Funding throughout the monetary companies expertise sector is creeping again up after plummeting in August.

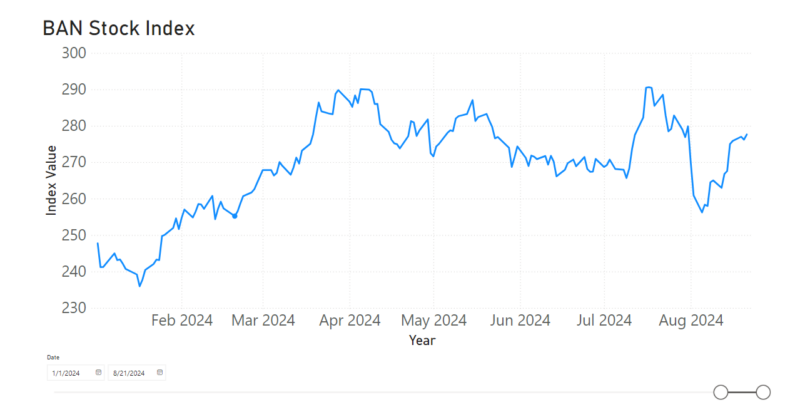

Following a July peak, Financial institution Automation Information’ BAN Inventory Index in August fell to 256.23, the bottom on the index since February, when it was 255.21. The BAN Inventory Index tracks the typical efficiency of monetary expertise suppliers.

The index tracks the day by day inventory efficiency of public expertise suppliers and fintechs of assorted market capitalizations since 2014.

In line with BAN’s BAN Inventory Portfolio, which tracks the day by day inventory efficiency of monetary service expertise suppliers, these public corporations have seen the very best proportion change in inventory value since market shut Sept. 6:

- DeFi Applied sciences’ shares are up 20.23% to $2.08. The corporate has a market capitalization of $673.72 million; and

- NEC shares are up 14.25% to $85.69. It has a market capitalization of $23.31 billion.

Behind the expansion

DeFi Applied sciences’ inventory progress follows a Sept. 5 announcement that it partnered with funding agency Skilled Capital Administration to broaden into the exchange-traded fund (ETF) market, in line with a DeFi Applied sciences launch.

“ETFs symbolize a transformative alternative to redefine how buyers entry and handle their portfolios,” Skilled Capital Administration founder and Chief Government Anthony Pompliano mentioned within the launch.

Additionally final week, NEC launched its Gateless Biometric Authentication system that’s aimed to authenticate massive numbers of individuals at one time whereas they’re in movement, in line with a Sept. 3 NEC launch.

View the BAN Inventory Portfolio right here and BAN Inventory Index right here.

Register for the upcoming complimentary webinar introduced by Financial institution Automation Information: “The way forward for open banking: Funds meet information,” on Tuesday, Sept. 17, at 11 a.m. ET. Register for the webinar right here.