Constellation Manufacturers, Inc. STZ will launch its third-quarter monetary outcomes, earlier than the opening bell, on Thursday, Jan. 9, 2025.

Analysts anticipate the Victor, New York-based firm to report quarterly earnings at $3.32 per share, up from $3.19 per share within the year-ago interval. Constellation Manufacturers initiatives quarterly income of $2.54 billion, in comparison with $2.47 billion a yr earlier, in accordance with knowledge from Benzinga Professional.

On Dec. 3, Constellation Manufacturers reached an settlement with international spirits firm Sazerac, to divest its SVEDKA model.

Constellation Manufacturers shares gained 0.6% to shut at $221.00 on Tuesday .

Benzinga readers can entry the most recent analyst scores on the Analyst Inventory Scores web page. Readers can kind by inventory ticker, firm title, analyst agency, ranking change or different variables.

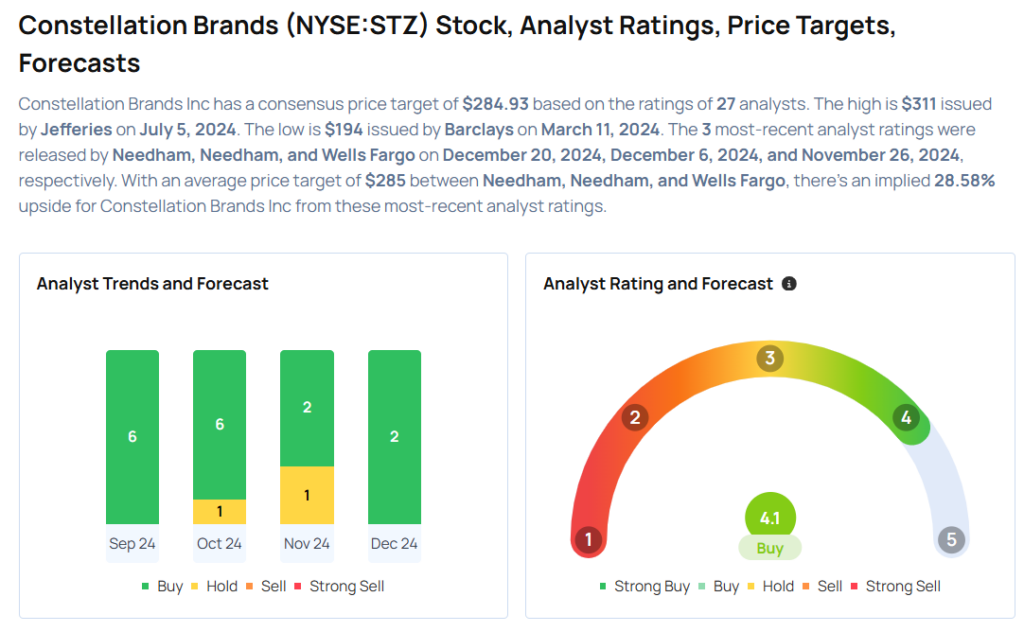

Let’s take a look at how Benzinga’s most-accurate analysts have rated the corporate within the current interval.

- Wells Fargo analyst Chris Carey maintained an Obese ranking and lower the value goal from $300 to $295 on Nov. 26. This analyst has an accuracy charge of 60%.

- BMO Capital analyst Andrew Strelzik maintained an Outperform ranking and slashed the value goal from $315 to $305 on Oct. 15. This analyst has an accuracy charge of 64%.

- TD Cowen analyst Robert Moskow downgraded the inventory from Purchase to Maintain and lower the value goal from $300 to $270 on Oct. 8. This analyst has an accuracy charge of 65%.

- Barclays analyst Lauren Lieberman maintained an Obese ranking and lower the value goal from $309 to $300 on Oct. 7. This analyst has an accuracy charge of 60%.

- B of A Securities analyst Bryan Spillane downgraded the inventory from Purchase to Impartial and slashed the value goal from $300 to $255 on Oct. 7. This analyst has an accuracy charge of 63%.

Contemplating shopping for STZ inventory? Right here’s what analysts suppose:

Learn This Subsequent:

Overview Score:

Speculative

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.