Ever questioned how prevalent bank card fraud actually is in Australia? Or which age teams are most in danger? To resolve these questions, we’ve gone straight to the supply: the Australian Bureau of Statistics (ABS).

The ABS gives a wealth of knowledge on fraud victimisation, however it may be onerous to know the story behind the numbers. So let’s dissect their newest launch: from state-by-state comparisons to the influence on completely different demographics, we’ll reveal the onerous numbers behind bank card fraud. The very best factor is all this knowledge is backed by the authority of the ABS.

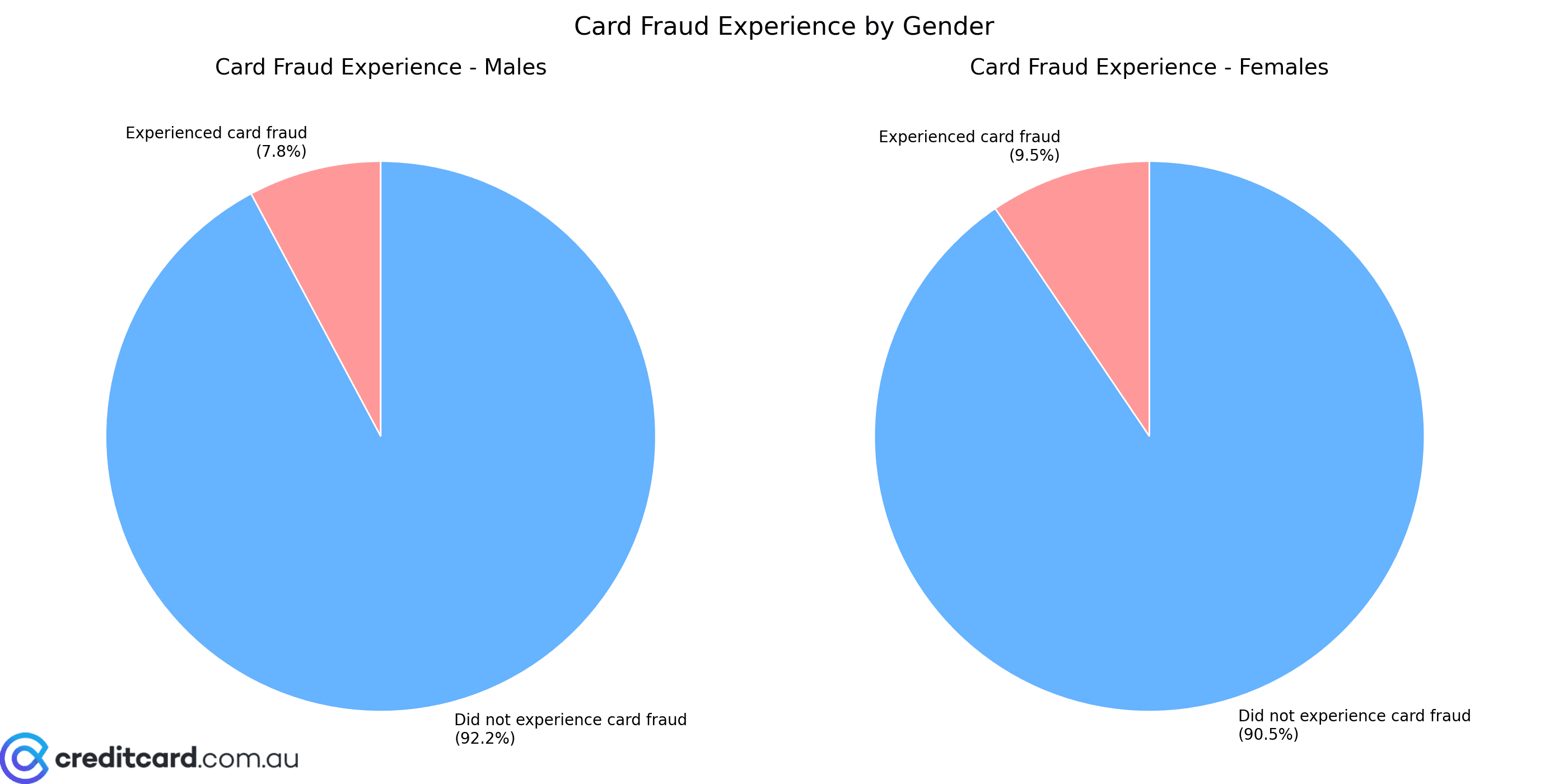

On first thought, it’s simple to imagine that bank card fraud impacts everybody equally. The ABS knowledge means that’s not essentially the case. Once we study the numbers by gender, we begin to see some fascinating variations. Males are sitting at 7.8% of the inhabitants, with females at 9.5%. However what do these percentages imply in quantity type? Let’s take a better look.

🚨 Card Fraud Expertise 💳

Skilled Fraud 😭

| Gender | Depend |

|---|---|

| Males ♂️ | 799,000 |

| Females ♀️ | 1,005,700 |

| Whole 📊 | 1,807,200 |

Did Not Expertise Fraud 👍

| Gender | Depend |

|---|---|

| Males ♂️ | 9,428,200 |

| Females ♀️ | 9,615,200 |

| Whole 📊 | 19,040,700 |

Once we take a look at these slices of the pie, there’s a really shut hole. It paints the slight distinction within the share breakdown of female and male victims.

Past the gender breakdown the ABS knowledge additionally gives priceless insights into how card fraud victimisation varies throughout completely different Australian states. One key remark when wanting on the state knowledge is the robust correlation between inhabitants and reported card fraud incidents. The numbers scale with inhabitants which implies bigger states report extra circumstances. Both approach, there are nonetheless some fascinating variations to discover.

🚨 Reported vs. Skilled Fraud (Australia) 🇦🇺

| Area | Reported Fraud | Skilled Fraud | All Individuals |

|---|---|---|---|

| New South Wales | 566,100 | 577,300 | 6,567,100 |

| Victoria | 476,600 | 486,500 | 5,389,800 |

| Queensland | 372,400 | 384,800 | 4,241,000 |

| South Australia | 108,900 | 110,900 | 1,477,500 |

| Western Australia | 150,900 | 161,000 | 2,211,400 |

| Tasmania | 34,300 | 35,200 | 466,300 |

| Northern Territory | 12,800 | 13,400 | 149,500 |

| Australian Capital Territory | 37,700 | 37,900 | 357,900 |

| Australia | 1,764,000 | 1,807,200 | 20,860,100 |

The ABS knowledge additionally permits us to observe the rising pattern of bank card fraud over the previous couple of years. The next graphs focuses on the time span from 2014-15 to 2022-23. We will see how the variety of reported incidents has modified throughout Australia’s states and territories. A number of financial and social elements might clarify the upward pattern in bank card fraud. The rise in on-line procuring accelerated by COVID-19 could have introduced extra alternatives for fraud. It’s fascinating to notice that Western Australia noticed a decline in scams, which is refreshing to see!

Dangerous actors are additionally using superior strategies reminiscent of AI-powered phishing and “deepfake” scams blurring the fact between rip-off and actuality. These are making it a lot more durable for customers and monetary establishments to detect and forestall fraud. This elevated sophistication possible performs a big function within the progress in reported incidents.

Past regional variations, the ABS knowledge additionally reveals vital variations in card fraud victimisation throughout completely different age teams. The information means that people within the 35-54 age vary are significantly focused by bank card fraud. This could possibly be on account of their increased on-line exercise, better monetary property, and susceptibility to stylish phishing and identification theft schemes. The 65+ demographic has a decrease victimisation charge then the center age teams, and this can be on account of reluctance to report scams. Skilled Card Fraud (Final 12 Months) As we’ve seen the info from the ABS gives a reasonably sobering snapshot of the present panorama. It clearly highlights the necessity for steady adaptation and enchancment in fraud prevention methods. The information reveals variations throughout gender, area, and age. These total numbers are regarding, however understanding these developments is step one in the direction of prevention. For those who’d prefer to be taught extra on how one can shield your self on-line, you may learn my information to bank card identification theft safety. Supply: ABS Private Fraud Statistics

To additional illustrate the regional variations in bank card fraud, we created this interactive map of Australia. By hovering your mouse over every state or territory (or tapping the state), you may see the particular victimisation charge. You’ll be capable of see a fast and visible strategy to evaluate the influence of fraud throughout the nation. The darker the shade of purple, the upper the victimisation charge.

Age Vary (years)

All Individuals

Victimisation Charge (%)

15—24

122,200

3.9

25—34

312,700

8.5

35—44

386,400

10.8

45—54

372,000

11.5

55—64

299,600

10

65 and over

307,500

7.2