Adani Ports & Particular Financial Zone Ltd – India’s foremost port operator

Included in 1998 and headquartered in Ahmedabad, Adani Ports & Particular Financial Zone Ltd. (APSEZ) is India’s largest non-public sector port operator. As a part of the Adani Group, APSEZ manages 15 home and 4 worldwide ports, together with India’s largest port at Mundra. With an goal to grow to be world’s largest transport utility firm, APSEZ at present owns 627 MMT cargo dealing with capability, 111 marine flotillas, 127 trains, 12 multi-modal logistics parks, 690 km of rail tracks, 2.4 mn sq. ft. of warehousing house, and 1.2 MMT of grain silos.

Merchandise and Providers

- Ports and Terminals: APSEZ manages roughly 24% of India’s port capability.

- Industrial Land: House to India’s largest port-based manufacturing hub, Mundra Industrial Land.

- Logistics: Consists of logistics parks, street logistics, rail operations, warehousing, and auto & agri logistics.

- Dredging: With a fleet of 23 dredges and help gear, the corporate provides dredging and reclamation options for port and harbour development.

Subsidiaries: As of FY24, Adani Ports & Particular Financial Zone Ltd. (APSEZ) has 106 subsidiaries and 27 joint ventures.

Development Methods

- Established Place: In FY24, APSEZ managed 27% of India’s general cargo and 44% of container cargo, with a 21% YoY development in home cargo quantity.

- File Volumes: Ten home ports, together with Mundra, achieved record-high cargo volumes, with Mundra dealing with 7.4 million TEUs, a 15% enhance over its closest competitor.

- Credit score Ranking: APSEZ obtained a ‘AAA’ ranking from CARE Rankings, turning into the primary non-public company infrastructure firm in India to realize this.

- Strategic Acquisitions: Accomplished acquisitions of Gopalpur and Karaikal ports, and shaped a JV with MSC for Ennore Container Terminal.

- Growth Initiatives: Investing in Dhamra LNG Terminal, CB3 berth growth at Hazira Port, and growing India’s largest transhipment port at Vizhinjam.

- Logistics Enhancements: Launched trucking section with 900 vehicles for last-mile connectivity and added 34 rakes, 3 MMLPs, 2 agri silos, and new warehouses in Mumbai and Indore.

Q4FY24

- Whole Revenue: Rs. 6,897 crore, up 19% from Rs. 5,797 crore in Q4FY23.

- EBITDA: Rs. 4,029 crore, a 23% enhance from Rs. 3,271 crore in Q4FY23.

- Internet Revenue: Rs. 2,015 crore, a 77% rise from Rs. 1,139 crore in Q4FY23.

- Cargo quantity: Elevated by 26% in the course of the quarter.

FY24

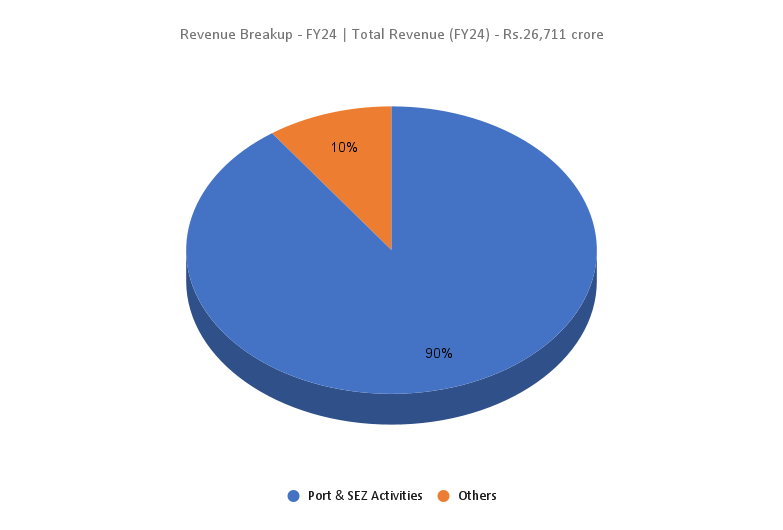

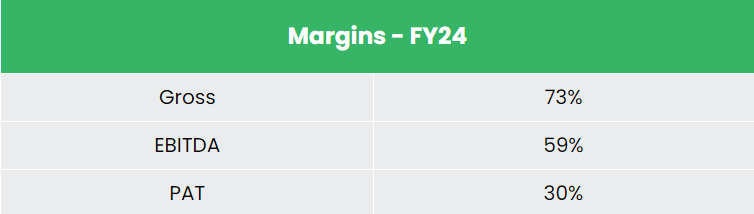

- Income: Rs. 26,711 crore, a 28% enhance from FY23, with 30% development in ports and 19% in logistics.

- EBITDA: Rs. 15,751 crore, up 44% from the earlier 12 months.

- Internet revenue: Rs. 8,104 crore, marking a 50% increase YoY.

- EBITDA margin: 59%, and web revenue margin: 30%, the best amongst friends.

Monetary Efficiency (FY21-24)

- Income and PAT CAGR: 29% and 21% over FY 21-24.

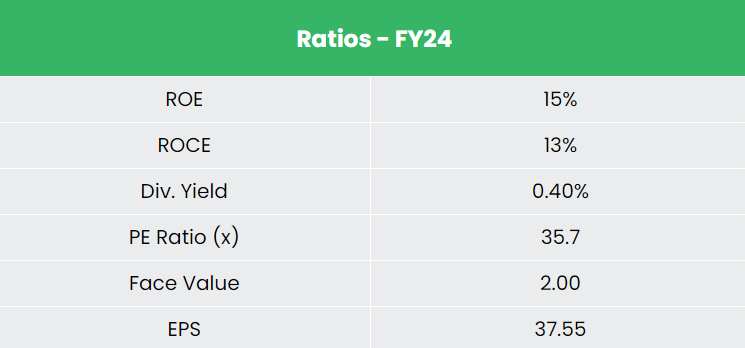

- Common 3-year ROE and ROCE: 16% and 11% for FY21-24.

- Debt-to-equity ratio: 0.94.

Trade outlook

- Maritime transport handles 95% of India’s buying and selling by quantity and 70% by worth.

- The Indian ports and delivery business is essential for commerce and commerce development.

- India, with a 7,517 km shoreline, is the sixteenth-largest maritime nation.

- The federal government provides incentives to help port improvement, inland waterways, and shipbuilding.

Development Drivers

- Funds Allocation: US$ 281.23 million (Rs. 2,345.45 crore) allotted to the Ministry of Delivery within the Interim Union Funds 2024-25.

- FDI Coverage: 100% FDI allowed beneath the automated route for port and harbour tasks.

- Sagarmala Program: Authorities initiative for port-led improvement and development of logistics-intensive industries.

Aggressive Benefit

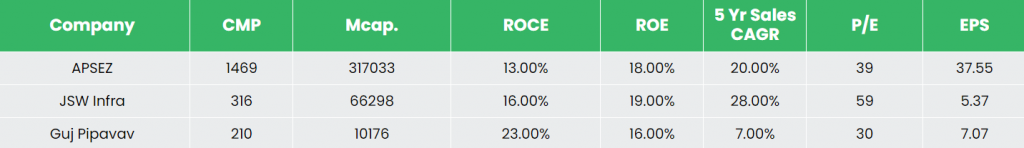

In comparison with the rivals like JSW Infrastructure Ltd, Gujarat Pipavav Port Ltd and many others.

APSEZ is probably the most undervalued inventory within the massive cap section delivering constant returns on invested capital and growing earnings in proportion to its gross sales development.

Outlook

- APSEZ is ready to outperform India’s general development with its strategic port portfolio and built-in logistics.

- Goals to grow to be the world’s largest non-public port firm by 2030 and carbon impartial by 2025.

- FY25 steerage: 460-480 MMT cargo volumes, Rs. 29,000-31,000 crore income, and Rs. 17,000-18,000 crore EBITDA.

- Entry into the transhipment port section, significantly Vizhinjam Port, is anticipated to spice up volumes considerably.

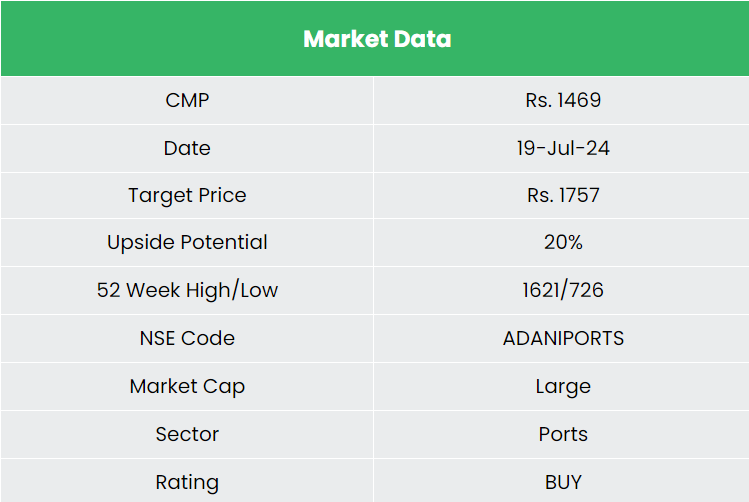

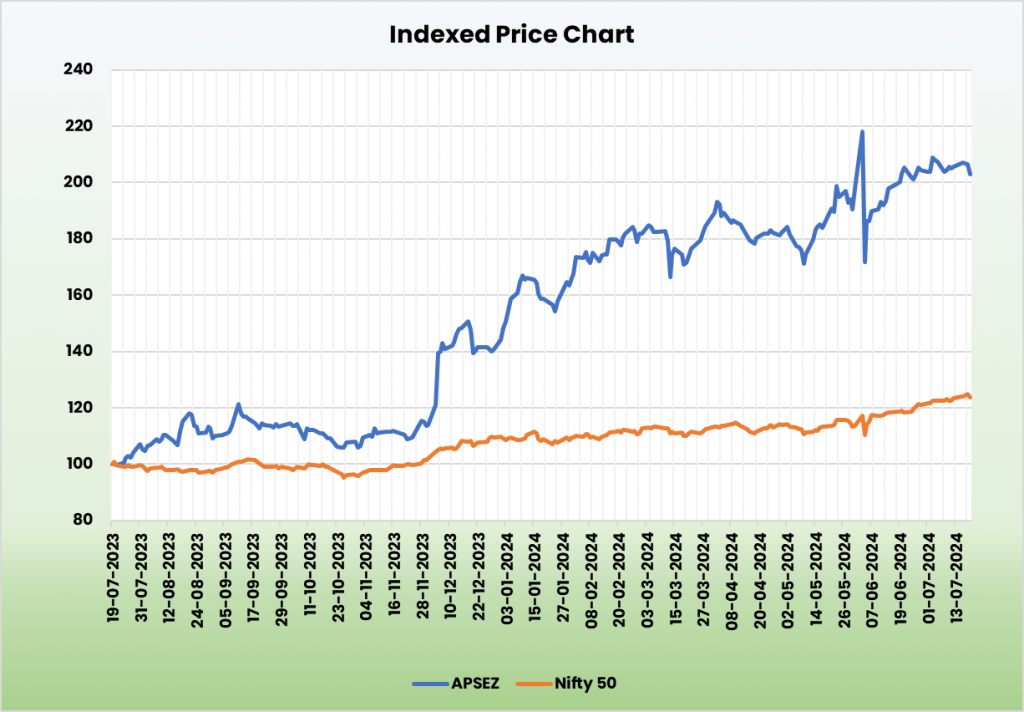

Goal Worth of ADANIPORTS

APSEZ’s strategic investments in ports and logistics are anticipated to strengthen the corporate’s ongoing development trajectory. We advocate a BUY ranking within the ADANIPORTS inventory with the goal worth (TP) of Rs. 1,757, 32x FY26E EPS.

Dangers

- Financial Danger: Slowdowns in key sectors might cut back cargo motion, affecting port utilization and income.

- Local weather Danger: Bodily dangers from climate-related occasions (e.g., sea degree rise, storms) might impression port operations.

- Monetary Danger: Points resembling declining credit score high quality, liquidity issues, or debt reimbursement failures might have an effect on monetary stability.

Observe: Please word that this isn’t a suggestion and is meant just for instructional functions. So, kindly seek the advice of your monetary advisor earlier than investing.

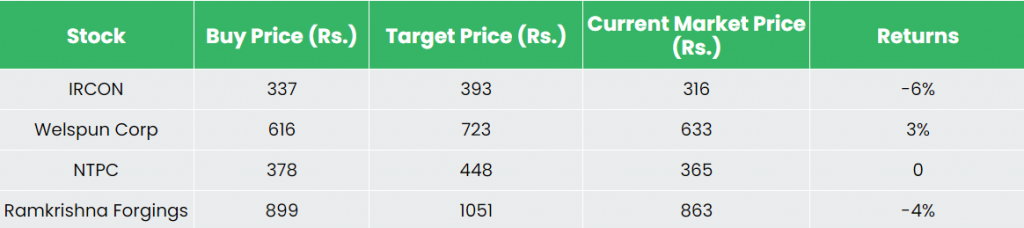

Recap of our earlier suggestions (As on 19 July 2024)

Different articles chances are you’ll like