Canada’s finest robo advisors are a wonderful investing resolution for the numerous of us who’re intimidated by the considered shopping for and promoting shares on their very own – however who don’t wish to pay the outrageous mutual fund charges that include the standard investments really helpful by banks and credit score unions.

There’s unbelievable worth in robotically taking a bit of your paycheque each month and robotically turning it right into a diversified funding portfolio. Approach too many people hesitate to get began with investing, and NEVER really put our cash to work. Robo advisors – or “on-line wealth managers” as some favor to be referred to as – are the right resolution in the case of avoiding paralysis by evaluation.

Canadian Robo Advisors Fast Comparability

Administration Charges

0.4% – 0.5%

Finest general robo advisor in Canada. Finest funding returns + low charges. High promo provide!

Administration Charges

0.4% – 0.5%

Canada’s largest robo advisor. Aggressive charges. Low customization choices. Mediocre returns.

Administration Charges

0.20% – 0.28%

Lowest charges, good platform, worst investing technique amongst the highest robo advisors.

Administration Charges

0.35% – 0.55%

Nice customer support. Aggressive charges. Good SRI choices.

Administration Charges

0.35% – 0.60%

Account Minimal

$1,000 For Canadian Residents

Finest Robo advisor for Canadian expats. Excessive charges. Good monetary recommendation.

Administration Charges

0.40% – 0.70%

Finest huge financial institution Robo Advisor. Larger charges however fairly probably the most effective platform and cellular app – makes investing extraordinarily straightforward.

Account Minimal

$100 – $1,500

Finest for RBC prospects. Nice number of ETFs together with SRIs, however restricted account choice.

Administration Charges

0.35% – 0.50%

Most suitable option for robo skeptics. Solely robo advisor with a free trial interval, plus no administration charges for small accounts.

Administration Charges

Flat charge tiered charges: $5-$150

Most suitable option for accounts with excessive balances. Due to Nest Wealth’s tiered pricing, the upper the steadiness climbs over $325,000, the decrease the relative charges develop into.

Earlier than we dive into extra element in our 2024 Finest Canadian Robo Advisor picks, let’s take a step again to determine if robo advisors are the most effective match for you.

If you’re:

1) Seeking to get into investing however unsure learn how to begin.

2) In search of the best doable technique to get math-backed funding returns for the long run.

3) Seeking to “set it and overlook it” in the case of your investments – versus checking your on-line brokerage account every month.

4) An skilled investor, however merely in search of a passive funding technique that requires minimal effort.

Then Canada’s prime robo advisors may be the right technique to construct your nest egg.

Justwealth – Canada’s Finest Robo Advisor

They’re not the flashiest.

They’re merely the most effective.

There are 5 areas that separate Justwealth from the remainder of Canada’s robo advisors:

1) They’ve probably the most selection in the case of their portfolios. With over 80 portfolios to select from, they’re leaps and bounds forward of their nearest competitor.

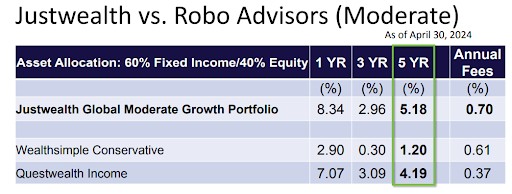

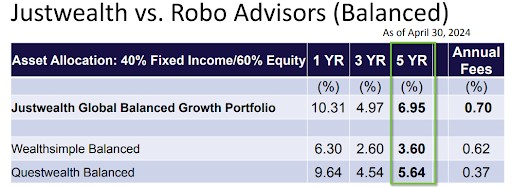

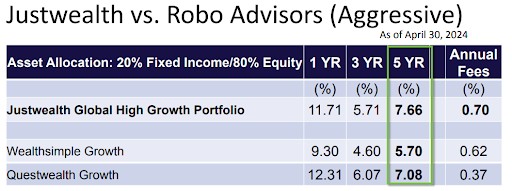

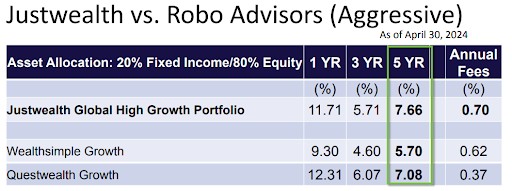

2) They’ve the most effective efficiency monitor document. Justwealth’s skill to place collectively ETF portfolios that ship the most effective returns is unmatched. Extra on this later within the present.

3) Each single shopper that indicators up with Justwealth will get assigned their very own monetary planner. That’s tremendous distinctive and tremendous helpful to most robo advisor purchasers. There’s one single level individual that may reply your questions and aid you navigate the platform.

4) The Justwealth goal date funds are excellent for RESPs and FHSAs. They robotically cut back danger as you get nearer to needing the money, and there’s nothing else like them out there amongst Canadian robo advisors in the intervening time.

5) They at present have by far the most effective promo provide – the place you may rise up to $500 in bonus money. Particulars beneath.

After all there are different the explanation why Justwealth is a good platform – it’s simply that they’re shared by the opposite robos on this checklist. They’re tremendous handy. Their charges are a lot decrease than these charged by mutual funds (and slightly greater than Canadian multi functional ETFs).

Lastly, they’re excellent for traders who simply need a actually good funding choice that gained’t require them to spend a bunch of time studying learn how to purchase and promote shares, in addition to rebalancing their very own investments.

- Account Choices: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Assigned a Private Monetary Planner: Sure

- Administration Charges: 0.40% – 0.50%

- MER: 0.1 – 0.2% (normal ETFs), 0.25 – 0.4% (SRIs)

- Minimal Funding: $1,000

- Cell App: Sure

- Full Evaluation: Justwealth Evaluation

Runner Up & Finest Robo Advisor for Tech-Obsessed Traders: Wealthsimple

Wealthsimple is by far the biggest of Canada’s robo advisors, and for a few years I’d have referred to as the corporate Canada’s prime robo advisor.

However the issue is that the corporate is not in any respect centered on robo advising. That’s a giant downside!

Wealthsimple was based about ten years in the past as an organization obsessive about three issues:

1) Making index investing so simple as doable for Canadians.

2) Reducing charges very near the bone.

3) Creating a web-based platform that was really easy and so cool to have a look at that it will really encourage Canadians to get began with investing.

The issues began to return as an increasing number of of Wealthsimple’s shares have been offered to massive Canadian monetary corporations. After which – shock, shock – these corporations determined that they wished to make some huge cash on their funding.

That quest for extra revenue wasn’t going to return from the low-fee world of robo advisors. So, they shuffled robo advising to the facet (calling it “Wealthsimple Managed Investing”) after which they began specializing in flashier stuff like crypto buying and selling, non-public credit score, non-public fairness, and together with treasured metallic investments of their portfolios. As they took their eye off the ball, they made some poor funding selections, and have continually tinkered with the make-up of their portfolios (as outlined by Ben Felix within the Globe and Mail).

They opened a reduction brokerage operation, they obtained into mortgages and excessive curiosity financial savings accounts. The issue is that they aren’t the most effective in any of those areas, and of their quest for extra revenue they’ve strayed fairly removed from their authentic give attention to their robo advising platform.

Oh – they usually additionally launched huge costly growth plans within the UK and USA… earlier than admitting failure and collapsing these operations.

Look, there’s nonetheless loads to love about Wealthsimple. They continue to be by far the most effective robo advisor platform in the case of aesthetic attraction and person expertise. Their web site has gained a number of design awards and you may inform that they actually emphasised the “expertise” side of “fintech” – as these on-line monetary corporations are sometimes branded.

The Wealthsimple Managed Investing platform remains to be a significantly better choice than conventional mutual fund investments – I simply want they’d transfer away from attempting to push all of this cryptocurrency buying and selling and personal fairness stuff, and get again to the straightforward elegant low-fee options that they used to give attention to.

- Account Choices: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Administration Charges: 0.40% – 0.50%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 4.70%

- Assigned a Private Monetary Planner: No

- Minimal Funding: None

- Cell App: Sure

- Full Evaluation: Wealthsimple evaluate

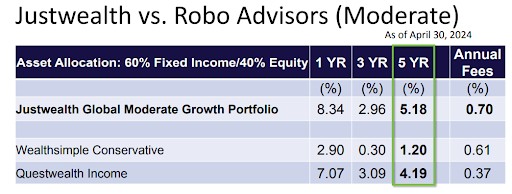

Questwealth Portfolios – The Lowest Charges

Questwealth is taken into account to be a hybrid robo advisor – which suggests their accounts are extra actively managed than than a standard robo. Personally, I’m not a giant fan of lively administration, as the entire level of a robo advisor is meant to be low-fee passive index investing, but it surely’s clearly an space that Questwealth determined they wished to spotlight as a way to stand out. Their 5-yr returns are considerably beneath these of JustWealth and CI Direct Investing (however above Wealthsimple) so I’d say the lively administration method hasn’t actually confirmed itself.

Questwealth Portfolios have a number of the lowest charges available on the market. Administration charges are 0.20-0.25% per yr. The truth that they’re in a position to maintain charges so low, whereas offering a stable platform, is proof that they deserve their place on this checklist. Now they only want to supply a extra passive-investing based mostly portfolio they usually’ll be a real contender.

- Account Choices: TFSA, RRSP, Non-registered, FHSA, RESP

- Administration Charges: 0.20%-0.25%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 6.83%

- Assigned a Private Monetary Planner: No

- Minimal Funding: $1,000

- Cell App: Sure

- Full Evaluation: Questwealth evaluate

CI Direct Investing – Finest For Canadian Expats

CI Direct Investing was previously often known as WealthBar, however rebranded in August of 2020. They’re at present the one robo advisor in Canada that caters to expats – in order that they have a particular place in our hearts.

Though they do require a whopping $25,000 minimal funding for expats, CI Direct Investing makes it in any other case extremely straightforward to make use of a robo advisor whereas overseas.

You don’t want a Canadian tackle and also you solely have to fret about paying the identical taxes as you’d wherever else as a Canadian non-resident.

Like Justwealth, CI Direct presents traders customized monetary recommendation. CI Direct presents 5 portfolio choices starting from conservative to aggressive. Their charges are greater than many of the different robo advisors (particularly for traders with beneath half one million in property). Whereas CI Direct additionally presents non-public funding portfolios, I’m not a giant fan of that asset class as properly, and would encourage folks to steer clear of these high-fee merchandise.

- Account Choices: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Administration Charges: 0.35%-0.60%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 7.29%

- Assigned a Private Monetary Planner: Sure

- Minimal Funding: $1,000

- Cell App: Sure

- Full Evaluation: CI Direct Investing Evaluation

BMO SmartFolio – Finest Possibility Out Of The Massive Banks

BMO SmartFolio is our decide for finest robo advisor at a Canadian huge financial institution. Many Canadians really feel secure utilizing the BMO robo advisor as a result of it combines a well-known model with the brand new expertise of the fintech world.

On account of their huge financial institution roots, BMO SmartFolio is a bit more costly than a number of the different robo advisors on this checklist, particularly in the case of traders with lower than $100,000 to take a position.

One other essential issue to contemplate with BMO SmartFolio is that present BMO purchasers can maintain their complete “monetary life below one roof,” so to talk.

On-line banks have lots of perks – there isn’t a denying that – however, there’s additionally lots of worth in simplicity and a way of safety in preserving your chequing, mortgage, mortgage, and investments all in the identical place.

It’s loads simpler to maintain tabs on your whole monetary data and accounts in a single place (or on one app!) than to repeatedly toggle forwards and backwards between a number of establishments. You merely should determine if the upper charges and decrease returns are well worth the comfort for you.

- Account Choices: RRSP, TFSA,, Non-registered

- Administration Charges: 0.40 – 0.70%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 5.35%

- Assigned a Private Monetary Planner: No

- MER: 0.20 – 0.35%

- Minimal Funding: $1,000

- Cell App: BMO banking app solely

- Full Evaluation: BMO Smartfolio evaluate

RBC InvestEase – Good (However Dear)

As Canada’s largest firm, you knew that ultimately RBC was going to get into the robo advisor world. Whereas they have been a bit late to the occasion (about 5 years after the primary Canadian robo advisors have been based) they clearly have an enormous rolodex of Canadian purchasers that they’ll use to advertise their merchandise.

Very similar to BMO Smartfolio, RBC InvestEase makes probably the most sense for traders who actually worth preserving all of their totally different accounts below one roof (and RBC is one large roof).

RBC collaborated with BlackRock Asset Administration Canada Restricted and created RBC iShares ETF which is the biggest and most complete ETF firm within the nation.

RBC InvestEase doesn’t have probably the most account choices or the bottom charges. Nonetheless, they make it very easy and easy to take a position, plus, they’ve the bonus of getting a well known respected identify behind them.

I favor SmartFolio in the case of the head-to-head conflict of massive financial institution robos, however attempt them each out if you wish to go the large financial institution route. Greater than something, the huge benefit that RBC Investease has is that so many Canadians use their different merchandise, and it’s simply merely simpler to go together with what you already know!

- Account Choices: TFSA, RRSP, Non-registered

- Administration Charges: 0.40-0.70%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 5.35%

- Assigned a Private Monetary Planner: No

- Minimal funding: $1,000

- Cell app: No

- Full Evaluation: RBC Investease evaluate

Finest Robo Advisor for Observe Account: ModernAdvisor

A terrific selection for individuals who aren’t fairly certain about this complete “robo advisor” factor, ModernAdvisor is the one robo on our checklist that offers new customers a free trial.

For 30 days ModernAdvisor provides you an account with $1,000 of their very own cash. In the event you select to open and fund an actual account inside the trial interval, they’ll allow you to maintain any beneficial properties you accrued.

ModernAdvisor has a extra lively method to portfolio administration than many robo advisors on our checklist (much like Questwealth). This may occasionally or might not attraction to you – however I’d be remiss if I didn’t level out that they’ve the second lowest returns on their balanced 5-year portfolios, coming in at 5.00% (solely forward of Wealthsimple’s 4.70%).

- Account Choices: RRSP, TFSA, RESP, LIRA, RRIF Non-registered

- Administration Charges: 0.35-0.50%

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 5.00%

- Assigned a Private Monetary Planner: No

- Minimal Funding: $1,000

- Cell App: Sure

- Full Evaluation: ModernAdvisor Evaluation

Finest Robo Advisor for Enterprise-to-Enterprise Mannequin: Nest Wealth

The robo advisor recognized (for now) as Nest Wealth has just lately been offered to an Italian firm often known as Objectway Group. It seems (in the intervening time) that not an excessive amount of has modified on the platform, however Objectway has mentioned that they’re including their very own monetary options and funding administration choices to the corporate (no matter which means).

Nest Wealth has actually tailor-made their funding method to draw impartial monetary advisors – versus particular person traders – over the previous few years. The thought is that monetary advisors can cost purchasers for his or her planning experience, however use Nest Wealth to deal with the shopper’s funding portfolio.

In any case, Nest Wealth is now extra of a robo advisor designed for “white labeling” by monetary advisory corporations (which then layer their charges on prime of Nest Wealth’s charges) than it’s a critical contender for finest robo advisor for people to make use of.

- Account Choices: RRSP, TFSA, RESP, LIRA, RRIF Non-registered

- Administration Charges: $5/month ($60/yr) – $150/month ($1800/yr) based mostly on account dimension

- Common 5-Yr After-Payment Returns (Balanced Portfolio): 7.11%

- Assigned a Private Monetary Planner: No

- Minimal Funding: $0

- Cell App: No

- Full Evaluation: Nest Wealth Evaluation

Our Battle for the High Spot: Justwealth vs Wealthsimple

|

|

|

|

Variety of Portfolios Accessible |

Over 80 totally different portfolios engineered to both develop your wealth, generate revenue, or protect wealth. |

3 normal portfolios, plus SRI and Halal choices. |

|

Customized Monetary Advisor |

||

|

5-year returns (balanced portfolio) |

||

|

$5,000 (With exceptions for RESP and FHSA accounts) |

||

|

$100-$500 Instantaneous Money Again |

||

What’s a Robo Advisor?

The “title” or “definition” of the time period robo advisor is troublesome to pin down.

The rationale behind this imprecise time period is that the entire robo advisor corporations hate being given the title of “robo advisor” – for the wonderful cause that it provides all kinds of unfavorable imagery about some robotic carelessly managing your cash!

Relaxation assured, there isn’t a robotic choosing shares or bonds, and you’ll not lose management over your cash at any level. The “robo” a part of robo advisor merely refers to the truth that after you select an investing portfolio, the cash you ship to your robo advisor will robotically (or “robotically”) be invested into that portfolio. All the corporations on this checklist will let you converse or electronic mail with human beings at any level within the course of – they know Canadians are reluctant to place their belief in something with the phrase “robo” within the title!

So, lots of the corporations listed on this article will as a substitute use phrases like “on-line wealth administration” or “automated funding advisor” or “digital investing platform”. Broadly, all of them imply the identical factor, or share lots of the similar traits.

Robo advisors acquire details about your private targets and danger tolerance and use it to take a position your funds in a diversified portfolio of ETFs. They monitor your portfolio and rebalance it as wanted so that you by no means have to fret about your investments – however don’t pay practically as a lot as you’d if you happen to invested in conventional mutual funds.

Utilizing a robo advisor is straightforward. You add cash to your account (everytime you select) and it’s invested into exchange-traded funds (ETFs) based mostly in your chosen danger stage. You are able to do the whole lot from including cash to your account, to monitoring your investments on-line by way of the web site or app.

Robo advisors are perfect for many who are extra serious about a set-it and forget-it kind of technique. One of many largest attracts for robo advisors is that, as a result of they’re automated and haven’t any brick-and-mortar places to pay for, they’re very cheap in comparison with the investments you’ll discover at credit score unions or banks. I’ll go extra in-depth about robo advisor investments in only a second.

Are Robo Advisors Protected?

Sure!

The highest robo advisors in Canada take pains to safeguard your funds and private data. They use bank-level encryption, institution-level firewalls, and two-factor authentication to assist shield your information.

All the robos on our checklist are reliable, and most are members of The Canadian Investor Safety Fund (CIPF) and/or the Funding Trade Regulatory Group of Canada (IIROC).

Which is a more-long-winded manner of claiming sure, all the most effective robo advisors in Canada are secure. They’re additionally properly established within the {industry} and are trusted by over one million folks. In the event you’re nonetheless not glad, check out our particular person critiques on the most effective robo advisors and also you’ll see that the workforce

How Do Robo Advisors Make investments Your Cash?

With a purpose to perceive how robo advisors make investments the cash you ship to them, you first should get a little bit of an understanding of what “passive” and “lively” investing are.

Daily traders everywhere in the world rise up they usually purchase and promote shares, bonds, and different property. Energetic traders consider that they’re higher at investing than the massive corporations which are shopping for and promoting hundreds of thousands of occasions on daily basis. They consider that they’re higher at choosing the most effective shares and bonds regardless of the opposite facet having Ivey League graduates, the most effective expertise on the earth, inside data, and insanely excessive bonuses for the highest performers. They actively purchase and promote, rack up fairly massive charges for doing so, and usually they do fairly badly. Because of this the large funding banks and hedge funds make a lot cash!

Passive traders alternatively consider that it’s not doable to beat all of these huge company sharks at their very own recreation. As a substitute, they principally simply say, “Look, I’m going to beat precisely half of you. You understand how I’m going to try this? I’m going to purchase slightly bit of each inventory or bond on this market, and I’m going to be precisely common. Common signifies that I beat half of you – and it additionally signifies that my investments will develop fairly darn quick over the long run.”

This “personal the entire market and get common funding returns” technique is called index investing or “sofa potato investing” and is predicated on the mathematical arguments developed by Nobel Prize winners.

The most important pool of cash on the earth (Norway’s Sovereign Wealth Fund) and practically all main college endowments (such because the billions that Harvard manages) are invested utilizing index investing. So not solely is that this method Nobel Prize-winning, it’s trusted by main monetary gamers worldwide.

Now, the best technique to passively make investments – to “personal the entire market” – is to make use of a particular kind of product referred to as an Change Traded Fund (ETF). These ETFs are very straightforward methods to purchase slightly little bit of the whole lot. For instance, if you happen to personal a Canadian inventory ETF, it’ll possible put slightly little bit of your cash into the 60 largest corporations in Canada. On the finish of on daily basis the mathematics components on the coronary heart of your ETF will look and see which corporations gained worth, and which misplaced worth. They may then put slightly extra of your cash into the businesses that gained worth, and take out a number of the corporations that misplaced worth. Consequently, your funding in an index ETF will at all times get you concerning the market common.

Robo advisors will merely take your cash and break up it right into a basket of those passively-managed ETFs.

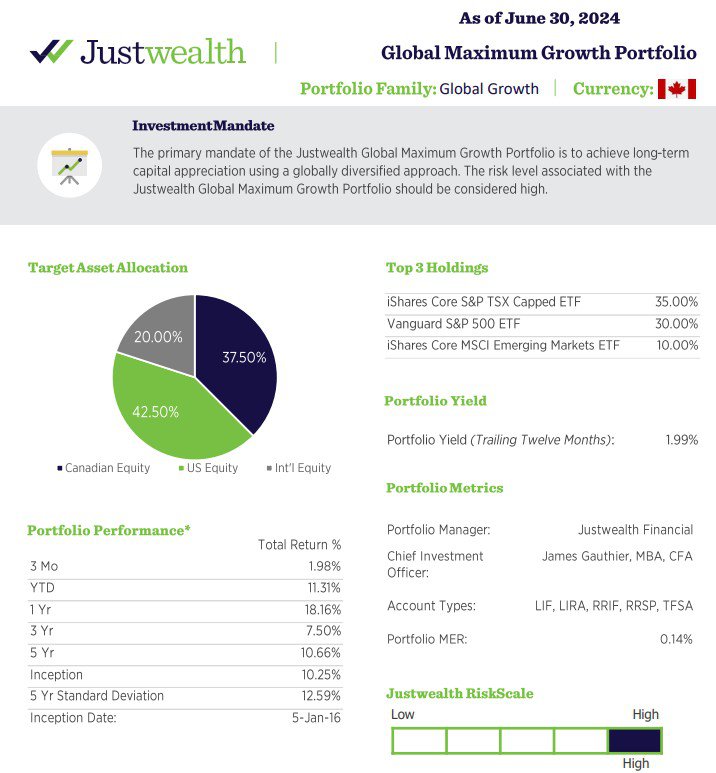

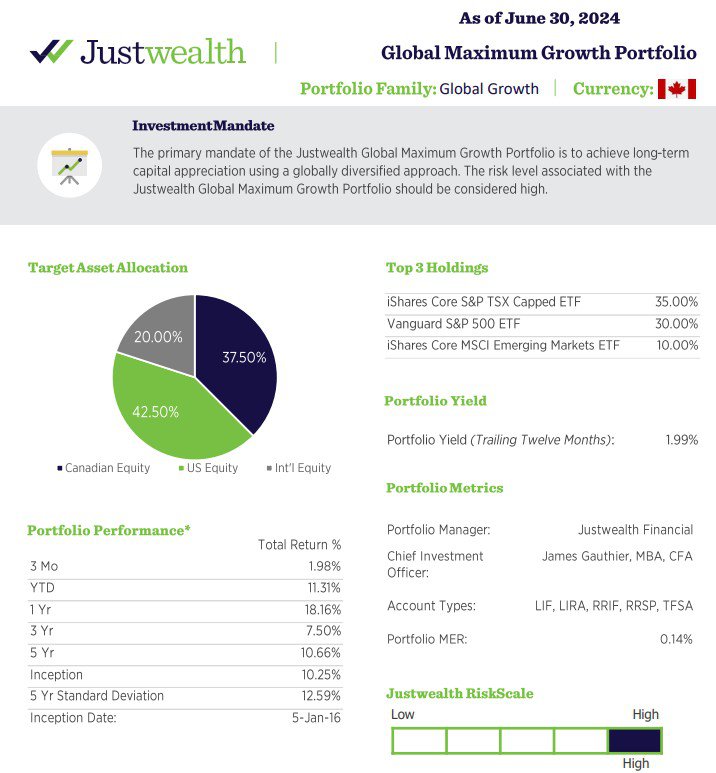

For example, let’s check out the JustWealth World Development Portfolio.

For each $100 that you just put into this portfolio, $35 goes to go in direction of Canadian corporations, $30 in direction of US corporations, $10 in direction of international locations we consider as rising markets (like South Korea and Taiwan), after which lastly, $25 to different smaller slices of the worldwide pie with slightly cash tossed into bonds for good measure. All of which means, that in spite of everything of that automated splitting up of your preliminary $100, the highest ten most essential holdings in your portfolio might be:

- RBC

- Apple

- Microsoft

- NVIDIA

- TD

- Shopify

- Amazon

- Enbridge

- Canadian Pure Sources

- Taiwan Semiconductor Manufacturing

You’ll have between $1.00 and $2.29 invested in every of these corporations. The remainder of your cash could be invested in a whole lot of different corporations from all over the world, in addition to a small quantity of bonds from the world’s largest international locations.

All of these corporations are large profit-makers, and promote merchandise/providers all all over the world. That is the last word instance of “diversification” in the case of your general portfolio.

Robo Advisors use your monetary targets and danger preferences to match you to the ETF portfolio that matches you finest.

Now, the entire Canadian robo advisors on this checklist use some combination of those ETFs. BUT – over time, a number of of those robo advisors have determined they are going to decide and select ETFs which are slightly totally different. They “actively handle” the ETFs.

A few of them make fairly poor selections (comparable to Wealthsimple’s determination to incorporate gold of their portfolios). However usually talking, robo advisors use passive investing to unfold your funding cash out into a whole lot of corporations and bonds, in a manner that eliminates 70-80% of the charges that Canadians are used to paying by way of mutual funds.

Robo Advisors or On-line Brokers?

Whenever you’re questioning whether or not to decide on a robo advisor or a web-based dealer to take a position your funds, the true query is how concerned you wish to be.

Robo advisors are largely hands-off. You reply some questions, deposit your cash, and sit again and watch your account develop (actually – you may verify the robo advisor’s app or on-line platform to observe your portfolio). You even have a supply of data if you’d like some assist answering questions.

In the meantime, on-line brokers are DIY buying and selling platforms for individuals who need full management over their asset allocation and inventory market purchases.

Canada has glorious low cost on-line brokers in addition to nice robo advisors. You possibly can examine our favourites in our lists of the most effective on-line brokers in Canada or the most effective inventory buying and selling app for Canadians.

So, with nice decisions on each side, it actually comes right down to your private desire. Dig in and become involved, or sit again and chill out? The selection is as much as you.

Robo Advisors vs Monetary Advisors and Mutual Funds

Robo advisors symbolize a wonderful “center of the highway” choice between the tremendous excessive charges related to conventional mutual funds + your financial institution’s monetary advisor, and slicing charges to the bone by utterly DIYing your individual funding portfolio.

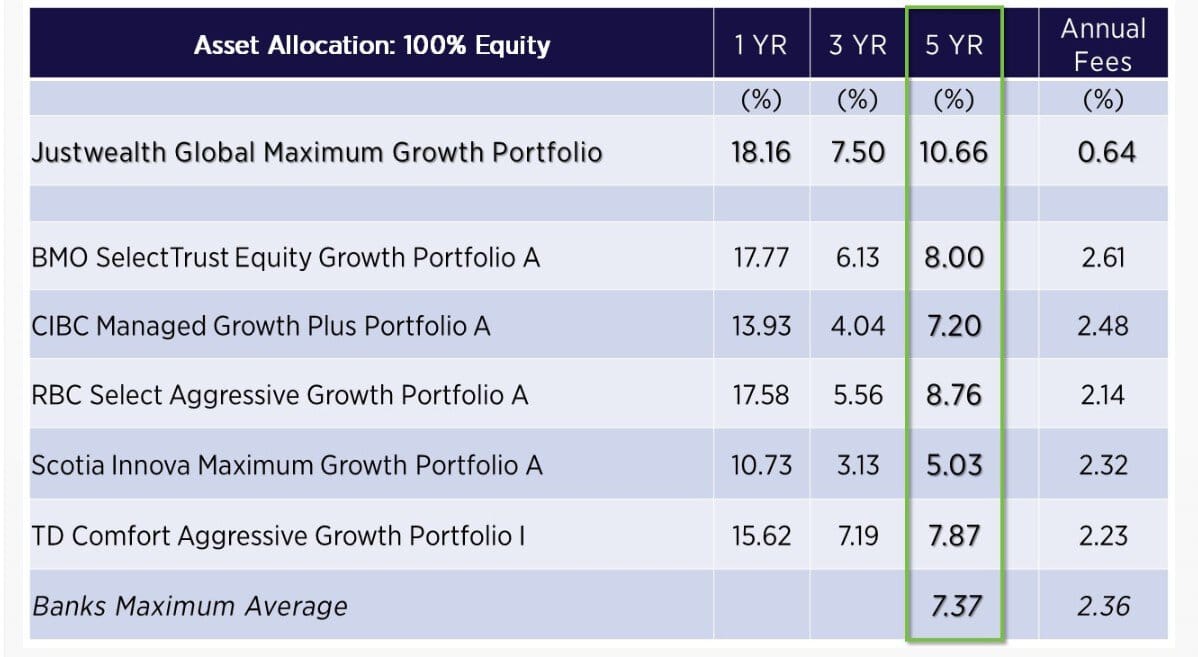

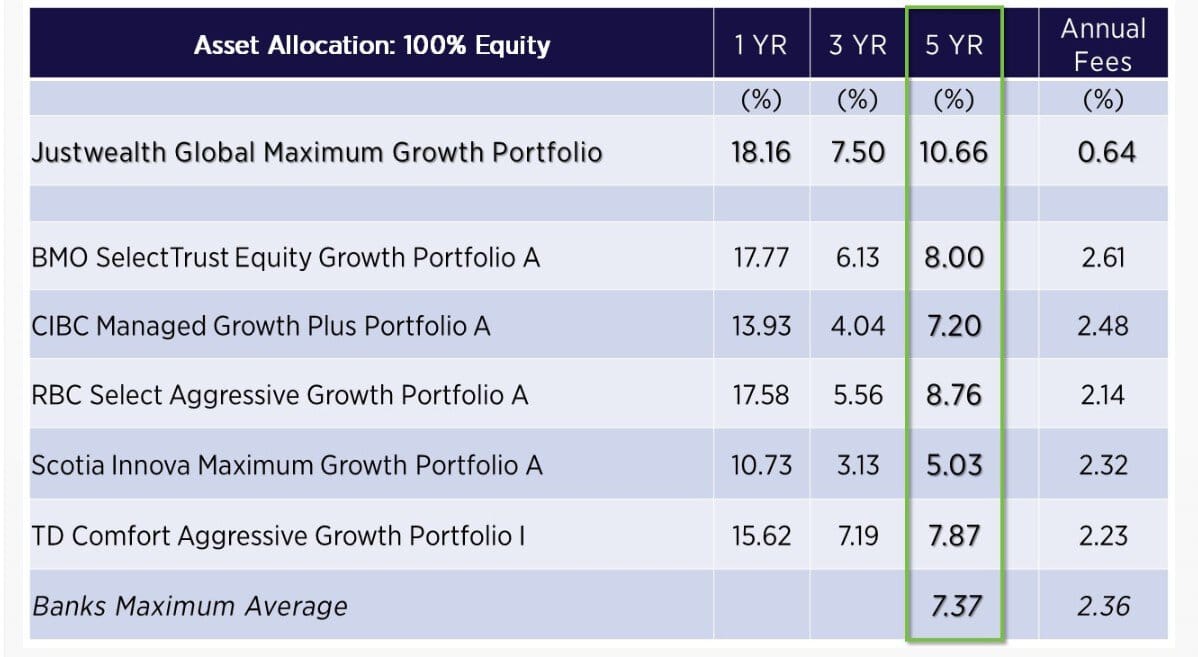

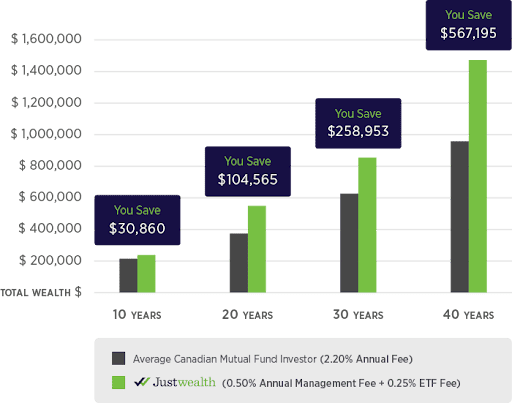

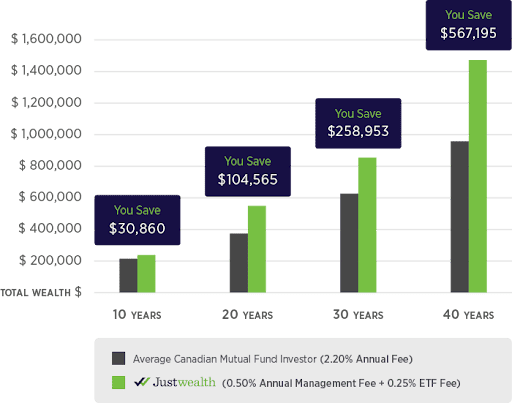

With a purpose to actually perceive the worth of Canadian robo advisors, you first have to know how Canadians have normally paid for monetary recommendation. You possibly can learn our article on the most effective monetary advisors in Canada if you happen to actually wish to perceive simply how dangerous most monetary recommendation is in Canada, and why it’s so unethical to hyperlink that recommendation to the sale of the world’s most costly mutual funds. Right here’s a direct comparability of JustWealth’s after-fee funding returns (our decide for finest Canadian robo advisor) vs the Massive Banks.

It’s essential to notice right here that after we’re coping with actually small numbers comparable to 0.64% and a couple of.6%, that it may be straightforward to ignore some actually essential math.

See, most individuals have a look at these two numbers and say, “Effectively, they’re each actually small numbers, how a lot distinction can 2% be anyway – 2% isn’t a lot?”

2% makes an enormous distinction!

That 2% goes to make a whole lot of 1000’s of {dollars}’ price of distinction over your lifetime. To place it one other manner – mutual funds are charging you FOUR TIMES as a lot cash to put money into a worse product (mutual funds – on common – lose to passive investing approaches even earlier than charges are thought of).

Now if you happen to deliver this math to the financial institution’s monetary advisor that you just’re coping with, they’re going to say one thing like, “To start with, I’d by no means put you in these funds, right here’s one other fund that’s higher. Additionally, these charges are the mutual fund firm paying me, in order that I can give you all of this useful recommendation – that manner it’s free to you.”

Right here’s the factor:

1) It’s not “free” to me – it’s going to price me 2% of my complete funding portfolio each single yr (even when the market loses cash). That’s going so as to add as much as a whole lot of 1000’s of {dollars} that I might have had in my retirement!

2) There is no such thing as a proof that you just as a Canadian monetary advisor

3) Through the use of JustWealth, I have already got entry to a monetary skilled that may reply all of my questions for me. So for a lot decrease charges, I can get monetary recommendation.

4) Your title of “monetary advisor” really has no authorized which means in Canada. As a substitute, the monetary skilled that I converse with at JustWealth really has a fiduciary duty to me. That’s as a result of JustWealth (in addition to Canada’s different robo advisors) are legally categorised as portfolio managers. That signifies that they are often held legally accountable if they supply recommendation that advances their pursuits, and never my very own. You – as a financial institution/credit score union monetary advisor – can’t say that.

How you can Select the Finest Robo Advisor For You

We’ve already given you particulars on every of the most effective robo advisors in Canada, however right here’s why we measured these robo advisors within the particular areas that we did, and a tough thought of how we arrived at these numbers.

Robo Advisor Charges In Canada

In terms of robo advisors you’ll principally pay two layers of charges:

1) The charges that they cost you as a way to earn cash as an organization. These are normally referred to as the corporate’s administration payment, and it’s expressed as a proportion of the amount of cash you at present have invested.

2) The charges that the funding corporations that create the ETFs cost you. These charges are additionally known as administration charges – or Administration Expense Ratios (MERs).

As a result of the entire portfolios that robo advisors make investments your cash into are going to have pretty related ETF MER charges, we centered our comparability on that prime layer of charges that goes to the robo advisor.

Robo advisor administration charges range from Questwealth’s 0.2% to BMO SmartFolio’s 0.7%.

Whereas we don’t advocate basing your selection of robo advisor solely on price, it’s nonetheless a good suggestion to check what you’re paying, with what you’re getting by way of worth.

Canadian Robo Advisor Funding Returns

One may assume that given all of Canada’s robo advisors are speculated to subscribe to very related passive investing philosophies, that their general funding returns ought to be related.

Nonetheless, that isn’t the case in any respect.

Most robo advisors are both owned by a giant mother or father firm, or have a facet take care of a big ETF firm. These offers and possession constructions imply that their robo advisors use solely the ETFs put out by the mother or father firm or accomplice firm – even when there’s a higher ETF out there that covers the identical asset class.

Justwealth is a totally impartial agency, and consequently can select the most effective ETF out there in every asset class it doesn’t matter what firm has created the ETF. These small benefits – together with superior danger administration – has allowed Justwealth to realize the most effective after-fee returns of any of Canada’s robo advisors (as you may see beneath and as reported within the Globe and Mail).

Rob Carrick wrote with regard to Wealthsimple that the “Efficiency of its robo advisor portfolios doesn’t impress.”

The reality is that Wealthsimple has modified their portfolio allocation a number of occasions, making fairly ridiculous errors when it got here to bond allocation methods and including in gold publicity (amongst different errors). They’re now specializing in cross-selling dangerous crypto property and doing all types of different ineffective promotions of their give attention to the underside line.

Ben Felix as additionally written within the Globe and Mail concerning the errors that Wealthsimple has made during the last 5 years, and particulars all of the tinkering that the corporate has carried out (thus indicating that they don’t think about their preliminary “set-it-and-leave-it-alone” investing philosophy).

Now, when evaluating funding returns on robo advisor portfolios it’s crucial to just be sure you’re evaluating apples-to-apples. That means that it’s a must to match up the type and asset allocation for every portfolio. As you may see from the case research above, there’s a huge distinction in how asset allocation was carried out between these robo advisors.

For our comparability of Canada’s Finest Robo Advisors we used the 5-year returns on a balanced portfolio as reported by Moneysense.

Variety of Portfolio Choices

The extra portfolio choices that your robo advisor presents, the higher the possibilities that your investments will most precisely mirror your particular danger tolerance and funding profile.

Elevated portfolio choices additionally enable robo advisors to create distinctive accounts for RESP and FHSA plans.

Why not have extra selection somewhat than much less proper? No us being shoehorned into one thing that solely “type of” matches!

Degree of Recommendation and Assist Accessible

Whereas the time period “robo advisor” conjures up (inaccurate) photographs of robotic bankers, the very fact is that there are groups of actual, skilled folks behind every of Canada’s finest robo advisors.

A lot of the finest robo advisors in Canada provide some type of person-to-person contact, whether or not that’s accredited monetary advisors who’re reachable by cellphone or customer support groups who can provide you primary recommendation.

Whenever you’re attempting to choose the most effective robo advisor for you, it’s worthwhile to think about how a lot private contact you’re going to need and whether or not the robo you’re contemplating presents that.

To the most effective of my data, JustWealth and CI Direct Investing are the one two robo advisors who assign every shopper their very own planner after they get began with the corporate. After all, many of the robos are prepared to supply extra recommendation choices to of us who’ve greater than $500,000-worth of property invested with them.

Buyer Service

Whereas the time period “robo advisor” conjures up (inaccurate) photographs of robotic bankers, the very fact is that there are groups of actual, skilled folks behind every of Canada’s finest robo advisors.

A lot of the finest robo advisors in Canada provide some type of person-to-person contact, whether or not that’s accredited monetary advisors who’re reachable by cellphone or customer support groups who can provide you primary recommendation.

Whenever you’re attempting to choose the most effective robo advisor for you, it’s worthwhile to think about how a lot private contact you’re going to need and whether or not the robo you’re contemplating presents that.

On the very least, you’ll discover detailed FAQs and useful resource pages – once you’re choosing the most effective robo advisor for you, it helps to contemplate how a lot aid you’re more likely to want.

- How difficult is your monetary scenario?

- How properly versed are you in monetary phrases?

- Can a web site like this one aid you brush up your data, or do it’s worthwhile to converse to somebody personally?

In our expertise, the oldsters behind the display screen at robo advisor places of work may help reply all however probably the most area of interest/superior questions that Canadians have. For instance, they’ll reply any TFSA vs RRSP questions, however maybe aren’t but prepared on your revenue belief “tax administration” follow-ups.

Robo Advisor Account Varieties

You’ll additionally need to check out the totally different account sorts supplied by the robo advisors as some have extra decisions than others.

In the event you’re simply in search of a robo advisor on your TFSA or RRSP, then you will have loads to select from. However, if you happen to’re in search of one thing extra particular, like a robo advisor on your RESP or FHSA, then make sure that to verify whether or not that kind of account is obtainable.A couple of robos, comparable to RBC InvestEase, solely provide a few primary account choices. They do a superb job with the accounts they do have, however their choice is proscribed.

Halal, SRI (Social Accountable Investing)

Some robo advisors additionally provide provide values-based investing choices. This consists of socially accountable investing (SRI) which is an funding technique that considers each your monetary returns, and the social/environmental affect of the industries concerned.

Wealthsimple Make investments additionally presents halal investing which follows Islamic ideas.

Platform Person Expertise

Persons are extra possible to make use of a platform that they take pleasure in utilizing.

So whereas the wonder and ease of utilizing a robo advisor may not immediately contribute to constructing your cash, it type of does in an oblique manner. In spite of everything, if you happen to by no means get began or full the preliminary establishing part, then

If having the ability to entry your robo advisor by way of your cellular app is essential to you, keep in mind to make it possible for your most well-liked robo advisor

For my part, Wealthsimple actually shines on this space. Their platform is flawless on each desktop and cellular. The whole lot seems to be like an artist created it. The one flaw is that they’re going to make use of that shiny shiny platform to cross-sell you on extra worthwhile merchandise than their robo advisor.

Canadian Robo Advisor Promotions

Lastly, it’s at all times price your whereas to regulate any promotions being supplied by robo advisors.

Much like how bank cards provide occasional incentives and bonuses for folks to enroll to their playing cards, robo advisors even have added perks to entice you to decide on them. Sometimes, in the case of robo advisor promotions, you’ll see money bonuses or a few of your funding (as much as a certain quantity) managed at no cost for a time frame (usually a yr).

Like the whole lot on this checklist, a promotion by itself isn’t sufficient to validate selecting a particular robo advisor. However, if you may get some additional perks thrown in then it’s possible you’ll as properly take benefit!

Our Finest 2024 Canadian Robo Advisor Promotion is featured beneath!

Robo Advisor Professionals and Cons

Many Canadians are turned off from investing (with robo advisors and in any other case) as a result of they both don’t understand how and assume they should be an knowledgeable, or they assume they want a giant chunk of money to get began.

Robo advisors take these boundaries away by making investing accessible and straightforward for everybody. Minimums are low. Investing is automated. It’s simple with none of the intimidating components. Right here’s a have a look at the professionals and cons of investing with the most effective robo advisors in Canada:

Now, robo advisors are nice, however they aren’t excellent. There are positively a couple of downsides to robo advisors that, maybe, might be rectified sooner or later however, for now, are one thing to pay attention to. Right here’s a breakdown of the principle professionals and cons of robo advisors.

| Professionals | Cons |

| Tremendous straightforward to get began | Whereas robo advisors do reply 98%+ of the non-public finance questions that Canadians have, they don’t provide full monetary planning. |

| MUCH higher than Canadian mutual funds | Barely costlier than managing your individual passive ETF portfolio by means of a Canadian low cost brokerage. |

| You possibly can totally automate the wealth-building course of. Simply “set it and overlook it” | |

| Questions answered shortly and effectively – no want to fulfill up in individual. | |

| Low Charges | |

| Low Investing Minimums | |

| Robo advisors usually are not ‘one dimension matches all’ | |

| Very straightforward to make use of |

Principally, robo advisors maintain wealth-building for you. They do what they’re designed to do extraordinarily properly, they usually’re excellent for traders who simply wish to develop their wealth with out worrying concerning the nuts and bolts.

Robo advisors aren’t designed to deal with extraordinarily advanced monetary planning points (in that case it’s finest to seek the advice of a monetary advisor). And if you wish to dig in and make your individual selections on a DIY buying and selling platform, they’re not the best choice for you. However in any other case, we don’t hesitate to advocate passive investing with one of many robo advisors on this checklist.

Robo Advisors In Canada – FAQ

American Robo Advisors: Betterment vs Wealthfront

I keep in mind going to a commerce present again in 2014, and being amazed at this comparatively new firm referred to as Betterment. I liked the concepts that American robo advisors have been bringing to the desk and I requested after they have been coming to Canada. They mentioned that they had really had preliminary discussions with the oldsters behind Energy Monetary up in Canada.

Effectively, we now understand how that one turned out. Energy determined to throw its appreciable weight behind Wealthsimple, and that firm grew in leaps and bounds.

Sadly, at the moment, Canadian residents can not put money into Betterment or Wealthfront except they’re an American Citizen with a US tackle and a Social Safety Quantity. Even in that scenario, I wouldn’t advise heading down the trail on account of tax issues.

Canada Robo Advisors in 2024 – Closing Ideas

Robo advisors are excellent for traders preferring to be hands-off, and are carried out with Canada’s ridiculous mutual fund {industry}.Their passive investing method is predicated on Nobel Prize-winning theories and has been confirmed to be far more efficient on common than lively administration.

One of the crucial widespread errors that I see Canadian traders make is assume that they should be consultants on investing earlier than they even get began. The trivia of investing will be overwhelming and the reality is that the typical individual won’t ever have the time or vitality to know all of it.

What you really want to know is that on common, the world’s shares and bonds have carried out very well over the previous 200+ years. Canada’s finest robo advisors are a wonderful manner for the typical Canadian to keep away from paralysis by evaluation and unfold funding danger out over an enormous pool of shares and bonds.

The very best robo advisors in Canada are reasonably priced, secure, and dependable. They’re nice for each novices and established traders. Canada has a spread of robo advisors that supply totally different account sorts, portfolio choices, payment constructions, and ranges of customer support.

Our prime really helpful robo advisor is JustWealth. It has a wonderful funding monitor document, probably the most portfolio choices, designates a particular monetary adviser for each shopper, and has some very distinctive RESP and FHSA choices. To not point out a wonderful provide for brand new purchasers!