What You Ought to Know

- Nationwide Common provides reductions for protected drivers of as much as 23%

- Save with Nat Gen’s anti-theft, low mileage, and protected driving reductions

- Policyholders who use an app to watch their driving conduct can save

Does Nationwide Common supply protected driving reductions? Sure, it can save you as much as 23% for with Nat Gen protected driving reductions, resembling anti-theft, defensive driving, low mileage, usage-based, and protected driver reductions.

Study Extra: Low-Mileage Auto Insurance coverage Low cost

Prepared to check safe-driving choices for inexpensive auto insurance coverage? Merely enter your ZIP code into our free quote comparability software above to get began.

Nationwide Common Presents Reductions for Protected Driving

Like many different insurance coverage corporations, Nationwide Common provides protected drivers many auto insurance coverage reductions for inexpensive protection. As an example, it can save you when you have security options in your automobile or haven’t had an accident shortly.

As you’ll be able to see, drivers can save as much as 22% with the Nationwide Common insurance coverage protected driver low cost in the event that they go and not using a declare for a sure interval. Additionally, it can save you 10% for passing a Nat Gen-approved defensive driving course.

Maintain studying to study extra about every protected driving low cost in depth.

Examine over 200 auto insurance coverage corporations directly!

Secured with SHA-256 Encryption

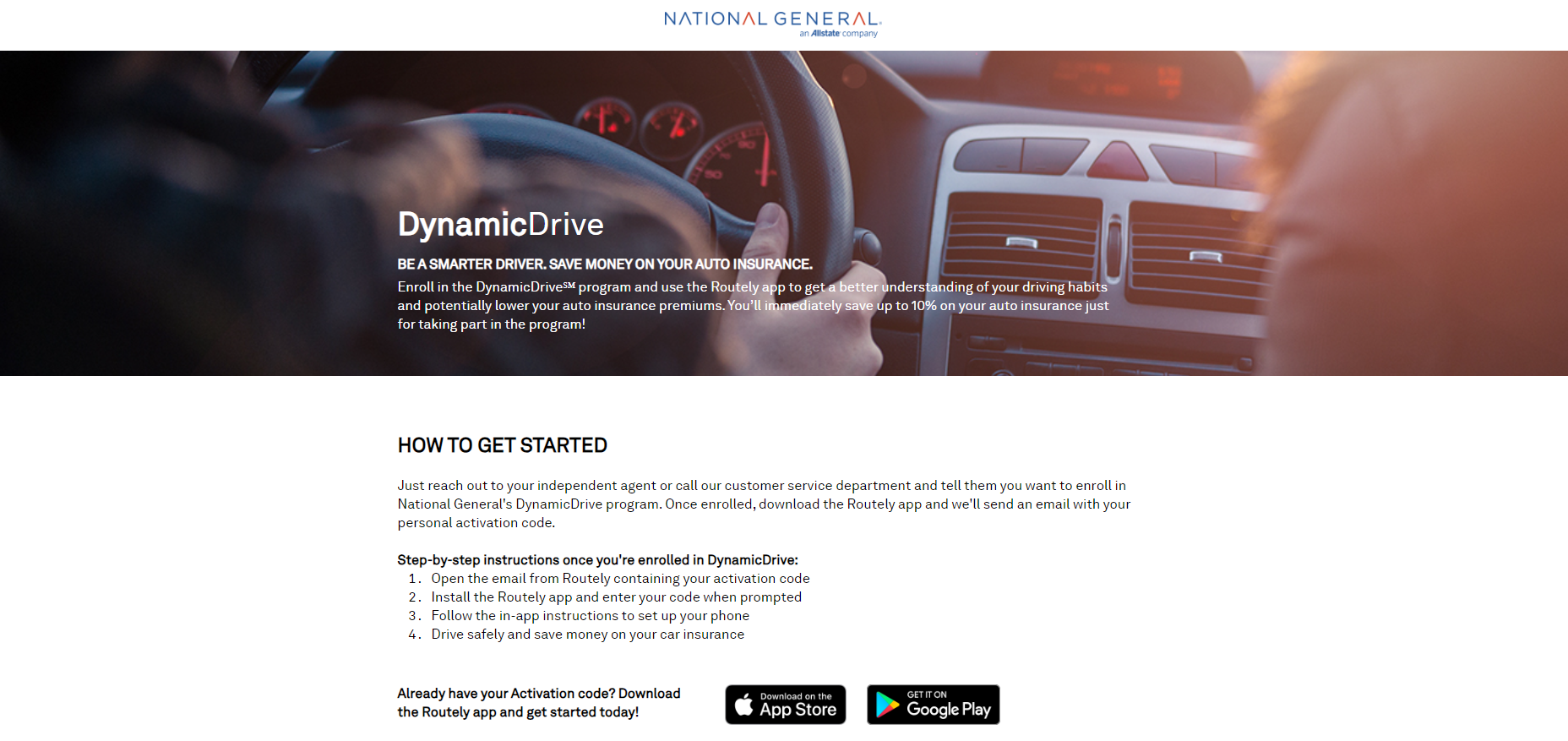

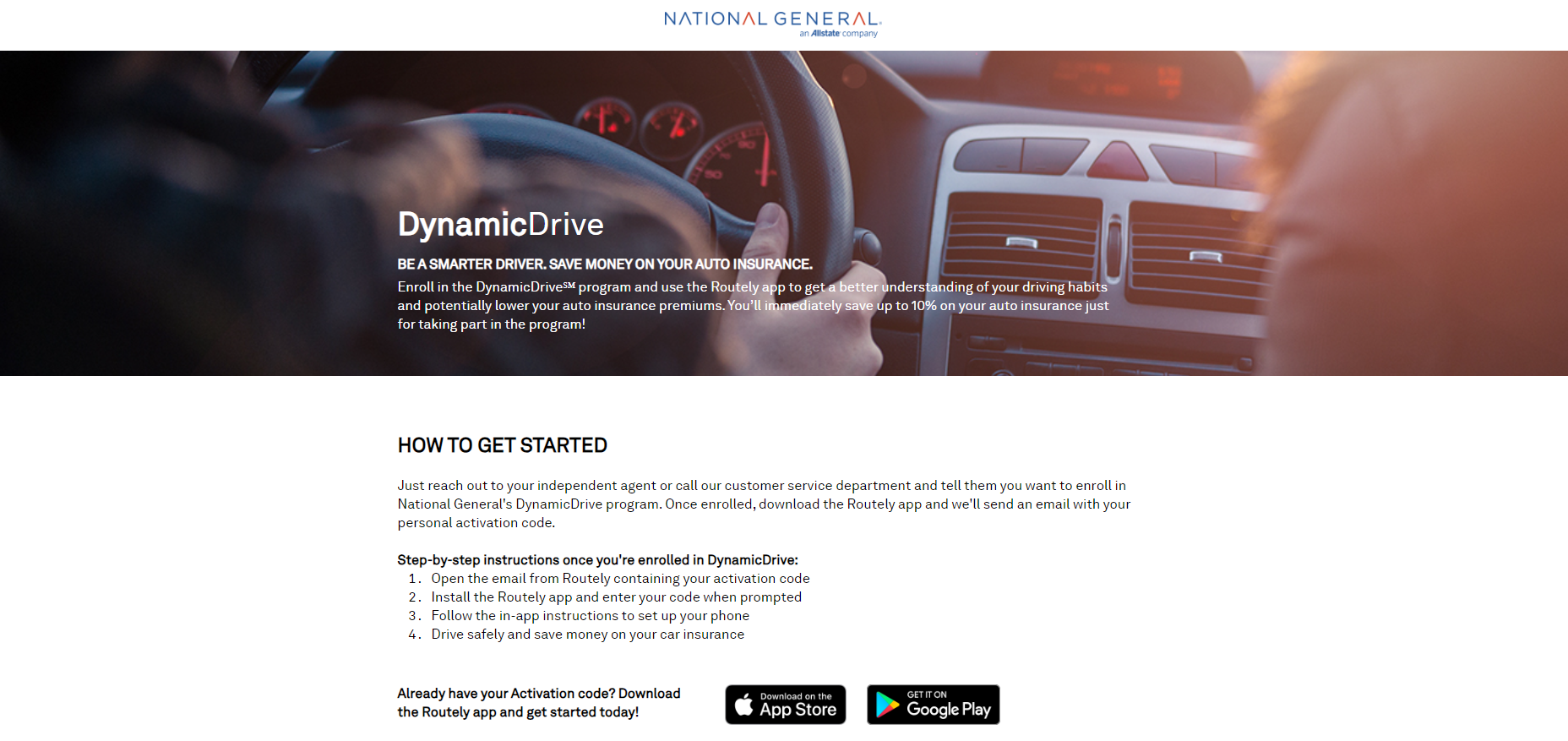

Protected Drivers Can Save With Nationwide Common’s DynamicDrive Program

Nationwide Common provides a usage-based insurance coverage program that rewards policyholders who use a monitoring app with decrease charges. This system is called “DynamicDrive,” which may decrease your automobile insurance coverage charges if it finds you drive safely.

Try the desk under to see how a lot you may save with Nationwide Common’s usage-based insurance coverage vs. different prime suppliers:

To take benefit, it’s essential enroll in this system and can then obtain an app to your iPhone or Android system. The corporate will then e mail you an activation code which you enter into the Nationwide Common protected driving app.

After getting completed the setup directions, the app will ship the corporate information about every journey you’re taking.

For those who point out that you are a safer driver by way of your driving habits, you may decrease your auto insurance coverage premiums. Nonetheless, enrolling within the Nationwide Common DynamicDrive program routinely saves you as much as 10%.

Brad Larson

Licensed Insurance coverage Agent

For those who don’t like the concept of gadgets routinely monitoring your driving habits, chances are you’ll wish to find out about inexpensive auto insurance coverage corporations that don’t monitor your driving.

Decrease Your Nat Common Charges With a Good Driving Report

As well as, drivers who’ve fewer site visitors violations over a given interval or make fewer claims might benefit from decrease charges once they renew their insurance coverage. These charges will range from state to state and buyer to buyer, so that you’ll must ask the corporate for particular particulars.

If you wish to know extra about violations and your driving file, study how a DUI impacts your auto insurance coverage charges, for instance.

Vehicles With Security Options Qualify for Nationwide Common Reductions

If eligible, you may additionally get decrease charges if you match security gadgets to your automobile that may scale back your threat. When your automobile already has sure security gadgets on board, you need to inform Nationwide Common so chances are you’ll qualify for a reduction.

A few of these security options embrace:

- Air baggage

- Anti-lock brakes

- Anti-theft gadgets

Questioning how a lot an air bag auto insurance coverage low cost will prevent with Nationwide Common? Name a Nationwide Common consultant to study extra.

Examine over 200 auto insurance coverage corporations directly!

Secured with SHA-256 Encryption

Protected Drivers Get Low-cost Nationwide Common Automobile Insurance coverage Charges

You’ll be able to benefit from a number of applications providing reductions by way of Nationwide Common in case you can present that you’re a protected driver. For instance, you’ll be able to enroll and obtain an app to speak your driving habits to the corporate.

As well as, it can save you when you have fewer site visitors violations or accidents or match sure security gadgets to the autos you insure.

Study Extra: Clear Driving Report for Auto Insurance coverage

Nonetheless, the quantity it can save you will range, and a few reductions will not be accessible in all states. Enter your ZIP code into our free comparability software under to see how a lot protected driving reductions may decrease your Nationwide Common quote.

Ceaselessly Requested Questions

How a lot is the Dynamic Drive low cost?

It can save you as much as 22% for good driving by way of Nationwide Common’s DynamicDrive program and a ten% low cost for preliminary enrollment. Nonetheless, Dynamic Drive with Nationwide Common may additionally elevate your charges in case you drive poorly.

Does Nationwide Common have a scholar low cost?

What are the Nationwide Common reductions?

There are a lot of methods to save lots of on auto insurance coverage with Nationwide Common, by bundling auto with householders’ insurance coverage, paying in full, or qualifying for a low mileage saving. You can even profit when you have a number of autos in your coverage or select paperless billing.

Are you able to lower your expenses in your insurance coverage with higher credit score?

Some states characteristic a confidential rating the place they calculate an insurance coverage rating primarily based on sure components discovered inside a shopper credit score report. These corporations might use this data to find out insurance coverage charges.

Are Protected Auto and Nationwide Common the identical?

Sure, in 2021, SafeAuto and Nationwide Common had been acquired by Allstate. Try our evaluation of Allstate insurance coverage to see if the corporate is a proper match for you.

Why is Nationwide Common insurance coverage so low cost?

Nationwide Common provides varied methods for protected drivers to save lots of on their protection, together with with auto insurance coverage reductions resembling protected driver, good scholar, paid-in-full, and paperless.

Enter your ZIP code into our free quote software under to check your Nationwide Common charges towards the highest opponents in your space.

Can Dynamic Drive enhance insurance coverage?

Sure, whereas most drivers get a reduction with DynamicDrive, you may see a surcharge when renewing in case you exhibit poor driving behaviors by way of this system.

What’s the low cost proportion for the nice driver low cost with Nationwide Common?

You might save as much as 22% with Nationwide Common’s protected driver low cost in case you go claims-free for a sure interval.

Is NatGen Premier the identical as Nationwide Common?

Ought to I let insurance coverage monitor my driving?

Permitting a automobile insurance coverage firm to watch your driving conduct may result in decrease charges in case you drive safely. Nonetheless, you need to contemplate your driving habits earlier than enrolling in usage-based insurance coverage.

Examine over 200 auto insurance coverage corporations directly!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance coverage Agent

Brandon Frady has been a licensed insurance coverage agent and insurance coverage workplace supervisor since 2018. He has expertise in ventures from retail to finance, working positions from cashier to administration, however it wasn’t till Brandon began working within the insurance coverage trade that he actually felt at dwelling in his profession. In his day-to-day interactions, he goals to reside out his enterprise philosophy in how he treats hello…

Editorial Tips: We’re a free on-line useful resource for anybody fascinated by studying extra about auto insurance coverage. Our purpose is to be an goal, third-party useful resource for the whole lot auto insurance coverage associated. We replace our website repeatedly, and all content material is reviewed by auto insurance coverage specialists.