Now that second quarter earnings are in, I felt prefer it was an optimum time to replace our 2024 Canadian financial institution shares article.

Ever since I began this web site again in 2008, Canadian financial institution shares have been reader favourites. The slow-steady-dependable nature of those corporations makes them a pure match for dividend lovers and Canadian retirees, and that’s why a number of of the banks occupy outstanding spots on our Finest Canadian Dividend Shares Record.

Rates of interest can’t go down quick sufficient for Canadian banks, because the variety of bankruptcies and dangerous loans banks must pay for on their aspect of the ledger ought to lower as cheaper credit score choices grow to be accessible. Banks additionally have a tendency to cut back their lending charges slower than the Financial institution of Canada’s key rate of interest comes down – thus making extra revenue from fundamental banking actions.

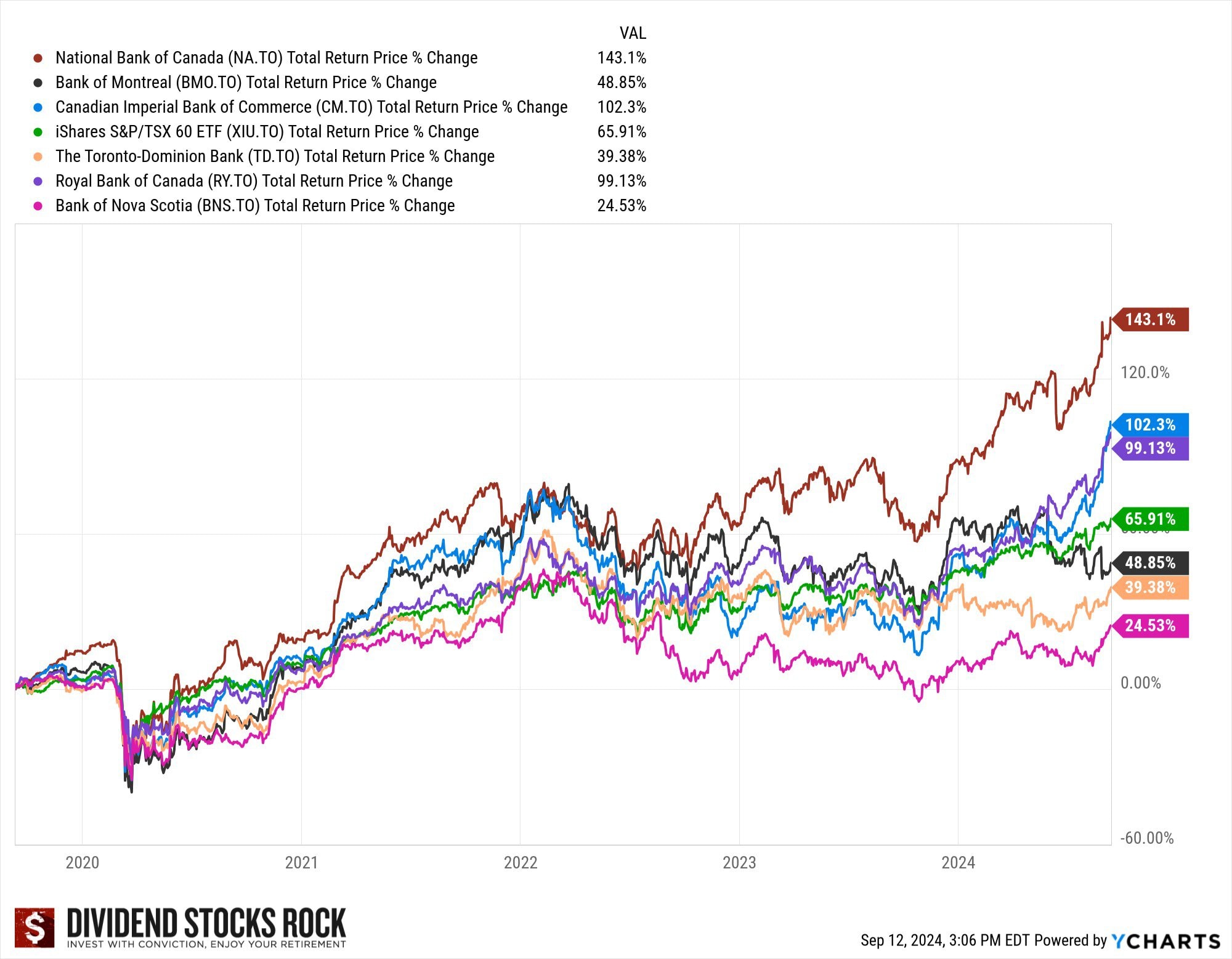

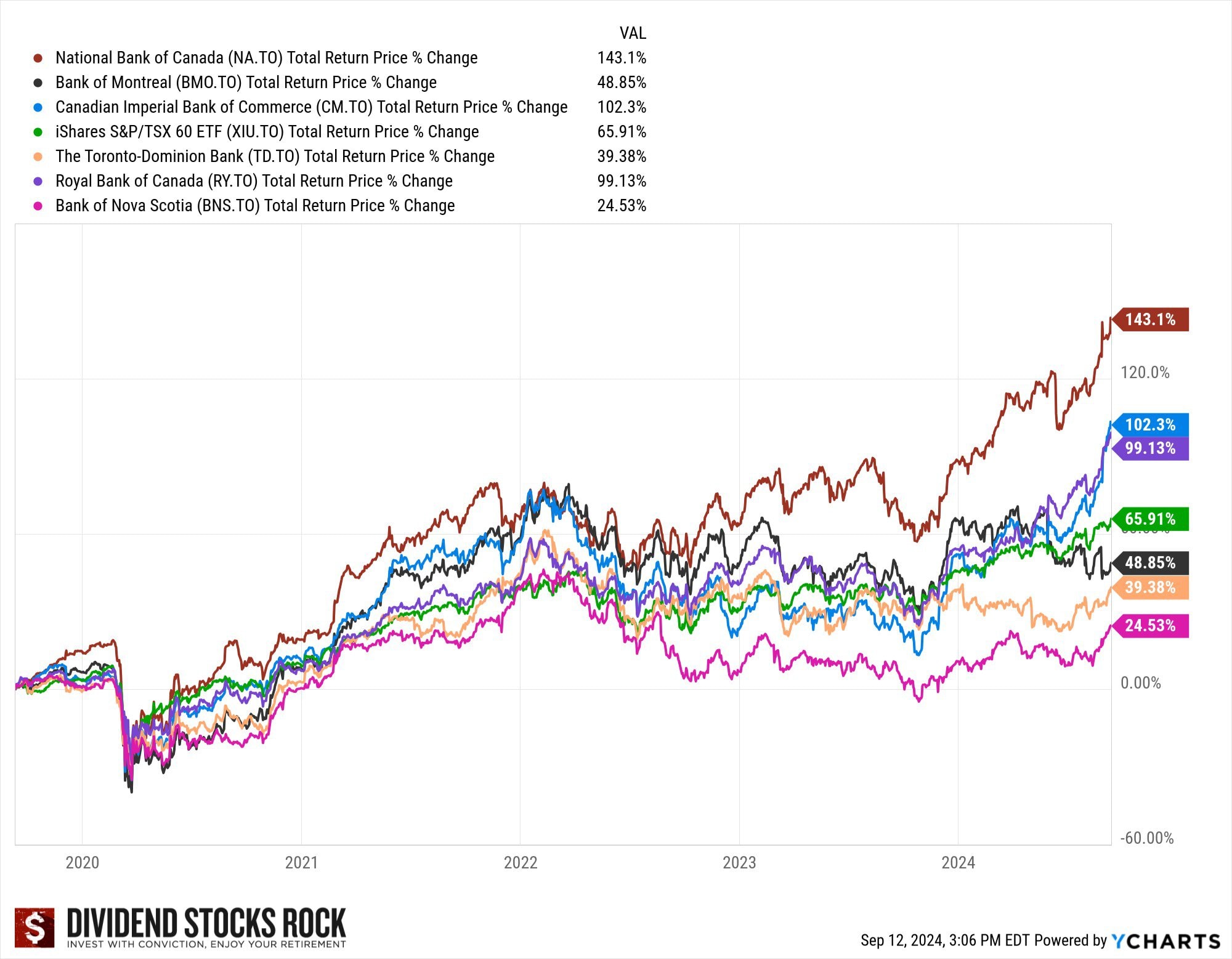

Mike Heroux created the chart above, and his e-newsletter is one that’s personally on the prime of my “should learn” listing. Click on under to get on Mike’s free e-newsletter listing and discover out extra about his unique Dividend Shares Rock platform.

To this point this yr, I went two for 3 with my Canadian financial institution inventory suggestions.

Nationwide Financial institution and RBC have been my two most really helpful shares on this sector for the previous 4 years, and each are doing wonderful. Each Nationwide Financial institution and RBC are up about 23% to this point in 2024, and that doesn’t even account for the juicy 3.5% dividend yield that needs to be tacked on when contemplating complete return. In actual fact, I appreciated Nationwide Financial institution a lot (and proceed to take action) that they have been my 2024 Canadian Dividend King decide for the yr.

Sure, that’s a wonderful return regardless of each banks ear-marking a whole lot of hundreds of thousands of {dollars} to cowl dangerous loans. In different phrases, regardless of extra Canadians defaulting on their money owed, the perfect financial institution shares in Canada are nonetheless making a living hand over fist!

Now… I’m not fairly as happy with my different decide – however I nonetheless assume the long-term funding thesis is sensible relating to TD Financial institution. In case you weren’t conscious, TD’s earnings report bought overshadowed by the large amount of cash that they needed to put aside to pay a penalty within the US. Lengthy story quick, TD is being investigated for laundering a whole lot of hundreds of thousands of {dollars} for drug cartels.

Not an important look.

TD bought a few of the Charles Schwab shares they’d within the pantry from their TD Ameritrade brokerage merger again in 2020 with a purpose to provide you with the $4 billion they determine they might want to pay the penalty. (The 2nd greatest penalty ever levied in North American banking.)

Now – all of that stated – are you aware any Canadians who’ve stopped banking with TD due to this exercise?

I don’t. Not one. No one has talked about shifting their mortgage or switching traces of credit score. Heck, aside from traders, I don’t know a single Canadian that’s even conscious of this information story.

Consequently, I believe TD’s Canadian operations will stay fairly worthwhile. I’ve downgraded my long-term sky-high expectations, as there at the moment are many problems to beat if their US-led progress technique goes to proceed. That stated, their share worth is crazy-low valuation proper now (principally flat for the yr to this point). So I’m not promoting shares but.

Homeowners of Canadian financial institution shares know that the large banks function in a really protecting oligopoly right here in Canada, and consequently, their vast moat permits them to go alongside worth will increase very effectively – thus defending revenue margins.

Canadian banks are a protected purchase as we speak as a lot as they have been final yr and much more so.

Canadian Banks vs. The Finest Dividend Shares in Canada

Right here’s a snapshot of how Canadian financial institution shares examine to huge corporations in different sectors. For extra data, learn our greatest Canadian dividend shares article, or our listing of dividend kings in Canada.

|

?????? (Hidden, click on for entry) |

??????? (Hidden, click on for entry) |

Q3 2024 Canadian Financial institution Shares Earnings

The headlines of the latest quarter for financial institution inventory earnings have been:

- The general Canadian financial system and banking sector is in good condition. Earnings per share have been very wholesome throughout all banks.

- As beforehand talked about, TD’s US-based penalties are going to harm them.

- All six banks have excessive CET Tier 1 Capital ratios.

In the case of the financial institution inventory dividends, not one of the Canadian banks raised their dividend. Whereas this wasn’t a shock for a lot of the banks (who normally elevate dividends as soon as per yr) it’s value noting that CIBC and Scotiabank used to boost dividends twice per yr.

So, it’s no accident that whereas these two banks proceed to have excessive dividend yields (and I’d argue the dividends are fairly protected) these funds are usually not growing on the identical charge they traditionally have.

In my view, these payout ratios proceed to assist the notion that Nationwide Financial institution and RBC are the 2 finest financial institution shares in Canada, and will proceed to have the next valuation than their friends. They’re merely higher run corporations at this level. CIBC has corrected for a few of their previous laggard methods and has actually stabilized. TD is de facto the large query mark of the group, as they’ve traditionally outperformed and have such sturdy model recognition in Canada – however clearly have actual US-based worries hanging over them.

Scotiabank and BMO proceed to look weak and I don’t assume they’re completed falling but.

When it got here to the all-important Provisions for Credit score Losses (PCLs), the themes mentioned above proceed to point out by. Mainly, Nationwide Financial institution, RBC, and CIBC present a really secure (and even declining) must put aside funds to cowl dangerous loans. Their self-discipline in not counting on dangerous loans to generate earnings helps them climate the storm. BMO has been the worst hit by having to put aside increasingly-large quantities of cash. TD has had a middling efficiency with reference to their PCL numbers.

The power to handle their general mortgage e book is clearly instantly correlated to the banks’ skill to supply revenue. Consequently, RBC and Nationwide Financial institution proceed to have sturdy prospects. I nonetheless assume TD goes to have the ability to flip issues round relative to their present valuation, however I actually really feel much less strongly than I did a number of billion dollars-worth of penalties in the past!

If you need all the particulars on Q3 for the Canadian financial institution shares, you’ll be able to try Mike Heroux’s breakdown video under – and also you get an computerized promo provide code for Mike’s Dividend Shares Rock platform (unique to Million Greenback Journey readers) by clicking the hyperlink beneath the video.

Nationwide Financial institution and Canada Western Financial institution Merger

The opposite huge information within the Canadian banking sector this previous quarter was the foremost growth by Nationwide Financial institution by way of an acquisition of Canadian Western Financial institution (CWB) the eighth-largest financial institution in Canada. The TLDR is that Nationwide Financial institution goes to purchase CWB’s property for $4.7 billion.

Most notably, that signifies that Nationwide Banks gained 65,000 shoppers in a single day, and 39 branches in part of the nation that NB didn’t have any footprint in. The purpose will after all be to market a few of Nationwide Financial institution’s present companies to CWB’s consumer listing.

Whereas gaining extra market share within the Canadian banking oligopoly is almost all the time a profitable proposition, Nationwide Financial institution did must pay a reasonably penny for the deal. Earlier than the acquisition was introduced CWB’s shares have been valued at slightly below $25 every, and they are going to be “bought” at $52.24. Any time you may make a 110% acquire in your funding, that’s a reasonably whole lot!

Because of the excessive price ticket (which was principally financed by issuing new shares, in addition to securing financing from the Quebec pension fund) Nationwide Banks share values did take a quick hit earlier than heading greater and setting new all-time highs this previous quarter. Within the huge image, Nationwide Financial institution seems to be firmly planting their flag within the “we’re going to grow to be a full-fledged cross-country competitor to the opposite huge banks” versus their earlier Quebec-centric enterprise mannequin.

Canadian Banks are Not SVB or Credit score Suisse

Investing may be scary generally.

When investing includes banks, there may be typically an exponentially higher emotional response as a result of typically it’s not solely your inventory publicity in danger – however your chequing account, possibly enterprise account, and many others.

Consequently, when phrases like “financial institution runs” begin to be uttered, it may be tempting to run for the exits. In fact, if corporations are basically sound, shopping for in at low valuations is strictly the way you beat the market. Anybody can make investments with conviction when all of the information is sweet, however it’s the flexibility to separate the noise from the truth when issues aren’t so rosy that usually determines long-term outperformance.

In the event you Google “Credit score Suisse” you’ll see that the financial institution has had numerous issues over the past ten years. Frankly, it has been concerned with numerous actually dangerous individuals/entities – one would possibly even say “shady” endeavors – and it doesn’t shock me that they appear probably the most shaky out of the massive “world systemic banks”. However even Credit score Suisse seems “to huge to fail” now with the Swiss Authorities stepping in and back-stopping liquidity worries.

In the case of SVB, it’s a very fascinating case examine from a geeky economics/enterprise perspective, however what it actually boils all the way down to is a ridiculous danger administration determination for that specific financial institution. It was an terrible determination to have primarily put all of their “protected property” – or “tier one liquidity” as we wish to say in Canada – in long-term US Treasuries after we have been about to enter a elevating rate of interest setting. When you think about an enormous share of their depositors (startups and tech corporations) are additionally very delicate to rate of interest hikes, you will have the makings of an ideal storm.

Neither of those two banks has a lot to do with the Canadian banks we’re discussing right here. You would possibly say that on the fringes, BMO and TD traders may need some small worries relating to latest American acquisitions, however given the energy of the US labour market, in addition to the brand new assure by each the Fed and the Biden Authorities, I wouldn’t fear all that a lot.

BMO’s Financial institution of the West acquisition can be the closest connection to the latest headlines, simply resulting from geographical proximity to SVB, in addition to having barely elevated numbers of non-insured deposits vs the foremost US banks. That stated, the US authorities simply implicitly assured all financial institution deposits, so I’d say that systemic danger is now off the desk.

As a serious TD investor (added to my place amidst the chaos on Monday – so didn’t get it on the backside, however I’m proud of my low cost) it actually wouldn’t break my coronary heart to see the $13.4 billion acquisition of First Horizon Corp go quietly into the evening. Maybe on the very least, TD can use this regional banking weak point to renegotiate extra advantageous acquisition phrases.

On a purely basic degree, I believe it’s value declaring that quarterly earnings outcomes from a number of weeks revealed that the Canadian banks proceed to make some huge cash, and that the foremost motive that earnings per share numbers weren’t by the roof was one thing known as “PCL”.

PCL is definitely fairly vital because it stands for Provision for Credit score Loss. That cash the Canadian banks are setting apart is the precise motive that I’m not nervous about them by way of their long-term sustainability. A bit ache within the quick time period resulting from decreased quarterly earnings, is greater than well worth the heartburn some American financial institution traders felt this week.

To recap, RBC, CIBC, TD, and Nationwide Financial institution, all considerably beat their quarterly consensus earnings predictions. BMO and Scotiabank each had solid-if-unspectacular quarters as nicely. The Large 6 all stay very liquid and really nicely capitalized.

I haven’t seen any rush inside Canada to drag cash out – and with FDIC insurance coverage, why would you? That being the case, I don’t see any motive to imagine that investing in Canadian financial institution shares is any extra dangerous within the long-term than it was a month in the past.

Canadian Financial institution Shares Efficiency in 2023

After two sub-par years for Canadian banks shares, traders are hoping 2024 brings a little bit extra to the desk.

That stated, it may have been loads worse. The final two months of the yr noticed our prime financial institution inventory picks make some stable positive factors, and the banks well-positioned for when rates of interest start to development downward once more.

Right here have been my important takeaway for the banks in 2023:

- Our prime financial institution inventory decide of Nationwide Financial institution had an important yr with over 10% in capital positive factors and about 5% in dividend yield, for a wonderful complete return.

- The spring banking disaster within the USA by no means actually materialized for Canadian banks – as soon as once more highlighting the strengths of the extra conservative Canadian banking system.

- RBC continued to point out why they’re the premier title amongst Canadian banks, and justified their comparatively excessive P/E ratio.

- I used to be incorrect on CIBC. It’s not that it’s a incredible financial institution, it’s merely that the inventory had gotten so overwhelmed up that it lastly supplied stable worth, and truly led the overall returns for Canadian financial institution shares in 2023.

- Scotiabank has some actual structural points and traders simply aren’t prepared to belief it proper now. It may simply be that Scotiabank may have a CIBC-like 2024 merely resulting from how low expectations have fallen, however I’m staying away till there may be extra stability there.

- The market stays extra skeptical of TD than I’m. I’ve learn loads about potential default dangers, however I see no proof of skyrocketing defaults by Canadian or American clients. Given the US publicity of the financial institution, I nonetheless assume it has wonderful progress prospects. Strolling away from their US-based acquisition in 2023 shouldn’t harm them, as they now have an enormous warfare chest to extend dividends and inventory buybacks with.

Given the very affordable valuations for the banks as a bunch on the finish of 2023, I proceed to assume Canadian banks shares are nicely positioned for 2024. It would take till the second half of the yr for traders to purchase again in, however I believe numerous income-oriented traders are going to seek out their manner again to Canadian banks once they can’t get 5%+ in a money ETF.

Investing in The Large Canadian Banks – Overview

Royal Financial institution of Canada (RBC)

RBC is the reigning king of Canadian banking. Royal Financial institution of Canada is a Canadian multinational monetary companies firm and the biggest financial institution in Canada by market capitalization. The financial institution serves over 16 million shoppers in Canada, the U.S. and 27 different nations.

They’re certainly one of North America’s most diversified monetary companies corporations, and supply private and industrial banking, wealth administration, insurance coverage, investor companies and capital markets services and products on a world foundation.

In abstract, they’re a dividend/earnings beast with so some ways to generate income.

TD Financial institution (TD)

TD can be a really well-diversified financial institution that concentrates on Canadian and U.S. retail banking and wealth administration. In actual fact, TD has extra branches within the U.S., in comparison with Canada. That stated, they generate extra income and earnings in Canada. That speaks to the very worthwhile oligopoly scenario in Canada.

TD Financial institution Group presents a full vary of economic services and products to greater than 26 million clients worldwide. TD additionally ranks among the many world’s main on-line monetary companies corporations, with greater than 15 million lively on-line and cellular clients.

U.S. monetary big Charles Scwab (SCHW) bought TD Ameritrade in 2019, giving TD a 13.5% stake in Schwab. Consequently, with TD you’re getting some very good U.S. publicity.

Scotiabank (BNS)

Scotiabank is probably the most Worldwide of the Canadian banks. Scotiabank serves greater than 26 million shoppers in Canada, and presents a variety of services and products within the U.S., Latin America (excluding Mexico), and in choose markets in Europe, Asia and Australia. They’ve a really strong world and capital markets division that features lending, deposit, money administration and commerce finance options and retail automotive financing operations.

Whereas there may be nice potential in growing markets, they haven’t all the time executed with precision in these international markets and have usually lagged behind the leaders lately.

Scotiabank additionally owns Tangerine, Canada’s main on-line financial institution.

Financial institution of Montreal (BMO)

BMO is perhaps thought of probably the most forward-thinking of Canada’s huge banks relating to introducing cost-cutting choices lately.

BMO serves greater than 12 million clients, with 8 million by way of Canada operations. They function in three divisions – private and industrial banking, capital markets and BMO wealth administration. BMO has been aggressively increasing its U.S. footprint by a collection of operations.

In Canada they’re nicely positioned because the main financial institution with respect to ETF property beneath administration. They’re in second place in Canada, solely behind BlackRock, however BMO is gaining floor and shutting that hole. Additionally they provide advice-Direct, a digital funding recommendation and portfolio administration platform.

Canadian Imperial Financial institution of Commerce (CM)

CIBC can typically be categorized because the also-ran among the many huge 5 Canadian banks. They’ve made some missteps and have lagged the opposite banks with respect to diversifying outdoors of Canada.

In 2019, Barry Schwartz, chief funding officer of Baskin Wealth Administration, supplied “They appear to be swinging previous the fastballs and lacking the simple layups that the opposite banks get proper.” That stated, analysts seem like warming to CIBC’s latest efforts.

CIBC serves 10 million clients and operates Canadian private and industrial banking, plus wealth administration. Within the U.S. they provide industrial banking and wealth administration. Additionally they have a capital markets division.

Dividend traders love CIBC’s dedication to paying shareholders constantly and simply because they aren’t the main title, doesn’t imply they will’t maintain main worth at a sure worth level!

Nationwide Financial institution of Canada (NA)

Nationwide Financial institution is a regional financial institution (Quebec) that has been efficiently diversifying. Nationwide is a really well-run financial institution, and has been the top-performing huge Canadian financial institution for 20 years or extra. It’s the favorite worth of Dividend Shares Rock – our most trusted supply for dividend progress data.

Nationwide generates 50% of its revenues in Quebec, which it then makes use of to fund extra progress initiatives outdoors of Quebec’s borders. Wealth administration is rising at 15% annual over the past 10 years. The financial institution can be lively within the U.S. and rising markets.

The very fact is that Nationwide Financial institution is a bit smaller and extra nimble (in comparison with the large 5) and extra responsive as they search acquisitions. This might result in outsized positive factors versus its giant market cap banking brethren.

The place to Purchase Canadian Financial institution Shares

This shares may be purchased by any dealer – all you need to do is open an account, add funds and decide the particular inventory you need to purchase. For extra data, you’ll be able to learn our newbie’s information to purchasing shares, or our comparability of the perfect on-line brokers in Canada.

Canadian Financial institution Shares are Low cost

A latest Globe and Mail article put it finest once they acknowledged:

“Although they’ve rebounded over the previous month, inventory costs are down 14 per cent since November. Comparatively low valuations, by way of price-to-book and price-to-earnings ratios, additionally seem to recommend that shares are priced for bother forward, if not an outright financial contraction.”

The identical article went on to disclose:

“At this level, we’re questioning if an excessive amount of negativity has been mirrored,” Gabriel Dechaine, an analyst at Nationwide Financial institution Monetary, stated in a observe.

Given the energy of the Canadian labour market, I believe the requires a dramatic long-term recession are overblown. The Canadian banks are doing what they all the time do and setting apart reserves for a wet day. That is the type of cautious transfer that has generated such sturdy confidence amongst traders.

I’m additionally of the opinion that the thought of an entire housing meltdown have been exaggerated. Individuals neglect that the overwhelming majority of Canadian householders both have absolutely paid off their mortgage, or locked right into a long-term deal over the past couple of historically-low curiosity years.

Sure, greater rates of interest will have an effect on new householders, however let’s now blow issues out of proportion right here. Most center class Canadians would quite promote an organ than foreclose on the home that they’ve tied up a lot of their identification in.

It’s value noting that probably the most present Canadian insolvency numbers are decrease than they have been in 2019 (pre-pandemic).

With ahead P/E ratios 10%+ under their historic averages, and their P/B metrics wanting fairly enticing as nicely, now might very nicely be the time to scoop up these shares at wonderful valuations.

Investing in Canadian Banks: FAQ

Canadian Financial institution Inventory Dividends For the Authorities?

The federal Liberal authorities is trying to hit the financials coming and going. First off, they wish to enhance the company earnings tax charge from 15% to 18% on all earnings above $1 billion. It’s estimated that collectively it should price the large banks about $1billion in earnings annually.

Additionally, the large Canadian banks and insurers might be paying a Canada Restoration Dividend. The 2 packages are slated to start in 2022-2023 and can run over a four-year interval. The speed or quantity of the Canada Restoration Dividend might be negotiated over the approaching months.

Analysts don’t see this as a serious hit to the very worthwhile banks and insurance coverage corporations. The taxes are probably already priced into the shares, as financial institution analysts already know what’s coming all the way down to the pipe.

It might be finest to focus extra on the long run progress prospects and people rising dividends that can find yourself in your pocket.

Investing in Canadian Banks for 2024 – Ignore the Noise

As you’ll be able to see from the chart above, there are nice causes to like and belief Canadian financial institution shares for the long run.

The steadiness of Canadian financial institution dividends helps all traders average their “animal spirits” relating to panic promoting, and their observe document relating to allocating capital for expenditures is second-to-none. This average tone will serve financial institution traders nicely 2024, as information headlines declare that the sky is falling resulting from recessions, elections, and many others.

With all of the unfavourable information in 2023, the present entry costs for Canadian financial institution shares signify one of many only a few “offers” that I can see available in the market proper now.

The distinctive regional background of Nationwide Financial institution, mixed with its smaller market cap relative to its “Large 6” financial institution cousins, provides the corporate probably the most stable prospects for progress out of the Canadian banks.

RBC has merely confirmed yr in and yr out to be worthy of their “finest in school” standing. The sheer scale and variety of their revenues proceed to make them one of many most secure shares on the earth from my perspective.

TD is my last decide for Canadian financial institution shares. It has been a robust second banana to RBC for a few years, and I like their publicity to the dynamic American market, in addition to their market share within the Canadian banking oligopoly. They weathered numerous unfavourable press in 2023, however I stay a fan of their Canadian/US publicity, and with such a robust stability sheet, I’m unsure why traders stay so squeamish.

On the finish of the day, nothing that has occurred within the final ten years has completed something to shake my religion in Canadian financial institution shares. They function in a protected oligopical setting, profit from huge boundaries to entry, are nicely run, and revenue off of Canadians’ collective indifference to charges and prices.

With Canada’s working inhabitants being juiced by aggressive immigration insurance policies, the one actual query is which Canadian financial institution shares will reward their shareholders with outsized returns (as a substitute of merely stable earnings progress). For different funding choices, learn our greatest Canadian dividend shares web page, or our listing of Canada’s dividend kings and aristocrats.