As we sit up for a brand new yr, it’s time to replace our record of Finest Canadian Dividend Shares for August 2024.

- Dividend Yield

- Dividend Progress Consistency

- Earnings Per Share

- Total Firm Revenues

Click on right here to leap straight to my high 10 dividend picks for August 2024.

The primary quarter of 2024 has seen a lot of the tech inventory momentum proceed (regardless of the current Nvidia pullback). That stated, Canadian dividend shares proceed to supply very stable worth, and I’d argue replicate extra advantageous valuations on the present time.

It seems increasingly seemingly that the Financial institution of Canada will start to chop rates of interest in August. As rates of interest go down, dividend shares grow to be extra enticing to income-oriented traders. Lots of people hanging on to GICs and high-interest financial savings accounts will quickly must take a tough have a look at a few of the juicy dividend yields that Canadian blue-chip shares presently reward traders with.

Given the robust earnings image, and continued inflation moderation, Canadian dividend shares look very enticing for the long run.

FT

You’ll see that most of the Canadian dividend picks under are in secure industries resembling banks, pipelines, and utilities. I like these firms as a result of they’ve such excessive limitations to entry (or what Warren Buffett calls a “Moat”). Good luck making a pipeline from scratch in Canada today!

On the similar time, there isn’t a doubt that prime rates of interest lead on to diminished backside traces for firms in these high-debt sectors. The enterprise mannequin for a utility signifies that a big amount of cash should be borrowed up entrance. As rates of interest come down, revenue margins will go up for these firms.

Whereas American rates of interest are more likely to keep higher-for-longer, it’s seemingly Canadians will see some curiosity aid in 2024. Financial coverage takes nicely over a yr to completely take impact, so we should always see downward stress for a lot of months after rate of interest decreases start.

Finest Canadian Dividend Inventory To Purchase Proper Now

Our 2024 high Canadian dividend inventory choose, Stella-Jones (SJ) had a really stable first quarter in 2024, seeing about 5.5% development. Let’s hope that optimistic momentum continues.

A couple of commenters puzzled about selecting a humble lumber producer with a 1.4% dividend yield as our #1 choose – however it’s a must to look below the hood to grasp what a powerful worth this underreported-on inventory brings to the desk.

To be trustworthy, I used to be tempted to choose Nationwide Financial institution, however I figured taking the identical inventory for 3 years operating is perhaps sort of dishonest (and it was undoubtedly boring).

I additionally thought-about Telus, as I like the corporate, and the share value acquired actually beat up in 2023. However, on the finish of the day, Mike over at DSR lastly gained me over to Stella-Jones, as he has been speaking about it for some time now. A stable acquisition report, and a really low payout ratio make up for the comparatively meager present dividend yield.

I like the variety of their income sources (45% utility poles, 25% railway ties, and 30% residential lumber) because it ensures that they’re not too depending on retail lumber markets. Whereas the substantial rise within the inventory value over the past couple of years does give me pause, earnings have saved up, leading to a reasonably enticing P/E valuation of about 14.

In terms of regular dividend earnings, I like SJ’s boring utility pole enterprise mannequin. With a lot of North America seeking to exchange unique infrastructure of 60-80 years in the past, plus the frenzy to impress autos, there’s a easy method there for regular development.

This specialization separates Stella-Jones from a primary lumber producer like West Fraser. Hydro One and BC Hydro alone have introduced plans that may require 100,000+ poles every over the following few years.

That doesn’t even get into the constructing growth that Canada’s governments appear to need to push via within the upcoming years as we search to resolve the shortage of housing drawback on this nation.

We’ve had a reasonably good current monitor report with our high picks the final couple of years with Enbridge in 2021, after which Nationwide Financial institution for the final two years. In 2023 Nationwide Financial institution completed with a capital acquire of practically 11%, and with a dividend yield initially of the yr of round 5%, the full return of our #1 Canadian dividend inventory choose was about 16% because of a incredible finish of the yr rally. All three years our picks have outpaced the TSX 60 index – and with decrease volatility as nicely.

As a longtime dividend investor (I’ve had a Canadian dividend investing portfolio for over 15 years now, since I began the Smith Manoeuvre) I’ve realized that whereas present dividend yield is a ravishing factor, it’s the long-term dividend development and earnings per share (EPS) that may actually drive your total portfolio returns.

My private choice for the highest dividend shares for long-term investments can be found under.

Our Prime 10 Canadian Dividend Progress Shares (August 2024 Up to date)

Right here’s a have a look at our high 10 long-term Canadian dividend shares so as of their dividend improve streak.

|

Canadian Nationwide Railway Co |

|||||||||

|

Canadian Nationwide Assets |

|||||||||

|

?????? (Hidden, click on for entry) |

???.?? (Hidden, click on for entry) |

?????? (Hidden, click on for entry) |

For my full 32-stock record of Canadian dividend earners that I’m shopping for at present – in addition to the 74-stock record of US Dividend all stars that I like to recommend – take a look at the platform that I personally use to do my dividend inventory analysis.

Word: Information on this text updates periodically. In case you are searching for actual time knowledge and steerage, learn our advice under.

As much as Date Dividend Inventory Information & Picks

The best solution to maintain updated with the very best dividend inventory picks, is by signing up with Dividend Inventory Rock. DSR is not only a weekly e-newsletter with inventory picks. It’s a program that may make it easier to handle your portfolio and enhance outcomes utilizing distinctive and complex instruments.

The particular person behind DSR is Mike, probably the most outstanding and lively dividend inventory blogger in Canada and is a licensed monetary planner since 2003.

You possibly can first learn our detailed DSR assessment, or join now by clicking the button under. Our readers are eligible for an unique 33% off low cost utilizing code MDJ33.

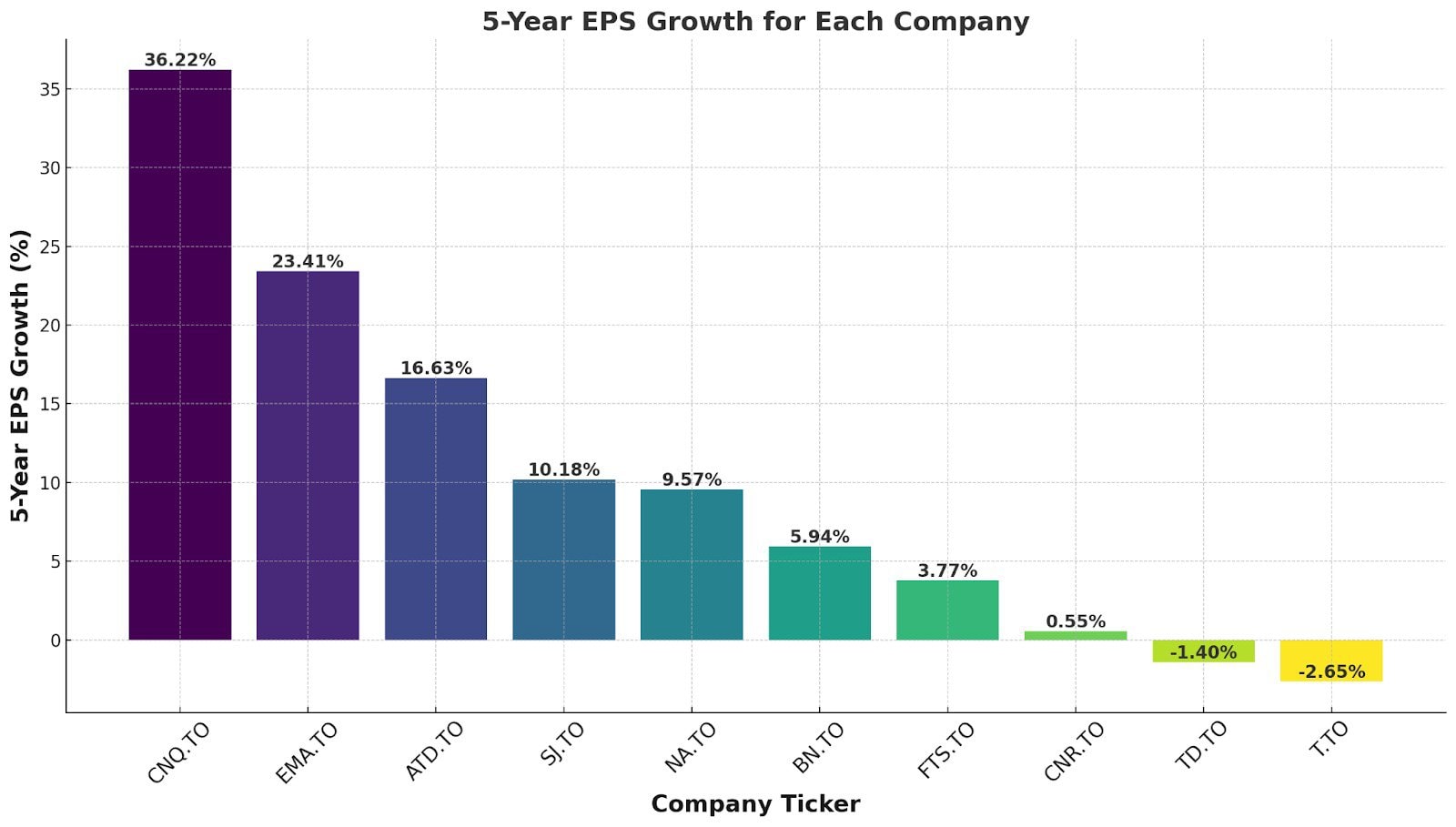

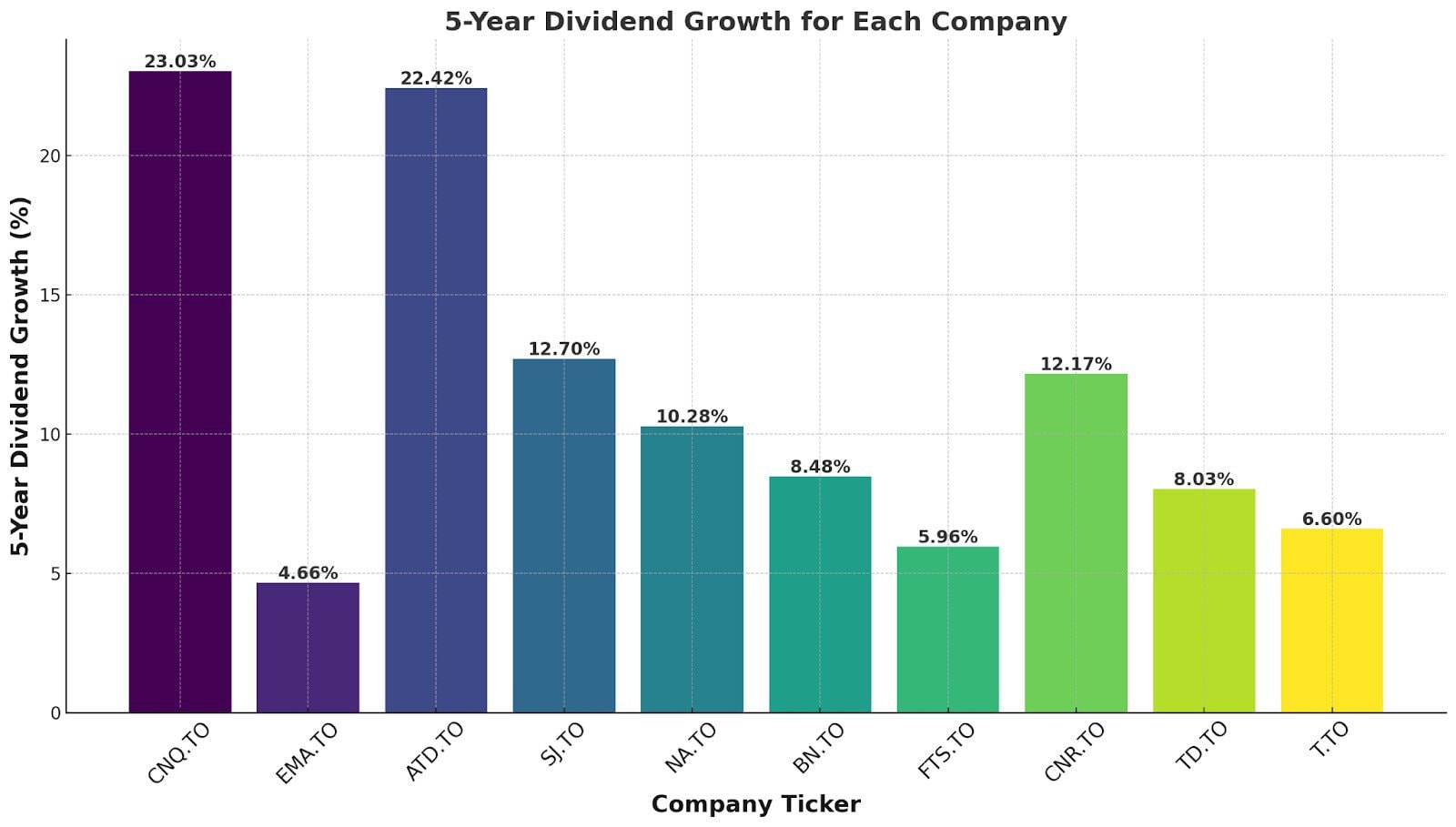

Canadian Earnings Per Share vs Dividend Progress in 2024

As a result of I’m seeking to spend money on Canadian dividend shares for the following a number of a long time, I like to take a look at medium- and long-term developments with regards to the corporate’s earnings and their dividend development. These metrics inform me two essential information:

1) Is the corporate usually making extra money annually?

2) Does administration consider in rewarding shareholders with dividend will increase on a constant foundation?

Right here’s a have a look at how our high Canadian dividend shares stack up over these two metrics.

Now after all, 5-yr dividend development and 5-yr earnings development aren’t the one standards that issues. It must be taken in context.

For instance once we have a look at the 2 charts above, the next information soar out at me:

- CNQ has clearly benefitted large time from elevated oil costs the previous few years. This seemingly isn’t sustainable over the long run.

- ATD has been an earnings beast on condition that they’re a retail inventory constructed for regular long-term development. There’s a motive why that is Mike’s favorite inventory.

- EMA, SJ, NA, BN, and FTS have the earnings development to assist their aggressive dividend development insurance policies.

- CNR, TD, and Telus, all bear nearer scrutiny. Increased rates of interest and huge capital expenditure prices have weighed on the earnings of CNR and Telus over the previous few years. These bills ought to go down, and the property ought to proceed to develop earnings – however they’re undoubtedly on my “shut watch” record.

- TD is one other story completely, and regardless of their brief time period earnings missteps (that are substantial), I merely consider their aggressive moat in Canada’s banking oligopoly, in addition to their conservative payout ratio give me motive to delay panic… for now. As rates of interest come down, TD might want to show that they will improve earnings sooner reasonably than later.

2024 Canadian Dividend Replace

As Canadians sit up for summer time, it’s time to replace our record of the very best Canadian dividend shares in 2024. Whereas the day-to-day market gyrations will at all times be part of the image, the Canadian market has by and huge continued its regular development monitor. The larger image continues to be dominated by rate of interest hypothesis and inflation projections.

As of at present, it seems like a June charge reduce continues to be probably the most possible end result, however the dangers of “larger for longer” rates of interest are rising bigger. The mixture of US Fed hawkish-ness and Canada-wide inflation shut to three% means that there’s undoubtedly a restrict on how a lot reducing we will do within the speedy future.

That’s clearly not nice information for Canadian dividend shares that always carry a large quantity of debt. Utilities, telephone firms, banks, and pipelines all earn more money when their annual curiosity funds keep low.

It additionally means that there’s much less demand for dividend earnings streams. The upper rates of interest keep, the extra seemingly income-seeking Canadians are to sock cash away in a GIC or high-interest financial savings account.

All of that stated, I believe the Canadian market may be very pretty valued proper now – particularly subsequent to the inventory costs of our southern neighbours. W

ith labour prices nonetheless rising resulting from inflationary results, it’s extra obvious than ever that firms with stable stability sheets and oligopoly-driven moat shares are the good long-term play. Firms that may move alongside these inflation-fuelled rises in prices have traditionally outperformed throughout heavy inflation cycles.

Our record of high Canadian inflation shares explains precisely which firms we consider are greatest positioned with a purpose to move alongside the inevitable value will increase and elevated prices which are the almost certainly end result in 2024.

After all we stay dedicated to our long-term technique of balancing EPS, with an organization’s means to develop its dividend, with a purpose to allocate our private dividend nest egg.

Afterall, the one factor higher than a excessive dividend yield at present, is a a lot bigger (and rising) one tomorrow! Take a look at our in-depth Dividend Shares Rock Evaluation for a deeper dive on simply why we belief the service a lot, and extra particulars on our unique promo provide code: MDJ33

Rogers, Bell, Telus Shares in 2024

The inclusion of Telus (T) in our Prime 10 Canadian Dividend Progress Shares chart clearly signifies that we’re large followers of the Canadian telecommunications sector. On condition that Rogers (RCI) simply finalized their takeover of Shaw, the deck is now much more stacked on this oligopoly’s favour.

That stated, 2023 was clearly a extremely tough yr for these firms. As a result of rising curiosity prices within the debt-intensive business, in addition to decreased money stream resulting from capital expenditures (placing 5G fiber in floor) revenue margins weren’t as excessive as inventors wished to see. Whereas I believe the 2nd half of 2024 will likely be far more mild, the primary few months of the yr once more noticed the three telecom heavyweights lose floor.

Rogers has made an enormous debt-based guess on Shaw, and with debt now totalling greater than 5x yearly earnings, it had higher show it could get probably the most out of these new property. In the meantime, Bell’s share value has deteriorated a lot that its dividend is into nosebleed ranges – indicating the market believes {that a} dividend reduce is feasible.

All of that stated, the three massive telecommunications firms (Telus, Bell, and Rogers) have a stranglehold on the very worthwhile Canadian market. Whereas the three firms aren’t famous for aggressive development plans, the general development of the Canadian inhabitants ought to guarantee secure development for the foreseeable future. Telus continues to be my low-risk favorite inventory to personal out of those three.

|

Rogers Communications Inc |

My Prime Canadian Dividend Inventory Suggestions

Sorted so as of dividend streak:

Fortis (FTS.TO) – 50 Years of Dividend Progress

- 4.08% Dividend Yield

- 6.54% 5 Yr Income Progress

- 5.78% 5 Yr Dividend Progress

- 74.83% Payout Ratio

- 18.15 P/E

Funding Thesis:

Fortis invested aggressively over the previous few years, leading to robust and stable development from its core enterprise. An investor can count on FTS’ revenues to proceed to develop because it continues to increase.

Bolstered by its Canadian primarily based companies, the corporate has generated sustainable money flows main to just about 5 a long time of dividend funds. The corporate has a five-year capital funding plan of roughly $20 billion over the interval of 2022 via to 2026. Solely 33% of its CAPEX plan will likely be financed via debt, whereas 61% will come from money from operations.

Likelihood is that the majority of its acquisitions will occur within the US (which I’m a fan of in the meanwhile). We additionally like the corporate’s objective of accelerating its publicity to renewable vitality from 2% of its property in 2019 to 7% in 2035. The current market downtrend gives a terrific entry level on the present value degree.

Dividend Progress Perspective:

Administration elevated its dividend by 6% like clockwork for the previous 5 years and has declared that it expects to extend dividends by 6% yearly till 2025. We prefer it when firms present motivation for development via acquisitions and reward shareholders on the similar time.

In any case, Fortis is among the many uncommon Canadian firms who can declare to have elevated their dividend for 49 consecutive years. Fortis is a superb instance of a “sleep nicely at night time (SWAN)” inventory.

Canadian Nationwide Railway (CNR.TO) – 27 Years of Dividend Will increase

- 2.15% Dividend Yield

- 3.28% 5 Yr Income Progress

- 11.67% 5 Yr Dividend Progress

- 36.82% Payout Ratio

- 18.59 P/E

Funding Thesis:

CNR has been recognized for being the “best-in-class” for working ratios for a few years. CNR has constantly labored on bettering its margins and was among the many first to take action. In the present day, friends have caught up and all railroads are managed in the identical approach. CNR additionally owns unmatched high quality railroads property.

It has a really robust financial moat as railways are nearly inconceivable to duplicate so we will subsequently depend on rising money flows annually. Plus, there isn’t any extra environment friendly solution to transport commodities than by prepare.

The benefit of CNR is that an investor can at all times look ahead to a down cycle to make an funding. We are able to usually spot an excellent event across the nook since we see railroads as enticing investments.

Lastly, the cancellation of the Keystone XL pipeline will drive demand for oil transport through railroads and CNR has benefitted. Administration is being challenged, and we should always see extra development rising from this difficult interval.

Dividend Progress Perspective:

Railroad upkeep is capital intensive and will adversely have an effect on CNR sooner or later. It’s a tough stability to acquire an environment friendly working ratio and well-maintained railroads. Steady (and substantial) reinvestments are required to keep up its community.

Nonetheless, CNR continues to boast among the finest working ratios within the business. CNR’s development may be negatively impacted sometimes because it is determined by Canadian useful resource markets. When the demand is low for oil, forest, or grain merchandise, demand for CNR’s providers will clearly sluggish accordingly.

We noticed how shortly the winds can shift the final couple of years. For instance, the pandemic brought about a slowdown in weekly rail site visitors of about 10% over the summer time of 2020. When the oil value is low, trucking steers some enterprise away from railroads. CNR is a captive of its greatest property since you may’t transfer railroads!

Canadian Nationwide Assets (CNQ.TO) – 22 Years of Dividend Will increase

- 4.33% Dividend Yield

- 12.88% 5 Yr Income Progress

- 22.52% 5 Yr Dividend Progress

- 48.93% Payout Ratio

- 14.31 P/E

Funding Thesis:

In a world the place the West Texas Intermediate (WTI) trades at $75+ per barrel, CNQ is a terrific funding (right here is your cue because the WTI is buying and selling above $70 these days!). It’s sitting on a big asset of non-exploited oilsands and reaches its breakeven level at a WTI of $35.

What cools our enthusiasm is the unusual course oil has taken together with the truth that oilsands aren’t precisely environmentally pleasant. Many nations are producing greener vitality and electrical vehicles. This might sluggish CNQ’s ambitions for the long run.

Nonetheless, CNQ may be very nicely positioned to surf any oil booms. The inventory value has greater than doubled in worth because the fall of 2020. It has beforehand invested very closely, and it’s now producing larger free money stream due to previous capital spending.

CNQ exhibited resilience in 2020, and this deserves a star of their guide! In case you are searching for a long-term play within the oil & gasoline business, CNQ seems on the high of our record at DSR.

Dividend Progress Perspective:

On high of a formidable dividend development streak of over 20 years, CNQ has not too long ago shifted gears with extremely beneficiant dividend will increase (28% firstly of the 2022, a particular dividend, after which one other improve of 13% in late 2022!).

CNQ has confirmed the resilience of its enterprise mannequin and confirmed its means to be a powerful dividend grower. That is really spectacular. Now that the oil market has strengthened, CNQ ought to be capable of generate wholesome money flows for years to return.

Telus (T.TO) – 19 Years of Dividend Will increase

- 6.86% Dividend Yield

- 7.25% 5 Yr Income Progress

- 6.73% 5 Yr Dividend Progress

- 251.01% Payout Ratio

- 44.29 P/E

Funding Thesis:

Telus has grown its revenues, earnings, and dividend payouts on a really constant foundation. Telus may be very robust within the wi-fi business and is now tackling different development vectors resembling web and tv providers.

The corporate has the very best customer support within the wi-fi business as outlined by their low churn charge. It makes use of its core enterprise to cross-sell its wireline providers.

The corporate is especially robust in Western Canada. Telus is well-positioned to surf the 5G expertise tailwind. Lastly, Telus seems to unique (and worthwhile) methods to diversify its enterprise. Telus Well being, Telus Agriculture and Telus Worldwide (synthetic intelligence) (TIXT.TO) are small, however rising divisions that ought to result in extra development going ahead.

Dividend Progress Perspective:

This Canadian Aristocrat is by far the business’s greatest dividend payer. Telus has a excessive money payout ratio because it places additional cash into investments and capital expenditures.

Capital expenditures are recurrently taking away important quantities of money resulting from their huge funding in broadband infrastructure and community enhancement. Such investments are essential on this enterprise. Telus fills the money stream hole with financing for now.

On the similar time, Telus continues to extend its dividend twice a yr, exhibiting robust confidence from administration. You possibly can count on a mid-single digit improve yr after yr.

Stella Jones (SJ.TO) – 18 Years of Dividend Will increase

- 1.21% Dividend Yield

- 9.34% 5 Yr Income Progress

- 13.90% 5 Yr Dividend Progress

- 16.26% Payout Ratio

- 15.54 P/E

Funding Thesis:

With its essential clients being utilities and railroads, the corporate will proceed to acquire sizable orders and receives a commission. SJ’s income surged between 2017 and 2021 as a result of the demand for its merchandise was robust from either side of the border. The enterprise has slowed because the second half of 2021, however SJ continues to develop.

In 2023, the corporate reported spectacular numbers as demand for infrastructure merchandise surged. Administration not too long ago introduced they have been searching for extra acquisition targets. With 15 amenities in Canada and 25 within the USA, the corporate is geographically diversified.

The corporate has confirmed to be a defensive choose throughout the pandemic. The “lumber COVID-hype” is over, however SJ stays a stable enterprise and advantages from a number of development vectors. Whereas residential building could decelerate resulting from larger rates of interest, the necessity for extra infrastructure and main initiatives proceed to drive gross sales larger.

Administration talked about they have been looking for acquisition targets, which is music to my ears given their previous success in integrating acquisitions.

Dividend Progress Perspective:

SJ’s dividend has nearly doubled over the previous 5 years, but the corporate displays a really low payout ratio. The most recent dividend will increase have been greater than beneficiant (going from $0.15/share to $0.18/share in 2021 after which to $0.20/share in 2022, and now to $0.23/share in 2023), so administration understands learn how to stability substantial dividend will increase with development.

Emera (EMA.TO) – 16 Years of Dividend Will increase

- 5.87% Dividend Yield

- 3.00% 5 Yr Income Progress

- 4.08% 5 Yr Dividend Progress

- 77.61% Payout Ratio

- 21.92 P/E

Funding Thesis:

Emera is an fascinating utility with a stable core enterprise established on either side of the border. EMA now has $32 billion in property and can generate annual revenues of about $6 billion. It’s nicely established in Nova Scotia, Florida, and 4 Caribbean nations.

This utility is relying on a number of inexperienced initiatives consisting of each hydroelectric and photo voltaic crops. Between 2022 and 2025, administration expects to take a position $8.4 to $9.4B in new initiatives to drive extra development. These investments lower the chance of future rules affecting its enterprise because the world is slowly making the shift towards greener vitality sources.

Most of its CAPEX plan (about 70%) will likely be deployed in Florida, the place Emera is already well-established. On the whole, Florida gives a extremely constructive regulatory atmosphere; in different phrases, EMA shouldn’t have any issues elevating charges. It is a “sleep nicely at night time” (SWAN) funding.

Dividend Progress Perspective:

Emera has been rising its dividend funds annually for over a decade. With the acquisition of TECO, vitality administration intends to uphold this custom. The corporate forecasts a 4-5% dividend development charge via to 2025 whereas concentrating on a payout ratio of 70-75%.

At a 4%+ dividend yield, it is a keeper for a number of years. Don’t be fooled by the excessive payout ratio because the adjusted earnings exhibit a payout ratio of roughly 80%, together with current dividend development. That is the kind of firm that matches completely in a retirement portfolio.

Nationwide Financial institution (NA.TO) – 13 Years of Dividend Progress

- 3.82% Dividend Yield

- 7.32% 5 Yr Income Progress

- 10.28% 5 Yr Dividend Progress

- 42.05% Payout Ratio

- 11.96 P/E

Funding Thesis:

My private #1 choose for 2022 and 2023!

NA has focused capital markets and wealth administration to assist its development. Personal Banking 1859 has grow to be a severe participant in that enviornment. The financial institution even opened personal banking branches in Western Canada to seize extra development.

Since NA is closely concentrated in Quebec, it concluded offers to offer credit score to funding and insurance coverage corporations below the Energy Corp. (POW). The inventory has outperformed the Massive 5 for the previous decade because it has proven robust outcomes.

Nationwide Financial institution has been extra versatile and proactive in lots of development areas resembling capital markets and wealth administration. At the moment, NA is looking for extra development vectors by investing in rising markets resembling Cambodia (ABA financial institution) and the US via Credigy.

We marvel if it could obtain extra success than BNS on worldwide grounds. It looks as if they might have discovered the appropriate method to take action! This is likely one of the uncommon Canadian shares having a near-perfect dividend triangle.

Dividend Progress Perspective:

Nationwide Financial institution continues to be extremely depending on Quebec’s financial system. As a hyper-regional financial institution, NA is extra weak to native financial occasions. To this point, this has not affected the financial institution considerably, however we advise to maintain monitor of its provisions for credit score losses.

Recessions and rising rates of interest might additionally have an effect on the financial institution’s debt portfolio. Capital markets’ revenues are additionally extremely risky. NA might expertise a nasty quarter if the inventory market turns into bearish.

Total, the financial institution has carried out very nicely, but it surely often takes somewhat extra danger to search out development vectors (such because the ABA financial institution funding and capital markets). To date it has paid off, but it surely doesn’t imply it should at all times be this manner sooner or later. Take into account that investments just like the one in Cambodia are unpredictable and will shift very quick.

Alimentation Couche-Tard (ATD.B.TO) – 13 Years of Dividend Progress

- 0.85% Dividend Yield

- 3.72% 5 Yr Income Progress

- 24.25% 5 Yr Dividend Progress

- 16.60% Payout Ratio

- 21.25 P/E

Funding Thesis:

Within the long-term, dividend payouts ought to develop within the double digits, and traders ought to see robust inventory value development. ATD’s potential is straight linked to its capability to accumulate and combine extra comfort shops.

Administration has confirmed its means to pay the appropriate value and generate synergies for every acquisition. ATD displays a stable mixture of the dividend triangle: income, EPS, and powerful dividend development.

The corporate counts on a number of natural development vectors resembling Contemporary Meals Quick, pricing & promotion, assortment, value optimization and community improvement. It has additionally confirmed that it has anticipated the shift to electrical, and is able to revenue from that mannequin as nicely.

Dividend Progress Perspective:

Within the long-term, dividend payouts ought to develop within the double digits, and traders ought to see robust inventory value development.

ATD’s potential is straight linked to its capability to accumulate and combine extra comfort shops. Administration has confirmed its means to pay the appropriate value and generate synergies for every acquisition. ATD displays a stable mixture of the dividend triangle: income, EPS, and powerful dividend development.

The corporate counts on a number of natural development vectors resembling Contemporary Meals Quick, pricing & promotion, assortment, value optimization and community improvement.

Toronto Dominion Financial institution (TD.TO) – 12 Years of Dividend Will increase

- 5.96% Dividend Yield

- 6.55% 5 Yr Income Progress

- 8.03% 5 Yr Dividend Progress

- 68.32% Payout Ratio

- 13.53 P/E

Funding Thesis:

TD had a tumultuous 2023, and detrimental newspaper headlines undoubtedly performed a component in driving down the worth of this inventory. That beat up inventory value is why I like the worth in 2024. Lengthy-term traders know that the financial institution enjoys primary or two market share positions for many key merchandise within the Canadian retail phase.

Along with Canadian retail although, what I actually like about TD is {that a} third of its enterprise comes from the U.S., together with a 13% stake in Charles Schwab from their TD brokerage merger again within the day.

I don’t suppose the Canadian banking sector goes to get damage practically as badly as persons are predicting resulting from a slowing financial system, and the US has appeared increasingly like an financial juggernaut these days.

Dividend Progress Perspective:

TD is a Canadian dividend aristocrat (which lets them have a “pause” within the dividend improve streak). TD shareholders have been fortunate sufficient to get pleasure from a dividend improve in early 2020 (+6.8%), proper earlier than regulators pressured a break in dividend development.

In 2021, the financial institution rewarded traders with a 12.7% dividend improve. It returned with a extra common improve in 2022 (+7.8%). In 2023, TD introduced a 6.25% dividend improve on the finish of the yr.

Going ahead, you may count on a mid-single-digit dividend improve as payout ratios are fairly low and TD is nicely capitalized. (That’s a enjoyable approach of claiming that as a result of they acquired out of a potentially-bad US acquisition of First Horizon Financial institution, they’ve a ton of money sitting of their checking account. A number of the money will seemingly go to dividend raises and inventory buybacks.)

Brookfield Corp – 11 Years of Dividend Progress

- 0.67% Dividend Yield

- 11.97% 5 Yr Income Progress

- -6.13% 5 Yr Dividend Progress

- 45.23% Payout Ratio

- 75.50 P/E

Funding Thesis:

I’ve been a bit tentative with regards to the Brookfield household of firms, as it may be fairly tough to essentially dig into their quarterly statements resulting from their measurement and complexity. That stated, their previous outcomes and distinctive company construction have ensured entry to billions of {dollars} in liquidity to finance its initiatives.

Brookfield is estimating various allocation to extend to 60% by 2030, from 25% at present, so it’s undoubtedly a lower-risk solution to make a renewables play. It’s an enormous firm that’s current in lots of nations demonstrating excessive development potential for years to return and a diversified enterprise basis. Over the previous few years, BN has witnessed a rise in each the quantity and measurement of common shopper commitments.

Brookfield Company is not going to solely do the asset-light supervisor’s job (technique + incomes charges on AUM), however it should additionally contribute with its personal property. Subsequently, it could profit from its methods by promoting these property at a revenue sooner or later.

Asset recycling occurs when an organization sells property it deems to be at a excessive worth (e.g. good time to promote) to reallocate the proceeds into new initiatives or undervalued property. That is the traditional “purchase low, promote excessive” idea.

Principally, Brookfield is a traditional instance of “company synergy” the place they will revenue at a number of factors in a venture’s improvement – all whereas providing distinctive experience and easy all-in-one packaging to potential shoppers. On the present price-to-book of 1.35x, this seems like a terrific guess for 2024, however after all, it’d take barely longer than one yr for BN to repay to the diploma I believe it should.

Dividend Progress Perspective:

After the spin-off of the unique Brookfield Asset Administration (BAM), it has grow to be clear that BN is a comparatively low-yield (lower than 1%) inventory with nice development expectations. We count on this dividend to extend annually and proceed the aggressive dividend development coverage. Nonetheless, in case you are searching for a extra beneficiant yield, the unique (BAM) is the higher choice.

BN has the benefit of proudly owning a stake in numerous property (throughout the Brookfield household) whereas BAM has the benefit of merely managing the cash (and incomes income on a payment charged on the property below administration).

Canadian Dividend Shares with 10 Years of Dividend Will increase

The previous couple of years have seen intense change and turmoil. First the pandemic brought about widespread panic and made of us dump their portfolios. Then we had meme-stock mania and a small bubble in sure markets. Lastly, we’ve been coping with inflationary results over the past 18 months which have elevated rates of interest and led to smaller total margins resulting from elevated debt prices.

All through all of this, there are 38 firms in Canada which have simply boringly raised their dividends yr after yr. Click on under for the record of Canadian dividend development shares that weren’t shaken by the pandemic, bubbles, panic, inflation, or rates of interest.

Canada’s 38 Dividend Progress Shares

(Ten Years or Extra Dividend Will increase)

Click on under to search out all the brand new additions to the earlier high Canadian shares. The next have been handpicked for his or her means to face the financial lockdown and thrive going ahead.

Dividend Investing in Canada – Regularly Requested Questions

“How do dividend shares work?”

Merely put, dividends are the fee that companies make to their house owners after bills have been paid for throughout a particular time interval. Some firms produce yearly dividends, however most pay “quarterly” (each three months).

Most dividend-heavy firms (actually all the Canadian dividend shares on the record above) announce their dividend intentions for the following yr, after which cut up up their after-tax revenue between dividends and retained earnings. The retained earnings are put again into the corporate in a single type or one other, whereas dividends are merely paid out to shareholders.

Firms can “slash” or reduce their dividend each time they need – there isn’t a legislation saying they have to pay out a sure share of revenue or something like that. Consequently, there’s usually an emphasis on long-time dividend development shares which have a confirmed monitor report of not solely paying out dividends, however rising them as time goes on, and thus rewarding shareholders.

“How is a dividend being paid?”

Dividends are paid to shareholders. They’re paid out on a per-share foundation, and for every share you personal as an investor, you receives a commission a specific amount. This quantity is mostly expressed a share of the present value of a inventory.

So for instance, you would possibly hear, “Enbridge presently has a dividend ratio of 8%.” This merely signifies that if Enbridge’s present inventory value was $40, (.08 x 40 = $3.20) an investor would count on to earn $3.20 in dividends from Enbridge for the upcoming yr. That $3.20 would seemingly come to them in 4 separate installments of $0.80.

Firms can even announce “Particular Dividends” at any time. On this state of affairs, there’s a distinctive one-time payout to shareholders.

In an effort to qualify for a dividend you should buy a share earlier than the “ex-dividend date” – which is introduced by every firm pretty far prematurely.

“How one can purchase dividend shares in Canada?”

When you can nonetheless purchase dividend shares via the quaint phone brokerage methods, the overwhelming majority of traders now buy dividends as DIY traders utilizing their low cost brokerage accounts.

At Million Greenback Journey, we now have put collectively dozens of critiques and comparisons items destined to offer our readers with insights concerning the very best Canadian dealer for long run investing.

Examine the preferred brokers like Qtrade and Questrade in addition to robo-advisors like Wealthsimple and discover ways to maximize your financial savings in that regard.

The opposite frequent solution to get portfolio publicity to Canada’s greatest dividend shares is thru dividend-ETFs on the Toronto Inventory Alternate (TSX). Utilizing a dividend ETF offers your funding greenback with on the spot diversification to firms which have a powerful dividend profile.

“When to purchase dividend shares?”

The trustworthy reply is: “Any time you’ve the investing funds accessible to take action”. There are various of us on the market who suppose that they will time the market and buy shares on the absolute good time. Regardless of that perception, there’s little or no proof that that is true.

It’s additionally fairly tough to time when shares are nearing the height. Consequently, probably the most profitable dividend traders that I’ve seen are of us who persist with a pre-planned technique and easily make investments their surplus funds as quickly as they’re in a position, into shares of dividend-payers that they’ve accomplished their homework on and anticipate holding for the long run.

“When is the time to promote dividend shares?”

In case you are like Warren Buffett and purchase shares that, “You need to maintain ceaselessly” – then the reply to when you need to promote your dividend shares is: By no means! In apply, there are a couple of instances over the previous 15+ years when firms have considerably reduce their dividend, and to me, it is a flashing crimson signal that one thing is majorly unsuitable with the corporate.

Slicing a dividend is often seen as a final resort as a result of it has such a dramatic impact on the inventory value. Main shareholders hate the concept of sacrificing that cashflow – so when the choice is made, I often sit up and take discover.

That stated, I desire to do my homework earlier than buying any single inventory. Consequently, I nearly by no means promote my dividend shares, as a result of I’m fairly assured of their long-term development. You possibly can learn my articles about Canadian dividend kings and beating the TSX for some particular options.

The statistics round making an attempt to leap out and in of the market simply aren’t superb, and it actually pays to be assured in your causes for selecting a inventory – with the intention to not solely grasp on to your shares throughout powerful instances out there – but additionally “Be fearful when others are grasping” and purchase extra shares of your favorite dividend shares when costs are down.

“What are the very best dividend shares?”

Nicely, clearly in the event you’ve learn this far into our article what our decisions are for greatest Canadian dividend shares! After years of private dividend investing and analysis, I’ve come to the conclusion that the Dividend Shares Rock approach of judging dividend shares by their “Dividend Triangle” is the very best long-term solution to worth stable Canadian firms. The primary thought is to equally weight an organization’s total revenues, their Earnings-Per-Share (EPS), and their dedication to dividend development over the long run.

I used to easily have a look at dividend yield because the “be-all and end-all” of dividend investing, however Mike has satisfied me over time that your long-term dividend payouts and capital good points are safer by specializing in the three metrics of revenues, earnings, and dividend development.

“Are there tax advantages for dividend inventory investing in Canada?”

Gaining earnings from dividend shares is likely one of the most tax-efficient methods that you would be able to put your

cash to give you the results you want. That is very true at decrease earnings ranges (resembling those who many retirees sometimes account for on the finish of the yr) when the dividend tax credit score actually shines.

In case you’ve by no means heard of the dividend tax credit score or the dividend gross up, right here’s the fundamental thought:

1) There are literally two totally different dividend tax credit: the Provincial Dividend Tax Credit score and the Federal Dividend Tax Credit score

2) The explanation for these tax credit is rooted within the thought of tax equity. As a result of companies pay company taxes earlier than cash is disbursed to shareholders, there’s a course of the place your dividend earnings is “grossed up” after which a tax credit score utilized.

3) What this so-called “gross up + tax credit score” usually seems like in apply is that your earnings will get artificially inflated, however then a really beneficiant quantity of your taxes owing is cancelled by the federal government.

Right here’s an instance:

If I owned 1,000 shares of Enbridge (ENB) throughout 2020, and earned $3.20 for every share, then my dividend earnings could be $3,200.

Now, relying on what different earnings that I had, I’d be positioned in a particular tax bracket. Clearly I might need dividend earnings from different shares, I may additionally have labored for a residing and have earned earnings.

If I made $60,000 in earned earnings, and Enbridge was the one inventory that I owned, then the next calculation could be made for my dividend earnings:

$60,000 of earned earnings could be taxed by the federal authorities at a charge of 0% on the primary $13,000, then a charge of 15-20.5% on the remaining. My $3,200 in Enbridge dividends would solely be charged a tax charge of seven.56% after the dividend gross up and dividend tax credit score have been utilized.

Wanting on the provincial facet of the equation. If I lived in Ontario, my $60,000 of earned earnings could be taxed at a charge of 0% on the primary $10,000, then a charge of 20-30% on the remaining. My $3,200 in Enbridge dividends would solely be charged a tax charge of

For a lot of retirees, who not earn a paycheque, it’s attainable to truly expertise a detrimental tax charge on the primary $30,000 or so of dividend funds – lower than a 0% tax charge!

Most Latest Information on Canadian Dividend Shares

The reality is that we’re in an unprecedented time with regards to the aftershocks of aggressive fiscal and financial coverage. Rate of interest will increase look like working, and inflation seems to be coming down slowly however certainly. (Extra certainly in Canada than within the USA, however even the mighty American shopper seems to be getting ta

There’s little question that all the discuss of “larger for longer” rates of interest affected a number of of our high Canadian dividend shares in 2023. When you may get an ultra-safe risk-free GIC [See our Best GIC Rates In Canada] with an computerized 5.25% return, the risk-reward stability of Canada’s utilities, pipelines, or telecommunications firms has been considerably altered.

Now, that stated, we now have to maintain issues in perspective. It’s not like 2023 was a nasty yr for dividend shares. Canadian dividend ETFs present good points within the 4-8% vary, plus a 4.5% dividend yield.

That’s fairly stable!

These returns simply look low subsequent to the supercharged returns of tech shares like Shopify or Constellation Software program. However keep in mind, dividend shares didn’t have that loopy down yr in 2022 to anyplace close to the identical diploma that tech shares did both.

It’s essential to do not forget that these firms we’re recommending have sturdy long-term aggressive benefits.

For instance, look how arduous it has been to get a single pipeline constructed – alongside a previously-existing route – in BC. They aren’t constructing extra pipelines, telecoms, utilities, or main banks in Canada. These revenue margins is perhaps hindered a bit by larger curiosity prices, however they’re nonetheless very sustainable.

As a facet observe, I believe that the frenzy to purchase the US Greenback (and its appreciation in opposition to the Canadian Greenback) is definitely actually good for the Canadian financial system.

What many individuals don’t notice is that whereas a weakening foreign money vs our most essential buying and selling accomplice (by far) is sort of a drag with regards to planning holidays or importing items, it’s extremely worthwhile to our firms. Canadian items and providers are successfully getting priced at a reduction proper now for the most important shopper market on the planet!

Canadian vitality firms, plus firms like Nutrien, Cameco, gold miners, and agricultural producers, have benefited from elevated demand for his or her merchandise.

As I discussed earlier on this article, the reducing of rates of interest all the way down to the three.5% vary over the following 12-18 months will likely be very helpful for Canadian dividend shares. After all, inflation might become stickier than we anticipate, however for now, it seems like an excellent guess that the Financial institution of Canada should make some cuts sooner reasonably than later.

As at all times, I place a number of significance on dividend development shares, their total revenues, and efficient administration that builds worth. I stay rock-solid in my private conviction for my portfolio. The benefits the businesses maintain are too sturdy, the present valuations fairly cheap, and so they have merely confirmed themselves time and again in all market circumstances.

My Latest Dividend Monitor Report

I began making public dividend inventory starting in 2021. That yr, I predicted that Canada’s midstream firms have been getting approach an excessive amount of unhealthy press and that their worth was being pushed down by the underlying value of commodities like oil and pure gasoline.

We thought there was a market inefficiency there because the pipelines solely have a free relationship between commodity costs and their revenue margin. Our high Canadian dividend inventory choose was Enbridge, and it paid off fairly nicely for us. We stable about 10% earlier than the inventory hit the highest and haven’t added to our place since. It’s not that Enbridge is a nasty firm, I simply suppose it’s not definitely worth the chubby place given the quantity of debt it has presently constructed up.

Extra not too long ago, my Canadian dividend kings choose for BOTH 2022 and 2023 was Nationwide Financial institution, and I’ve been very pleased with its total efficiency.

The sixth greatest financial institution in Canada continues to be a inventory with a really low ground (because of a really stable stability sheet and big aggressive benefit in Quebec), with a comparatively excessive ceiling versus Canada’s different banks due its small market cap. Administration has proven a dedication to rewarding shareholders over the long run and I don’t see any motive to consider that dedication will change given their most up-to-date earnings report.

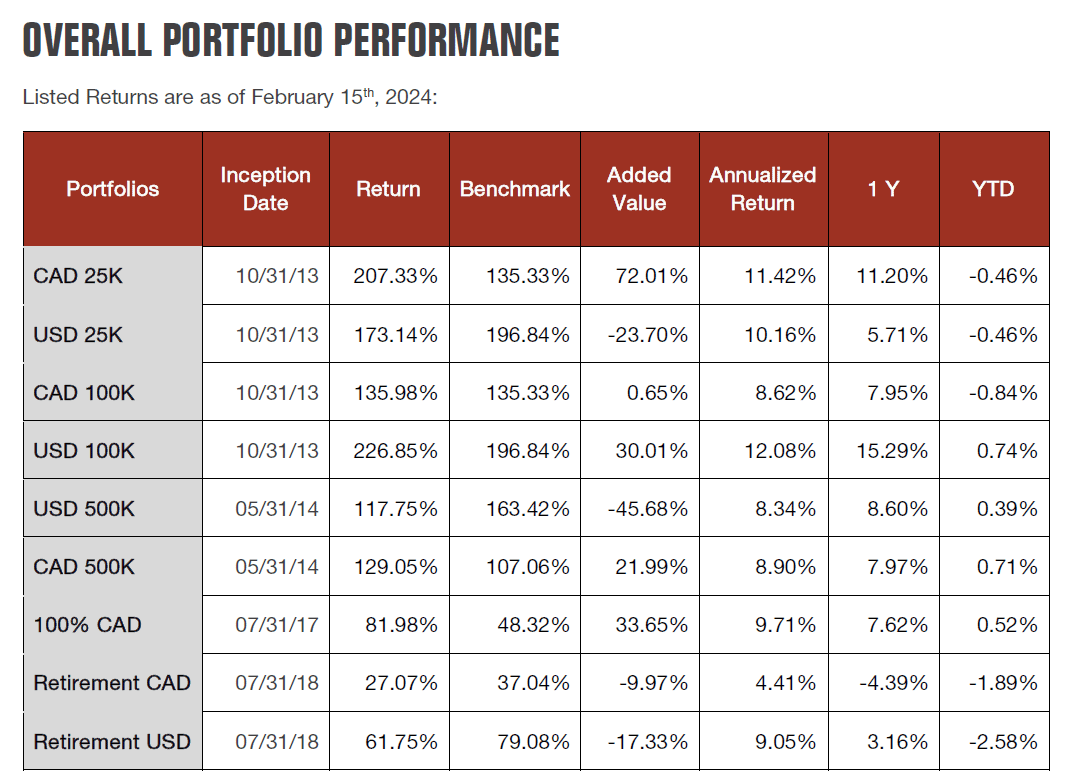

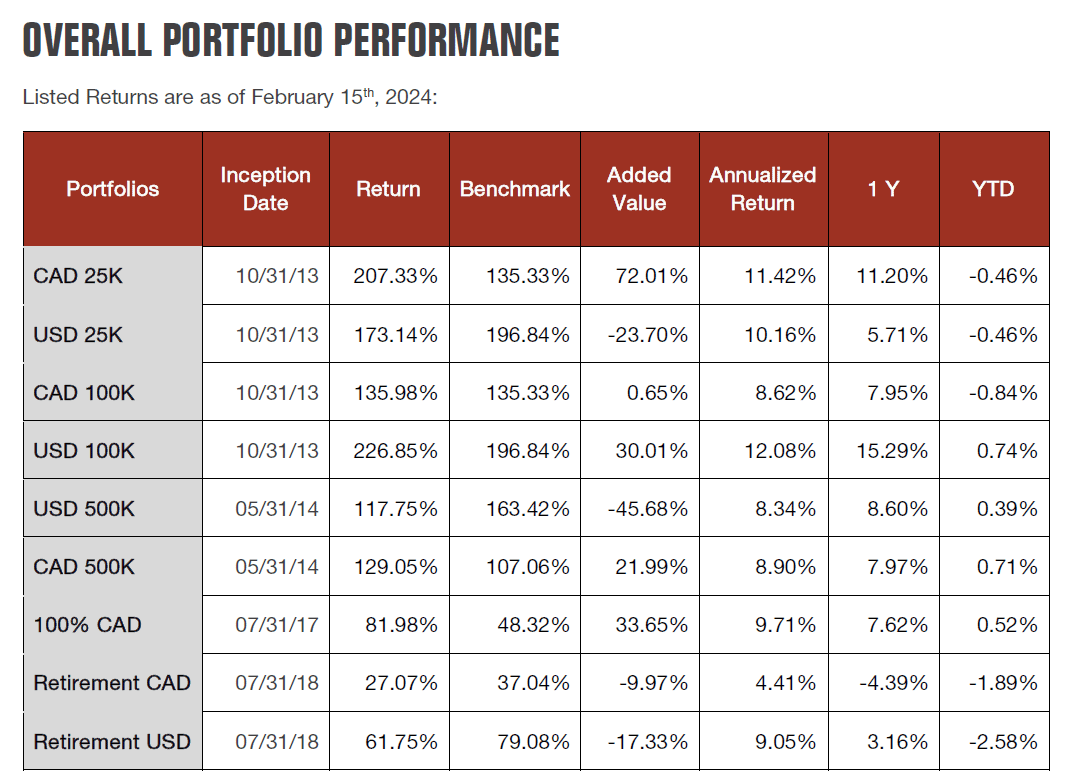

I’m stacking up nicely in opposition to the benchmarks, and I’m even beating my dividend buddy Mike Heroux for a few his portfolios (and admittedly, shedding to him on a number of extra… I might need to begin driving his coattails much more). See under for his publicly-posted monitor report over the past decade:

Additional Analysis on Prime Canadian Dividend Shares

Whereas I targeted on Canadian dividend development shares on this article, after I need data on something dividend-related (together with US dividend shares and undervalued dividend shares) I additionally use the Dividend Shares Rock (DSR) service by Mike Heroux.

Mike is a longtime Canadian author who began concurrently myself. He’s a CFA and former monetary adviser. Prior to now I’ve subscribed to premium Globe and Mail channels, in addition to well-liked funding newsletters resembling Morningstar – Mike’s last product is just the very best.

Today he makes a speciality of not solely researching Canada’s greatest dividend shares, but additionally speaking the outcomes of that analysis in artistic, easy-to-understand methods.