The evolution of the highest inventory buying and selling apps in Canada has been nothing in need of exceptional since I first launched Million Greenback Journey nineteen years in the past. Again then, the choices had been restricted, clunky, and predominantly dominated by the massive banks.

Quick-forward to at this time, and the aggressive push from revolutionary fintech corporations has fully reworked the panorama. These newcomers have compelled conventional monetary establishments to step up their recreation, slashing charges, refining their consumer interfaces, accelerating account setup processes, and delivering a extra streamlined cellular investing expertise.

Whereas I stay largely a desktop-guy for my DIY investing (therefore the deal with desktop platforms in my Finest On-line Brokers in Canada comparability) I’ve made it a precedence to totally check the cellular inventory buying and selling apps featured right here. These apps are not only a supplementary device; they’re changing into an important a part of trendy investing, particularly for individuals who worth fast entry and on-the-go performance.

Since I personally use a Samsung machine, my app opinions are primarily based on the Android ecosystem. Nonetheless, at Million Greenback Journey, we satisfaction ourselves on providing a balanced perspective. A number of of our contributors are avid Apple customers, guaranteeing we will ship hands-on insights into the iOS variations of those apps as nicely. As a crew, we’ve labored laborious to focus on the strengths and weaknesses of prime Canadian investing apps under so that you could decide the suitable one for you!

Finest Inventory Investing Apps of 2024 In contrast

Buying and selling Charges

$6.95 – $8.75

ETF Charges

Free shopping for AND promoting of 100+ ETFs

Finest dealer general in Canada. Barely dearer inventory buying and selling than Questrade, however has a greater app, service and promo.

Buying and selling Charges

$4.95 – $9.95

ETF Charges

Free BUY of ETFs (full costs for ETF gross sales)

Low buying and selling charges. Sturdy on-line platform with superior knowledge streams. The “Robinhood” of Canada.

ETF Charges

Free shopping for and promoting of 80+ ETFs

Finest Massive Financial institution Brokerage – 80+ Free ETF Trades, Massive Financial institution Comfort, Excessive Charges.

ETF Comissions

Solely TD ETFs are free, in any other case $9.95 per commerce

Buying and selling Charges

$9.99 (first 50 trades free)

Nice number of academic instruments and implausible customer support. 50 free inventory trades per 12 months. Restricted choice and no promo provide.

Strong Massive Financial institution Brokerage with decrease charges than different massive banks. No promo provide, charges apply to purchasing and promoting ETFs.

ETF FEES

Free to Purchase And Promote

Inventory buying and selling app (Wealthsimple Commerce) may be very fundamental – clunky cellular app and nonexistent customer support. However it’s free.

Finest Inventory Buying and selling App: Qtrade

Qtrade’s app is quick and, simple to make use of and navigate, and Qtrade additionally has wonderful buyer help, making it good for inexperienced persons who want some additional help.

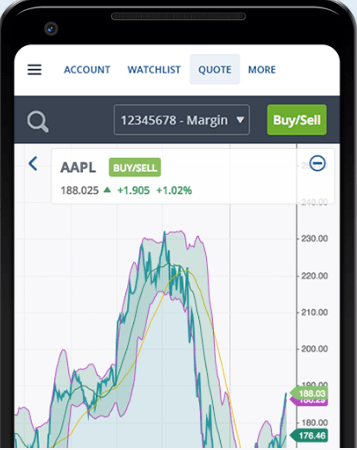

The cellular app offers customers entry to intensive info on main North American exchanges and actual time quotes for particular person shares. It additionally makes use of the most recent encryption expertise for enhanced security measures.

“Qtrade excels in each space – particularly in customer support.”

Mark Brown, Investing and Rankings Editor for MoneySense

The crew of writers at MDJ has made no secret of our love for QTrade, persistently rating it as our prime really helpful DIY on-line dealer in Canada over time. Qtrade has persistently rewarded our religion and help by innovating spectacular new particulars and re-investing in elite customer support, plus excellent consumer expertise.

Qtrade additionally persistently affords the most effective join promotions that we see with regards to Canadian Buying and selling Apps. At present, for those who go to Qtrade and open a TFSA, RRSP, RESP, FHDA or a non-registered account, they’re going to offer you $150 money. Then they’re going to offer you more money again relying on how a lot you begin investing with.

For those who open a number of accounts, after which make investments $5,000 (it may well all be in a single account like an FHSA – or unfold amongst a number of accounts), Qtrade goes to toss $400 your means. That’s an computerized 8% return! For those who transfer over an present brokerage account, Qtrade can pay the switch charges, and better funding balances can earn as much as $2,150!

- Minimal Steadiness: $0

- Buying and selling Charges: $6.95 – $8.75 (Free to purchase and promote ETFs)

- Account Choices: TFSA, RRSP, LIRA, RESP, RRIF, FHSA, LIF, Margin, Non-registered

- Present Promotion: Up To $2,150 Money Again see the complete particulars right here with our Qtrade Promo Code.

- Full Overview: Qtrade Overview

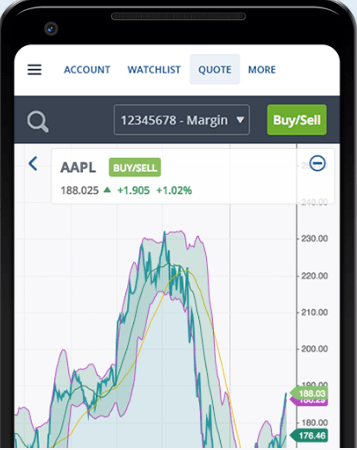

Lowest Charges Cellular Investing App: Questrade

Questrade’s cellular app revamp within the fall of 2021 was a recreation changer for one among our prime really helpful DIY buying and selling platforms.

Questmobile (their new and completely redesigned cellular app) options an intuitive interface, streamlined design, and biometric login. Questrade constructed the app with pace and ease of use in thoughts—and it exhibits!

Questrade’s inventory buying and selling app additionally options Studying Mode, which permits buyers to entry definitions, inventory and ETF info, and actual time snap quotes (a step up from the earlier 15 minute wait).

Questrade just lately misplaced out to Qtrade for our prime really helpful on-line buying and selling platform. Their new on-line platform (redesigned to match the app) has brought on extra adverse reactions than constructive ones (it’s not our cup of tea both)—however so far as apps go we’ll be the primary to confess that Questmobile is superb.

- Minimal Steadiness: $0

- Buying and selling Charges: $4.59-9.95 (ETFs free to purchase)

- Account Choices: TFSA, RRSP, RESP, LIRA, RIF, LIF, Non-registered, Company, Belief, Margin

- Present Promotion: $50 in free trades

- Full Overview: Questrade Overview

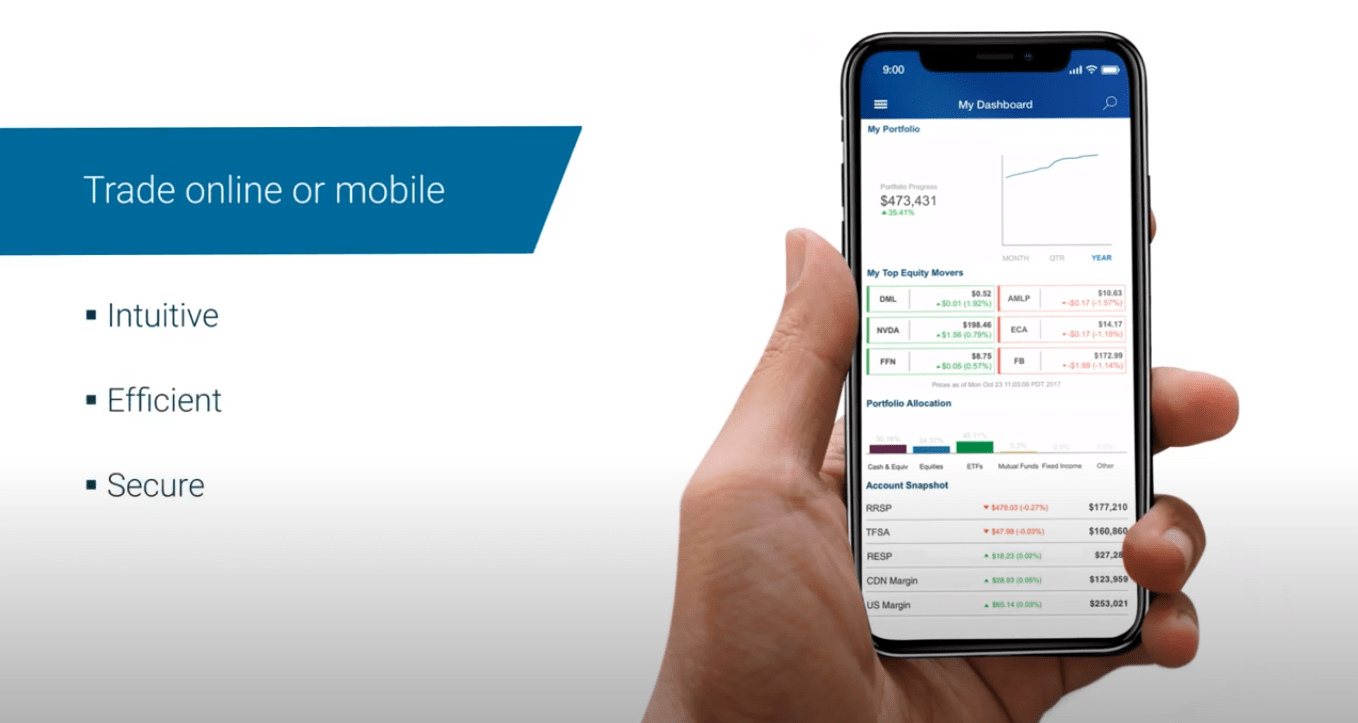

Finest Canadian Massive Financial institution Inventory Buying and selling App: BMO Investorline

BMO Investorline is our decide for greatest Canadian buying and selling app if you wish to follow the main banks.

It’s not the most affordable possibility on the market. Nonetheless, many people are drawn to the comfort of preserving all of their monetary and banking wants below one super-trustworthy roof.

The BMO Investorline cellular app emphasizes flexibility, simplicity, safety, comfort, and complete info. For our cash, it delivers on these guarantees and provides the sleek consumer expertise you’d count on from a world-leading model.

Most opinions of the BMO Investorline app point out that it’s simple and simple to make use of – It’s a easy 5-second thumb faucet to shift cash out of your BMO chequing account, to your low cost brokerage account, and put it to be just right for you.

Nonetheless, others word that it isn’t as detailed because the desktop platform. There are additionally a number of complaints from customers experiencing technical difficulties on a semi-regular foundation. And naturally, the fly within the ointment is the upper buying and selling charges relative to Qtrade or Questrade.

Minimal Steadiness: $0

Buying and selling Charges: $9.95 (free to commerce some ETFs)

Account Choices: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Company, Belief, Margin

Present Promotion: 50 free trades (as much as $500 worth)

Full Overview: BMO Investorline Overview

Finest Massive Financial institution Inventory Buying and selling App for Newcomers: TD Direct Make investments

TD Direct Investing’s fundamental inventory buying and selling app (a part of the primary TD app) is nothing to jot down house about however they’ve been making fascinating strikes in 2022 with their TD Simple Commerce app (previously TD GoalAssist)

Whereas TD’s typical inventory buying and selling charges are among the many highest of all of the DIY brokerages, at $9.99/commerce, TD Simple Commerce offers customers 50 free inventory trades a 12 months earlier than these charges kick in. Additionally they provide limitless TD ETF trades.

That signifies that for those who’re simply beginning out and need to follow a giant financial institution inventory buying and selling platform, TD Simple Commerce offers you the possibility to get used to issues with out incurring any charges. There aren’t any account charges both, so it offers customers a pleasant little grace interval the place they pay nothing in any respect.

There are a few catches, although:

- TD Simple Commerce affords RESP, RRSP, and Non-registered accounts solely

- TD Simple Commerce customers can solely commerce TD ETFs or shares on Canadian and US markets

If you wish to arrange every other sorts of accounts or take a look at every other sorts of belongings, this isn’t the app for you. However for those who’re simply getting began and don’t thoughts the comparative lack of choices, TD Simple Commerce is price a glance (did we point out the app is free?).

- Minimal Steadiness: $0

- Buying and selling Charges: 50 free inventory trades (then $9.99/commerce), limitless free TD ETF trades

- Account Choices: RRSP, TFSA, Non-registered

- Present Promotion: None (the 50 free trades provide is an annual characteristic)

- Full Overview: TD Direct Investing Overview

Lowest Charges for a Massive Financial institution Inventory Buying and selling App: CIBC Investor’s Edge

Though CIBC Cellular Wealth, the cellular app for CIBC Investor’s Edge, began out clunky and unresponsive, it improved considerably after an replace in late 2021.

CIBC Cellular Wealth connects customers with a set of instruments that make it simple to watch and perceive your portfolio. Additionally they have enhanced accessibility options for individuals who want them.

CIBC’s standout characteristic is comparatively decrease charges in comparison with different massive financial institution platforms ($6.95/commerce, or $5.95 for college kids, in comparison with $9.95 for many different massive banks). Additionally they have a particular $4.95 value for energetic merchants.

For those who’re on the lookout for all-time low charges, this isn’t the app for you—however if you wish to follow a giant financial institution and wish extra account or funding choices than TD Simple Commerce can provide you, it’s price a glance. Simply take into account that these buying and selling charges do add up.

- Minimal Steadiness: $0

- Buying and selling Charges: $6.95 ($5.95 for college kids)

- Account Choices: TFSA, RRSP, LIRA, RESP, RIF, LIF, LIRA, Margin, Non-registered, Belief, Company

- Present Promotion: None.

- Full Overview: CIBC Investor’s Edge Overview

Finest Free Inventory Buying and selling App: Wealthsimple Commerce

We are able to say with confidence that Wealthsimple Commerce has the bottom charges of any inventory buying and selling app on this record. That’s as a result of it affords commission-free buying and selling for each shares and ETFs. The pricing is, frankly, laborious to beat.

That being stated, while you get one thing totally free it is advisable to count on a trade-off. The Wealthsimple Commerce app is clunky and complicated. It’s our least favorite cellular buying and selling app by far.

Nonetheless…for those who’re on the lookout for the most affordable platform, this might be it. And that’s why it’s on our record. In case your precedence is an easy-to-use, well-designed app, look elsewhere – however you WILL save on charges with Wealthsimple Commerce. It’s only a trade-off it is advisable to be keen to make.

Additionally, take into account that in the event that they’re not getting their cash from buying and selling charges, they’re getting it from someplace (normally from promoting your knowledge or attempting to upsell you).

For those who’re on the lookout for a inventory buying and selling app that allows you to mess around with small sums with out worrying about blowing your total steadiness on charges that may value as much as $9.99 per commerce, Wealthsimple Commerce is a good alternative.

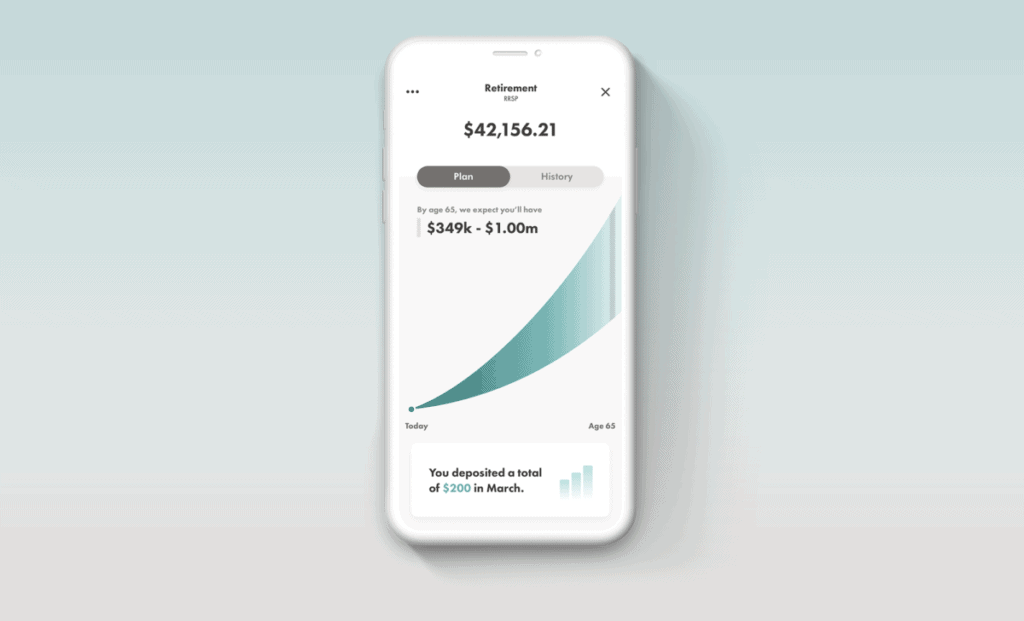

Wealthsimple’s robo advisor, Wealthsimple Make investments, is among the greatest in Canada, and we admire every thing Wealthsimple affords to Canadian buyers. We simply actually don’t love the Wealthsimple Commerce app or the platform normally.

- Minimal Steadiness: $0

- Buying and selling Charges: $0

- Account Choices: TFSA, RRSP, Non-registered private

- Present Promotion: $50 Money Bonus

- Full Overview: Wealthsimple Commerce Overview

Latest Inventory Buying and selling App in Canada: Nationwide Financial institution Direct Brokerage (NBDB)

The Nationwide Financial institution inventory buying and selling app has lengthy been touted as a challenge the corporate was pursuing, however we lastly acquired to see the early remaining product on the finish of 2022.

As we enter 2024 the NBDB cellular inventory market app continues to be working the bugs out of its just lately launched Apple Retailer product, and hasn’t but launched the Android model.

Preliminary opinions are that it’s a pretty strong first effort. Among the bugs and limitations talked about by the primary customers embrace:

- No capacity to switch cash out of your checking account to brokerage account.

- No easy-to-see portfolio possibility equivalent to these discovered on different main Canadian dealer apps.

- No cellular app alerts possibility.

- No present capacity to trace your portfolio utilizing solely the cellular app.

- Limitations in buying shares priced under a greenback.

We’ll proceed to replace our Nationwide Financial institution Direct Brokerage evaluation as extra particulars turn out to be obtainable.

Finest Inventory Buying and selling App for Devoted Royal Financial institution Prospects: RBC Direct Investing

Look, for those who had been to press me, I’d must admit that there’s nothing game-changing in regards to the RBC Direct Investing cellular expertise. It does what it’s purported to, has a strong consumer interface, and is usually fairly sound.

Maybe one characteristic that’s distinctive to the RBC buying and selling app is their observe accounts. Only some Canadian brokerages have observe accounts, so if that’s one thing you’re all in favour of, then it’s obtainable and works easily to get your investing toes moist.

Apart from the observe account, the one actual cause I feel you go together with the RBC Direct Investing cellular app is just because it’s the most handy method to hold your whole belongings below one banking roof. There’s nothing unsuitable with being keen to pay a little bit extra in commissions and quarterly account charges for the sheer comfort of going with Canada’s largest financial institution.

Personally, I’ve a number of accounts with RBC resulting from company partnerships. That didn’t cease me from purchasing round for the most effective deal on a mortgage, a GIC, or a inventory buying and selling platform.

- Minimal Steadiness: $0

- Buying and selling Charges: $9.95

- Account Choices: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Company, Belief, Margin

- Present Promotion: None

- Full Overview: RBC Direct Investing Overview

The Inventory Buying and selling App for Scotiabank Prospects

Scotiabank has had some issues preserving as much as its massive financial institution rivals over the previous couple of years. This has not solely impacted its inventory value, however has resulted in a subpar efficiency for the Scotiabank iTrade app as nicely.

For those who peruse the Google Play opinions for the iTrade inventory buying and selling app, you’ll see that after the massive replace in 2022, there was a disproportionate quantity of points with bugs and general consumer expertise. In actual fact, thus far in 2024, the app has solely acquired one-star opinions (not precisely a glowing endorsement).

Fundamental performance points like not with the ability to full the sign-up course of from throughout the app are understandably a difficulty for youthful shoppers used to the seamless usability of recent fintech corporations. Apparently, there has additionally been pushback from a number of the older customers (judging from how way back they began utilizing the iTrade app) with regard to how tough the brand new app is to navigate. The prevailing knowledge seems to be, “the outdated app was boring, however a minimum of you could possibly discover what you wanted to and it didn’t have any bugs.”

Whereas I personally don’t thoughts the desktop Scotia iTrade platform, the cellular app does go away one thing to be desired. If you mix that with the massive financial institution charges, the one individuals I may actually advocate it too would individuals who place a excessive premium on the comfort of preserving all of their banking belongings below one roof – and have every thing setup throughout the broader Scotiabank universe.

- Minimal Steadiness: $0

- Buying and selling Charges: $10

- Account Choices: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Company, Belief, Margin

- Present Promotion: None

- Full Overview: Scotia iTrade brokerage evaluation

Finest Canadian Inventory Buying and selling App for iPhone and Android

Our prime inventory buying and selling apps have largely constructive on-line opinions. Questmobile has a 4 star score on the Apple retailer and a good 3.3 star score on the Google Play (customers appear universally happy with the interface, however the biometrics gave them a little bit hassle again when the app launched).

My vital different and I take advantage of Qtrade, which is MDJ’s prime decide for 2024. I’m a devoted Google/Android consumer and he or she belongs to the “darkish aspect” of the Apple universe. Neither of us have ever had any points with the Qtrade app.

Typically talking, I don’t see a lot distinction after I have a look at any of the main inventory buying and selling apps on both my spouse’s cellphone or my very own. Clearly these corporations perceive simply how essential consumer expertise is and are repeatedly working to refine their product.

Ten years in the past it’s doable that you simply may need discovered bugs or glitches on the Android or Apple variations of particular buying and selling apps, however these days are fortunately gone for probably the most half.

These days the worst you’ll normally discover is that the interface isn’t good, the load time is gradual, or the customer support is iffy – and relying in your tolerance for these sorts of points, you’ll have the ability to discover an app that works for you.

It helps to verify opinions on the app retailer of your alternative earlier than you make your determination—however it’s essential to maintain these two issues in thoughts:

- You’ll want to verify the age of the evaluation as a result of these apps are frequently being improved.

- Needless to say the standard of the app is just one issue it is advisable to think about—if a buying and selling platform has a killer app however doesn’t provide the accounts or funding choices you need, then it’s not the suitable alternative for you.

Finest Canadian Inventory Buying and selling Apps for Newcomers

As talked about in our evaluation part, we advocate Qtrade for newbie customers. Their cellular app and buying and selling platform have wonderful shopper training sources and top-notch usability. Their simplicity and flexibility makes them our best choice for greatest inventory buying and selling app for inexperienced persons.

Frankly, most of Canada’s massive banks have user-friendly apps that may work for. RBC, TD, CIBC and Scotiabank have all created low cost brokerage apps that almost all Canadians would discover pretty intuitive after a little bit studying on learn how to purchase shares in Canada. What separates BMO from that group is the mix of a variety of account choices and free ETF buying and selling.

In fact, Qtrade nonetheless will get my private prime vote resulting from its edge in shopper training and funky portfolio evaluation instruments that present newbie merchants with some distinctive funding insights. For those who’re simply studying learn how to purchase shares in Canada, it may well enable you to get every thing sorted out.

The opposite place the place Qtrade actually shines with regards to newbie buyers is in its customer support (the place it has persistently ranked as the most effective in Canada for years). Customer support is rarely extra essential than while you’re simply beginning to get used to on-line investing and utilizing the varied platforms.

Finest Free Inventory Buying and selling App For Canadians

It ought to be famous proper off the bat that there isn’t any such factor as a very free inventory buying and selling app!

Certain, you may not pay something upfront for a selected investing platform app, and also you may even keep away from per-trade charges. Nonetheless, for those who aren’t paying instantly, then you possibly can make sure that you’re paying in another means.

Often this fee comes from promoting your knowledge to the “massive fish” additional upstream and/or repeated adverts that attempt to upsell you. For those who’re conversant in the varied controversies regarding the “free” Robinhood inventory buying and selling app within the USA, then you recognize what I’m speaking about.

Lengthy story quick, there’s a cause why we advocate tried-and-true low cost brokerage apps equivalent to Qtrade, Questrade, and BMO Investorline. They cost charges – however you get what you pay for.

If you would like a really restricted product that’s free on the level of supply, then your greatest guess for a free inventory buying and selling app in Canada is Wealthsimple Commerce. It’s also possible to see different choices on our free shares buying and selling web page.

Whereas this platform means that you can commerce shares totally free, it has many usability points (that it claims to be step by step fixing) and solely affords a really restricted variety of account varieties to be opened. Whereas Wealthsimple is our decide for the most effective free app, general we imagine that you simply’re higher off avoiding free apps altogether and on the lookout for high quality as an alternative

Finest Inventory Monitoring Apps in Canada

I personally use my Qtrade account to do all of my monitoring of apps (whether or not the are on my wishlist or already a part of my portfolio).

That stated, I do know a number of individuals who want to make use of a chosen inventory monitoring app alongside their precise inventory buying and selling app that their dealer gives.

By far the 2 hottest Canadian inventory monitoring apps are Passiv and Wealthica.

Passiv is mainly a no brainer for those who’re a Questrade consumer since you get it totally free. The thought is that you simply’ll preset your threat tolerance, and the app will enable you to to rebalance your asset allocation while you’re not within the splendid zone in your designated threat stage.

Wealthica at the moment works with the overwhelming majority of inventory buying and selling apps and brokerage platforms in Canada, and is extra of an general private finance app. It not solely offers you a every day replace of your portfolio, but additionally tracks your charges, internet price, and might even be used to create month-to-month budgets.

Canada’s Finest Inventory Buying and selling Apps FAQ

Canada’s Inventory Buying and selling Apps: Remaining Ideas

The quick reply – YES!

Look, for those who’ve learn our comparability of Canada’s greatest on-line brokerages you’ll see why we expect you must use this platform – whatever the present promotion.

That stated, getting paid to open a brand new account is a few fairly nice icing on an already-tasty cake!

Right here’s a fast have a look at how the Qtrade RRSP season promotion can rapidly stack up. The mathematics under works for those who open an RRSP or an FHSA account (as each provide tax deductible contributions as a profit).

For those who earn an earnings of between $50,000 and $150,000 in Canada, you’re possible paying a marginal tax fee of about 40%. Meaning, for those who open an RRSP or FHSA account with Qtrade and make investments $5,000, you’ll immediately get:

- $2,000 again in your taxes

- $150 join bonus

- $250 money again bonus

- Free trades to make your first RRSP investments over the following few months

That’s $2,500+ price of causes to get began ASAP. Plus – they’ll even cowl your switch charges if you wish to carry your TFSA or one other account over from one other brokerage!

The cool portfolio analyzer instruments and helpful investor info providers can be found to all customers – and never simply “elite merchants” who make 200+ trades each month. If you mix the wonderful consumer expertise with best-in-class customer support, free ETF trades, and a flawless cellular app – then prime it off with some free money – it merely can’t be matched within the present dealer panorama.

No matter for those who’re simply getting began with investing or when you have been coping with one other brokerage that you simply’re not happy with, there has by no means been a greater time to decide on the Qtrade inventory investing app.