Is BMO Investorline Protected and Trusted?

In a phrase, YES.

As considered one of Canada’s oldest and most trusted firms (based in 1817) the Financial institution of Montreal is as protected, trusted, and legit as you may get.

InvestorLine has been round longer than the web – BMO launched self-directed buying and selling method again in 1988 earlier than shifting on-line in 2000. That’s a formidable historical past!

BMO InvestorLine is IIROC regulated and CIPF insured. They use 128-bit encryption and multi-factor person authentication to maintain your knowledge protected. Whereas any on-line monetary transaction has some danger, BMO is as protected because it will get.

BMO InvestorLine Overview – Cellular App & Software program

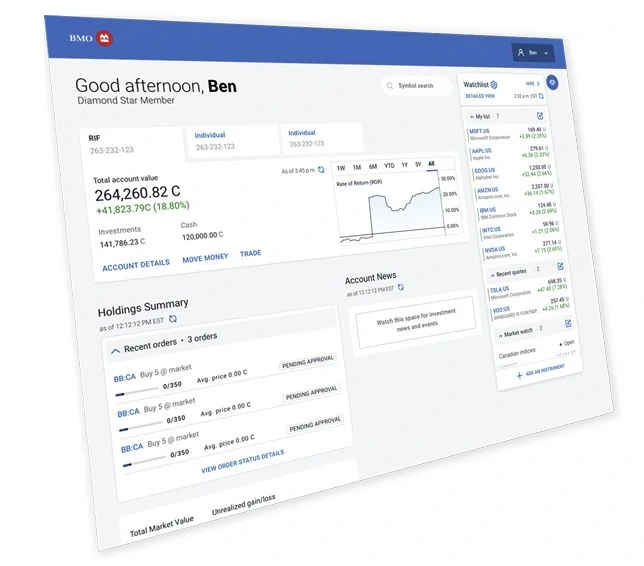

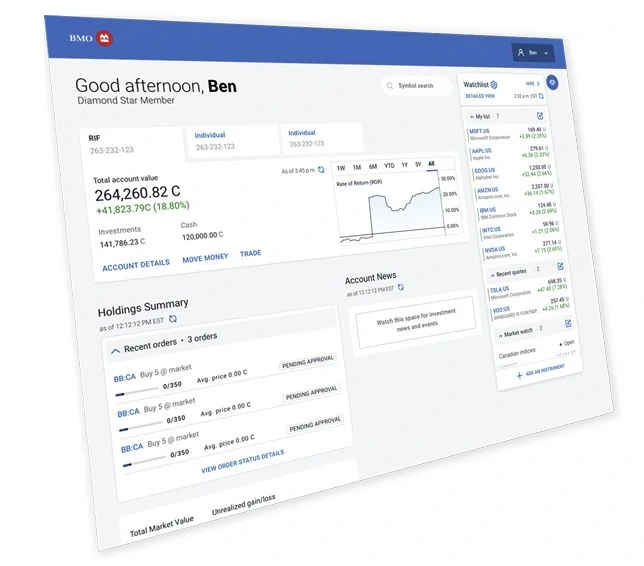

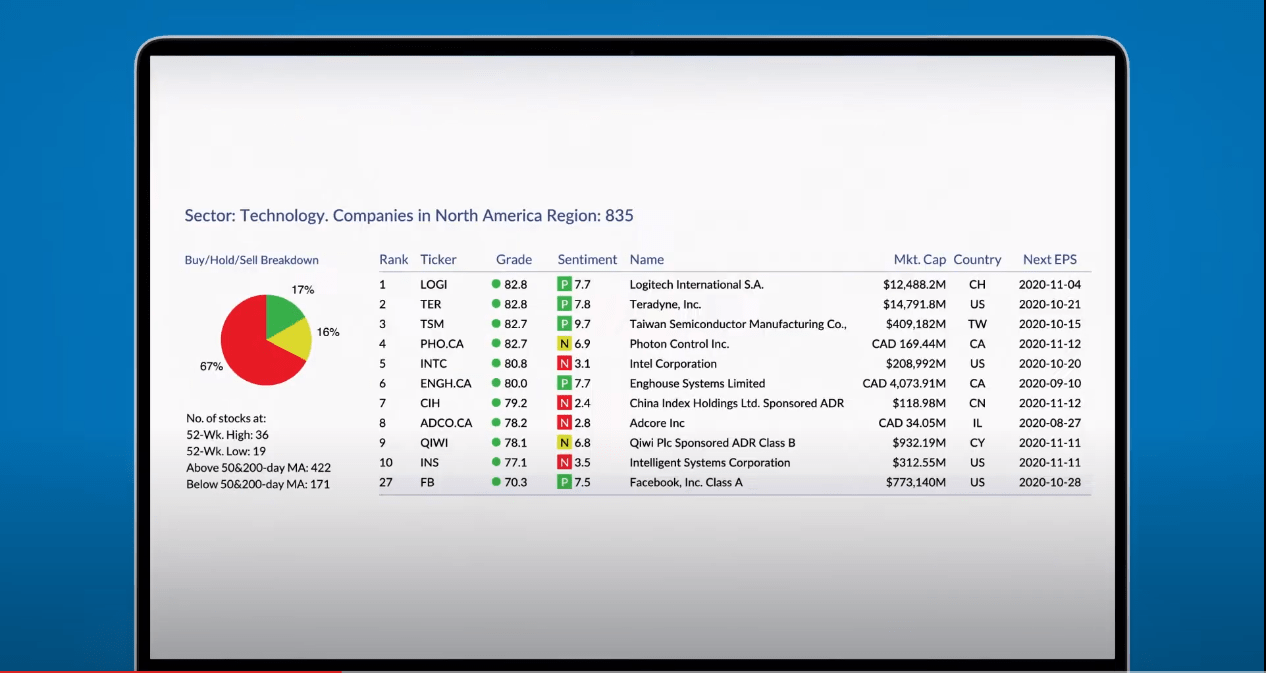

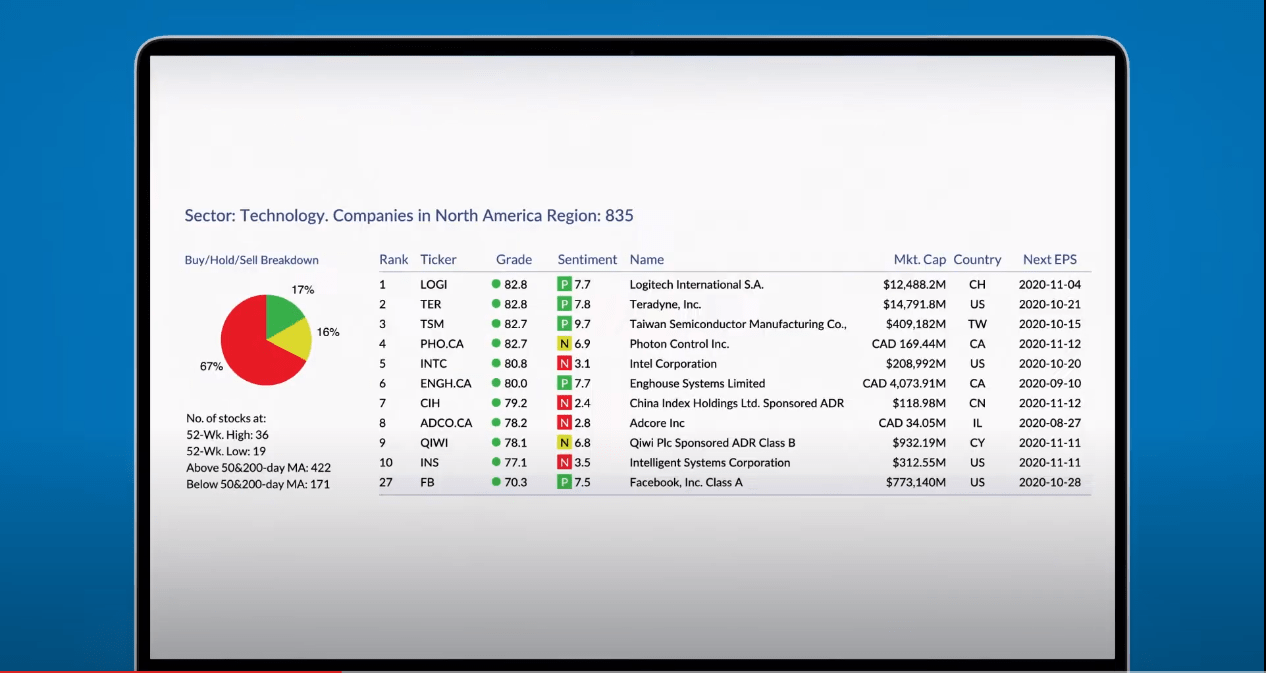

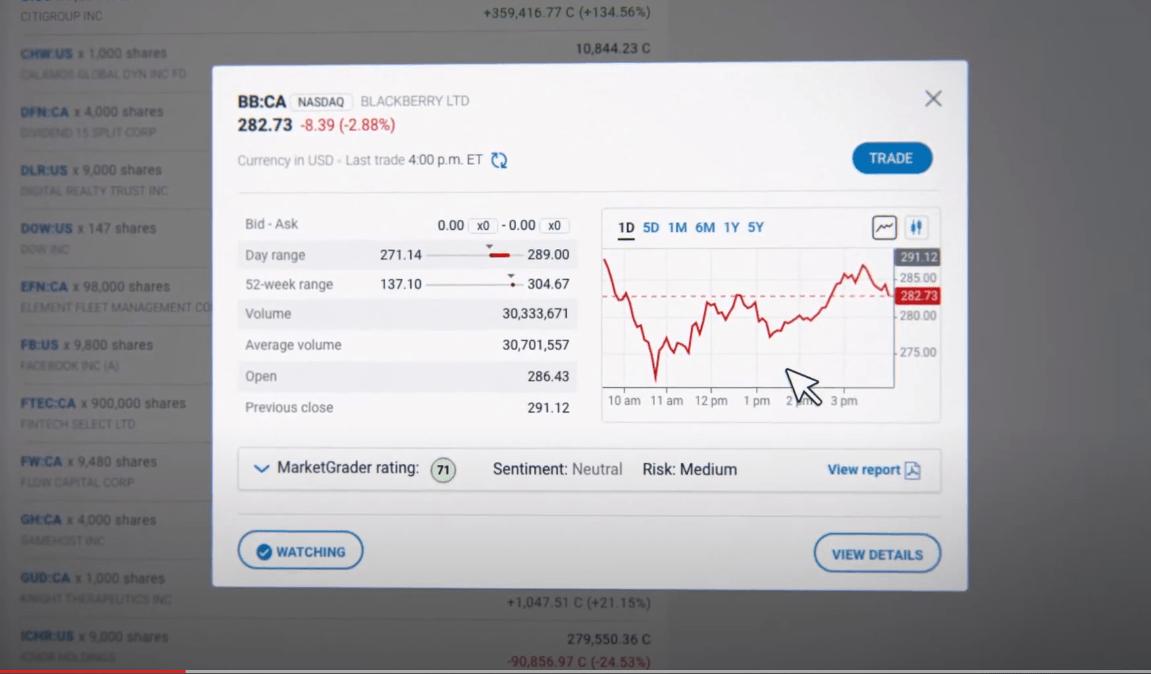

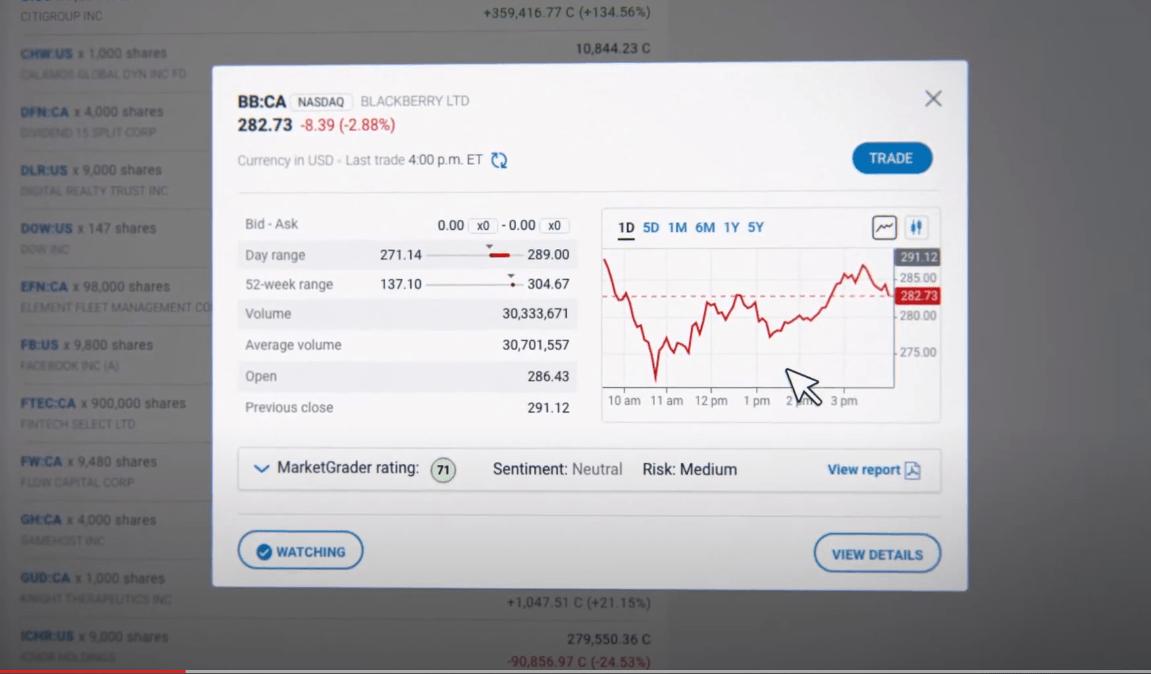

BMO has a robust on-line platform that’s handy and easy to make use of. Its cell app ranked the very best of the massive banks in our record of the Finest Inventory Buying and selling Apps in Canada. Nonetheless, the cell apps for each Qtrade and Questrade come out forward of BMO Investorline by a large margin.

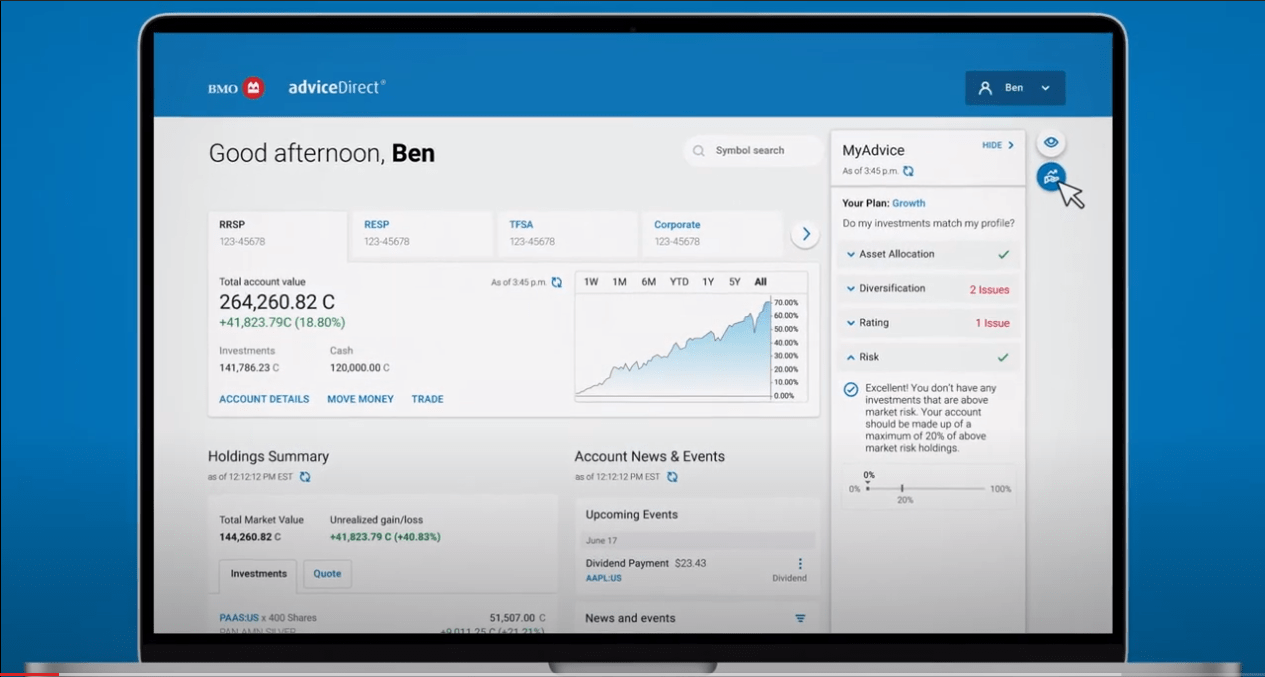

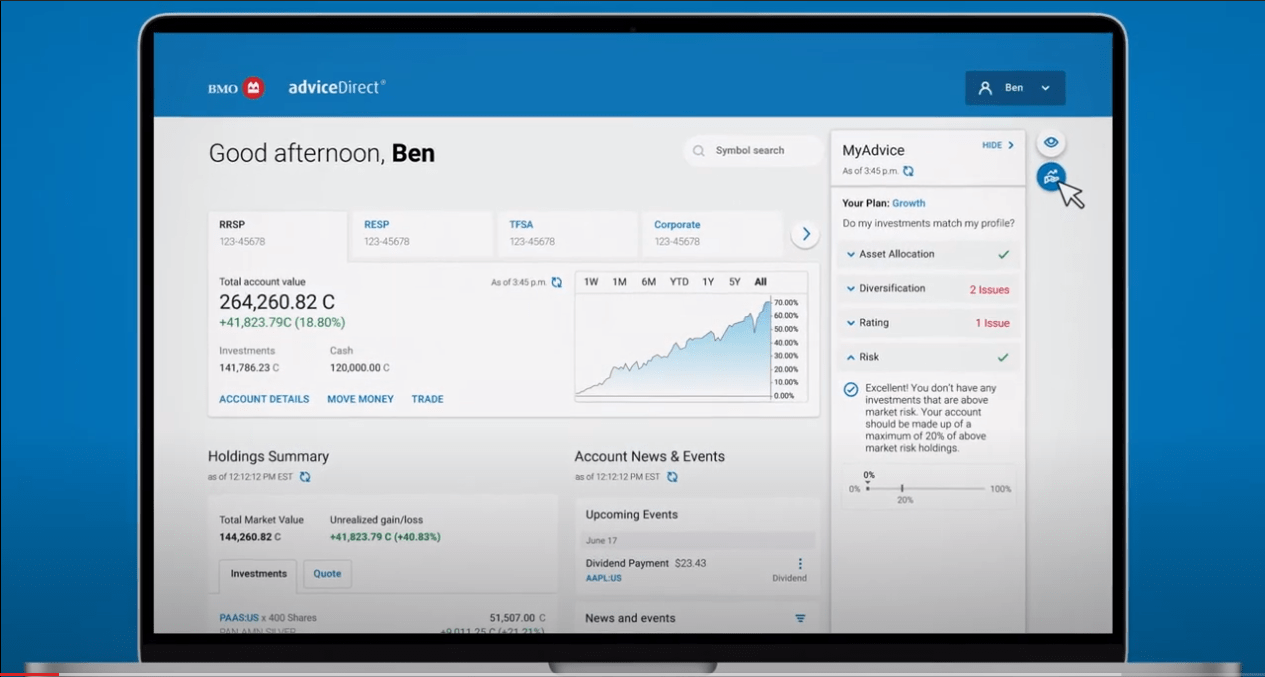

The web platform’s dashboard is streamlined and straightforward to navigate, however nonetheless provides you entry to all of the instruments you want. It’s additionally extraordinarily customizable, that means you possibly can conceal any instruments or options that you just’re not focused on seeing frequently. It is a nice function for novice traders or folks with easy portfolio wants.

The MDJ editorial group appreciates the flexibility to get a chook’s eye view of a portfolio on a single display. This enables customers to raised perceive their asset allocation and make essential funding choices that may assist them meet their objectives quicker.

For the extra research-inclined, the BMO platform additionally provides customers entry to loads of industry-leading instruments and market knowledge.

The cell app affords flexibility and comfort. Customers report that it’s barely much less complete than the web platform, nevertheless it will get the job carried out. Making trades and shifting your cash is straightforward, fast, and safe.

BMO Investorline Free ETF Buying and selling – $0 Commissions

In June 2021, BMO grew to become the primary of the massive financial institution brokerages to supply an inventory of ETFs which might be utterly free to commerce (offering that you just maintain on to them for a minimum of someday).

This has turned out to be an actual game-changer so far as providing worth to low cost brokerage prospects, with different banks corresponding to Scotia iTrade and Desjardins becoming a member of within the enjoyable. Qtrade and NBDB additionally provide utterly free shopping for AND promoting of ETFs, with Questrade providing free ETF purchases solely.

Generally when a financial institution affords free trades on ETFs, they imply free trades on their very own ETFs ( you, TD Simple Commerce). However there’s no bait and change in relation to BMO’s commission-free ETFs, which has some wonderful names on the record. My private favourites embrace:

- VCN – Vanguard FTSE Canada All-Cap Index ETF

- VFV – Vanguard S&P 500 Index ETF US

- VIU – Vanguard FTSE Developed All -Cap ex-North America Index ETF

- VAB – CA Vanguard Canadian Combination Bond Index ETF

- All the Vanguard and BMO all-in-one-ETFs can be found

- A number of ESG index ETFs can be found

It’s wonderful to see that creating ultra-diversified, super-simple portfolios simply retains getting cheaper and cheaper for Canadians!

Day merchants ought to do not forget that the trades are solely free in case you maintain onto the ETF in query for a minimum of 24 hours.

BMO Works Finest for Giant Portfolios

The BMO InvestorLine 5 Star Program is the financial institution’s lure for prime net-worth people and/or energetic merchants. Most of Canada’s low cost brokerages have some model of this break for top-tier traders.

The 5 Star Program doesn’t price something – customers are routinely enrolled in the event that they meet the eligibility requirement: a $250,000 account stability or a minimum of 15 trades in a 3-month span. Right here’s a take a look at the perks that you just’ll take pleasure in in any respect three ranges:

|

Gold Star ($250,000+ OR 15-74 trades per quarter) |

Platinum Star (2M+ OR 75-179 trades per quarter) |

Diamond Star ($5M+ OR 180+ trades per quarter) |

|

|

First precedence 5 Star help |

|||

|

BMO Market Professional Lite (real-time market quotes) |

|||

|

BMO Market Professional (real-time Stage 2 quotes) |

|||

|

Capital Markets TSX 60 Analysis |

|||

|

Schooling occasions and BMO Capital Markets TSX60 analysis |

|||

|

Unique IPO Allocation Choices |

|||

|

Entry to Non-public Banking Choices |

The essential thought of BMO’s 5 Star Program is that in case you generate substantial buying and selling charges or have a big sum of money invested with BMO, you’ll get a small break on the $9.95 payment, and also you’ll get entry to some elite buying and selling data streams, plus portfolio evaluation, customized watchlist updating and so forth.

The Platinum and Diamond ranges additionally provide reductions of 100% on RRSP homebuyer and lifelong studying withdrawals and on deregistration and extra RIF funds.

With over 12 Million worldwide prospects and practically $1.41 Trillion in property managed, BMO actually has the sources to compete with the options that some other Canadian brokerage account brings to the desk.

BMO Investorline Overview: Buying and selling Charges and Costs in 2025

Once we take a look at BMO Investorline’s Self-Directed buying and selling and account charges, it’s essential to take into account that main Canadian banks corresponding to BMO and their opponents over at RBC, Scotia Financial institution, CIBC, and TD, aren’t attempting to supply the most affordable merchandise available on the market. As an alternative, the final goal of their merchandise is to be cost-competitive, however to prioritize the next:

- Extremely-safe merchandise backed up by centuries of banking expertise.

- A big customer support and know-how group.

- Elite usability and design.

- Most person customization choices.

BMO Investorline Self-Directed Account Charges

Whereas there are no minimal deposits wanted to open a BMO InvestorLine Self-Directed account and get began, you’ll be charged quarterly account charges of $25 in case your non-registered account stability is below $15,000 or in case your registered accounts are below $25,000. RESP accounts below $25,000 are charged an annual administration payment of $50.

Clearly, in case you open an account and deposit greater than these quantities you’ll not owe any account charges in any respect.

BMO Investorline Self-Directed Buying and selling Charges

BMO Investorline’s buying and selling charges are usually aggressive with the remainder of Canada’s huge banks and are larger than Qtrade or Questrade. At a flat $9.95 per commerce (it doesn’t matter what number of shares you purchase) it’s a easy – if barely dear – enterprise mannequin.

As famous above, there are quarterly or annual charges that depend upon account balances. Take note of this minimal as it may possibly add up in a rush in case you open a couple of accounts with BMO Investorline however carry a small stability in them for a couple of quarters.

Clearly, the upper payment mannequin is considerably normal for Canada’s huge banks. In return, you get to entry to an enormous full service financial institution that means that you can maintain your whole banking actions below one umbrella. You additionally get an important long-term observe report of security and stability.

Right here’s a fast take a look at the remainder of BMO Investorline’s charges:

|

$9.95 + $1.25 per contract |

|

|

$35 + $1.00 per ounce for gold, $0.10 per ounce for silver |

|

|

$0 for accounts larger than $25,000 |

|

|

$0 for accounts larger than $25,000 |

|

|

$0 for accounts larger than $15,000 |

|

BMO Investorline Self-Directed Choices Buying and selling Charges

Personally, choices buying and selling isn’t part of my funding portfolio, however in case you’re into the adrenaline rush of shorts, hedging, and so forth., then Investorline goes to cost $9.95 per commerce + $1.25 per contract. That is the usual price throughout all of Canada’s massive banks.

BMO Investorline Account Varieties

As considered one of Canada’s prime on-line brokers, BMO Investorline provides you entry to basically each sort of investable account in Canada, together with:

- Non-registered accounts (each CAD and USD)

- Margin Accounts

- RRSP (each CAD and USD)

- Spousal RRSPs

- TFSA (each CAD and USD)

- FHSA

- RESP

- RRIF

- Spousal RRIFs

- LIF

- LIRA

- Company Accounts

- Non-Revenue Group Accounts

- Estates and Formal Belief Accounts

That is one benefit of an enormous financial institution platform: you may pay extra in commissions to make use of BMO InvestorLine Self-Direct, however you’re going to completely have entry to the entire accounts that you can ask for as a Canadian investor. And once more, in case you go along with ETFs from their commission-free buying and selling record, you’re not even paying extra in any respect.

BMO InvestorLine Promotional Supply

With many on-line brokerages providing engaging promotional affords, BMO has joined in providing a promo bonus of its personal. You’ll earn money again relying on how a lot you make investments.

| Should you make investments: | You’ll obtain: |

| $5,000-$24,999 | $300 |

| $25,000-$99,999 | $400 |

| $100,000-$249,999 | $500 |

| $250,000-$499,999 | $600 |

| $500,000-$999,999 | $1,050 |

| $1,000,000-$1,499,999 | $2,050 |

| Over $1,500,000 | $3,500 |

Moreover, present BMO prospects will obtain an additional $50.

Whereas these cashback quantities fall in need of Qtrade’s present promotional providing, they’re respectable, particularly in case you had been going to open an account with Investorline anyway!

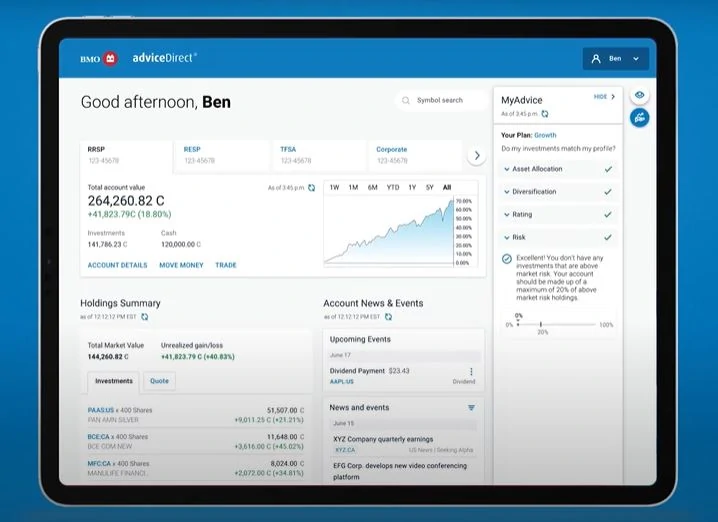

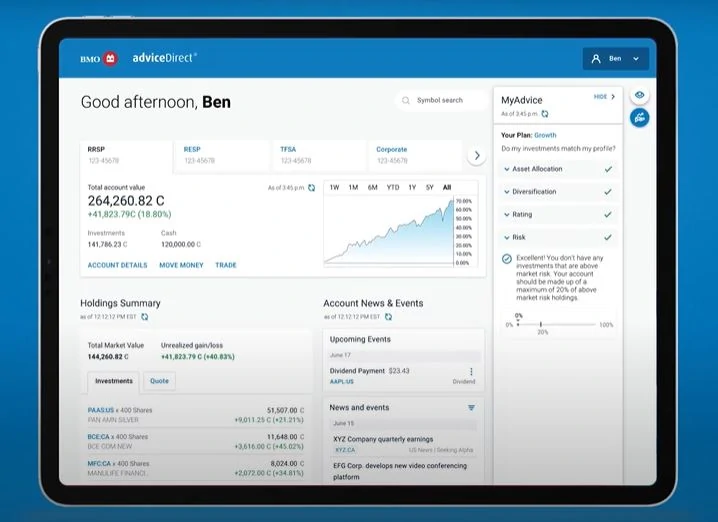

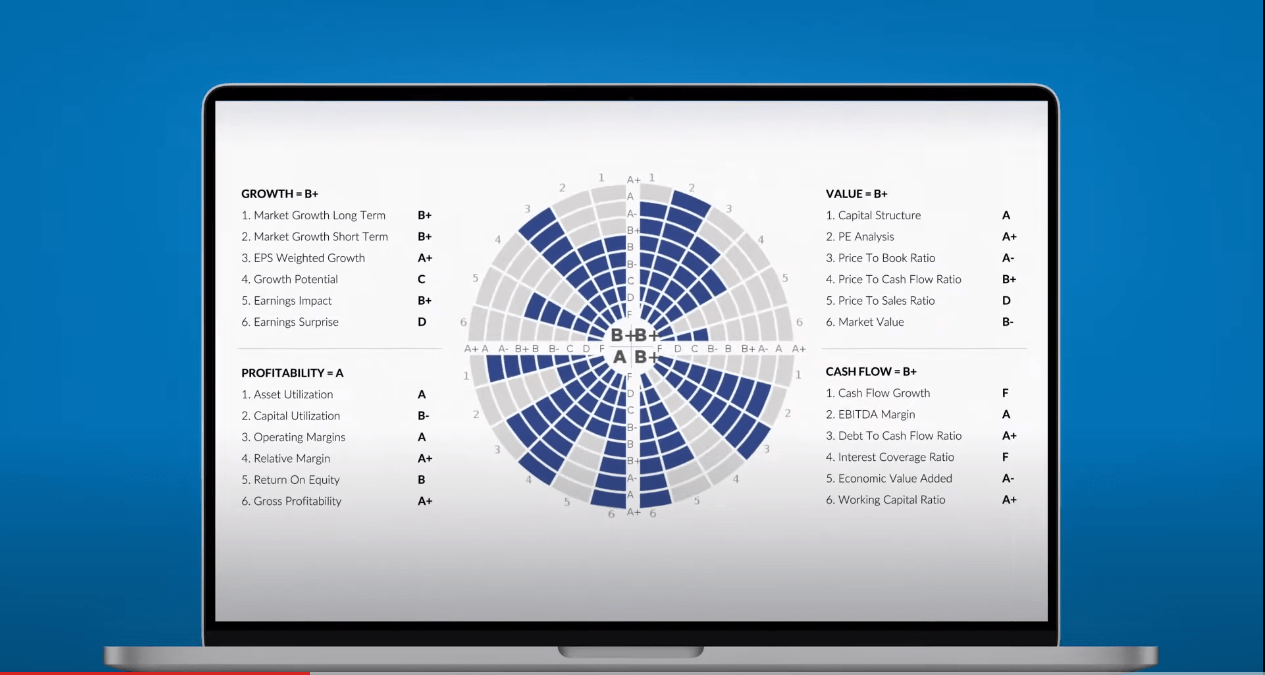

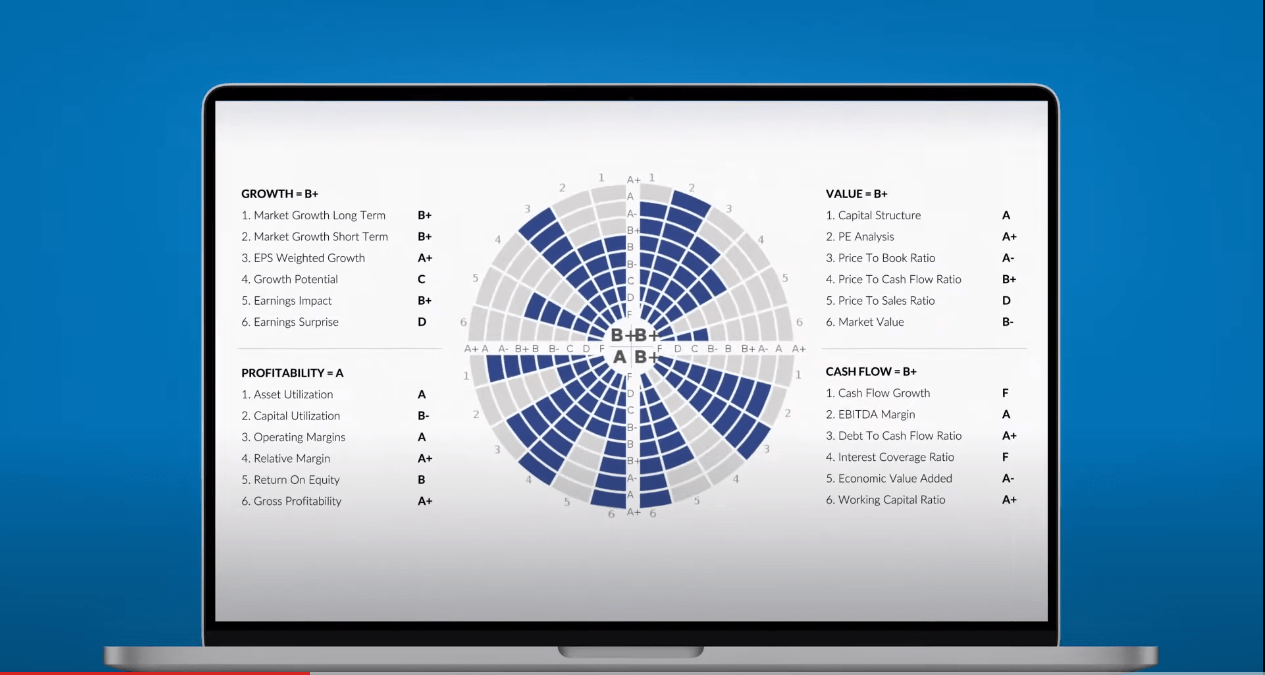

BMO Investorline Overview: What Is adviceDirect?

We’ll take a deeper dive into the distinctive service often called AdviceDirect in a separate assessment, however we thought we’d point out it right here briefly.

AdviceDirect is a pleasant little mid-point between a full-service monetary advisor mannequin, and a very hands-off DIY product.

In order for you the flexibleness and accountability of utilizing a reduction brokerage to handle your personal investments, but additionally really feel that you can use some assist in choosing particular investments or staying on prime of your portfolio, then you might need to look intently on the BMO adviceDirect account.

AdviceDirect’s companies embrace:

- Automated portfolio monitoring

- Distinctive data flows

- Unique investor training choices

- A devoted group of licensed monetary advisors

As energetic investing goes, a premium service like adviceDirect is a strong selection. It provides you entry to monetary consultants – at a a lot cheaper price level than conventional mutual fund channels. The MER on mutual funds is often about 2.5%, whereas adviceDirect is just 0.75%, with a most payment cap per yr. That’s a superb worth.

BMO InvestorLine and BMO adviceDirect could complement each other, however they’re two separate merchandise with completely different functions and companies. So whilst you undoubtedly do NOT have to subscribe to adviceDirect so as to use the BMO InvestorLine brokerage, it might presumably be a greater choice relying in your expertise stage and need for professional help.

BMO InvestorLine Overview FAQ

2025 BMO InvestorLine Scores

Yearly we be certain to take a look at the Surviscor and Globe and Mail dealer scores, as we discover them probably the most complete on-line (aside from our personal after all).

For the 2025 BMO Investorline report card we’ll begin with the Globe and Mail. Their rankings are based mostly on over 100 elements, additional damaged into 5 classes:

- Comfort and safety

- Price

- Investing expertise

- Instruments

- Providers for retirees

“InvestorLine is an instance of bank-owned brokers with old-school pricing, particularly buying and selling commissions slightly below $10 for shares and exchange-traded funds. Should you pay prime worth, you must ask the place the worth is. InvestorLine delivers for probably the most half, however with out the flicker wanted to be within the entrance rank on this group. A giant plus is the menu of 108 commission-free ETFs from the BMO, iShares and Vanguard households.”

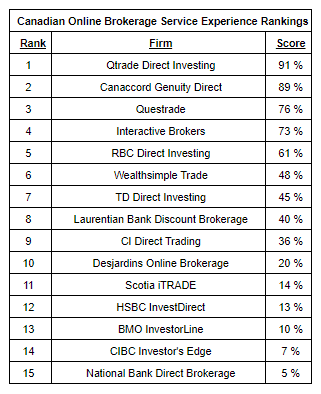

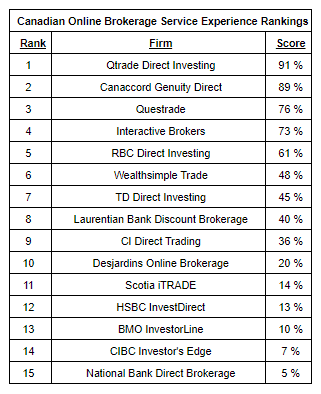

Surviscor then again provides brokerages a “Peer Expertise Rating” as a proportion score, after which ranks them based mostly on their percentages. Their rankings concentrate on customer support, and are based mostly on a compilation of 100,000 person experiences by way of all platforms all through 2024. Listed here are the up-to-date rankings for “Canadian Finest On-line Brokers Rankings” by Surviscor:

As you possibly can see from the chart above, Surviscor’s BMO InvestorLine isn’t a prime contender in relation to a person expertise and customer support viewpoint. Nonetheless, within the time that now we have been watching these rankings, BMO has made enhancements on this area.

Who Is the BMO InvestorLine Low cost Dealer Finest for?

Should you’re already a BMO buyer, there’s no disgrace in paying a bit extra for the comfort of holding all the things in a single place—it’s all about trade-offs.

Nonetheless, you’ll be paying a premium for a platform that doesn’t provide as many options as a few of the prime Canadian on-line brokers. For a comparability between BMO Investorline’s predominant opponents, check out our Qtrade vs. Questrade Overview.

One space the place BMO shines in comparison with different “Large Financial institution” brokerages is its collection of 100+ commission-free ETFs. As somebody who loves index investing, that is undoubtedly a function I admire.

As common MDJ readers know, I keep on prime of the Canadian brokerage panorama, so you should definitely verify again for any updates to my BMO Investorline assessment.