American Specific Platinum Reserve Credit score Card is positioned as a Premium Credit score Card in Amex lineup, standing one step beneath the Platinum Cost Card (steel). The Amex Reserve Credit score Card was by no means a go-to card previously for many due to it low rewards and excessive annual payment.

Whereas these concern nonetheless stay even after the present refresh, some modifications have been made to the product to make it barely higher for some. Right here’s all the things it’s essential know in regards to the AmEx Reserve Credit score Card in its newest kind in 2024:

Overview

| Sort | Premium Credit score Card |

| Reward Fee | 1% – 3% |

| Annual Price | 10,000 INR + GST |

| Finest for | Month-to-month Spends of 50K INR |

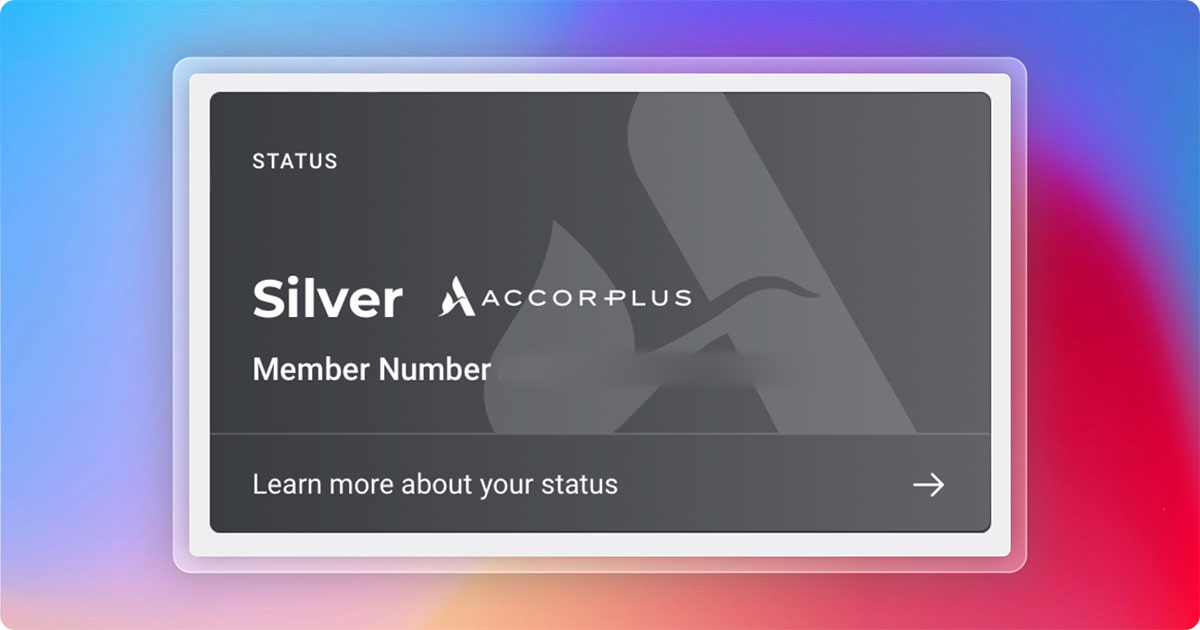

| USP | Accor Plus Membership |

The Accor Plus membership is the USP of the Reserve Credit score Card, as there is just one different card that provides this membership, which is the Axis Reserve. Let’s discover extra about Accor Plus little later on this article.

Becoming a member of Charges

| Becoming a member of Price | 10,000 INR + GST |

| Welcome Profit | 11,000 Reward Factors (~5,500 INR worth) |

| Renewal Price | 10,000 INR + GST |

| Renewal Price waiver | On spending 10 Lakhs |

| Renewal Profit | Nil |

Anticipating 10L spend for the renewal payment waiver is unreasonable for the advantages it affords. Nonetheless, you may get it waived for a lot much less with a retention provide, extra on that beneath.

Apply via the hyperlink on the web page to get additional 4,000 Referral Bonus MR factors (~2,000 INR Worth) submit 5K INR spend in 90 days.

Design

The brand new design appears nice on the display screen and fairly good in actuality too.

Nonetheless, the identify on the cardboard form of disturbs the attractive design, particularly when your identify just isn’t accurately aligned in middle, not like mine.

Rewards

| SPEND TYPE | REWARD POINTS | REWARD RATE |

|---|---|---|

| Common Spends | 1 MR / 50 INR | 1% – 2% |

| Utility, Insurance coverage, Gasoline & EMI | No Rewards | Nil |

The reward fee is predicated on the belief that one can get 1MR=0.50 INR simply with Marriott Factors switch however getting 1MR=1 INR isn’t simple in most circumstances.

So, a 1% reward fee similar to most different Amex playing cards, is sort of a disappointment, however properly, that’s why the milestone profit exists.

Month-to-month Milestone

| SPEND REQUIREMENT | MILESTONE BENEFIT | VOUCHER TYPE |

|---|---|---|

| 50,000 INR | 1,000 INR (2% worth) | Flipkart, BookMyShow, MakeMyTrip & extra |

- Enrolment is necessary to avail the profit

Whereas the revamped milestone profit is healthier than earlier than, life would have been significantly better if it was a quarterly/annual profit.

Nonetheless, it’s a great way to earn 2% on spends that wouldn’t earn rewards in any other case.

On condition that there are such a lot of restrictions on different financial institution bank cards in 2024, this card might assist get some worth again on these sort of spends as properly.

Accor Plus

- As much as 50% off on eating throughout Asia Pacific

- Accor ALL (Accor’s loyalty programme) – Silver Standing

- 20 Standing Nights in Accor ALL Program to get nearer to Gold or past

- Upto 50% off on rooms with crimson scorching rooms sale

American Specific Reserve Credit score Card comes with an “Accor Plus Traveller” Membership as complimentary. Be aware that it doesn’t provide a complimentary evening keep, or different eating/keep low cost vouchers.

The first use case of Accor Plus membership is the eating profit with which you may get 50% off on eating (if 2 particular person dine).

That is a tremendous profit that would save few hundreds on eating once you’re travelling overseas with household.

Whereas it’s meant for Asia Pacific solely, surprisingly it additionally works in few different international locations as properly, like in South Africa & Egypt the place I availed it few months in the past. Maybe it’s simply hotel-specific once you transcend APAC.

Taj Epicure

- 25% low cost on meals & beverage and Qmin

- 20% low cost on Jivas Spa & Salon

- Complimentary celebration cake (500 gms) in birthday month

- Pleased Hours 1:1 at Taj Membership Lounge, legitimate twice

- And few extra vouchers

Taj Epicure Plus is the personalised membership by Taj Lodges for American Specific cardholders and it’s barely higher in comparison with what we get with ICICI Emeralde Non-public Metallic (or) HSBC Premier.

Nonetheless, similar to Accor Plus, Taj Epicure additionally doesn’t include the complimentary evening profit.

That stated, the 20% low cost on Spa and 25% off on f&b are the advantages that some Taj loyalists that I do know can’t reside with out.

Be aware that you just may must order the celebration cake 1 day prior, as generally the resort doesn’t have it prepared the identical day, because it was the case not too long ago with me at Taj Exotica, Goa.

Golf

- 2 Video games per thirty days

- Spend Requirement: 50,000 INR (two months prior)

Traditionally, Amex Reserve was primarily used for Golf and now Amex has determined to place an finish to it, actually.

Spending 2 months prior, monitoring it, and reserving them later just isn’t one thing that one can simply do.

They might have as an alternative merely enabled the complimentary entry primarily based on annual spend and saved cardholders from processing pointless calculations.

Airport Lounge Entry

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Home (Main) | Amex | 12/12 months (3/qtr) |

| Worldwide (Main) | Precedence Cross | 2/12 months |

The brand new addition of Worldwide lounge entry is nice to see on the Reserve card however the limits are approach too low for the payment it comes with.

If one wants home & worldwide lounge entry for self and add-on, HDFC Regalia Gold is the one you want.

That apart, Amex Reserve not affords entry to Amex lounges in Mumbai and Delhi. Because of Plat Cost Cardholders who’re travelling left and proper, leaving no room for others to step in.

Different Advantages

- Eazydiner Prime membership (25% financial savings at most eating places)

- No Gasoline surcharge at HP gasoline pumps (limits apply)

- 3X on Reward Multiplier

Companion Card Standing

Most Amex Reserve Cardholders that I do know have gotten it as a companion card issued as complimentary with Amex Platinum Cost Card.

Nonetheless, submit the refresh of Reserve card advantages, now Amex has dropped this companion card profit on Amex Plat Cost.

To those that already maintain Reserve as a companion card, it could proceed as is, so long as the Plat Cost is energetic.

Retention Supply

Aside from card spends being the first issue, Amex additionally retains altering the retention provide on occasion.

The excellent news is that 100% renewal payment waiver can be a part of the retention provide, as of now.

One may must have spent ~5L (unsure of newest rule) for this, however at occasions you may as properly get a spend linked goal (often 1L-2L spend in 90 days) to get the 100% renewal payment waiver.

Methods to apply?

Making use of on-line is the quickest strategy to get American Specific Playing cards in India.

Presently, probably the greatest affords you could possibly get is 4,000 extra bonus factors as part of Restricted Interval Supply once you apply utilizing a referral hyperlink.

Apply via the hyperlink on the web page & you’ll get 11,000 MR Factors (INR 5,500 Worth) on 25K INR spend in 90 days + 4000 Referral Bonus MR factors (INR 2,000 Worth) on 5K INR spend in 90 days.

Bottomline

The re-imagined American Specific Platinum Reserve Credit score Card in 2024 is actually higher than what it was once previously. It’s good for many who could make use of Accor Plus profit together with month-to-month milestones.

However apart from the Accor Plus and some different advantages, American Specific Plat Journey Card is a significantly better alternative because it’s not solely gentle on the pocket but additionally can get you greater than 2X the reward fee on Reserve.

So, the Amex Reserve with refreshed options holds good just for a small section, leaving a number of room to develop if it wants to draw a bigger section. Maybe American Specific has to re-imagine the product but another time.

Till then, Amex might take into account doing a little small additions like including Accor ALL as factors switch, which even at 2:1 would make the cardboard promote like wildfire.