 22, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Is It Too Late to Purchase Nvidia Inventory? was initially revealed by The Motley Idiot