It’s raining new fund affords.

Two new fund affords, nevertheless, caught my consideration.

- Mirae Asset Nifty 200 Alpha 30 Index Fund of Fund

- Edelweiss Enterprise Cycle Fund

The curious factor about these 2 funds is their give attention to one thing known as ‘elements’.

Issue primarily based investing or sensible beta portfolios have picked investor’s fancy in India not too long ago.

You do bear in mind the Nifty 200 Momentum 30 Index which has had a dream run of kinds. UTI MF has an older fund there, HDFC MF too launched its personal in early 2024.

Can issue primarily based investing or sensible beta portfolios make a distinction to your portfolio? Let’s discover out.

What are “elements”?

Elements are like components that blend, of which might make the meals tastier or more healthy.

A film has elements just like the script, solid, manufacturing high quality and enhancing that may decide its success or failure.

In investing too, the function of things is being recognised to find out a technique’s success or failure.

Various factors for various outcomes

There are a number of elements that may be recognized in a portfolio however let me spotlight a couple of on your reference.

a) Low Volatility – Shares whose costs have lesser extremes or technically, low customary deviation.

b) High quality – Shares which have proven higher capital administration, decrease dangers, debt and better return on capital.

c) Worth – Shares which might be undervalued with respect to the Worth to Earnings, Worth to Guide and Dividend Yields.

d) Momentum – Trending shares which have delivered higher returns during the last 3, 6 or 12 months.

e) Alpha – Usually measured as extra return over a predefined benchmark.

f) Equal Weight – Instance, having equal weight to Nifty 50 or Nifty 100 shares will take away any dimension bias and permit every inventory to contribute equally.

How issue primarily based investing has began to turn into standard is mirrored within the variety of indices which might be on the market. Each the index suppliers affiliated to NSE and BSE are on a spree.

A few of these indices use standalone elements and others a combo of a number of elements.

Listed below are some examples:

- Nifty 200 Momentum 30 Fund

- Nifty 100 Low Volatility 30 Fund

- Nifty 200 High quality 30 Fund

- Nifty 200 Worth 30 Fund

- Nifty 200 ALpha 30 Fund

- Nifty Alpha Low Volatility 30 Fund

- Nifty High quality Low Volatility 30 Fund

and lots of extra. See a complete checklist right here

Quiz: Which one of many above checklist is a multi issue index?

Does issue primarily based investing work?

Nicely, previous research and backtests present that there’s a distinction in outcomes when issue primarily based portfolios are used compared to customary benchmarks from which these portfolios are created.

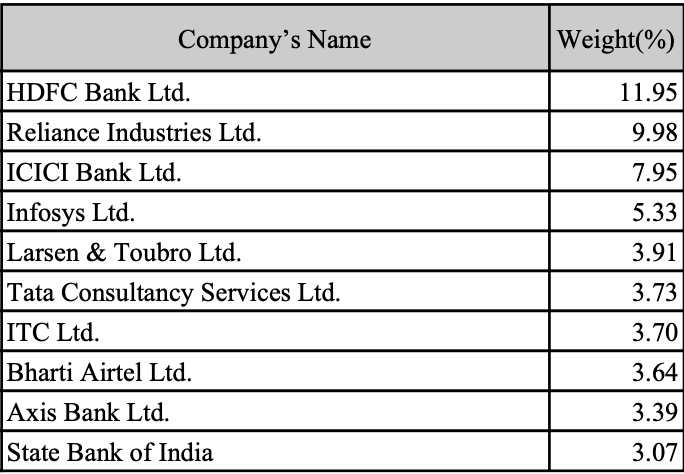

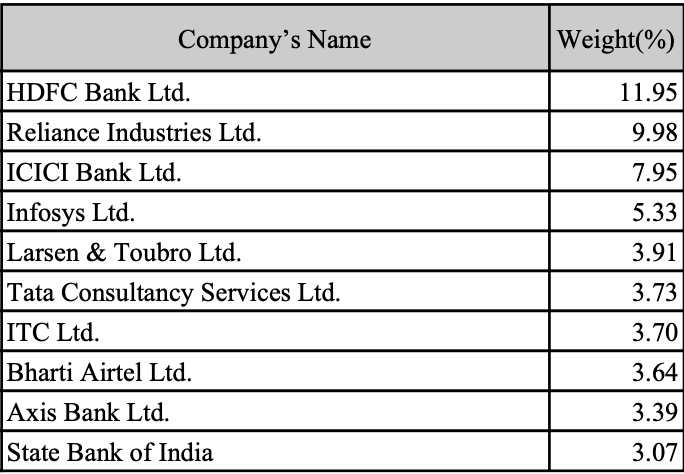

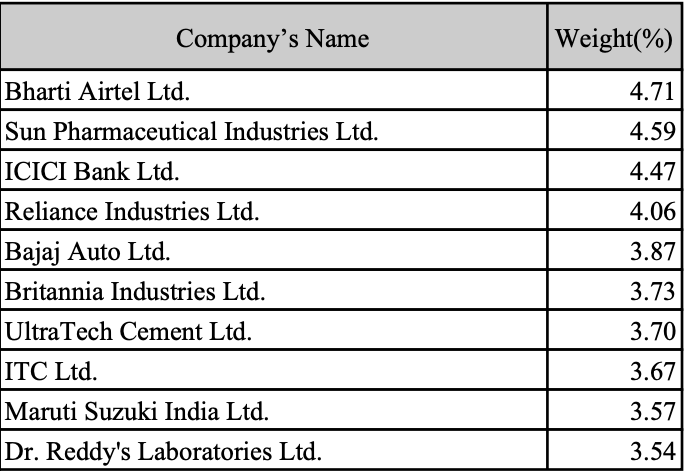

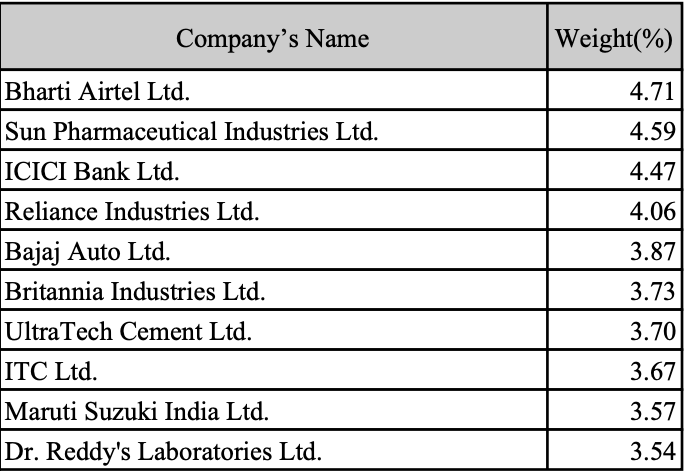

To start with, as talked about earlier, an element primarily based strategy is prone to provide a unique portfolio than the common index. How completely different? We are going to examine portfolios primarily based on the 4 massive elements.

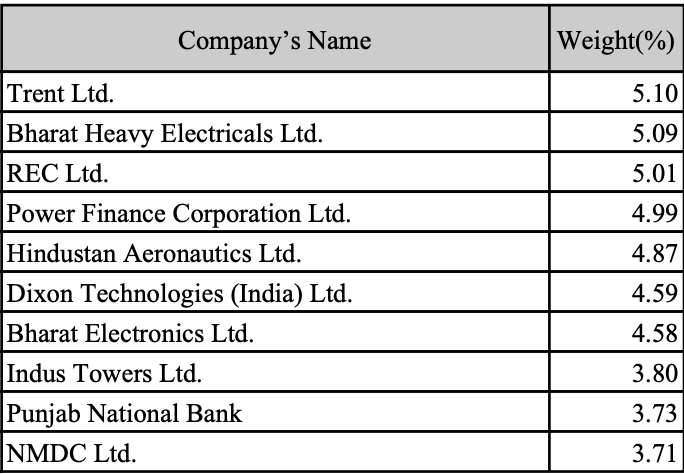

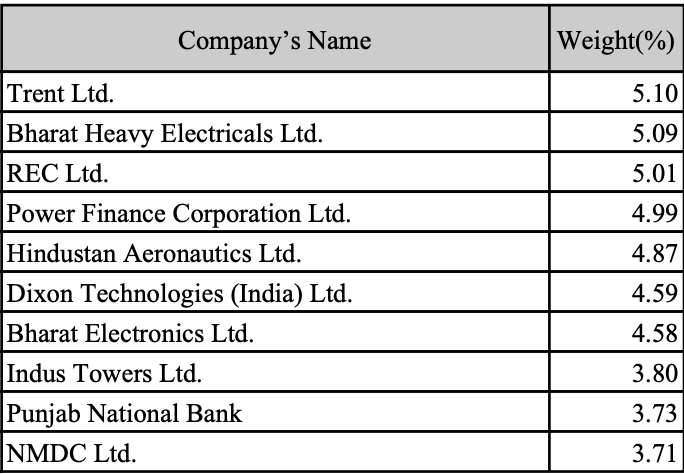

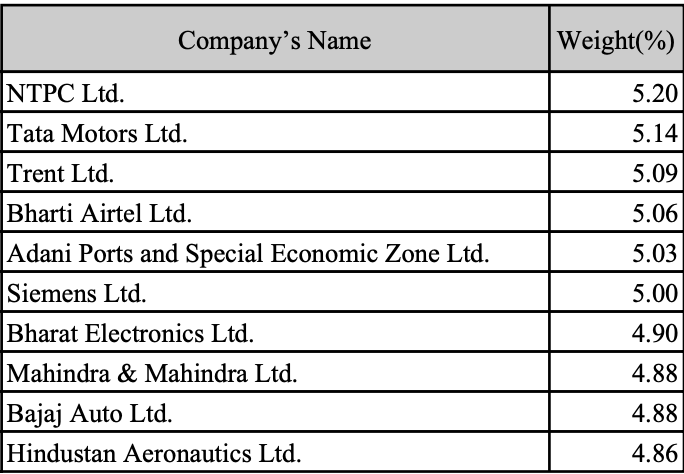

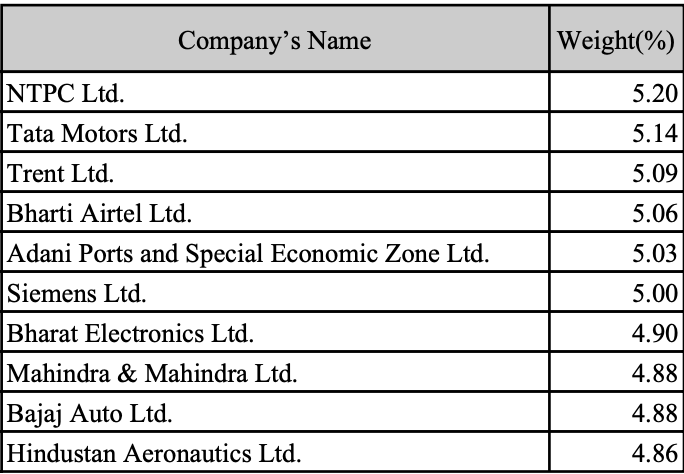

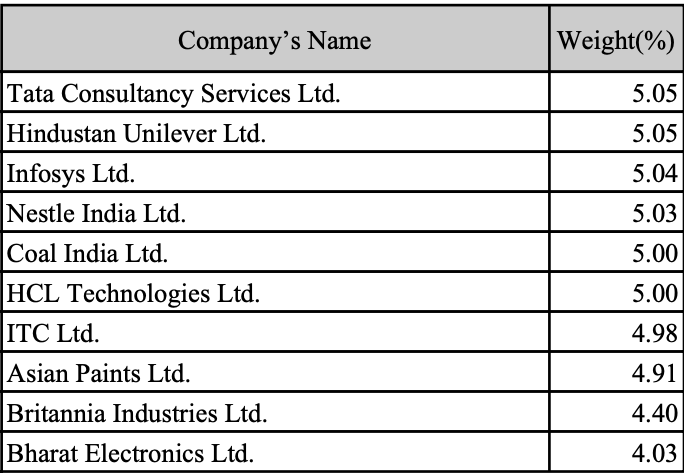

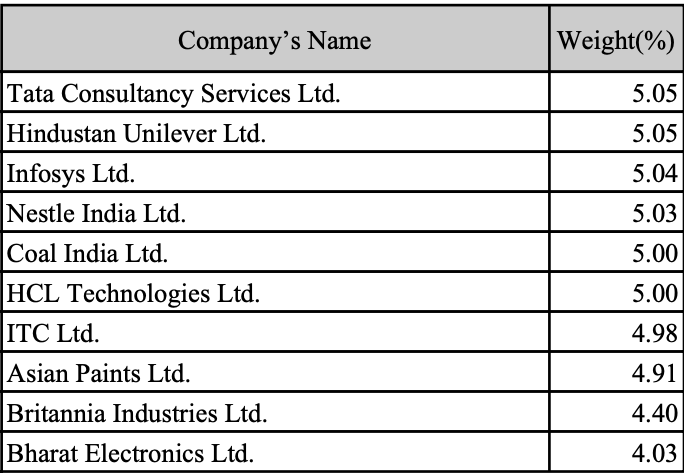

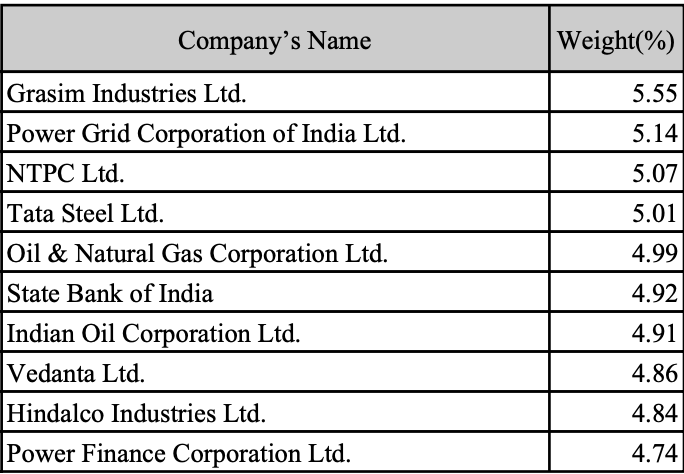

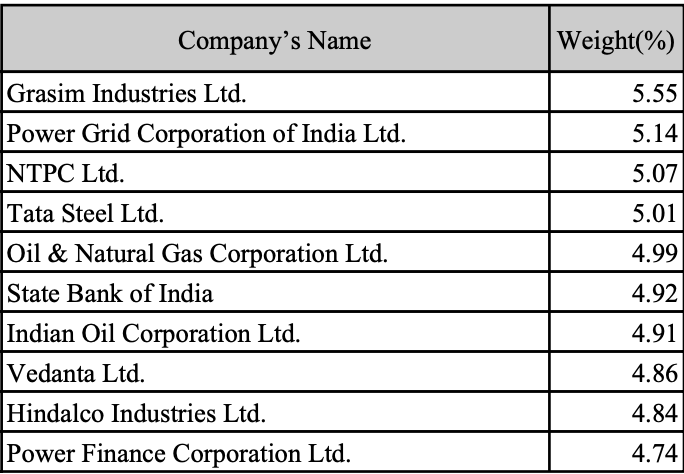

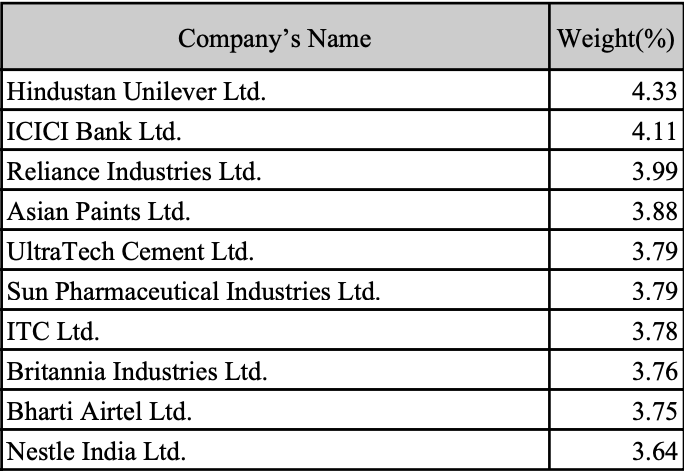

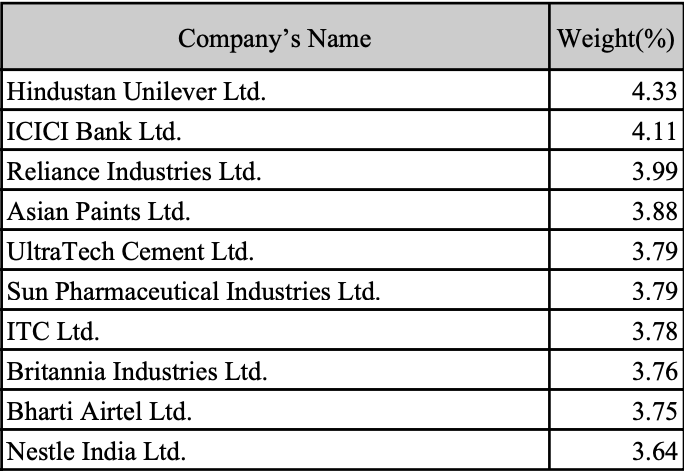

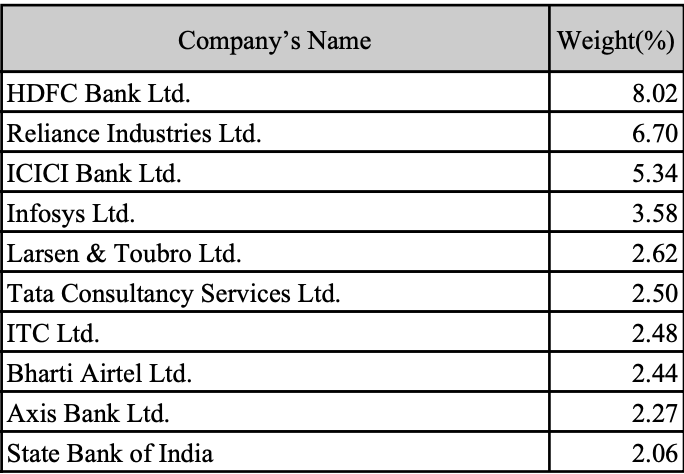

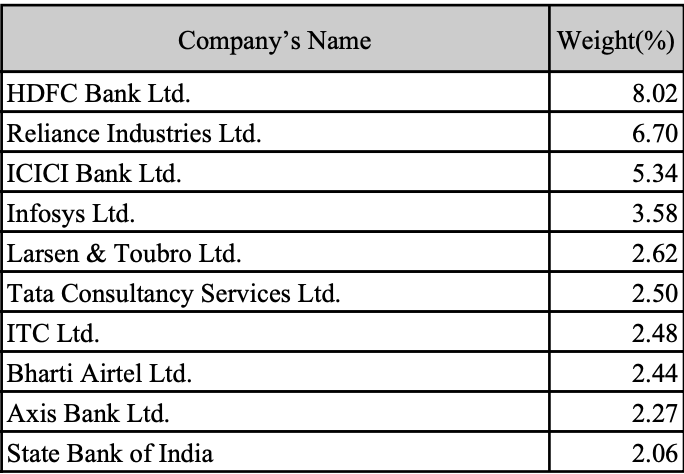

Prime Holdings in numerous issue technique indices as of June 28, 2024

Nifty 2oo Alpha 30 Index

Nifty 2oo Momentum 30 Index

Nifty 2oo High quality 30 Index

Nifty 2oo Worth 30 Index

Nifty 1oo Low Volatility 30 Index

Nifty 2oo Index

Nifty 50 Index

Nifty Alpha Low Volatility 30 Index

Quiz: Which inventory seems in each – Low Volatility in addition to High quality indices?

How do these portfolios translate into outcomes?

To start with let’s have a look at how numerous elements have behaved throughout calendar years.

We’ve knowledge from April 1, 2005 until July 16, 2024 for whole return index of every of the issue primarily based indices. We used it to calculate calendar yr returns as proven in picture under.

Calendar Yr Returns for numerous issue indices

Knowledge Supply: www.niftyindices.com, compiled by Unovest. Please word all the information proven under is again examined knowledge on the index numbers. It doesn’t account for bills or any actual world impression prices. It’s previous efficiency and has no relation to future outcomes.

Simply to offer you an instance let’s see how altering one issue can change the behaviour of the portfolio. In case of Nifty 50 and Nifty 50 Equal Weighted, the weighting standards moved from free float market cap to equal weight. See the outcomes.

For different issue primarily based indices, the respective rating for the elements is used as a weighting standards for the inventory within the portfolio.

What are the opposite observations?

The contribution of varied elements change throughout cycles and years.

It seems that the worth issue has fairly a little bit of extremes whereas alpha and momentum elements appear evergreen.

And sure, Nifty 200 Alpha 30 appears to have delivered over plain vanilla Nifty 200.

Let’s attempt a unique level to level and see the way it adjustments issues.

Monetary Yr Returns for numerous issue indices

Knowledge Supply: www.niftyindices.com, compiled by Unovest

These numbers look completely different than the calendar yr returns.

Do your observations change?

Nicely, worth nonetheless is vulnerable to extremes.

Nifty Equal Weight index has proven outperformance solely publish covid.

Throughout the group, the mix of Alpha and Low Volatility seems to be a extra reliable possibility.

The query I ponder over is what occurs to the plain vanilla Nifty index.

–

Now, we will go every level to level knowledge through the years – however that will probably be very cumbersome.

So, let’s go a step additional and get rolling returns into the image. We are going to calculate the median throughout this every day interval rolling sequence.

Rolling Returns abstract for numerous issue indices

Rolling returns calculated with every day intervals. Knowledge primarily based on Whole Worth Index of respective indices from April 1, 2005 to July 16, 2024. Supply: www.niftyindices.com, compiled by Unovest. For added emphasis on the dangers, we embrace drawdowns and potential losses.

This looks like an entire new body of reference. The usual indices Nifty 50 and Nifty 200 appear to have been left far behind by issue primarily based methods (single or multi).

The Alpha issue doesn’t come with out its worth. It has an enormous value by way of anticipated drawdown (this -75.3% above truly occurred through the monetary disaster in 2008).

Low Volatility is a stabilising issue for a portfolio or in multi issue methods.

Nicely, with a lot on the market, one is certainly spoiled for alpha decide selections.

The query then is what do you wish to give attention to – Extra returns or much less danger or a mixture or simply your model/issue desire?

–

Let’s circle again to the two funds we talked about earlier.

The Alpha Issue – Mirae Nifty 200 Momentum 30 Alpha Fund of Funds

Mirae’s fund proposition is to have a fund of funds construction that can feed into its present ETF (brief for Change Traded Fund) Mirae Nifty 200 Momentum 30 Alpha ETF..

On this index, the alpha works with a particular formulation or a measure known as Jensen’s measure.

The measure is used to find out the shares’ extra return (alpha) and use it rank the very best shares and assign them weightage too.

You see the place the portfolio is taking to ship a unique danger / return profile in opposition to, say, a Nifty 50.

The important thing factor to grasp right here is that the fund has modified its portfolio development model and is now doing the next:

- Use a extra concentrated portfolio of 30 shares in opposition to Nifty 50’s, nicely, 50 shares.

- Change the weightage of shares and base it on the alpha rating as a substitute of market cap weight methodology utilized by customary indices akin to Nifty 50. The per inventory weightage is restricted to five% or thereabouts.

- The universe of shares is greater – Nifty 200 shares in opposition to the Nifty 50

One can query as to why examine it with Nifty 50 in gross sales presentation and sure, it isn’t the proper comparability however it’s good to beat one thing.

The fund did higher in comparison with the usual index.

Don’t bear in mind? Return to the tables proven earlier.

Multi Issue magic – The Edelweiss Enterprise Cycle fund?

This fund proposes to take a multi issue strategy in a extra broad primarily based inventory universe of 300 shares. Its ‘proprietary mannequin’ will decide shares primarily based on a mixture of worth, progress, high quality and momentum elements and use it for sector rotation primarily based on a algorithm.

They actually had me confused about elements and sectors.

The portfolio can have about 60 shares – the quantity divided equally between giant cap and small/mid cap.

That is an actively managed fund and never a passive just like the Mirae Alpha fund.

However everyone seems to be searching for one factor – MORE.

Additionally know that many of the mutual fund schemes are designed to draw extra property and as they appeal to extra property they begin to resemble the market, for numerous causes. Over time, their outcomes might not be so completely different from the market itself.

So, if you’re investing in a fund which is massively standard or has numerous shares, suppose if it will probably nonetheless do the issues which helped make it standard and/or a prime ranker within the first place.

Must you put money into issue indices / sensible beta methods?

Human nature poses an enormous downside to investing success. Everytime there’s a new possibility on the horizon we wish to latch on to it within the hope that that is the one that can do the magic.

However by the point you wish to decide that issue up, it’s time is finished for then and you’re feeling disillusioned.

I imagine that a few of the extra standard issue primarily based funds at present will disappoint within the close to future.

Quite the opposite, if you happen to had been actually involved in an element primarily based portfolio and I had been to let you know to select a High quality and Low Volatility issue?

What I’m making an attempt to let you know is that don’t get caught up in the identical age previous circus of chasing returns.

Elements in a method are a easy solution to work along with your investor kind. If you’re a price investor, a price issue primarily based fund / portfolio, provides you the car to trip your conviction.

In the event you suppose momentum is the way in which to go for years (even with setbacks in between), there’s the issue portfolio for you.

Or, if that is an excessive amount of to ask, then allocate between elements and maintain rebalancing commonly.

Issue / sensible beta methods might have their function however solely if you’re keen to stay to the trail and let time do its half.

You must topic your self to guidelines to maintain the monkey within the thoughts from doing silly issues.

The one alpha, in that case, is to these you pay your charge and taxes to.

—

What’s your success issue going to be?

–

Frankly, you’d be an exception if you are able to do it your self. All different sensible folks, who’ve accepted that it’s past them, are working with an advisor.

The advisor’s function is to assist persist with a path to compound your wealth which ends up in not only a fear free retirement however extra which means too. That’s an alpha value chasing.

–

In the event you want to know extra about Nifty Indices and their methodology, take a look at this hyperlink

![[Factor Investing] In Search of Alpha [Factor Investing] In Search of Alpha](https://i1.wp.com/unovest.co/wp-content/uploads/2024/07/FACTOR-BASED-INVESTING.gif?w=696&resize=696,0&ssl=1)