Finviz

Product Identify: Finviz

Product Description: Finviz is a beginner-friendly device that gives in-depth technical evaluation of U.S. shares.

Abstract

Finviz gives instruments for elementary and technical inventory evaluation and has a strong free plan plus a premium plan for individuals who need much more options. You possibly can create as much as 50 portfolios on the free plan and as much as 100 on the paid plan.

Execs

- Many free analysis instruments for shares and ETF

- In-depth inventory screener and warmth maps

- Helps elementary and technical analysis

- 30-day refund assure for paid memberships

- Backtesting for Elite members

Cons

- Solely covers U.S. shares (excludes OTC and ADR listings)

- Free charting instruments don’t embrace superior indicators

- Portfolio tracker doesn’t sync with brokerage accounts

- The free model reveals adverts.

- No cellular app and never mobile-friendly

Anybody who trades shares and pays consideration to technical evaluation is aware of how priceless a superb inventory screener will be. However with dozens of inventory screeners to select from, how do you discover one which’s best for you?

Finviz is a well-liked selection for newbie and skilled buyers alike, providing options like charts, warmth maps, insider buying and selling, and portfolio monitoring.

On this Finviz assessment, I dive into all the things Finviz has to supply, together with its key instruments and pricing. I additionally share just a few Finviz alternate options.

At a Look

- Newbie-friendly technical evaluation of U.S. shares

- Plenty of options on the free plan

- Free plan permits as much as 50 portfolios and 50 tickers per portfolio

- Paid plan permits as much as 100 portfolios and 500 tickers per portfolio

Finviz Options

Desk of Contents

- At a Look

- Finviz Options

- What Is Finviz?

- Finviz Options

- Homepage

- Inventory Screener

- Charting

- Warmth Maps

- Teams

- Portfolio

- Watchlists

- Information

- Insider Buying and selling

- Futures

- Foreign exchange

- Crypto

- Alerts

- Backtests

- How A lot Does Finviz Value?

- Finviz Free vs. Elite

- Options to Finviz

- FAQs

- Ultimate Ideas on Finviz

What Is Finviz?

Finviz, which is brief for Monetary Visualizations, is an funding analysis web site that may assist you to discover funding concepts or dig deep into a selected ticker. You should utilize it for technical and elementary evaluation.

You possibly can analysis the next asset sorts:

Finviz is without doubt one of the higher free inventory evaluation instruments due to its intensive, beginner-friendly instruments, plus a stunning quantity of knowledge, that are usually behind a paywall with different platforms.

The technical analysis options go additional than most on-line inventory brokerages, that are nice for elementary evaluation and usually provide in-depth charting, too.

Finviz Options

Finviz gives a number of analysis instruments that can assist you consider potential investments and monitor your present positions. Right here’s a more in-depth have a look at its key options.

Homepage

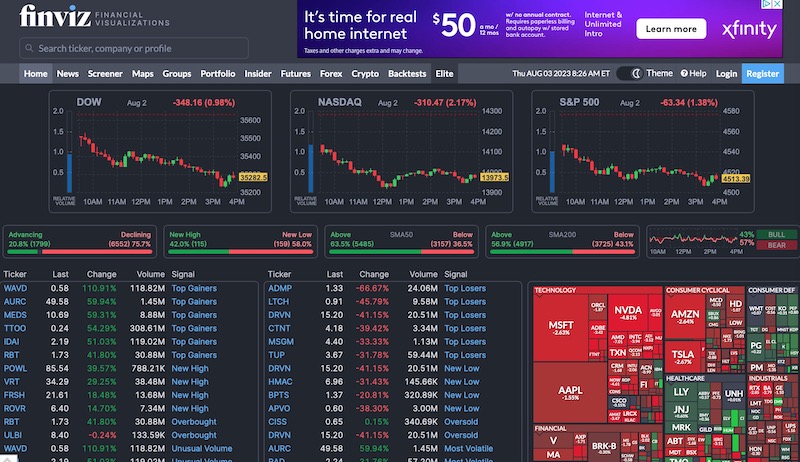

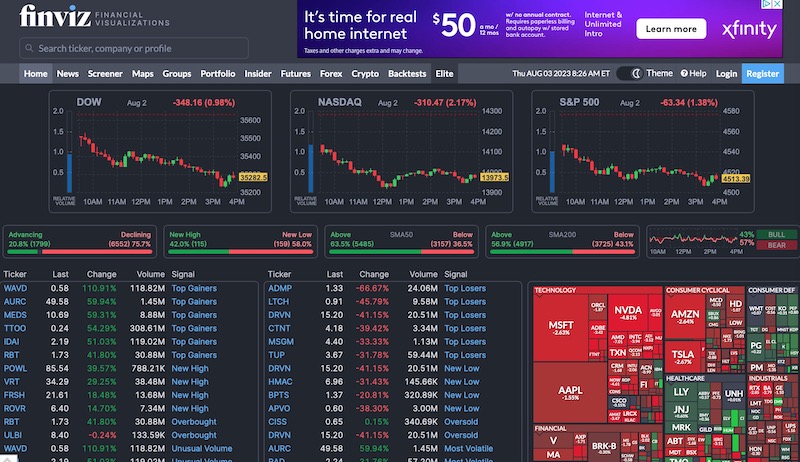

The Finviz homepage makes it straightforward to digest what’s taking place out there and is split into the next sections:

- Present buying and selling day efficiency for the S&P 500, Nasdaq, and Dow

- Prime-performing and worst-performing shares of the day

- Tickers with a buying and selling worth close to a sure buying and selling sample (wedge, triangle)

- Headlines

- Market calendar

- Newest insider buying and selling

- Earnings launch dates

- Futures

- Foreign exchange and bonds

Different low cost brokerages or superior buying and selling platforms might provide comparable particulars, however with Finviz, anyone can entry this info with out creating an account.

The web page format is straightforward to grasp because of the distinguishable classes and pink or inexperienced efficiency indicators. Scanning the homepage will be a wonderful approach to monitor the market and resolve the place to begin researching.

Inventory Screener

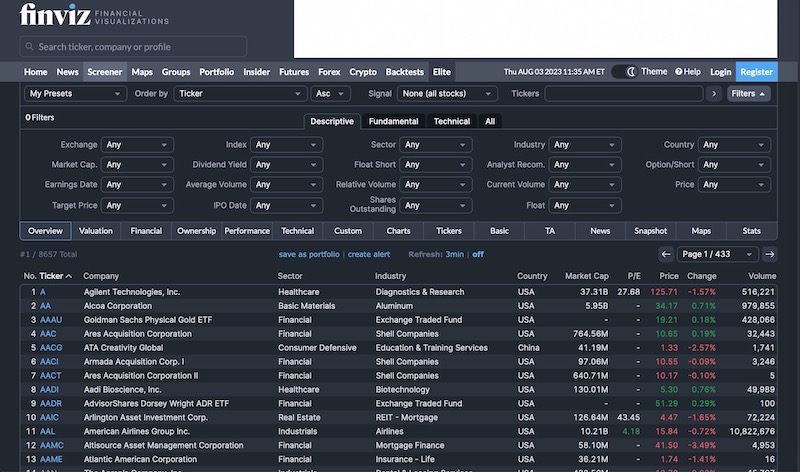

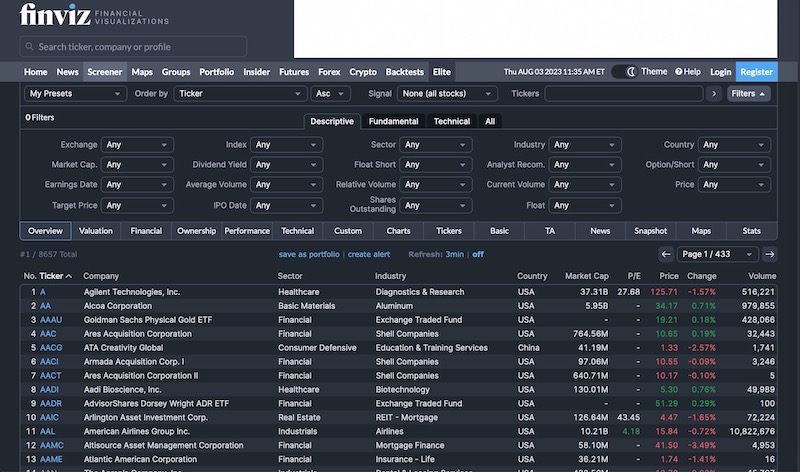

Finviz’s inventory screener makes it straightforward to check U.S.-listed shares and ETFs, though you can’t examine ADR and OTC shares or commodity shares the place the frequent inventory trades on international exchanges.

Regardless of its limitations with frequent shares, Finviz has many free and premium analysis instruments. You possibly can display shares by customizable filters, together with:

- Descriptive: Trade, trade sector, dividend yield, common quantity, and so forth.

- Basic: P/E ratio, price-to-sales, insider transactions, EPS development, and so forth.

- Technical: Easy shifting common (20-day, 50-day, 200-day), RSI, and so forth.

You possibly can choose filters from the descriptive, elementary, and technical tabs to see a listing of shares matching the standards beneath.

From there, you may select completely different tabs to check the shares by varied metrics, corresponding to:

- Valuation (P/E ratio, PEG ratio, and different funding ratios)

- Monetary (Dividend fee, return on fairness, gross margin, revenue margin)

- Possession (Excellent valuation, insider possession proportion, float brief)

- Efficiency (Funding returns for the previous week, month, quarter, 12 months)

- Technical (Easy Shifting Common, RSI, worth change from open, hole)

Viewing the charts, warmth maps, and information headlines for screened shares can also be doable.

Charting

Many inventory buying and selling apps have spectacular charting instruments that allow you to carry out technical evaluation and purchase inventory shares on the identical platform, however many overlook analysis instruments in favor of free trades and micro-investing.

Take into account charting shares in Finviz when your go-to investing app solely gives a primary historic worth chart.

All customers can view costs on every day, weekly, or month-to-month buying and selling intervals. You may as well regulate the candlestick show to your most popular setting, making it simpler to identify tendencies.

A number of primary higher and decrease indicators mechanically show on every chart:

- 20-day easy shifting common (SMA)

- 50-day SMA

- 200-day SMA

- Quantity

It’s necessary to notice that you should improve to FINVIZ*Elite to overlay with over 100 technical indicators, have drawing capabilities, and consider in full display. You may as well see if a paper buying and selling simulator gives the options to check short-term methods.

Warmth Maps

The visually interesting warmth maps characteristic helps you to view the efficiency of particular person shares and ETFs. Firms are organized by trade (expertise, communication companies, healthcare, vitality, railroads).

Larger packing containers point out a bigger market cap. A inexperienced shade suggests the inventory trades at the next worth for the buying and selling day, whereas a pink hue is for decrease pricing.

Extending the efficiency interval from sooner or later to a 12 months is feasible. You possibly can monitor year-to-date efficiency too.

The map can monitor extra metrics corresponding to:

- P/E ratio

- Float brief

- Dividend yield

- Analyst suggestions

- Earnings date

You may as well filter the inventory listings by S&P 500 or ETF.

The world filter shows a worldwide map and locations the inventory ticker the place the corporate headquarters are.

Teams

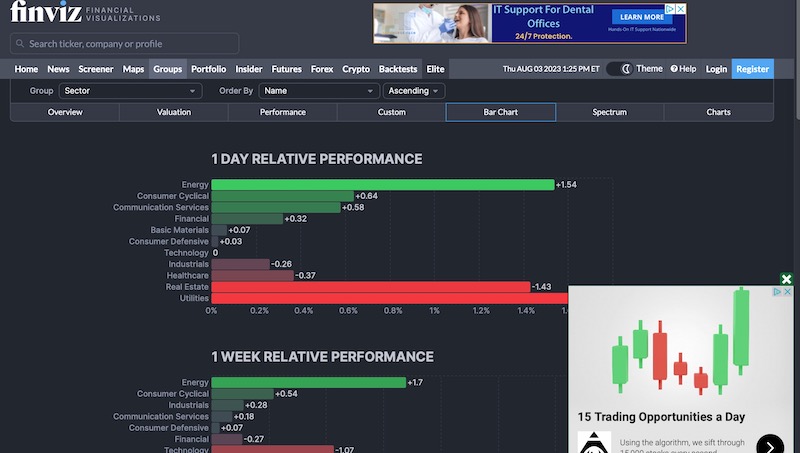

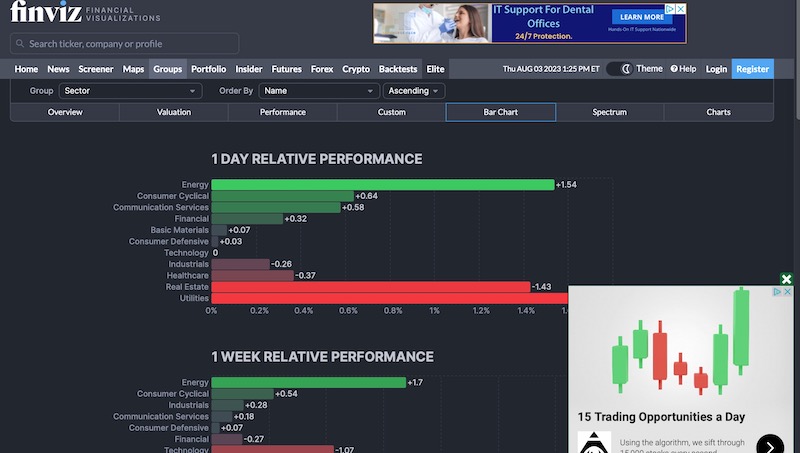

The Teams characteristic highlights the efficiency of sectors over a selected buying and selling vary. You possibly can examine the efficiency of varied industries, corresponding to vitality, finance, and actual property.

It’s additionally doable to have a look at the efficiency of subsectors inside a selected trade. One instance is evaluating the efficiency of oil and fuel exploration to midstream suppliers by choosing the Vitality trade.

The colour-coded bar charts make it straightforward to gauge the efficiency of a sector. A number of the graphs additionally break down the outcomes by the underlying corporations, which might make your analysis even simpler.

To additional discover an trade or sector, merely faucet the chart row, and a separate tab opens with the screener web page for the underlying shares.

Portfolio

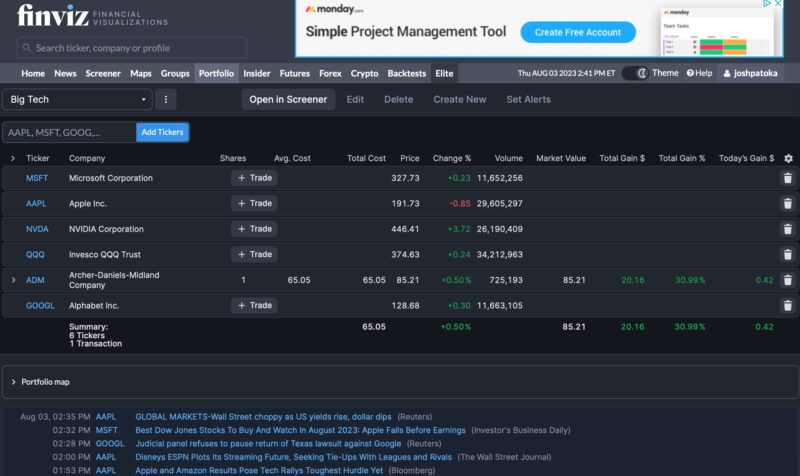

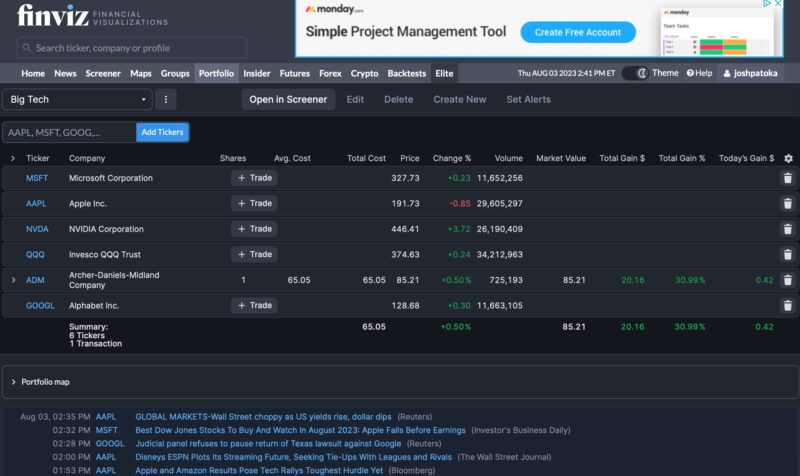

The Finviz portfolio tracker may also help you monitor the efficiency of your holdings and watchlist positions.

Free accounts could make 50 completely different portfolios, and premium members can create as much as 100. With the ability to create so many lineups is a pleasant characteristic and helps personalize your consumer expertise for analysis functions.

Trackable metrics embrace:

- Present market worth

- Whole loss or achieve

- At this time’s efficiency

You may as well consider your portfolio utilizing interactive and portfolio-related warmth maps.

One potential downside is having to enter every place element manually. Correct monitoring means coming into the acquisition date, common buy worth, and place measurement. Moreover, the monitoring instruments are comparatively primary in a number of features.

Different portfolio trackers are higher on this regard, as they’ll mechanically add your particulars, providing you with extra time to analysis investments.

Watchlists

Finviz just lately added a watchlist characteristic that can assist you monitor potential investments inside one in every of your Finviz portfolios.

When inspecting a inventory or ETF, click on “add to portfolio.” Subsequent, you may select “Watch” beneath the transaction kind, with “Purchase” and “Promote Brief” being the opposite two choices.

Information

Many free and premium inventory analysis companies mixture information headlines. You possibly can see ticker-specific headlines or scan the “Information” or “Blogs” columns to get a gist of what’s taking place and probably study one thing new.

Many articles are free, however others disguise behind the paywall or require a subscription after maxing out your month-to-month allotment of free articles.

You possibly can entry articles from the next shops by Finviz:

- Bloomberg

- Fox Enterprise

- MarketWatch

- Mish Discuss

- New York Occasions

- Reuters

- Zerohedge

For buyers who love staying on prime of inventory information, Finviz is without doubt one of the greatest methods to scan the headlines at no cost.

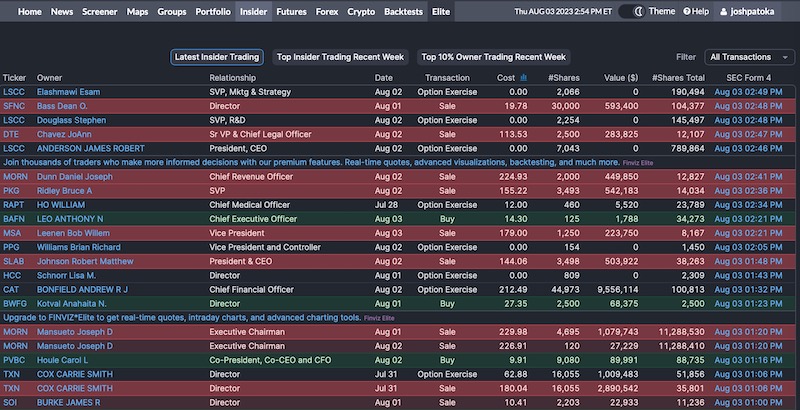

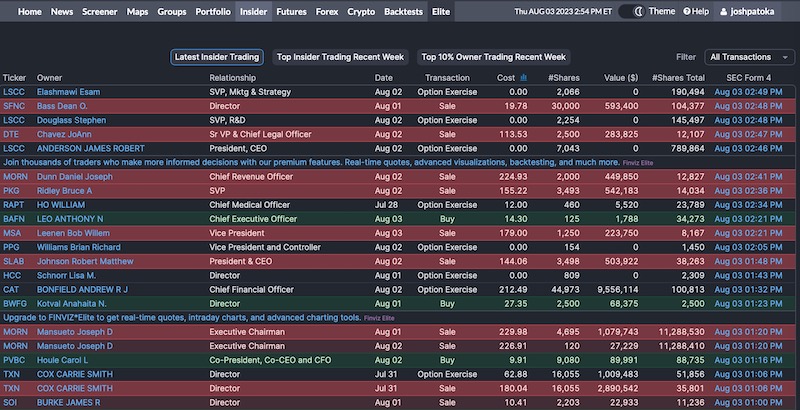

Insider Buying and selling

If an organization’s senior management buys or sells shares, it could actually point out how the share worth will pattern. Company executives periodically promote shares and train choices to obtain financial compensation. Nonetheless, there are occasions when their actions can encourage you to dig deeper in case you need to observe their lead.

These particulars are free to entry as executives should file types with the federal authorities disclosing sizable trades.

You possibly can filter the information within the following methods:

- Newest insider buying and selling (lists the latest trades first)

- Prime insider buying and selling current week (largest trades by nominal worth)

- Prime 10% proprietor buying and selling current week (largest transactions from buyers with a minimal 10% possession stake)

Monitoring down this knowledge with out the assistance of a service like Finviz will be time-consuming. You may additionally discover that you just overlook reported trades as you attempt to monitor a number of executives.

Futures

Traders who prefer to commerce commodities or inventory futures will discover Finviz’s Futures characteristic useful as you may view worth quotes, efficiency, and charts for these funding choices:

- Indices (DJIA, Nasdaq 100, Russell 2000, DAX, VIX, and so forth.)

- Bonds (Treasury Bonds: 2-year, 5-year, 10-year, 30-year)

- Currencies (USD, EUR, JPY, GBP, CAD, CHF, AUD, NZD)

- Vitality (Brent crude oil, WTI crude oil, pure fuel, gasoline)

- Grains (Corn, oats, soybeans, wheat)

- Meats (Stay cattle, feeder cattle, lean hogs)

- Metals (Gold, silver, platinum, copper, palladium)

- Softs (Cocoa, espresso, cotton, lumber, orange juice, sugar)

Foreign exchange

Aggressive foreign exchange merchants can retrieve the pricing for forex pairs between worldwide currencies. You possibly can view the value chart at intervals of 5 minutes, hourly, every day, weekly, month-to-month, and yearly.

Most comparisons measure the efficiency of a international forex to the U.S. greenback (USD). The analysis instruments are comparatively primary in comparison with the platform’s inventory screener and warmth maps, which extra buyers will most likely use to purchase lengthy or promote brief.

Crypto

If you happen to dabble in cryptocurrency, you may simply see worth quotes for extremely traded tokens like Bitcoin, Ethereum, and Litecoin. Most quotes worth the token in U.S. {dollars} and Euros.

Clicking on a worth quote helps you to view a primary worth chart consisting of a 5-minute to one-year increment. Much like inventory charts, you will have to be an elite member to customise the chart show and indicators. These worth quotes and charts can complement these provided by crypto portfolio trackers.

Alerts

Obtain free alerts when a inventory or ETF performs a selected motion, corresponding to:

- Crossing above or beneath a goal buying and selling worth

- Basic or technical metrics

- Turns into overbought or oversold

- Vital insider buying and selling

Premium members can obtain alerts based mostly on real-time knowledge, whereas free customers might must depend on delayed inputs.

Backtests

Backtesting is without doubt one of the greatest causes to improve to a paid membership. Portfolio evaluation instruments like Finviz can monitor your precise funding efficiency but additionally see how changes might change your historic efficiency.

Whereas no person is aware of how the inventory market will carry out sooner or later, backtesting helps you to take a look at your portfolio in opposition to comparable market circumstances so that you will be ready for extra conditions.

This service checks your portfolio in opposition to 24 years of historic info. You may as well examine it in opposition to the SPY benchmark (S&P 500) and with 100 technical indicators.

How A lot Does Finviz Value?

Finviz gives two free plans and one paid membership tier. It’s possible you’ll need to begin with one of many free tiers to check out the platform to see if it’s price upgrading.

Some buyers will need to go for the paid membership due to the ad-free expertise, backtesting, and real-time worth quotes.

Free

Anybody can use the inventory screener and charting instruments. You can’t save earlier screens or monitor your portfolio, however you don’t have to offer your e mail tackle. That is unusual, as many platforms need your contact particulars to market premium merchandise.

Primary options embrace:

- Delayed quotes, charting, and streaming

- Maps and Teams are delayed 3 to five minutes.

- Three years’ entry to statements

- Screener rows per web page (20 tables/36 charts/10 snapshots)

Registered

Registering for a free account helps you to save presets, monitor portfolio positions, and make primary customizations.

Along with the Free tier options, you additionally get these perks:

- Portfolios: As much as 50 per consumer

- Tickers: As much as 50 per portfolio

- Screener presets: As much as 50

- Customization: Structure and indicators

Creating as much as 50 portfolios helps you to monitor your funding returns for a number of methods and thematic investing.

FINVIZ*Elite

FINVIZ*Elite is Finviz’s premium tier and is right for frequent merchants and those that need full entry to this system. You’ll pay $39.50 month-to-month or $299.50 yearly (that boils all the way down to $24.96/month).

Upfront cost is critical for both subscription plan, however you may request a full refund throughout the first 30 days. So, use the primary month to check drive the platform.

Core advantages embrace:

- Actual-time inventory quotes (consists of premarket and aftermarket knowledge)

- Superior charts (Intraday, overlays, drawing instruments, full-screen layouts)

- Superior screener (Information export, custom-made filters, statistics view)

- Correlations (Optimistic and inverse correlations between chosen shares and ETFs)

- Backtesting (24 years of historic knowledge, 100 technical indicators)

- Alerts and notifications (On the spot e mail and push notifications)

- Advert-free format

- Eight years of economic statements (vs. three years for registered customers)

- As much as 100 portfolios (vs. 50 portfolios for registered customers)

- As much as 500 tickers per portfolio (vs. 50 tickers for registered customers)

- Max 200 screener presets (vs. 50 for registered customers)

- Screener rows per web page (100/120 charts/50 snapshots)

Finviz Free vs. Elite

Whether or not you need to keep on with the free model of Finviz or improve to the elite tier is dependent upon your analysis wants, present analysis instruments, and buying and selling frequency.

When to Use Finviz Free

The free model is greatest for informal buyers who are usually long-term holders or solely place just a few transactions yearly. Additional, the free options are ample to observe your present portfolio or control the broad market.

Even should you commerce incessantly, you could use the screener to search out watchlist candidates together with your chosen elementary and technical metrics. Then, you need to use your brokerage or standalone instruments with higher charting capabilities to analysis and place a commerce.

When to Improve to Finviz*Elite

The premium membership is greatest for frequent merchants who depend on real-time knowledge and wish superior screening and charting instruments. Getting the message field saying you must improve to a paid subscription to proceed researching is a nuisance.

The $300 annual payment is critical, and you will have to commerce often and use the Finviz instruments persistently to justify the value. Nonetheless, this payment is aggressive with comparable inventory analysis apps and extra reasonably priced when buying an annual membership.

Options to Finviz

The next web sites are additionally wonderful locations to analysis potential investments and inspect present holdings. Earlier than signing up with Finviz, I like to recommend trying out different platforms.

Morningstar Investor

Morningstar Investor is an interesting inventory screener for elementary buyers. The screener incorporates over 200 filters to determine shares, ETFs, and mutual funds matching your standards. As well as, the Morningstar analyst staff curates lists of the highest-rated shares and funds for a lot of classes, which serves as a wonderful place to begin.

A premium subscription additionally consists of portfolio evaluation and funding monitoring instruments that may assist optimize your asset allocation and funding technique. There may be additionally a lot bullish and bearish commentary in regards to the market and particular investments.

Learn our Morningstar Investor assessment for extra.

Study Extra About Morningstar Investor

In search of Alpha

In search of Alpha has many overlapping analysis instruments. You possibly can learn bullish and bearish commentary written by impartial contributors for almost any inventory and ETF. Finviz doesn’t actually provide inventory evaluation however is best for researching inventory metrics.

In search of Alpha consists of proprietary rankings that may make it simpler to evaluate potential investments. Moreover, the premium model syncs together with your brokerage accounts which saves time and prevents knowledge enter errors to rapidly see the rankings of your holdings and monitor your funding efficiency.

You possibly can study in regards to the variations between the free and premium memberships in our In search of Alpha assessment, however in comparison with Finviz, the free analysis instruments are considerably restricted.

Study Extra About In search of Alpha

Inventory Rover

Basic buyers and people with a buy-and-hold funding technique might need to take into account Inventory Rover. Like Finviz, it’s received elementary and technical inventory screens, however the extra analysis instruments cater to long-term buyers as a substitute of short-term merchants.

Inventory Rover’s custom-made inventory screens can mannequin legendary buyers and outstanding hedge funds, a novel characteristic. You may as well learn analysis stories and mechanically sync your brokerage portfolios for easy monitoring and updates.

4 completely different plans can be found, together with a free membership. For extra info, take a look at our Inventory Rover assessment.

Study Extra About Inventory Rover

FAQs

One of the best inventory screener is the one which’s best for you. Nonetheless, FinViz is right as a result of it helps elementary and technical metrics. You may as well save display presets if you create a free account. Nonetheless, different companies are higher if you wish to analysis OTC shares and thinly traded penny shares or have a platform with analyst stories as properly.

Sadly, there isn’t a Finviz cellular app, and the Android or iPhone net browser isn’t user-friendly. Your greatest guess is to entry Finviz from a desktop laptop. Giant tablets may additionally be ample.

Finviz has many free options, and most buyers can use it with out paying a dime, though you’ll view adverts on every web page. A paid membership is critical in order for you superior charting instruments past the easy shifting common and to backtest or keep away from adverts.

Ultimate Ideas on Finviz

Finviz is a wonderful inventory analysis service that gives a number of the greatest free analysis instruments. It ought to be one of many first locations you search for elementary and technical evaluation if you’re unhappy together with your brokerage instruments.

You possibly can profit from utilizing Finviz whether or not you’re a short-term dealer or long-term investor. It’s additionally a wonderful analysis companion to funding newsletters, which offer a primary background for the month-to-month funding concept however nonetheless require additional analysis earlier than shopping for shares.

I don’t advocate Finviz should you want buying and selling shares out of your telephone because the web site isn’t mobile-friendly and doesn’t have a inventory screener app.