Axis Financial institution has very many premium and tremendous premium bank cards and likewise the Atlas Credit score Card which serves as a starter for these exploring the world of airmiles.

Axis Financial institution Atlas Credit score Card is one in every of a form, fairly distinctive the best way it really works however on the similar time seems sophisticated for many. That mentioned, right here’s a easy information that will help you perceive it higher and use it successfully, when you select to use for one.

Overview

| Sort | Journey Credit score Card |

| Reward Charge | 4% to 18% |

| Annual Charge | 5,000+GST |

| Greatest for | Direct Resort & Airline Spends |

| USP | Tiered advantages based mostly on spends |

Ideally its finest fitted to most premium bank card customers with a give attention to journey and it additionally serves as a great alternative for Axis Magnus in 2024 put up it’s devaluation.

Charges

| Becoming a member of Charge | 5,000 INR+GST |

| Welcome Profit | 2500 Edge Miles (5,000 INR worth simply) |

| Renewal Charge | 5,000 INR+GST |

| Renewal Profit | 0 Edge miles (Silver) 2,500 Edge miles (Gold) 5,000 Edge miles (Platinum) |

| Renewal Charge waiver | Nil |

The welcome profit of two.5K edge miles might be transferred to ITC (amongst others) and might be redeemed for five,000 INR value of keep, meals, and many others at ITC motels.

Or, when you’re into Accor motels (Ibis, Novotel, Sofitel, Fairmont, Raffles, and many others) then you definitely would get about 9,000 INR in worth.

It means you’re paying 5K INR and getting worth upto 9K INR – that’s like an in a single day achieve of fifty% in worth.

Whereas there isn’t a renewal charge waiver choice on this card, the advantage of the Atlas Credit score Card is that it provides engaging renewal profit when you spend nicely throughout the card anniversary 12 months.

Design

The design seems not solely neat, easy and exquisite but additionally related to the kind of card, so is the selection of identify: Atlas.

Should you’ve had the cardboard in hand, you’ll agree that the cardboard seems and feels pretty much as good as you see within the picture above.

Rewards

Not like all different Axis Credit score Playing cards, Axis Atlas doesn’t earn “Edge Rewards”, however it earns “Edge Miles”.

It’s a separate miles stability that displays on the Axis Edge Rewards account and isn’t linked with some other product up to now.

| SPEND TYPE | Edge Miles | REWARD RATE (EDGE REWARDS PORTAL) | REWARD RATE (POINTS TRANSFER) | Max. Cap (per 30 days) |

|---|---|---|---|---|

| Common Spends | 2 / 100 INR | 2% | ~4% | – |

| Axis Journey Edge Portal, Airways & Lodges (Direct) | 5 / 100 INR | 5% | ~10% | 2L INR Spend |

It’s to be famous that when you intend to pre-pay for flights/motels utilizing journey edge portal, Axis Magnus [burgundy variant with 5:4] could be a greater choice.

Excluded spends for milestone profit together with respective MCC’s:

- Pockets: 6540

- Lease: 6513

- Gold/ Jewelry: 5094, 5944

- Insurance coverage: 6300, 6381, 5960, 6012, 6051

- Authorities Establishments: 9222, 9311, 9399, 9402

- Utilities: 4814, 4816, 4899, 4900

- Gas: 5541, 5542, 5983

Whereas the exclusions are anticipated, excluding gold/insurance coverage/utilities are completely unfair.

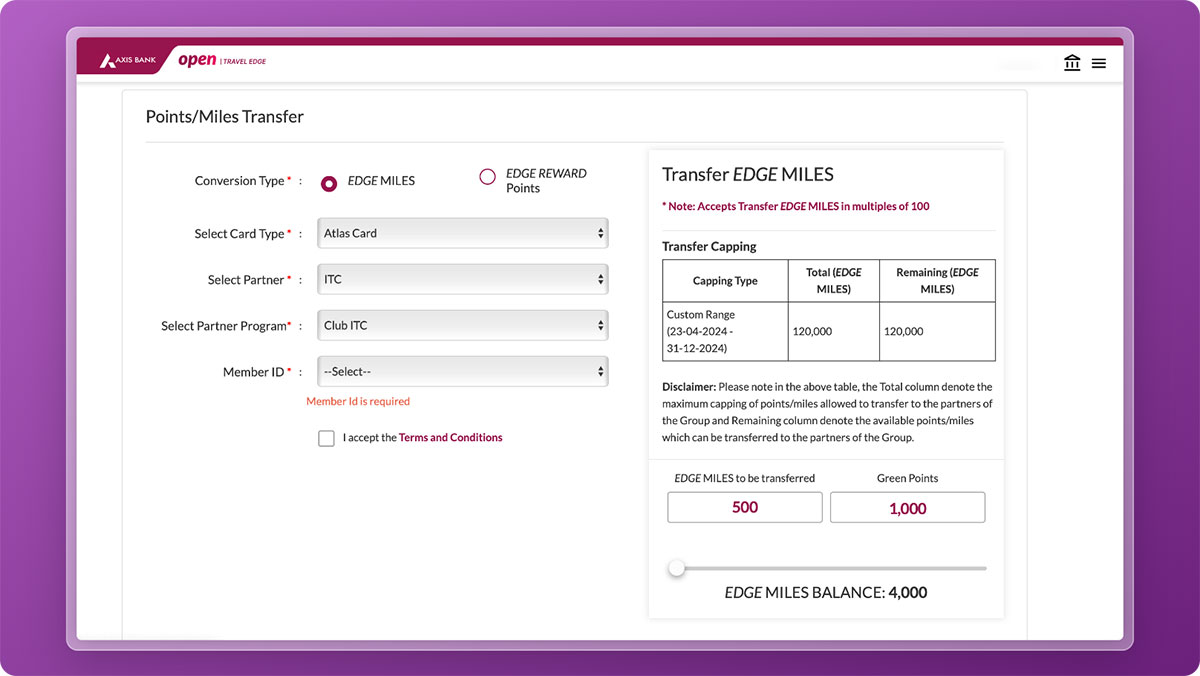

Redemption

There are a number of choices to redeem edge miles, broadly divined into two, as under:

- Redeem on Journey Edge portal: 1:1 (for flights/motels)

- Switch Edge miles to airline/resort companions

Whereas redeeming on journey edge portal is the tremendous easy choice with a static worth, we don’t get nice worth there.

As an alternative, one can switch the factors to airways and motels and get fairly good worth. Right here’s a fast take a look at the switch ratio.

| Airline | Conversion Charge (Edge Miles:Accomplice Miles) |

|---|---|

| All Airways* | 1:2 |

| Lodges: IHG & ITC | 1:2 |

| Resort: Marriot Bonvoy | 2:1 |

- Airways: United, Singapore Airways, Turkish, Etihad, Qatar, Air France, Ethiopian, Vistara & Spicejet

As you’ll be able to see, the switch ratio is 1:2 throughout all airways & motels, aside from Marriott Bonvoy which is at 2:1. So it’s not sensible to switch these factors to Marriott from Atlas Credit score Card.

Should you’re into Marriott, you’ll be able to nonetheless switch your factors to ITC after which to Marriott (2 ITC factors = 3 MB factors), however that is restricted to 10K factors per quarter or so.

Usually, ITC is the goto choice for many cardholders to get higher worth, because it’s lot simpler and likewise permits to switch the factors additional to Marriott Bonvoy.

Should you want to discover worldwide airline redemptions, our easy guides are right here: Singapore Airways – KrisFlyer & United Airways – MileagePlus (extra to comply with quickly).

Redemption Capping

- Group A: 30,000 Edge Miles (60K associate miles)

- Group B: 1,20,000 Edge Miles (2.4L associate miles)

Whereas the cardboard is closely devalued (which was anyway anticipated), above limits are honest sufficient for a card that sells for 5K INR with eligibility not being an issue for many within the phase.

Milestone Profit

| Spend Requirement | Milestone Profit |

|---|---|

| 3 Lakhs | 2,500 Edge Miles |

| 7.5 Lakhs | 2,500 Edge Miles |

| 15 Lakhs | 5,000 Edge Miles |

Assuming you’re capable of do “common” spends of 15 Lakhs, you’ll get 40,000 Edge Miles (30K+10K) that may be simply valued at 80,000 INR (like with ITC) and even ~1,44,000 INR (Accor & airline candy spots), with a tremendous reward fee.

Do notice that the excluded MCC’s for incomes common Edge Miles are relevant for Milestone profit as nicely.

Membership Tiers

| Membership Tier | Annual Spends |

|---|---|

| Silver | < Rs. 7.5 lacs |

| Gold | Rs. 7.5 lacs to Rs. 15 lacs |

| Platinum | Rs. 15 lacs & above |

Axis Atlas Credit score Card comes with membership tiers and it’s a novel system within the bank card business.

Whereas it used to make sense prior to now due to it’s airport concierge and airport switch providers, it now not is smart to complicate the product with such membership tiers, although it exists for the sake of lounge entry and the renewal profit.

Airport Lounge Entry

The complimentary lounge entry limits on Axis Atlas Credit score Card works as per the tiered system talked about under.

| Membership Tier | Home Visits | Worldwide Visits |

|---|---|---|

| Silver | 8 | 4 |

| Gold | 12 | 6 |

| Platinum | 18 | 12 |

- Be aware: Above visits covers each Main cardholder + friends, if any.

So, as you see above, the excellent news in regards to the Atlas Card is that we will avail these complimentary lounge entry each for main cardholder & friends, identical to the Axis Reserve Credit score Card.

Nonetheless, notice that typically you could be charged for the friends (glitch) and if that occurs, simply drop them an electronic mail requesting for the reversal simply incase if the fees usually are not auto reversed as confirmed by Axis buyer assist.

Do you have to take Atlas?

For all those that had been having fun with the Magnus at 5:4 factors switch in 2023 and unable to get the “Magnus for Burgundy” put up devaluation, Axis Atlas is a superb choice to absorb 2024 even after the devaluation of Atlas in 2024.

Because the rewards are actually capped, including Amex Platinum Journey Card would make sense for many travellers, because it’s being issued as “First 12 months Free”.

My Expertise

I bought the Axis Atlas Credit score Card when it was initially launched. The devoted card administration dashboard for Atlas on Cell & net-banking works splendidly nicely.

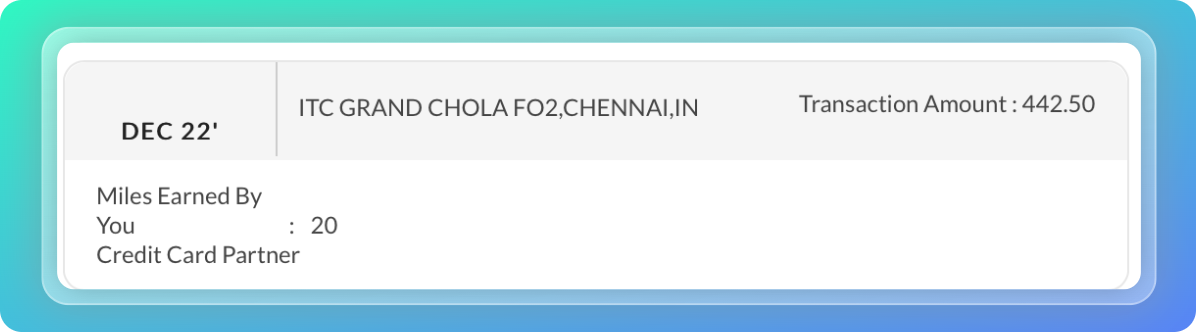

Other than that, the 5X rewards will get credited for resort spends on time, hopefully so for airways. I did a small txn few months in the past to test the identical and it does work as anticipated.

Eligibility

- Annual Revenue: 9 Lakhs & above

- Current different Financial institution Credit score Card: ~3 Lakhs (or) above restrict

It’s traditionally simple to get authorized, so chances are you’ll not want to fret about it. Additional, to not overlook that you could be maintain upto 3 Axis Financial institution Credit score Playing cards concurrently at any time limit.

Find out how to Apply?

It’s possible you’ll apply on-line on Axis Financial institution web site in a matter of few clicks. Axis Financial institution is not too long ago identified for processing recent bank card functions fairly quick, like card supply in 5 days at instances.

Usually chances are you’ll get the cardboard authorized inside per week from the date of software and another week for card supply.

Should you’re new to financial institution, to not fear, you don’t have to open a recent Axis Financial institution Financial savings A/c to get an Axis Credit score Card.

Backside line

General Axis Financial institution’s Atlas Credit score Card is a superb card at this charge vary and has the power to earn miles that can provide return on spend pretty much as good as ~7% (like accor) which is in par with the India’s lengthy standing finest journey bank card: Amex Platinum Journey.

Should you intend to have 3 finest premium bank cards from Axis Financial institution, Atlas might be one amongst – others being Axis Magnus for Burgundy & Axis Vistara Infinite.

Do you’ve Axis Financial institution Atlas Credit score Card? Be at liberty to share your experiences within the feedback under.