What’s CI Direct Investing and Is It a Robo Advisor?

CI Direct Investing is a mix of an automatic investing platform and a private accessible monetary advisors.

In relation to taking a bit of your month-to-month pay cheque and turning it right into a diversified funding portfolio – CI Direct Investing does that for you. That a part of the enterprise could be thought-about a “robo advisor mannequin”.

What units CI Direct Investing aside although, is the truth that proper from Day 1, you should have entry to wonderful monetary recommendation at your fingertips. This monetary advisor will often maintain the credential of a Licensed Monetary Planner® skilled. That’s an necessary distinction, as a result of it carries authorized duties far past that of a “monetary planner”.

Because the precursor to CI Direct Investing, WealthBar took nice pains to emphasise the utilization of sound monetary recommendation relative to different FinTech corporations (which had been typically lumped collectively underneath the generic title of “robo advisor”). In our JustWealth Evaluate we clarify how that robo advisor has actually emphasised the monetary planner’s function within the course of as nicely.

Should you’re somebody who is definitely on the lookout for a monetary planner, over a hybrid robo advisor/monetary planner platform, it would be best to try our article of the Finest Monetary Advisors in Canada.

What Accounts Does CI Direct Investing Provide?

If you register with CI Direct Investing (you may get began in as little as ten minutes) you’ll be able to open the next accounts:

- Fundamental Non-Registered Account

- Financial savings Account

- Joint Account

- TFSA

- RRSP

- Spousal RRSP

- RIF/RRIF

- RESP (together with Quebec residents)

- LIRA

- LIF

- Company Funding Account

- Belief Accounts (Formal Belief Accounts and Casual Belief Accounts)

- Charitable Group Funding Accounts

- Group TFSAs and RRSPs (to your workers in the event you personal an organization)

- Particular person Pension Plans

- Private Pension Plans

CI Direct Investing Evaluate: Charges

Your portfolio goes to have two ranges of charges once you make investments via CI Direct Investing.

- The charges that your underlying ETFs will cost you.

- The charges that CI Direct Investing will take for serving to you out in your investing journey.

The underlying ETF charges are going to value between .16% and .30% for the passive ETF portfolios. The energetic ETF portfolios and the Socially Accountable Funding (SRI) portfolios will include a better ETF payment.

The ETF charges that we check with are generally known as a Administration Expense Ratio (MER) and are generally proven as a share of your general property. As a result of MERs are an inherent a part of the ETFs themselves, purchasers is not going to see this cash deducted from their CI Direct Investing account.

CI Direct Investing’s charges are charged underneath the next annual construction:

.60% in your first $150,000 invested

.40% on $150,000-$500,000

.35% on something over $500,000

So, in the event you had $100,000 invested, you’d owe CI Direct Investing about $600 for the 12 months, and the interior prices of your ETFs could be round $180-$260 which might be mirrored in your portfolio’s efficiency.

Should you had $750,000 invested with CI Direct Investing, you’d owe:

$150,000 x .6 = $900

$350,000 x .4 = $1,400

$250,000 x .35 = $875

Complete CI Charges = $3,175

ETF Charges = $1,350-$1,950

That’s it – fairly clear and straightforward to calculate!

CI Direct Investing for Canadian Non-Resident Expats

At one time CI Direct Investing was the one robo advisor choice out there for Canadian residents who’re additionally non-residents for tax functions (aka: expats). Given my expat journey to Qatar, this was clearly very pertinent to me! JustWealth has said they’d contemplate non-resident accounts on a case-by-case foundation.

When doing my analysis, I did come throughout a few robo advisor-style platforms based mostly out of Switzerland and Singapore – however they had been prohibitively costly and fairly sophisticated to make use of. For my part, CI Direct Investing is by far the most suitable choice for Canadian expats.

I’m very impressed with what CI Direct Investing has put collectively for his or her expat purchasers. If you’d like the simplest strategy to get into index investing as a Canadian expat – that is far and away the perfect answer! You’re going to pay a bit greater than you’d in the event you had been index investing utilizing a Canadian low cost brokerage, however relying on how large your portfolio is, it’s fairly attainable that you just’ll pay much less in general charges than you’d with a global low cost brokerage – plus you get a ton of further providers in return to your cash.

The one caveat right here is that CI Direct Investing is just not out there within the USA or sure different nations comparable to North Korea, Iran, and so forth.

Right here had been the solutions to my expat questions once I emailed CI Direct Investing.

What do Canadian Expats want as a way to open up a robo advisor account with CI Direct Investing?

- $25,000 account minimal

- Your downloaded account assertion for a Canadian checking account

- An digital doc issued by a Canadian authorities company, or a cellular phone firm, or a utility firm.

- Canadian SIN

- Any international tax ID numbers which were assigned to you

- A signature (both digital or old-fashioned)

Do I’ve to be in Canada at any level or have a Canadian deal with as a way to open a non-resident account with CI Direct Investing?

Completely not.

What accounts can I open as a Canadian non-resident?

You must follow a plain, vanilla non-registered account as a non-resident. Nevertheless, you possibly can additionally switch over any current RRSP and/or TFSA accounts you’ve gotten as a way to preserve life easy and have all of your investments underneath one roof.

What taxes will I’ve to pay with CI Direct Investing?

The identical taxes you’d need to pay anyplace else as a Canadian non-resident. Specifically, the withholding tax on Canada-sourced revenue. What you owe in your new nation clearly is determined by native legal guidelines.

How does having a CI Direct Investing account have an effect on my non-resident standing – and is it a powerful resident tie?

Neither a non-resident CI Direct Investing account, nor a non-resident low cost brokerage account goes to be a secondary residential tie to Canada. It is not going to be sufficient – by itself – for the CRA to think about you a factual resident. Should you additionally personal a automobile in Canada that you just use once you come for the vacations, by no means cancel your provincial medical insurance, and nonetheless have a provincial driving license… The mix of all of these issues would possibly begin to tilt the scales towards being thought-about a factual resident.

How Does It Work? CI Direct Investing ETF Portfolios

If you first join with CI Direct Investing, you’ll be matched to the proper funding based mostly in your objectives and threat profile. You may join with an adviser how and when it really works for you. Merely join through electronic mail, cellphone, video or chat.

CI Direct Investing has 4 totally different investing paths: Passive Portfolios, Energetic (Personal Funding) Portfolios, Socially Accountable Portfolios, and Money Equal Portfolios. The Passive Portfolios are their ETF portfolios which is probably going what you might be on the lookout for when studying this text.

Throughout the broad Passive/ETF Portfolios at CI Direct Investing, there are eleven asset allocation choices:

- Important Security Portfolio

- Important Balanced Portfolio

- Important Aggressive Portfolio

- Conservative ETF Portfolio

- Development ETF Portfolio

- Important All Fairness Portfolio

- Important Conservative Portfolio

- Important Development Portfolio

- Security ETF Portfolio

- Balanced ETF Portfolio

- Aggressive ETF Portfolio

Every of those all-in-one options is made up of the next ETFs – simply held in numerous proportions relying on how a lot threat you need to take.

- iShares Core Canadian Universe Bond Index ETF (XBB) = Canadian bonds

- CI Canadian Combination Bond Index ETF (CAGG) = Canadian bonds

- CI Canadian Fairness Index ETF (CCDN) = Canadian shares

- Vanguard World Combination Bond Index ETF (CAD-hedged) (VGAB) = Bonds from around the globe, hedged to the Canadian greenback

- CI U.S. 500 Index ETF (CUSA.B) = US shares

- CI Excessive Curiosity Financial savings ETF (CSAV) = Canadian banks excessive curiosity financial savings accounts

- BMO MSCI EAFE Index ETF (ZEA) = Canadian and US shares

- BMO Excessive Yield US Company Bond Index ETF (ZJK) = US bonds from companies

- CI U.S. 1000 Index ETF – Unh (CUSM.B) = US shares

- CIBC World Bond ex-Canada Index ETF C$ (CGBI) = World mounted revenue

- iShares Core MSCI EAFE ETF (IEFA) = Developed market equities excluding the US and Canada

- iShares Core MSCI Rising Markets ETF (IEMG) = Rising market equities

- CI Rising Markets Alpha ETF (CIEM) = Fairness and Fairness-related securities of corporations in rising markets, or serving clients in rising markets

- CI Enhanced Quick Period Bond Fund (FSB) = World Fastened Revenue

- CI Fairness Asset Allocation ETF (CEQT) = World Fairness Securities

- CI Balanced Revenue Asset Allocation ETF (CBIN) = World mounted revenue and fairness securities

- CI Balanced Development Asset Allocation ETF (CBGR) = World fairness and glued revenue securities

For instance, right here’s a take a look at the balanced ETF Portfolio (as at the moment constructed on the time of writing).

|

iShares Core Canadian Universe Bond Index ETF |

||

|

CI Canadian Fairness Index ETF |

||

|

Vanguard World Combination Bond Index ETF (CAD-hedged) |

||

|

CI Rising Markets Alpha ETF |

||

|

CI Enhanced Quick Period Bond Fund |

||

|

BMO Excessive Yield US Company Bond Index ETF |

Like JustWealth, CI Direct Investing gives Socially Accountable Investing (SRI) portfolios – – fifteen of them to be precise! A lot of their SRI portfolios are merely their passive portfolios from above, however with a “Cleantech add-on”.

Right here is how their Balanced Influence Portfolio breaks down (as at the moment constructed on the time of writing).

|

CI MSCI World ESG Influence ETF (CAD Hedged) |

||

|

NEI World Influence Bond Fund |

||

|

First Belief NASDAQ Clear Edge Inexperienced Vitality Index ETF |

Typically talking, in case you have long run objectives, and a better threat profile, your ETF portfolio will likely be weighted extra closely in the direction of shares and fewer in the direction of bonds.

CI Direct Investing has chosen the ETFs for his or her portfolios by utilizing the next standards:

- Monitoring error minimization to reflect the index

- Greater buying and selling quantity ETFs chosen for finest pricing

- Precedence given to funds with increased Belongings Underneath Administration

- All else equal, they select the ETF with the decrease share value

- Nation of origin thought-about to cut back foreign money alternate costs

- Profitable efficiency historical past verified

- Lowest MER attainable

If you wish to change your chosen ETF portfolio, you are able to do that at any time – BUT – needless to say you had been positioned in a portfolio for a motive. Has your threat tolerance actually modified, or are you merely chasing latest efficiency? These are nice conversations to have along with your CI Direct Investing advisers.

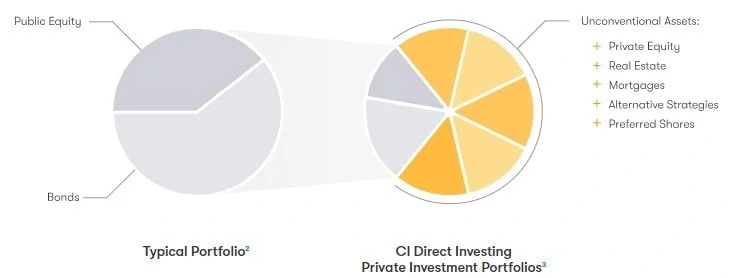

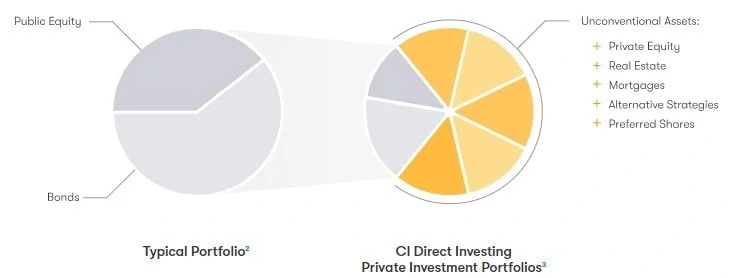

How Does It Work? CI Direct Investing Personal Funding Portfolios

To know the distinction between CI Direct Investing’s ETF portfolios and their Personal Funding Portfolios (additionally known as Energetic Portfolios), it helps to get a fast refresher on energetic vs passive investing.

Energetic Investing Mindset: Whomever I decide to handle my investments is smarter than the common one that invests in property within the inventory/bond/actual property/commodity markets. As a result of they’re smarter, they will decide investments which might be at the moment price greater than what persons are paying, or that can do higher sooner or later than most individuals suppose. The flexibility to choose these higher investments will result in higher general returns on my funding cash and/or my portfolio can have a lot much less volatility (i.e. “large ups and downs”). As a result of the funding professionals will likely be working actually laborious to pick out these better-than-average investments, the individuals who will handle my investments might want to receives a commission and can cost me a share of my complete portfolio annually.

Passive Investing Mindset: There isn’t any statistical proof that we will establish which funding folks or funds are going to be better-than-average in terms of selecting the perfect shares/bonds/actual property/commodity investments. It’s actually, actually laborious to choose investments that beat the common, as a result of plenty of extremely good persons are making an attempt to do exactly that every single day. As a result of it’s actually, actually laborious to choose investments that beat the common by even a small quantity, that further that I’m paying in charges signifies that they need to be a super-duper All Star to ensure that me to pay their further charges, and nonetheless have sufficient funding returns leftover to beat the common.

I’m probably higher off simply slicing my charges as little as attainable and taking the common of the asset class. I can try this by utilizing the ETF portfolios to personal almost each giant firm on the earth.

Energetic Investing + Totally different Asset Lessons

CI Direct Investing’s Personal Portfolios use actively managed Nicola Wealth Funds to construct purchasers a portfolio of investments that embody “unconventional property” as proven under.

There are three totally different Personal Portfolio choices out there.

- Security Personal Portfolio

- Balanced Personal Portfolio

- Aggressive Personal Portfolio

Right here’s an instance of what your asset allocation would seem like in the event you selected the “Aggressive” choice (correct on the time of publishing).

|

Nicola Core Portfolio Fund |

||

Personally, I stay unconvinced that the Personal Portfolios supply any further utility to the common investor. I perceive the idea of making an attempt to diversify into asset lessons that aren’t correlated to shares/equities, however these excessive MER charges that go together with energetic administration scare me.

The Personal Portfolios do have a comparatively good observe document over their brief lifespan, however as with all issues investing, “Previous outcomes are usually not indicative of future efficiency.”

I like to recommend maintaining it easy and staying away from these extra sophisticated choices.

Is CI Direct Investing Secure?

Sure!

CI Direct Investing is as protected as any banking and funding choice in Canada!

After all, one has to do not forget that in terms of investing, “protected” means various things to totally different folks. There isn’t any firm that may assure funding returns. CI will ensure that your info stays protected, and that your investments are shielded from sure / some fraud or company chapter – however your investments can nonetheless go down in worth. If any firm claims that they will assure the “security” of your funding returns – I’d stroll away instantly.

CI Direct Investing is the robo advisor arm of an enormous firm that manages over $280 Billion price of property. Corporations this huge make use of the most recent in on-line safety and encryption requirements. I might hesitate to say that any web site or on-line platform is “hack-proof”, however on the very least, you’re as protected with CI as you’d be anyplace on-line.

Some folks ask, “What occurs if my robo advisor goes bankrupt?”

No worries on that entrance. Firstly, there are every kind of legal guidelines that stop monetary corporations from dipping into your funding property to pay their bills. In order that’s one degree of safety.

The second degree of safety is definitely simply the free market! You’re a fee-paying buyer, and so if for some loopy motive CI Direct Investing decides that their robo advisor department of the corporate isn’t pulling its weight, it’s fairly probably the corporate could be bought to a different robo advisor platform, and your property would keep good and protected whereas new administration took over.

The ultimate layer of safety is maybe the one which evokes probably the most confidence. If you use CI Direct Investing your investments are robotically insured by the Canadian Investor Safety Fund (CIPF) as much as $1 Million per account via a third get together supplier they accomplice with. This provides your funding portfolio the complete safety of the Canadian authorities, and consequently is about as strong a assure as you’ll find.

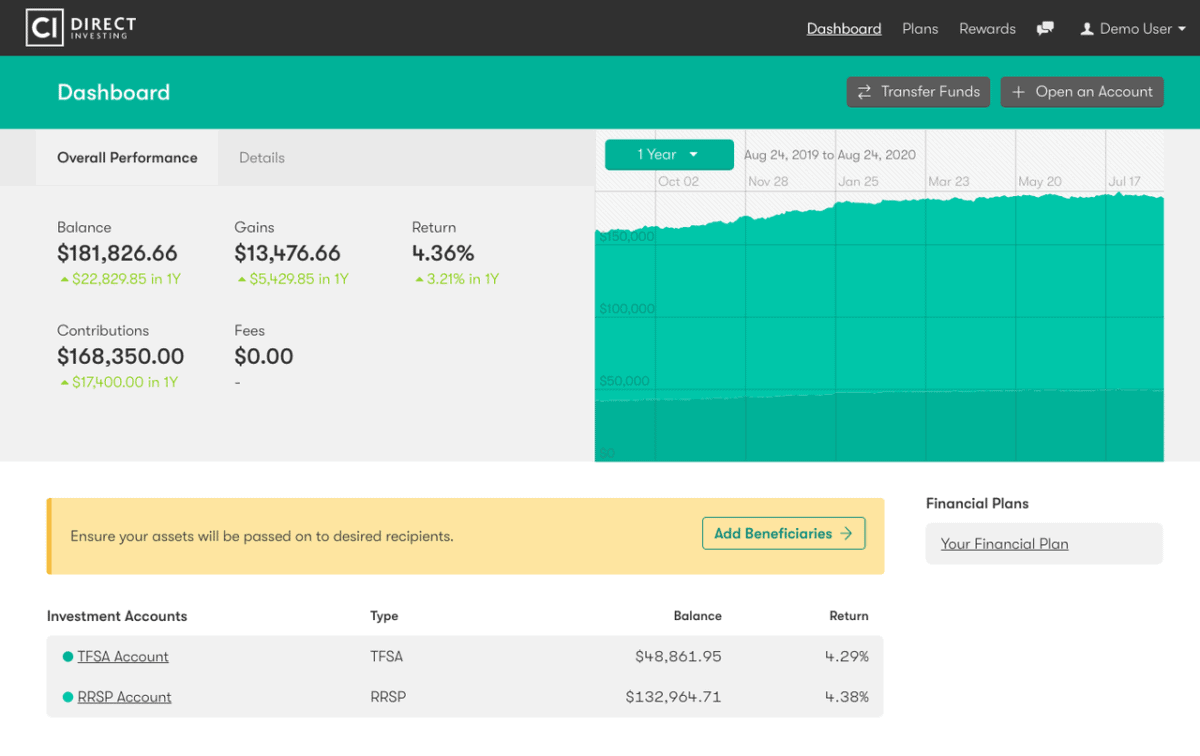

CI Direct Investing Cell App Evaluate

With CI Direct Investing’s app you’ll be able to entry your entire CI Funding Accounts in a single place. Its smooth interface is straightforward to navigate, permitting you to fund your accounts, observe your investments, and even open an curiosity incomes financial savings account in addition to entry monetary recommendation.

The app has a strong 4.6 star score on each the Google Play retailer and the Apple App Retailer. Customers critiques embody feedback on its wonderful performance, and easy accessibility to actual monetary advisors. Getting access to monetary advisors via their app undoubtedly units CI Direct Investing other than different cellular platforms.

When Did WealthBar Develop into CI Direct Investing?

In 2019 CI Monetary bought Wealthbar and merged the corporate into their giant umbrella of Canadian funding corporations. In addition they bought the low cost brokerage firm Digital Brokers.

In August 2020 the Wealthbar model formally turned CI Direct Investing – however the firm took nice pains to make it crystal clear that whereas the title had modified, the dedication to wonderful customer support and monetary recommendation had not.

Wealthbar was based again in 2014 by Tea and Chris Nicola. In a Globe and Mail interview, Tea defined, “I felt like finance wanted a lift of benevolence to be trustworthy, I needed to be Robin Hood, in my very own manner.” With a strong background of working at Nicola Wealth, the duo hit the bottom working, rapidly constructing what would change into generally known as the Canadian robo advisor choice that almost all emphasised sound monetary planning.

CI Direct Investing vs Justwealth

When evaluating a robo-advisor choice like CI Direct Investing, we at all times examine it with our high advice, Justwealth, to offer you a transparent image of how they stack up.

Each CI Direct Investing and Justwealth supply a spread of interesting options:

- Easy software course of

- A number of funding account choices

- Personalised ETF portfolios based mostly in your monetary objectives and preferences

- Decrease charges in comparison with conventional Canadian mutual funds

That will help you higher perceive the variations between these two platforms, we’ve put collectively a comparability desk:

|

|

|

|

11 Passive ETF Portfolios, 15 SRI Portfolios, and three Energetic/Personal Portfolios |

80 portfolios with 50 totally different ETFs |

|

|

Personalised Monetary Advisor |

||

|

0.35% to 0.60% relying on portfolio worth |

0.40% to 0.50% relying on portfolio worth |

|

|

Administration Expense Ratios (MERs) |

0.16% to 0.30% (for passive ETF portfolios) |

|

|

RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA, Company Funding Account, Belief Accounts, Group TFSAs and RRSPs, Particular person and Private Pension Plans |

RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA |

|

|

$100 for choose portfolios, some are as excessive as $50,000 – Account minimal for Canadian expats is $25,000 |

$5,000 (though there are exceptions for RESP and FHSA accounts) |

|

|

$100-$500 Immediate Money Again |

||

Charge construction: CI Direct Investing has a payment of 0.51% to 0.90% (administration payment of 0.35% to 0.60% plus an ETF payment between 0.16% to 0.30%). Justwealth’s payment is on the decrease finish of this vary: 0.55% to 0.75% (administration payment of 0.40% to 0.50% plus an ETF payment between 0.15% and 0.25%).

The account measurement dictates the administration account payment with each Justwealth and CI Direct Investing. After $500,000 Justwealth’s administration payment drops to 0.40% and CI Direct Investing’s administration payment drops to 0.35%.

After all, you additionally must keep in mind the ETF charges to your chosen portfolio. All issues thought-about, you’re going to come back out forward with JustWealth general from a pure-fees perspective till your general portfolio tops about $1.25 million.

Account minimums: CI Direct Investing’s minimums take a little bit of digging to uncover. The account minimal to open a CI Direct Investing account is simply $100. Nevertheless, every portfolio has a distinct minimal that’s required earlier than your cash is invested in that beneficial portfolio. Once I was trying round on their web site I noticed numbers various from as little as $100 to as excessive as $50,000! Canadian expats have an account minimal of $25,000.

Justwealth has an account minimal of $5000, though there are exceptions for RESP and FHSA accounts.

ETF choices: CI Direct Investing has near 30 ETF portfolio choices. In the meantime, Justwealth has entry to round 50 ETFs which results in over 80 numerous portfolios. Each CI Direct Investing and Justwealth present accountable investing (RI) choices, permitting buyers to align their portfolios with their private values and social or environmental priorities.

Vary of providers and accounts: CI Direct Investing is a part of CI Monetary Group, which is considered one of Canada’s largest and most established funding companies. Justwealth is concentrated solely on robo-advising, however it does a incredible job with this focus, providing a variety of account choices together with FHSAs and target-date RESPs. Whereas each platforms have monetary advisors, with Justwealth you should have a personally devoted monetary advisor.

Cell App: Each Justwealth and CI Direct Investing have cellular apps that will let you add funds to your account, view funding exercise, and observe your portfolio’s progress. Justwealth’s cellular apps haven’t been round for lengthy, however the CI Direct Investing app is very rated by each Android and Apple customers (4.6 stars).

Our conclusion: Whereas CI Direct Investing is a wonderful choice for Canadian expats, it falls brief when in comparison with different trade leaders within the robo-advisor house, significantly for the common Canadian investor in search of low-fee options.

Justwealth continues to be our high advice for a motive – it gives distinctive account choices, low charges, and private advisors for on a regular basis buyers. On high of that, Justwealth is at the moment providing a beneficiant sign-up bonus of as much as $500. To be taught extra about why we extremely suggest Justwealth, try our in-depth Justwealth Evaluate.

Regularly Requested Questions

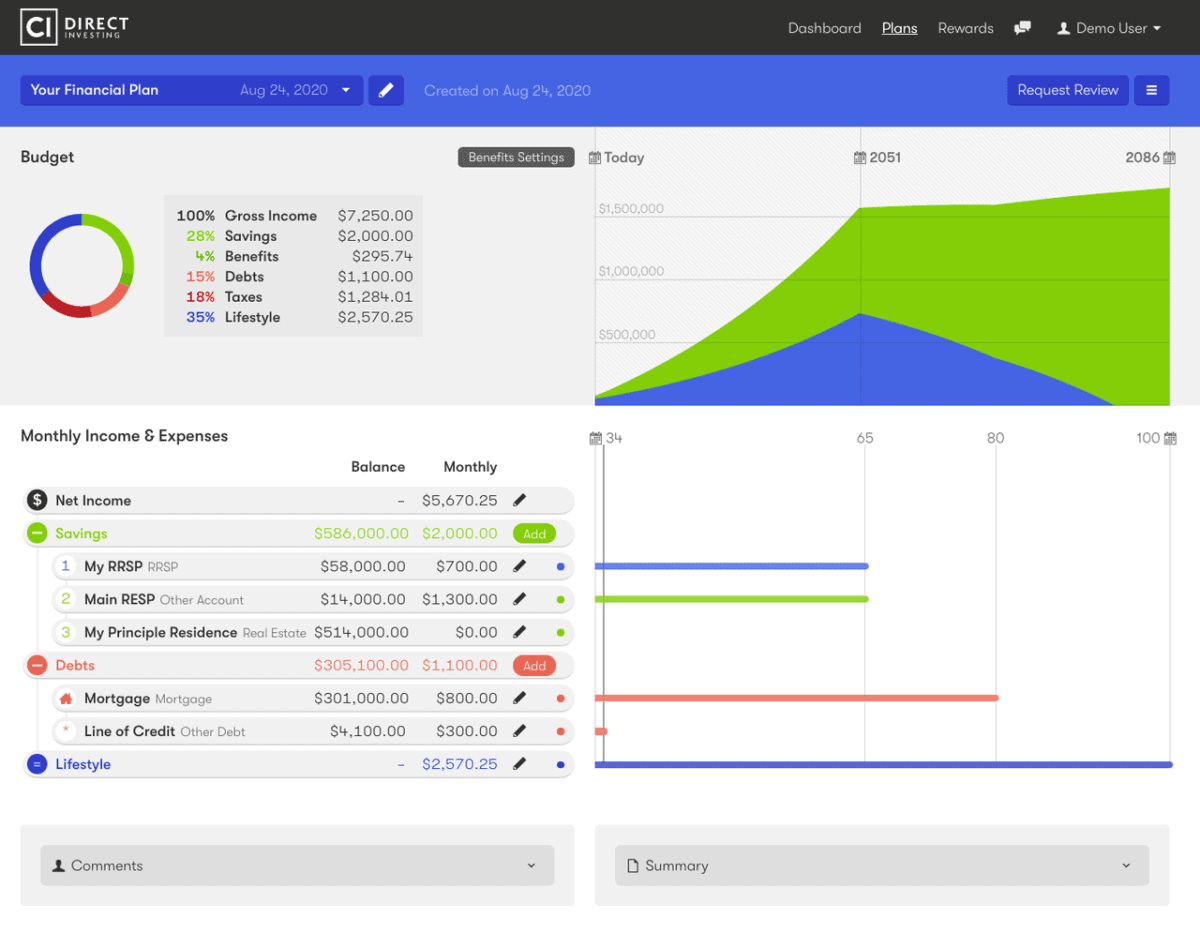

Setting Up an Account: A Peek Inside CI Direct Investing

Right here’s what your screens will seem like once you join, along with a number of the extra distinguished promoting that CI Direct Investing is at the moment working.

CI Direct Investing Evaluate: Who Is It Finest For?

CI Direct Investing’s hybrid robo-advisor service is especially interesting to passive buyers, particularly these residing overseas. Simplifying the complexities and paperwork related to being a Canadian non-resident is an enormous draw. When you’ll want a minimal of $25,000 to open an account, the advantages, such because the comfort and accessibility at a low value, make it worthwhile for a lot of expats.

Nevertheless, for Canadians residing in Canada, CI Direct Investing is probably not your best option for a couple of causes. The excessive minimal funding steadiness for a lot of portfolios is a major barrier, particularly when in comparison with opponents like Wealthsimple, which has no minimal, or Justwealth, which requires simply $5,000 (with decrease minimums for RESPs and FHSAs). Moreover, platforms like Justwealth, which takes high place in our listing of Finest Canadian Robo Advisors, supply a broader vary of economic providers, together with entry to customized advisors.

If maintaining prices low is your high precedence, chances are you’ll need to contemplate DIY investing as an alternative of utilizing a robo-advisor. DIY buyers can cut back prices even additional by selecting one of many Finest Canadian On-line Brokers, which gives low charges and better flexibility for self-directed buyers.

Take a look at our interviews with Wealthbar co-founder and CI Direct Investing CEO Tea Nicola.