They’re not good for staff and distract from the important thing difficulty: steady protection.

One thing I don’t perceive about a few of my colleagues is their enthusiasm for outlined profit plans – extra particularly for “conventional” plans the place advantages are equal to, say, 1.5 % of ultimate wage for every year of service, the place ultimate wage is outlined because the final 5 years, and advantages usually are not adjusted for inflation after retirement.

Conventional outlined profit plans wouldn’t be good for a lot of non-public sector staff – some extent pushed dwelling by our latest bout of inflation. Inflation erodes the worth of advantages within the accumulation section and erodes the true worth of unindexed advantages in retirement.

The dearth of indexing of outlined profit pensions is apparent; hundreds of thousands of households have seen the buying energy of their advantages decline by greater than 20 % since inflation took off in 2021. That’s a everlasting loss that may by no means be recovered.

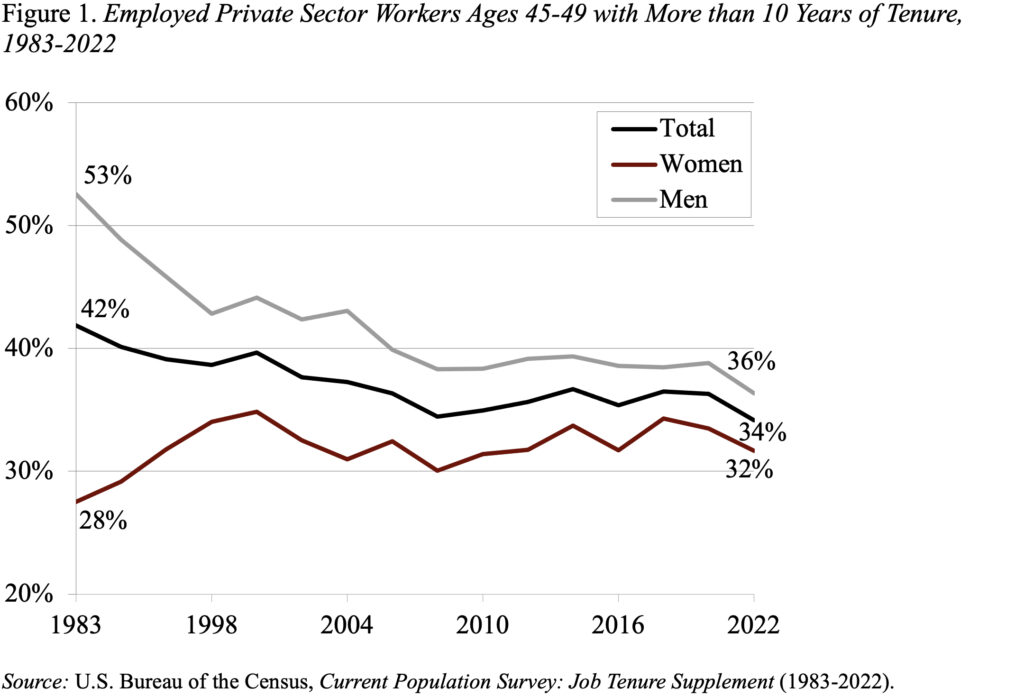

What’s much less apparent is the impact of inflation on the buildup facet of outlined profit pensions, the place shifting jobs significantly erodes retirement earnings. And staff do shift jobs. Amongst these ages 45-49, solely a couple of third of staff had been with their employer for greater than 10 years (see Determine 1). Whereas the query of whether or not mobility has elevated over time is controversial, the truth that the U.S. has a really cellular workforce is uncontroversial.

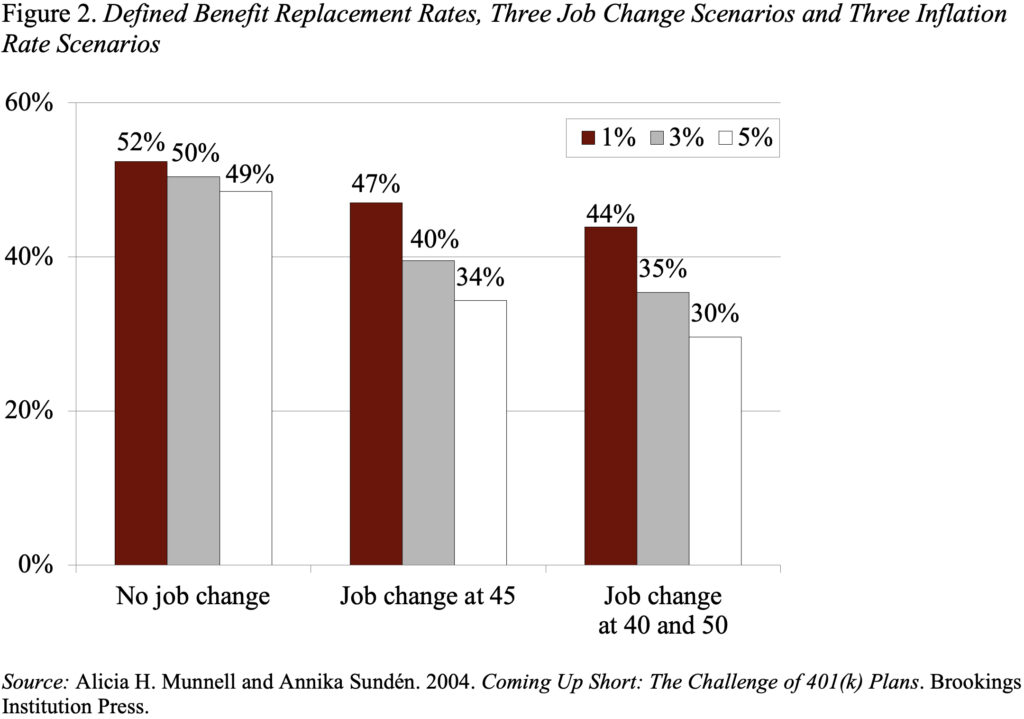

Combining job shifting with inflation signifies that staff with outlined profit plans expertise a big discount of their retirement earnings. That’s, staff with such plans who change jobs, even amongst corporations with similar plans and quick vesting, obtain considerably decrease advantages than staff with steady protection beneath a single plan – assuming these staff have the identical future earnings path as they’d have had with out the job change. The explanation job changers have much less retirement wealth is as a result of their advantages are primarily based on earnings on the time they terminate employment. Employees who don’t change jobs see the earnings used for the calculation of retirement advantages rise over their careers, because of inflation and productiveness progress. Job changers, nonetheless, lose the rise of their retirement advantages generated by this progress in nominal earnings. These variations are better if inflation is quicker, as a result of ultimate earnings from earlier jobs turn into more and more insignificant with quickly rising wages (see Determine 2).

The one means for cellular staff to keep away from such losses beneath conventional plans can be for the employer to supply advantages primarily based on projected earnings at retirement relatively than on the time that the employee leaves the job. Enhancing advantages for terminated staff, nonetheless, would both value the employer or decrease advantages for remaining staff. Conventional outlined profit plans usually are not wager for cellular staff in an inflationary setting.

A fair larger concern, nonetheless, with the nostalgia about conventional outlined profit plans is that it’s a diversion from an important difficulty for retirement safety – specifically, making certain staff have steady protection over their work lives. At any time, about 50 % of personal sector staff don’t take part in a office retirement plan. That difficulty is far more essential than whether or not these with steady protection have an outlined profit or 401(okay) association.