EQ Financial institution Account Choices and Curiosity Charges

| Account Kind | Curiosity Price | Greatest For |

| Every day Excessive Curiosity Account | 2.50%* (Plus 1.50% in the event you direct deposit your pay) | Individuals who need the very best constant rate of interest in Canada + free e-transfers + tremendous low-cost worldwide cash conversion + FREE BANKING + USD Accounts for Canadians |

| EQ GICs | 3.75% – 4.60% | Of us seeking to get a excessive ultra-safe return |

| EQ TFSA Account | 4.60% | The best assured fee of return in a TFSA in Canada. |

| EQ RRSP Account | 4.60% | The best assured fee of return in an RRSP in Canada. |

| EQ Discover Account | 5.00% | Folks seeking to save outdoors of an RRSP or TFSA for a automobile, journey, equipment, and so forth. |

EQ Financial institution Evaluate by a Longtime Buyer

As one among EQ’s very first purchasers eight years in the past (I used to be even a part of their beta testing “early chicken” group) I don’t suppose there are various individuals on the market capable of write a extra authoritative EQ Financial institution evaluation.

I can actually say that over time, EQ’s lead over the remainder of the pack has simply continued to develop.

At this level, I’m unsure what the argument for staying with one other financial institution is. You get the perfect rates of interest within the nation, a brilliant user-friendly web site/app to make use of, AND no month-to-month charges.

I’ve tracked what I’ve saved in month-to-month banking charges versus the massive title financial institution that I used to be with eight years in the past, and I’m as much as $2,500! That doesn’t even think about all of the smaller activity-specific charges that I’ve saved, and the foreign money

Beneath you’ll discover all the highlights that I’ve personally skilled as a longtime EQ Financial institution buyer. Every thing from the EQ app and the EQ cell pockets, to the free Interac e-transfers and USD accounts.

Now, if they might simply full the rollout of their small enterprise account, and provides Canadians an RESP possibility, there can be nothing left for me to want for!

EQ Financial institution’s Private Account

The primary attraction for EQ Financial institution is the excessive quantity of curiosity that the financial institution persistently gives throughout all of their financial savings merchandise. Every thing from GICs, to TFSAs, FHSAs, and possibly better of all – the EQ Private Account (which is their on a regular basis excessive curiosity checking account).

On the time of this EQ Financial institution Evaluate (August 2024), the rate of interest on the EQ Private Account is 2.50%* – however there’s an computerized bonus of one other 1.50% once you determine to auto-deposit your pay cheque into EQ. That brings the rate of interest as much as 4% – which is greater than 5 instances what the key banks in Canada provide.

All of us want emergency funds and a few prepared money for our day-to-day bills, so why would you accept lower than 1% (which is pretty widespread at Canada’s large banks), when you possibly can simply earn greater than double that with a free account at EQ Financial institution?!

To me, this was a no brainer, and EQ Financial institution has change into my major location the place I maintain our emergency fund, spending cash, and the a part of my funding portfolio that I need ultra-safe and assured. Therefore, it’s rated #1 on our Canada’s Greatest Excessive Curiosity Financial savings Account comparability.

On prime of that, EQ Financial institution at present gives new clients a promotional fee of 4% for the primary 12 months.

Do I Have to “Lock In” Cash Inside a Private Account to Get 2.50%+ Bonus 1.5%*?

The reply is solely put –

No!

You need to use your cash everytime you need.

Earlier than EQ Financial institution got here alongside, there was a standard strategy of everyone having two financial institution accounts:

1. The primary can be a “chequing account” the place the cash is offered always. However the draw back was that it earned you virtually no curiosity.

2. The second account can be a “financial savings account”. This could be the place you’d obtain a barely larger rate of interest than a chequing account (though nonetheless nowhere close to what EQ Financial institution gives), however the draw back was that the cash wasn’t out there for day-to-day spending.

Should you wanted it, you needed to provoke a switch to your chequing account, look forward to a day, after which lastly you’d have entry to the cash.

The extra annoyance that you would need to endure is that banks sometimes impose limits on what number of transactions like this you are able to do, and there are charges charged in the event you exceed your allowed variety of transactions.

The neat factor about EQ Financial institution is that this old-school mind-set about your accounts goes out the window. As a substitute, you possibly can simply have one account which known as the Private Account. Right here, you earn the excessive rate of interest AND the cash is offered to you always.

Have to ship somebody cash instantly?

No drawback, you are able to do that without cost.

You don’t need to play the sport of transferring cash out of your financial savings account, to your chequing account, ready for a day… after which lastly transferring the cash over whereas being charged some e-transfer charge.

This added comfort with EQ Financial institution is nice, as you not need to handle how a lot you will have in your financial savings vs your chequing accounts.

All the cash is solely out there always – and it’s all incomes that top fee of curiosity.

If you wish to supercharge your EQ Financial institution excessive rates of interest, I like to recommend scrolling down to take a look at my ideas on the EQ Financial institution GIC choices.

In different phrases, you not need to trade-off between having instantaneous entry to your cash, and incomes a better rate of interest.

Schitt’s Creek Loves EQ Financial institution

Hey don’t simply take my phrase for it on the subject of EQ – take heed to Johnny and David from Schitt’s Creek (Eugene Levy and Dan Levy) let you know why it’s a superb deal

Apparently Eugene is genuinely a fan of EQ saying in a latest Hive interview that, “Most mother and father signed their little ones up for a checking account so they might study cash and saving from an early age. The thought of highlighting the unintended results of that call – excessive financial institution charges and never a lot curiosity – and exploring mother and father’ epiphany second was the hook that Daniel and I discovered humorous.”

“Each parent-child relationship has had their justifiable share of finance talks. Getting the possibility to satirize these conversations with my dad was plenty of enjoyable – and a bit of cathartic, too.”

Senior Vice President Mahima Poddar had this to say in regards to the advert spot: “Many Canadians settle for financial institution charges and no curiosity for many of their lives just because it’s what they’re used to – nevertheless it doesn’t need to be that approach. We have been excited on the alternative to point out Canadians what they could possibly be making, with out the take, with a recent strategy.”

EQ Financial institution Charges

There’s virtually no technique to pay charges to EQ Financial institution!

In brief, EQ’s Private Account has:

- No month-to-month account charges

- Limitless Work together e-Transfers®

- No charges for invoice funds

- No overdraft charges

- No dormant account charges

Should you’re questioning what the catch is – there isn’t any catch.

EQ Financial institution makes cash by taking your money and lending it out to others at a better rate of interest. The distinction between what they pay you, and what they lend out on the opposite aspect, is giant sufficient to make substantial income.

EQ Financial institution doesn’t depend on month-to-month account charges, or “nickel & diming” you on particular person transactions as a way to make a greenback. As a substitute they lower their working prices to absolutely the bone by streamlining their product choices, and never having to pay a ton of prices to open bricks-and-mortar banking branches.

EQ Discover Account *NEW* GIC/Excessive Curiosity Hybrid

The brand new EQ Discover Account is sort of a GIC and an everyday excessive curiosity financial savings account determined to hitch forces and change into tag group champions of the world.

It combines the straightforward entry of EQ’s common private and joint banking accounts, with the ultra-high rates of interest of a short-term GIC. With the intention to lock in these excessive rates of interest, it’s a must to give EQ not less than 10 days discover earlier than you withdraw cash. So in some methods it’s like a 10-day or a 30-day GIC – however a lot simpler to make use of.

There are three issues that you must know in regards to the EQ Discover Account:

1) Whereas it’s a brand new product in Canada, a number of British banks have been utilizing an analogous mannequin for years.

2) Your cash can be absolutely insured by the federal government of Canada below the Canadian Deposit Insurance coverage Company (CDIC) – it’s the most secure attainable customary for a checking account in Canada (as much as $100,000 per account).

3) It’s the very best long-term rate of interest within the nation – and it’s prone to keep that approach! No teaser charges right here!

|

RBC Excessive Curiosity eSavings |

TD ePremium Financial savings Account |

||||||

|

CDIC (Authorities Insured) |

|||||||

|

Paycheque Deposit Required? |

|||||||

|

Perks: EQ Financial institution Card, no international transaction charges, RRSP, TFSA, FHSA out there, joint accounts out there, and so forth |

(Provided that you even have an EQ Private Account) |

||||||

One other nice innovation from EQ Financial institution. I proceed to be impressed by the dedication of Canada’s greatest on-line financial institution on the subject of bringing worth to clients. The EQ Discover Account is tremendous simple to make use of alongside of your common private or joint EQ accounts, as you simply switch money over, choose the 10-day or 30-day possibility, after which on the finish of your chosen time period you get entry to your money once more (with curiosity after all).

Should you want your cash out earlier than the 10-day or 30-day interval is up, you possibly can entry it – you simply lose the curiosity you’d have gained. With all the things CDIC insured, it’s robust to go fallacious with the EQ Discover Account. The SVP of private banking at EQ, Mahima Poddar, has additionally acknowledged that EQ is providing an EQ Discover kind of account that you possibly can maintain inside an RRSP or TFSA – so we’ll eagerly await that innovation as properly!

The New EQ Financial institution Card: EQ’s New Pay as you go Choice

I used to be a reasonably completely happy man when EQ lastly rolled out their EQ Financial institution Card final 12 months.

Sure, in an ideal world there can be an EQ bank card possibility, however the EQ Financial institution Card is an ideal match for lots of people. I’ve personally obtained a ton of mileage out of the truth that there are not any international trade charges hooked up to the cardboard since I’ve been doing a lot touring during the last couple of years. It’s like an computerized 3% financial savings on all the things I purchase once I’m outdoors of Canada vs what I might be paying with different playing cards.

The EQ Financial institution Card is a pay as you go card with the next key options:

- FREE Withdrawals from any ATM in Canada

- 0.5% computerized money again on each buy

- Automated connection to your Private Account Means 2.5% [Plus 1.5% Bonus] in the identical merely account that you just use to pay for stuff

- No International Trade charges or different hidden charges

- Works anyplace that Mastercard is accepted throughout Canada – and 210 different international locations!

I imply… What extra are you able to ask for from a card that actually prices you nothing? (Not like dear premium bank cards.)

You’ll be able to join the cardboard in minutes and order your free card in just a few faucets/clicks. The utmost you possibly can placed on the cardboard is $10,000, and there’s an infinite variety of free month-to-month ATM withdrawals allowed.

The EQ Financial institution card is now out there in Quebec below the title of Carte Banque EQ. Head of private banking Mahima Poddar acknowledged:

“Based mostly on our understanding, EQ Financial institution Card customers are probably the most glad banking clients in Canada, and we wish to provide that very same expertise to the Québec market. We provide on a regular basis banking that mixes the advantages of a chequing account with the excessive curiosity of a financial savings account, and we’re seeing this resonate in Québec. The EQ Financial institution Card rounds out that providing and we’re assured that that is the cardboard Québec clients will need of their pockets for day-to-day spending, money entry, or journey.”

Whether or not you determine to stay with our outdated EQ Financial institution Hack of paying for issues along with your favorite bank card, after which routinely paying off the bank card out of your EQ Financial institution Account – or make the most of the tremendous easy new EQ Financial institution Card – you actually can’t go fallacious.

EQ Financial institution Cell Pockets

If you join the brand new EQ Financial institution Card, you additionally get the low upkeep possibility to make use of the EQ Financial institution Cell Pockets.

That is merely a approach so as to add your EQ Financial institution Card account to your cellphone’s predominant cost app (corresponding to Apple Pay or Google Pay) and simply use your cellphone to make contactless “faucet” funds.

Should you’ve by no means used cell wallets earlier than they’re tremendous protected, as they’re encrypted and it’s a must to authenticate the app along with your cellphone earlier than it makes the cost. It’s additionally nice to not have to fret about the place you set your pockets each time you exit.

EQ Financial institution Evaluate: RRSP and TFSA GIC Accounts

In 2021, EQ Financial institution rolled out one among their most long-awaited improvements – an RRSP and TFSA possibility that Canadians can use for mid- and long-term financial savings progress.

The EQ Financial institution TFSA GIC Account is providing an preliminary fee of 4.60% for a 1 12 months time period – and since it’s sheltered in a registered account, your curiosity positive factors won’t be taxed!

The EQ Financial institution RRSP GIC Account runs alongside an analogous observe and has the identical 4.60% curiosity provide. As with an RRSP contribution, utilizing the EQ Financial institution RRSP will decrease your taxable earnings, and for most individuals, will set off a pleasant little tax refund.

As with all issues EQ Financial institution the next noteworthy traits apply to each the EQ RRSP and EQ TFSA accounts.

- $0 Charges for any account

- No minimal Stability

- Tremendous simple enroll expertise (minutes)

- All deposits in your EQ Financial institution TFSA or RRSP are lined by Canadian Deposit Insurance coverage Company (CDIC) safety.

- With seamless account linking, organising a simple automated contribution plan solely takes a couple of minutes.

EQ Financial institution’s Private Account Evaluate: Minimal Balances

No minimal required to open an EQ Financial institution Financial savings Account.

I see plenty of different banks provide incentives corresponding to: Should you maintain a big sum of money in an account, you received’t need to pay the banking charges and also you’ll get a excessive rate of interest.

But, I discovered that even in the event you meet these situations, the speed you get remains to be sometimes a lot decrease than what you get with EQ Financial institution.

With EQ Financial institution, you don’t have to fret about minimal balances, and about rapidly being charged some month-to-month charge in the event you fall under that minimal stability threshold. Preserve studying under for extra info on EQ Financial institution Charges.

EQ Financial institution Private Account Free Interac e-transfers® and Digital Funds Transfers

Whereas the excessive rate of interest is unquestionably the factor that originally attracts most individuals to EQ Financial institution (not less than that was the case for me), I additionally discovered super comfort in with the ability to ship cash without cost via limitless Interac e-Transfers® and Digital Funds Transfers.

Sure, there are different banks that supply free Interac e-transfers® now too, however I discover that the mixture of this function plus the a lot larger rate of interest that EQ Financial institution offers, make EQ Financial institution the clear winner.

EQ Financial institution’s Limitless Transactions

Not do it’s a must to fear about conserving observe and going over your “transactions” restrict which leads to you having to pay further financial institution charges.

That is one other main motive why I don’t perceive why individuals nonetheless use banks that impose such limits on them.

We’re all busy and have sufficient issues to recollect and observe in our day-to-day lives. Why would you wish to even have to recollect what number of transactions you will have left in a month?

With EQ Financial institution, such limits by no means enter your thoughts. You simply use your cash nonetheless you see match, pay no matter payments that you must pay, ship cash to whoever that you must ship, and purchase no matter it’s that you must purchase. All this with no considerations of hitting some arbitrary transaction restrict and getting charged some further charges set out by the financial institution.

Is EQ Financial institution Protected?

Completely!

Right here’s the inside track: EQ Financial institution is a part of Equitable Financial institution, and so they’re each below the protecting umbrella of the Canada Deposit Insurance coverage Company (CDIC). This implies your hard-earned money parked with EQ Financial institution is insured, similar to with any big-name financial institution.

Now, let’s discuss EQ’s progress – it’s been nothing wanting spectacular. They’ve rallied over 578,000 clients and are sitting on a hefty $8 billion in deposits. And guess what? They’re not slowing down. At this fee, EQ’s carving out a spot for itself as an enormous participant within the Canadian banking scene for years to return – as they only formally turned the seventh largest financial institution in Canada.

EQ’s rise to prominence was highlighted by as soon as once more being topped the #1 Financial institution in Canada by Forbes in 2023 – the third straight 12 months they’ve received this title! It’s essential to notice these surveys are based mostly on 48,000 client surveys – it’s not just a few author’s private checklist or from a sponsored content material producer.

Clients rated EQ as elite throughout a number of areas corresponding to trustworthiness, phrases & situations, customer support, digital savvy, and monetary recommendation. When a financial institution will get this sort of nod from the individuals who use it, you already know they’re doing one thing proper.

Upon accepting the award, President and CEO of Equitable Financial institution, Andrew Moor stated, “This recognition is extraordinarily significant as a result of it comes straight from our clients, who encourage us daily to ship excellent service and progressive banking options that present them with nice worth.

Difficult the established order is in our DNA. We imagine that Canadians deserve higher, no-nonsense methods to handle their cash and maintain extra of it of their pocket. Being rated the perfect financial institution in Canada three years in a row validates that we’re heading in the right direction.”

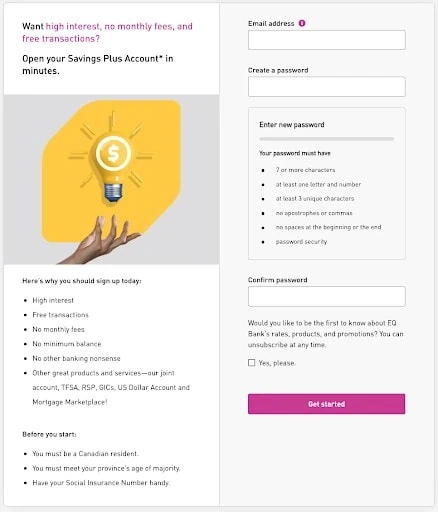

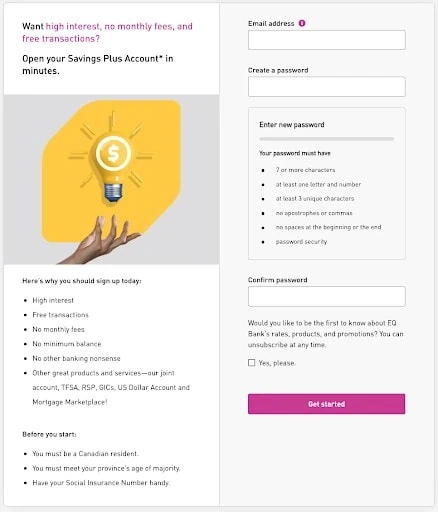

Find out how to Signal Up for EQ Financial institution’s Private Account

You’ll be able to join free utilizing this hyperlink.

On the principle web page, merely click on the “Be a part of Now” or “Arrange an account” button.

When you do this, simply enter your e mail deal with and the password that you just’d like to make use of.

EQ Financial institution might want to verify your identification (for tax functions and safety functions), so be able to reply some identification questions. As an example, they’ll want your Social Insurance coverage Quantity (SIN) as they need to report the curiosity you earn annually to the Canada Income Company (CRA).

In case you are having hassle signing up, use their reside chat function, or click on on the cellphone icon on the prime of their web page.

Take into account that you have to be a Canadian resident to open an account. EQ Financial institution is offered in Quebec as of 2024!

EQ Financial institution Drawbacks

No RESP Accounts Obtainable

As of the start for 2024, EQ had but to deal with RESP accounts to associate with their RRSP and TFSA choices). That’s too unhealthy, as I do know plenty of people that may love to make use of an EQ GIC as a way to save for his or her little one’s training. Hopefully they’ll take a look at including this functionality sooner or later.

Widespread Questions About EQ On-line Banking

EQ Financial institution GIC Charges

Should you’re seeking to obtain much more curiosity out of your financial savings, then an EQ Financial institution GIC is another choice to think about.

The primary distinction between a Financial savings Account and a GIC, is that the GIC offers you extra curiosity, however the cash can be locked-in/unavailable for a sure time period that you just specify.

The longer you might be keen to lock-in your cash, the upper the rate of interest that you just’ll obtain:

|

Registered (TFSA & RRSP) GIC Price |

||

A typical technique is to have a portion of your money in a financial savings account to fund your day-to-day bills and your emergency fund. Any money that you’ve left over (which you aren’t going to be investing within the markets) can go right into a GIC to earn that larger fee of curiosity.

Are GICs dangerous? No. You obtain a assured fee of return for the time period that you choose. For EQ Financial institution, the phrases vary between 3 months and 10 years.

The cash that you just put into the GIC can be eligible for deposit insurance coverage from the CDIC.

Total, GICs generally is a useful gizmo to assist maximize the curiosity that you just obtain on money that you already know you received’t want for a sure time period.

They can be nice for giant bills that you’ve arising, as you possibly can lock-in a better fee for a time period that finishes proper earlier than you will have that giant expense.

New GICs do fluctuate with rates of interest, so you should definitely test the latest GIC charges and promotions.

To buy a GIC, you’ll need a Private Account which you will get without cost right here. To see how EQ compares to different on-line banks, see our Greatest GIC Charges in Canada article.

The EQ Financial institution Referral Program

Should you have been searching for another reason to go along with my favorite on-line financial institution, the EQ Financial institution referral program is a good perk.

Right here’s the deal: EQ goes to pay you to inform your mates how nice they’re.

How a lot?

About 20 bucks for every buddy.

Just a few caveats right here. First off, the EQ Financial institution referral program will solely allow you to earn about $500 earlier than it says, “That’s sufficient associates – thanks,” and also you’re capped at that quantity. The $20 will hit your account when your buddy deposits $100 of their account.

EQ Financial institution Buyer Service: My Private Expertise

I’ve obtained nothing however good issues to say about EQ Financial institution Buyer Service after seven years with the corporate. After all, I’m comfy with accessing assist on-line, in order that’s actually the place most of my customer support expertise comes from.

EQ has been very aware of my emails, and all the time obtained again to me in a well timed method. They actually make the EQ cell app and on-line platform as easy, and user-friendly as attainable, so I feel this actually helps them head-off issues earlier than clients expertise them (finally the perfect customer support coverage).

I personally haven’t known as EQ’s customer support representatives over the telephones fairly often, however you possibly can name them at 1-844-437-2265 (toll-free inside North America) or 1-416-551-3449 in the event you’re outdoors of North America. They’ll decide up the cellphone between 8AM and midnight (ET), seven days every week – which is fairly spectacular availability for a Canadian financial institution.

Lastly – I hesitate to even point out this, however there’s a chatbot out there 24/7. I hate chatbots, as I discover that they’re not often an enchancment on the fundamental search engine. That stated, when you have a fast query for EQ, the web service is offered 24/7 (chatbots don’t get drained).

Pay Lower than 1% on International Forex Transfers

One other distinctive space that we needed to spotlight in our EQ Financial institution Evaluate is that the online-only financial institution gives substantial financial savings on the subject of foreign money transfers.

Canada’s giant banks cost you as soon as with a $15 wire charge, after which hit you once more once you trade your Canadian {dollars} into American (or another foreign money you require) with an expansion averaging at greater than 2%. In layman’s phrases, it signifies that for every $1,000 switch you’ll pay $35. If that you must make a large transaction of $100,000, you’ll depart between $2,000 and $2,500 on the desk.

EQ Financial institution now makes it simpler to switch cash overseas with a reduction, utilizing one of many world’s most sought-after cash switch methods – Transferwise!

On December 12, 2019, EQ Financial institution launched a world cash switch service powered by Transferwise (now “Smart”). Shoppers will be capable to entry it via their financial institution platform with none further hurdles – and switch cash overseas rapidly, cheaply and effectively.

About Smart: UK’s most recognizable startup firm has been funded by distinguished VCs and angel buyers like Peter Thiel, PayPal’s founder. The corporate has raised in extra of USD$400m, and has positioned itself as an trade chief over the course of its 7 years of operation. The corporate these days boasts greater than 1,900 workers globally, with a transaction quantity of greater than CAD$7bn every month.

The charges charged by EQ Financial institution’s worldwide switch service, powered by Smart:

- Roughly 0.85% of small transfers of as much as $1,000.

- Roughly 0.77% of medium transfers of $1,000 to $2,000.

- Roughly 0.73% of large-medium transfers of $5,000 to $10,000.

- As much as 0.7% for actually giant, six determine, transfers.

Transfers inbound to Canada from the UK, EU or Australia will incur roughly 0.5% in charges no matter dimension (that’s how their pricing works within the majority of nations). To study extra about Smart, Take a look at this in-depth Transferwise evaluation.

EQ Financial institution USD Accounts for Canadians’ US {Dollars}

The EQ Financial institution USD Account, launched as a part of a strategic collaboration with Smart in 2021, is tailor-made for Canadians who discover themselves coping with US foreign money pretty usually. We predict it’s among the best USD accounts in Canada.

It uniquely combines the comfort of avoiding necessary foreign money conversions with the power to earn a 1% rate of interest on USD deposits.

This USD account stands out by providing a seamless resolution for people and buyers seeking to handle their USD holdings effectively – with out the necessity for a U.S. checking account. It displays EQ Financial institution’s dedication to innovation and assembly the various monetary wants of Canadians.

Canadian Monetary Summit All-Star and Group Head of Private Banking at EQ Financial institution, Mahima Poddar acknowledged:

“Our EQ Financial institution US Greenback Account solves a number of issues for Canadians: from combating notoriously low rates of interest to determining a greater technique to ship cash to family members or transfer it between accounts.

We needed clients to have a US account possibility that was each rewarding and headache-free, and now we’ve efficiently completed that with one other no-nonsense EQ Financial institution product. We’re listening to our clients and dealing laborious to carry them the very best worth banking attainable. We’re pleased with that.”

Three years after the preliminary launch of the EQ USD Account, I can decisively say that it’s the greatest USD financial savings account in Canada. I don’t use US {Dollars} that usually, however I sometimes do some freelance work for a consumer down south, and this account lets me settle for cost, and conveniently maintain it in USD till my household goes takes a US trip, or till we use a US airport to fly some other place (usually less expensive than flying out of Pearson).

EQ Financial institution Mortgage Market

EQ Financial institution just lately launched a cool new function known as the Mortgage Market.

Mainly, it features as a spot for EQ Financial institution’s “mother or father firm” – Equitable Financial institution (the ninth largest Schedule I Financial institution in Canada) to point out how aggressive their wonderful mortgage charges are.

You received’t be “getting a mortgage via EQ Financial institution” can as a substitute immediately evaluate over 2,000 mortgage merchandise provided by lenders throughout Canada. Equitable Financial institution is betting that after seeing how they evaluate to the competitors, you’ll select them.

Right here’s how one can see what your greatest private mortgage match is.

1) Apply on-line after signing into EQ.

2) Fill out the Mortgage Market questionnaire.

3) Let the EQ Mortgage Market work it’s algorithmic magic – and suggest the perfect mortgage choices to your particular conditions.

4) Converse to a mortgage dealer to verify that you’ve the suitable match.

5) The mortgage dealer will get you a pre-approval or submit your mortgage software to the chosen lender.

I haven’t used the Mortgage Market function myself, nevertheless it looks as if an important thought. You’ll be able to all the time test the suggestions you get towards a number of the different rate-comparison websites on the market in spite of everything.

Forbes Names EQ Financial institution as Greatest Canadian Financial institution

For the fourth straight 12 months, Forbes has acknowledged EQ as one among 2024’s World’s Greatest Banks.

Every year, Forbes asks greater than 48,000 individuals from all over the world, what they consider greater than 400 banks.

With award-winning design and customer support (to associate with the perfect rates of interest) it’s no shock to me why EQ continues to win this award year-after-year.

President and CEO of EQ Andrew Moor had this to say in regards to the award: “This recognition is extraordinarily significant as a result of it comes straight from our clients, who encourage us daily to ship excellent service and progressive banking options that present them with nice worth.

Difficult the established order is in our DNA. We imagine that Canadians deserve higher, no-nonsense methods to handle their cash and maintain extra of it of their pocket. Being rated the perfect financial institution in Canada three years in a row validates that we’re heading in the right direction.”

EQ has additionally been acknowledged for his or her employee-led useful resource teams and dedication to range within the office. With 52% of the corporate’s workers being girls, EQ’s emphasis on equality isn’t simply lip service.

EQ Financial institution FHSA – First Residence Financial savings Account

When the EQ Financial institution FHSA was introduced in 2023, many first-time dwelling patrons breathed a sigh of aid. Lastly – a simple technique to save for a downpayment!

Should you’re conversant in the product and match the goal demographic, chances are you’ll wish to take a look at our article on Canada’s First Residence Financial savings Account.

The rationale so many Canadian private finance geeks have been excited to see this product added to the EQ combine, is that the assured GICs and on a regular basis financial savings charges that the web financial institution gives are second-to-none. This makes them an ideal match for the short- to medium-term wants of somebody saving for a housing downpayment.

Whereas the EQ Financial institution First Residence Financial savings Account isn’t out there for the time being, it ought to come on-line any day, and you’ll be part of the waitlist proper now so that you just don’t waste any time getting your financial savings below the FHSA tax umbrella.

If you mix EQ’s excessive rates of interest, with the perfect of the TFSA and RRSP (which is what the FHSA principally is) you get a implausible choice to sock away $40,000 in the direction of your first dwelling. Should you’re shopping for a house with another person, you possibly can every make the most of that $40,000 max.

EQ Financial institution Small Enterprise Financial institution Account: Coming Quickly

Our persistently up to date EQ Financial institution Evaluate was the primary place in Canada to report on the EQ Financial institution Card (again when it was a rumor on a few of Canada’s private finance boards).

So once we give the within scoop, you already know we’ve obtained some juice behind it.

The EQ Financial institution Small Enterprise Financial institution Account seems to be the reply to our pleas over time to present enterprise house owners (similar to yours actually) a spot to carry our company money!

Proper now you possibly can be part of the mailing checklist to safe your home in line.

EQ has promised that their Small Enterprise Financial institution Account will embrace the next:

- All the advantages of a enterprise checking account with not one of the prices!

- $0 in month-to-month charges

- Elite excessive rates of interest (similar to their different accounts)

- No minimal stability

- Limitless Transactions

- Simple full digital enroll with out paperwork and cellphone calls

I’ll proceed to go alongside updates on the EQ Financial institution Small Enterprise Financial institution Account as they roll out the product. (I used to be one of many first individuals within the queue!)

EQ Financial institution Evaluate: Ultimate Suggestion

For cash (and it’s actually my cash on this case) – EQ Financial institution is straightforward the perfect banking possibility in Canada.

They’ve all the time had the perfect GIC rates of interest in Canada, and are all the time prime three for top curiosity financial savings accounts.

However along with that, they only proceed to innovate each single 12 months. All the cool secondary options like being the one financial institution in Canada to supply a Discover Account, or having an EQ Financial institution Card with no foreign money conversion charges – to not point out providing a brilliant user-friendly cell app expertise – simply actually enable EQ to face out. I’d argue they’ve truly lengthened their lead on different on-line banks over the previous few years.

After I replace this EQ Evaluate each month or two, I don’t depend on simply my very own expertise, however discuss to different MDJ writers (we’re all purchasers), in addition to search via new feedback and emails I’ve gotten. Over the previous couple of years, the pattern appears to be that we discover one thing to nitpick (i.e. “No financial institution playing cards”) after which EQ responds.

In that vein, after they get the company accounts off the bottom, I’d like to see EQ arrange an RESP possibility for folks. I feel there are a ton of Canadians on the market who aren’t comfy with investing within the inventory market on the subject of an RESP – however they might completely use GICs (backed by CDIC insurance coverage) as a way to optimize their financial savings for post-secondary training.

After all, the unique worth proposition of EQ – no charges on something, limitless transactions, limitless transfers – remains to be a reasonably phenomenal deal, and there aren’t many locations in Canada the place yow will discover something prefer it. (They nonetheless haven’t caught as much as the place EQ was eight years in the past.)

Simply for instance how user-friendly EQ is, I helped my dad open his free EQ Private Account just a few months in the past, and it took a complete of 12 minutes. That is for a man on rural Canadian web, who spends about 2 hours monthly on-line (largely checking the climate). It has been really easy, that he has even managed to arrange a Discover Account for himself!

When you’ve got any private knowledge factors let me know and I’ll ensure to incorporate them in my subsequent 2024 EQ Financial institution evaluation replace. If anybody on the market has used the Discover Account, FHSA Account, and/or is likely one of the first EQ Enterprise Account customers, I’d love to listen to from you!

*Curiosity is calculated every day on the full closing stability and paid month-to-month. Charges are every year and topic to vary with out discover.

† Equitable Financial institution is a member of CDIC. EQ Financial institution is a commerce title of Equitable Financial institution.”