Misperceptions of long-term care wants and prices are trigger for concern.

Households approaching retirement face all kinds of dangers to their monetary safety. They could stay longer than deliberate and deplete their sources; they could expertise unexpectedly excessive inflation; or they could obtain unusually poor returns on their investments. Equally consequential is the danger that households will face main bills to cowl medical and long-term care prices. My colleagues and I simply accomplished a research primarily based on a brand new survey to find out the extent to which older adults perceive the dangers they face.

The main focus of our concern was primarily the prices related to long-term care. In fact, medical dangers are extremely unsure and doubtlessly costly, however a lot of this threat is insured by Medicare (and Medicaid for these eligible for each applications).

Lengthy-term care dangers, in distinction, should not properly insured. Solely 3 % of all U.S. adults or 15 % of these ages 65+ have long-term care insurance coverage, and Medicaid, the general public insurance coverage program focused at low-income people, shouldn’t be a practical possibility for many middle-income households.

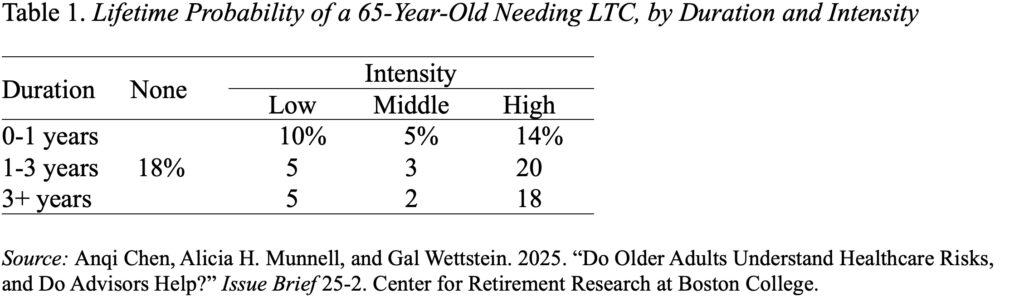

But, 80 % of 65-year-olds will want long-term care in some unspecified time in the future over their remaining life (see Desk 1). And whereas the depth and period of those long-term care wants differ considerably, about 40 % would require high-intensity take care of greater than a yr.

Given the in depth wants and lack of insurance coverage, relations usually cowl nearly all of care hours for individuals with low and average wants and complement the efforts with paid caregivers as wants improve. Paid LTC, nevertheless, may be very expensive – in 2023, the median annual prices had been $116,800 for a non-public room in a nursing dwelling, $75,500 for dwelling well being aides, and $64,200 for an assisted residing facility.

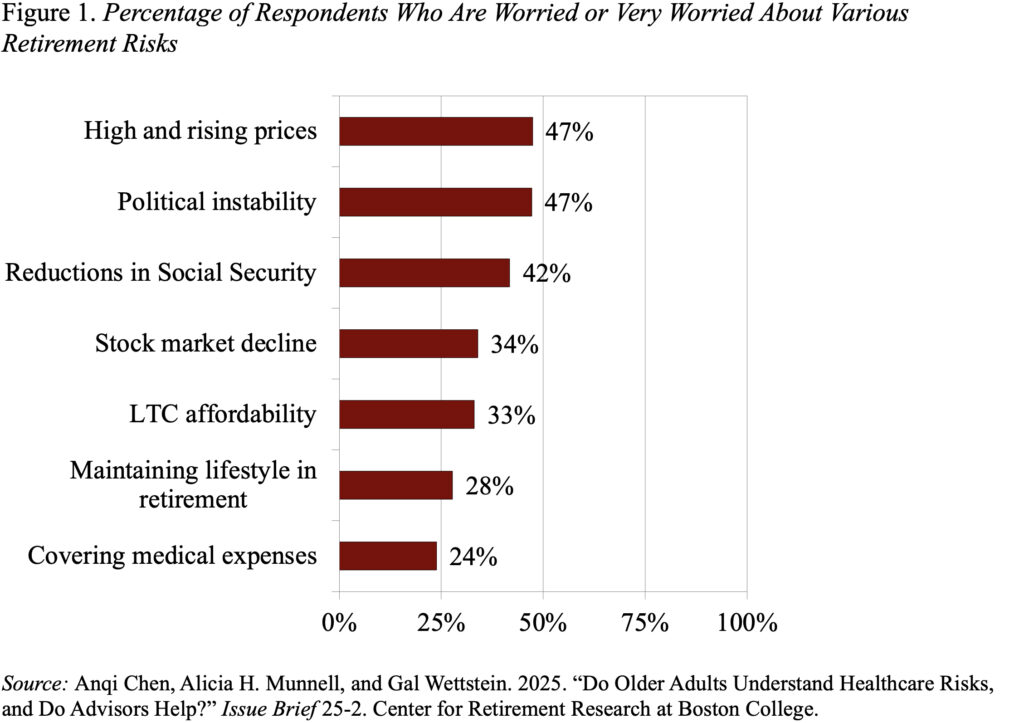

To take a look at households’ perceptions concerning healthcare dangers, Greenwald Analysis interviewed on-line 508 people ages 48-78 with a minimum of $100,000 in investable property in July 2024. The outcomes confirmed that medical and long-term care wants had been low on most respondents’ listing of considerations (see Determine 1) – a discovering according to different research.

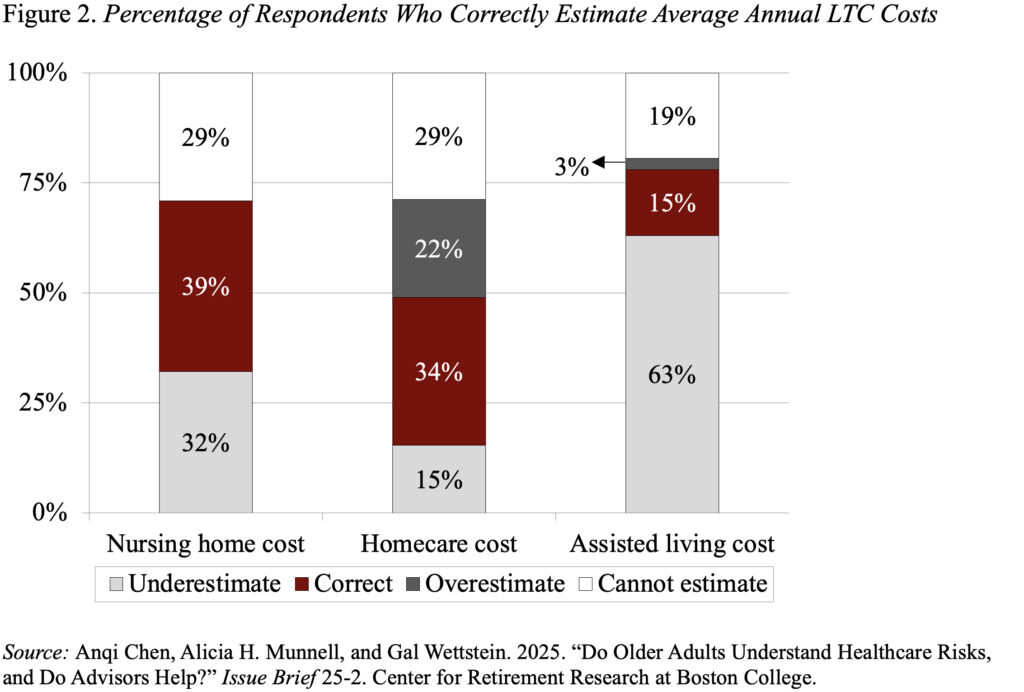

Furthermore, solely 39 % of older households may accurately estimate the price of a nursing dwelling, 34 % for dwelling care providers, and solely 15 % for assisted residing amenities (see Determine 2).

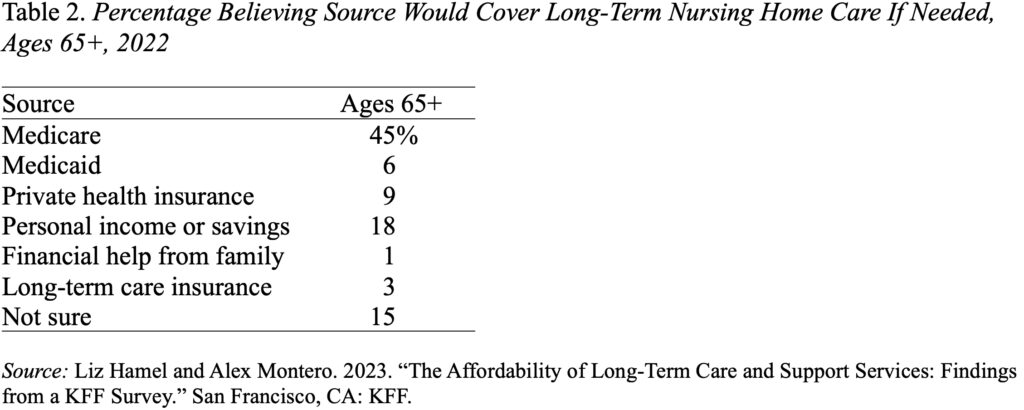

One motive that households have such large misperceptions about each the dangers and the prices of long-term care is that survey after survey has discovered that many mistakenly imagine that Medicare covers LTC. The newest instance from KKF reveals that 45 % of respondents ages 65+ assume that Medicare pays for his or her LTC and one other 9 % assume that their prices will likely be lined by personal medical insurance (see Desk 2).

Underestimating healthcare dangers – significantly the dangers of long-term care wants – has actual prices. Households don’t buy long-term care insurance coverage nor save prematurely for such an occasion. As a substitute, they’re left on their very own with insufficient sources to navigate a really demanding, sophisticated, and dear problem.