I suspected most monetary belongings had been in 401(okay) plans and most 401(okay) holdings had been directed by target-date funds, however the information instructed a considerably totally different story.

When attempting to determine individuals’s style for danger by wanting on the share of equities of their monetary portfolio, I used to be questioning in a world of 401(okay)s in regards to the extent to which this share would all be decided by the sample of goal date funds. Candidly, my prior was that, for all besides the very wealthy, most family monetary belongings had been in 401(okay)s and that the majority 401(okay) belongings had been in goal date funds. It’s all the time helpful, nevertheless, to have a look at a bit information. It seems that my situation just isn’t fairly the place we at the moment are, however may describe the place we’re headed.

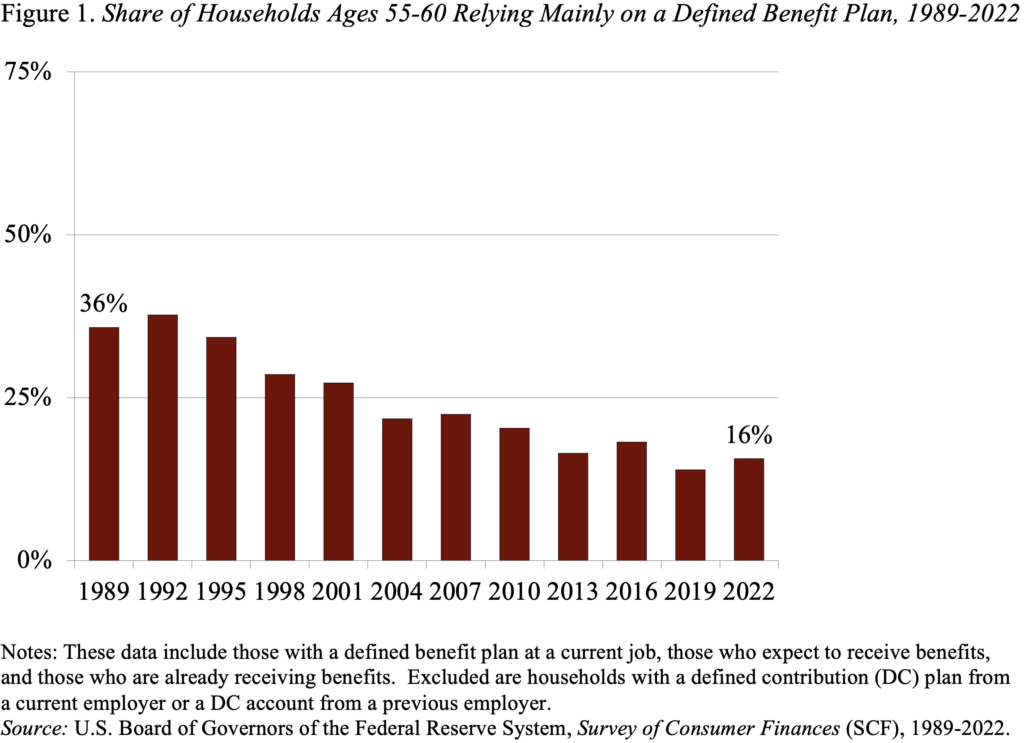

The notion was not a loopy one in that the 2020s signify the primary time that staff may have spent a complete profession lined by a 401(okay) plan. Certainly, solely about 16 p.c of households approaching retirement in 2022 are relying primarily on an outlined profit plan (see Determine 1). That evolution suggests that the majority retirement saving could now be in 401(okay)s or Particular person Retirement Accounts (IRAs).

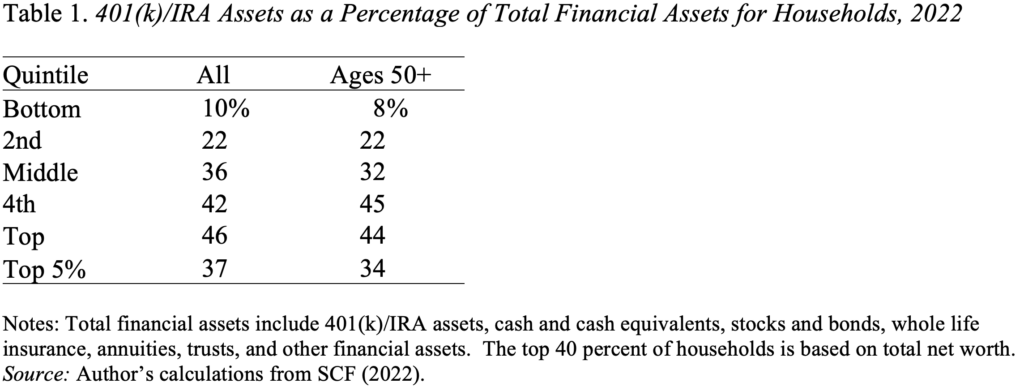

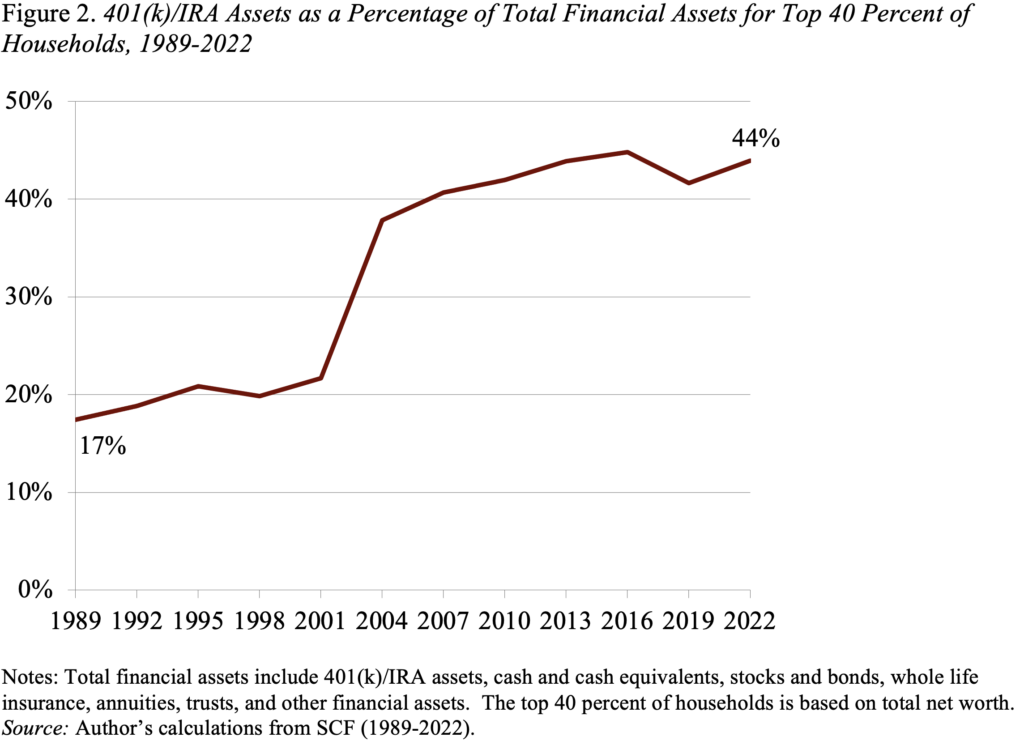

So, the query is what share of economic belongings are 401(okay)/IRA balances? These percentages for 2022 by internet value quintile present that for the highest two quintiles – the highest 40 p.c, who maintain a lot of the 401(okay) belongings – retirement belongings account for about 45 p.c of whole monetary belongings (see Desk 1). The richest 5 p.c cut back the proportion for the highest quintile as a complete as a result of they maintain a lot in non-retirement belongings. Nonetheless, the chances are considerably lower than I had hypothesized.

If the state of affairs was not precisely what I assumed, are we no less than trending in that course? Certainly, the proportion has elevated sharply over time, albeit it’s not clear the place it’s going from right here (see Determine 2).

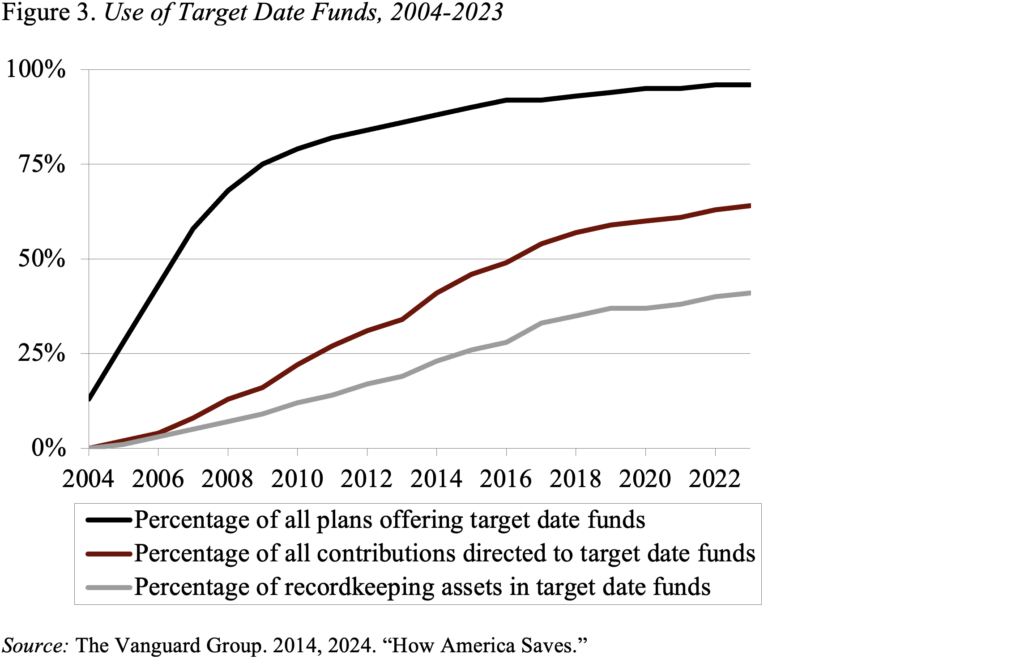

It looks like I used to be additionally a bit forward by way of the function of goal date funds (TDFs) – funds that robotically cut back fairness holdings as individuals age – inside 401(okay)s. It isn’t stunning provided that the large change got here when the Pension Safety Act of 2006 allowed plan sponsors to robotically enroll workers utilizing TDFs because the default funding. Since then, the proportion of plans providing, the proportion of contributions directed towards, and the proportion of belongings in TDFs have all been growing quickly (see Determine 3).

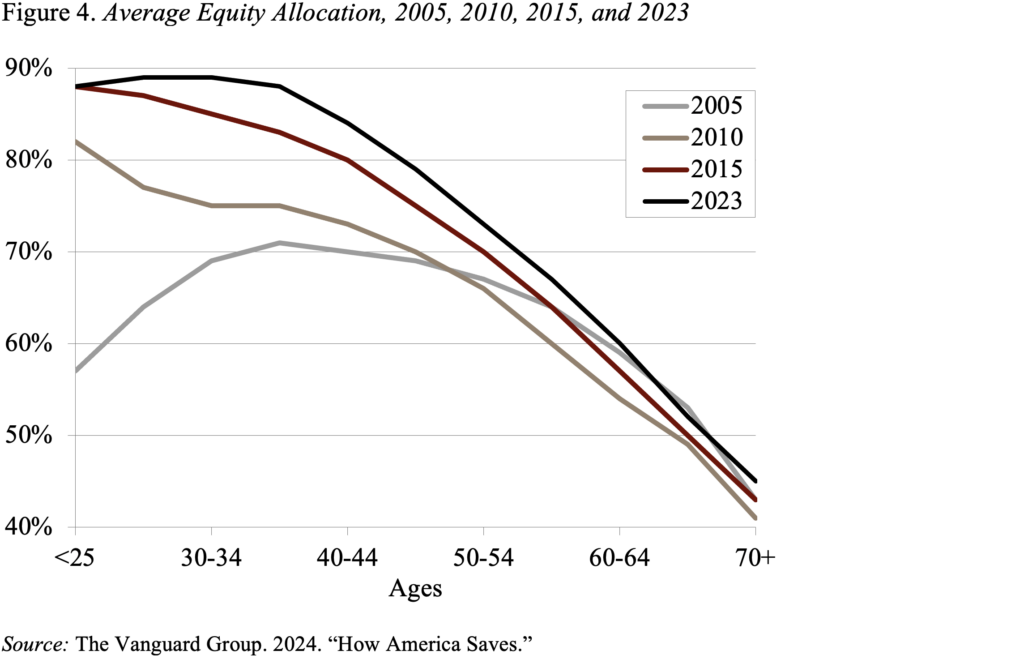

Funding in TDFs has modified the profile of asset allocation and elevated holdings in equities (see Determine 4). In 2005, the allocation of equities was hump-shaped; youthful individuals had been extra conservative, middle-age individuals held essentially the most equites and older individuals sharply diminished their holdings. In 2023, the fairness allocation of individuals sloped downward by age, beginning at 88 p.c for younger staff, declining to 73 p.c for these ages 50-54 after which to 45 p.c for these 70+. Not solely is the sample very totally different, however the share of 401(okay) belongings in equities has additionally elevated markedly.

So, the story wasn’t as clear as I had thought. For these within the high 40 p.c of the wealth distribution, retirement belongings are solely about 45 p.c of whole belongings and the proportion appears steady. Inside 401(okay) plans the significance of goal date funds has been growing over time and is more likely to be much more essential sooner or later. However, individuals have a tendency to maneuver their belongings out of 401(okay) plans into IRAs and should change their allocations. So, I suppose that individuals train extra discretion over their fairness holdings than I assumed.