Choices are top-of-the-line methods to capitalize on market tendencies and improve profitability – if you get your prediction proper. Whereas shopping for choices has a restricted draw back on a per contract foundation, it is usually one of many “greatest” methods to lose your cash available in the market – or as WSJ put it “Extra Males are Hooked on the Crack Cocaine of the Inventory Market”.

Choices buying and selling is just not for the faint of coronary heart, and shouldn’t be utilized by novice merchants. Truthfully, the common Canadian investor has no must ever take a look at choices buying and selling, as they’d be a lot better served utilizing one of many Greatest ETFs in Canada to execute a low-fee index investing plan.

Nevertheless, should you’ve made up your thoughts to commerce choices, like so many Congress members opted to do in 2023, it’s one other a kind of areas the place discovering essentially the most appropriate dealer could make a number of distinction.

This information will provide help to perceive the fundamentals of possibility buying and selling in Canada, stroll you thru the way to use inventory choices to invest on market outcomes, in addition to the way to hedge different investments, and the way to use choices as a way of producing fastened revenue. Lastly, we’ll provide help to uncover the very best platforms and apps in Canada for purchasing and promoting choices.

Greatest Choices Dealer in Canada Comparability

These platforms supply each Canadian and US choices:

Choices Buying and selling Charges

$1 per contract/$6.95 Min.

Greatest dealer in Canada for choices. Robust on-line platform with superior information streams.

Choices Buying and selling Charges

$1.25 per contract/$8.75 Min.

Greatest dealer total in Canada. Barely costlier for possibility buying and selling than Questrade, however higher service.

Choices Buying and selling Charges

$1.25 per contract/$9.95 Min.

Greatest Massive Financial institution Brokerage – 80+ Free ETF Trades, Massive Financial institution Comfort, Medium Price

Choices Buying and selling Charges

$1.25 per contract/$1.50 Min.

Lowest buying and selling charges – Nice for Skilled merchants who borrow cash to speculate and use possibility buying and selling extensively.

Choices Buying and selling Charges

$1.25 per contract/$0 Min.

Very low charges, however a subpar buying and selling platform – no cell app, poor customer support and extra

Choices Buying and selling Charges

$1.25 per contract/$9.99 Min.

Serviceable Platform, Good Comfort, Excessive Charges

Choices Buying and selling Charges

$1.25 per contract/$6.95 Min.

A advantageous platform, however missing the bells and whistles of the opposite Canadian Financial institution Brokerages

*See our full Canadian on-line brokers assessment for particulars on simple methods to drop account charges to zero.

**IBKR has a singular payment construction the place you’ll both pay $10 per thirty days or $10 in buying and selling charges.

Greatest Possibility Buying and selling Platforms in Canada – Reviewed

Buying and selling platforms could also be related in that they permit buyers to purchase and promote shares, choices, bonds and extra, however there are a selection of key variations amongst them.

Understanding these variations will provide help to select the very best choices buying and selling platform to your explicit wants at a worth you’re keen to pay. Let’s dive deeper into how they examine.

Questrade

Questrade is without doubt one of the prime Canadian on-line brokerages. It presents a protected and safe technique to spend money on a variety of economic merchandise, together with choices buying and selling.

The payment for buying and selling choices on Questrade will price you a $9.95 minimal and $1 per contact. Whereas it’s not the most affordable possibility on the market, you may relaxation assured understanding that Questrade has glorious customer support. This may occasionally simply turn out to be useful, particularly if you’re firstly of your choices buying and selling journey.

With Questrade you may full transactions utilizing web-based Questrade Buying and selling, QuestMobile, Questrade Edge and Questrade World. To be taught extra concerning the platforms, charges and extra, try our full Questrade assessment.

Qtrade

Qtrade, in our opinion, is Canada’s greatest dealer for a lot of causes. Shopping for and promoting with Qtrade is simple, price efficient, and the customer support is stellar. The platform presents a big number of commission-free equities, they usually constantly improve their product lineup.

In the case of choices buying and selling, Qtrade prices aggressive charges which have been lowering 12 months over 12 months. Proper now, when you have an “Investor Plus” account, then you may take pleasure in a minimal of $6.95 per buy + $1.00 per contract. Choices assignments price a flat $30.

They’ve additionally launched a brand new instrument referred to as Choices Lab, just like a product of the identical title from Interactive Brokers. This instrument is extremely helpful, breaking down pricing parts, displaying potential outcomes at numerous strikes (possibility buying and selling simulator of kinds), and even serving to novices discover a tailor-made technique with a easy questionnaire.

The truth that Qtrade continues to regulate its choices charges and launch merchandise aimed particularly at choices merchants demonstrates that they view this phase as each significant and invaluable. Qtrade presents web-based and cell app buying and selling, each of that are easy and simple to make use of, together with in depth analysis instruments past the Choices Lab – that are particularly useful for superior merchants or speculators. You possibly can learn why it tops our checklist of Canada’s Greatest Brokers in our Qtrade assessment.

BMO Investorline

BMO Investorline is without doubt one of the greatest bank-owned brokers in Canada. Whereas that does sound good, it merely isn’t ok to prime our checklist as top-of-the-line brokerages in Canada.

That being mentioned, BMO is usually a sensible choice for choices buying and selling if the truth is you’re already a BMO buyer and just like the comfort of getting every little thing in a single place.

In the case of price, BMO Investorline prices a regular $9.95 minimal, plus $1.25 per contract, which is just about the business customary. There’s a quarterly payment of $25, however will probably be waived in case your non-registered account is $15,000 or extra, or your registered account $25,000.

BMO Investorline presents each an app and web-based platform, making choices buying and selling as easy and simple as attainable. In contrast to another banking apps, the BMO Investorline app has respectable scores on each the Google Play retailer and the App Retailer. Discover out extra on our BMO Investorline Overview.

Interactive Brokers

Interactive Brokers (IBKR) is a worldwide favourite amongst day merchants, foreign exchange merchants, futures merchants and in addition – possibility merchants.

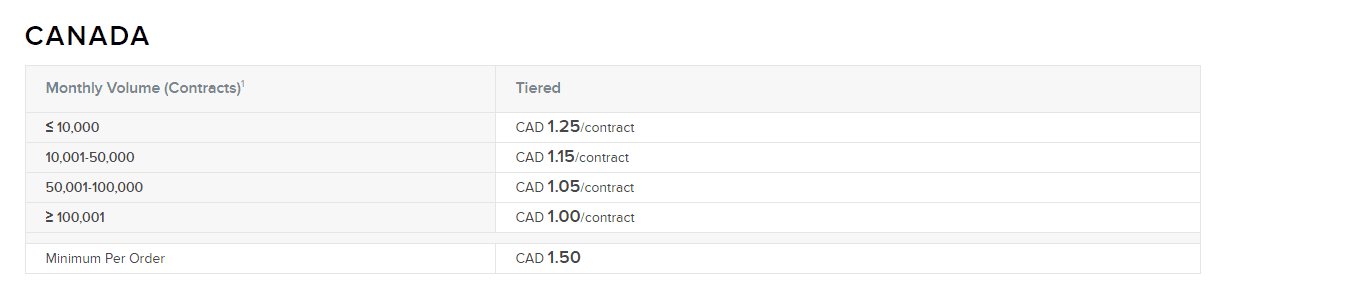

The platform presents each hypothesis instrument you may consider, after which some extra. You’ve got Choices, Futures, Future Choices, and CFDs available. Interactive Brokers additionally has the bottom minimal set at $1.5 (USD) however a increased price per possibility than Qtrade should you don’t commerce in excessive volumes, as detailed under:

The platform presents in depth possibility buying and selling instruments however the stage of usability has a lot to be desired. These instruments can show fairly helpful for superior merchants, however aren’t actually adequate for individuals who do that in knowledgeable capability, whereas we discovered them to be complicated for individuals who wish to make “easy speculations”.

One other factor about Interactive Brokers is that 0DTE choices (choices that are expiring on the identical day as shopping for them, one of many speculator crowd’s favourite dishes) is problematic. They will independently resolve to promote your place primarily based in your account’s margins which defies the aim of 0DTEs.

Learn extra on why in our full Interactive Brokers Overview.

Nationwide Financial institution Direct Brokerage

We now have at hand it to Nationwide Financial institution Direct Brokerage (NBDB) for being the primary Massive Financial institution to supply free brokerage accounts to its prospects. For many who are already NBDB prospects, this may be a handy technique to start your choices buying and selling journey.

Whereas there isn’t a fee payment to commerce choices with NBDB, there’s a $6.25 minimal payment and a cost of $1.25 per contract.

NBDB’s choices buying and selling charges may be lower than different brokerages, they make up for by charging a $100 annual payment for accounts holding lower than $100, or that makes lower than 5 trades per thirty days.

The opposite draw back is that NBDB doesn’t at the moment have a cell app model, making it much less handy for individuals who must commerce on the go. Learn extra concerning the execs and cons of NBDB in our full Nationwide Financial institution Direct Brokerage assessment.

TD Direct Investing

TD is one in all Canada’s most trusted monetary corporations with a protracted observe document. There’s a good likelihood that you simply or somebody has a TD account for investing. TD presents choices buying and selling, nevertheless it’s undoubtedly not essentially the most price efficient.

Choices buying and selling with TD comes with a $9.99 minimal, plus $1.25 per contract, making it one of many costlier choices on the market. In the case of buying and selling platforms, TD Direct Investing has three choices. Most choices merchants beginning out might be utilizing the TD app or TD WebBroker.

In addition they supply a wealth of instructional instruments to assist buyers be taught and enhance their expertise. To search out out extra, try our full TD Direct Investing assessment.

CIBC Investor’s Edge

One other Massive Financial institution possibility, CIBC Investor’s Edge, presents a spread of economic merchandise at a decrease price than different Canadian Massive Banks.

That being mentioned, it’s nonetheless not even near the only option for choices buying and selling in Canada, or another buying and selling for that matter. CIBC Investor’s edge prices an annual $100 account payment. This would possibly make sense if it supplied glorious service, however that’s undoubtedly not the case.

CIBC Investor’s Edge common buying and selling accounts will price $6.95, plus $1.25 per contact. For energetic merchants, it prices a decrease $4.95.So far as platforms go, CIBC Investor’s Edge presents each web-based and cell platforms, each of which obtained a refresh not so way back.

Now customers have a wider vary of instruments and sources to assist them make the very best choices. This may be very helpful, particularly in terms of choices buying and selling. Take a look at our CIBC Investor’s Edge assessment for extra particulars.

Demo Accounts Are Out there

With Qtrade, Questrade, and Interactive Brokers, you may open a demo account to check your methods earlier than venturing into the deep and oftentimes murky waters of choices buying and selling.

We strongly advocate doing so by opening a number of positions and observing the boom-or-bust nature firsthand, previous to risking any of your hard-earned cash on leveraged and risky trades.

Why Commerce Choices?

Possibility buying and selling is unquestionably a extra advanced kind of investing from the place most investor’s begin their journey, comparable to all-in-one ETFs and Canadian dividend shares. As a part of an total choices buying and selling buying and selling technique, we’ll even be sharing the way to considerably defend your portfolio from market volatility.

There’s debate over whether or not choices are really a “zero-sum sport,” however current market turbulence, coupled with a wave of latest merchants, has drawn the eye of savvy, sometimes passive buyers. These buyers, who typically favor long-term index or dividend methods, at the moment are exploring the potential advantages of choices buying and selling.

The objective? Capitalize on volatility and earn what some would possibly name “free cash” by strategically betting on market motion. However whereas long-term buyers solely must predict which corporations might be value extra sooner or later, choices merchants should appropriately reply two questions:

- How a lot will an organization be value sooner or later?

- When, precisely, will it attain that worth?

That timing piece could be very key to know.

Why Commerce Choices (2)

The secondary causes to commerce choices, which we are going to contact on additional under, embrace hedging your portfolio (to restrict draw back – at the price of limiting upside), hedging a sure place (scale back the volatility of a part in your portfolio that modifications too quickly), or promote choices on an asset that you simply’re holding to gather premiums (should you suppose the premiums available in the market are increased than what you’re anticipating to make of that asset).

I perceive these ideas might be complicated with out additional elaboration, however what I’m attempting to say right here is that there are individuals who make the most of choices as a way to stability their portfolio reasonably than add dangers. They simply have to essentially know what they’re doing after they try this.

What are Choices?

Very merely put, choices are contracts that give the dealer a proper to purchase or promote a monetary instrument, comparable to shares, for a specified worth and for a specified time period. Choices are often known as monetary derivatives, as their worth is derived from an underlying asset.

Choices, because the title implies, make it non-obligatory for the dealer to truly purchase or promote throughout the timeframe of a contract. It’s merely a assure for the value and the timeframe set within the contract.

Choices can be found for a spread of economic merchandise, comparable to securities/shares, ETFs, and indices (or Futures).

What’s an Choices Buying and selling Platform?

An choices buying and selling platform is just a brokerage account that means that you can conduct monetary buying and selling actions as a person investor.

Because of this the identical platform you utilize to purchase and promote shares, ETFs and different monetary merchandise may additionally be the identical platform you utilize to purchase choices.

This isn’t the case for all Canadian brokerages. For instance, Wealthsimple Commerce is a web based brokerage however on the time it doesn’t supply choices buying and selling.

Additionally, it’s essential to bear in mind the charges for buying and selling choices are typically on the upper aspect. In the event you make a profitable buy throughout your choices contract, then the payment could possibly be value it. In the event you don’t find yourself making a purchase order throughout your contract because of unfavorable market circumstances, that’s cash down the drain.

How Choices Work

The very first thing to notice is that OPTIONS typically are available in two flavours: CALL OPTIONS and PUT OPTIONS.

Each of those flavours differ considerably from their distant cousin EMPLOYEE STOCK OPTIONS – that are monetary devices issued by corporations to their workers. EMPLOYEE STOCK OPTIONS are an worker profit that represents the flexibility to buy treasury shares proper from the corporate at a specified worth for a specified time period (normally 2 years or thereabouts).

For now, we’re going to concentrate on the extra widespread kind of inventory choices buying and selling, pertaining to CALL possibility and PUT possibility varieties.

Choices are each a quite simple idea, and on the identical time, a really versatile and complicated portfolio administration instrument. There are very conservative possibility methods and VERY dangerous possibility methods. Extra press is given to the riskier methods sadly. Each time I clarify some easy possibility methods to buyers, eyebrows are raised and questions are requested… there simply isn’t sufficient data and investor training on choices on the market.

Let’s start by speaking about Name Choices. Choices are a kind of “spinoff” – and a spinoff is a safety “whose worth is derived from the worth of one thing ELSE.”

What it means on this case, is that once you buy a name possibility on a inventory – you haven’t truly purchased the inventory – however the worth of the choice that you simply simply purchased IS associated to the worth of that “underlying” inventory. I’ll spare you the academia from this level on and simply get proper to the nitty-gritty…

Whenever you purchase a Name Possibility, you’re shopping for the OPTION to buy a inventory sooner or later for a set worth, for a set time period.

This may be advantageous should you thought the inventory was going to go up sooner or later. As a result of, if that occurred, you may now purchase the inventory on the outdated – decrease – worth, and your portfolio would now have an asset that was value the brand new – higher- worth.

Additionally of be aware, is that decision choices present for a level of leverage (permitting you to extend your potential returns).

Let’s look at a typical Name Possibility quote on the inventory ABC, which has a present inventory market worth of $50:

Uncover Canada’s greatest on-line brokers under and keep away from overpaying on a spinoff which is pricey to start with.

| Possibility Sort | Safety | Expiry | Strike Worth | Premium |

|

Name |

ABC | Apr | 55 |

2.50 |

Studying from left to proper: This quote is for a CALL OPTION on the safety ABC. The choice contract EXPIRES IN APRIL. The STRIKE PRICE of $55 is what the choice holder should buy the shares of ABC for anytime up till the third Friday of April. To buy the flexibility to do that would price the choice holder $2.50 per contract per share.

It’s not fairly as simple as a typical inventory quote and definitely some quirks too!

In all probability the factor that stands out most is that every one choices expire on the third Friday of the month listed. Which means the choice holder has the flexibility to train their possibility as much as and together with the third Friday of the month – in any other case the choice expires on the Saturday.

The second factor that I wish to level out is the “strike worth”.

In the event you have been to buy this selection contract, you’ll have the choice of shopping for 100 shares of ABC for $55 per share, it doesn’t matter what the inventory was buying and selling at.

Clearly it might make no sense to “train your possibility” and buy shares of ABC for $55 immediately when they’re solely buying and selling for $50 on the open market. If, then again, ABC was buying and selling at $70 earlier than April, you may nonetheless purchase it for $55, since that’s the possibility you’ve got purchased. Clearly, that’s a no brainer fast win.

Thirdly, be aware that I discussed the amount of 100 shares. Every possibility contract is specified for 100 shares of the underlying inventory. So though the premium (the value to purchase this Name Possibility Contract) is $2.50 – your outlay might be $250 ($2.50 x 100 shares).

Fourthly, when the worth of the underlying inventory begins buying and selling ABOVE the Strike Worth, the choice contract is claimed to be “IN-THE-MONEY”. When the inventory worth is the same as the strike worth, it’s “AT-THE-MONEY”. And at last, when the inventory worth is BELOW the strike worth – the choice is “OUT-OF-THE-MONEY”.Possibility contracts can be used as adopted in monetary parlance: I personal an April 55 Name on ABC.

Sensible Examples for Name and Put Choices

Okay, so we’ve gotten the semantics out of the way in which now, so let’s take a look at some examples of buying the above name possibility contract with three completely different outcomes:

- Inventory goes up

- Inventory worth doesn’t change

- Inventory goes down.

Situation 1: ABC goes as much as $60 earlier than the Expiry Date

On this case the choice contract turns into “in-the-money”. Since you may promote shares of ABC within the open marketplace for $60/share – it might make sense to train your possibility to purchase the shares at $55/share after which instantly promote them for a $5/share achieve.

However, that being mentioned, many individuals don’t truly train their possibility – reasonably, they simply promote the choice contract itself. The choice contract’s worth will fluctuate with the underlying inventory’s worth – and when the contract is within the cash, the choice contract’s worth rises in lock-step. You might promote the choice contract and get the identical return as should you exercised the choice after which offered the shares.

If ABC is buying and selling at $60/share, then the Apr 55 Name might be buying and selling for very near $5. Keep in mind you solely paid $2.50 for it – so should you offered the choice, you’ll have doubled your cash (purchased the choice contract for $2.50 and offered it for $5.00 = a $2.50 achieve x 100 shares = $250 achieve). In the event you did it the arduous approach, then the mathematics would look as follows:

To procure the contract for $2.50, which multiplied by 100 shares = $250 (price).

You train your possibility so you purchase 100 shares at $55 = $5,500 (price).

You then promote your shares instantly for the market worth of $60 x 100 shares = $6,000 (proceed).

$6,000 – $5,500 – $250 = $250

So the mathematics on doing it both approach is equal.

In the event you examine this to the common methodology of being lengthy a inventory, your achieve is just not fairly so spectacular. You would possibly usually purchase 100 shares of ABC at $50 {dollars}, after which simply flip round and promote these shares at $60/share after they admire.

Your preliminary outlay would have been $5,000 (100 shares x $50/share).

Your sale proceeds would have been $6,000 (100 shares x $60/share).

There was no premium paid for any contracts, in order that’s it. You’ll’ve had a achieve of $1,000 on $5,000 – or 20%.

Keep in mind although, we’ve simply appeared on the “rosy” aspect of issues – it is advisable weigh the choices (pun completely meant) of the opposite two outcomes.

Situation 2: ABC stays at $50 as much as the Expiry Date

On this case, the April 55 Name can be “out-of-the-money”. The worth of the choice would slowly dwindle right down to ZERO by the expiry date. The rationale it has any worth in any respect throughout this time is because of the truth that the additional away we’re from the expiry date, the extra likelihood there’s of ABC attending to its strike worth. That is truly often known as the TIME VALUE OF THE OPTION.

Warning: Tangent Starting…

Really, now is an efficient time to make a segway concerning the pricing of choices. The worth of an possibility is made up of two parts:

- The Time Worth of the Possibility

- The Intrinsic Worth of the Possibility.

The Intrinsic Worth of the Possibility is sort of simple to calculate. It’s merely the distinction between the underlying inventory’s worth and the strike worth every time the choice is “in-the-money”. So if ABC have been $60 – the intrinsic worth of the choice is $5.

Easy as that.

The Time Worth of the Possibility is a *bit* extra difficult.

You see, you may’t actually quantify the time worth of the choice in and of itself, however you may determine it out primarily based on the distinction between the choice contract’s worth and the intrinsic worth of the choice. So if the choice contract is priced at $5.50 (once you personal an Apr 55 Name on ABC and ABC is $60/share) then the intrinsic worth is $5 – due to this fact the time worth is $0.50.

In the event you purchased the Apr 55 Name contract on ABC when ABC was at-the-money (i.e. the strike worth is identical because the share worth) and the value of the contract was $2.50, then $2.50 can be the time worth of the choice. The time worth of the choice relies on provide and demand of the contract primarily based on a mixture of the time to expiry coupled with the space to the strike worth.

Tangent Over! 🙂

Okay, so again to our instance, if ABC by no means appreciates (or in different phrases, by no means will get to the strike worth) then the choice contract will expire nugatory! Which means that you’re out the $2.50 contract premium you paid and you’ve got misplaced 100% of your cash or $250 (100 shares x $2.50)!

Evaluate this to only going out and shopping for the 100 shares for $50/share after which promoting them for $50/share. You spent $5,000 and obtained again $5,000 (nicely, I suppose you’ll be out a couple of bucks for commissions, however for the sake of our argument – let’s omit commissions for now). On this case you continue to have your total principal.

So – impulsively, the world of choices is dropping a few of its luster, n’est-ce pas?

Situation 3: ABC goes right down to $40

Properly, by now you must notice that except ABC is within the cash by the expiry date of the choice contract, the choice contract will expire nugatory it doesn’t matter what. So you continue to have misplaced 100% of your cash by shopping for the Name Possibility Contracts on this case. It doesn’t matter if ABC turns into delisted – you may solely lose 100% of your cash when shopping for a Name Possibility Contract.

However for the investor who goes out and buys 100 shares of ABC at $50/share after which sells them for $40/share, they are going to have misplaced $1,000 on their preliminary $5,000 outlay – for a complete lack of 20%.

However whereas a 20% loss sounds higher than a 100% loss – on this case the choice contract holder solely misplaced $250 whereas the standard methodology yielded a lack of $1,000. So absolutely the loss is bigger than with the standard methodology on this case.

Uncover Canada’s greatest on-line brokers under and keep away from overpaying on a spinoff which is pricey to start with.

Are Calls, Places, and Hedging for You?

Okay, so now you’ve got seen the mechanics behind how name choices work. I feel I’ve offered a balanced view of how they will work (or backfire) for an investor.

So who buys choices?

Properly there are two major causes for purchasing name possibility contracts.

1) Excessive potential leverage – when a inventory solely has to understand by (within the instance case) 20% to yield a 100% return in your cash – nicely that’s quintessential leverage isn’t it?

2) Restricted danger – Perhaps that sounds paradoxical when you may lose 100% of your funding, however think about absolutely the worth of the loss might be small (the worth of the contract buy) which in our pattern case was $250.

When you’ve got a idea or a hypothesis {that a} inventory goes to understand, shopping for an possibility means that you can leverage your lengthy place in that inventory for a fast and huge achieve… in idea.

In actuality, when you find yourself shopping for a inventory possibility name or put, you’re the truth is paying a hefty premium and notably in instances like immediately through which the volatility is at peak as additionally mirrored on the VIX (which measures volatility expectations by measuring the premium charges on places – if the VIX is excessive it signifies that put premiums are excessive). As of immediately, taking important positions might be very costly to do and whereas your loss in shopping for choices is capped you continue to have a variety to beat.

One of the simplest ways to clarify this idea is with an instance.

Let’s take a look at June 20, 2020, for SPY (SPDR S&P 500 ETF). Let’s assume you suppose that by Jan 15, 2021, the market will drop. You’re both attempting to defend your lengthy portfolio by betting in the other way, or just making a hypothesis.

The present SPOT for SPY is 308 (precisely 10% of the SPX), and also you suppose it would drop a hefty 20% by then to 277. So you purchase put choices for a 277 strike for Jan 15, 2020.

A single possibility will run you $17.56 and one contract consisting of 100 choices will price you $1,756. That signifies that you solely begin incomes when SPY drops under 260 factors (deducting the unfold price from the precise strike)… and even when that occurs, a single contract isn’t going to defend a lot of your portfolio!

Even when SPY drops to 240 which is a really drastic situation, that contract is simply going to internet $2,000 in revenue (or $3,756 in whole return, which incorporates your preliminary prices).

So to guard a large portfolio you have to to purchase a superb variety of such contracts, and that capped/restricted loss idea is voided since you’ll be risking a considerable quantity of your portfolio into that possibility.

Therefore, the conclusion is that should you have been to purchase put choices to hedge your portfolio or a selected funding, you must do it earlier than all the world is submerged in possibility shopping for and each second headline on the tv speculates the place the inventory market is heading, as a result of then premiums might be at their absolute PEAK making your so-called “insurance coverage choices” fairly ineffective.

Choices Promoting / Writing

You must know that buyers have the choice of SELLING name choices too.

That is generally known as Name Possibility WRITING. On this case you’ll promote the contract and gather the premium (versus BUYING the contract and PAYING the premium).

The choice purchaser would have the choice of shopping for your shares earlier than the expiry date, and you’ll be OBLIGATED to promote your shares to them. If the inventory by no means reaches the strike worth, the contract expires nugatory to the choice holder (though you’ll have saved the premium it doesn’t matter what – and nonetheless personal the inventory within the case of a “lined” name write).

Uncover Canada’s greatest on-line brokers under and keep away from overpaying on a spinoff which is pricey to start with.

Coated Name Writing

In my view, Coated Name Writing is without doubt one of the most suitable choice buying and selling methods. Versus bare name shopping for, it has one notably fascinating use:

It’s another technique to set a “restrict promote order”.

As an alternative of instructing your dealer to promote when your inventory will get to a sure level, you may simply WRITE or SELL a name possibility and choose up some extra income (the value you get for the contract) besides. When the inventory reaches the strike worth, the choice holder will train their proper to purchase the shares and you can be compelled to promote – once more: nice should you have been as an alternative planning on setting a restrict promote order.

That is in all probability the commonest “entry level” in terms of utilizing choices for the common investor.

For instance should you purchased a inventory for $50 and thought that when/if it reaches $60 can be a superb time to promote, you would possibly instruct your dealer (or buying and selling platform) to mechanically promote at $60. In that case you’ll have made a achieve of 20% ($10 achieve on $50 funding – ignoring commissions).

Alternatively, should you purchased the inventory for $50 and as an alternative WROTE a name possibility with a strike worth of $60 and offered that contract for $2.50 – then assuming the inventory appreciated to $60, the choice holder would train their possibility to purchase at $60, and you’ll be compelled to promote.

You’ll have collected a $10 achieve from the inventory AND the $2.50 premium from promoting the choice contract for a complete achieve of 25% versus 20%. An additional 5% achieve, with the one added danger being that you may miss out on a big-gaining inventory (which you’d have anyway should you had a promote order in place).

In reality, the achieve could possibly be increased if the decision possibility expires earlier than reaching the inventory worth. If that have been the case, you’ll preserve writing the decision choices on an ongoing foundation and preserve pocketing the premiums alongside the way in which. If the second name possibility you wrote was exercised then your achieve can be 30% ($10 achieve from the inventory + [ 2 x $2.50 per contract ] ).

Many buyers will simply preserve writing lined calls and amassing the premiums time and again.

When a contract expires, they are going to flip round and write one other one. When you’ve got used this technique on BCE for the final 8 years you’ll have collected not solely the wholesome dividend from BCE’s inventory, but in addition the continued premiums for numerous expired name possibility contracts that you simply wrote time after time. This may have taken away a number of the sting of BCE’s share worth falling.

That is referred to as “COVERED Name Writing”. “Coated” signifies that you personal the inventory.

In the event you didn’t personal the inventory it might be referred to as “Bare Name Writing”. Bare Name Writing is usually a VASTLY RISKIER proposition as a result of if the inventory’s worth will increase dramatically you can be compelled to promote shares on the strike worth (by brief promoting – like in The Massive Quick) after which masking your brief at a better inventory worth.

Let’s take a look at an instance of Bare Name Writing:

You don’t personal ABC – which is buying and selling at $50, however you resolve to write down a unadorned name possibility contract with a strike worth of $54 and an possibility premium of $2, expiring in 4 months. If ABC doesn’t get to $54 inside 4 months, you’ll have pocketed the $2 – all whereas placing down none of your personal cash!

BUT, let’s say that ABC shoots up at some point to $60.

On this case, if the choice holder workouts their possibility of shopping for ABC at $54, then you definitely should present ABC to them at $54/share. So as to ship the shares, you have to to purchase ABC on the open market at $60/share. Subsequently, you got at $60, and offered for $54 for a $6 loss. You continue to pocket the $2 for promoting the choice contract within the first place, in order that reduces your loss from $6 to $4.

You possibly can see from this instance that if the inventory strikes considerably, your losses might be excessive!

Uncover Canada’s greatest on-line brokers under – uncover dependable and quick platforms that allow you to take action.

Tips on how to Write a Coated Name Possibility in Apply

Let’s assume that you’ve an fairness that you’re keen to write down a name possibility towards.

Right here’s the steps you’ll observe:

1) Decide a inventory or ETF that you simply wish to write a name on.

2) Learn the choice desk. Choices expire the third Friday of the month and there’s a consistently evolving set of “betting strains” with reference to what the worth might be for that inventory or ETF on that day.

3) Select a strike worth. The strike worth is the value you’re keen to promote your shares at. In the event you promote a name for $50, it means that you’re keen to promote your inventory or ETF for $50 if the client pays you a premium of $$$.

4) If on that date the inventory is value greater than $50, then you can be compelled to promote the inventory for $50 – however you continue to get to maintain your premium. Whether it is value lower than $50, no shares commerce arms and also you stroll away along with your premium.

5) Keep in mind that one contract equals 100 shares of underlying inventory.

6) For transaction kind, deciding on “Promote to Open”. This merely means that you’re promoting the choice to open the place. If you wish to purchase again the choice that you simply offered, or purchase any possibility “lengthy”, you select “purchase to shut”.

The Fairness Collar – One other Danger Discount Choices Technique

Hypothesis and hedging are the 2 major causes for utilizing derivatives. Hypothesis is the taking up of danger, and hedging is the discount of danger.

Inside each broad choices buying and selling classes, there are various levels of every. The Fairness Collar could be very a lot a hedging technique designed to cut back danger.

An Instance

Maybe as a way to facilitate understanding I’ll begin with an investor profile after which work within the technique as an answer to the issue. Let’s say that Sally is 64-years-old and has collected a large portfolio that’s strictly invested in an ETF that tracks all the inventory market.

Let’s say that this inventory market is buying and selling at 10,000 proper now and the ETF’s unit worth is $100. The markets have pulled again just lately, and Sally is not sure if we’ve hit backside or if there’s extra draw back to the markets.

She want to retire on the finish of this 12 months (9 months from now). At which level she has determined she’s going to then change her portfolio to 50% equities and 50% fastened revenue. She owns 5,000 models of the ETF for a complete portfolio worth of $500,000.

She feels strongly that with the current pull-back within the markets that if we’re at a backside, the market may have a constructive 12 months and find yourself at perhaps 10,800 factors, or up 8%. On the identical time, she realizes that within the brief time period the markets can pull again additional and doesn’t wish to erode her retirement financial savings any additional if that have been to occur as she is 9 months away from retirement as talked about.

If she needed to guard her portfolio (or insure it from additional losses) she might purchase a put possibility on the ETF with a strike worth of $100. This put possibility offers Sally the fitting (however not the duty) to promote her ETF shares on the strike worth of $100/unit up till the choice contract expires. This now protects her from losses in her portfolio up till the expiry date of the choice (which in her case can be 9 months from now).

So for instance, on the finish of the 12 months if the market had dropped from 10,000 right down to 9,200 (a lack of 8%), her ETF models would have equally dropped from $100/unit to $92/unit. Nevertheless, Sally might train her proper to promote her models for $100/unit. Subsequently she protected her portfolio from loss.

After all – as with every insurance coverage there’s a price concerned – which I’ve omitted up up to now. Let’s assume that the price of the put choices are $2/share to buy. On this case, to utterly defend her portfolio she would want to purchase 50 put possibility contracts (an possibility contract is for 100 shares) to insure her total $500,000 portfolio. This may price her $10,000 in whole ($2/share x 5000 shares). When you issue on this price, then actually the portfolio is insured to not fall under $490,000 as a result of you would need to pay this $10,000 price it doesn’t matter what occurred.

For some folks, this price of insurance coverage may be too excessive they usually could wish to discover a technique to scale back or remove it. If Sally have been to show round and SELL a name possibility (this implies she is giving somebody ELSE the fitting, however not the duty, to purchase her models) for a strike worth of $110, she would possibly get $1.50/share from the sale of that contract. That is what is named writing a lined name.

On this case, if she wrote (offered) 50 name possibility contracts with a strike worth of $110/unit, she would obtain $7,500 in premiums ($1.50/share x 5,000 shares). This could possibly be used to offset the acquisition of the put choices of $10,000 for a internet price to Sally of $2,500 versus $10,000.

The trade-off is that she is now assured not more than a ten% achieve on her portfolio as the decision possibility holder would train their proper to purchase Sally’s shares as soon as they reached over $110/unit.

The Outcomes

What’s the finish end result?

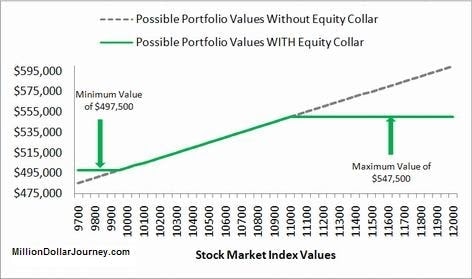

Sally is assured to have between $497,500 and $547,500 by the point she retires. That assure has price her $2,500.

She has protected her portfolio from a lack of not more than 0.50%, however has restricted herself to a most attainable achieve of 9.5%.

It’s attainable to utterly offset the purchased put choices’ premiums with the offered name choices’ premiums if Sally have been to decrease the strike worth on the decision choices she sells to maybe $108.

On this case she would possibly command a better premium of $2/share for promoting the decision choices which might utterly offset the price of the put choices. On this case her portfolio can be certain between $500,000 and $540,000 (assured return between 0% and eight%). Once more although, Sally is buying and selling off much more upside potential for her portfolio.

The simultaneous buy of a put possibility with the sale of a lined name possibility is named the Fairness Collar.

Vital: Dwell Charges are CRITICAL

A standard mistake novice choices merchants make is counting on platforms like Yahoo for possibility chain costs or utilizing a dealer like Interactive Brokers with out the right subscriptions for real-time information. As a result of possibility costs can transfer extraordinarily quickly (that by not utilizing algorithmic buying and selling you’re already at an inherent drawback).

Therefore, relying on delayed or outdated data can result in main errors. For example, choices would possibly swing 50% in a matter of simply 5 minutes. In the event you’re utilizing stale information, you would possibly find yourself bidding at a worth that’s now not legitimate or paying considerably greater than you must have.

One other challenge for these transitioning from “plain vanilla” inventory buying and selling is mechanically paying the Ask worth reasonably than bidding at a set worth they’ve decided. They assume a 5–10 cent distinction per contract gained’t matter, however with the leverage concerned in choices, it actually can.

If the subsequent commerce happens at 10 cents under your crammed order, you’re already at a theoretical loss, though the underlying asset’s worth hasn’t modified. Plus, when factoring within the not-insignificant prices of shopping for choices, you may be taking a look at a MAJOR loss earlier than the asset worth moved (notably true for OTM low cost choices).

Choices Buying and selling in Canada – FAQ

Backside Line on Choices Buying and selling in Canada

Choices pose a possibility for important leverage in your portfolio.

It permits the “refined buyers” to hedge potential losses or, alas, to extend the extent of hypothesis danger (in comparison with shares and ETFs).

Promoting choices and notably lined choices is a stable approach of amassing premiums at an affordable danger (so long as they’re COVERED). In the fitting arms, choices are a strong instrument. Massive monetary establishments (filled with math PhDs) use them en mass – which may attest to their validity as a usable spinoff.

Once more, we’re not huge followers of choices investing for the common Canadian. That mentioned although, when you have made as much as your thoughts to dip your toe in these waters, just be sure you perceive your Canadian choices buying and selling platform and the related payment construction.

Uncover precisely what the Greatest Canadian On-line Brokers can supply by way of day buying and selling and extra in our full write up. In case you are simply getting began in your funding journey, our information on Tips on how to Purchase Shares in Canada is a superb place to begin.

Written for MDJ by a wide range of writers together with FT and Preet Banerjee – Canadian monetary creator and fintech entrepreneur.