It’s getting uncontrolled, and everyone seems to be pissed off by it. A beloved one passes away, and inside days, the GoFundMe marketing campaign reveals up in your Fb feed…

“Requesting Assist for Funeral – Joe had no Life Insurance coverage :(” It’s unhappy. It’s irritating. It’s awkward. And it pisses lots of people off!

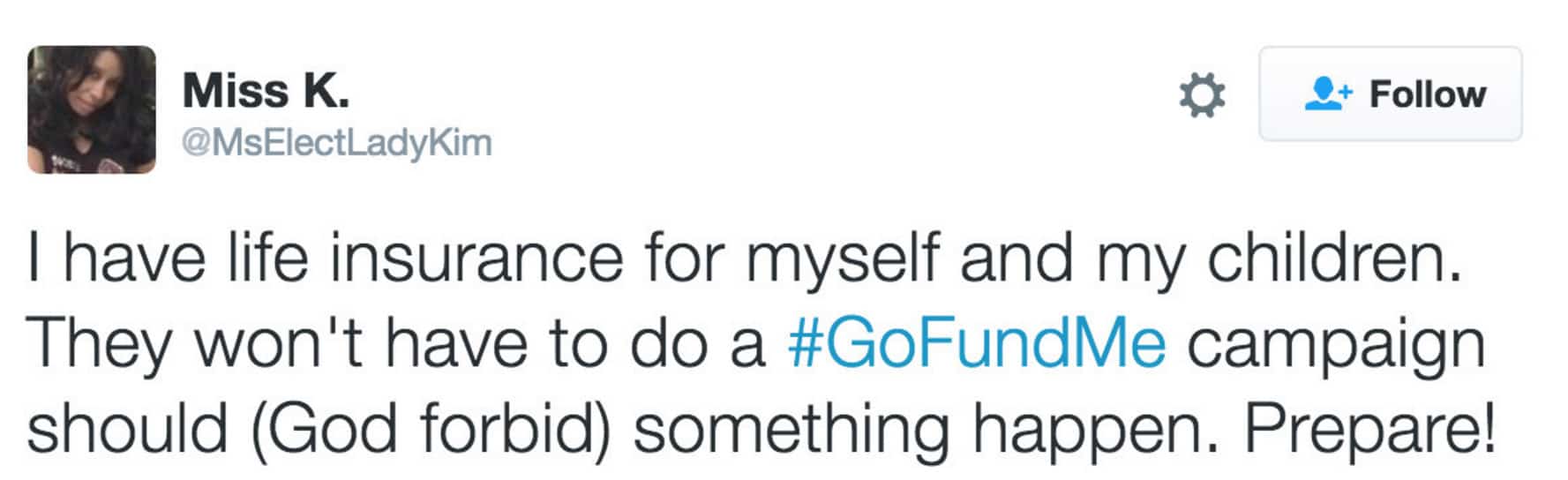

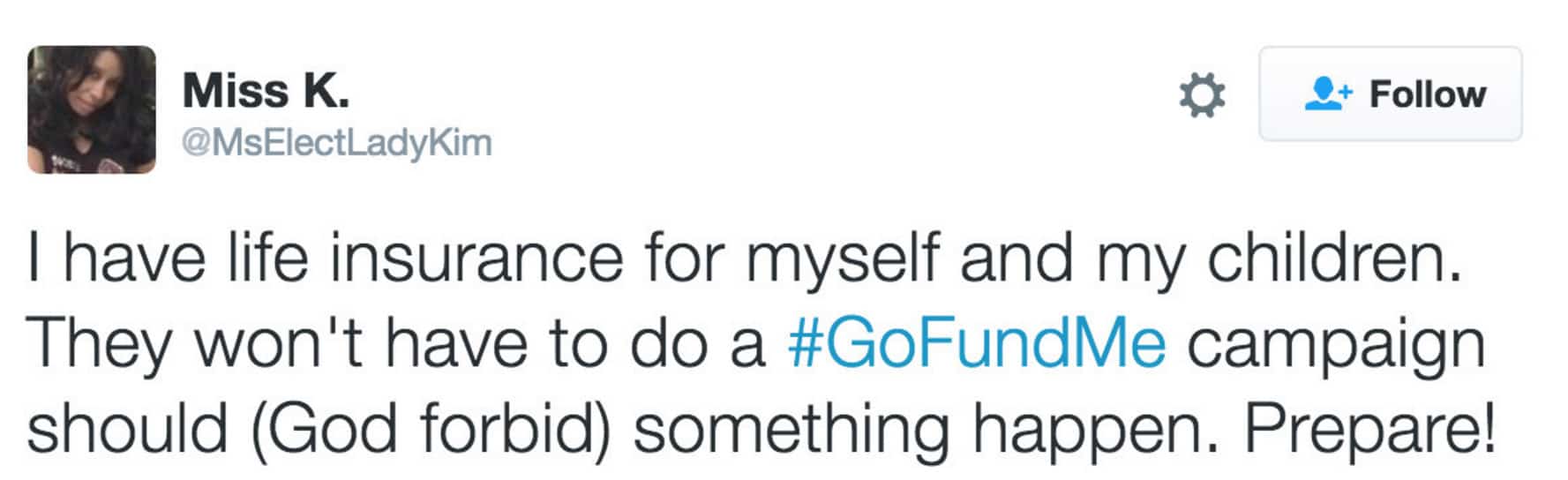

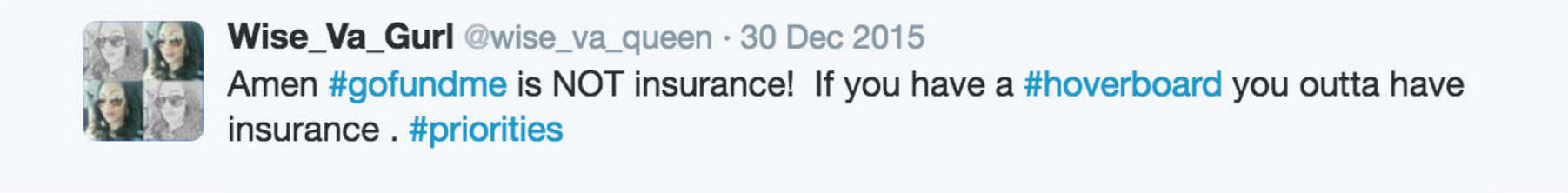

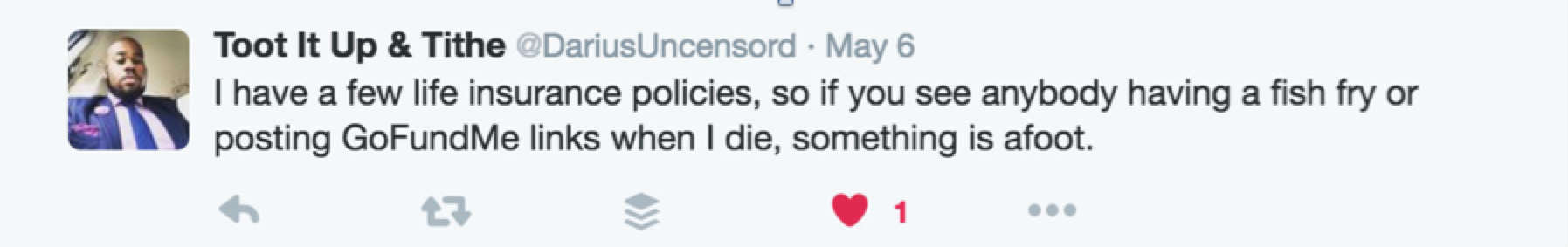

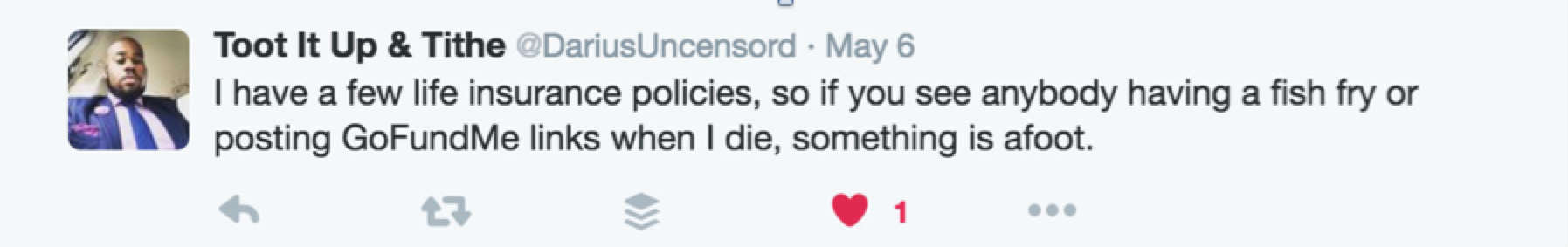

Check out what individuals are saying on Twitter:

Click on right here for extra tweets. A few of these are hilarious!

I say they’re proper! When you agree, discover out how one can assist finish these campaigns in 3 straightforward steps.

Welcome to the GoFundMe Insurance coverage Rise up!

The GoFundMe revolt is about robust love.

It’s like telling your 32-year-old son with no job who gained’t transfer out of your home and sits round in your sofa taking part in video video games bare consuming Cheetos, that he has 3 months to both transfer out or begin paying lease. Guess what. He’ll get his ass off the sofa and begin searching for a job!

… Powerful love.

What occurs each time individuals see these campaigns get funded? They subconsciously determine that planning for dying simply isn’t that necessary as a result of another person can bail my household out. And on goes the cycle.

Wish to assist cease GoFundMe life insurance coverage campaigns? Cease contributing to them.

Take the “Fund” out of “GoFundMe”, and we’ll finish the cycle.

RELATED: 5 Crucial Ideas You Should Know Earlier than Shopping for Life Insurance coverage

When You Ought to Name BS on a GoFundMe Marketing campaign (and while you shouldn’t)

Some GoFundMe campaigns have their place – you understand them while you see them. We’re not right here to cease campaigns elevating $20,000 for that surgical procedure that your medical insurance didn’t cowl. We’re right here to battle for this noble thought:

Go Fund Me Campaigns ought to be used for bills that accountable individuals by no means noticed coming.

May a accountable individual probably foresee and plan for an surprising dying? You wager.

So if Joe is a wholesome, 50-year-old and abruptly dies of a coronary heart assault or will get hit by a automobile, whether or not he’s single with no dependents, or married with 3 children…we shouldn’t see a GoFundMe marketing campaign.

Why? He was wholesome. Meaning he *may have* certified for life insurance coverage!

So if Joe was a middle-income American, he ought to’ve deliberate forward, and it shouldn’t be our burden to bail his household out as a result of he mismanaged his cash. However Joe’s “center earnings” instance brings up a superb level.

What About Individuals Who Can’t Afford Life Insurance coverage?

“What if they honestly didn’t have the means to place any cash away or purchase life insurance coverage?” To begin with, I do know the place your coronary heart is with this assertion and I recognize that. However critically, are you aware how a lot it prices for only a $100,000 time period coverage? When you’re below 50 and wholesome, usually below $20 bucks per 30 days!

You’ll need to be the decide of the way you reply to the GoFundMe requests from low-income households.

In the event that they’re struggling simply to make ends meet and pay for the necessities – meals, clothes, housing, and so forth., then I can see sympathizing and serving to a household out who really couldn’t have “saved up” or purchased life insurance coverage to stop the necessity for a GoFundMe marketing campaign.

But when I can image Joe’s spouse writing the GoFundMe request on her iPad whereas sipping a White Chocolate Mocha at Starbucks, you be the decide of whether or not or not you need to contribute, however hell no, I’m not serving to!

RELATED: Examine Pattern Life Insurance coverage Charges by Age (No Private Information Required)

Enter your ZIP code beneath to view corporations which have low cost insurance coverage charges.

Secured with SHA-256 Encryption

Wish to Assist Finish Irresponsible GoFundMe Insurance coverage Requests?

We are able to finish these requests in 3 straightforward steps:

1. Make the Pledge – see beneath

2. Cease contributing to GoFundMe insurance coverage campaigns

3. Share the Rise up

As a substitute of GoFundMe, Purchase Life Insurance coverage

It begins with you. You’ve bought to get YOUR monetary geese in a row to guarantee YOUR household gained’t be requesting crowdsourced funds on YOUR behalf. That might imply you might want to spend a bit much less and save extra. That might imply you might want to look into shopping for some life insurance coverage.

That might imply speaking to your family members about your needs upon your dying.

Make a pledge that no GoFundMe marketing campaign might be used upon your dying, and share it on Fb, Twitter, Snapchat, and so forth.

“I vow that no GoFundMe marketing campaign might be arrange upon my dying, nor will I set one up for my relations. #gofundmerebellion”

Listed below are a couple of fast shareable concepts:

GoFundMe will not be life insurance coverage! #gofundmerebellion

Two Fast Bulletins: 1) I’m now not contributing to GOFUNDME campaigns 2) Life insurance coverage is tremendous low cost – Now go do the correct factor! #gofundmerebellion

LIMRA, a life insurance coverage analysis affiliation, says that individuals overestimate the price of life insurance coverage by over 3 occasions! It’s reasonably priced individuals. Don’t depend on GOFUNDME! #gofundmerebellion

Go Fund Me Campaigns ought to be used for bills that accountable individuals by no means noticed coming. #gofundmerebellion

Final Ideas on GoFundMe For Life Insurance coverage

So in case you’re a middle-income American, please cease with the Go Fund Me requests. It makes your family and friends uncomfortable.

Nobody ought to have to consider the way in which Joe mismanaged his cash and may have purchased life insurance coverage, however didn’t.

Enter your ZIP code beneath to view corporations which have low cost insurance coverage charges.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance coverage Agent

Jimmy McMillan is an entrepreneur and the founding father of HeartLifeInsurance.com, an impartial life insurance coverage brokerage. His firm makes a speciality of life insurance coverage for individuals with coronary heart issues. He is aware of personally how tough it’s to safe well being and life insurance coverage after a coronary heart assault.

Jimmy is a licensed insurance coverage agent from coast to coast who has been featured on ValientCEO and the podcast…

Editorial Tips: We’re a free on-line useful resource for anybody all in favour of studying extra about insurance coverage. Our objective is to be an goal, third-party useful resource for every thing insurance coverage associated. We replace our web site frequently, and all content material is reviewed by insurance coverage consultants.