Welcome to the Million Greenback Journey August 2024 Monetary Freedom Replace – the primary replace of the 12 months! If you need to observe my complete monetary journey, you may get my updates despatched on to your e-mail, by way of Twitter and/or Fb.

For these of you new right here, since reaching $1M in web value in June 2014 (age 35), I shifted my focus to reaching monetary independence by constructing my passive earnings sources to the purpose the place they’re sufficient to cowl our household bills. Principally by passive index and tax-efficient dividend investing.

Right here is a bit more element on our passive earnings objectives:

The way it all Began – Unique Monetary Objective

I at all times discover it attention-grabbing to look again at earlier objectives. Right here was the massive purpose after hitting the Million Greenback Web Price milestone:

Our present annual recurring bills are within the $55k vary (after-tax), however that’s with out trip prices (and no mortgage or automobile funds). Nonetheless, whereas journey is essential to us, it’s one thing that we take into account discretionary (and albeit, a luxurious).

If cash ever turns into tight, we might minimize trip for the 12 months. In mild of this, our final purpose for passive earnings is to have sufficient to cowl recurring bills, and for enterprise (or different lively) earnings to cowl luxuries corresponding to journey, financial savings for a brand new/used automobile, and easily further money stream.

Main Monetary Objective: To generate $60,000/12 months (after-tax) in passive earnings by finish of the 12 months 2020 (age 41).

Reaching this purpose would imply that my household (2 adults and a couple of youngsters) might dwell comfortably with out counting on full-time salaries (most not too long ago a one-income household). At that time, I might have the selection to depart full-time work and permit me to focus my efforts on different pursuits, hobbies, and entrepreneurial pursuits.

Replace: As a noteworthy replace, with rising inflation and prices of preserving teenage children in actions, our annual bills have elevated to nearer to $65k/12 months after-tax (as of 2023).

Attaining Monetary Freedom:

It’s possible you’ll be pondering, 2020 is lengthy gone – what has occurred since then? I’m completely happy to report that we reached monetary independence in 2020 (slightly forward of schedule)! Whereas the purpose now could be to proceed constructing and reinvesting these dividends throughout the portfolio I’m discovering that because the years go by, extra focus is being placed on indexing.

Having mentioned that, even to today in 2024, I’ve bought little or no in dividend positions in favour of index ETFs. Nonetheless, we plan on holding our TFSAs till later in life, we are going to regularly transition our particular person positions to index-based ETFs – no less than in that account. That is all to simplify our holdings (and life!) over the long run.

Whereas I’ll typically say that dividend investing is just not for everybody (like those that are going for a conventional retirement and/or who’ve excessive earnings and wish to put money into a taxable account), there’s a variety of advantage in dividend investing for individuals who goal to retire early.

A few of the advantages for early retirees embrace:

- Tax-Effectivity – Dividends as an earnings supply are extraordinarily tax-efficient when you’ve got no different earnings.

- Reduces Sequence of Returns Threat – The inventory market is risky which isn’t nice throughout the withdrawal section of your portfolio – particularly if you’ll want to promote positions to fund your life-style. Dividend funds have a tendency to return by even throughout the worst of bear markets (offering that you’re diversified) taking the stress off needing to promote when the market is low.

- Psychological advantages – It’s an enormous mind-bender going from being a saver with an everyday paycheck to a spender withdrawing from a portfolio that you just’ve spent years/a long time constructing. It took me some time to make the adjustment, however one factor that did assist me was seeing dividends frequently and robotically deposited into my funding accounts. Even higher – getting common raises from these dividends which has actually helped throughout these inflationary occasions!

In fact, with any technique, there are downsides corresponding to:

- Effort and time – The time requested to analysis dividend shares and to watch them over time (ie. dividend raises and cuts). For me, I take pleasure in this half however is just not for everybody.

- Lack of Diversification – In case you are a devoted dividend investor, you could possibly find yourself with a really concentrated portfolio consisting of some sectors. Whereas some high-net-worth traders would advocate for top focus, I might argue that the frequent retail investor must be as diversified as attainable to take care of constant (and no less than common) returns over the long run. For us, we take a hybrid method of dividend shares for Canadian publicity, however index ETFs for international market publicity.

- Tax implications – If in case you have a excessive wage, any dividends acquired in a taxable account will get punished with earnings tax. For many traders, it’s greatest to put money into tax-sheltered accounts first, and in case you attain your contribution limits, then take into account a non-registered/taxable account.

Monetary Independence Replace – August 2024 – The First Replace of the Yr

So what’s been occurring within the markets in 2024? First, let’s check out 2023 the place the story was rising rates of interest! So meaning corporations which can be extremely leveraged (ie. utilities, actual property corporations) usually underperform, however however, bond costs will usually discover their footing.. finally! Quick ahead to August 2024, and we have already got two fee cuts! Because of this bonds have turned bullish, and financial savings rates of interest (and mortgage charges) have began their descent.

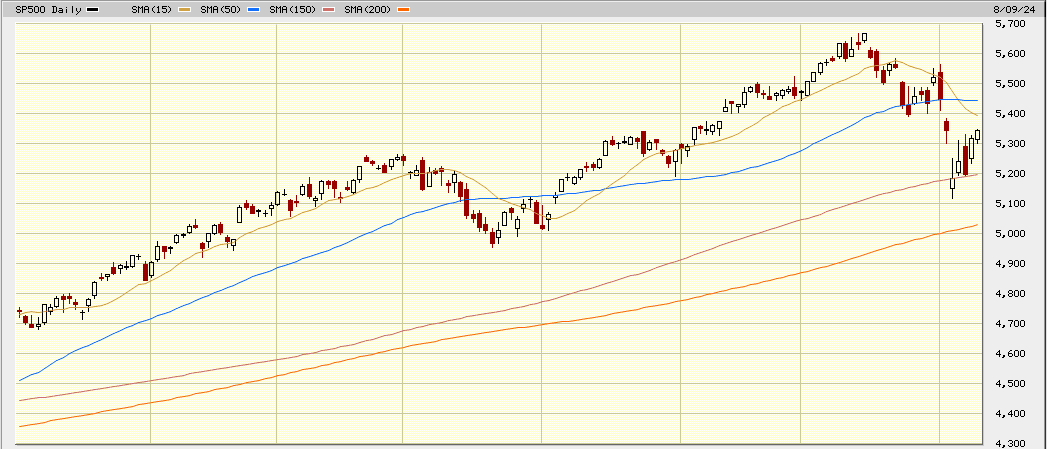

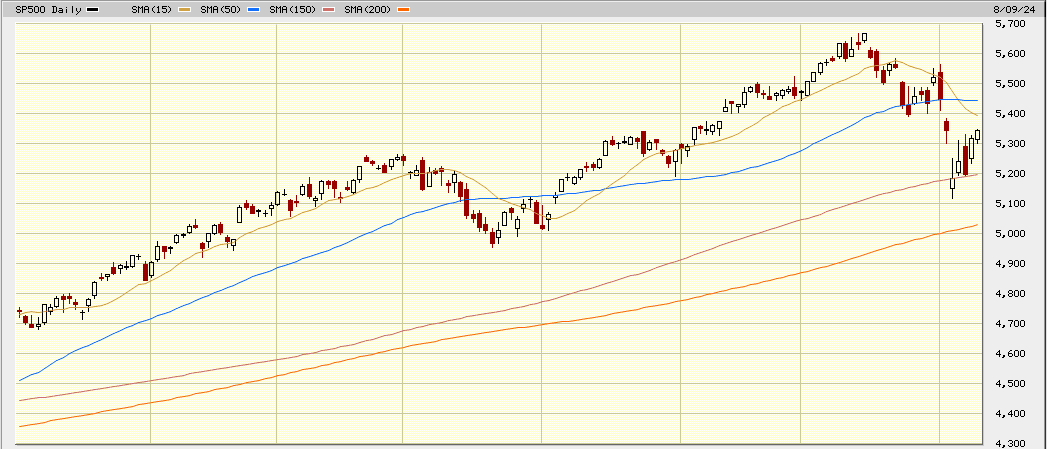

When it comes to the broad market, 2024 up to now has been the 12 months of synthetic intelligence (AI) which has pushed the markets increased. Any publicly traded firm regarding AI has been on an aggressive bull run (see NVDA!). With the S&P500 index pushed by know-how shares, the index has been on a tear, however curiously, the index minus tech shares hasn’t been as fairly. Regardless, the S&P500 is up 11.5% up to now in 2024 (not together with dividends).

S&P500 YTD Chart

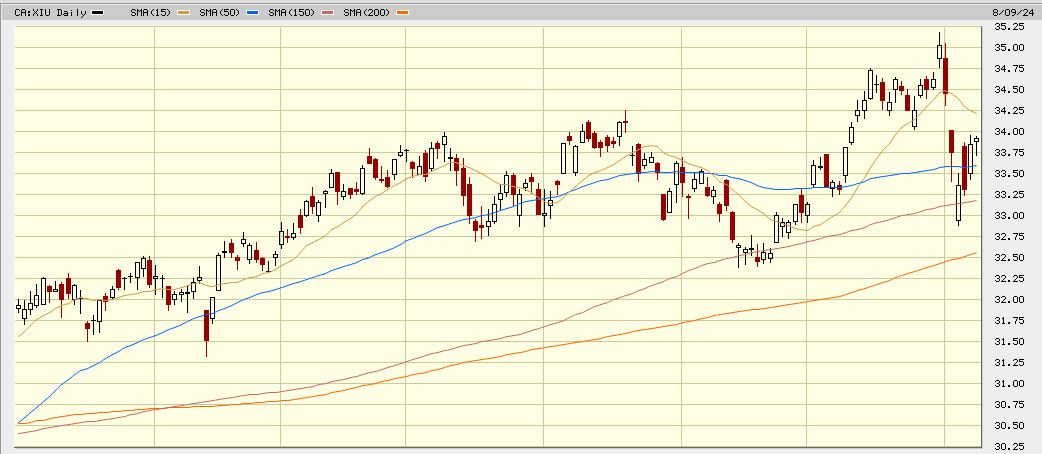

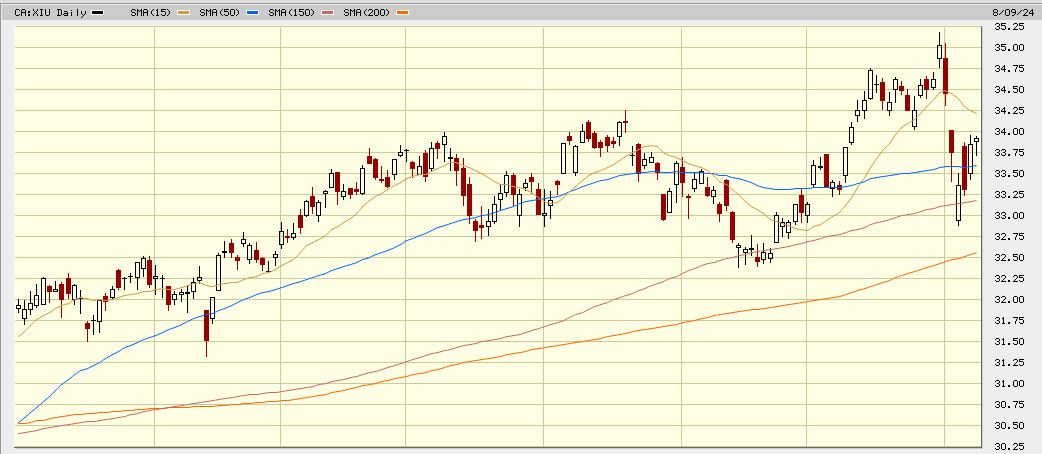

The TSX has additionally trended increased up to now in 2024. Whereas it has been a little bit of a see-saw trip over the previous few months, the principle Canadian index is up about 6% YTD (not counting dividends).

TSX YTD Chart

What ought to a younger investor do? When you may have money obtainable, shut your eyes and proceed shopping for. Analysis exhibits that in case your time horizon is lengthy sufficient, it’s not about timing the market, however time out there.

How Typically and When Do I Make the Resolution to Purchase?

I like to purchase high quality dividend corporations (and indexes) when their valuations are engaging. In different phrases, when they’re being bought off (ie. dip). You possibly can see a few of my favorite Canadian dividend shares right here.

The dividend progress technique goals to select robust corporations with an extended observe report of dividend will increase. For the reason that final replace, there have been extra dividend will increase – test them out under.

2024 Dividend Raises

Up to now in 2024, the Canadian portion of my portfolio has already acquired dividend raises from the next corporations:

- CU.TO (1% enhance)

- MRU.TO (10% enhance)

- CNR.TO (7% enhance!)

- BIP.UN/BIPC (6% enhance)

- CNQ.TO (5% enhance!)

- NTR.TO (1.8% enhance)

- BCE.TO (3.1% enhance)

- BEPC.TO (5% enhance)

- TRP.TO (3.2% enhance)

- ENGH.TO (18% enhance!)

- TRI.TO (10% enhance)

- T.TO (3.45% enhance)

- L.TO (15% enhance)

- WN.TO (15% enhance)

- FTT.TO (10% enhance)

- H.TO (1.2% enhance)

- SLF.TO (3.8% enhance)

- BMO (3% enhance)

- NA (4% enhance)

- IMO (20% enhance)

- EMP.A (9.5% enhance)

- CPX (5.2% enhance)

High 10 Holdings

Our prime 10 holdings transfer round fairly a bit. This time, it’s a superb mixture of industrials, infrastructure, utilities, power, telecom, and financial institution shares.

In our general portfolio, listed below are the present prime 10 largest dividend holdings:

- Royal Financial institution (RY)

- Fortis (FTS)

- TD Financial institution (TD)

- Brookfield Infrastructure (BIPC)

- Canadian Nationwide Railway (CNR)

- Canadian Pure Sources (CNQ)

- Enbridge (ENB)

- Waste Connections (WCN)

- Emera (EMA)

- Telus (T)

*not counting index ETFs (they’re my largest holding).

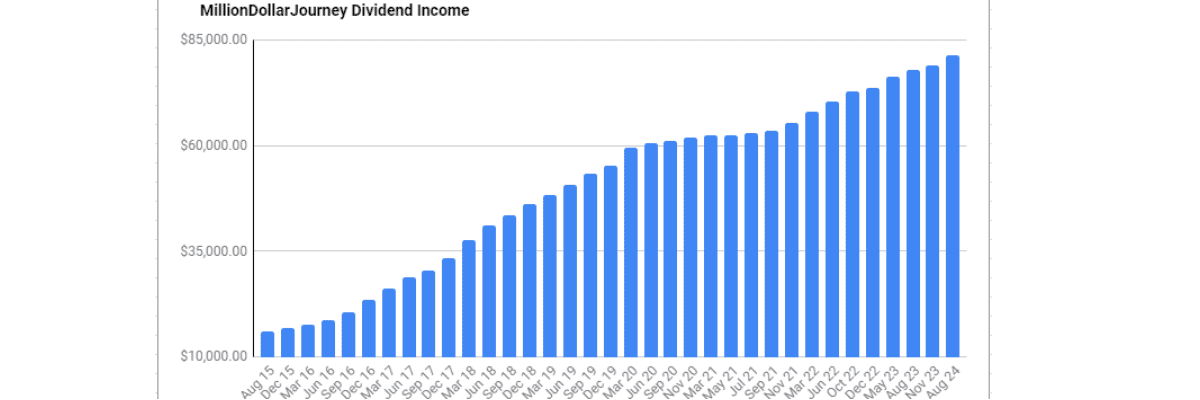

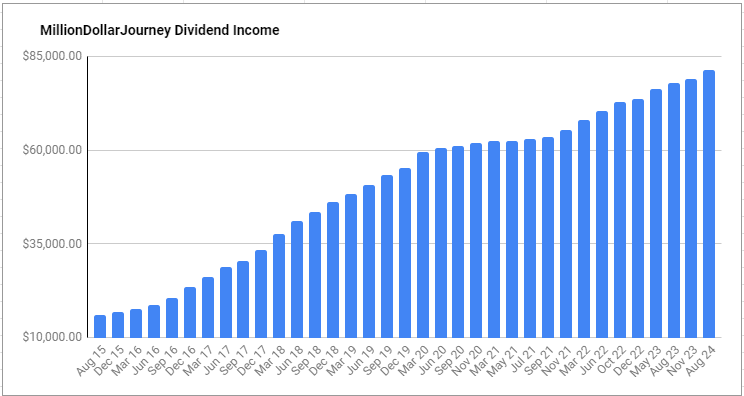

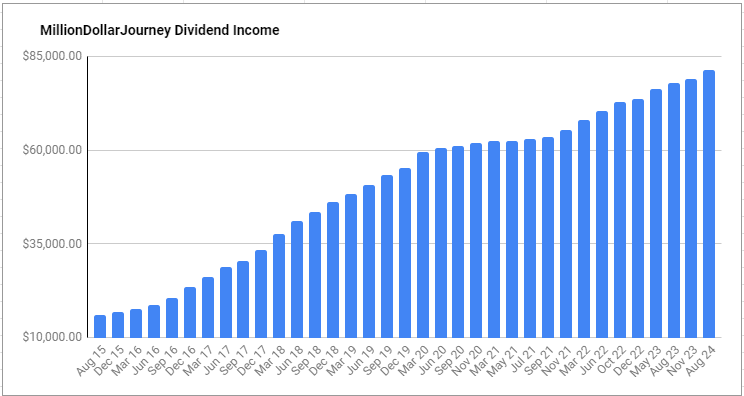

Dividend Revenue Replace

As talked about, there have been a variety of wholesome dividend will increase. As you may see within the chart under, the dividend will increase have actually made a distinction in rising our ahead annual dividend earnings to $81,500. Given sufficient time for portfolios to compound, sluggish and regular does work!

The dividends are counted from all of our household accounts together with non-registered (together with leveraged account by way of the Smith Manoeuvre), RRSPs, company funding account, and TFSAs.

With increased rates of interest, a few of chances are you’ll be fascinated by my leveraged investing account (Smith Manoeuvre account). Whereas the required funds to my HELOC have grown considerably, I’ve additionally been withdrawing the dividends to pay down the HELOC which, as of this publish, is breaking even. Should you rely the tax break, the dividends nonetheless come out forward (prime is at present 6.7%).

Closing Ideas

Should you have a look at the worldwide markets each day, the dips and sell-offs (ie. volatility) will be scary! Nonetheless, in case you zoom out and have a look at the long-term pattern, the dips are extra of a resting section earlier than shifting increased – possibly even a possibility to purchase extra.

No matter market circumstances, what additionally retains my thoughts comfy is that the dividends maintain rolling in. This is among the main advantages of dividends for retirees – getting paid whatever the markets being up or down! As with most issues, there isn’t any good resolution. As beforehand talked about, dividend investing is just not greatest for everybody.

I’ve seen that different dividend traders/bloggers are evaluating their dividend earnings to a comparable earnings/hr. $81.5k/12 months equates to about $41/hr in passive earnings (primarily based on a 40-hour work week), and relying on how the investments are structured, most of that may be tax-free!

I wrote a publish about withdrawing out of your RRSP or TFSA the place, with no different earnings in retirement, you can also make as much as $50k in dividend earnings (inside a taxable funding account) and pay little or no to no earnings tax (relying on the province). The advantages are even better in case you can break up the dividend earnings with a companion/partner.

In case you are additionally within the dividend progress technique, here’s a publish on the way to construct a dividend portfolio. With this record, you’ll get a common concept of the names that I’ve been including to my portfolios.

If you’d like an easier investing technique that outperforms most mutual funds on the market, take a look at my publish on the greatest all-in-one ETFs in Canada. I’m a fan of indexing because the iShares XAW is my prime particular person holding.

Preserve investing that money stream and keep on with a long-term plan. Your future wealthier self (earlier than you assume!) will thanks for it.