What You Have to Know

- Expectations for fee cuts have mounted quick, and bonds do very effectively in that atmosphere.

- When the S&P 500 Index misplaced about 6% over the primary three buying and selling days of August, the Treasury market posted positive factors of virtually 2%.

- Nonetheless, the approaching week brings loads of danger for bond bulls.

Gregg Abella, a cash supervisor in New Jersey, wasn’t anticipating the flood of cellphone calls he obtained from purchasers this previous week. “All of the sudden persons are saying to us, ‘Wow, do you suppose it’s a very good time for us so as to add bonds?’”

It’s one thing of a vindication for Abella. He’s been, in his phrases, “banging the gong” for bonds — and asset diversification, extra broadly — for years. This was lengthy a decidedly out-of-favor suggestion. Till, that’s, shares began to tumble this month.

Rapidly, demand for the security of debt soared, driving 10-year Treasury yields at one level early final week to the bottom ranges since mid-2023.

The rally has shocked many on Wall Road. The age-old relationship between equities and bonds — whereby fixed-income offsets losses when shares droop — had been thrown unsure in recent times.

Particularly in 2022, when that correlation completely collapsed as bonds failed to supply any safety in any respect amid the slide in shares. (US authorities debt, in reality, posted its worst losses on file that yr).

However whereas the selloff again then was triggered by an inflation outbreak and the Federal Reserve’s scramble to quell it by ratcheting up rates of interest, this newest equities droop has been sparked largely by worry the financial system is slipping right into a recession.

Expectations for fee cuts, because of this, have mounted quick, and bonds do very effectively in that atmosphere.

“Lastly the rationale for bonds is shining by way of,” stated Abella, whose agency — Funding Companions Asset Administration — oversees about $250 million together with for rich People and nonprofits.

Because the S&P 500 Index misplaced about 6% throughout the primary three buying and selling days of August, the Treasury market posted positive factors of virtually 2%. That enabled buyers with 60% of their property in shares and 40% in bonds — a as soon as time-honored technique for constructing a diversified portfolio with much less volatility — to outperform one which merely held equities.

Bonds would ultimately erase a lot of their positive factors as shares stabilized over the previous few days, however the broader level — that fastened revenue labored as a hedge at a second of market chaos — stays.

“We’ve been shopping for authorities debt,” stated George Curtis, a portfolio supervisor at TwentyFour Asset Administration. Curtis truly first started including Treasury bonds months in the past — each due to the upper yields they now provide and since he too has anticipated the outdated stock-bond relationship to return as inflation receded. “It’s there as a hedge,” he stated.

Inverse Once more

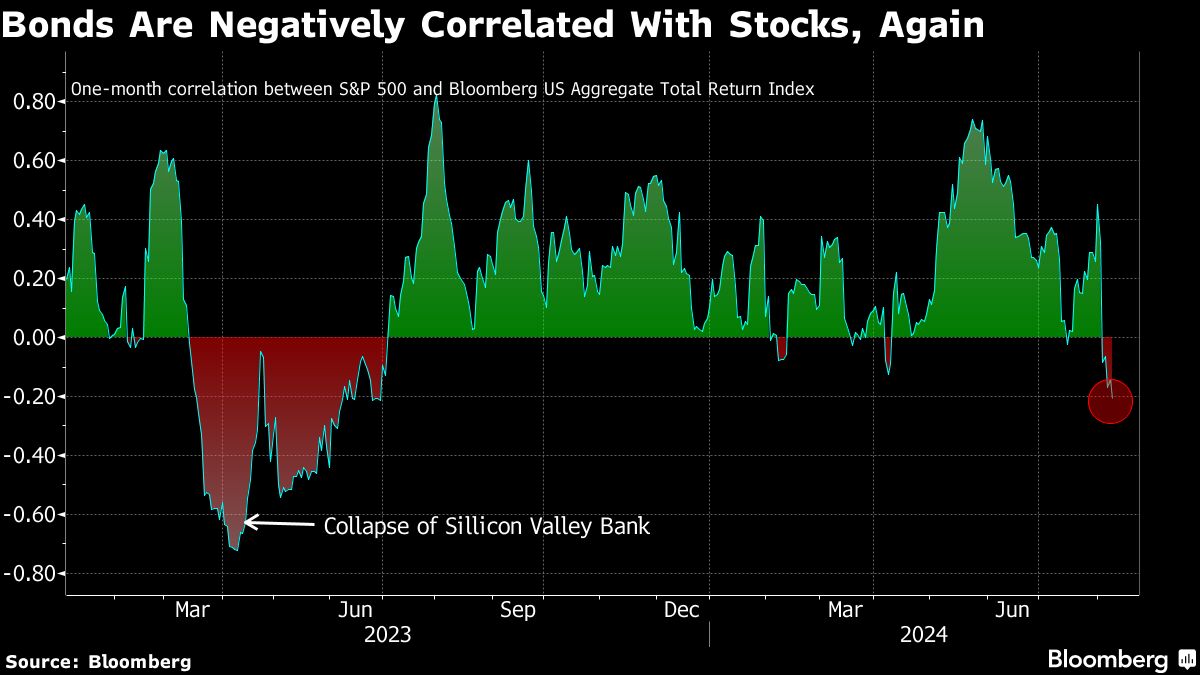

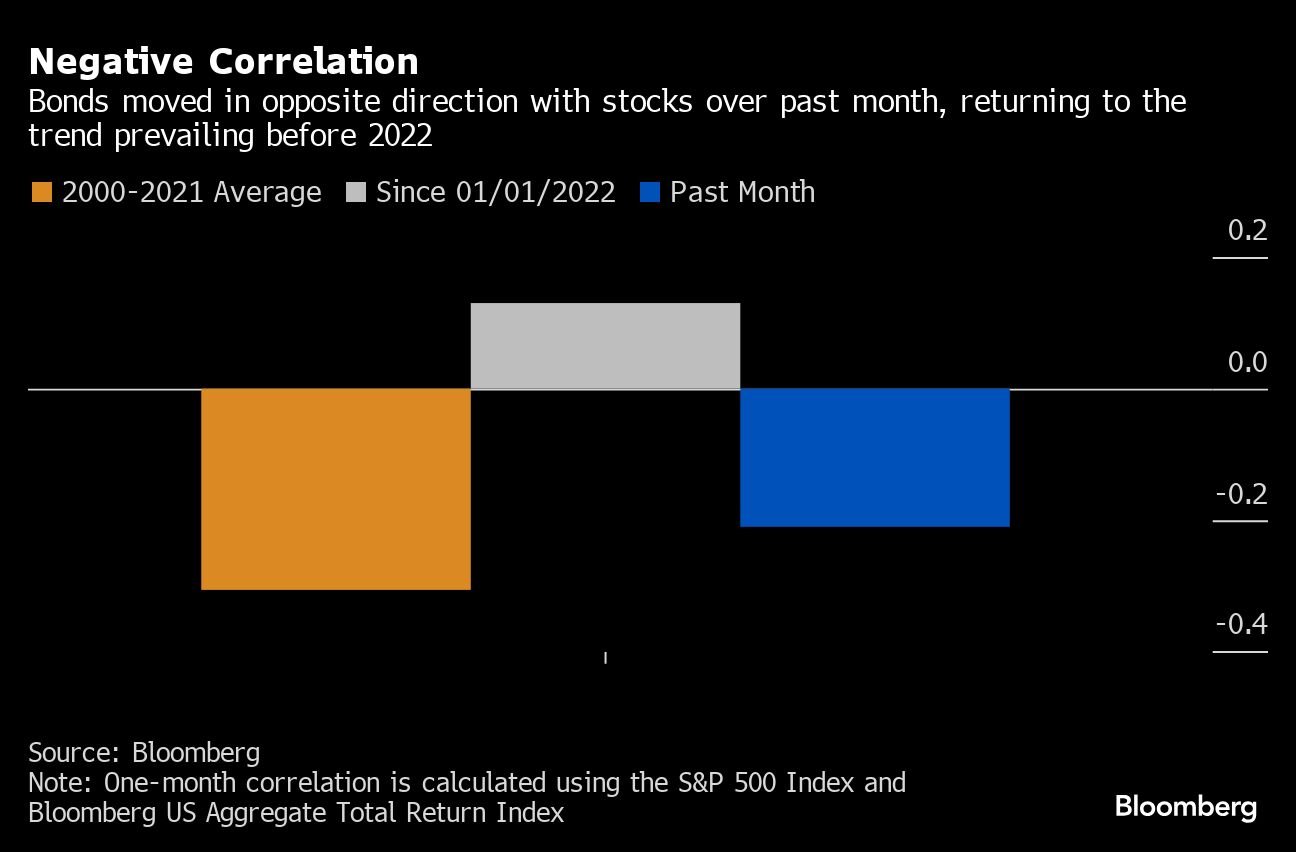

There’s one other solution to see that the standard, inverse relationship between the 2 asset courses — which largely held for the primary couple a long time of this century — is again, no less than for now.

The one-month correlation between shares and bonds final week reached probably the most damaging for the reason that aftermath of final yr’s regional-bank disaster. A studying of 1 signifies the property transfer in lockstep, whereas minus 1 suggests they transfer in the other way. A yr in the past, it eclipsed 0.8, the very best since 1996, indicating bonds have been virtually ineffective as portfolio ballast.

The connection was turned on its head because the Fed’s aggressive fee hikes starting in March 2022 induced each markets to crater. The so-called 60/40 portfolio misplaced 17% that yr, its worst efficiency for the reason that international monetary disaster in 2008.