The transient’s key findings are:

- Lengthy-term care is the foremost uninsured threat most retirees face. To mitigate this threat, Washington State enacted WA Cares in 2019.

- WA Cares covers as much as $36,000 for care wants and is financed by a 0.58-percent payroll tax.

- The state proactively recognized and resolved potential kinks in this system, and its funds seem strong over the long run.

- WA Cares will provide worthwhile assist for middle-income households and function a proof of idea for different states and the federal authorities.

- The one threat it faces is a poll initiative that will make it voluntary, which might basically kill this system.

Introduction

Lengthy-term care is the foremost uninsured expense for many retirees. Neither personal medical health insurance nor Medicare covers long-term care bills, though Medicare supplies for care in a talented nursing facility for as much as 100 days following hospitalization. Lengthy-term care insurance coverage is offered within the personal market, however lower than 5 % of individuals buy plans.1 Consequently, many flip to members of the family for care or are compelled to deplete their sources to qualify for Medicaid.

To mitigate a few of this threat, the state of Washington in 2019 enacted WA Cares – a state-level program to offer qualifying Washington residents with a lifetime advantage of as much as $36,500 (adjusted for inflation) to cowl long-term care prices, financed by a payroll tax of 0.58 %. In its first yr, this system has accrued greater than $1 billion in reserves. The primary advantages shall be paid in July 2026. Whereas this initiative is modest, it’s going to present worthwhile assist for middle-income households and function an essential proof of idea for different states and for the federal authorities ought to Congress resolve to ascertain a nationwide social insurance coverage program for long-term care.

The dialogue proceeds as follows. The primary part discusses the long-term care panorama, and the second critiques the nation’s failed try and create long-term care insurance coverage via the CLASS program. The third part describes the evolution of WA Cares because the state recognized and addressed kinks in this system over the past 5 years. The fourth part appears on the long-term outlook for this system’s funds, and discusses the specter of a poll initiative to make participation voluntary. The ultimate part concludes that WA Cares will present not solely worthwhile assist to the state’s middle-class households, but in addition a wealth of knowledge on utilizing social insurance coverage to handle a few of the dangers of long-term care prices.

The Lengthy-term Care Panorama

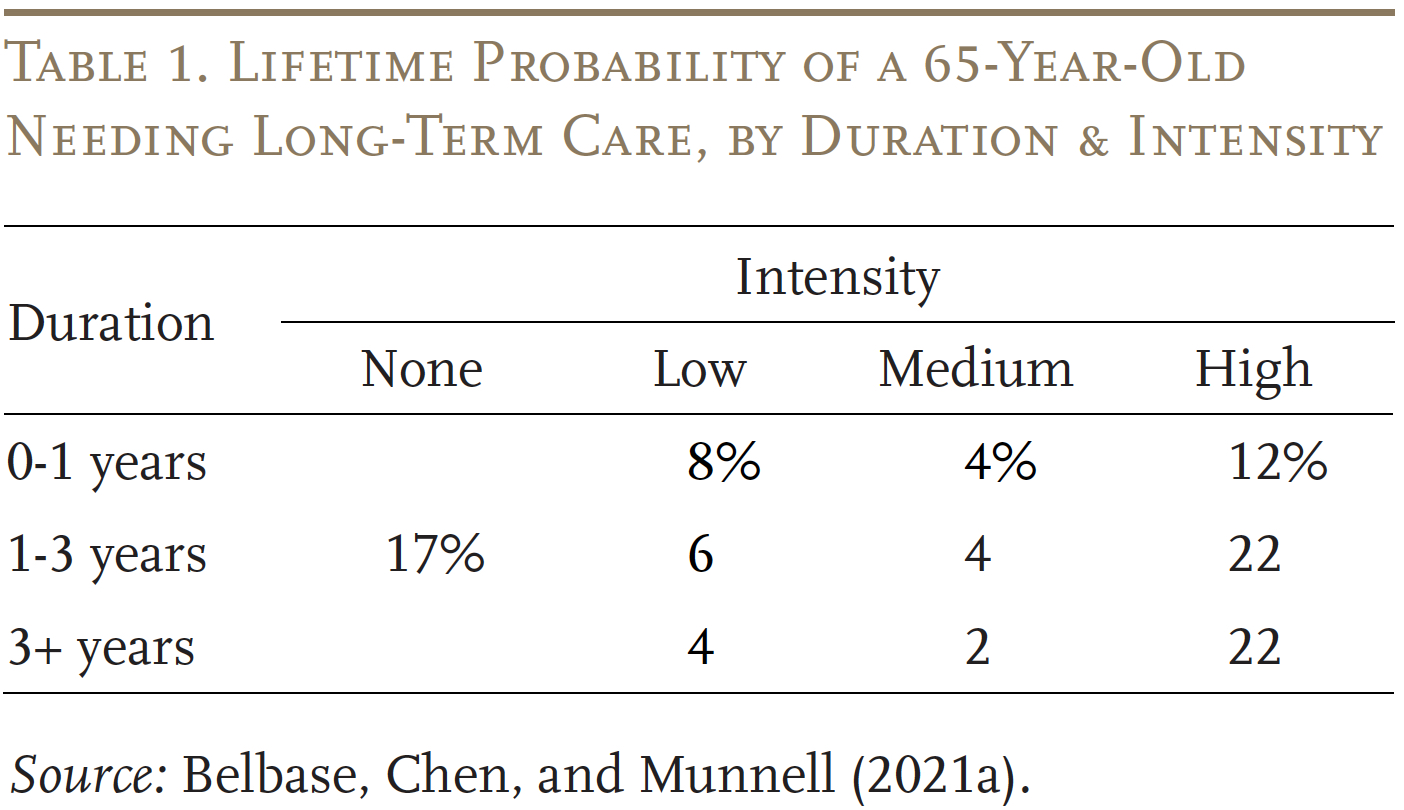

Most older adults will want some long-term care. In reality, projections for the care wants of the typical 65-year-old over their retirement present that solely 17 % will get by scot-free (see Desk 1). Nevertheless, amongst those that will want care, the depth and length differ dramatically. About 22 % will want high-intensity take care of greater than three years – essentially the most dreaded consequence – with the remaining falling someplace between the 2 extremes.

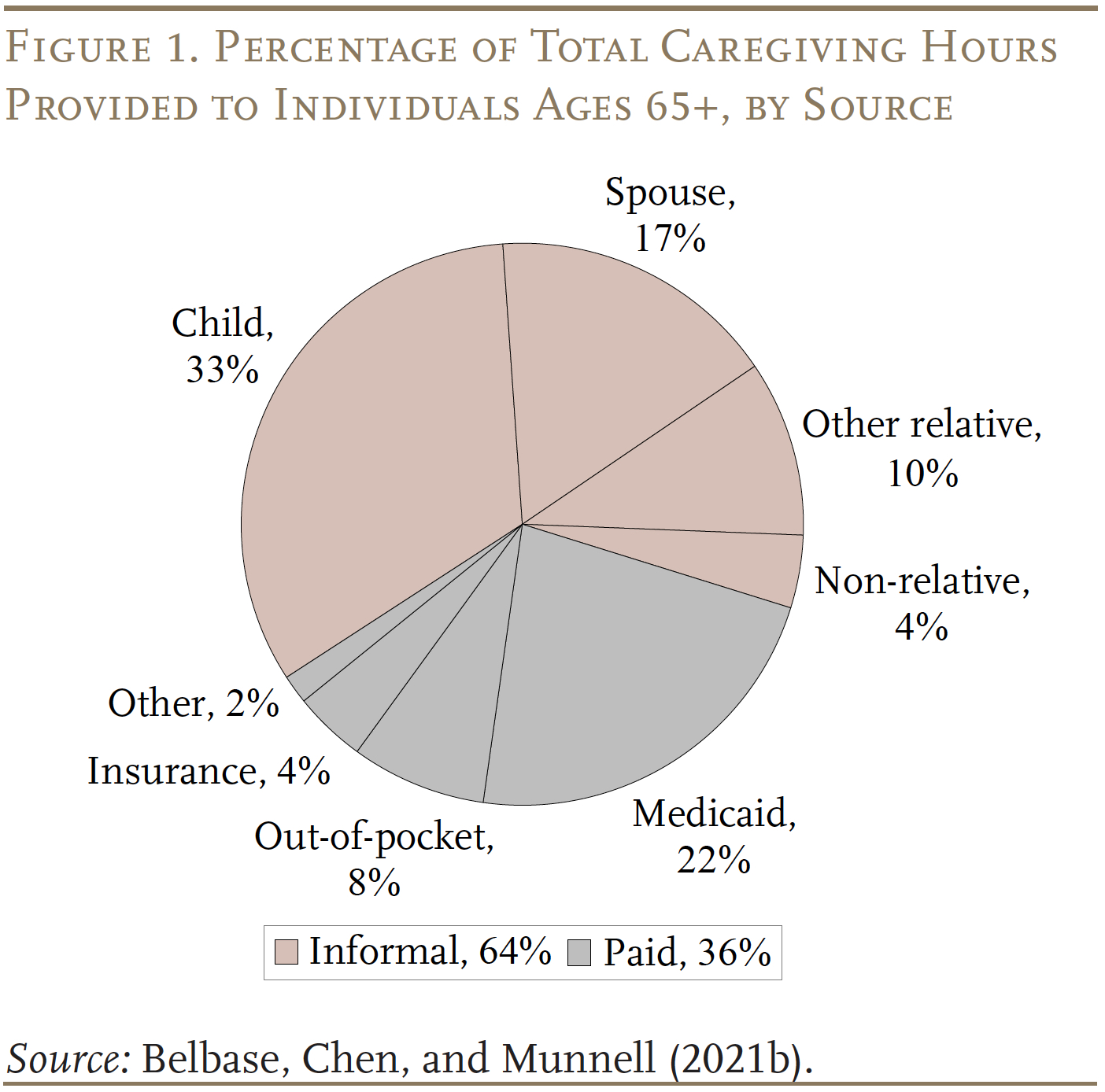

Households cowl these long-term care wants in two methods. The extra widespread is unpaid casual care supplied by members of the family (see Determine 1). The much less

widespread method is paid formal care, financed primarily out-of-pocket or via Medicaid. At the moment, as famous, lower than 5 % of adults has long-term care

insurance coverage.

Paid formal care is de facto costly. The typical price of a house well being aide was $33/hour in 2023.2 Paid care as a complement to casual care for somebody with high-intensity wants would price greater than $35,000 a yr – greater than the whole annual revenue for about half of older Individuals and greater than the whole web value for about one-fifth.3 Assisted dwelling amenities and nursing properties are much more costly, costing round $64,000 and $117,000 a yr, respectively.4 Going ahead, paid care is more likely to be unattainable for a big share of households.

Medicaid has grow to be a default payor for catastrophic prices. Nevertheless, the revenue restrict in 2024 for Medicaid eligibility for these over age 65 is often round $2,800 ($5,600 for {couples}) and the asset restrict is often $2,000 ($3,000 for {couples}), however varies by state. So, qualifying for Medicaid requires middle-income folks to spend down the family’s sources.5

By way of unpaid casual care, social change will doubtless cut back its availability going ahead.6 Declines in fertility and the rise in divorce will diminish the availability of casual caregivers.7 And, the share of retirees with prolonged household or different neighborhood assist methods has been declining for 3 many years.8 One examine estimated that about one-fifth of retirees are “elder orphans.”9 A discount in casual care will increase the necessity for costly formal care, which shall be out of attain for a lot of. The tip end result shall be that many may have care wants that merely go unmet.

Briefly, the present system for long-term care locations an infinite burden on kin caring for family members, forces households to impoverish themselves, or leaves folks with out the care they want.

Classes from Earlier Efforts – CLASS

WA Cares isn’t the primary authorities try to offer long-term care insurance coverage. The 2010 Reasonably priced Care Act included a provision to ascertain a program often known as Neighborhood Dwelling Help Providers and Helps, or CLASS. CLASS, not like WA Cares, was designed as a voluntary program.

To be coated by the CLASS program, a employee’s employer needed to elect to take part, during which case employees can be robotically enrolled in this system and have their premiums deducted instantly from their paychecks, except they determined to decide out. CLASS differed from personal long-term care insurance coverage in that eligibility depended solely on minimal employment necessities and concerned no underwriting to disqualify these with well being issues. The premium was to be set at a stage that ensured this system can be self-financing over a 75-year interval. Members would have been eligible for advantages after paying premiums for 5 years and the Congressional Price range Workplace assumed a mean each day advantage of $75 that will improve every year with inflation. (The regulation specified that the typical minimal profit should be not less than $50.) The advantages, supplied via a debit card account, would have continued for so long as the person wanted care.10

The important thing drawback with CLASS was that success trusted broad participation from American employees, particularly the younger and wholesome. This goal required that employers resolve to supply the plan and that people – robotically enrolled – didn’t decide out. Broad participation is an unrealistic purpose given folks’s pure reluctance to consider the potential of turning into disabled and the backstop of Medicaid. Consequently, with out underwriting to exclude these with well being issues, a larger proportion of the much less wholesome would have been drawn to this system (antagonistic choice). Disproportionate participation by these with well being issues would have pushed up per-participant prices and, given the requirement of 75-year actuarial stability, required a rise in premiums. Premium will increase would have additional discouraged wholesome folks from signing up and inspired wholesome members in this system to drop their protection as their notion of worth declined. Such continued shifts within the composition of the coated inhabitants would ultimately have necessitated even steeper premium hikes, making a “loss of life spiral.”11

In response to the dangers related to antagonistic choice, CLASS was by no means applied and was repealed by Congress in early 2013. However, the enactment of the laws acknowledged the issues with the present system, and the repeal of the laws acknowledged the infeasibility of a voluntary strategy.12

Growth of WA Cares

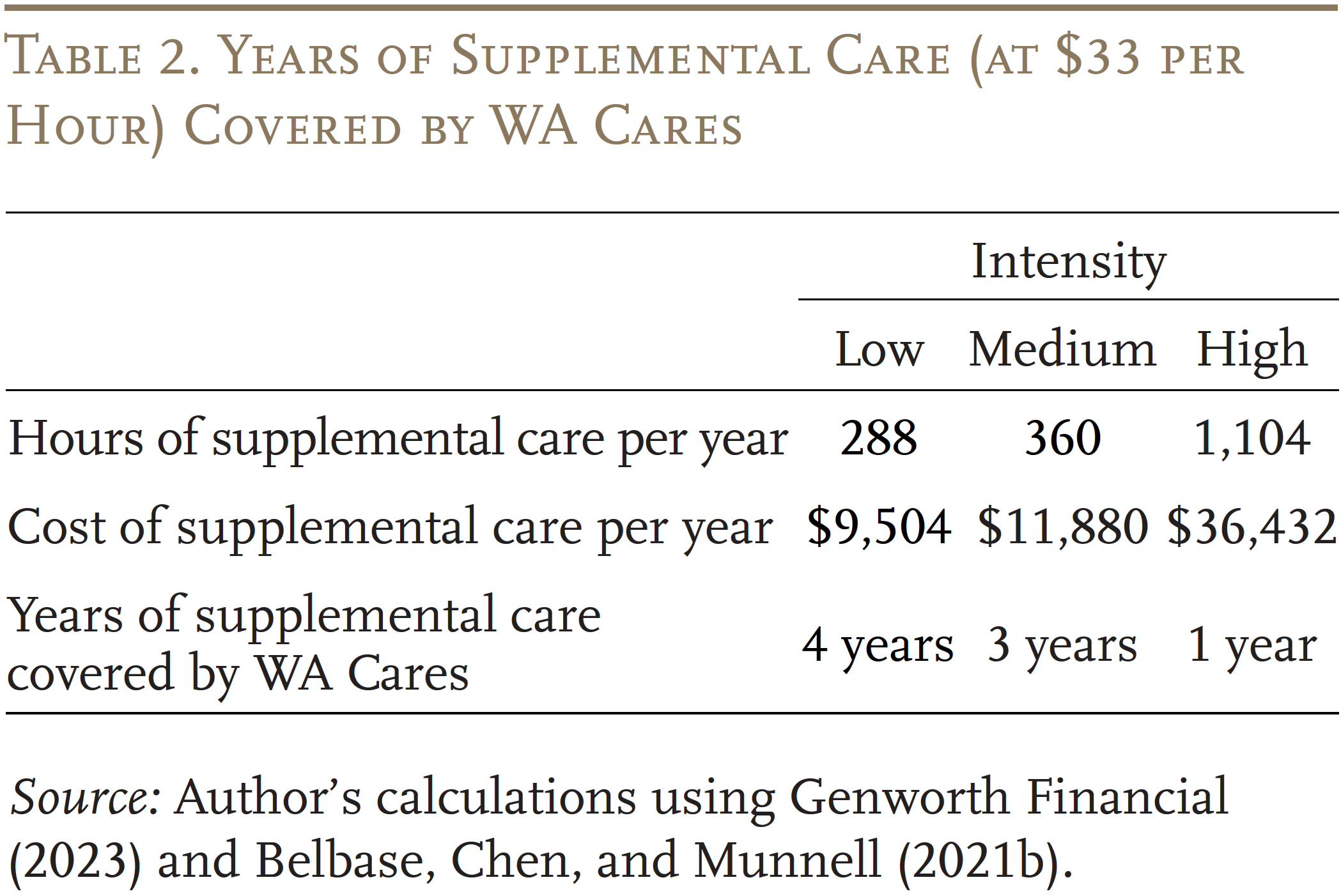

To satisfy the hole in long-term care insurance coverage, in 2019 the state of Washington enacted WA Cares to offer qualifying residents with as much as $36,500 (adjusted for inflation) to cowl the price of long-term care providers or helps.13 Whereas this system is clearly not designed to fulfill all long-term care wants, it will cowl a number of years of paid care as a complement to casual care (see Desk 2). This system is financed by a 0.58-percent tax on whole earnings – that’s, together with earnings above Social Safety’s taxable most.

The unique plan was to begin gathering taxes in January 2022 and to pay first advantages in January 2025, however the schedule was postponed. Beneath the revised schedule, the gathering of payroll taxes started in July 2023, and the primary advantages shall be paid in July 2026. The delay allowed the state to enhance the equity of this system. For instance, it created a pro-rated profit for near-retirees (these born earlier than 1968), who won’t have been capable of fulfill the 10-year vesting pathway. Most significantly, it made advantages moveable, in order that employees who go away the state can proceed taking part and declare advantages elsewhere, and even overseas.

The delay additionally allowed the state to iron out some kinks in this system, concerning people unlikely to ever gather, the flexibility to decide out with personal insurance coverage, and the therapy of the self-employed. It’s value saying a phrase about every since they’re thorny points that will come up in any state program.14

People Not Prone to Acquire Advantages

After enactment, the directors acknowledged that this system would levy taxes on some people who had been unlikely ever to obtain advantages. These teams included employees who lived in one other state, employees resident underneath non-immigrant visas, army spouses who had been more likely to go away the state, and veterans with not less than 70 % incapacity who already qualify for VA advantages. To right this drawback, the legislature handed amendments permitting members of those 4 teams to use for exemptions from the payroll tax.15 Permitting these teams to take part on a voluntary foundation creates the potential of some antagonistic choice, whereby the wholesome and rich are much less doubtless to enroll. Nevertheless, these teams are comparatively small, in whole accounting for lower than 2 % of the state’s workforce.16

Opting Out with Personal Insurance coverage

People who attested earlier than December 31, 2022, that that they had personal long-term care insurance coverage with advantages corresponding to the state plan earlier than November 1, 2021, can be exempt from paying the tax and barred from this system. Critics had been alarmed that 443,649 exemption requests had been filed with the state as of early December 2021.17 Certainly, provided that the requested exemptions amounted to about 13 % of the three.5 million Washington residents employed in 2022 and that lower than 5 % of adults nationwide had long-term care insurance coverage, the numbers had been suspiciously excessive.18 The Washington legislature acknowledged the doable antagonistic choice drawback and instructed the LTSS Belief Fee, which oversees WA Cares, to discover methods to require recertification (to make sure that folks weren’t shopping for insurance policies to get an exemption after which dropping them), however no such course of was applied. On the constructive facet, the variety of requested exemptions dropped sharply to 32,638 in 2022, and no claims may be filed after 2022. So, the personal insurance coverage exemption was a one-shot drawback and its influence will diminish over time, however different states adopting such a long-term care program might embrace a rigorous certification process to confirm personal protection quite than permitting folks to self-attest.

The Self-Employed

The self-employed had been solely included in this system in the event that they opted in as a result of the state of Washington, with out an revenue tax, has no automated mechanism for gathering taxes from this group. For the reason that payroll tax is levied on uncapped earnings, the self-employed with excessive earnings had been much less more likely to be a part of. As well as, the self-employed had been ready to sport the system. They may decide in just for the final 10 years of their profession, or decide in for 10 years early of their profession after which decide out as quickly as they hit the 10-year vesting threshold, then decide again in once they wanted advantages.

To stop such gaming of the system, the legislature dominated in 2021 that the self-employed who want to take part in this system needed to decide in inside three years of when premium assortment started. As soon as they decide in, they continue to be enrolled and topic to tax on self-employment revenue till they file a discover that they’re now not self-employed or have retired.19

Ideally, the employed and the self-employed needs to be handled equally underneath a long-term care insurance coverage program. Such an consequence can be straightforward to manage in any state with a private revenue tax. For states with out an revenue tax, the state might search cooperation from the Inner Income Service in verifiying whole W-2 and Schedule C revenue of everybody who participates in this system and base the payroll tax on the sum.

Funds of WA Cares

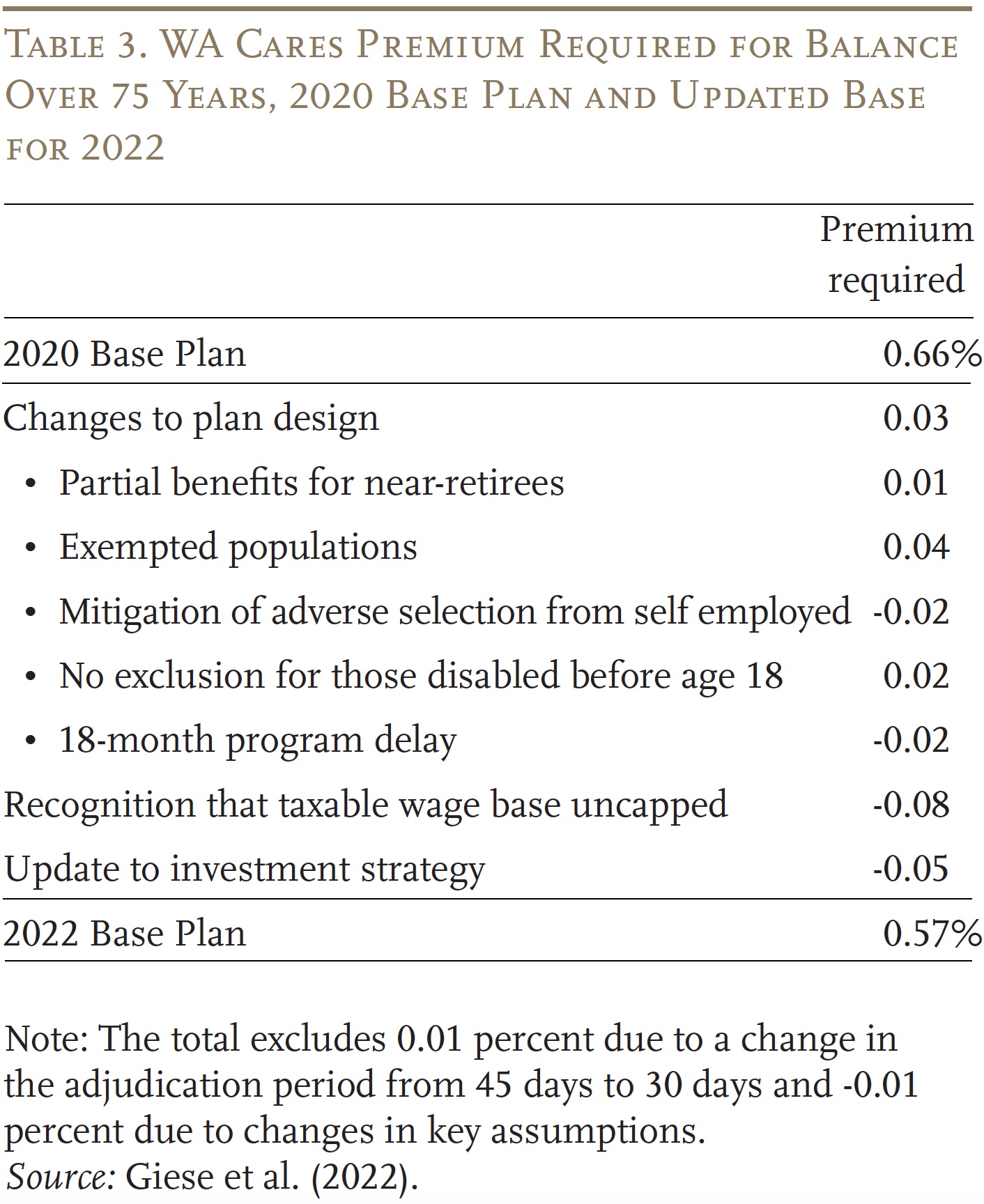

In 2020, the state commissioned an actuarial evaluation of the WA Cares projected prices and outlays over a 75-year interval. The newest evaluation, which mirrored up to date details about this system, was launched in October 2022.20 The adjustments from 2020 to 2022 are fascinating as a result of they spotlight the problems mentioned above, which signifies that the actuaries have famous profit expansions once they have occurred and acknowledged the prices of antagonistic choice the place they exist. Earlier than trying on the causes for the adjustments, it is very important be aware that the required premium contribution to maintain this system solvent for 75 years is 0.57 % – very near the legislated fee of 0.58 %.21 Furthermore, this evaluation ignores the financial savings to the state Medicaid program, which Milliman estimates will quantity to about 10 % of program prices.22

Plan design adjustments between 2020 and 2022 elevated program prices by 0.03 % of wages (see Desk 3). Main the record is offering pro-rated advantages for near-retirees and exempting populations unlikely to obtain advantages from necessary protection, which will increase the probability that high-earning, wholesome people won’t take part. Offsetting these will increase is the mitigation of antagonistic collection of the self-employed. Dropping the exclusion of these disabled earlier than age 18 elevated price, however these prices had been offset by the 18-month program delay. The rise in price as a result of program adjustments was greater than offset by the clarification that the payroll tax utilized to uncapped wages – that’s, together with earnings in extra of the Social Safety taxable wage base –and the growth of funding choices past U.S. Treasuries.

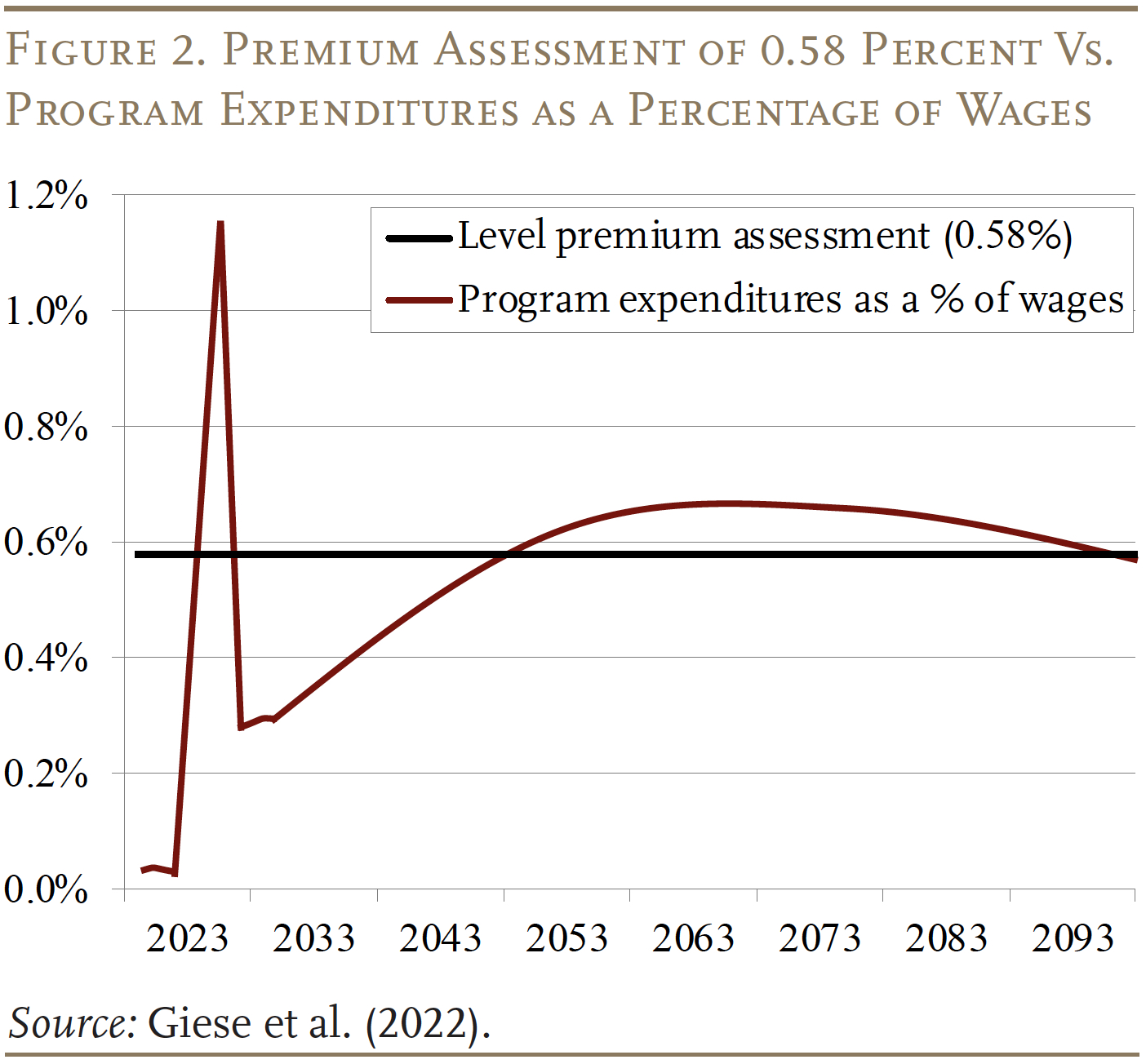

The truth that a tax fee of 0.58 % covers all prices over a 75-year interval doesn’t inform the entire story. If the sample concerned surpluses within the early phases and deficits later, 75-year deficits would seem as quickly because the projection interval moved out a yr – as has occurred with the Social Safety program. Happily, the connection between revenues and expenditures is comparatively secure on the finish of the interval (see Determine 2).

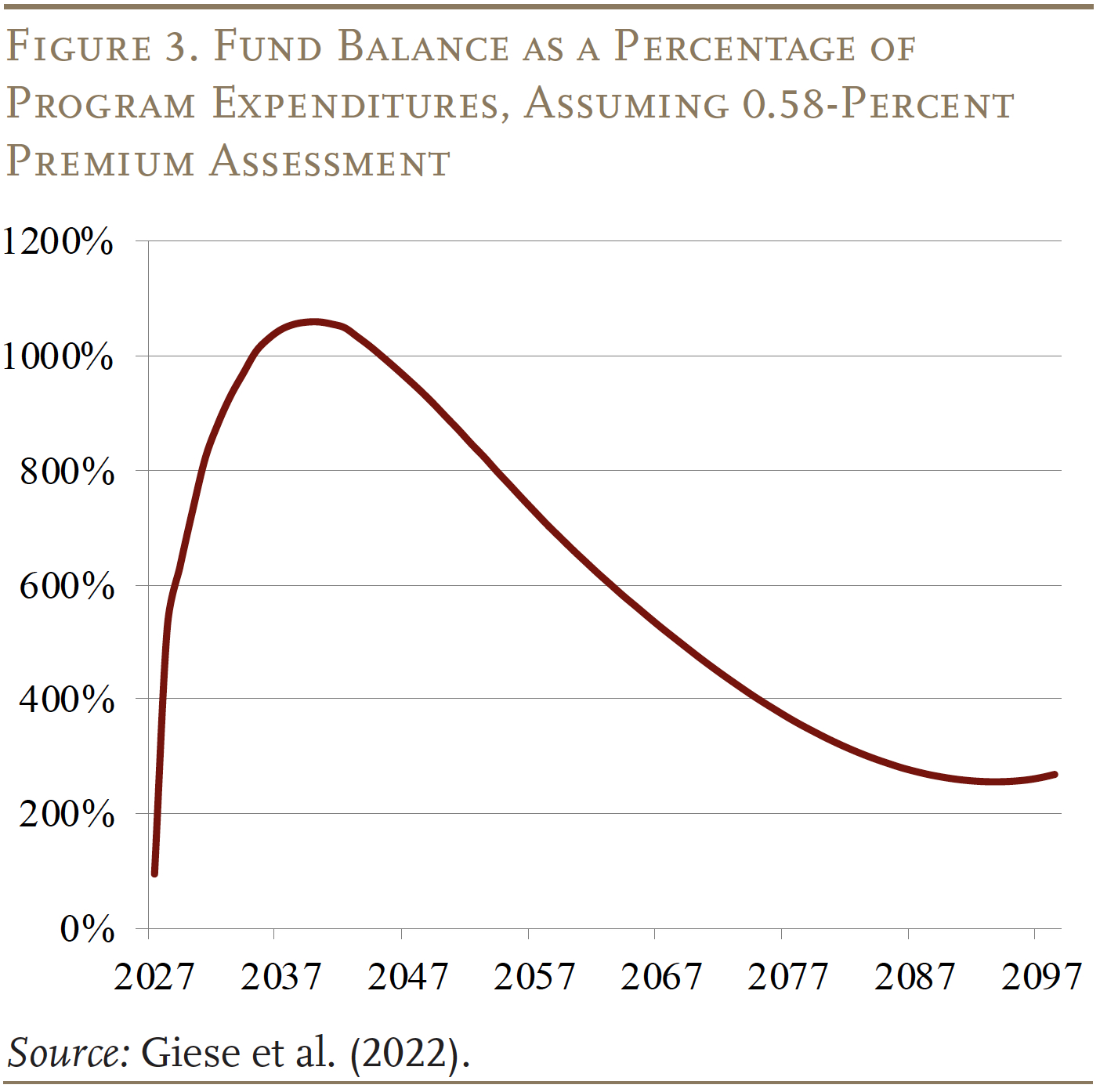

The sample of expenditures and revenues is mirrored within the fund balances as a share of outlays (see Determine 3). Fund balances rise sharply within the early years – when premiums are flowing in and most members haven’t but happy the vesting necessities – after which decline when expenditures exceed revenues. By the top of the interval, the fund stability is projected to stabilize round 270 % of expenditures. Thereafter, the fund stability could properly develop, as profit funds, that are listed to costs, rise extra slowly than revenues, that are primarily based on wages.

The monetary projections benefit a number of feedback. First, it is very important reiterate that the actuaries clearly incorporate the influence of antagonistic choice of their projections. Second, the 2022 projections don’t embrace the influence of creating advantages moveable, however this omission shouldn’t be vital provided that the legislature included price offsets when it enacted the supply.23 Third, some dialogue has occurred about investing a portion of the fund property in equities, which might doubtless improve the income projections.24 Lastly, since all projections are unsure, it will make sense to incorporate some automated adjustment mechanism to alter advantages or taxes ought to 75-year imbalances emerge.

Whereas this system appears solidly funded, a menace has emerged within the type of a November 2024 poll initiative to make participation voluntary.25 As evident from the demise of CLASS, a program financed with voluntary contributions will virtually actually go right into a loss of life spiral.

Conclusion

The probability of needing a significant quantity of long-term care is the foremost threat dealing with older people. The median personal nursing dwelling room price of practically $120,000 per yr exceeds the annual revenue of over 90 % of the aged, and the availability of dwelling healthcare employees could be very tight. Medicaid supplies assist for these with very restricted property and revenue, and some folks – lower than 5 % – purchase long-term care insurance coverage, however the overwhelming majority of older Individuals face the chance of huge outlays on care as they age.

Recognizing the necessity for collective motion, the state of Washington in 2019 enacted WA Cares – to offer qualifying residents as much as $36,500 (adjusted for inflation) in order that they’ll stay of their properties or to pay for brief institutional stays. This system shall be notably worthwhile to the state’s middle-class households. Furthermore, recognizing that this system doesn’t meet all wants, the Fee has labored with personal insurers and client safety advocates to design a statutory framework for a supplemental personal LTC coverage, which might insure dangers above $36,500 and permit continuity of care, notably by household caregivers. This non-compulsory product can be accessible for these wishing to enhance the bottom profit supplied by WA Cares.

At this level, Washington’s long-term care program is in operation. In its first yr, this system has accrued greater than $1 billion in reserves. The primary advantages shall be paid in July 2026. Its funds seem like strong over the subsequent 75-year projection interval. Different states are taken with an identical initiative. New York, Massachusetts, and California have all licensed funding for actuarial feasibility research; California has accomplished its research. Further states are in earlier phases of exploration. The foremost threat to WA Cares is the 2024 poll initiative to make participation voluntary, during which case this system would now not be possible.

References

Aaron, Henry J. 2022. “The Way forward for WA Cares: A Response to Warshawsky.” Washington, DC: Brookings Establishment.

American Academy of Actuaries. 2011. “Actuaries Agree with HHS Issues on CLASS Program.” Information Launch (October 14). Washington, DC.

American Academy of Actuaries. 2009. “Actuarial Points and Coverage Implications of a Federal Lengthy-Time period Care Insurance coverage Program.” Letter to the U.S. Senate Committee on Well being, Schooling, Labor and Pensions. (July 22). Washington, DC.

Ballotpedia. 2024. “Washington Initiative 2124, Choose-Out of Lengthy-Time period Providers Insurance coverage Program Initiative.” Middleton, WI.

Belbase, Anek, Anqi Chen, and Alicia H Munnell. 2021a. “What Degree of Lengthy-Time period Providers and Helps Do Retirees Want?” Challenge in Transient 21-10. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Belbase, Anek, Anqi Chen, and Alicia H Munnell. 2021b. “What Sources Do Retirees Have for Lengthy-Time period Providers & Helps?” Challenge in Transient 21-16. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Brown, Susan L. and I-Fen Lin. 2012. “The Grey Divorce Revolution: Rising Divorce Amongst Center-Aged and Older Adults, 1990-2010.” Journals of Gerontology Collection B: Psychological Sciences & Social Sciences 67(6): 731-741.

Brown, Susan L. and Matthew R. Wright. 2017. “Marriage, Cohabitation, and Divorce in Later Life.” Innovation in Getting older 1(2): 1-11.

Carney, Maria T., Janice Fujiwara, Brian E. Emmert Jr., Tara A. Liberman, and Barbara Paris. 2016. “Elder Orphans Hiding in Plain Sight: A Rising Susceptible Inhabitants.” Present Gerontology & Geriatrics Analysis.

Middle for Retirement Analysis at Boston School. 2024 (forthcoming). “Healthcare and Lengthy-Time period Care Dangers in Retirement: A Overview of Current Literature.” Ready for Jackson Nationwide. Chestnut Hill, MA.

Facilities for Medicare and Medicaid Providers. 2010. “Estimated Monetary Results of the ‘Affected person Safety and Reasonably priced Care Act,’ as Amended.” Memorandum from Richard S. Foster (April 22). Washington, DC.

Congressional Analysis Service. 2023. “Lengthy-Time period Care Insurance coverage: Overview.” (July 21). Washington, DC.

Genworth Monetary, Inc. 2023. “Price of Care Survey.” Richmond, VA.

Giese, Christopher, Allen Schmitz, Annie Gunnlaugsson, and Evan Pollock. 2022. “2022 WA Cares Fund Actuarial Research.” Commissioned by the Workplace of the State Actuary. Seattle, WA: Milliman.

Giese, Christopher, Jill Herbold, Jeremy Cunningham, Annie Gunnlaugsson, and Dean Johnson. 2021. “WA Cares Fund Financial savings for the Medicaid Program.” Commissioned by the Workplace of the State Actuary. Seattle, WA: Milliman.

Gleckman, Howard. 2012. “The Rise and Fall of the CLASS Act: What Classes Can We Be taught?” In Common Protection of Lengthy-Time period Care in america: Can We Get There?, edited by Douglas Wolf and Nancy Folbre. New York, NY: Russell Sage Basis.

Gruber, Jonathan and Kathleen McGarry. 2023. “Lengthy-term Care in america.” Working Paper 31881. Cambridge, MA: Nationwide Bureau of Financial Analysis.

King, Valarie and Mindy E. Scott. 2005. “A Comparability of Cohabiting Relationships amongst Older and Youthful Adults.” Journal of Marriage & Household 67(2): 271-285.

LIMRA. 2022. “Do Shoppers Actually Perceive Lengthy-Time period Care Insurance coverage?” Information Launch (November 15). Windsor, CT.

LTSS Belief Fee. 2021. WA Cares Fund Threat Administration Framework. Olympia, WA: WA Cares Fund.

Munnell, Alicia H. 2024. “Washington State’s Lengthy-Time period-Care Program Might Be Killed by Poll Initiative.” Weblog Publish (July 8). MarketWatch: New York, NY.

Munnell, Alicia H. and Josh Hurwitz. 2011. “What’s ‘CLASS’? And Will It Work?” Challenge Transient 11-3. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Nationwide. 2023. “The Nationwide Retirement Institute 2023 Lengthy-term Care Survey.” Columbus, OH.

Spillman, Brenda C., Eva H. Allen, and Melissa Favreault. 2020. “Casual Caregiver Provide and Demographic Adjustments: Overview of the Literature.” Ready for the U.S. Division of Well being and Human Providers. Washington, DC.

Stepler, Renee. 2017. “Led by Child Boomers, Divorce Charges Climb for America’s 50+ Inhabitants.” Washington, DC: Pew Analysis Middle.

U.S. Congress Joint Financial Committee. 2019. “An Invisible Tsunami: ‘Getting older Alone’ and Its Impact on Older Individuals, Households, and Taxpayers.” (January 24). Washington, DC.

Warshawsky, Mark J. 2022. “The Second Failed Try at Public Insurance coverage For Lengthy-Time period Providers And Helps.” Well being Affairs Forefront.

Wettstein, Gal and Alice Zulkarnain. 2019. “Will Fewer Youngsters Increase Demand for Formal Caregiving?” Working Paper 2019-6. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.