The temporary’s key findings are:

- The 2024 Medicare Trustees Report, launched this spring to little fanfare, contained comparatively excellent news.

- The hospital program’s long-term deficit fell to its lowest degree in years, and the depletion date of its belief fund has been pushed out 5 years.

- And Medicare’s total spending outlook continues to be a lot better than a decade in the past, even underneath assumptions that policymakers curb some price controls.

- That mentioned, Medicare continues to face excessive and rising prices as a result of the general U.S. healthcare system is so costly.

Introduction

Whereas U.S. healthcare prices as a proportion of GDP are by far the best within the developed world, the information from the 2024 Medicare Trustees Report is comparatively good. It’s true that the Hospital Insurance coverage (HI) program faces a long-term deficit, however that deficit is the smallest it has been for greater than a decade and the 12 months of depletion of belief fund reserves has been pushed out 5 years to 2036. Sure, the remainder of the Medicare program would require growing quantities of common revenues, however they’re similar to these anticipated final 12 months. This temporary summarizes the present state of Medicare’s funds.

The dialogue proceeds as follows. The primary part offers an summary of the Medicare program. The second part describes the 2024 Trustees Report projections that use current-law assumptions. The third compares the current-law projections to another situation ready by Medicare’s Workplace of the Actuary. The ultimate part concludes that whereas prices stay excessive, Medicare’s funds – even underneath the choice assumptions – proceed to enhance.

An Overview of Medicare

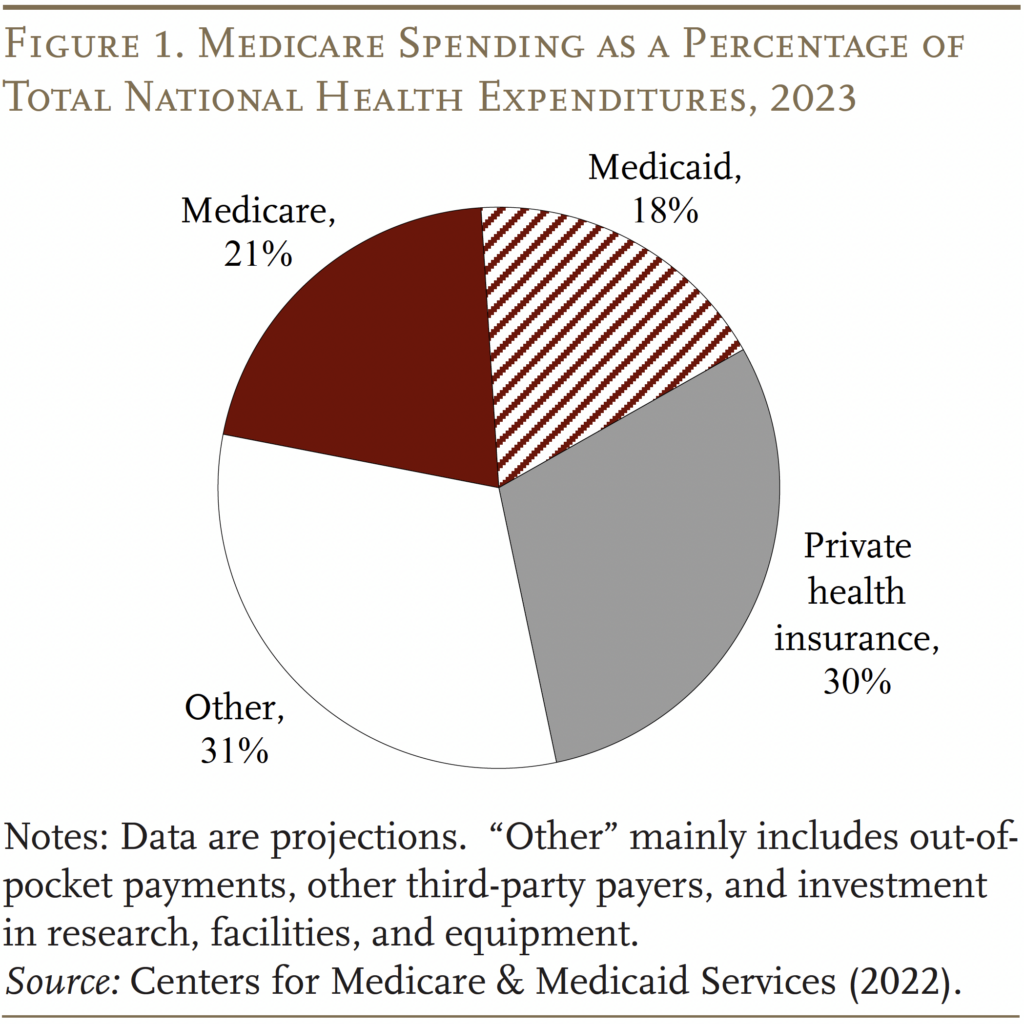

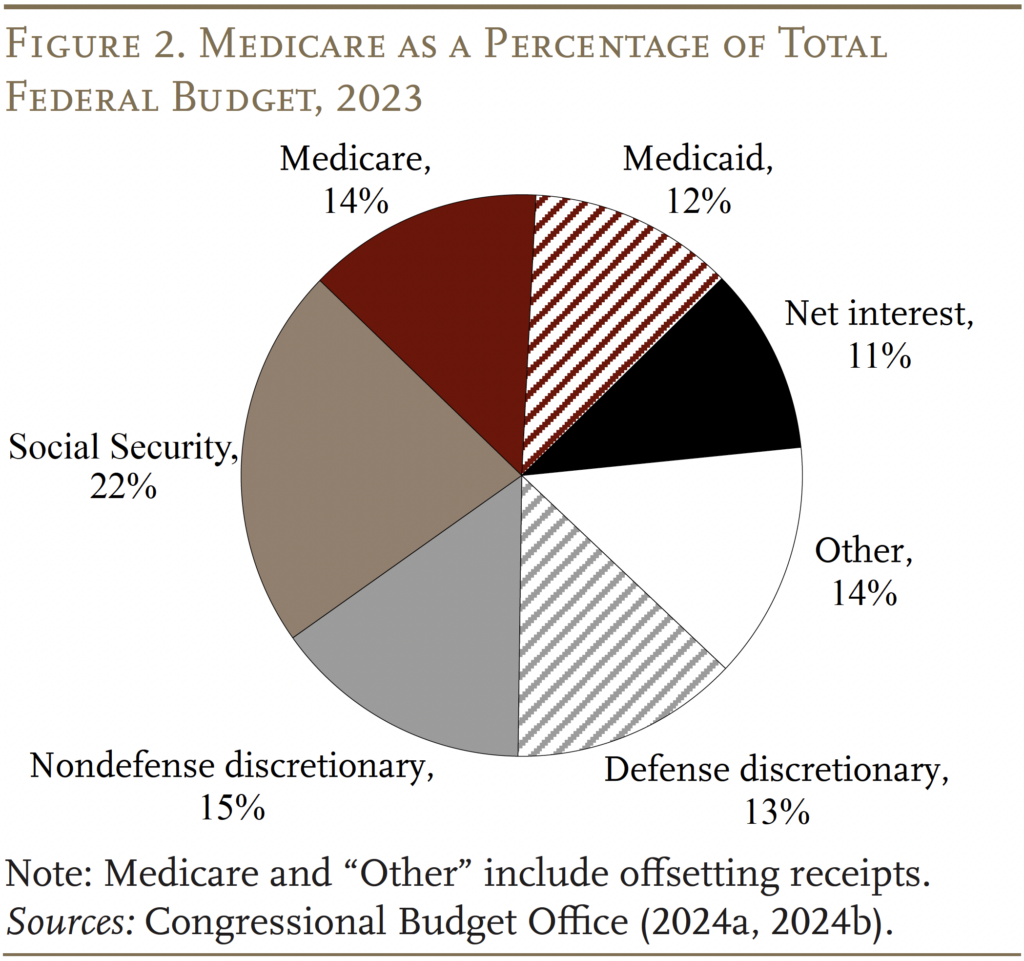

Medicare is the biggest public well being program in the US. It covers just about all individuals ages 65 and older and individuals who obtain federal incapacity insurance coverage advantages. As proven in Figures 1 and a pair of, this system accounts for 22 p.c of nationwide healthcare spending and 14 p.c of the federal funds.

Conventional Medicare consists of two applications. The primary – Half A, Hospital Insurance coverage (HI) – covers inpatient hospital providers, expert nursing amenities, house healthcare, and hospice care. The second – Supplementary Medical Insurance coverage (SMI) – consists of two separate accounts: Half B, which covers doctor and outpatient hospital providers, and Half D, which was enacted in 2003 and covers pharmaceuticals. The preparations are barely extra sophisticated as a result of Medicare additionally consists of Half C – the Medicare Benefit plan possibility, which makes funds to non-public insurance policy that present each Half A and Half B providers.

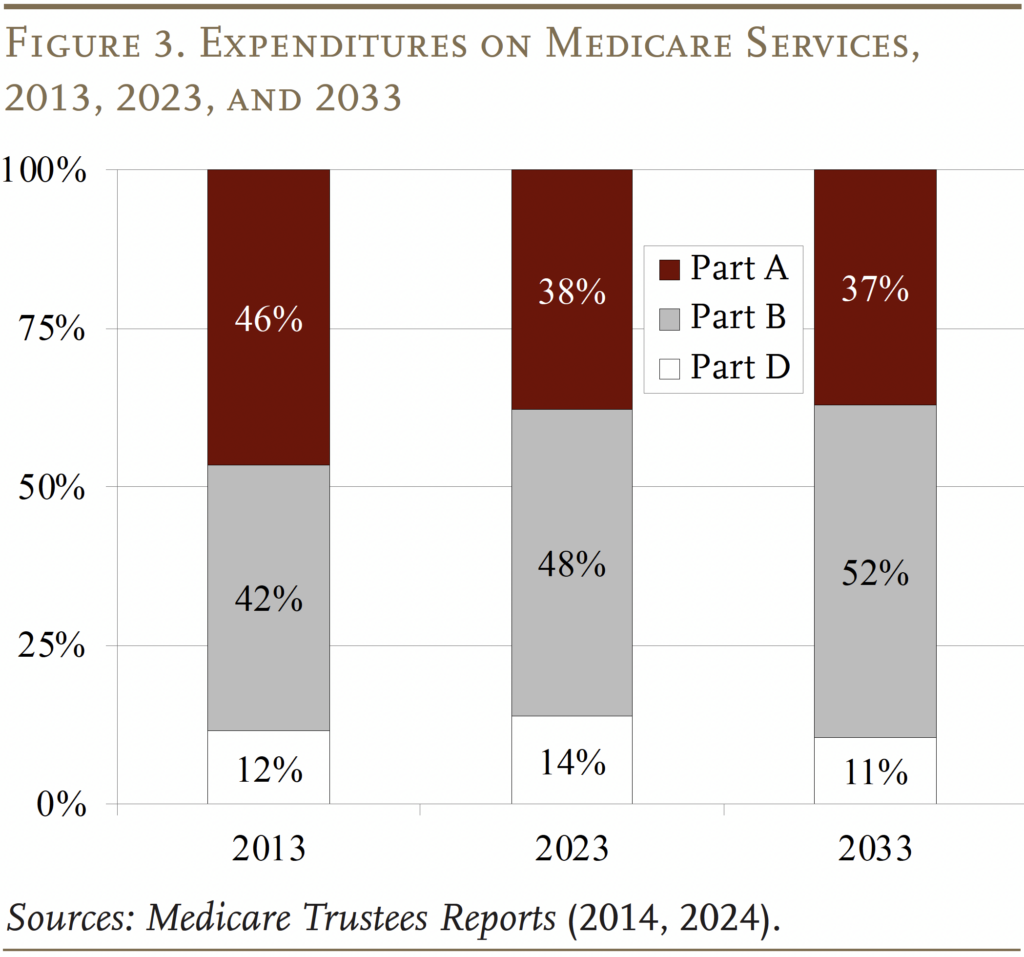

The sample of Medicare expenditures has shifted over time (see Determine 3). In 2013, Half A was the biggest part, accounting for 46 p.c of complete expenditures. By 2023, Half A had declined to 38 p.c, reflecting a shift from inpatient to outpatient providers, and spending on Half B advantages had grown to 48 p.c. This shift is anticipated to proceed sooner or later, in order that Half B will account for greater than half of complete spending in 2033. Spending on Half D prescription drug advantages has been a roughly fixed share of complete spending over time.

Every Medicare program has its personal belief fund and its personal supply of revenues. Half A (HI) is paid for primarily by a 2.9-percent payroll tax on all lined wages (with no cap), shared equally by employers and staff. As well as, high-income staff pay an additional 0.9-percent tax on their earnings above a threshold of $200,000 for singles and $250,000 for married {couples}. Many of the remaining income comes from a portion of the federal earnings taxes that Social Safety recipients pay on their advantages.

Half B is financed by a mixture of participant premiums and common revenues. Most beneficiaries pay the usual premium ($174.70 per 30 days), which is ready by legislation to equal 25 p.c of the estimated common per-person price. Beneficiaries with larger annual incomes pay further quantities that vary from $69.90 to $419.30. The majority of Half B prices are lined by common revenues.

Half D, which covers outpatient pharmaceuticals, is financed primarily by common revenues (73 p.c) and beneficiary premiums (14 p.c), with an extra 12 p.c coming from state funds for beneficiaries enrolled in each Medicare and Medicaid. Increased-income enrollees pay a bigger share of the price of Half D protection, as they do for Half B.

The annual Medicare Trustees Experiences undertaking this system’s funds underneath present legislation. As well as, the actuaries put together another situation that limits the extent to which Medicare funds to hospitals and physicians fall beneath these made by personal insurers.

Medicare Funds underneath Present Regulation

Within the wake of the Reasonably priced Care Act of 2010 (ACA), the Medicare current-law projections have assumed a considerable discount within the progress charge of per-capita well being expenditures relative to historic expertise. Whereas such projections for presidency applications typically show optimistic, Medicare has truly skilled slower spending progress in recent times.

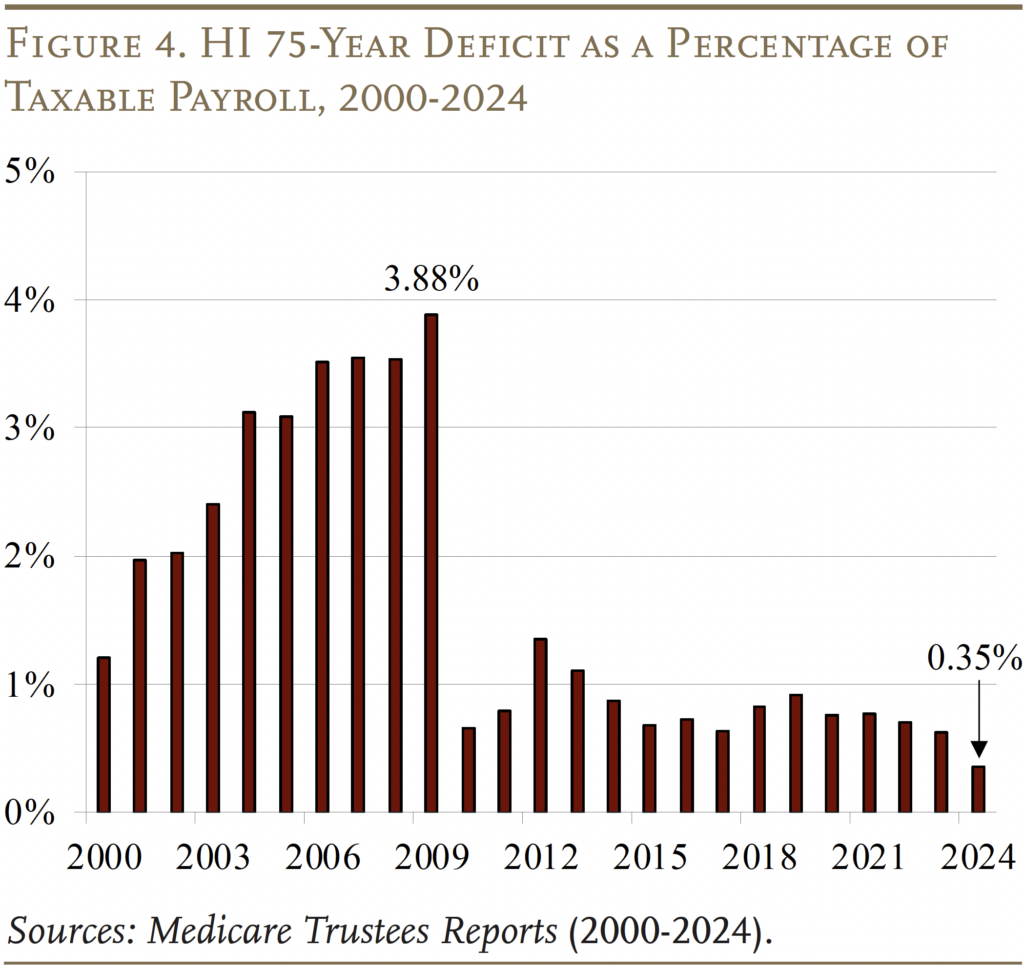

The Outlook for Half A – HI

When it comes to the HI program – the part of Medicare financed by the payroll tax – the decrease projected prices have led to considerably smaller 75-year deficits (see Determine 4). The 2024 Medicare HI deficit of 0.35 p.c of taxable payrolls is the bottom because the passage of the ACA in 2010. The advance since final 12 months’s Trustees Report is because of a number of elements: larger payroll taxes on account of a stronger-than-expected financial system, precise expenditures in 2023 that had been decrease than anticipated, and a coverage change that corrected the accounting for medical schooling bills in Medicare Benefit plans.

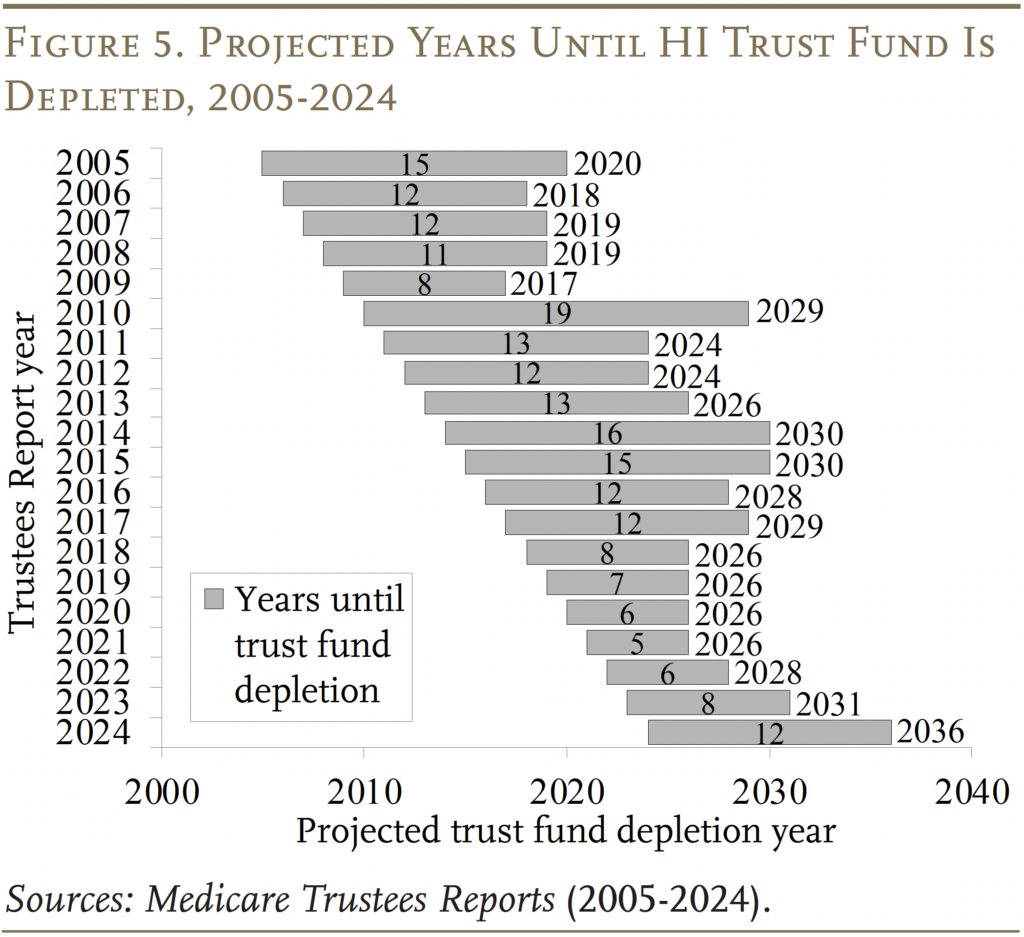

The HI belief fund is projected to deplete its reserves in 2036 – 5 years later than projected in final 12 months’s Trustees Report (see Determine 5). As soon as the fund is depleted, persevering with program earnings shall be adequate to pay 89 p.c of scheduled advantages.

The Outlook for Half B and Half D

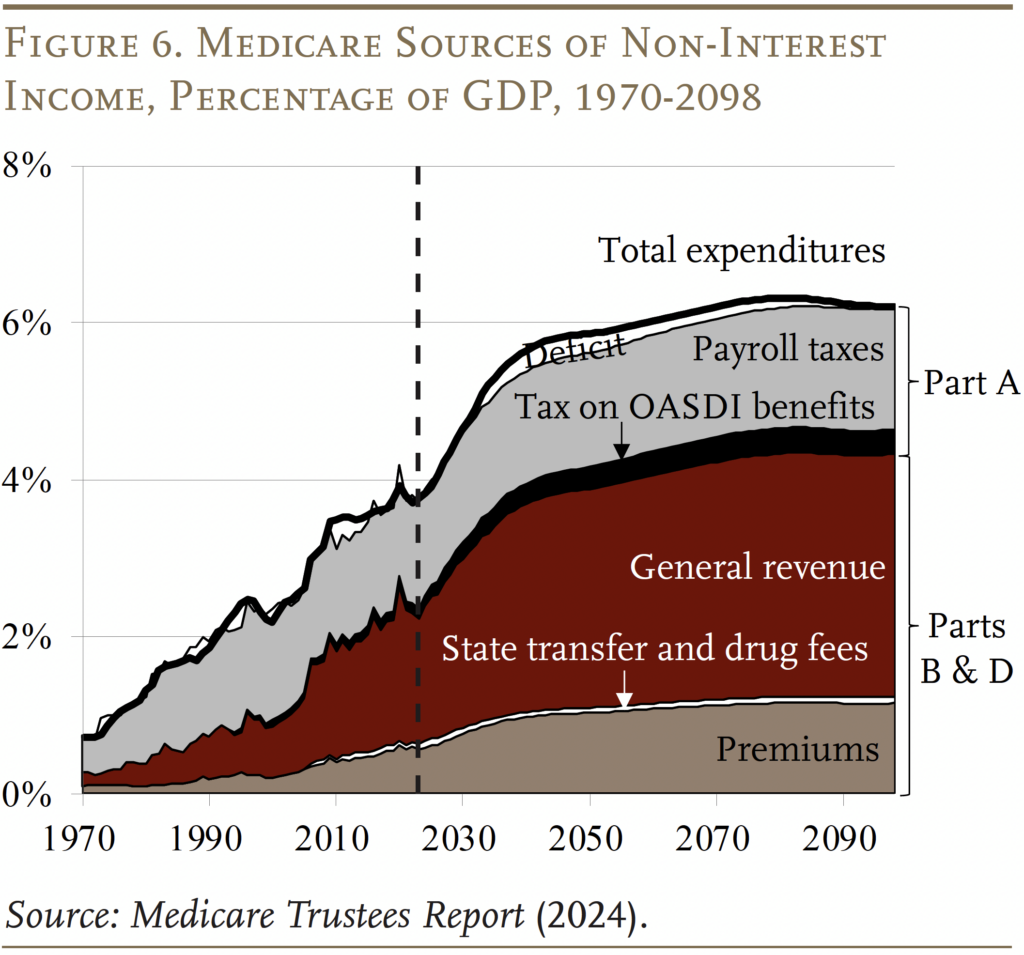

Half B, which covers doctor and outpatient hospital providers, and Half D, which covers pharmaceuticals, are each adequately financed for the indefinite future as a result of the legislation offers for common revenues and participant premiums to fulfill the subsequent 12 months’s anticipated prices. In fact, an growing declare on common revenues places strain on the federal funds and rising premiums place a rising burden on beneficiaries (see Determine 6).

The sample of projected expenditures in comparison with final 12 months is blended. For Half B, outlays are decrease till the 2050s and better thereafter – the results of decrease projected spending within the close to time period on outpatient providers and revised GDP projections. For Half D, expenditures are projected to be larger early within the projection interval after which extra comparable in direction of the tip – the results of revised projections for drug utilization, enrollment, and GDP.

Projections underneath Various Assumptions

The Trustees’ essential projections are based mostly on present legislation and, due to this fact, embrace the influence of cost-control provisions within the ACA and subsequent laws. To the extent that these provisions produce insufficient reimbursement for Medicare suppliers, hospitals and medical doctors may both cease serving Medicare sufferers or shift a few of the prices to non-Medicare sufferers. In response, Congress could discover it essential to curtail the fee reductions. To account for the unsure way forward for the associated fee management measures, the Medicare actuaries additionally produce different projections.

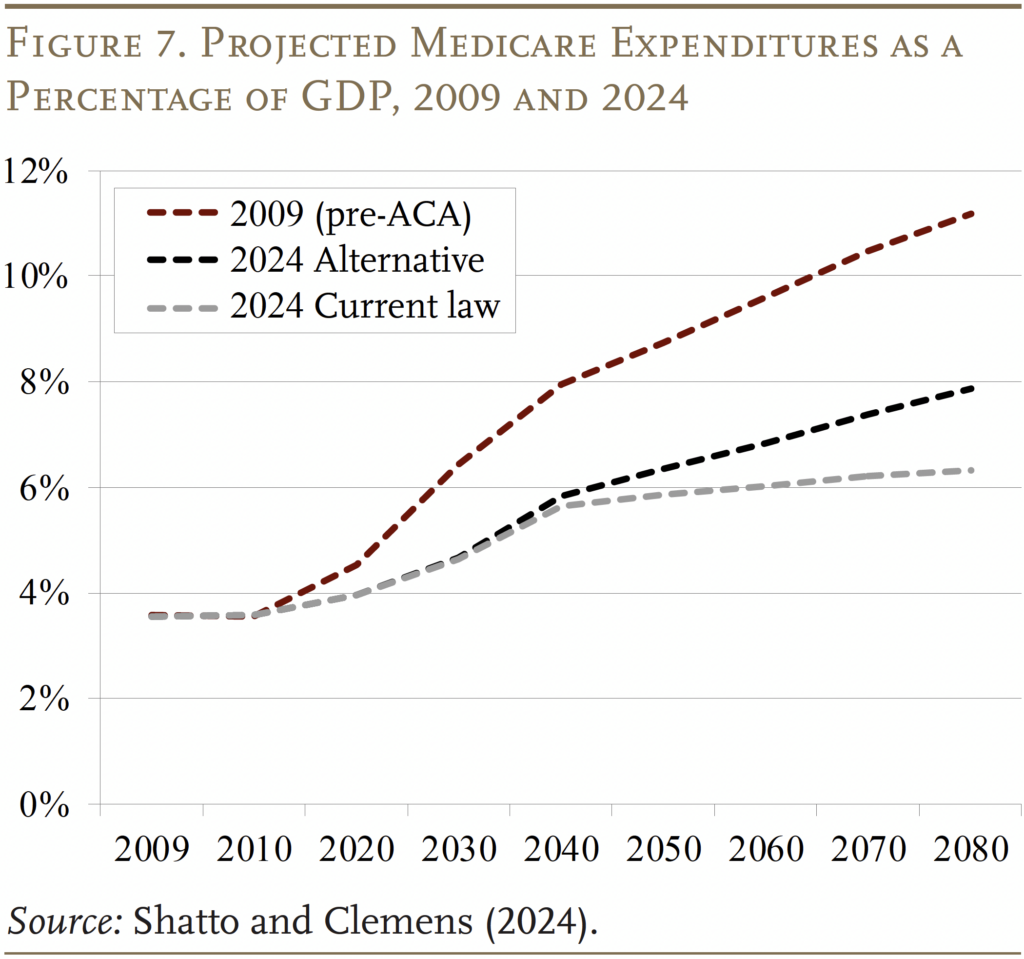

With the comfort of cost-saving provisions in present legislation, expenditures underneath Elements A and B would enhance as a proportion of GDP. (Half D prices weren’t affected by legislated price controls.) By 2090, the entire price of Medicare shall be about 2 p.c of GDP larger underneath the choice than underneath the current-law provisions, however even these larger expenditure numbers are means beneath pre-ACA projections (see Determine 7).

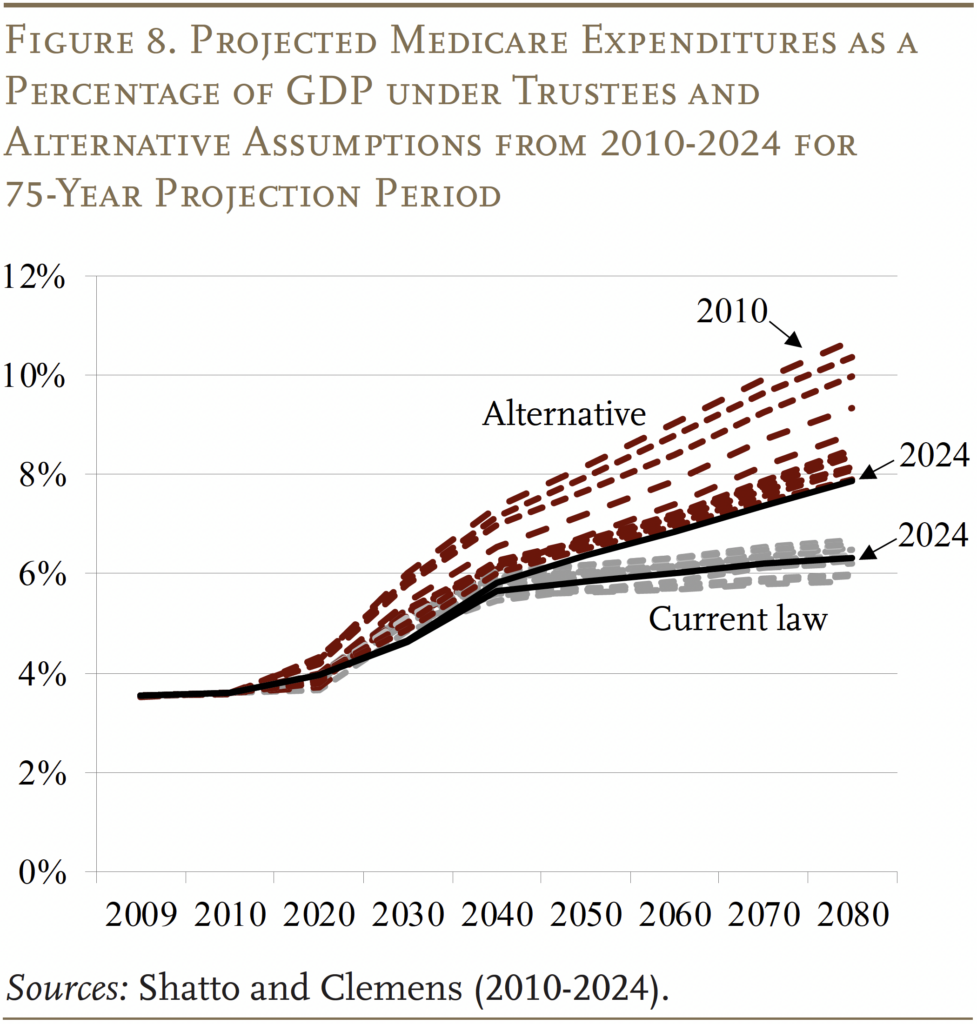

With 15 years of Trustees’ and different projections for comparability, an attention-grabbing query is whether or not they converge or diverge over time. As proven in Determine 8, the current-law projections have remained inside a comparatively slender band, with the 2024 projections roughly within the center. In distinction, the choice projections have declined noticeably, with 2024 on the low finish. Thus, the 2 units of estimates have converged considerably, and the expenditure hole within the 2090s seems to have stabilized at barely lower than 2 p.c of GDP.

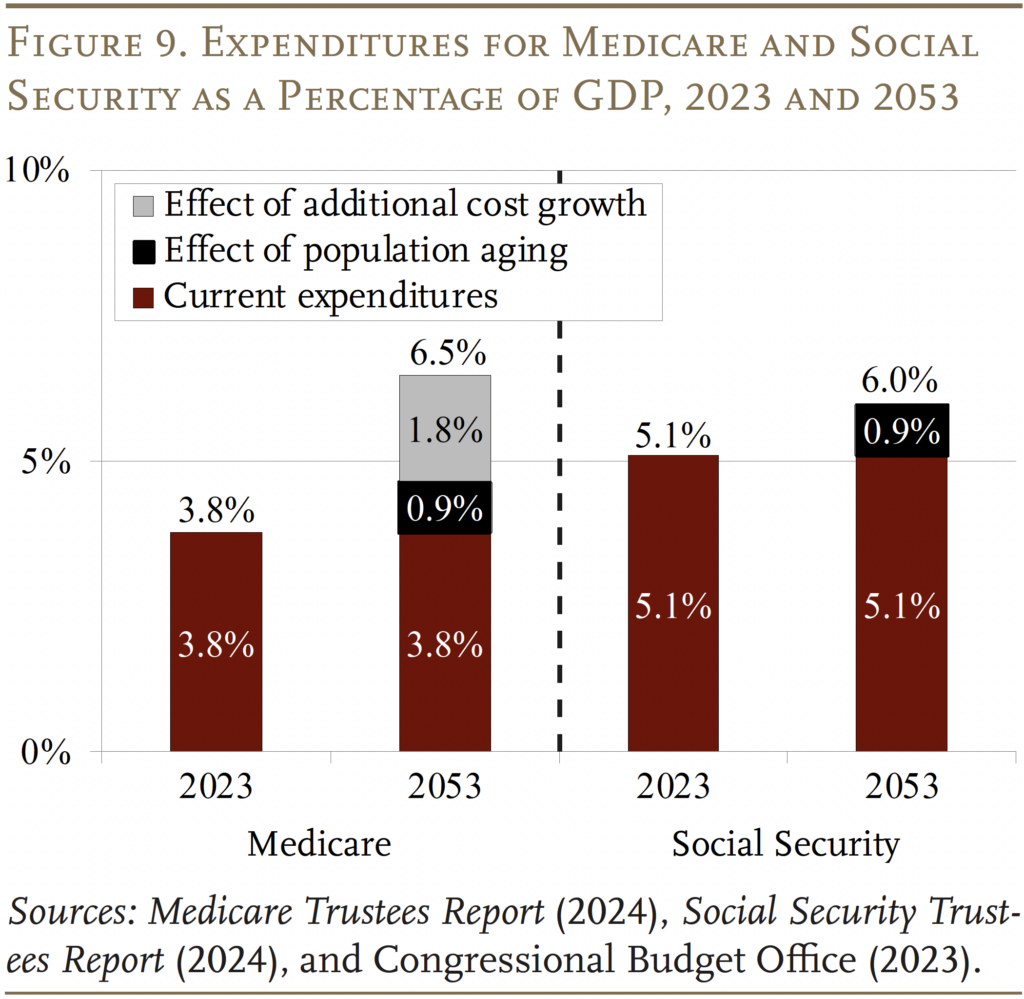

Whereas the 2024 Trustees Report produced comparatively excellent news on the Medicare entrance, this system’s prices are excessive and rising. In distinction to Social Safety, the place inhabitants getting older can clarify all the expansion in expenditures over the subsequent 30 years, an getting older inhabitants explains a lot lower than half of the projected future progress in Medicare (see Determine 9). The remaining comes from the prices for hospital and doctor providers rising sooner than GDP. The underside line is that the one option to management Medicare prices is to get nationwide healthcare spending underneath management.

Conclusion

The 2024 Medicare Trustees Report contained no dangerous information. In truth, in Half A, the depletion of the HI belief fund was pushed out 5 years and the HI deficit was on the low finish of post-ACA numbers, whereas expenditures for Half B and Half D had been similar to these within the 2023 report. That mentioned, Medicare does face vital financing challenges: it operates in a rustic with terribly excessive healthcare prices.

References

Facilities for Medicare & Medicaid Companies. 2000-2024. Annual Report of the Boards of Trustees of the Federal Hospital Insurance coverage and Federal Supplementary Medical Insurance coverage Belief Funds. Washington, DC: U.S. Division of Well being and Human Companies.

Facilities for Medicare & Medicaid Companies. 2022. Nationwide Well being Expenditure Accounts. Washington, DC: U.S. Division of Well being and Human Companies.

Congressional Funds Workplace. 2024a. Historic Funds Knowledge. Washington, DC.

Congressional Funds Workplace. 2024b. “The Funds and Financial Outlook: 2024 to 2033.” Washington, DC.

Congressional Funds Workplace. 2023. “The 2023 Lengthy- Time period Funds Outlook.” Washington, DC.

Shatto, John D. and M. Kent Clemens. 2010-2024. “Projected Medicare Expenditures underneath an Illustrative Situation with Various Cost Updates to Medicare Suppliers.” Washington, DC: U.S. Division of Well being and Human Companies.

U.S. Social Safety Administration. 2024. The Annual Experiences of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.