Self Credit score Builder

Product Identify: Self Credit score Builder

Product Description: The Self Credit score Builder Account is a private mortgage that builds each credit score and your financial savings on the similar time.

Abstract

The Self Credit score Builder Account is a mortgage that, as a substitute of receiving the funds from the mortgage, they’re put right into a CD to be launched to you when the mortgage is paid off. You make funds for twenty-four months and on the finish you obtain the funds from the CD, minus curiosity and costs from the mortgage. This builds credit score and financial savings concurrently.

Execs

- No credit score examine.

- Your credit score historical past will likely be reported to all three main credit score bureaus.

- Construct financial savings and your credit score on the similar time.

- Free month-to-month credit score rating.

- There isn’t a minimal earnings requirement.

- Self provides a $10 referral bonus for household and pals you refer.

Cons

- You may have just one energetic Credit score Builder Account at anyone time.

- The Self Secured Visa® Credit score Card credit score line is tied to the stability in your Credit score Builder Account.

- There’s a small early withdrawal penalty if you happen to pull out of this system early.

In case you have weak credit or no credit score, then you understand how onerous it may be to extend your credit score rating. However fortunately, there’s a monetary service that may assist you to to both construct or rebuild your credit score.

The Self Credit score Builder Account is a mortgage that you should utilize to construct your credit score and your financial savings. Whenever you take a mortgage, as a substitute of receiving the cash from the mortgage, it’s put right into a CD. You make funds on the mortgage, and when the mortgage is paid off, you’ll obtain entry to the funds within the CD minus the mortgage curiosity and costs.

Your funds are reported to the credit score bureaus, and on the finish you may have some cash in financial savings.

At a Look

- Builds credit score and financial savings on the similar time

- 4 plans accessible, with funds beginning at $25 monthly

- No onerous credit score examine

- A bank card that’s secured by the CD can be accessible

Who Ought to Use a Self Credit score Builder Account?

Self is greatest for many who have to rebuild their credit score however don’t need to put down a safety deposit for a secured card. It provides a authentic and cheap option to concurrently construct credit score and financial savings.

There aren’t any earnings limits or onerous credit score examine, however you do want to supply your social safety quantity. You additionally must be at the very least 18 years previous and have a checking account. You’ll additionally need to select a cost plan that matches simply into your finances. Plans are between $25 and $150 a month.

Self Credit score Builder Options

Desk of Contents

- At a Look

- Who Ought to Use a Self Credit score Builder Account?

- Self Credit score Builder Options

- What’s the Self Credit score Builder Account?

- How a Self Credit score Builder Account Works

- Self Credit score Builder Account Mortgage Choices

- Learn how to Open a Self Credit score Builder Account

- Self Visa® Credit score Card

- Why Not Simply Apply for a Credit score Card or a Private Mortgage?

- Self Credit score Builder Account Options

- Self Credit score Builder Account Pricing & Charges

- Self Credit score Builder Account Pricing & Charges

- Options to Self Credit score Builder

- Will Self Credit score Builder Work for You?

What’s the Self Credit score Builder Account?

Based mostly in Austin, Texas, and based in 2014, the corporate’s official title is Self Monetary, Inc.; nonetheless, it’s generally identified merely as Self. The corporate is devoted to giving its prospects the flexibility to both higher their credit score or to construct it from the bottom up. The corporate studies that greater than 500,000 shoppers have used the service.

Self is a expertise firm providing their Credit score Builder Account to those that both don’t have any credit score or don’t have entry to conventional monetary merchandise. The account is an installment mortgage that allows prospects to construct a constructive cost historical past, whereas additionally saving cash.

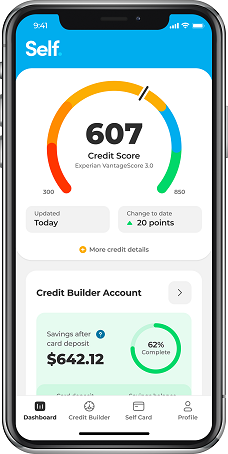

Self Monetary has a Higher Enterprise Bureau ranking of “B”, on a scale of A+ to F. It additionally has a ranking of 4.8 stars out of 5 by almost 16,000 customers on Google Play, and 4.9 out of 5 stars amongst greater than 39,000 customers on The App Retailer.

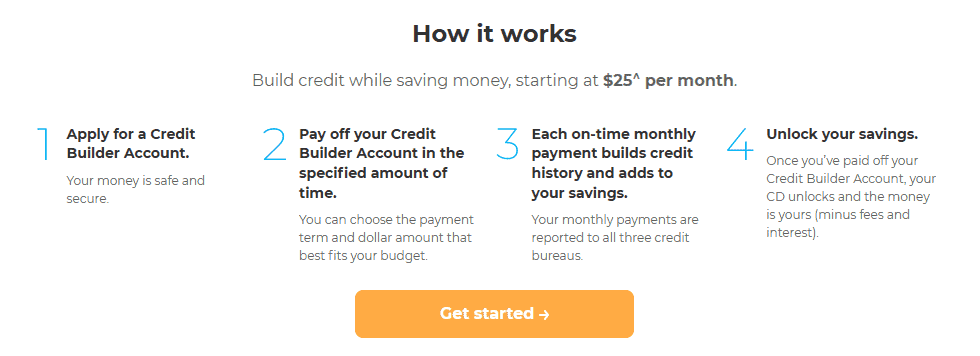

How a Self Credit score Builder Account Works

As described above, Self provides their Credit score Builder Account, which is a mortgage that runs for a time period of 24 months. You may select the compensation plan that matches your finances. And every time you make a month-to-month cost, it is going to be reported all three main credit score bureaus – Experian, Equifax, and TransUnion. Whether or not you haven’t any credit score or poor credit score, making your funds on time every month will assist you to to both construct or higher your credit score historical past.

There’s an added bonus to the association, and it’s big. Every time you make a month-to-month cost, you’ll be including funds to a certificates of deposit (CD) in your title, which acts as safety for the mortgage.

You’ll begin the method by making use of for a mortgage that will likely be held with one in every of Self’s financial institution companions. Financial institution companions embody Dawn Financial institution, Lead Financial institution, and First Century Financial institution. The identical financial institution may also accumulate the month-to-month contribution to the CD portion of your funds.

Self Credit score Builder Account Mortgage Choices

Self provides 4 totally different mortgage choices, every with 24-month phrases. The small print of every are as follows:

| Month-to-month Cost | APR | Whole Funds | CD Steadiness at Finish of Time period |

|---|---|---|---|

| $25 | 15.92% | $600 | $511 |

| $35 | 15.69% | $840 | $717 |

| $48 | 15.51% | $985 | $985 |

| $150 | 15.82% | $3,600 | $3,069 |

So you possibly can see, for the primary instance, you pay $25 a month for twenty-four months. Over that point, you’ll pay $600 in mortgage funds and also you’ll obtain $511 from the CD on the finish of the mortgage. So primarily, you’ll have paid $89 to enhance your credit score.

You may select to repay or shut your account early. Nevertheless, you can be charged a small early withdrawal charge on the CD. Self warns that paying off the Credit score Builder Account early can lower your credit score betterment efforts.

Additionally, bear in mind that you’ll not have entry to the CD stability till the time period mortgage is paid in full. CD funds will likely be launched inside 10 to 14 enterprise days of mortgage payoff and be delivered both by examine or ACH switch into your checking account.

Learn how to Open a Self Credit score Builder Account

To be eligible to open an account you have to to be at the very least 18 years previous, and both a US citizen or legitimate everlasting US resident with a bodily tackle within the US.

You’ll additionally have to have the next accessible:

- A checking account, debit card or pay as you go card (bank cards aren’t accepted).

- A sound electronic mail tackle and cellphone quantity.

- Your Social Safety quantity.

The data is important to confirm your id and make funds in your account.

Credit score: Self will run a “delicate credit score pull,” which is not going to have an effect on your present credit score rating. Nevertheless, nobody is denied a Self Credit score Builder Account primarily based on their credit score rating. They do warn it’s attainable to be denied for different functions, together with lack of adequate verification of your ID, being below age 18, not having a Social Safety quantity, or not being both a US citizen or everlasting resident.

Self additionally discloses that every of their financial institution companions will run your title by ChexSystems. That is of a repository utilized by banks that tracks client efficiency in managing their financial institution accounts. For instance, if you happen to ever closed a checking account with an open stability, it’ll seem within the ChexSystems database. That is one other attainable cause it’s possible you’ll be denied for a Credit score Builder Account. (not all banks will use ChexSystems although)

Earnings: Self doesn’t require a minimal earnings. They solely require that the month-to-month cost you select be one which you can afford.

As soon as your account is permitted, you’ll pay a one-time, non-refundable administrative charge for the service — particulars will likely be offered below Self Credit score Builder Account Pricing & Charges under.

One of many three financial institution companions will give you a small mortgage, with the mortgage funds held in a certificates of deposit that’s totally FDIC insured. The next month, you’ll start compensation in your account. The mortgage will likely be for a hard and fast time period of 24 months.

As you make your funds on time every month, your cost historical past will likely be reported to the three main credit score bureaus, permitting you to construct or rebuild your credit score historical past. As soon as the mortgage has been totally paid, the CD will mature, and the funds will likely be accessible to you. That is the technique utilized by Self to each higher your credit score and allow you to build up financial savings in the identical program.

As an added bonus, you may get your month-to-month credit score rating by Self freed from cost.

Self Visa® Credit score Card

Self additionally provides a Visa bank card. Nevertheless, to be eligible for the cardboard, you’ll have to first open a Credit score Builder Account, and meet the next eligibility necessities:

- You could have made at the very least three month-to-month funds on time.

- Have at the very least $100 in financial savings progress in your Credit score Builder Account.

- Your account have to be in good standing.

Simply as with the Credit score Builder Account, your credit score historical past — or the dearth of it — is not going to be a consider figuring out your eligibility for the cardboard. Actually, there isn’t any onerous credit score examine.

When you change into eligible for the Self Visa® Credit score Card, you possibly can select what portion of your financial savings progress will likely be used to safe your card and set your credit score restrict. That restrict have to be a minimal of $100. The credit score restrict may be elevated in increments of $25 at a time, primarily based on the rise in your portion of the stability in your Credit score Builder Account CD.

The Self Visa® Credit score Card doesn’t supply rewards or enable stability transfers or money advances. It is usually not attainable so as to add an approved consumer. Nevertheless, simply as is the case with the Credit score Builder Account, your cost historical past on the Self Visa®Credit score Card may also be reported to all three main credit score bureaus, supplying you with one other good credit score reference.

Your Self Secured Visa® Credit score Card credit score line is tied to the funds on deposit in your Credit score Builder Account. The one option to have these funds launched on the finish of the mortgage time period is to cancel your Visa® card. Sadly, the portion of your Credit score Builder Account CD that secures your Visa® bank card doesn’t earn curiosity.

Why Not Simply Apply for a Credit score Card or a Private Mortgage?

In idea, you would apply for both a bank card or a private mortgage that will help you construct or rebuild your credit score. However there are a few issues with that technique.

First, if you happen to don’t have a credit score rating, it’s virtually unattainable to get a bank card or private mortgage. Second, in case you have weak credit, you received’t be eligible for conventional bank cards or private loans.

In both case, you’ll be pressured to take a bank card or private mortgage that may both cost exorbitant rates of interest and/or very excessive annual or month-to-month charges. And simply as necessary, bank cards and private loans for shoppers with no credit score or weak credit are infamous for very low mortgage limits. Plus, within the case of bank cards, it’s possible you’ll be required to supply a safety deposit

And in contrast to the Self Credit score Builder Account, neither a bank card nor a private mortgage will go away you with cash in financial savings after you’re finished with the preparations. That’s as a result of Self gives a twin benefit: credit score constructing whereas additionally constructing financial savings (minus curiosity and costs, after all).

Self Credit score Builder Account Options

Availability: All 50 US states. Self shouldn’t be accessible outdoors the US.

Financial savings safety: All funds gathered by your month-to-month funds will likely be held in a CD at a companion financial institution and will likely be totally FDIC insured.

Referral bonus: The Self Monetary dashboard will provide you with entry to a singular referral URL. You may present that to family and friends members and earn $10 for every one that indicators up for a Credit score Builder Account. The referral bonus will likely be paid after the pal or member of the family has been permitted for an account and has made his or her first account cost.

Cell App: Out there at The App Retailer for iOS units, 10.0 and later, and is suitable with iPhone, iPad, and iPod contact. Additionally accessible on Google Play for Android units, 5.0 and up.

Buyer assist: Out there by electronic mail and stay chat, Monday by Friday, from 9:00 AM to five:00 PM, Central time.

Self Credit score Builder Account Pricing & Charges

Every mortgage has a particular rate of interest and APR. These APRs are proven below the “4 Totally different Self Credit score Builder Account Mortgage Choices” part above.

When you shut your account earlier than the tip of the time period, it’s possible you’ll be topic to an early withdrawal charge of as much as $5, relying on the account measurement.

Late charge: If a mortgage cost is greater than 15 days overdue, you’ll be charged a late charge equal to five% of the scheduled month-to-month cost. If the cost is greater than 30 days overdue, it is going to be reported as a late cost to the three credit score bureaus.

Self Credit score Builder Account Pricing & Charges

Every mortgage has a particular rate of interest and APR. These APRs are proven below the “4 Totally different Self Credit score Builder Account Mortgage Choices” part above.

When you shut your account earlier than the tip of the time period there’s an early withdrawal charge of as much as $5 relying on the account measurement.

Late charge: If a mortgage cost is greater than 15 days overdue, you’ll be charged a late charge equal to five% of the scheduled month-to-month cost. If the cost is greater than 30 days overdue, it is going to be reported as a late cost to the three credit score bureaus.

Options to Self Credit score Builder

Self Credit score Builder isn’t the one credit score builder mortgage accessible. There at the moment are a number of firms that supply credit score builder loans, right here’s how they evaluate:

Kikoff

Whenever you join Kikoff, you may get a $750 credit score line (Kikoff Credit score Account) with no credit score examine — however there’s a $5 month-to-month membership charge (annual dedication). You may then make purchases from the Kikoff retailer.

You may also get a secured bank card. It’s a secured card that acts like a pay as you go debit card. You load cash onto the cardboard, as you spend cash is eliminated out of your accessible stability and put aside. The cost is then made in full from the put aside funds.

Your funds to each the road of credit score and the bank card are reported to all three credit score bureaus.

If you wish to be taught extra, try our Kikoff evaluate.

Chime

Chime has a Chime Credit score Builder Secured Visa Credit score Card. This card works like a pay as you go debit card. When you load the cardboard, you should utilize it like every other bank card. As you spend, the acquisition quantities are eliminated out of your card and put apart for use to repay the cardboard on the due date. There aren’t any annual or month-to-month charges on this account.

Chime additionally studies to all three bureaus – Experian, Equifax, and Transunion.

Our full evaluate of Chime has extra info on this.

Be taught extra about Chime Credit score Builder

Chime is a monetary expertise firm, not a financial institution. Banking providers offered by The Bancorp Financial institution, N.A. or Stride Financial institution, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Financial institution or Stride Financial institution pursuant to a license from Visa U.S.A. Inc. and could also be used all over the place Visa debit playing cards are accepted. Please see again of your Card for its issuing financial institution.

StellarFi

StellarFi allows you to construct credit score by paying your common payments. It really works by paying your payments for you, primarily lending you the cash. Then, you pay StellarFi again. They report that cost to the credit score bureaus, which builds your credit score.

There are three plans accessible, and so they value between $4.99 and $29.99 monthly, relying on how a lot the payments are that you really want paid.

Be taught extra at our full evaluate of StellarFi.

Will Self Credit score Builder Work for You?

When you’re not pleased along with your credit score report and credit score rating, or you haven’t any credit score profile in any respect, the Self Credit score Builder Account is an effective possibility. What’s extra, it’ll additionally assist you to start constructing financial savings. That’s necessary as a result of these with weak credit usually have a scarcity of financial savings, which is a part of the rationale for the weak credit itself.

In that manner, the Self Credit score Builder Account will assist you to obtain two crucial monetary milestones in the identical program. You may take part in this system with a month-to-month cost of as little as $25, and each charges and rates of interest are very affordable.

Give it some thought — you possibly can construct your credit score over 24 months, and by the point you full this system, there’ll be a funded CD ready for you. Self has put collectively a best-in-class service to assist shoppers each higher their credit score. When you’re trying to do both or each, that is this system for you.

*All Credit score Builder Accounts made by Lead Financial institution, Member FDIC, Equal Housing Lender, Dawn Banks, N.A. Member FDIC, Equal Housing Lender or Atlantic Capital Financial institution, N.A. Member FDIC, Equal Housing Lender. Topic to ID Verification. Particular person debtors have to be a U.S. Citizen or everlasting resident and at the very least 18 years previous. Legitimate checking account and Social Safety Quantity are required. All loans are topic to client report evaluate and approval. All Certificates of Deposit (CD) are deposited in Lead Financial institution, Member FDIC, Dawn Banks, N.A., Member FDIC or Atlantic Capital Financial institution, N.A., Member FDIC.

**The secured Self Visa® Credit score Card is issued by Lead Financial institution or First Century Financial institution, N.A., every Member FDIC. See Self.inc for particulars.

***Pattern loans: $25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

****Card eligibility: Lively Credit score Builder Account in good standing, 3 on-time funds, $100 or extra in financial savings progress, and fulfill earnings necessities. Necessities are topic to alter.

*****Credit score Builder Accounts & Certificates of Deposit made/held by Lead Financial institution, Dawn Banks, N.A., First Century Financial institution, N.A., every Member FDIC. Topic to credit score approval.