Preliminary stories that Apple‘s (NASDAQ: AAPL) newest batch of smartphones had been witnessing weaker demand than final yr’s fashions weighed on the inventory not too long ago. However it appears to be like like these stories might not maintain a lot water in any case, as the corporate’s iPhone 16 lineup appears to be receiving a stable response from prospects.

Extra importantly, a more in-depth take a look at the potential gross sales prospects of the most recent iPhone fashions signifies that Apple might witness a pleasant bump in gross sales going ahead.

An enormous improve cycle might assist Apple promote extra iPhones

Counterpoint Analysis estimates that iPhone 16 fashions are witnessing strong demand in India, with gross sales reportedly leaping between 15% and 20% on the day the smartphones went on sale in that nation. It’s price noting that Apple’s gross sales in India surged a powerful 35% in fiscal 2024 (which led to March this yr), and the robust begin that the corporate’s newest gadgets are having fun with in that market means that the momentum is about to proceed.

In the meantime, T-Cellular CEO Mike Sievert additionally identified that the provider is promoting extra iPhone 16 fashions this yr as in comparison with final yr. Although Sievert identified that the delayed rollout of Apple Intelligence might result in an extended shopping for cycle, it’s price noting that the iPhone maker might finally get pleasure from robust gross sales due to an ageing put in base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an put in base of 1.5 billion iPhones, 300 million haven’t been upgraded in 4 years. So, with generative synthetic intelligence (AI) options set to make their technique to the most recent Apple iPhones, there’s a good likelihood {that a} important chunk of those older iPhones might be upgraded. On condition that Apple offered slightly below 235 million iPhones final yr, the stage appears set for an enormous bounce within the firm’s shipments going ahead.

That is why traders might need to purchase shares of Apple, contemplating that the tech large’s progress is about to enhance because of the arrival of its AI-enabled smartphones. Nonetheless, there’s one other inventory that is set to learn large time from the iPhone 16’s potential success, and traders should purchase that firm at a less expensive valuation proper now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot within the arm for TSMC because of the brand new iPhones

Taiwan Semiconductor Manufacturing, popularly generally known as TSMC, is the corporate that manufactures the processors that energy Apple’s iPhones. The A18 and A18 Professional processors contained in the iPhone 16 fashions are manufactured utilizing TSMC’s 3-nanometer (nm) course of node.

Apple claims that its iPhone Professional fashions can ship 15% efficiency features whereas consuming 20% much less energy than final yr’s fashions. In the meantime, the A18 chip discovered on the iPhone 16 and iPhone 16 Plus is reportedly 30% quicker and consumes 35% much less energy than final yr’s telephones. The improved processing energy and low consumption will play a key function in serving to the brand new iPhones run the Apple Intelligence suite of AI options and assist the corporate faucet a fast-growing area of interest.

Apple reportedly started manufacturing its newest iPhones in June this yr and ramped up their manufacturing subsequently earlier than they hit the market this month. This is without doubt one of the the explanation why TSMC has witnessed a major bump in its income of late. The Taiwan-based foundry large’s month-to-month income elevated 33% yr over yr in June, adopted by a forty five% improve in July and a 33% improve in August.

Apple is TSMC’s largest buyer and reportedly accounted for a fourth of the latter’s high line in 2023. So it’s straightforward to see why TSMC’s income has been rising at spectacular ranges of late. After all, Nvidia is one other key TSMC buyer, because the semiconductor large has been tapping the latter’s foundries to fabricate its AI chips. Nonetheless, Nvidia reportedly accounted for 11% of TSMC’s income final yr, which implies that Apple strikes the needle in a extra important means for the foundry large.

Ives expects the manufacturing of iPhone 16 fashions to hit 90 million items in 2024, up by 8 million to 10 million items from final yr’s fashions. This estimated improve in manufacturing by Apple appears to be contributing to TSMC’s spectacular progress in latest months. Extra importantly, we noticed earlier that there’s a big put in base of customers that would transfer to Apple’s AI-enabled iPhones sooner or later. Because of this, TSMC’s largest buyer might proceed to play a central function in driving its progress.

Even higher, stories recommend that Apple might have already bought all of TSMC’s manufacturing capability of 2-nm chips for its 2025 iPhone lineup. It’s price noting that Apple has executed the same factor previously when it bought all of TSMC’s 3nm manufacturing capability for a yr in 2023 in order that it will probably make sufficient iPhones.

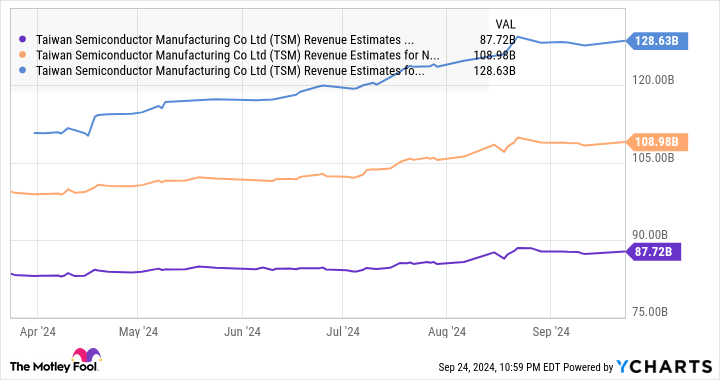

In all, TSMC’s progress prospects within the AI chip market because of prospects reminiscent of Nvidia, together with its tight relationship with Apple, are the the explanation why there was a major improve within the firm’s income estimates for the subsequent three years.

What’s extra, TSMC is buying and selling at 31 instances trailing earnings and 21 instances ahead earnings proper now. It’s cheaper than Apple, which is buying and selling at 34 instances trailing earnings and 30 instances ahead earnings. So, TSMC inventory offers traders a less expensive and extra diversified technique to capitalize on the potential progress in iPhone gross sales, in addition to the secular progress of the AI chip market.

For this reason traders ought to contemplate shopping for this semiconductor inventory proper now earlier than it might fly larger following the 75% features it has already clocked in 2024.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends T-Cellular US. The Motley Idiot has a disclosure coverage.

Prediction: Apple’s iPhone 16 May Develop into a Runaway Hit, and Right here Is 1 Inventory to Purchase Hand Over Fist Earlier than That Occurs was initially revealed by The Motley Idiot