The Axis Financial institution Magnus Burgundy Credit score Card (or Magnus for Burgundy) was launched following a major devaluation of the common Magnus Credit score Card. The Magnus Burgundy Credit score Card is completely issued to the financial institution’s true Burgundy clients and is ideally fitted to these with excessive spending sample.

The Axis Magnus Burgundy Credit score Card just isn’t solely the most effective bank card in India for HNI’s but additionally the most effective on the planet due to it’s profitable reward construction on ongoing spends. Let’s see the way it stands in 2025,

Overview

| Sort | HNI Credit score Card |

| Reward Charge | 4.8% to 25% |

| Annual Price | 30,000+GST |

| Finest for | Excessive Worth Spends |

| USP | Airline/resort switch companions |

As a result of excessive becoming a member of charge, the Magnus Burgundy Credit score Card is particularly designed for high-value spenders who’re prepared to take a position a while to discover its airline and resort switch companions to maximise the purpose worth.

Charges

| Becoming a member of Price | 30,000 INR+GST |

| Welcome Profit | 5,000 INR Yatra Voucher |

| Renewal Price | 30,000 INR+GST |

| Renewal Profit | Nil |

| Renewal Price waiver | On spending >30 lakhs |

- Spend requirement for annual/renewal charge waiver will exclude spends completed on: Insurance coverage, Gold & Gasoline

It’s humorous if you get solely 5K INR voucher whereas the becoming a member of charge is ~35K INR (with GST).

But when you already know the worth of airmiles or resort loyalty factors, you’ll shut your eyes and go for it.

Design

The Axis Financial institution Magnus Burgundy Credit score Card is available in a lightweight steel kind issue and primarily operates on the Mastercard platform.

Apparently, the financial institution has chosen to not embody the phrase “Burgundy” wherever on the cardboard’s design.

Because of this, it’s unimaginable to distinguish between the common Magnus and the Magnus Burgundy solely primarily based on look.

Rewards

| SPEND TYPE | REWARDS | REWARD RATE (EDGE REWARDS PORTAL) |

REWARD RATE (POINTS TRANSFER at 5:4) |

|---|---|---|---|

| Common Spend | 12 RP / 200 INR | 1.2% | 4.8% |

| Axis Journey Edge Portal (5X) | 60 RP / 200 INR | 6% | 24% |

The earn price of Edge Rewards on common Magnus & Magnus for Burgundy are identical, nonetheless, due to the distinction in factors switch ratio (5:2 for Magnus / 5:4 for Magnus Burgundy), it makes a world of distinction, like 100% extra worth to be exact.

Exclusions for Rewards:

- Lease (Capped at 50K INR a month)

- Pockets, Utilities & Gov. Spends

- Insurance coverage, Gold/Jewelry

- Gasoline

Accelerated Rewards

- On Spends of >1.5L a month: Get 35 factors / 200 INR (~14%)

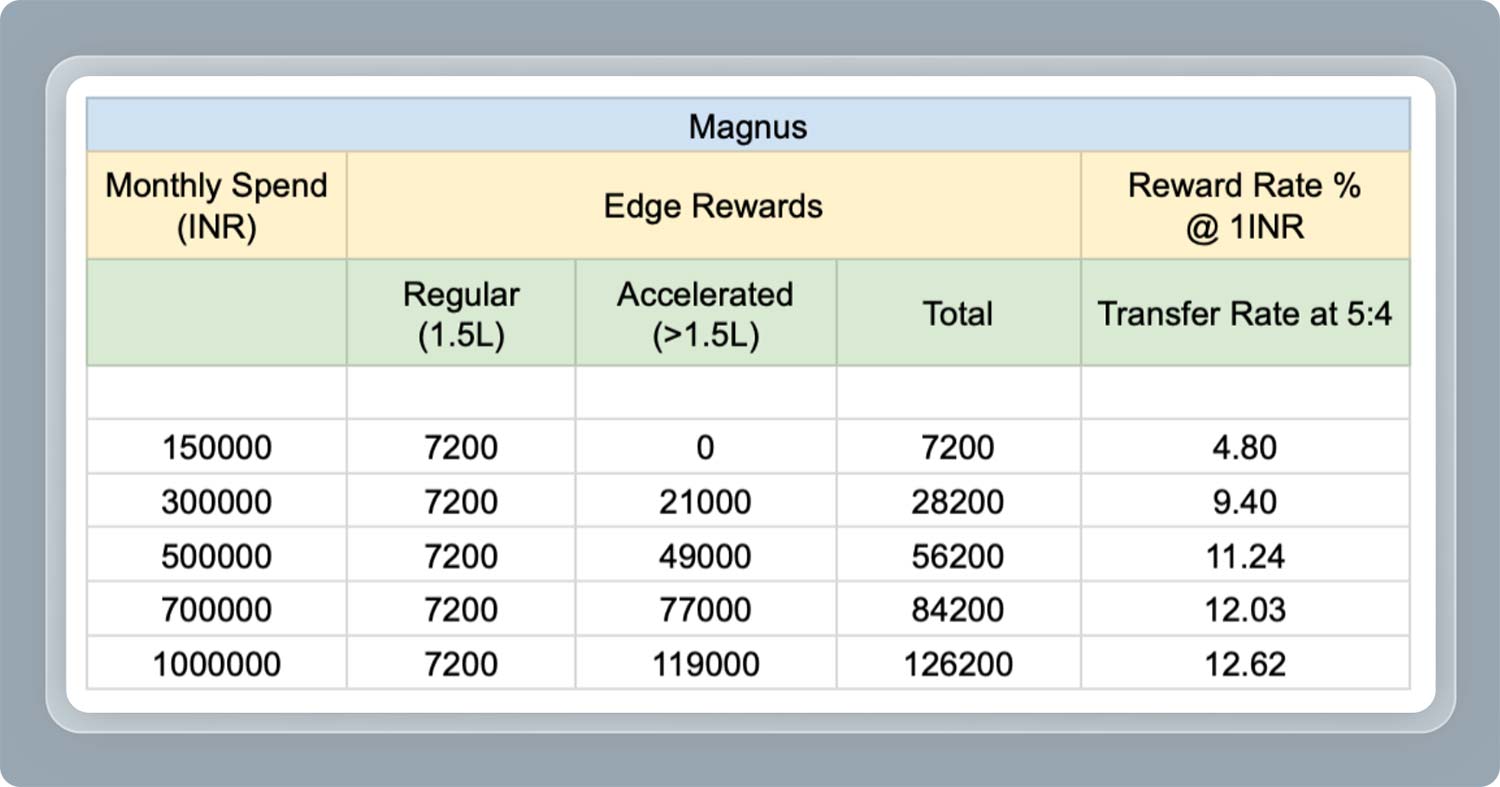

Magnus Burgundy is an incredible bank card for prime spenders as its reward price beats any card in any financial institution within the “world”, particularly when “month-to-month” spends go up.

You get 14% return for spends over 1.5L INR in a month. However realistically, right here’s how the numbers seem like on common, as first 1.5L spend offers solely 4.8% return.

As you may see, ~3L month-to-month spend on a mean is the candy spot to get near 10% reward price.

To offer a perspective of how profitable it’s, HDFC Infinia used to supply the best reward price for very a few years, which is 3.3% on common spends.

On high of that, when you transfer the factors to Accor, then it’s 1.8X the worth, which is a candy 18% return on day-to-spends.

5X on Journey Edge

- Earn 60 factors / 200 INR (~24% as miles) upto 2L spends a month

- Earn 35 factors / 200 INR (~14% as miles) past 2L spends a month

Whereas 5X Rewards on Edge Rewards is sweet in a method, do observe that coping with Journey Edge portal just isn’t a straightforward affair.

Whereas 5X on journey edge is sweet, particularly for flights, HDFC Infinia offers 33% return on smartbuy resort bookings.

Redemption

- Redeem Edge Rewards to factors/miles at 5:4 ratio

- Max up-to 10L factors a calendar 12 months: 2L to Group A & 8L to Group B

| GROUP A | GROUP B |

|---|---|

| Accor (Motels) | ITC (Motels) |

| Marriott (Motels) | IHG (Motels) |

| Wyndham (Motels) | Qantas Airways |

| Air Canada | Air India |

| Qatar Airways | Air France |

| United Airways | Spice Jet |

| Singapore Airways | Air Asia |

| Turkish Airways | |

| Thai Airways | |

| Japan Airways | |

| Ethiopian Airways | |

| Etihad Airways |

In the event you’re questioning the place to redeem, Accor Motels (1.8 INR per Accor ALL Level) in Group A & ITC (1 INR per ITC Inexperienced level) in Group B are the secure & common companions.

In the event you’re in search of airline companions, Air Canada, Singapore Airways and Qatar are the following greatest.

However remember that airline companions are dangerous as they have an inclination to devalue miles in a single day and also you may find yourself sitting on ~50% decrease worth, similar to how I’m sitting on few lakh miles with United Airways.

Airport Lounge Entry

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Home Lounge Entry | Visa / Mastercard | Limitless | 4 |

| Worldwide Lounge Entry (Major) | Precedence Cross | Limitless | 4 |

Visitor entry is an efficient one to have and it’s restricted to 4 per “calendar yr” which is first rate however 8 as earlier than would have been lot higher.

Observe: With impact from 1st Might 2024, the airport lounge advantages (home solely) can be found after spending 50K INR prior to now 3 calendar months. That is merciless for a card of this grade.

Airport Meet & Greet

- Complimentary Entry: 4 / Calendar yr

The home airport meet & greet service – which Axis Financial institution calls as “airport concierge” service is the USP of this product. It offers VIP Help Providers for a clean and hassle-free airport transfers in India.

Add-On Playing cards

Getting add-on playing cards with any Axis Financial institution bank card is hard however is getting higher.

I wouldn’t counsel taking add-on playing cards when you’re in search of peace of thoughts. As a result of even when you get it, you may find yourself in OTP dealing with points. Hope Axis Financial institution fixes this Add-on playing cards concern without end.

Foreign exchange Markup Price

- Overseas Forex Markup Price: 2%+GST = 2.4%

- Web Return: Rewards – Markup Price = 4.8% – 2.4% = ~2.4%

2.4% achieve on foreign exchange spends is an excellent return on spend within the business. On high of it, in case your month-to-month spends are increased, then it’s undoubtedly the most effective bank card for foreign exchange spends.

Options & Advantages

- No Money Withdrawal charge (however finance costs applies)

- 1% gasoline surcharge waiver (400 INR to 4000 INR)

- Purchase 1 Get 1 Bookmyshow supply has been discontinued from April 2024

My Expertise

I’ve been holding the common Axis Magnus Credit score Card ever because it was launched after which moved to the Axis Magnus Burgundy once they initially rolled out the LTF supply.

It’s extremely profitable for certain and have been utilizing it for each home & worldwide spends.

The one draw back of the cardboard is the lengthy listing of exclusions, together with utilities, which is sort of unacceptable for card of this grade.

Must you get it?

If I have a look at the latest consultations, I’ve at all times steered the Axis Magnus Burgundy Credit score Card as a major card, particularly when the annual spends are ~40 Lakhs or extra.

If the spends are barely on decrease aspect and nonetheless want to get higher return on spend, a number of Axis Atlas & Amex Platinum Journey Credit score Playing cards within the household would additionally assist.

That mentioned, Atlas Credit score Card is sort of a profitable card even now and may as effectively get devalued additional anyday however Magnus for Burgundy may stand bit longer because it’s tied to NRV which provides some revenue to the financial institution.

And to not point out that Axis Financial institution doesn’t such as you to do enterprise spends on their playing cards.

So, when you’re holding Magnus Burgundy or when you intend to use for one, ensure to regulate the most recent updates which the financial institution communicates every now and then, so that you simply’re not up for an disagreeable shock.

Tips on how to Apply?

- Eligibility: 30L NRV to begin with; then 30L NRV or 10L AMB

In the event you already meet the eligibility standards and maintain an present Axis Financial institution Credit score Card, name Axis Financial institution assist and you must be capable of apply over the decision.

In the event you’re new to financial institution, then you definitely’ll have to observe the 30L NRV route for fast issuance, through department.

Backside line

Axis Financial institution Magnus Burgundy Credit score Card is a splendidly rewarding bank card for prime spenders. It’s a will need to have card for many who’re spending >1.5L a month.

Whereas it’s undoubtedly an awesome card with no limits on incomes functionality, capping the Group A redemptions to solely 2L a yr feels too low, apart from Accor Motels that provides distinctive worth.

I want the financial institution will increase that quantity or maybe strikes some companions to Group B in future.

If that’s not going to occur, we’ll should depend on further playing cards like Axis Atlas for redemptions past 2L Factors in a calendar yr.