Battling a trio of challenges, together with weaker client confidence, much less snowfall at its North American ski resorts, and hard comparables after a post-COVID resurgence, Vail Resorts (NYSE: MTN) has seen its shares decline 50% since 2021.

Whereas Vail is the most important world ski resort with 42 places throughout North America, Australia, and Europe, it’s nonetheless topic to the cyclical nature of its trade — and at the moment, most of those considerably random elements are working in opposition to it.

Nevertheless, due to the corporate’s management place, its vast moat, and the market’s harsh response to its inventory, Vail Resorts might show to be a magnificent dividend inventory buying and selling at a once-in-a-decade valuation. This is what makes it so intriguing proper now.

An trade chief with a large moat

Dwelling to 37 ski resorts in North America — together with the highest three and 5 of the highest 10 most visited yearly — Vail Resorts dominates the ski resort trade on its house continent. Equally, the corporate additionally operates three of the highest 5 most visited resorts in Australia, rounding out Vail’s portfolio of fashionable snowboarding locations.

Whereas working from this place of energy because the trade’s chief is a bonus in and of itself, the corporate additional advantages from the truth that no new resort of scale has been developed within the final 40 years. In easiest phrases, there are solely so many good mountains accessible for ski resorts, and Vail has already staked its declare on the most well-liked ones.

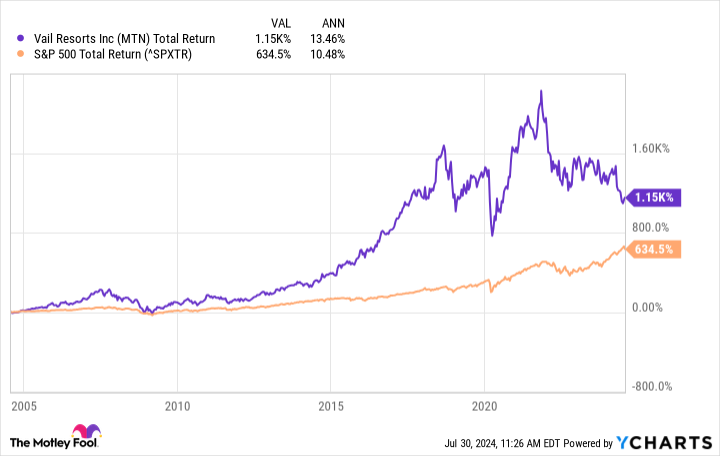

This mix of Vail’s irreplaceable mountain resorts and its dimension and scale provides the corporate a large moat round its operations. Usually talking, companies with a number of highly effective kinds of moats like these are in a position to ship long-lasting intervals of success. Proving this notion to a sure diploma, Vail has delivered complete returns almost double that of the S&P 500 index over the past 20 years regardless of its current 50% pullback.

Nevertheless, simply because the corporate already has a management place in its area of interest, do not contemplate it a stodgy worth inventory. Buying its second European resort, Crans-Montana, for $107 million this yr, Vail continued its growth into the world’s largest ski market. Dwelling to just about 3 times the variety of ski visits as North America, Europe might show to be the following chapter of Vail’s progress story as the corporate takes a measured method to increasing within the area.

Vail is snowboarding by 2024’s challenges

Regardless of going through a trio of cyclical challenges, Vail managed to develop earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA), earnings per share, and free money stream (FCF) by 11%, 17%, and 28%, respectively, in its all-important third quarter. These outcomes occurred regardless of the corporate’s western North American resorts receiving 28% much less snowfall this yr, serving to to spur an 8% drop in complete skier visits throughout the quarter.

This persistent profitability and FCF technology throughout difficult working situations is a testomony to the facility of Vail’s rising and non-refundable subscription mannequin of promoting passes to its members. Now house to 2.4 million loyal subscribers, the corporate generates almost three-quarters of its visits from pre-committed go holders.

These go holders ski 3 times as many days as non-subscribers who purchase carry tickets. This tidbit is essential because it gives Vail with extra alternatives to promote its ancillary choices, reminiscent of classes, eating, and rental tools, to skiers.

Now intent on disrupting its personal rental provides enterprise, Vail is launching its ski tools subscription, My Epic Gear. Testing very favorably at choose resorts, My Epic Gear ought to decrease the annualized price of ski tools for each homeowners and renters. Leveraging Vail’s huge tools provide chain and the insights gleaned from its database of 25 million friends, Vail will cost-effectively present skiers with the most recent and hottest gear.

Why Purchase Vail Resorts now?

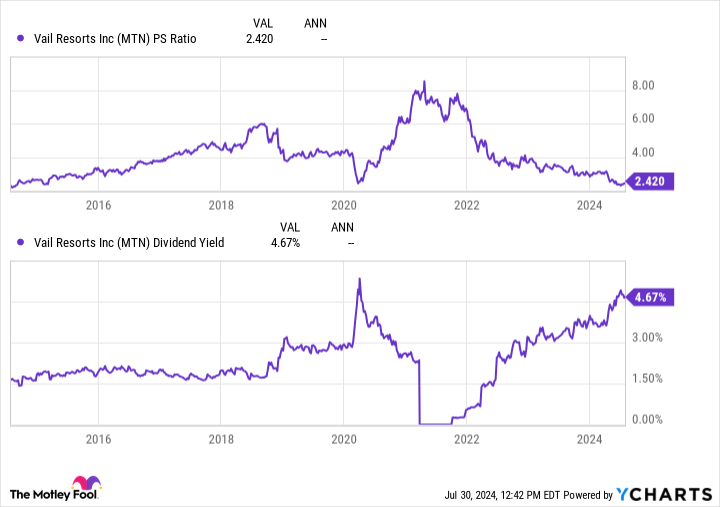

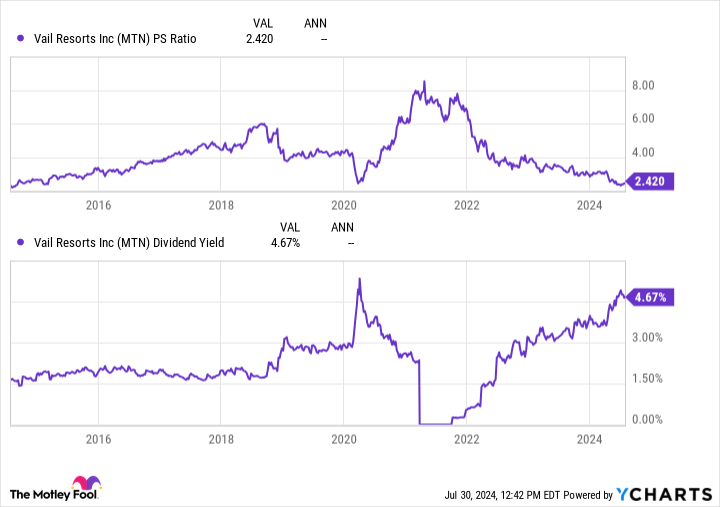

At present, Vail’s price-to-sales (P/S) ratio is at its lowest stage of the previous decade.

Concurrently, its 4.7% dividend yield is the best it has ever been, exterior of a short second in March 2020. Due to this mix of things, Vail might show to be a once-in-a-decade alternative at right now’s costs.

To place this P/S ratio of two.4 in perspective, let’s assume that Vail is ready to return its FCF margin to its historic common of 15%. Ought to this happen, the corporate would solely be buying and selling at 16 occasions FCF — a deep low cost to market averages.

Moreover, regardless of paying this hefty dividend, Vail solely makes use of 83% of its FCF to make these funds. Whereas this does not go away a ton of room for future will increase till its FCF margins return to regular, it exhibits that the dividend should not be susceptible to getting lower anytime quickly, both.

Finally, Vail Resorts’ management place in its area of interest and its vast moat ought to proceed to assist the corporate experience out the present down cycle, making it a powerful dividend inventory to purchase at right now’s once-in-a-decade valuation.

Must you make investments $1,000 in Vail Resorts proper now?

Before you purchase inventory in Vail Resorts, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Vail Resorts wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $657,306!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 29, 2024

Josh Kohn-Lindquist has positions in Vail Resorts. The Motley Idiot has positions in and recommends Vail Resorts. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Decade Alternative: 1 Magnificent Dividend Inventory Down 50% to Purchase Now and Maintain Perpetually was initially printed by The Motley Idiot