Investing in Canadian Dividend Kings (usually known as Dividend Aristocrats) is at all times a well-liked technique when high-flying belongings get pulled again all the way down to Earth. I wager there are loads of Tesla and Shopify shareholders proper now that just like the sounds of steady, reliable revenue progress!

Alternatively, it’s not fairly as straightforward to maintain that conviction whenever you see an progressive inventory like Nvidia go stratospheric. The problem of being a dividend investor is to stay constant in all market circumstances. Click on right here to leap on to my 2024 picks.

To this point, 2024 hasn’t precisely been a banner 12 months for Canadian dividend kings. If we use the S&P/TSX Canadian Dividend Aristocrats Index as our measuring stick, we see that it’s about even on the 12 months to this point. That mentioned, the dividend yield on that index is about 4%, so we’re nonetheless “within the black”. The S&P/TSX Composite Index has accomplished barely higher to this point this 12 months, because it’s up about 3%.

This most likely isn’t an enormous shock to most dividend traders, as excessive rates of interest proceed to tug down loads of the sectors that we like to select from. Telecoms, pipelines, banks, and utilities would all profit from a discount in rates of interest over the remainder of 2024, as their comparatively excessive debt hundreds result in decreased revenue margins throughout higher-interest charge instances.

That mentioned, for corporations with the long-term observe document of Dividend Aristocrats or Dividend Kings, rate of interest gyrations are nothing they haven’t managed by way of earlier than. With rates of interest now set to pattern downward in 2024 and 2025, I’d argue that it’s a reasonably logical conclusion that we’re prone to see outperformance by these shares.

Whenever you examine the most effective Canadian dividend shares or dividend kings with the high-flying US tech shares which have produced eye-popping returns the final couple of years, it’s essential to take valuation into consideration. Nvidia, Apple, Microsoft et al., are all wonderful corporations – that’s not up for debate. They’ll actually proceed to churn out earnings. However the true query for traders is how a lot you need to pay for these future earnings – as a result of proper now, you need to pay a really steep value.

Valuations within the “boring” reliable world of Canadian dividend shares are rather more affordable. If the market goes “sideways” for some time with out huge share value returns, constant dividends will look fairly good in hindsight.

High Canadian Dividend King Choose for 2024: Nationwide Financial institution

Once I made my 2024 Canadian dividend king choose again in January right here’s what I believed I’d be getting:

- A robust regional financial institution

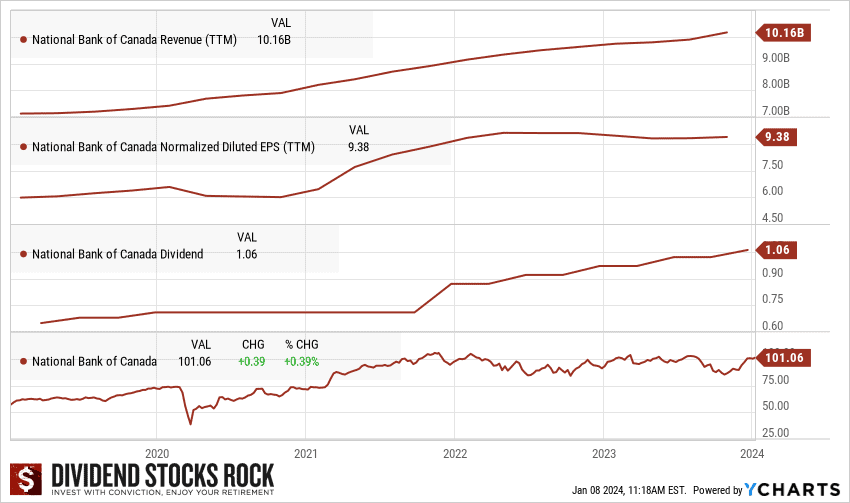

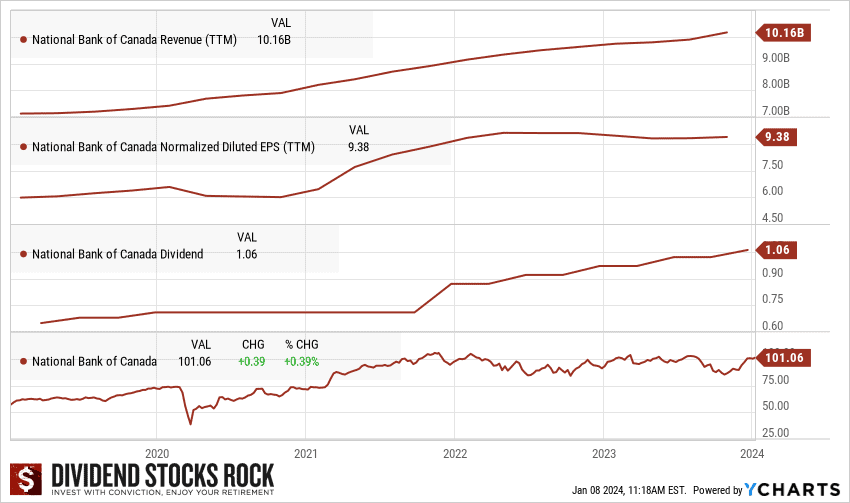

- A rising dividend

- A robust steadiness sheet

- A deal with the Quebec and wealth administration markets

- An excellent likelihood at outsized progress versus the “Large 5 Banks”

These are the primary causes I selected Nationwide Financial institution. I used to be fairly accustomed to the inventory after making it my #1 choose in each 2022 and 2023 – and I noticed no purpose why it could reverse the pattern in 2024. With many different dividend aristocrats affected by excessive debt hundreds, Nationwide Financial institution continued to appear to be a superb wager!

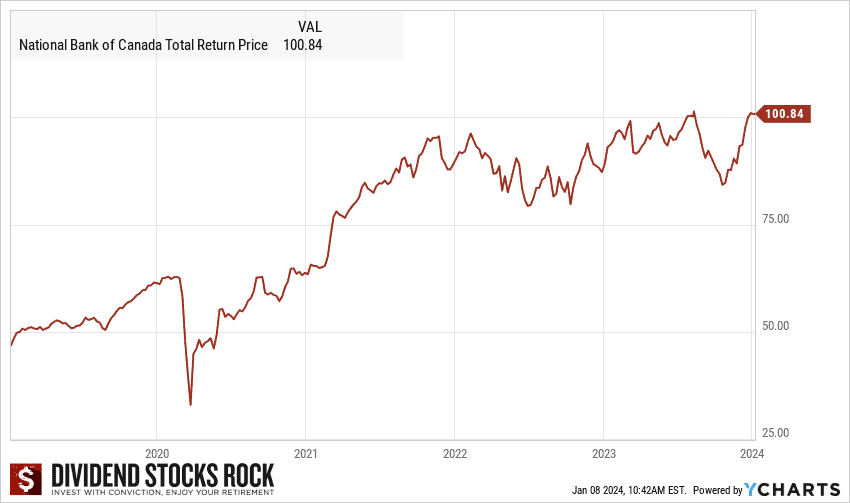

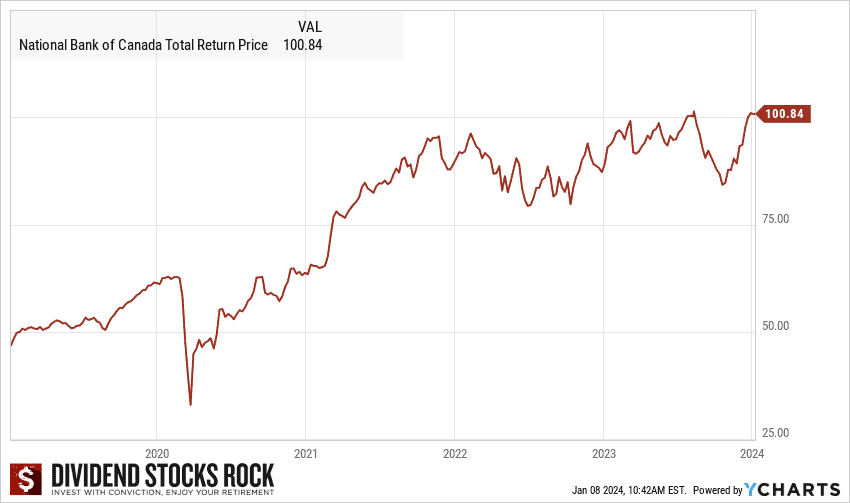

What I didn’t suppose I’d be getting was a inventory that may go on a little bit of a tear, going up almost 20% whenever you thought-about dividends at one level in 2024. I additionally didn’t suppose I’d see Nationwide Financial institution make an aggressive acquisition transfer. In case you missed it, Nationwide Financial institution made massive headlines over the past couple of weeks because it introduced a suggestion to purchase Canadian Western Financial institution for $5 Billion.

A number of traders weren’t proud of the information, and shares sunk about 5% on the day. These detractors are usually not improper in mentioning that Nationwide Financial institution paid a reasonably penny for the eighth largest financial institution of Canada. In an effort to persuade shareholders to promote, Nationwide Financial institution needed to supply greater than double the present worth of the inventory (“a 110% premium).

Nationwide Financial institution doesn’t have loads of expertise operating retail operations exterior of Quebec, and so if you wish to see the glass as half empty, you could possibly actually stare at this acquisition till that actuality appeared.

Alternatively (and I ought to admit my bias upfront, as I positively fall into this camp), this deal has a really excessive likelihood of paying off in the long term for Nationwide Financial institution shareholders. Certain, the one-time value is excessive, however we’re speaking about securing a big piece of the quickest rising a part of Canada (Alberta). That makes a complete lot extra sense to me than tossing capital at dangerous banking markets all around the world which have a ton of competitors.

In a single fell swoop Nationwide Financial institution lands a ton of business purchasers that they’ll cross-sell different merchandise to, in addition to an instantaneous presence exterior the comparatively small market that they’ve saturated over the past decade. Moreover, Nationwide Financial institution accomplished the deal with out taking over a lot debt. Given the high-interest charge surroundings, that’s a key issue.

This deal goes to ultimately boil all the way down to how steady western Canada’s business progress is (as CWB was rather more of a business financial institution than retail financial institution), in addition to how effectively NB’s administration group is ready to squeeze the juice out of including to many new prospects to their broader banking ecosystem. I feel it’s a reasonably good wager on each accounts.

I additionally suppose that investing in Canada – land of banking oligopolies – gives rather more steady progress trajectory than investing in growing international locations or attempting to face off towards giant American rivals.

So whereas the value tag was notable – it’s a one-time deployment of capital that ought to supply considerably elevated earnings going ahead.

Even with Nationwide Financial institution shares taking a little bit of successful with the acquisition information, the inventory continues to be up 6% on the 12 months – outpacing its banking rivals, different Canadian dividend kings, and the broader S&P/TSX Composite Index. That comes on the heels of an unimaginable whole return of almost 20% in 2023!

With, higher-for-longer rates of interest and elevated loan-loss provisions slimming again down once more over the following couple of years, revenue margins ought to start to rise again up. I wrote extra concerning the mortgage loss provisions that the monetary establishments have been setting apart in my investing in Canadian financial institution shares article.

Out of all of the Canadian banks, Nationwide financial institution has been probably the most beneficiant with its dividend raises over the past 3- and 5-year intervals – BUT even with all that dividend generosity, it nonetheless has a reasonably low payout ratio. That bodes effectively for the long-term, and positively means there isn’t any dividend reduce in retailer for 2024. I predict an 8-9% improve within the dividend for 2024.

The banks ought to proceed to profit from the rising rate of interest spreads, and their cautious constructing of reserves is the precise purpose why they’re such strong long-term investments.

My insights on Nationwide Financial institution – in addition to the 2024 Canadian Dividend Kings checklist beneath – are based mostly alone analysis, but in addition relied closely on the recommendation and instruments offered by Dividend Shares Rock. DSR not solely offers wonderful written recommendation, but in addition a ton of free webinars, and splendid instruments for analyzing each the Canadian and American dividend markets.

Learn my DSR overview for an in-depth have a look at simply why I’m such an enormous fan of what fellow Canadian Mike Heroux has put collectively.

Listed below are Mike’s ideas on the place my favorite Canadian Dividend King (Nationwide Financial institution) stacks up towards different Canadian dividend shares for 2024.

Dividend Aristocrats and Dividend Kings Provide Secure Development

Actually, many research (resembling Vanguard) have confirmed that dividend growers are prone to outperform the market and do it with much less volatility. Dividend growers resembling the most effective Canadian dividend aristocrats will proceed to extend their dividend in 2024.

Canadian corporations with a protracted historical past of dividend progress will usually present a powerful enterprise mannequin and sturdy financials. They’ve gone by way of many recessions and by no means stopped rising dividend funds. In instances of confusion and concern, you may return and have a look at how corporations went by way of the previous disaster and saved their dividend streak alive.

I exploit Canadian dividend investing for my leveraged portfolio, important parts of my RRSP and TFSA portfolios, and our company portfolio. We at present gather $78,800 per 12 months in dividends, and you’ll learn extra about that in my most up-to-date internet price replace when you’re .

Prior to now, I’ve written plenty of articles on dividend progress shares, I’ve by no means correctly categorized them. Listed below are the most typical dividend phrases as they relate to the U.S. inventory market:

- A Dividend Achiever is an organization that has elevated its dividend at the least 10 years in a row;

- A Dividend Contender is a traded firm that has raised dividends for 10 to 24 consecutive years.

- A Dividend Champion is an organization that has elevated its dividend at the least 25 years in a row (regardless whether it is a part of the S&P 500 or not);

- A Dividend Aristocrat is an organization that’s a part of the S&P 500 and that has elevated its dividend at the least 25 years in a row;

- A Dividend King is an organization that has elevated its dividend at the least 50 years in a row. The true cream of the crop.

Dividend Aristocrats and Dividend Kings in Canada

Right here in Canada, we’ve got a comparatively small market and a fair smaller checklist of high quality dividend shares. In a earlier article concerning the high Canadian dividend progress shares, you will note plenty of dividend achievers (10 years+ ), a handful of dividend aristocrats (25 years+), and FINALLY for the primary time ever, we’ve got an official “dividend king” (utilizing the US-based definition) in Canada and it’s Canadian Utilities (CU) which formally has a 50-year streak of not chopping their dividends! Congrats CU!

Shut behind, you’ll see Fortis is about to fulfill the factors for changing into an official dividend king as effectively. That mentioned, I feel it’s essential to contextualize that Canada simply doesn’t have as many massive worldwide corporations because the USA, so simply because one thing isn’t formally a “dividend king” within the American sense of the phrase, doesn’t imply it’s not a worthy, high-quality dividend inventory.

As of August 2024

|

Canadian Nationwide Railway |

|||||

|

Canadian Nationwide Sources LTD |

|||||

|

Finning Worldwide Inc |

|||||

|

Cogeco Communications Inc. |

|||||

|

??????? (Hidden, click on for entry) |

??????? (Hidden, click on for entry) |

??????? (Hidden, click on for entry) |

Canadian Dividend Aristocrat Definition

Whereas I used the phrases dividend achievers and dividend aristocrats for the Canadian inventory market within the earlier part, I have to spotlight that the official definition of the Canadian dividend aristocrat differs from the one established within the U.S.

In an effort to be thought-about as a S&P Canadian Dividend Aristocrat, the corporate should have elevated its dividend payout yearly for 5 years – Due to this fact, we’re taking a look at shares which have a superb potential for elevating its dividend however nonetheless fairly distant from 25 consecutive years.

Dividend Kings Checklist

In a couple of years, we will have a shortlist of Canadian dividend kings (together with Fortis and Canadian Utilities). Within the meantime, the place do we discover these elusive dividend kings? You’ll have to have a look at the largest market on the earth – the US! Within the US, there are 30 dividend kings which have elevated their dividend at the least 50 years in a row.

Here’s a desk equipped by Dividend Shares Rock:

|

Stanley Black & Decker, Inc. |

|||

|

Cincinnati Monetary Corp. |

|||

|

Federal Realty Funding Belief |

|||

|

American States Water Co. |

|||

|

California Water Service Group |

|||

|

Northwest Pure Holding Co. |

Purchase Dividend Shares Utilizing the Greatest No Charge Low cost Brokers

We continuously overview and examine low cost brokers with a selected deal with FREE ETFs, in an effort to rebalance your portfolio with out paying greater than you need to. Examine the most well-liked brokers like Qtrade and Questrade in addition to robo-advisors like Wealthsimple and learn to maximize your financial savings!

Presently, the most effective place to purchase Canadian dividend ETFs is Qtrade. Not solely is it the most effective on-line dealer in Canada by a good margin, Qtrade can also be the one place the place you should purchase AND promote ETFs totally free.

Right here is similar desk sorted by yield:

|

Northwest Pure Holding Co. |

|||

|

Federal Realty Funding Belief |

|||

|

Stanley Black & Decker, Inc. |

|||

|

Cincinnati Monetary Corp. |

|||

|

California Water Service Group |

|||

|

American States Water Co. |

|||

As you may see from the checklist, a few of these names are very recognizable with world model consciousness and long run aggressive benefit. Names resembling Procter & Gamble, Coke, Johnson & Johnson, 3M, Colgate, and Lowe’s.

Additionally, you will discover that almost all of them present a low dividend yield. The dividend king common yield is 2.74% with a mean dividend progress of 6.50%. This reveals you that one should pay for the standard. Lastly, most dividend growers won’t solely reward shareholders with dividend will increase, but in addition with regular capital appreciation.

As a disclaimer, I maintain the next dividend kings inside my RRSP: Procter & Gamble; 3M; Emerson Electrical; Coca-Cola; Goal; and, Johnson & Johnson. Additionally, this publish isn’t meant to supply suggestions to your portfolio, however a place to begin to your analysis.

Dividend King Investments for Canadian Retirees

Canadian retirees love accumulating steady, reliable Canadian dividends. It is sensible that amongst those that prioritize stability and earnings movement, Dividend Kings and Dividend Aristocrats are within the highest demand.

Along with the plain causes for retirees to like Canadian blue chip corporations with robust steadiness sheets, there’s a little bit of a hidden purpose as effectively: the tax benefits. Canadian dividend earnings is definitely taxed at a detrimental charge till you hit the $40,000-$50,000 vary (actual determine is determined by which province you reside in).

Which means that a retired couple can earn near $100,000 in Canadian dividend earnings earlier than they pay a dime in earnings tax! At decrease earnings thresholds, that detrimental tax charge can really assist offset earnings tax owing from part-time work or CPP/OAS funds.

In fact, it needs to be identified that one should maintain these Canadian dividend shares exterior of their RRSP and TFSA with the intention to profit from this tax therapy. It’s additionally essential to grasp that this advantageous tax therapy solely pertains to Canadian shares, and to not American or different worldwide shares. Dividends generated by these corporations will nearly assuredly be hit with a withholding tax earlier than you get the cash in your brokerage account.

Given the tax advantages and relative stability (nonetheless extra dangerous than a Canadian GIC) it’s no marvel that Canadian Dividend King shares are successful with retirees. It’s key to recollect although, that variety is your investing pal. It may be straightforward to grow to be too targeted on one particular sort of firm inside the Canadian market.

Canadian Dividend King FAQ

Canadian Dividend King 2024 Outlook

Investing in dividend kings isn’t about attempting to make a fast buck utilizing speculative funding methods resembling momentum buying and selling or something like that.

It’s merely about choosing corporations which have proven the self-discipline and administration effectivity that’s essential to develop a dividend over a protracted time period.

In case you are keen to be affected person, and deal with long-term sturdy aggressive benefit, then Canadian dividend kings are very prone to reward you given their long-term observe document, in addition to Canada’s general progress.

My principal supply for Canadian dividend information (in addition to information on American Dividend Aristocrats) is Mike Heroux’s “Dividend Shares Rock” platform. Mike’s detailed evaluation and private transparency are second-to-none. His unique webinars containing up-to-the-minute info supply unimaginable investor worth.