In October 2024, India’s mutual fund trade celebrated a historic achievement, as month-to-month inflows from systematic funding plans (SIPs) crossed ₹25,000 crore for the primary time, reaching a report excessive of ₹25,323 crore. This determine, a marked enhance from September’s ₹24,509 crore, signifies a rising pattern amongst Indian retail traders towards disciplined, long-term wealth creation by mutual fund SIPs.

Key Milestones and Knowledge Highlights

1. October File: Month-to-month SIP inflows reached ₹25,323 crore, marking a big leap from ₹24,509 crore in September 2024.

2. Yr-on-Yr Development: October 2024 inflows represented a considerable enhance from ₹16,928 crore in October 2023, reflecting robust annual progress in retail participation.

3. SIP AUM: Property underneath administration (AUM) by SIPs recorded a formidable ₹13.30 lakh crore in October, setting one other excessive.

4. SIP Account Numbers: The variety of energetic SIP accounts surged to an all-time excessive of 10.12 crore in October, up from 9.87 crore in September. Internet new accounts created additionally hit a report, with 24.9 lakh accounts added in the course of the month.

5. New SIPs registered: The variety of new SIPs registered in October 2024 stood at 63.69 lakh.

6. Sector-Vast Development: Open-ended fairness mutual fund inflows additionally surged by 21.69% month-over-month, totalling ₹41,887 crore in October 2024 throughout the fairness phase, which additional underscores investor confidence

Knowledge Desk (Particulars as per AMFI)

| Month | SIP Influx (₹ Crore) | SIP Accounts (Crore) | SIP AUM (₹ Lakh Crore) |

| October 2024 | 25,323 | 10.12 | 13.30 |

| September 2024 | 24,509 | 9.87 | 13.81 |

| August 2024 | 23,547 | 9.61 | 13.38 |

| July 2024 | 23,332 | 9.33 | 13.09 |

This information exhibits a transparent upward trajectory in SIP contributions. The gradual enhance in month-to-month contributions highlights each rising monetary consciousness and a steady rise in SIP reputation throughout demographics.

Components Driving SIP Development

Elevated Monetary Literacy: Campaigns by AMFI, monetary establishments, and different stakeholders have bolstered monetary consciousness, particularly amongst youthful traders and people in smaller cities.

Digital Accessibility: Fintech improvements have made SIPs extra accessible, permitting traders to open accounts, handle contributions, and entry real-time fund data by digital platforms.

Market Confidence: Regardless of world uncertainties, the Indian inventory market’s resilience has strengthened investor belief in mutual funds as a viable avenue for wealth technology. Moreover, the presence of recent fund affords (NFOs) and thematic schemes in sectors like know-how and infrastructure has added variety to funding choices, attracting new traders and inspiring greater SIP commitments.

Increasing Retail Participation: Development in SIPs has not been restricted to metros; semi-urban and rural areas have proven rising SIP adoption, pushed by focused monetary consciousness campaigns. This elevated participation is essentially because of rising monetary literacy and a powerful push from mutual fund distributors and monetary advisors, encouraging SIPs as a dependable long-term funding software.

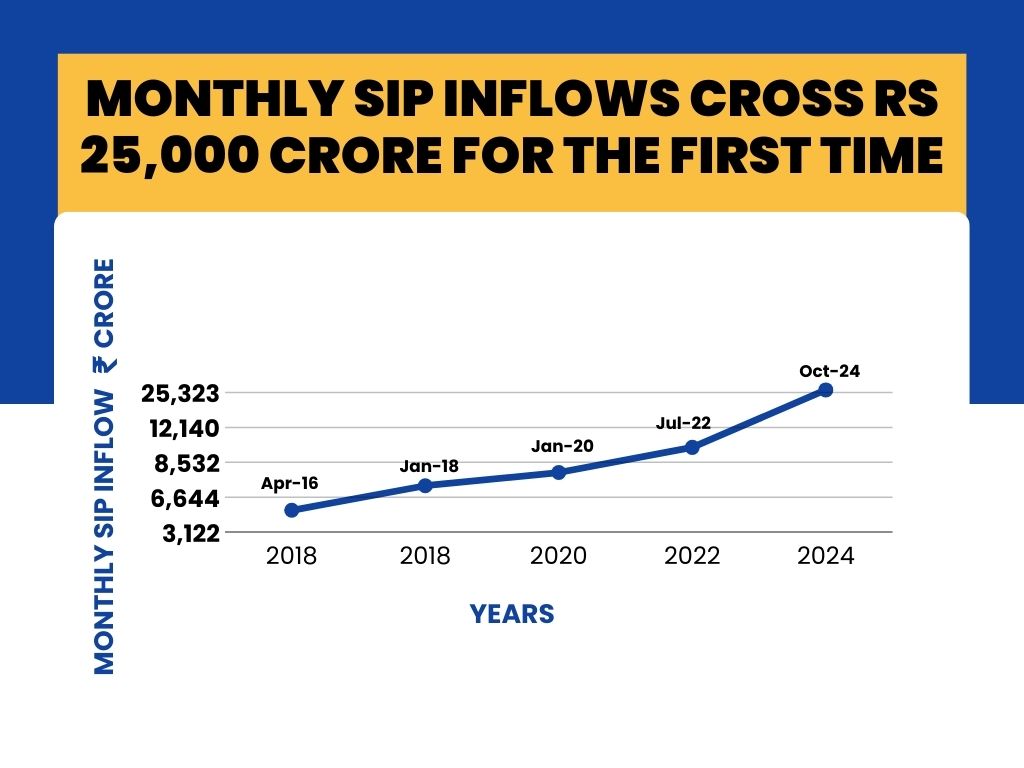

A Look at SIP Development Over the Years

The journey of SIP inflows has been exceptional. From ₹3,122 crore in 2016, month-to-month SIP contributions surged to ₹8,532 crore by 2020. Publish-COVID, as markets recovered and monetary literacy improved, month-to-month SIP inflows breached ₹10,000 crore for the primary time in 2021 (₹10,351 crore in September 2021). In April 2024, SIP contributions crossed the ₹20,000 crore threshold (₹20,371 crore), setting the stage for October’s unprecedented ₹25,323 crore mark.

Broader Implications

With over 10 crore energetic SIP accounts and rising AUM, India’s mutual fund panorama is about for additional enlargement. The mutual fund trade is predicted to hit ₹100 lakh crore in whole AUM by 2030, which is able to possible be pushed by continued SIP progress and a steadily rising investor base.

Conclusion

This record-breaking SIP influx is a strong indicator of the transformation in India’s retail funding tradition. With mutual funds changing into a mainstream alternative for long-term wealth creation, SIPs signify each a monetary software and a automobile for fostering disciplined monetary habits throughout various demographics. As extra Indians undertake SIPs, the mutual fund trade is poised to play a good bigger function in shaping the monetary safety and progress of the nation’s households.