Anybody who works within the trade in all probability noticed this coming. However those that don’t may be left scratching their head.

Yesterday, the Fed lastly pivoted and lower its personal fed funds charge, but mortgage charges went up. Why does this all the time appear to occur?

Shouldn’t excellent news on the rate of interest entrance push charges decrease throughout the board? Appears completely logical till you dig into the small print.

There are two most important the explanation why mortgage charges typically defy the Fed’s personal transfer.

One is that the Fed’s coverage is commonly pretty telegraphed and never a shock, and the opposite is that the information is often baked in already.

The Fed Merely Follows the Financial Knowledge

First issues first, the Federal Reserve is just making financial coverage choices (hike, lower, nothing) based mostly on the financial knowledge in entrance of them.

So their FOMC assertion and accompanying rate of interest choice usually don’t come as a lot of a shock.

Yesterday, there was just a little extra uncertainty than regular, with each a 25-basis level and 50-basis level lower a chance.

The Fed opted to go along with a 50-bps lower, which had been the favourite with a ~60%+ chance per CME FedWatch.

In different phrases, the Fed did what the market anticipated, as they typically do. The explanation the Fed does what the market expects is as a result of they base their choices on publicly obtainable knowledge.

And the information is considerably previous by the point the Fed makes its announcement. That removes a lot of the component of shock.

Nonetheless, what can transfer the bond market after the FOMC rate of interest choice is the press convention with the Federal Reserve chairman Jerome Powell.

He defined that they took the step of creating a 50-bps lower as a result of they’d patiently waited for inflation to come back down, and had been now comfy to make a “sturdy transfer.”

The larger lower permits them to (hopefully) keep away from an enormous improve in unemployment whereas additionally stopping a return to excessive inflation.

However he added that there shouldn’t be an expectation that 50-bps cuts are the brand new regular. The choices will nonetheless be made meeting-by-meeting.

So no actual surprises right here and never sufficient new info for mortgage charges to proceed falling.

Mortgage Lenders Have Already Dropped Charges a Ton Main As much as the Fed Price Resolution

The opposite related piece right here is that mortgage lenders had been already aggressively reducing mortgage charges heading into the Fed assembly.

In case you have a look at the 30-year mounted, it had already fallen almost 150 foundation factors (1.50%) because the finish of April.

In different phrases, bonds and mortgage-backed securities (MBS) had been making large strikes based mostly on the information and the anticipated Fed pivot for months now.

Numerous the value enchancment, if not almost all, was priced in earlier than Fed day. It’s form of a “promote the information” state of affairs.

You realize one thing is coming so you purchase bonds or MBS and as soon as the information really hits, it could possibly be time to dump a bit.

On this case, it’s simply an anticipated bounce in the wrong way as everybody digests the widely-anticipated Fed choice.

To place it one other method, mortgage lenders have a tendency to cost their charges defensively forward of an FOMC rate of interest choice, so typically instances there’s a little bit of a reduction rally after a hike.

Simply have in mind that is however sooner or later, and mortgage charges could develop a longer-term trajectory based mostly on what’s occurring with the Fed and underlying financial knowledge.

However the greatest solution to observe mortgage charges is by watching the 10-year bond yield and/or MBS costs.

Since yesterday, the 10-year yield has already ticked up about 10 foundation factors and MBS costs have fallen a bit.

No main motion, however maybe a disappointment for individuals who thought mortgage charges would fall additional after the Fed lower charges.

Mortgage Charges Are inclined to Defy the Fed

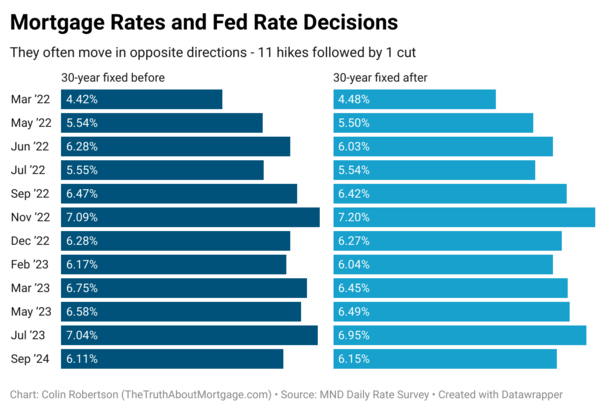

September 18th, 2024: Price lower, mortgage charges up

July twenty sixth, 2023: Price hike, mortgage charges down

Could third, 2023: Price hike, mortgage charges down

March twenty second, 2023: Price hike, mortgage charges down

February 1st, 2023: Price hike, mortgage charges down

December 14th, 2022: Price hike, mortgage charges down

November 2nd, 2022: Price hike, mortgage charges UP

September twenty first, 2022: Price hike, mortgage charges down

July twenty seventh, 2022: Price hike, mortgage charges down

June fifteenth, 2022: Price hike, mortgage charges down

Could 4th, 2022: Price hike, mortgage charges down

March sixteenth, 2022: Price hike, mortgage charges UP

I used to be curious what tends to occur with mortgage charges on Fed choice day so I seemed on the previous 12 choices and used MND knowledge for mortgage charge motion on the times in query.

I included the 11 charge hikes since March 2022 and the pivot to a lower yesterday. Unsurprisingly, so far as I’m involved, mortgage charges are likely to defy the Fed most of the time.

In different phrases, when the Fed raises charges, mortgage charges typically fall. And when the Fed cuts, mortgage charges have a tendency go up.

I’ll want extra knowledge on the latter piece as they proceed to make anticipated cuts. But it surely wouldn’t shock me to see this pattern proceed.

Simply be aware that the mortgage charge motion post-Fed charge choice typically isn’t important. And over time, issues can change much more.

For instance, although lenders typically lower charges on Fed hike day, the longer-term path of mortgage charges was decidedly larger.

Now we would see the alternative. Because the Fed is predicted to make further cuts, lenders could step by step decrease charges over time.

However once more, it’s not due to the Fed! It’s the underlying knowledge and path of the economic system.