After Kyle wrote about the most effective monetary advisors in Canada a few weeks in the past, we acquired a number of emails that requested some model of, “Ought to I take advantage of Edward Jones monetary advisors?” or one of many different giant monetary advisory companies in Canada.

Since I’ve had a number of mates use their providers, and plenty of of their advisors usually seem atop the Globe and Mail rankings yearly, I made a decision to put in writing an Edward Jones Overview that particulars precisely why Kyle was fairly laborious on them a few weeks in the past.

I ought to word that I’ve solely corresponded with readers and talked with mates about Edward Jones Canada – not their US or worldwide wings, so my commentary can be targeted on Canada-specific details. The opposite factor to remember is that Edward Jones shouldn’t be alone in lots of the charges and practices that you simply’ll examine beneath (in actual fact it’s all too widespread) they’re simply the most important one, and the one we acquired essentially the most questions on.

Edward Jones Charges and MER Defined

I’m not saying that Edward Jones doesn’t have good advisors working for them. Perhaps a few of them know their stuff. What I do know past a shadow of a doubt is that it’s extremely obscure Edward Jones’ charges and prices.

You’re going to pay commissions to Edward Jones, additional percentages to high-fee mutual fund suppliers, transaction charges, technique charges, commissions for promoting you insurance coverage, commissions for promoting you mortgages, and so on. All of these charges and commissions stack on prime of one another.

Right here’s a have a look at the charges and prices concerned versus Kyle’s choose for prime monetary advisory.

Edward Jones vs Recommendation-Solely Monetary Planner Charges Comparability

| Recommendation Solely/Charge Solely Monetary Planners | Edward Jones | |

| Is there an upfront quote that’s simple to grasp? | Sure! | Undoubtedly Not. Many percentages and charges to calculate. |

| Proportion the monetary advisor and firm will take out of your portfolio | 0% | Someplace within the 1-3% vary – see beneath for particulars. |

| Are there a number of layers of extra charges corresponding to markups whenever you purchase securities, “technique charges”, and account charges for each RRSP, TFSA, RESP, FHSA and investing account that you’ve? | No! | Sure! |

| Are advisors paid commissions to advocate investments? | No | Sure |

| Are advisors paid commissions to advocate insurance coverage merchandise? | No | Sure |

| Are advisors paid commissions to advocate mortgages? | No | Sure |

| Does the advisory firm cost charges for providers/merchandise corresponding to account transfers, margin accounts (loans), overseas change, buying and selling charges, markups on investments you purchase, and so on? | No | Sure |

*The above data was interpreted from the Edward Jones “Understanding how we’re compensated for monetary providers” doc discovered right here. Please seek the advice of this doc to completely perceive the complexity of compensation concerned.

Edwards Jones Options

My most popular various to Edward Jones (and different commission-based monetary advisors in Canada) is Goal Monetary Companions.

Goal is run by Jason Heath. Should you Google Jason’s title, you’ll discover out that he’s trusted to put in writing for essentially the most trusted publications in Canadian private finance. He has a long time of expertise within the trade, and has constructed an excellent group of specialists that may care for any monetary planning curveball you throw their means.

Once you go to them with a query or asking for a monetary plan, they’ll let you know precisely what is required to get you heading in the right direction – and offer you a quote for his or her time. It’s quite simple and doesn’t require digging by means of pages of jargon-filled compensation fineprint.

Jason and his group don’t make a nickel off of any merchandise that they advocate to you. Additionally they don’t receives a commission extra for those who make investments extra of your cash by means of their non-public platform (they don’t have a personal buying and selling platform to funnel traders into like the large wealth administration firms do). Consequently, they’re utterly goal (therefore the title) concerning the investments they advocate, and the monetary planning instruments they advise to make use of.

Goal Monetary Companions is an unbiased entity and doesn’t have a bunch of overhead prices from paying lease in strip malls or shopping for the naming rights to a giant stadium. You may simply schedule an appointment with them each six months – or for those who simply need assistance one time to be sure you’re heading in the right direction, they’ll try this for you as properly. I’ve but to stump them with a monetary quandary – let me know for those who handle to take action!

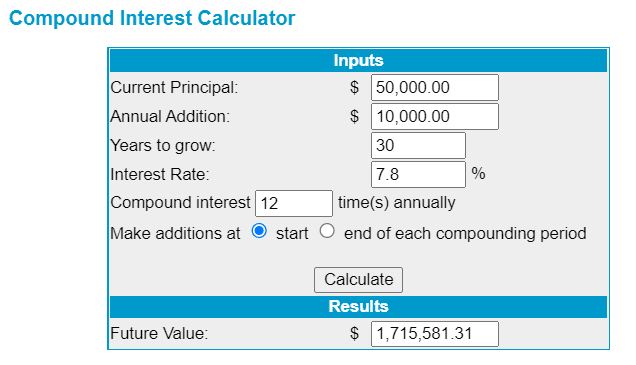

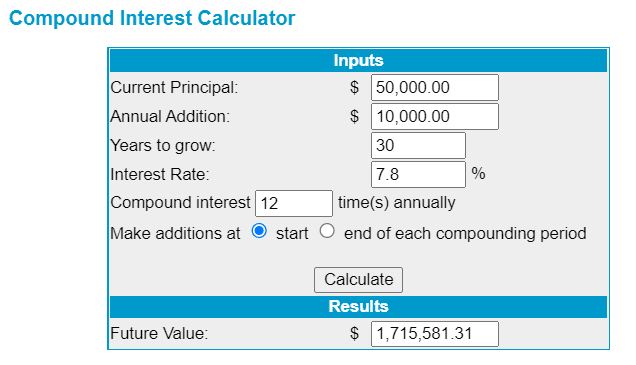

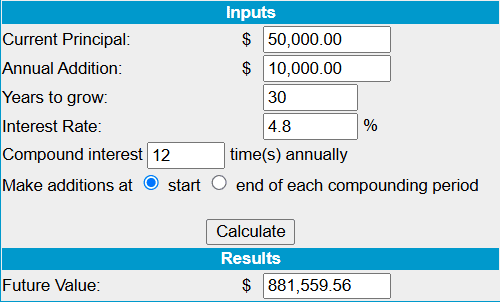

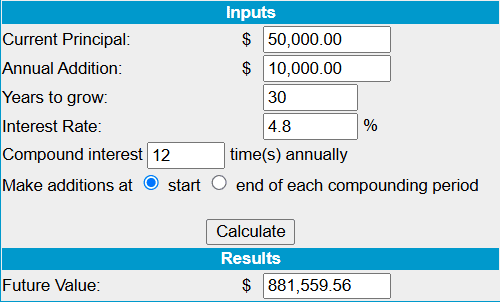

In case you’re questioning if all of those small charges make a distinction, let’s check out a hypothetical state of affairs. Say you might be 35-years-old and have saved $50,000 in your funding accounts. You hope so as to add $10,000 per yr. Right here’s a hypothetical have a look at how I personally suppose (based mostly on publicly-available knowledge) your cash could be prone to develop:

| Utilizing a fee-only, advice-only monetary planning firm like Goal | Utilizing Edward Jones Portfolios |

| Description of all charges paid: Upfront pre-quoted greenback quantity for the preliminary monetary plan. Anytime you need a comply with up assembly, you’ll pay a predetermined payment – simply as you’d for the time of every other skilled. You then would pay the .20% MER (tough estimate for diversified index ETFs that anybody in Canada can entry). |

Approximation of charges paid: -Possible advisory payment of about *1.5%. -Possible mutual fund charges and different funding charges of about *1.5% -All kinds of expenses described above – averaging out to .2% of your portfolio. |

| Whole % taken out of your investments EVERY YEAR: .20% | Whole % taken out of your investments EVERY YEAR: 3.2% |

*Be aware: Edward Jones Canada lists their Guided Portfolio program charges as “begins at 1.5%” right here on their web site. We weren’t capable of finding any knowledge on the precise mutual funds utilized in these Guided Portfolios, however this text from Rob Carrick on the Globe and Mail, in addition to this current article from Morningstar spotlight the actual fact Canada has a number of the highest mutual fund charges on the planet.

The odds related to annual account charges clearly rely on the dimensions of your portfolio. The schedule of charges may be discovered right here. In our instance, the charges on our 35-year-old with a $50k portfolio could be near .50% initially, however would go down from there as a share of a rising (hopefully) portfolio

Your Portfolio With Charge-Solely vs Edward Jones (assuming 8% return)

That’s nearly one million {dollars} distinction! By taking 3%+ out of your portfolio every year as an alternative of the .20% in ETF charges that you’d pay with a fee-only, advice-only adviser, you could possibly be voluntarily paying what’s principally one million greenback tax!

Edward Jones Investments

The above have a look at how Edward Jones’ charges can rapidly eat up your portfolio assumes that you’ll earn the identical total market returns with Edward Jones’ investments as you’d with fundamental low-cost index investing ETFs.

That assumption is nearly assuredly incorrect, because it’s more likely the investments chosen by your advisor can be worse than the market common because of lively investing underperformance.

Right here’s what Edward Jones Canada writes about their “technique” for choosing investments in your behalf:

With our years of expertise, we all know what high quality seems to be like. Our Analysis division recommends shares, bonds and mutual funds that we consider will carry out properly over time – by means of good and unhealthy markets.

The difficulty is that there isn’t a proof that lively funding can in any means predict which shares, bonds, and mutual funds will carry out properly over time. It’s my opinion that the uncommon handful of geniuses on the market who can truly inform “what high quality seems to be like” forward of time – are working for enormous hedge funds – actually not as small-scale advisors.

It’s not possible to know what particular investments that your Edward Jones advisor will advocate to you. The entire firm’s literature says that your investments can be based mostly on attending to know you and growing an total plan. But we see substantial proof that the corporate misled traders from 2013 to 2018, and urged them to “churn” portfolios in order that they’d generate increased charges.

Three issues we all know for positive with regards to Edward Jones investments.

1) They are going to be costly.

2) The overall charges that you simply’re paying can be obscure.

3) Given the long-term statistics round lively administration, the investments are nearly assured to be beneath common.

Comparability of Monetary Recommendation

Apart from investments, evaluating a fee-only, advice-only monetary planning firm like Goal Monetary to Edward Jones may be tough on the floor. A lot depends upon the precise advisor that you simply select. I believed Kyle’s tackle how to decide on the suitable individual for you in his finest monetary advisors in Canada article was an excellent place to begin.

That stated, some broad generalizations may be made:

- Edward Jones’ advisors receives a commission extra to advocate sure insurance coverage merchandise over others.

- Edward Jones’ advisors receives a commission to advocate merchandise corresponding to mortgages and contours of credit score.

- Edward Jones’ advisors obtain extra bonuses and prizes the extra they promote services to you. These even embody applications just like the Edward Jones Journey Awards Program.

- Charge-Solely, Recommendation-Solely monetary planners corresponding to Goal Monetary or fellow Canadian author Robb Engen DO NOT obtain bonuses or every other sort of fee for promoting merchandise to you.

So, in saying all that, which advisor provides you with higher recommendation?

The one who will get a bonus plus a free journey to Hawaii in the event that they advocate a particular insurance coverage plan or funding fund?

OR

The one who will get paid to easily offer you recommendation – and will get paid precisely the identical regardless of which merchandise they advocate.

Clearly it’s not possible to say with 100% certainty which advisor goes to provide the higher recommendation, however I believe it’s fairly clear why Kyle (and myself) are so keen on fee-only, advice-only monetary planners.

Edward Jones Overview: FAQ

Edward Jones Overview – Last Verdict

Is it doable to get good recommendation from an Edward Jones advisor: Sure… it’s doable.

Personally, I can’t advocate any monetary planning firm that expenses an impossible-to-define share of your total portfolio each single yr. You may see from my calculations above that making the improper determination about your monetary advisor might value you tons of of 1000’s of {dollars} by the point you attain retirement.

There’s a cause why almost all of Canada’s monetary columnists (who don’t receives a commission for recommending any sort of funding recommendation mannequin or particular investments) all advocate fee-only, advice-only monetary advisors. These embody Rob Carrick, Andrew Hallam, and even Canada’s personal Rich Barber – David Chilton (in a current podcast episode). Certainly, a current article within the Globe and Mail revealed that there’s a booming marketplace for fee-only advisors. It seems the message is lastly being broadly accepted.

There actually isn’t an argument to be made on behalf of advisors that cost a share of a portfolio any longer. We all know that it promotes the improper sort of incentives – it’s merely a matter of teaching the general public, in order that they perceive how they need to be paying for monetary recommendation vs how they’ve paid for it previously.

When all the public consultants who don’t receives a commission to advertise one thing are recommending one sort of economic recommendation mannequin – and the one defenders of that mannequin are all getting paid by it… we’ll, I believe it’s fairly simple to attract conclusions simply from that truth alone.

There are most likely worse monetary advisory companies on the market than Edward Jones, however I personally don’t discover any proof that they’re price your consideration. The underside line is that their charges are simply WAY too excessive and WAY too tough to completely perceive – plus their advisors are paid extra in the event that they promote you extra merchandise.

Don’t simply take my Edward Jones assessment as Gospel nevertheless – be happy to do your individual analysis and report again within the remark part beneath.

Some Last Notes on Canadian Mutual Funds

Upon additional reflection, once I up to date this text, I felt that I wanted to supply some extra information on simply why Canadian mutual funds are a horrible deal for Canadians. Edward Jones is certainly NOT the one firm that takes a fee with a purpose to advocate mutual funds – however there’s a lot misinformation on the market on this subject, that I believed I’d take a second to record some indeniable details about why Canadian mutual funds are unhealthy investments.

1) Over 98% of Canadian mutual funds didn’t match the return you’d have gotten for those who would have invested in a fundamental Canadian equities ETF ten years in the past.

2) The worst mutual funds aren’t even included in most statistics because of one thing referred to as Survivorship Bias. The essential concept is that yearly the worst mutual funds get eradicated, in order that they don’t even have 10-year data to measure in opposition to. Which means that considerably greater than 98% of mutual funds wouldn’t have matched the common – however they only aren’t round to be included within the statistic!

3) Lively investing will encourage you to maneuver out and in of mutual funds – normally on the worst instances. The overwhelming majority of mutual fund traders truly find yourself getting lower than the common returns of the funds they’re invested in! For extra data on this phenomenon, Google “mutual fund charges thoughts the hole”.

4) Mutual funds in each nation are a fairly unhealthy deal, however Canada has a number of the highest mutual fund charges on the planet.

5) Many mutual funds incur a ton of taxation because of shopping for and promoting investments – passive funding in ETFs don’t incur these prices. Search for the work achieved by Stanford economists Joel Dickson and John Shoven for extra data.

6) Simply have a look at all of the commercials you see for the large names within the funding trade. Have a look at who pays hundreds of thousands of {dollars} for the naming rights on Canadian rinks and stadiums. The place do you suppose all that cash comes from?

7) Don’t take my phrase for it. Right here’s current Nobel Prize-winning economist Daniel Kahneman in an interview with Der Spiegel: “Within the inventory market… the predictions of consultants are virtually nugatory. Anybody who needs to take a position is healthier off selecting index funds.” There are various Nobel Prize-winners that agree with Mr. Kahneman! Even former Wall Streeter and best-selling creator Michael Lewis invests in index funds – and he has spent the final three a long time interviewing the sharpest monetary minds on the planet!

8) Jack Meyer, the top of Harvard College’s endowment fund said, “The funding enterprise is a big rip-off. It deletes billions of {dollars} yearly in transaction prices and charges.”

9) Andrew Hallam quoted CFP Olivia Summerhill on this most up-to-date e-book, and he or she said, “Throughout the Licensed Monetary Planning in depth coaching, the main target shouldn’t be on funding autos. A CFP candidate doesn’t get coaching of their program if actively or passively managed funds are higher for shoppers.” He goes on to record comparable sentiments from a number of different CFPs. Mix that with the huge monetary incentives that advisors should advocate mutual funds… and you’ll see why it’s a longstanding drawback.

I might truly maintain going and make this record 20+ factors lengthy – however I believe you get the image!