The temporary’s key findings are:

- Uninsured healthcare prices in retirement will be substantial, so older households want an excellent understanding of the potential dangers.

- New survey outcomes present that many underestimate their healthcare wants and know little in regards to the prices of medical or long-term care providers.

- In distinction, monetary advisors have a greater sense of wants and prices, however households with advisors don’t appear to know greater than these with out.

- In consequence, many retirees might not defend themselves towards well being shocks, forcing them to make troublesome modifications to cowl shocks once they do happen.

Introduction

Households approaching retirement face all kinds of dangers to their monetary safety. They might dwell longer than deliberate and deplete their assets; they might expertise unexpectedly excessive inflation; or they might obtain unusually poor returns on their investments. Equally consequential is the danger that households will face main bills to cowl medical and long-term care (LTC) prices.

This temporary, which relies on a current paper, investigates how older households and monetary advisors understand medical and LTC dangers in retirement, how these perceptions examine to actuality by way of incidence and prices, and the way households plan to reply if their assets show insufficient.1

The dialogue proceeds as follows. The primary part introduces the 2 parts of medical and LTC dangers – particular person threat and normal worth threat – and discusses the extent to which every is roofed by insurance coverage. The second part describes a brand new family survey and compares households’ beliefs to precise experiences from the Well being and Retirement Examine (HRS), a big longitudinal survey. The third part, utilizing outcomes from a brand new advisor survey, explores advisors’ information of medical and LTC dangers and their capacity to transmit that data to their shoppers. The fourth part assesses the reasonableness of households’ deliberate responses ought to assets show inadequate. The ultimate part concludes that older households are likely to underestimate medical and LTC dangers and prices in retirement. Advisors, however, have a greater sense of those dangers and prices, however their older shoppers don’t seem to know greater than households with out advisors.

Healthcare Dangers in Retirement

On this temporary, we use “healthcare” to check with any health-related prices, whether or not they contain periodic medical care or long-term care. Medical and LTC dangers have totally different implications for retirement planning, as a result of they differ by way of particular person threat and normal worth threat. Particular person threat is the probability {that a} retiree will truly face a medical shock or want LTC. Common worth threat is the probability that the rising value of the providers will erode a family’s monetary safety. The distinction between these two parts is that particular person threat can, theoretically, be insured by threat pooling, whereas normal worth threat impacts everybody and thus can’t be dealt with by pooling.

Medical Dangers

Medical dangers are essentially excessive and unsure. Luckily, a lot of this threat is insured by Medicare (and Medicaid for these eligible for each applications), which limits out-of-pocket funds. That stated, for middle-income retirees, medical premiums and copays eat up about one-third of Social Safety earnings and one-fifth of complete earnings.2 The danger that can’t be insured is that of premiums rising. The premiums for Medicare Half B (physician visits) have a tendency to extend quicker than inflation. In consequence, whereas retirees could also be reasonably well-insured towards a big medical expense in a given 12 months, compounding will increase of unpredictable measurement in premiums can erode their disposable earnings over time.

LTC Dangers

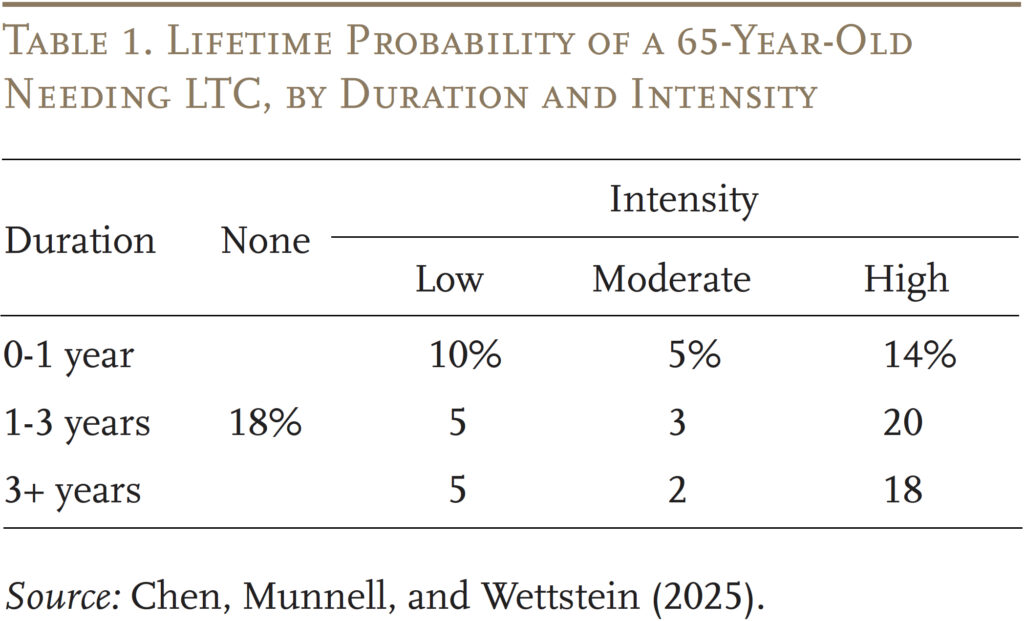

Along with medical dangers, most older adults could have some LTC wants. In actual fact, solely about 20 p.c will get by scot-free (see Desk 1). Nonetheless, among the many 80 p.c who would require some LTC, wants range dramatically in each depth and length. About 40 p.c could have high-intensity wants for greater than a 12 months.3 Many on this group have Alzheimer’s illness or associated dementias – they usually want around-the-clock supervision and might dwell for a few years with the illness.

In contrast to medical dangers, particular person LTC dangers usually are not properly insured. Regardless of the excessive probability and price of LTC, solely about 7.5 million folks have LTC insurance coverage, representing round 3 p.c of all U.S. adults or 15 p.c of these ages 65+.4 Medicaid, the general public insurance coverage program focused at low-income people, has develop into a default insurer for catastrophic prices. For middle-income households, nevertheless, qualifying for Medicaid would require spending down to fulfill this system’s stringent earnings and asset exams.5 In 2024, the month-to-month earnings restrict for Medicaid eligibility for these over age 65 is often round $2,800 ($5,600 for {couples}) and the asset restrict is often $2,000 ($3,000 for {couples}), however varies by state.

Relations usually cowl the vast majority of care hours for folks with low and average wants and complement the efforts with paid caregivers as wants enhance.6 Traditionally, girls, notably spouses and daughters, have offered the majority of household care. Going ahead, modifications within the labor drive participation of girls might influence the provision of household caregivers.7

Paid LTC could be very costly – in 2023, the median annual prices had been $116,800 for a personal room in a nursing dwelling, $75,500 for dwelling well being aides, and $64,200 for an assisted residing facility.8 The extent of the final worth threat households face sooner or later is unclear. The scarcity of certified employees and rising want for specialised care has pushed up the final worth of paid LTC.9 Albeit, some research counsel that the shift from nursing dwelling care to home-and-community-based providers in current many years might assist sluggish the worth traits for formal care.10

Briefly, households face the prospect of huge outlays for healthcare prices in retirement. The query is the extent to which households and their advisors understand these dangers and have plans to handle them. To reply these questions, the subsequent part turns to the outcomes of two current surveys carried out by Greenwald Analysis in July and August of 2024.

Perceptions of Healthcare Dangers

For the family survey, Greenwald Analysis interviewed on-line 508 people ages 48-78 with no less than $100,000 in investable belongings in July 2024. Within the case of married/partnered people, the survey participant should no less than share monetary decision-making duties. The survey requested contributors about their perceived probability of experiencing a medical shock or needing intensive LTC, in addition to the potential value of those occasions. The responses had been then in comparison with the precise experiences of older adults within the HRS to find out whether or not households have an excellent sense of the probability of their shocks and their uninsured dangers.

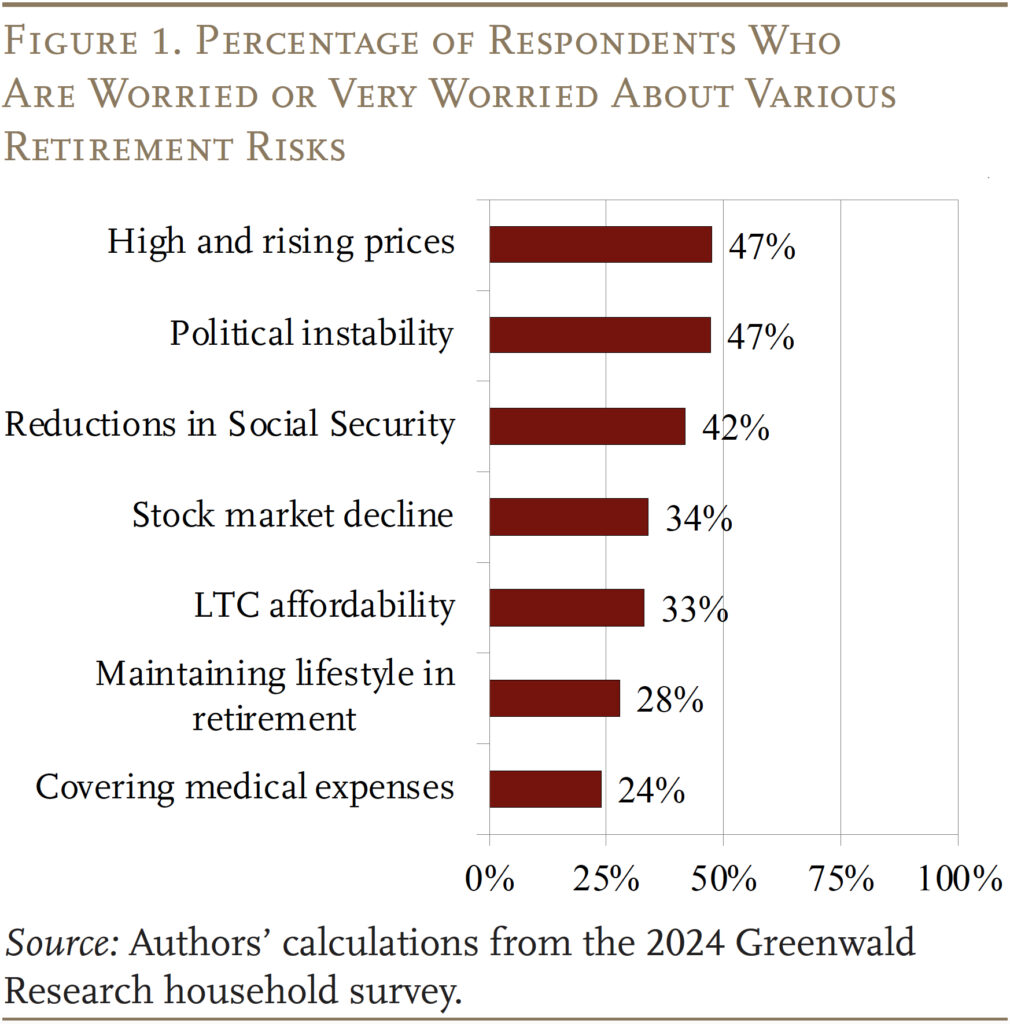

Earlier than wanting on the particular responses, it’s fascinating to notice that medical and LTC wants had been low on most respondents’ record of considerations (see Determine 1). This discovering is in step with different research exhibiting older households rank healthcare worries fairly low.11

Respondents had been then requested whether or not they had been involved about having a significant sickness, creating LTC wants, or having cognitive impairment. Apparently, solely a couple of third of them had been involved with any of those dangers.

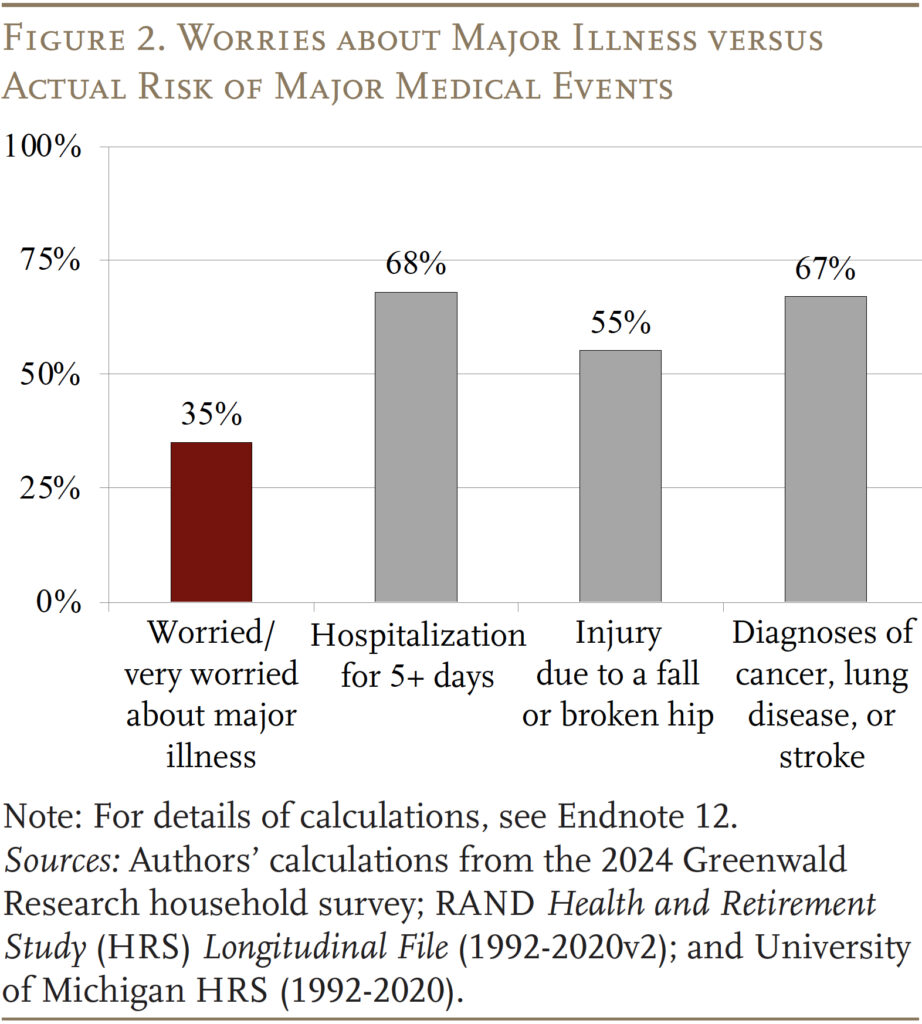

In actuality, households are more likely to expertise a significant sickness than the 35 p.c predicted by survey contributors (see Determine 2).12 However the monetary implications for households in underestimating their threat of a medical shock will not be that extreme as a result of most of those prices are insured.

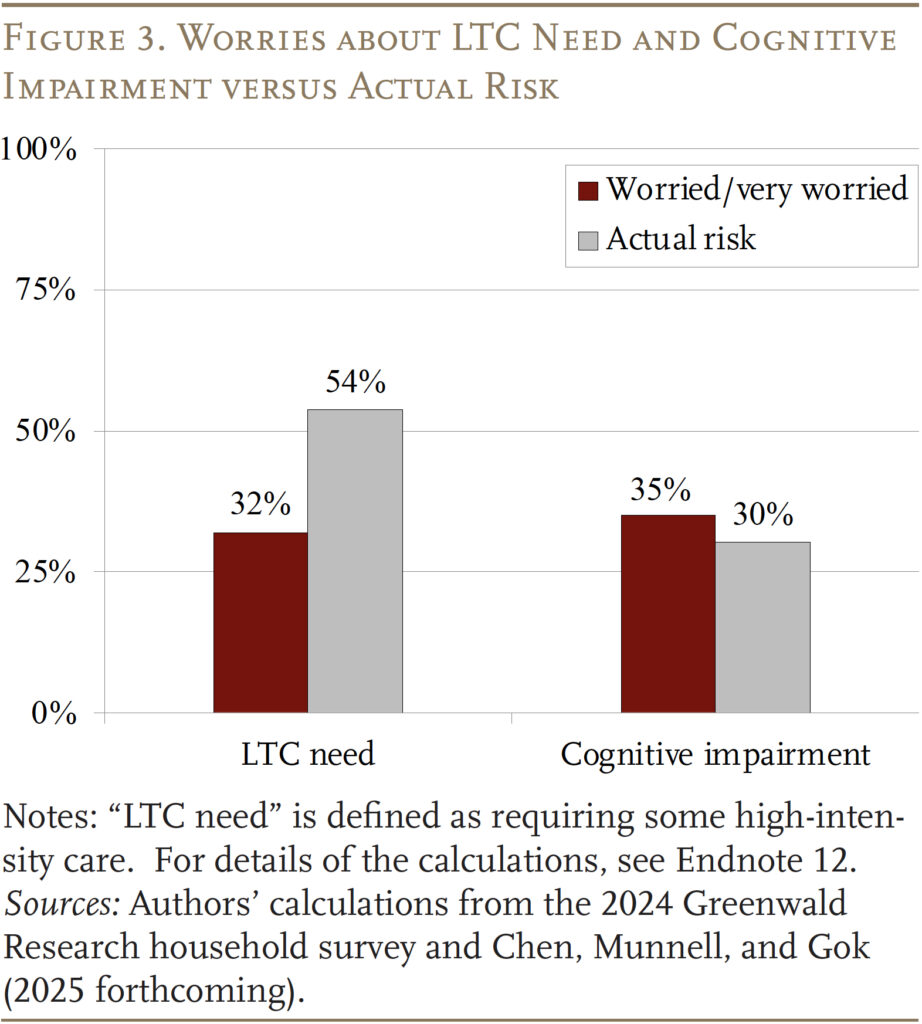

LTC prices, however, usually are not properly insured, and solely 32 p.c of households are nervous about creating LTC wants. In actuality, over half of households ages 65+ will want some high-intensity care (see Determine 3).13 However, contributors’ evaluation of the danger of cognitive impairment could be very near actuality.

Having an excellent estimate of the probability of healthcare wants as one ages is simply half of the retirement planning equation. The opposite essential part is having an excellent sense of how a lot these wants may cost.

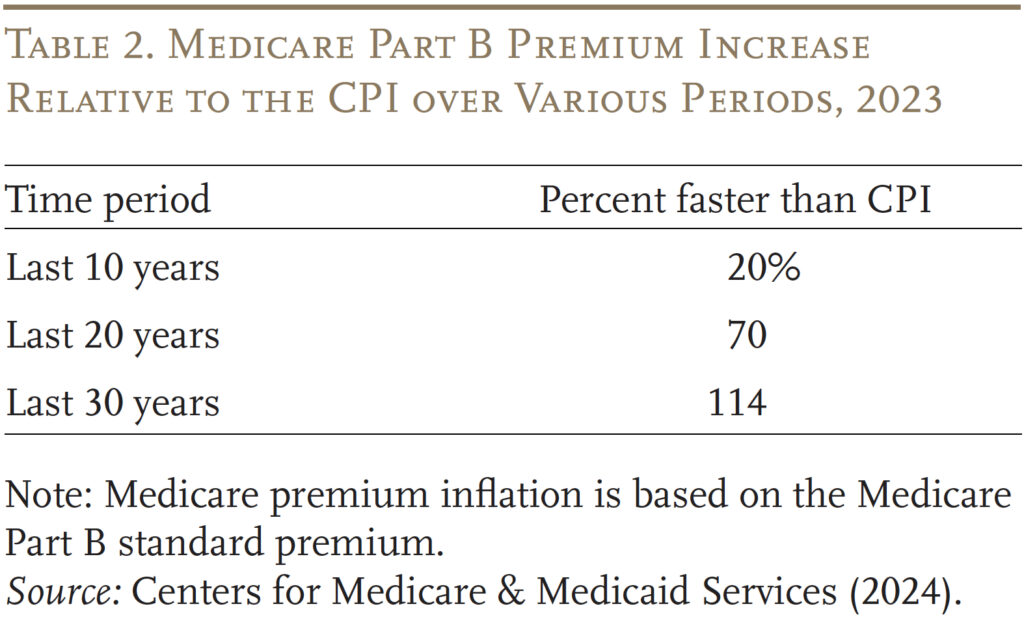

As famous earlier, particular person medical threat is properly insured; the massive threat is normal worth threat. Certainly, Medicare Half B premiums have grown 20 p.c quicker than the Shopper Value Index (CPI) within the final 10 years, 70 p.c quicker within the final 20 years, and greater than twice as quick within the final 30 years (see Desk 2). Solely a 3rd of survey respondents, nevertheless, had been nervous about rising Medicare prices. Luckily, Half D (prescription drug) premiums have remained comparatively low in greenback phrases.

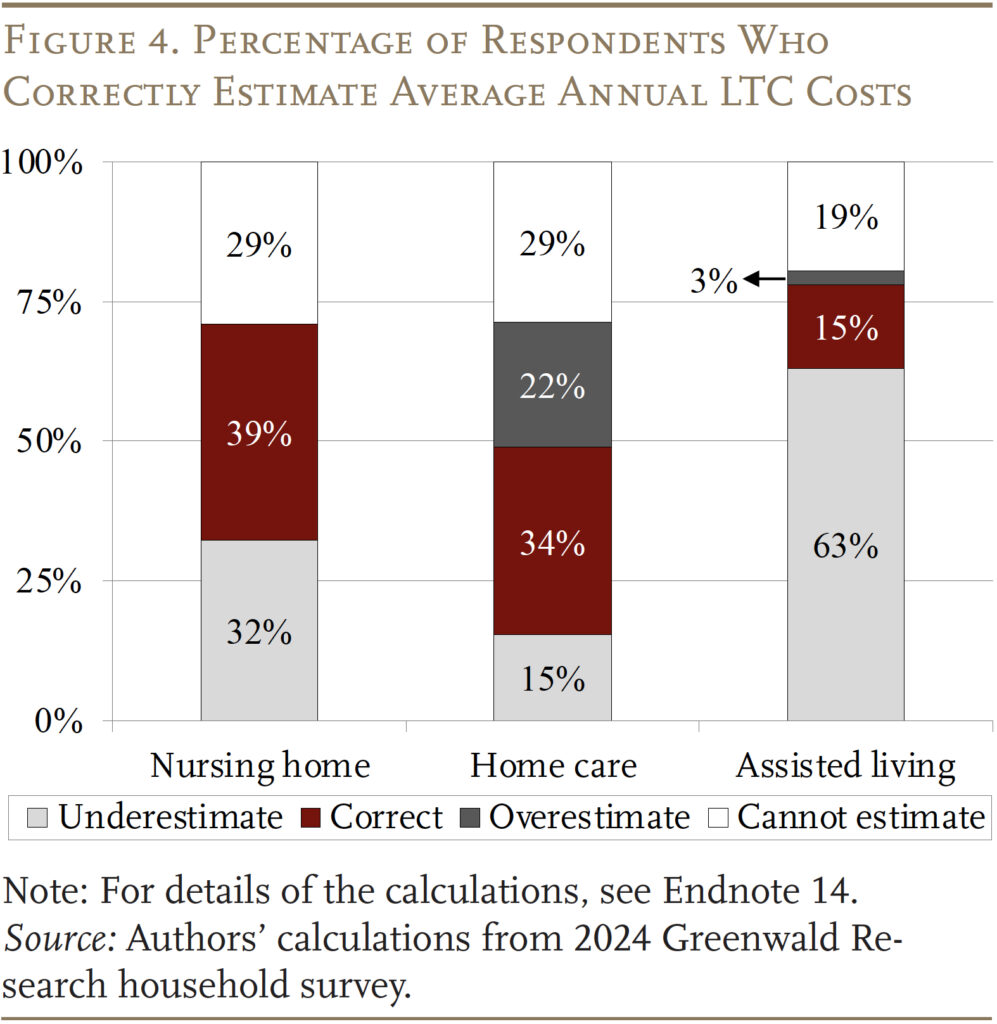

LTC prices, after all, usually are not properly insured, which makes it extra essential that people have a way of the prices they might face. Determine 4 exhibits that solely 39 p.c of older households may accurately estimate the price of a nursing dwelling, 34 p.c for dwelling care providers, and solely 15 p.c for assisted residing services.14

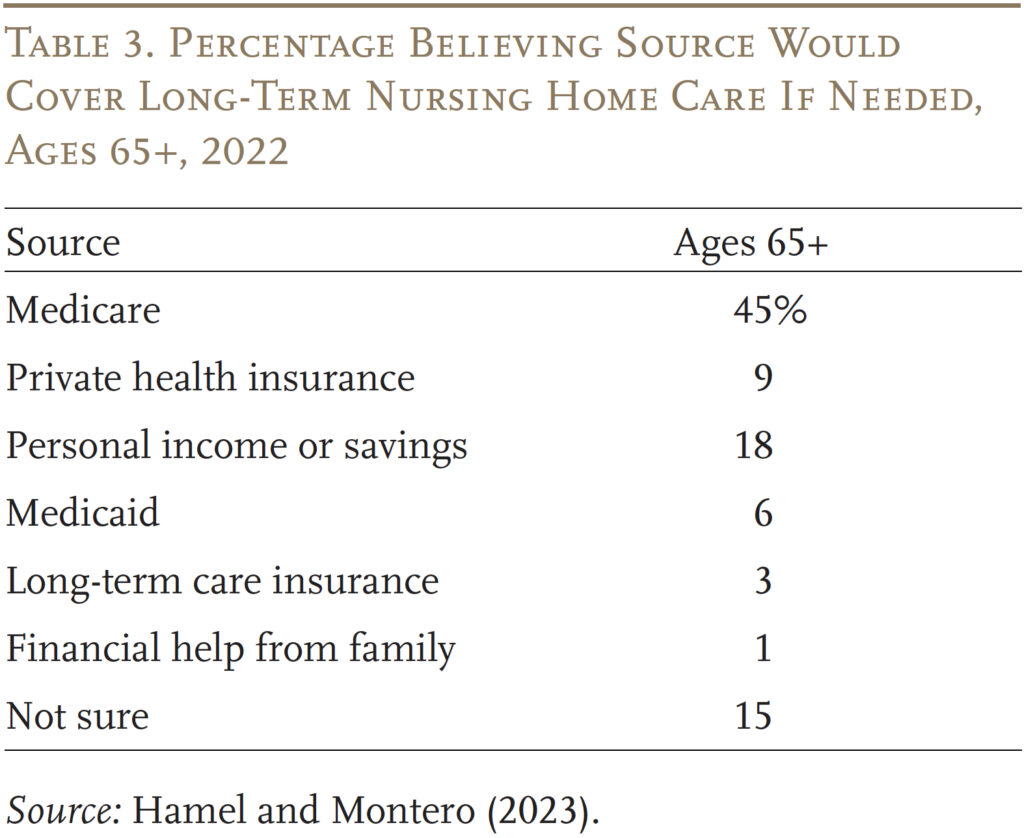

One motive that households have such huge misperceptions about each the dangers and the prices of LTC is that survey after survey has discovered that many mistakenly consider that Medicare covers LTC. The newest complete survey on LTC affordability was carried out by KFF in 2022. The outcomes, offered in Desk 3, present that 45 p.c of respondents ages 65+ assume that Medicare pays for his or her LTC. One other 9 p.c assume that their personal medical insurance will.15

Briefly, misperceptions about who bears the price of LTC might play an essential function in how households plan for dangers in retirement. The remaining questions are whether or not monetary advisors have a greater sense of healthcare dangers and prices and whether or not their recommendation impacts their shoppers’ perceptions.

The Position of Monetary Advisors

About two-thirds of the households surveyed work with a monetary advisor. An essential query is whether or not advisors have a greater sense of healthcare dangers and prices. And in that case, do households with an advisor have a greater sense of their dangers and make higher plans? To reply this query, Greenwald Analysis fielded a survey on-line of 401 monetary advisorsin late July and early August of 2024.16

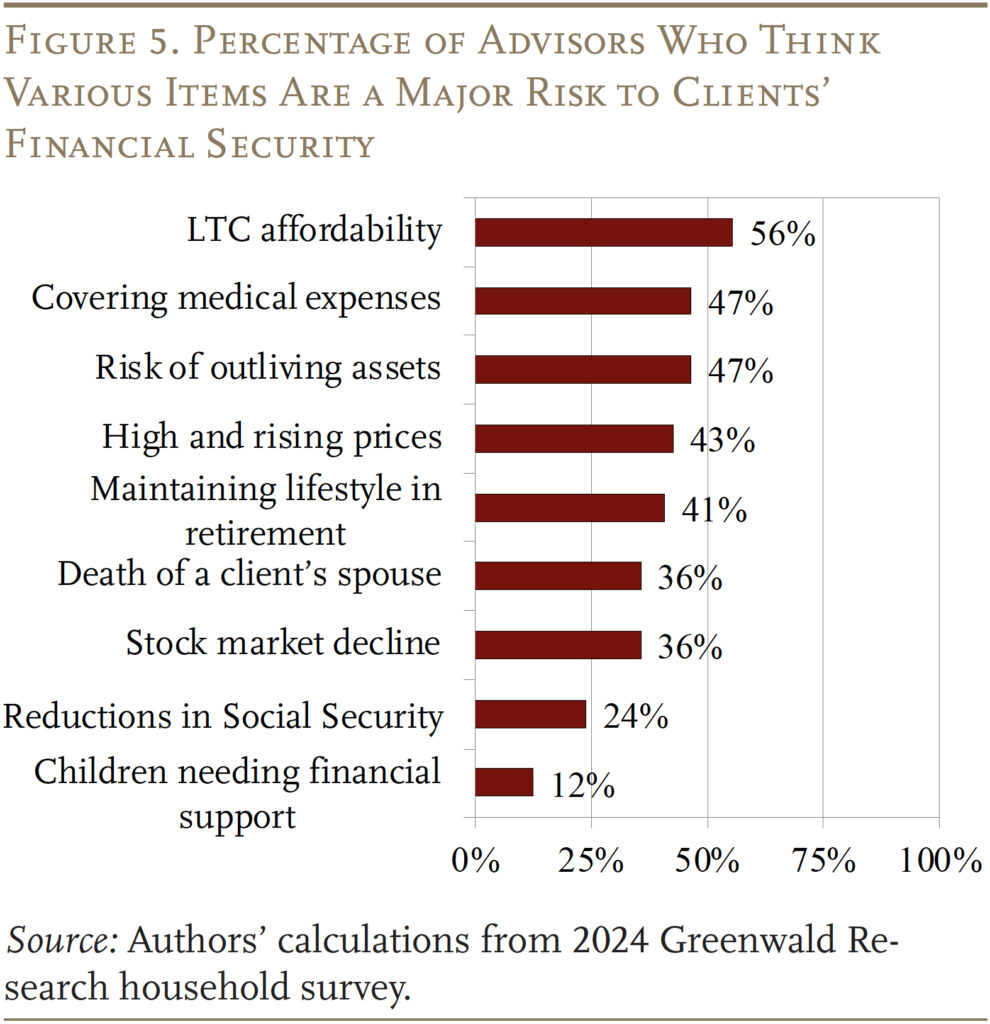

In contrast to the households, monetary advisors surveyed assume that LTC affordability or overlaying medical prices are the largest dangers their shoppers face to making sure a safe retirement (see Determine 5). Nearly three-fifths of advisors consider that LTC affordability is a significant threat in comparison with simply 33 p.c of older households. Equally, nearly half of advisors are nervous about their shoppers overlaying medical bills in comparison with simply 24 p.c of survey respondents. Advisors additionally rank these two dangers as the best for his or her older shoppers, whereas buyers themselves rank them among the many lowest.

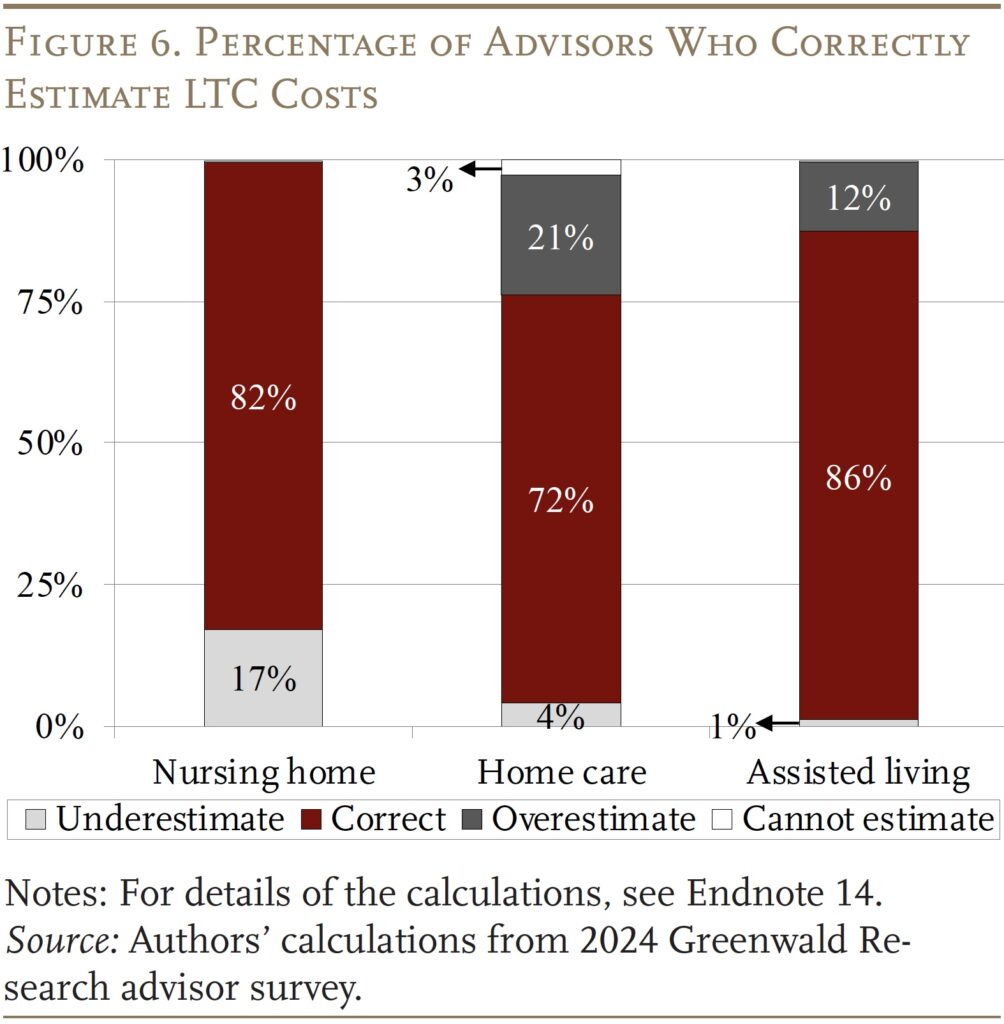

Lengthy-term care affordability heads the record of the key dangers dealing with shoppers. Certainly, near 60 p.c of advisors assume that no less than 1 / 4 of their shoppers will want 3+ years of LTC in retirement. The advisors even have a reasonably good sense of how a lot numerous LTC providers value, with over 80 p.c estimating the right vary for nursing dwelling and assisted residing prices (see Determine 6). Advisors had been barely much less educated about dwelling care prices however, even then, almost three-quarters of advisors offered an excellent estimate. Furthermore, roughly 90 p.c of advisors had been no less than considerably assured about their value estimates.

Do Advisors Affect Their Consumer’s Threat Perceptions?

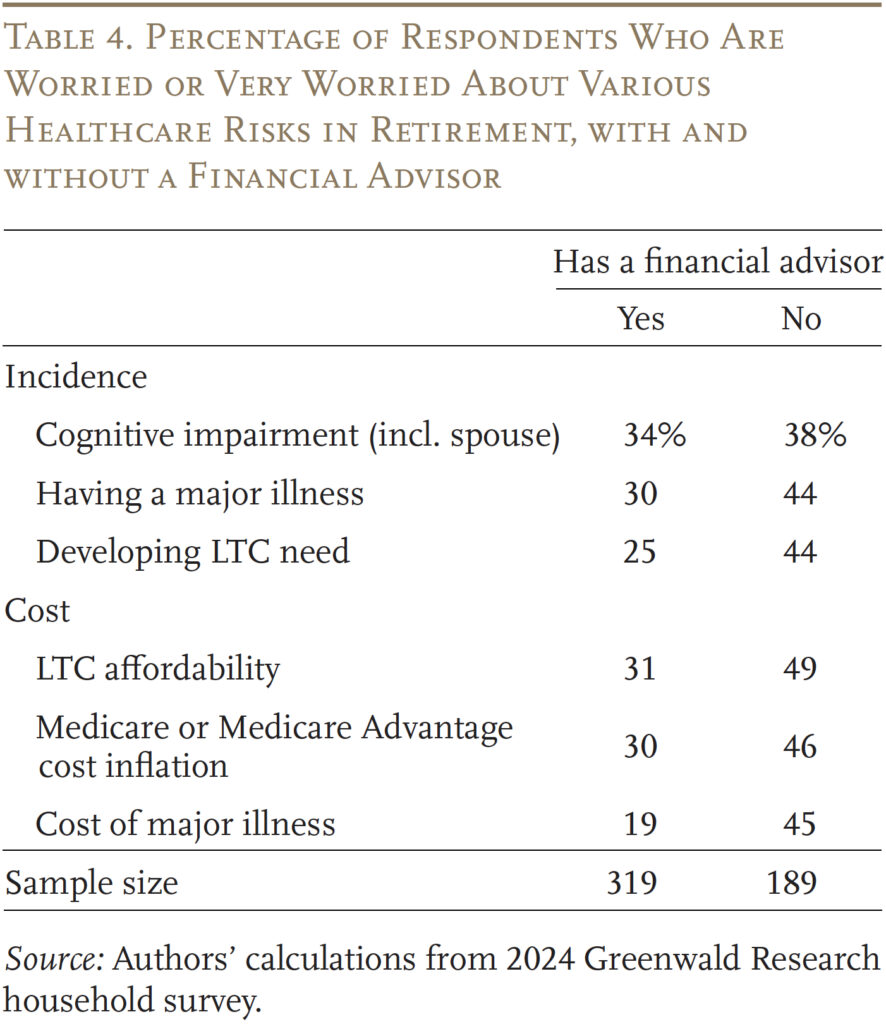

Even supposing monetary advisors have a reasonably good sense of prices, older households with advisors don’t appear to have a greater sense of their dangers. In actual fact, these with advisors are even much less nervous about their dangers and their capacity to cowl the price of main healthcare shocks (see Desk 4).

One motive could also be that households with a monetary advisor are extra ready to deal with the dangers. For instance, they might have LTC insurance coverage, be wealthier, and/or be married and have kids who could possibly maintain them. Nonetheless, regression evaluation exhibits that even after controlling for LTC insurance coverage, wealth, marital standing, and different demographic traits, these with an advisor are nonetheless much less involved about their healthcare dangers than these with out.

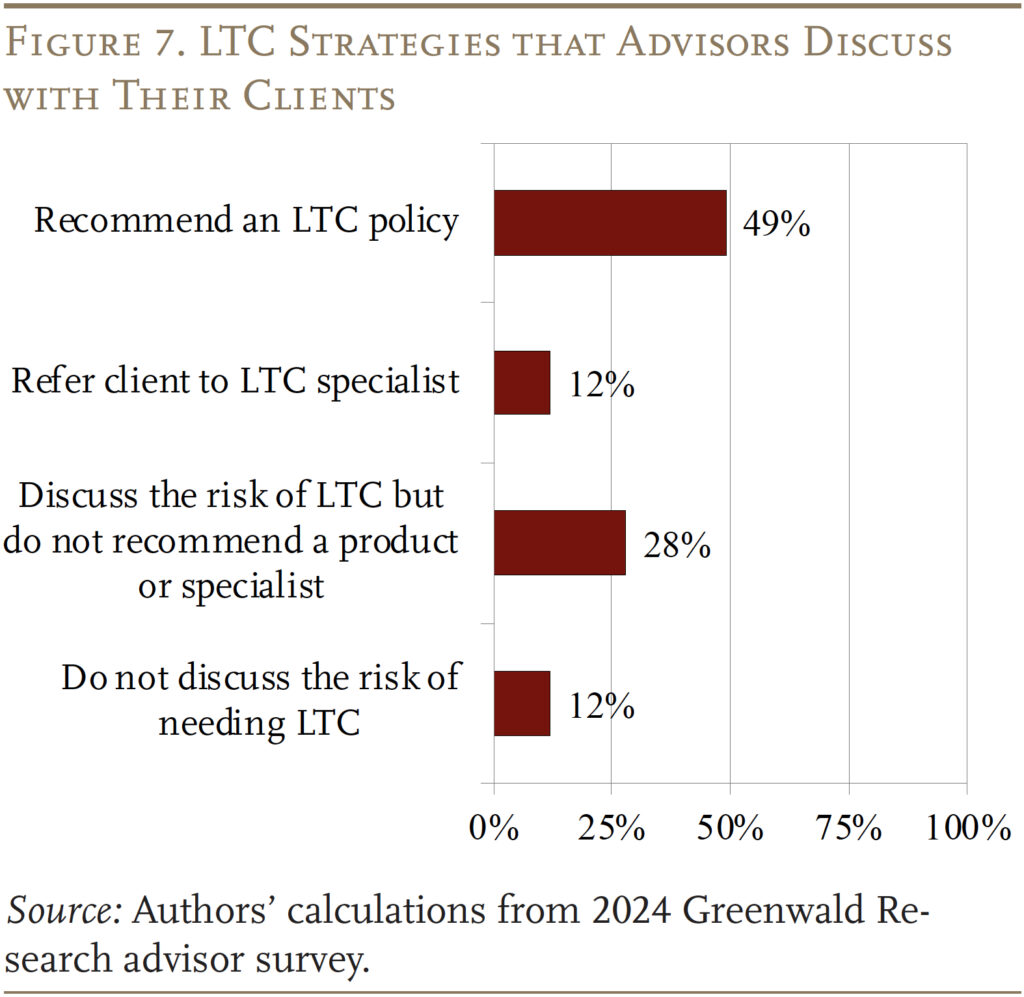

A second motive could also be that monetary advisors usually are not discussing these dangers with their shoppers. Nonetheless, the survey outcomes present that the overwhelming majority of advisors no less than focus on LTC dangers with their shoppers and over 60 p.c both advocate a coverage or advocate their shoppers to knowledgeable who’s extra educated about LTC insurance coverage merchandise (see Determine 7).

If advisors do certainly focus on LTC dangers with shoppers, a 3rd motive for low shopper information could possibly be that they depend on the advisors to know these points for them and don’t give attention to absorbing the knowledge.

A key query is why advisors, regardless of their very own information and consciousness, have little or no influence on how older households view these dangers. Research on the influence of monetary advisors on retirement safety have largely centered on their roles in serving to shoppers make funding selections.17 A couple of restricted research have proven that monetary advisors will be useful in guiding households to set financial savings targets.18 Nonetheless, just about no analysis has centered on how monetary advisors may help their shoppers handle the big spending dangers from medical and, notably, LTC wants in retirement. This space is ripe for future analysis.

Implications of Underestimating Healthcare Dangers

The implications of households underestimating their healthcare dangers are that they might not plan properly to guard themselves towards these dangers. The primary causes advisors cite for his or her shoppers not shopping for LTC insurance coverage is that they “underestimate the price of LTC” or they “would quite not take into consideration needing LTC.”

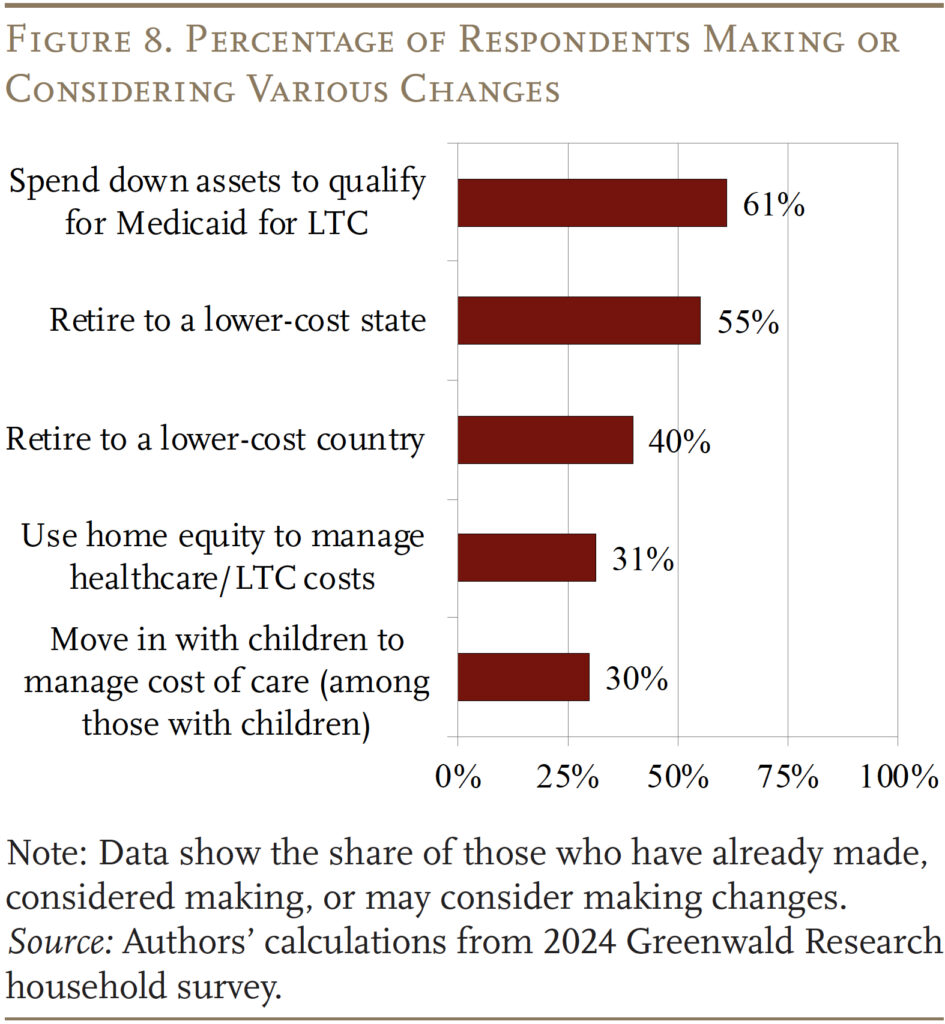

With out the suitable insurance coverage or assets, older households might need to make substantial changes or contemplate less-preferred choices. When requested what contingency plans they’d contemplate if they might not afford their medical or LTC bills, over 60 p.c stated they’d contemplate spending right down to Medicaid, whereas solely 30 p.c stated they’d think about using their dwelling fairness or transferring in with their kids (see Determine 8). Nonetheless, many of those preferences will not be life like.

Spend All the way down to Medicaid

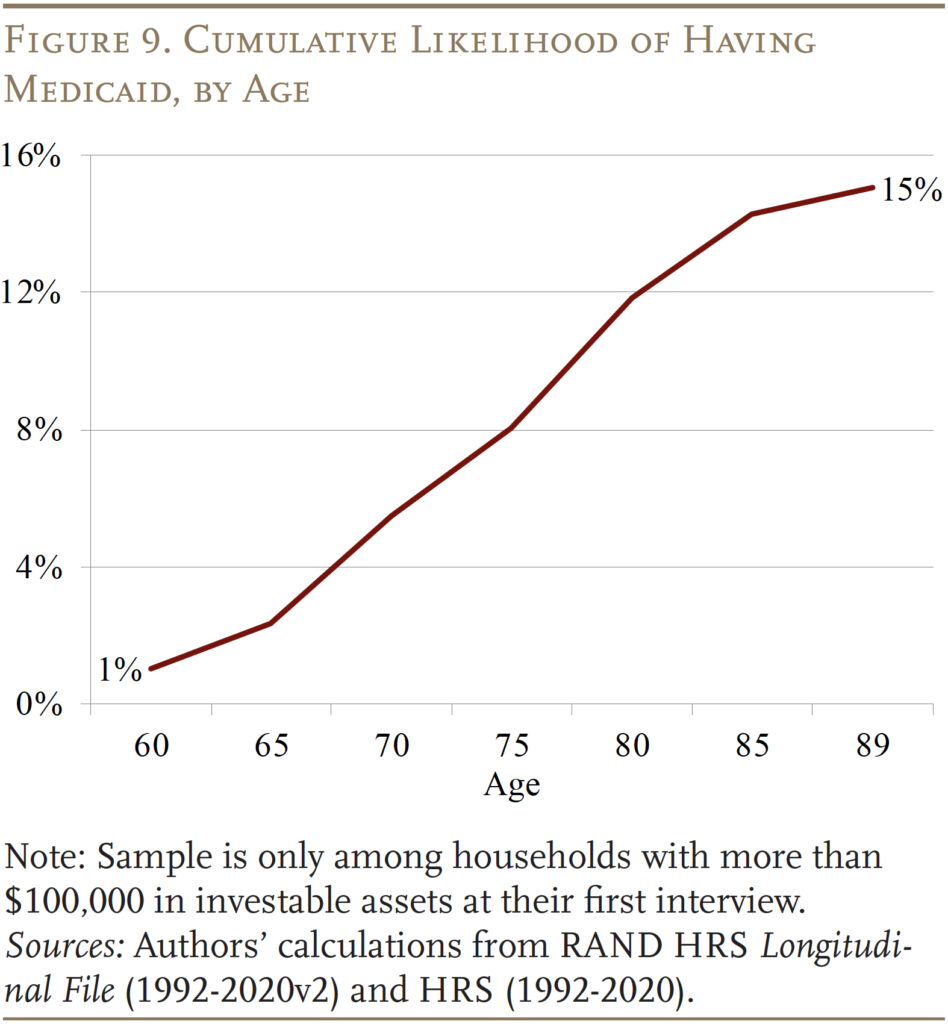

Many older households who consider they will at all times fall again on Medicaid might not notice that this system’s earnings and asset limits require impoverishment. Amongst households with greater than $100,000 in investable belongings, like these in our survey, nearly none would qualify based mostly on the usual earnings guidelines as a result of their Social Safety profit and outlined profit earnings would put them above the restrict. A number of states have particular earnings guidelines for long-term care with barely increased limits. Even then, 70 p.c of households in our pattern wouldn’t qualify. In actuality, solely 15 p.c of households with greater than $100,000 in preliminary belongings will truly find yourself on Medicaid, in comparison with the 60 p.c of households who assume that spending right down to Medicaid is an possibility for them (see Determine 9).

Tapping Residence Fairness

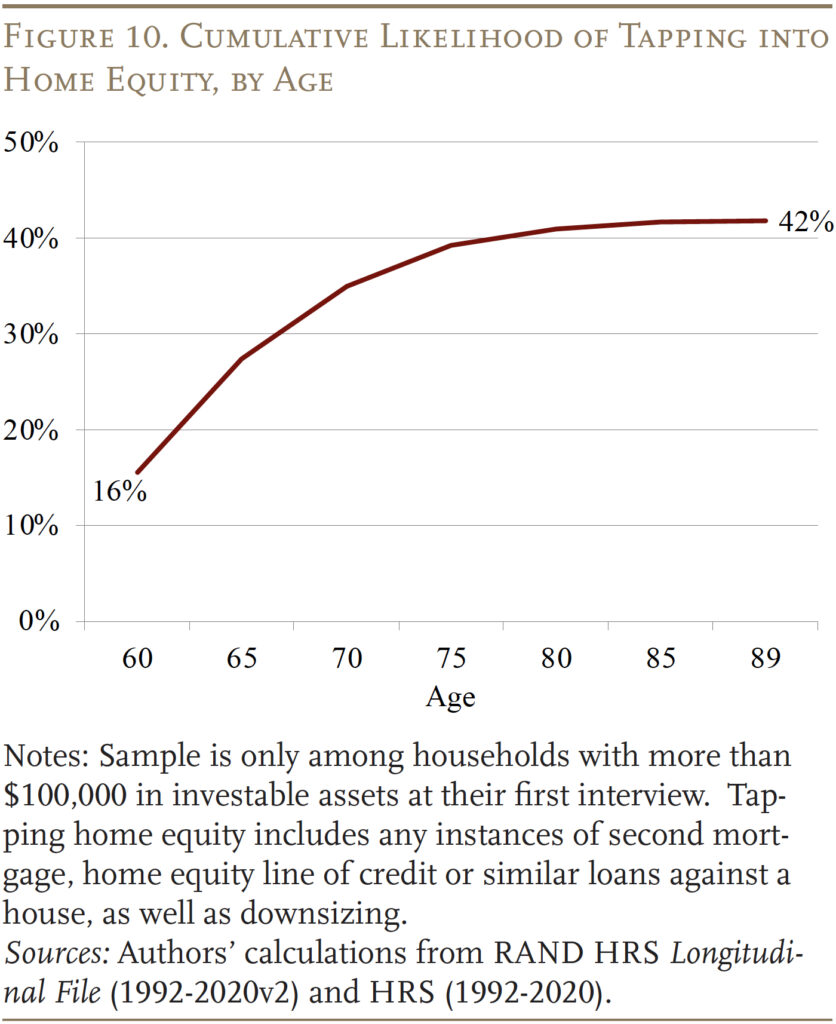

One of many least widespread contingency choices for financing healthcare prices is tapping dwelling fairness. Lower than a 3rd of households stated they’d contemplate it. Nonetheless, in actuality, over 40 p.c will faucet dwelling fairness in retirement – both by getting a second mortgage, making use of for a house fairness line of credit score or different loans towards the home, or downsizing and transferring to a much less useful home (see Determine 10).19

Residing with Youngsters

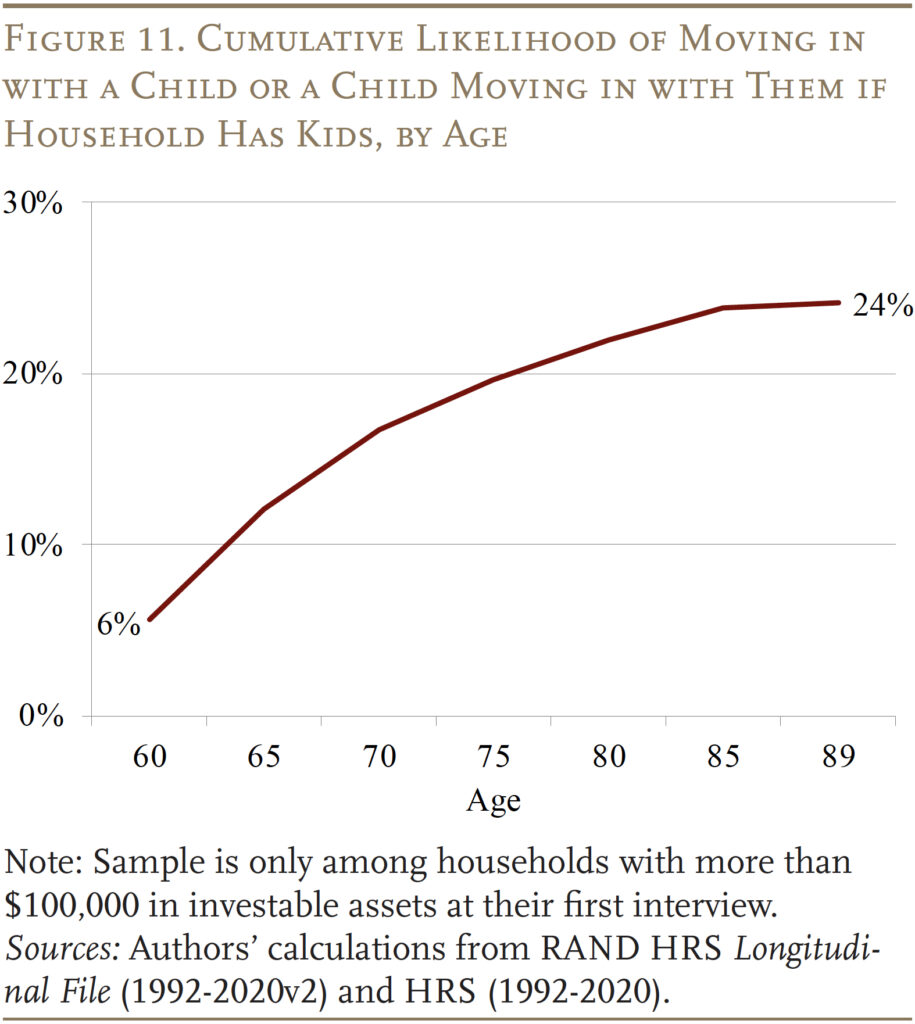

Lastly, one other unpopular possibility for managing healthcare wants amongst respondents is transferring in with kids. Once more, lower than a 3rd say they’d contemplate this feature. Apparently, in the true world, solely a couple of quarter of older households in our wealth group find yourself residing with their kids (see Determine 11). So, this feature does seem to be the least most popular back-up if plans fail.

Conclusion

The uninsured parts of healthcare prices in retirement will be substantial, and older households have to have an correct notion of those dangers to plan their spending appropriately.

The outcomes of recent surveys present that older households are likely to underestimate their healthcare dangers in retirement and have little or no sense of how a lot medical shocks or LTC providers might value. Advisors, however, have a greater sense of the prevalence and prices. Apparently, older households who work with advisors don’t appear to know extra about these dangers or prices than these with out an advisor. It isn’t clear why advisors have little influence on their shoppers’ perceptions.

The implications of older households underestimating healthcare dangers are that many might need to make substantial changes or contemplate unpalatable choices. Nearly all of older households say they’d spend right down to Medicaid and like to protect their dwelling fairness. In actuality, many find yourself tapping dwelling fairness and solely a minority find yourself on Medicaid.

References

American Affiliation for Lengthy-term Care Insurance coverage. 2020. Lengthy-Time period Care Insurance coverage Information – Information – Statistics – 2020 Reviews. Westlake Village, CA.

Belbase, Anek, Anqi Chen, Patrick Hubbard, and Alicia H. Munnell. 2021. “Who Will Have Unmet Lengthy-Time period Care Wants and How Does Medicaid Assist?” Situation in Transient 21-18. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Facilities for Medicare & Medicaid Companies. 2024. Annual Report of the Boards of Trustees of the Federal Hospital Insurance coverage and Federal Supplementary Medical Insurance coverage Belief Funds. Washington, DC: U.S. Division of Well being and Human Companies.

Chalmers, John and Jonathan Reuter. 2020. “Is Conflicted Funding Recommendation Higher Than No Recommendation?” Journal of Monetary Economics 138(2): 366-387.

Chen, Anqi, Alicia H. Munnell, and Gal Wettstein. 2025. “Do Retirement Buyers Precisely Understand Healthcare Dangers, and Do Advisors Assist?” Working Paper 2025-3. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Chen, Anqi, Alicia H. Munnell, and Gal Wettstein. 2025 (forthcoming). “How Do Retirees Deal with Uninsured Healthcare Prices?” Working Paper. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Chen, Anqi, Alicia H. Munnell, and Nilufer Gok. 2025 (forthcoming). “Do Households have a Good Sense of Their Lengthy-Time period Care Dangers?” Working Paper. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Chokshi, Niraj. 2017. “Out of the Workplace: Extra Individuals Are Working Remotely, Survey Finds.” (February 15). New York, NY: The New York Occasions.

Favreault, Melissa and Judith Dey. 2015. “Lengthy-Time period Companies and Helps for Older Individuals: Dangers and Financing Analysis Transient.” Washington, DC: U.S. Division of Well being and Human Companies, Assistant Secretary for Planning and Analysis.

Freedman, Vicki and Brenda Spillman. 2014. “The Residential Continuum From Residence to Nursing Residence: Measurement, Traits and Unmet Wants of Older Adults.” The Journals of Gerontology: Collection B 69(1) S42-S50.

French, Kenneth R. and James M. Poterba. 1991. “Investor Diversification and Worldwide Fairness Markets.” The American Financial Assessment 81(2): 222-226.

Genworth Monetary. 2023. “Genworth Releases Value of Care Survey Outcomes for 2023: Twenty Years of Monitoring Lengthy-Time period Care Prices.” Richmond, VA.

Grinblatt, Mark and Matti Keloharju. 2001. “How Distance, Language, and Tradition Affect Stockholdings and Trades.” The Journal of Finance 56(3): 1053-1073.

Goetzmann, William N. and Alok Kumar. 2008. “Fairness Portfolio Diversification.” Assessment of Finance 12(3): 433-463.

Gohringer, Kimberly. 2017. “Telecommuting and Dependent Care: Work Options for Caregivers.” Eugene, OR: Digital Vocations web site.

Gruber, Jonathan and Kathleen M. McGarry. 2023. “Lengthy-term Care in america.” Working Paper 31881. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Hackethal, Andreas, Michael Haliassos, and Tullio Jappelli. 2012. “Monetary Advisors: A Case of Babysitters?” Journal of Banking & Finance 36(2): 509-524.

Hamel, Liz and Alex Montero. 2023. “The Affordability of Lengthy-Time period Care and Assist Companies: Findings from a KFF Survey.” San Francisco, CA: KFF.

Hou, Wenliang. 2020. “How Correct Are Retirees’ Assessments of Their Retirement Threat?” Working Paper 2020-14. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Johnson, Richard W. and Joshua M. Wiener. 2006. “A Profile of Frail Older Individuals and Their Caregivers.” Occasional Paper Quantity 8. Washington, DC: City Institute.

Johnson, Richard W. and Judith Dey. 2022. “Lengthy-Time period Companies and Helps for Older Individuals: Dangers and Financing, 2022.” Analysis Transient. Washington, DC: U.S. Division of Well being and Human Companies, Workplace of the Assistant Secretary for Planning and Analysis.

Kramer, Marc M. 2012. “Monetary Recommendation and Particular person Investor Portfolio Efficiency.” Monetary Administration 41(2): 395-428.

Kim, Kyoung T., Tae-Younger Pak, Su H. Shin, and Sherman D. Hanna. 2018. “The Relationship Between Monetary Planner Use and Holding a Retirement Saving Objective: A Propensity Rating Matching Evaluation.” Monetary Planning Assessment 1(1-2): e1008.

Liu, Zhikun, Michael Finke, and David Blanchett. 2024. “Skilled Monetary Recommendation and Investor Habits In the course of the COVID-19 Pandemic.” Monetary Planning Assessment 7(1): e1172.

Marsden, Mitchell, Cathleen D. Zick, and Robert N. Mayer. 2011. “The Worth of Looking for Monetary Recommendation.” Journal of Household and Financial Points 32: 625-643.

McInerney, Melissa, Matthew S. Rutledge, and Sara Ellen King. 2022. “How A lot Does Well being Spending Eat Away at Retirement Earnings?” Situation in Transient 22-12. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Radu, Sintia. 2018. “How Quickly Will You Be Working from Residence? Telecommuting May Not Simply Be A Firm Perk within the Subsequent Decade.” (February 16). Washington, DC: U.S. Information & World Report.

RAND. Well being and Retirement Examine Longitudinal File, 1992-2020v2. Santa Monica, CA.

Shapira, Zur and Itzhak Venezia. 2001. “Patterns of Habits of Professionally Managed and Unbiased Buyers.” Journal of Banking & Finance 25(8): 1573-1587.

Spillman, Brenda C. 2009. “Coverage Analyses Utilizing the 2004 Nationwide Lengthy-Time period Care Survey.” Washington, DC: U.S. Division of Well being and Human Companies, Workplace of the Assistant Secretary for Planning and Analysis.

Spillman, Brenda C., Eva H. Allen, and Melissa Favreault. 2021. “Casual Caregiver Provide and Demographic Modifications: Assessment of the Literature.” Washington, DC: U.S. Division of Well being and Human Companies, Workplace of the Assistant Secretary for Planning and Analysis.

Spillman, Brenda and Liliana Pezzin. 2000. “Potential and Energetic Household Caregivers: Altering Networks and the ‘Sandwich Era.’” The Milbank Quarterly 78(3): 347-374.

Spillman, Brenda, Vicki Freedman, Judith Kasper, and Jennifer Wolff. 2020. “Change Over Time in Caregiving Networks for Older Adults With and With out Dementia.” The Journals of Gerontology: Collection B 75(7): 1563-1572.

U.S. Congress Joint Financial Committee. 2019. An Invisible Tsunami: “Ageing Alone” and Its Impact on Older Individuals, Households, and Taxpayers. SCP Report No. 1-19. Washington, DC.

College of Michigan. Well being and Retirement Examine, 1992-2020. Ann Arbor, MI.

von Gaudecker, Hans-Martin. 2015. “How Does Family Portfolio Diversification Range with Monetary Literacy and Monetary Recommendation?” The Journal of Finance 70(2): 489-507.

Wettstein, Gal and Alice Zulkarnain. 2019. “Will Fewer Youngsters Increase Demand for Formal Caregiving?” Working Paper 2019-6. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Wolff, Jennifer and Judith Kasper. 2006. “Caregivers of Frail Elders: Updating a Nationwide Profile.” The Gerontologist 46(3): 344-356.