You’d suppose it’d be a comparatively straightforward quest to reply the query: How a lot will a Canadian spend in retirement?

Once I got down to create the first retirement course for Canadians trying to retire within the subsequent 25 years (or within the early levels of retirement) I figured that figuring out how a lot the common Canadians spent in retirement can be fairly easy. You possibly can try what that course has to supply by clicking right here.

I additionally knew that it was fairly essential to get this data appropriate, as there isn’t a approach to reply the way more widespread query of, “How a lot cash do I must retire?” – with out first having a reasonably good concept of what retirement spending will appear to be.

Are You Saving Sufficient for Retirement?

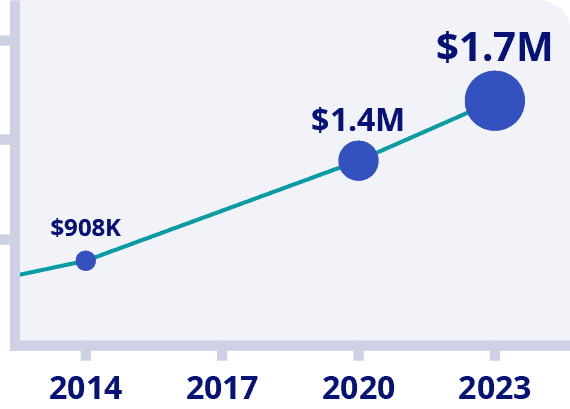

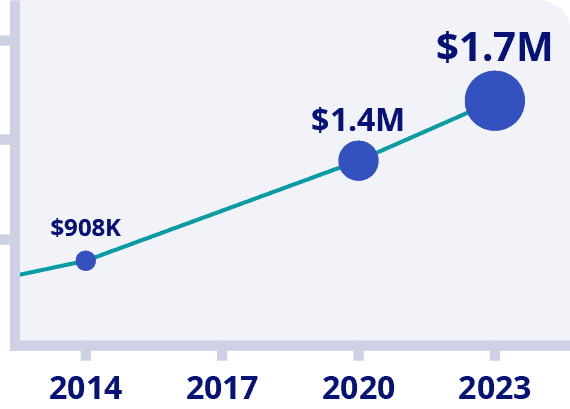

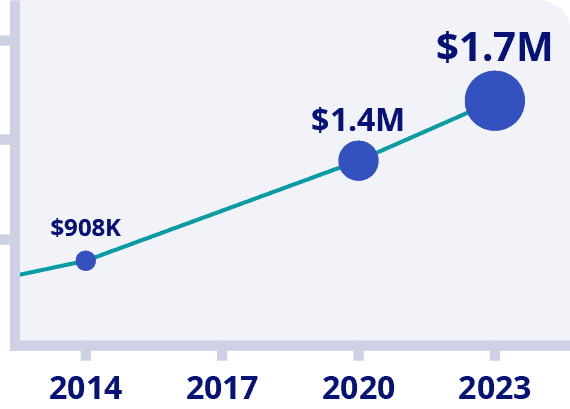

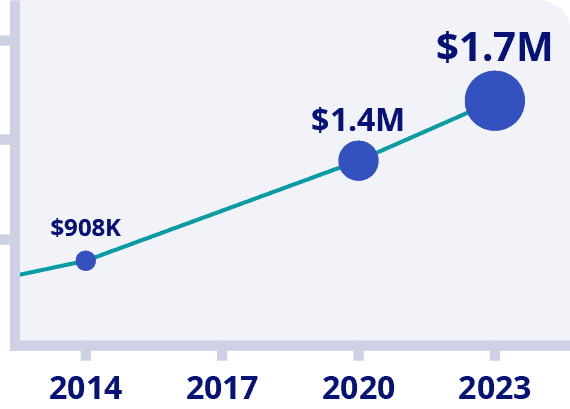

Canadians Consider They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Monitor?

Grow to be your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Attempt Now With 100% Cash Again Assure

*Knowledge Supply: BMO Retirement Survey

Determining how a lot you’ll spend in retirement is the important thing start line to working backwards – and figuring out how a lot you’ll want in your nest egg while you retire. From there, we will get some concept of how a lot we needs to be saving every year to construct as much as that retirement nest egg objective.

Upon getting a ballpark concept of what spending will appear to be, you possibly can consider your CPP, OAS, and attainable pension revenue – then use the 4% rule to find out what your withdrawal charge for retirement needs to be.

Canadian Spending In Retirement – What the Consultants Say

Earlier than we get to how a lot it is advisable to save and make investments to be able to retire comfortably in Canada, we have to know the best way to create a retirement spending plan that matches our distinctive profile.

Afterall, it doesn’t actually matter what the common bills in a Canadian retirement are, or how a lot the common Canadian has of their RRSP the day they retire – it’s actually about your private plan and your distinctive circumstances!

So as to information your planning, I regarded round for some helpful guidelines of thumb. As a result of latest inflation will issue into a few of these numbers that have been created a number of years in the past, I’ll do my greatest to regulate for inflation. It’s key to do not forget that whereas general inflation numbers have been excessive, the spending profile for many retirees doesn’t embody issues like shelter prices (for those who personal your individual dwelling).

Consequently, the efficient inflation charge for many retirees will probably be a bit decrease than the CPI numbers that you just see within the information. Positive, grocery costs are up large time over the past 5 years – however gasoline, home equipment, mobile phone plans, and TVs haven’t actually gone up at everywhere in the final 5 years.

So it’s essential to suppose logically about inflation and never emotionally react to one-off information factors comparable to your newest grocery or restaurant invoice.

Listed below are the most effective Canadian retirement spending “guidelines” and averages from respected sources.

1) Jason Heath is a wonderful fee-only CFP who has written extensively in a number of Canadian publications and is the Managing Director at Goal Monetary Companions in Toronto. Again in 2019 he estimated the common retired couple most likely spent a little bit greater than the $31,332 Solar Life reported, and that spending would lower by about 24% (pre-tax) for retired {couples} vs what they’d spent instantly earlier than retiring. Inflation-adjusted, that Solar Life quantity can be nearer to $35,000.

2) The Canadian authorities’s Assured Revenue Complement (GIS) statistics present that roughly 37% of the Canadian seniors eligible for Previous Age Complement (OAS) – which is principally each senior who has lived in Canada for at the least 15 years – are additionally eligible for GIS. That signifies that they’re incomes beneath the $21,768 threshold if they’re a one-person family, and $28,752 if each companions kind a two-person family.

Simply as a thought experiment, I encourage you to speak to a number of the of us gathering GIS, as I do know a number of who’re fairly comfortable and dwell very fulfilling lives. (In addition to a number of that aren’t – to be honest.)

3) David Aston, a long-time private finance author in Canada wrote in 2020 that he believed a very good rule of thumb was that Canadian retirees ought to look to exchange 60% of their pre-tax wage in the event that they needed to get pleasure from the identical lifestyle they’d created whereas working. He felt that quantity would possibly have the ability to go all the way down to 50% for those who have been a pair that had youngsters, and was getting into retirement with a mortgage-free home.

His closing conclusion was that “a barebones however fulfilling middle-class retirement for a single individual in Canada begins about $33,000 per 12 months for a single, and $44,000 per 12 months for {couples}.” These numbers have been for 65-year-old retirees who owned their very own dwelling. His middle-of-the-road retirement quantity for a pair was $65,000, and his prosperous retirement quantity was $100,000 in annual spending.

If we regulate these numbers for inflation, it could look extra like $36,000-$47,000 for barebones-but-fulfilling, $71,000 for middle-of-the-road, and $110,000 for prosperous.

4) Maybe the person most certified to offer solutions to all issues retirement cash in Canada is Fred Vettese. Fred is the previous VP and Chief Actuary of Morneau Shepell, and is a Fellow of the Canadian Institute of Actuaries (FCIA).

He has written quite a few books and articles on Canadian retirement monetary decisions, and on a latest podcast episode he put the pre-tax wage substitute quantity at 40-50% and even talked about a number of individuals he knew who have been very comfortable in retirement solely spending 30% of their pre-tax former earnings.

In his newest e book (launched in 2024) Vettese notes that Canadian seniors really save a better proportion of their revenue than youthful Canadians do! He goes on to state:

“If we fail to acknowledge the true spending patterns of older retirees, political correctness might have one thing to do with it. The mere suggestion that older individuals don’t want fairly as a lot cash can come throughout as senior-bashing. However whereas it’s a delicate topic, I don’t suppose that justifies our shying away from the reality.”

Vettese then goes on to quote quite a few research from all over the world that present spending lowering as of us age into their 70s – and in lots of instances, web worths really begin to enhance on common at this level!

Vettese additionally cites information from actuary Malcolm Hamilton, who discovered Canadian seniors on common have been saving cash, even whereas making a gift of a mean of 16.1% of their revenue. That information was from manner again in 2001 – however right here’s the craziest factor: The typical revenue for Canadian seniors went up 38% between 1998 and 2020 – AFTER we take inflation into consideration.

It’s value making that 38% quantity crystal clear. That’s in “actual” phrases – which means that inflation went up a sure proportion over these 22 years, after which the amount of cash coming to senior residents really went up 38% MORE than that general inflation quantity.

5) Nick Maggiulli wrote in 2022 from an American perspective that, “Throughout all wealth ranges, 58 % of retirees withdraw lower than their investments earn, 26 % withdraw as much as the quantity the portfolio earns, and 14 % are drawing down principal.”

That’s an incredible statistic when you concentrate on it. Most individuals who’ve a portfolio of investments as they enter retirement aren’t even touching the capital!

Maggiulli’s concept is that retirees will typically regulate their spending downward to match no matter revenue degree that they really feel compelled to. As a consequence of a lack of know-how of markets and possibilities, this results in retirees spending a lot lower than they may – or “ought to” if you wish to take an optimization method. I additionally suggest studying my earlier article on secure withdrawal charges for retirement if you need much more proof of this idea.

For context, let’s toss in a number of different random examples.

6) My buddies Bryce and Kristy are retired in 2016 and traveled the world on about $40,000 per 12 months. That’s all-in together with medical insurance coverage. Adjusting for inflation, it’s nonetheless effectively underneath $50,000.

7) Impressed by Bryce and Kristy, my spouse and I really semi-retired (we have been now not working 9-to-5 jobs) and traveled to Portugal, Thailand, Japan, Bali, and Los Angeles final 12 months. We spent about $55,000 – and didn’t watch the price range all that carefully.

8) Andrew Hallam has actually opened my eyes to the chances of a retirement overseas, and he has written about of us who retire on between $300 and $500 monthly (USD) in creating nations like Mexico. I did a deep dive into the most effective nations for Canadians to retire overseas in.

9) Lastly, I talked to a number of latest retirees in my prolonged family and friends circle.

Now to offer the complete context, I grew up (and my household continues to dwell in) one of many lowest revenue components of Canada. It’s a really rural a part of the Canadian prairies, the place well-maintained 1,300 sq. ft. bungalows can nonetheless be bought for $230,000 or much less.

A number of relations acknowledged that whereas they’d miss their annual heat all-inclusive resort vacation through the winter months, they as a pair may dwell fairly effectively on $35,000, even with latest inflation figures. Now these are of us who purchase beef “by the facet” and take delight in rising a vegetable backyard, so maybe it’s not sensible for a lot of Canadians – I simply thought it was one other helpful information level.

How A lot Do You Must Spend Per Month In Retirement?

It has been mentioned earlier than, however it bares repeating:

Private finance is private!

Consequently, my objective in offering the varied estimates above have been merely to offer you some large, broad parameters.

Do I believe it’s attainable to retire in Canada spending lower than $2,500 monthly as a pair?

Sure.

Do I believe it’s attainable to retire in Canada spending lower than $2,500 a month as a pair – whereas dwelling in Toronto or Vancouver and never proudly owning a mortgage-free dwelling?

No.

There are a number of variables that solely it is possible for you to to reply relating to creating your perfect retirement state of affairs.

- Do you want to lease or personal? (Bear in mind to issue within the upkeep and property taxes that include proudly owning.)

- Will you need to spend your entire 12 months in Canada?

- What’s your most well-liked leisure price range?

- How a lot much less will you spend on issues like transportation, clothes, and workplace lunches for those who’re now not working?

- What function did youngsters play with reference to your price range? Presumably they may now not be a serious price range merchandise upon retiring.

- With revenue splitting, how a lot decrease will your taxes be in retirement than they have been earlier than?

That is simply scratching the floor relating to the variables related to retirement spending, however I believe the most effective start line for many middle-class Canadians who personal their very own house is Vettese’s estimate of 40% of your pre-tax revenue over your previous few years earlier than retirement.

Most individuals are inclined to need the identical way of life that they’ve grown accustomed to, so a proportion of your closing few years earlier than retiring is smart to me. I used the decrease finish of the Vettese scale just because I used to be pulled in that path by the compelling proof of so many retired Canadian {couples} spending lower than $3,500 monthly. Clearly, relying on what luxuries you need to add from that time – or what kind of elevated spending your portfolio returns enable – you might regulate up from there.

The Retirement Spending “Smile”

Opposite to what many individuals would assume relating to retirement spending over the course of a number of a long time, most individuals don’t spend extra as they age. David Blanchett launched a landmark examine in 2014 that detailed what he known as the “retirement spending smile” and each retirement researcher that I’ve learn has confirmed the thought.

Blanchett tells us that whereas individuals begin out spending their full self-allotted price range in early retirement (the “go go Golden Years” as some name them), that spending dramatically falls as of us begin to enter that 70-85 age vary (the “gradual go years”).

For the lucky retirees who proceed so as to add to the information after 85, the numbers do start to creep up once more, as medical bills can start to develop, however these are sometimes called the “no go years” for good cause – it’s fairly powerful for many to take these dream holidays climbing Mount Kilimanjaro once they’re 91.

This spending sample seems to carry true throughout nations and throughout the overwhelming majority of revenue/web value ranges. And when you concentrate on it, it form of has an intuitive widespread sense really feel to it, proper?

Vettese has identified that almost all Canadian retirement spending doesn’t even sustain with inflation!

All that to say, I believe the worry that almost all Canadians have of working out of cash is probably out of proportion to the precise probabilities that it’ll occur.

Do I Have Sufficient and Am I Saving Sufficient to Retire in Canada?

Upon getting an estimate of what your normal way of life and spending sample will appear to be in retirement, you possibly can start to place a plan in place.

Over the past 12 months, I’ve helped a whole bunch of Canadians create their very own retirement plan as a part of my course: 4 Steps to a Fear-Free Retirement. You possibly can save $50 by clicking the orange button beneath and getting into within the code: MDJ50 when it asks for a coupon at checkout.

My course is study at your individual tempo and contains dozens of useful movies – in addition to an non-compulsory workbook you can obtain or print to be able to enable you to create your individual step-by-step retirement plan. You possibly can see what the course seems to be like by clicking play on the video beneath.

FAQ About Retirement Spending in Canada

Retirement Spending vs Years In Retirement – The Happiness Tug of Struggle

The total value of continuous to work to be able to add to your retirement nest egg isn’t apparent while you first give it some thought.

Positive, there may be the added value of possibly having two automobiles for a family, or possibly spending extra on work-related wardrobe items.

However there may be additionally the chance value of not doing no matter you need for that point as effectively. Bear in mind, you have got finite time on this planet – and nobody is aware of simply how finite that point is.

By adjusting your retirement spending plans downward, we’ll see within the weeks to return the drastic impact this could have on the dimensions of nest egg you want going into retirement.

The price of not having giant quantities of cash out there in retirement is simple to see: fewer holidays, older automobiles, possibly a semi-forced downsizing of your home. However the prices of countless, “yet another year-ing” your approach to a later retirement are much less straightforward to ascertain. That doesn’t make their impact in your happiness any much less actual.

Some individuals love their jobs and need to work so long as they’re succesful – and that’s superior. What an unimaginable place to be in! However that’s not most Canadian 55+ year-olds that I do know.

Whilst you’re making an attempt to work out your particular person quantity for spending in a Canadian retirement, try this Ted Speak on the longest examine on happiness, and this one on the shocking science of happiness. Then ask your self in case your retirement spending plan will make you probably the most comfortable – each in your closing years of full-time employment and all through your golden years.

Are You Saving Sufficient for Retirement?

Canadians Consider They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Monitor?

Grow to be your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Attempt Now With 100% Cash Again Assure

*Knowledge Supply: BMO Retirement Survey