We’ve had tons of of Canadians e mail us or remark, “Ought to I purchase Bitcoin?” all through the latter a part of 2020 and the start of 2021, after which over time it type of dwindled out. The latest hike in worth, bolstered by American old-new President Trump, has despatched Bitcoin’s worth to greater than $120,000, and has reignited the curiosity of Canadians.

Why is bitcoin and Different Crypto-Belongings Hovering?

Following Trump’s victory, Bitcoin’s worth skilled a considerable enhance, surpassing USD $90,000 for the primary time. This surge is attributed to investor optimism concerning the potential for extra favorable cryptocurrency rules below the brand new administration. With President Trump’s marketing campaign guarantees to make the U.S. a “crypto capital” and set up a nationwide Bitcoin stockpile, traders anticipate clearer rules and elevated institutional funding within the sector. This yielded a 35% enhance for the reason that November 5 election date.

In a notable improvement, President Trump introduced the creation of the “Division of Authorities Effectivity” (DOGE), to be led by Elon Musk and Vivek Ramaswamy. This announcement led to a major surge in Dogecoin’s worth, with the cryptocurrency buying and selling at 42 cents and reaching a market capitalization of almost $60 billion. For the reason that starting of the 12 months, Dogecoin has surged by 353% and elevated 106% since Trump’s election victory. It ought to be famous that this new authorities division has no precise connection to any type of cryptocurrency.

That makes little or no sense for conventional traders like myself, however I can see why individuals are drawn into the idea that the world’s richest and now most likely strongest man on earth is pumping a specific lower-cap asset. Many adrenaline-fuelled speculators imagine this rally will proceed no less than till the tip of 2024.

On this article I’ll share my views on the cryptocurrency market, whether or not this ought to be part of your portfolio, and what’s one of the simplest ways to purchase crypto in Canada.

The way to Purchase Bitcoin in Canada Safely

Given the truth that banking heavyweights similar to JP Morgan have suggested their prospects that allocating 1% of their property to cryptocurrency could be a sound transfer, and the variety of techno wizards and institutional traders leaping on board has elevated – there is no such thing as a getting round the truth that there may be an urge for food for data on the best way to purchase Bitcoin in Canada within the most secure and least expensive approach doable.

Finest Approach: Shopping for Bitcoin Immediately By way of Exchanges and Platforms

One of many most secure strategies to buy Bitcoin in Canada is thru regulated cryptocurrency exchanges similar to CoinSmart, which stays our #1 really useful Canadian crypto market. CoinSmart affords an intuitive person interface that’s simple to make use of, even for newcomers, and helps a wide range of cryptocurrencies like Bitcoin and Dogecoin.

CoinSmart additionally boasts same-day Interac e-Switch funding with 0% charges for transfers over CA$2,000. Shopping for Bitcoin by means of CoinSmart incurs buying and selling charges starting from 0.2% to 0.4%, that are fairly aggressive available in the market.

Utilizing CoinSmart:

- Join an account and full the verification course of.

- Fund your account by way of Interac e-Switch, wire switch, or financial institution draft.

- Navigate to the purchase/promote display screen and choose Bitcoin (BTC).

- Enter the quantity you want to buy and make sure your transaction.

Tip of the day: Keep away from utilizing a bank card to purchase Bitcoin by means of CoinSmart to sidestep hefty charges of as much as 6%.

Second Finest: Different Platforms and Fee Strategies

- Wealthsimple Crypto and MogoCrypto are extra platforms the place Canadians should purchase Bitcoin, albeit with greater charges.

- PayPal is one other technique that may quickly be the simplest approach to purchase Bitcoin in Canada, although charges are projected to be round 5% or extra.

- Bank cards can be used on varied exchanges, however the charges might be monumental.

Non-obligatory: Bitcoin Cryptocurrency ETFs in Canada

An alternate for traders preferring to not purchase Bitcoin instantly is to spend money on Canadian Bitcoin ETFs. These are fastened to Canadian {Dollars}, don’t require you to do any particular preparations similar to opening a brand new dealer account (if you have already got one), and can be simpler to report.

There are a number of Bitcoin ETFs, similar to:

- Function Bitcoin Fund (BTCC)

- Evolve Fund Group’s Bitcoin ETF (EBIT)

- CI Galaxy Bitcoin ETF (BTCX.B)

The primary Bitcoin ETF on this planet was the Function Bitcoin Fund (BTCC), and regardless of its 1% MER charge, it has collected effectively over $3 Billion property below administration.

BTCC’s direct competitor – Evolve Fund Group’s Bitcoin ETF (EBIT) – launched a day later and has an MER of 0.75%, and can also be simply traded.

A 3rd Bitcoin ETF – the CI Galaxy Bitcoin ETF (BTCX.B) – and has a good decrease MER of 0.40%. Many extra functions are within the cryptocurrency ETF pipeline.

Along with not needing to know what a “chilly pockets” is or any of the opposite nuances round the best way to instantly purchase bitcoins in Canada, Bitcoin ETFs might be held in an RRSP or TFSA (making them way more tax pleasant than instantly holding the property).

From every little thing I’ve learn, the businesses behind these ETFs all state that they instantly personal Bitcoin by means of the Gemini Belief firm (which acts as a custodian). This construction ought to reliably monitor the value actions of BTC, and it seems that the market has religion within the product to take action.

Shopping for Bitcoin ETFs:

- Open a reduction brokerage account.

- Seek for the ETF’s ticker image on the Toronto Inventory Change.

- Execute the commerce as you’ll with some other inventory or ETF.

This strategy affords a degree of security and comfort, particularly for traders unfamiliar with the mechanics of buying and selling cryptocurrencies instantly.

What Is Bitcoin for Newcomers and Non-Techies

Bitcoin is both the proper creation of the techno deities – that can someday rule us all – or it’s a semi-worthless piece of the web that individuals simply haven’t realized is nugatory but.

The reality is that totally understanding Bitcoin is past the scope of this text. There are some first rate documentaries on the market, and a few nice podcast episodes. (I like to recommend this one with Preet Banerjee.)

A buddy of mine describes Bitcoin as “Somebody took a bunch of Tremendous Mario cash… however stated that there’s solely so lots of them, so now they’re greater than your automotive.” They’re not completely fallacious.

Bitcoin is firstly essentially the most well-known instance of a digital or “crypto” foreign money.

Digital currencies are basically pc packages that search to develop into a method of trade (like some other sort of cash). The speculation goes, that if someday sufficient individuals imagine in these digital currencies, and settle for them as fee for items, then at that time the currencies have lots of worth.

The aforementioned idea usually stems from the thought of, “Effectively hey, what’s any cash actually? It’s merely the assumption that you should utilize some type of paper or small piece of cheap steel to purchase no matter you want, and so subsequently you’ll settle for it as fee on your personal time or possessions. If that’s true – and since we’ve now largely changed the paper/steel half with bank cards and on-line transactions – why can’t digital currencies develop into a factor?”

The supporters of cryptocurrencies (some outstanding examples of cryptocurrencies apart from Bitcoin can be Etherium and Solana) would say that the power of two events to finish transactions with out getting banks concerned is a large benefit in relation to changing our conventional system. In idea, Bitcoin cuts out a lot of the necessity for banks and banking charges.

The financial institution’s position is semi-replaced by one thing known as a digital ledger. The thought is that each time a transaction takes place that makes use of a digital foreign money it creates a “block” of data. This block is then inserted on a “chain” (therefore the time period “blockchain”) and is accessible for everybody to see (with out seeing the small print of the 2 individuals doing the transaction).

This type of public transparency is a sort of assure in opposition to fraud and signifies that we will hint transactions for an infinite time period. The digital ledger would exist on the cloud and as soon as transactions have been made, they may not be modified by any single individual. The easy concept that authority over all the system is decentralized is a characteristic, not a bug.

The place Does Bitcoin Come From?

Reply: Your pc, my pc, everybody’s pc.

The Bitcoin ecosystem was constructed within the late 2000’s by the legendary Satoshi Nakamoto. Who or what that entity is has been the subject of a lot hypothesis, and has develop into part of Bitcoin folklore. To the perfect of my information, nobody has really confirmed who this individual or group of individuals really is. The community is now maintained by hundreds of individuals.

When the “God of Bitcoin” (lately revealed?) created their digital gold, they solely put a lot of it within the digital floor. This shortage is what most bitcoin consumers imagine provides it its worth. Your pc “finds” bitcoins by doing mathematical computations.

About 19.9 million of the 21 million bitcoins that have been created have now been mined. Earlier than you hearth up your laptop computer attempting to get your arms on one of many final chunks, simply notice that you simply’re computing with large supercomputers from around the globe and it’s most likely not value your effort.

Is Bitcoin Changing into Institutionally Owned?

When Bitcoin was in its early years, it was purported to be the “everyman’s decentralized foreign money”. Most used for unlawful offers on the darknet and extremely speculative holding by a small subset of techies who believed that it was digital salvation.

Because it has grown in worth, Bitcoin turned extra mainstream amongst retail traders. Then the 2017/2018 Growth-and-Crash occurred and chased away the overwhelming majority (if not all) of the massive institutional traders. The large hedge funds, funding banks, multinational companies, and different massive swimming pools of cash basically swore off of cryptocurrencies.

Quick ahead to 2021 and we’ve Tesla, the world’s most revered (or hyped) auto producer that has determined to trade 1.5 Billion {Dollars} of its money property into the digital foreign money. PayPal, the funds big, has determined to include Bitcoin shopping for and holding in its platform. Sq., one other fee big, can also be storing a few of its reserves in Bitcoin. Even a BANK, and never simply any financial institution – however America’s previous financial institution (BNY Mellon) – has began providing a bitcoin service.

The kicker being JP Morgan, considered one of Bitcoin’s most vocal critics which was additionally as soon as thought-about the “Bitcoin killer” has suggested prospects to shift as much as 1% of their portfolios into Bitcoin.

As increasingly of those institutional traders have determined that they need a small quantity of publicity to Bitcoin, the demand for the scarce digital useful resource has clearly shot by means of the roof. I’m very to see what company boards and shareholders determine to do with their allocation the subsequent time Bitcoin loses 60%+ of its worth in a pair weeks.

For now, there is no such thing as a query that the suggestions cycle of institutional demand – generates big constructive press headlines – which spurs extra retail hypothesis – drives the value even greater – thus reinforcing the institutional FOMO, has some highly effective momentum.

What’s a Bitcoin or Crypto Excessive-Curiosity Financial savings Account?

BlockFi affords an 8.6% curiosity account for Bitcoin holders, roughly 3% higher than any Canadian financial savings account. Whereas that is an attractive choice, traders ought to perceive the dangers. The crypto curiosity account house remains to be rising and isn’t as regulated as conventional banking. Nonetheless, platforms like BlockFi preserve that they’ve sturdy safety measures in place.

Taxes and Legality of Bitcoin in Canada

One of many larger surprises that Canadians who purchase and promote bitcoin run into is that the federal government is totally concerned – simply as they’d be with some other asset class.

For some purpose there may be this fable on the market that cryptocurrencies have in some way transcended authorities management, and are usually not topic to the identical taxes as you’ll be accountable for should you purchased and bought gold for example.

The reality is that if you’re buying and selling Bitcoin in Canada you’ll owe capital features taxes on the distinction between what you bought your bitcoins for and what you bought whenever you bought them. The one exception to this could be utilizing a Bitcoin ETF in a TFSA or RRSP.

If you happen to used a Block Fi account to realize curiosity in your Bitcoin, then that’s 100% taxable, simply as some other type of curiosity revenue can be in Canada.

If you happen to settle for bitcoins as fee for a traditional enterprise service, then you definitely’ll must convert the worth to Canadian {dollars} on the time of transaction with the intention to report and report official revenues to the CRA. Right here is the official CRA information on crypto and taxes.

Different Cryptocurrencies Value Exploring

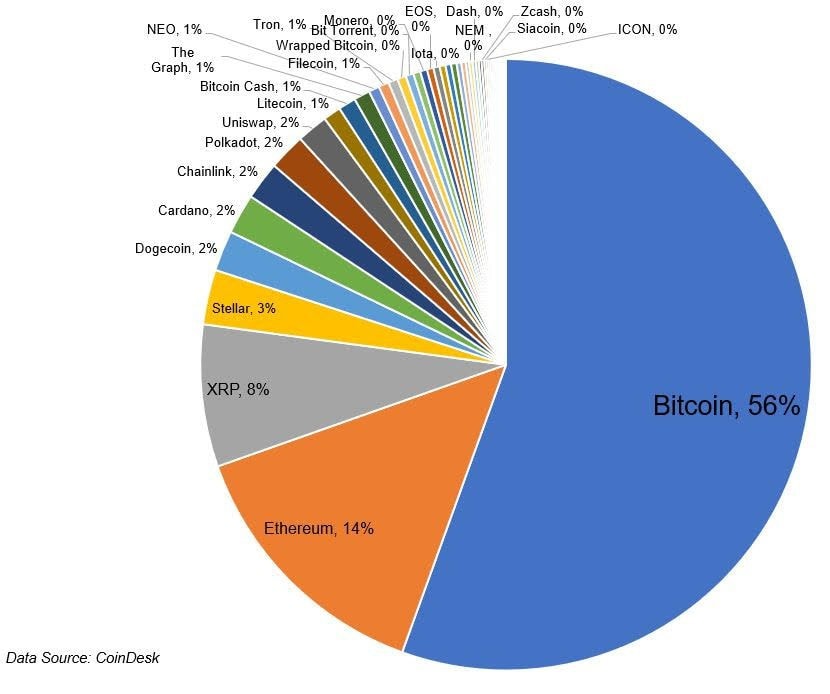

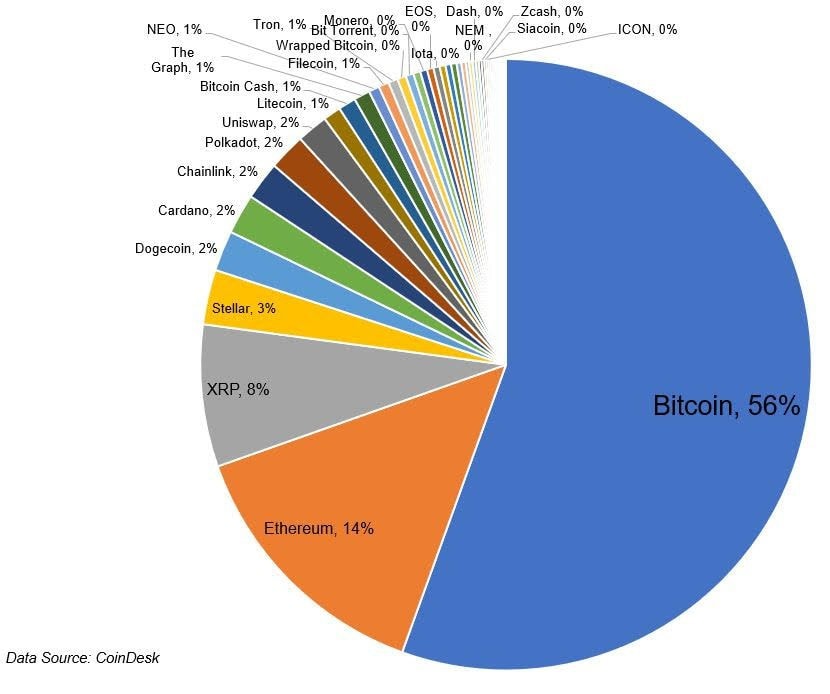

You would possibly see many web boards pumping the newest cryptocurrency fad (anybody else seeing lots of Dogecoin advertisements nowadays?) however by far the second greatest cryptocurrency is Ethereum (ETH) which has some fascinating technological options.

My understanding that is fairly restricted – however the reality this foreign money contains “good contracts” which point out future transactions primarily based on whether or not sure situations – are met makes it an excellent candidate to interchange conventional monetary contracts. The corporate was as soon as thought-about a pacesetter in innovating the underlying blockchain know-how, however with so many different corporations now competing for that title, the unique benefit could be dissipating.

There’s lots of improvement primarily based on Ethereum, and by way of efficiency, it has intently tracked bitcoin in earlier years (not a lot since 2022). So when you’ve got determined to construct a small cryptocurrency egg nest, chances are you’ll as effectively go and purchase some ETH. Canada lately launched the world’s first Ethereum ETFs.

In addition to the, different common cryptocurrencies embrace Dogecoin (DOGE), which has surged following bulletins from influential figures like Elon Musk, in addition to Solana is the “base foreign money” of all Memecoins, a very unusual subset of crypto-currencies primarily based on a joke.

Steadily Requested Questions About Bitcoin In Canada

Closing Verdict – Ought to I Put money into Bitcoin?

Bitcoin could go as much as $1m as a few of its supporters adamantly declare, however I nonetheless favor primary index investing by means of all-in-one ETFs, Canada’s robo advisors, or Canadian dividend shares.

Earlier than finally making the choice on shopping for bitcoin or not, simply please perceive one factor:

At this time limit you might be utilizing your cash to invest on what’s going to occur. You’re looking on the names of horses at a horse race, studying the flyer that the racetrack gave you, and betting on a winner.

You’re NOT investing. You’re speculating.

Speculating might be very enjoyable and really worthwhile – but it surely’s not investing.

Oh – and on this horse race, it’s totally doable that each horse may win, but when historical past is any indicator, it’s way more possible that each horse will lose.